RENAULT GROUP: Solid start to 2023 with 30% increase in revenue in

the first quarter

|

Press Release April 20, 2023 |

| |

| |

RG_2023Q1 Revenue_PR_GB

Solid start to

2023 with 30% increase in

revenue in

the first quarter

-

Renault Group worldwide sales amounted to 535,000 vehicles in the

first quarter, up 14.1% versus 2022 Q1. In Europe, Group sales were

up 27.3% in a market up 16.2%

-

Group revenue at €11.5 billion, +29.9%1 vs 2022

Q1

-

Automotive revenue at €10.5 billion, +29.7%1 vs

2022 Q1

-

Continued price effect of

9.4 points over

the quarter and increased product mix

impact

at 5.2

points driven by the commercial policy focused on

value and the success of new products:

- 68% of Group sales on the retail channel in the Group’s five

main countries in Europe2

- Marked improvement in Renault brand

C-segment sales in Europe: up more than 51% vs 2022 Q1 thanks to

the success of Megane E-TECH Electric, Arkana and Austral

- Renault Austral already recorded

15,500 sales in 2023 Q1 with 67% of hybrid mix and 61% of high trim

versions. Orders since launch reached 40,000 units

- Renault Megane E-TECH Electric

records more than 11,000 sales in 2023 Q1, with more than 70% on

high trim versions and above 80% on the most powerful engine

(60kWh/220 hp). Orders since launch amounted to more than 54,000

units

- Renault Arkana recorded more than

18,500 sales in 2023 Q1 of which 60% in E-TECH version

- Dacia recorded

sales up 41% to nearly 150,000 units in Europe in Q1 thanks to the

successful renewal of its range. Dacia Sandero remains the

best-seller to retail customer in Europe

-

Renault Group pursues its electrification offensive:

- Renault brand maintains its leading

position in Europe in the first quarter with a 24% volume increase

in electrified3 passenger car sales versus 2022 Q1, accounting for

38% of the brand’s passenger car sales in Europe

- The first hybrid version in the

Dacia range was launched in January 2023 on Jogger. Dacia Jogger

Hybrid 140 already represents around 25% of the order mix. Jogger

is a key product to attract new customer profiles and its hybrid

version supports Dacia smooth electrification strategy

- Dacia Spring (100% electric)

records close to 110,000 orders in Europe since launch. It was

again on the podium of retail electric vehicles in Europe in

Q1

-

Strong Group's orderbook in Europe remains at record

levels in absolute value and is at 3.3 months of

sales at the end of Q1. It would remain above the target of 2

months through 2023, even with a market 30% below 2019.

-

Renault Group confirms its 2023

financial outlook

“Renault Group

is off to a

solid start

in the year with a

30% increase in the

first quarter revenue, supported by

strong pricing

and product mix

effects.

The Group pursues its

commercial policy focused on value

– by optimizing

its pricing policy

and commercial

discounts, and

focusing on the

most profitable

channels. It also

benefits from

the first

successes of its

renewed line-up with

Arkana, Megane

E-TECH

Electric and Austral for

the Renault brand and Dacia

Jogger. