Regulatory News:

Sopra Steria (Paris:SOP):

This is a joint press release by Ordina N.V. ("Ordina")

and Sopra Steria Group SA ("Sopra Steria" or the

"Offeror") pursuant to the provisions of Article 4,

paragraph 3 of the Dutch Decree on public takeover bids (Besluit

openbare biedingen Wft) (the "Decree") in connection with

the recommended public offer by the Offeror for all the issued and

outstanding ordinary shares in the capital of Ordina (the

"Offer"). The information in this announcement is not

intended to be complete. This announcement does not constitute an

offer, or any solicitation of any offer, to buy or subscribe for

any securities in Ordina. The Offer is made solely by means of an

offer memorandum (the "Offer Memorandum") approved by the

Dutch Authority for the Financial Markets (Stichting Autoriteit

Financiële Markten, the "AFM") which was published on 17

July 2023, and subject to the restrictions set forth therein.

Capitalised terms used herein but not defined in this press release

will have the meaning as ascribed thereto in the Offer Memorandum.

With reference to the joint press releases by Ordina and the

Offeror dated 21 March 2023 and 17 July 2023, the Offer is subject

to the satisfaction or waiver of the Offer Conditions, all in

accordance with the terms of the Offer Memorandum. This press

release is not for release, publication or distribution, in whole

or in part, in or into, directly or indirectly, any jurisdiction in

which such release, publication or distribution would be

unlawful.

Sopra Steria and Ordina jointly announce that during the Offer

Period, that expired today at 17:40 hours CET, 83,471,252 Shares

have been tendered under the Offer, representing approximately

92.73% of Ordina's Outstanding Capital. As a result of the adoption

of the Asset Sale and Liquidation Resolutions at the extraordinary

general meeting of Ordina on 6 September 2023, the Acceptance

Threshold of at least 80% has been reached.

Next steps

In accordance with Article 16, paragraph 1 of the Decree and

section 5.6 of the Offer Memorandum, the Offeror will announce

whether it declares the Offer unconditional on or before 29

September 2023.

Further information

The Offeror is making the Offer on the terms and subject to the

conditions and restrictions contained in the Offer Memorandum. In

addition, Ordina has made available the Position Statement,

containing the information required by Article 18, paragraph 2 and

Annex G of the Decree in connection with the Offer.

This announcement contains selected, condensed information

regarding the Offer and does not replace the Offer Memorandum or

the Position Statement. The information in this announcement is not

complete and additional information is contained in the Offer

Memorandum and the Position Statement. Shareholders are advised to

review the Offer Memorandum and the Position Statement in detail

and to seek independent advice where appropriate in order to reach

a reasoned judgment in respect of the Offer and the content of the

Offer Memorandum and the Position Statement. In addition,

Shareholders may wish to consult with their tax advisors regarding

the tax consequences of tendering their Shares under the Offer.

Digital copies of the Offer Memorandum and Position Statement

are available on the website of Ordina (www.ordina.com) and a

digital copy of the Offer Memorandum is available on the website of

Sopra Steria (www.soprasteria.com). Such websites do not constitute

a part of, and are not incorporated by reference into, the Offer

Memorandum. Copies of the Offer Memorandum and the Position

Statement are also available free of charge at the offices of

Ordina and the Settlement Agent, at the addresses mentioned

below.

Ordina: Ordina N.V. Ringwade 1 3439 LM Nieuwegein The

Netherlands

The Settlement Agent: ING Bank N.V. Bijlmerdreef 106 1102

CT Amsterdam The Netherlands iss.pas@ing.com

See also: www.shareholderofferordina.com

About Ordina

Ordina is the digital business partner that harnesses technology

and market know-how to give its clients an edge. We do this by

using smart solutions to connect technology, business challenges

and people. We help our clients to accelerate, to develop smart

applications, to launch new digital services and ensure that people

embrace those services. Ordina was founded in 1973. Its shares are

listed on Euronext Amsterdam and are included in the Smallcap Index

(AScX). In 2022, Ordina recorded revenue of EUR 429 million.

You will find more information at www.ordina.com.

About Sopra Steria

Sopra Steria, a European Tech leader recognised for its

consulting, digital services and software development, helps its

clients drive their digital transformation to obtain tangible and

sustainable benefits. It provides end to-end solutions to make

large companies and organisations more competitive by combining

in-depth knowledge of a wide range of business sectors and

innovative technologies with a fully collaborative approach. Sopra

Steria places people at the heart of everything it does and is

committed to putting digital to work for its clients in order to

build a positive future for all. With 50,000 employees in nearly 30

countries, the Group generated revenue of €5.1 billion in 2022.

The world is how we shape it

Sopra Steria (SOP) is listed on Euronext Paris (Compartment A) –

ISIN: FR0000050809

For more information, visit us at www.soprasteria.com.

General restrictions

This press release contains inside information within the

meaning of the EU Market Abuse Regulation (596/2014). The

information in this announcement is not intended to be complete.

This announcement is for information purposes only and does not

constitute an offer or an invitation to acquire or dispose of any

securities or investment advice or an inducement to enter into

investment activity. This announcement does not constitute an offer

to sell or issue or the solicitation of an offer to buy or acquire

the securities of Ordina in any jurisdiction.

The distribution of this press release may, in some countries,

be restricted by law or regulation. Accordingly, persons who come

into possession of this document should inform themselves of and

observe these restrictions. To the fullest extent permitted by

applicable law, the Offeror and Ordina disclaim any responsibility

or liability for the violation of any such restrictions by any

person. Any failure to comply with these restrictions may

constitute a violation of the securities laws of that jurisdiction.

Neither Ordina, nor the Offeror, nor any of their advisors assume

any responsibility for any violation by any person of any of these

restrictions. Shareholders in any doubt as to their position should

consult an appropriate professional advisor without delay.

Forward-looking statements

This press release may include "forward-looking statements" such

as statements relating to the impact of the Transaction on the

Offeror and Ordina and the expected timing and completion of the

Offer and the Transaction. Forward-looking statements involve known

or unknown risks and uncertainties because they relate to events

and depend on circumstances that all occur in the future.

Generally, words such as may, should, aim, will, expect, intend,

estimate, anticipate, believe, plan, seek, continue or similar

expressions identify forward-looking statements. These

forward-looking statements speak only as of the date of the Offer

Memorandum. Although the Offeror and Ordina, each with respect to

the statements it has provided, believe that the expectations

reflected in such forward-looking statements are based on

reasonable assumptions, no assurance can be given that such

statements will be fulfilled or prove to be correct, and no

representations are made as to the future accuracy and completeness

of such statements.

Forward-looking statements are subject to risks, uncertainties

and other factors that could cause actual results to differ

materially from historical experience or from future results

expressed or implied by such forward-looking statements. These

forward-looking statements are not guarantees of future

performance. Potential risks and uncertainties include, but are not

limited to, (i) the risk that required regulatory approvals may

delay the Offer or result in the imposition of conditions that

could have a material adverse effect on the integration of Ordina

into the Offeror's Group or cause the Offeror to abandon the Offer,

(ii) the risk that the Offer Conditions may not be satisfied, (iii)

risks relating to the Offeror's ability to successfully operate

Ordina without disruption to its other business activities, which

may result in Ordina not operating as effectively and efficiently

as expected, (iv) the possibility that Ordina may involve

unexpected costs, unexpected liabilities or unexpected delays, (v)

the risk that the businesses of the Offeror or its Affiliates may

suffer as a result of uncertainty surrounding the Offer, (vi) the

effects of competition (in particular the response to the Offer in

the marketplace) and competitive developments or risks inherent to

the Offeror's or Ordina's business plans, (vii) the risk that

disruptions from the Offer will harm relationships with customers,

employees and suppliers, (viii) political, economic or legal

changes in the markets and environments in which the Offeror and

its Affiliates, shareholders, officers, directors, employees,

advisors, agents, representatives and members do business, (ix)

economic conditions in the global markets in which the Offeror and

Ordina and, where applicable, their respective Affiliates operate,

in particular the current macro-economic developments, (x)

uncertainties, risks and volatility in financial markets affecting

the Offeror and Ordina and, where applicable, their respective

Affiliates, shareholders, officers, directors, employees, advisors,

agents, representatives and members, and (xi) other factors that

can be found in the Offeror and Ordina's press releases and public

filings.

Each of the Offeror and Ordina expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statements contained herein to reflect any

change in the expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based, except as required by Applicable Rules or by any Competent

Regulatory Authority.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230926047743/en/

For more information:

Investor Relations Olivier Psaume

olivier.psaume@soprasteria.com +33 (0)1 40 67 68 16

Press Relations Caroline Simon (Image 7)

caroline.simon@image7.fr +33 (0)1 53 70 74 65

For more information:

Investor Relations Anneke Hoijtink

anneke.hoijtink@ordina.nl +31 615396873

Media relations Uneke Dekkers, CFF Communications

uneke.dekkers@cffcommunications.nl +31 650261626

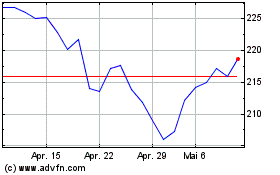

Sopra Steria (EU:SOP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

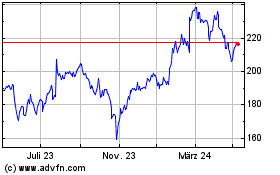

Sopra Steria (EU:SOP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024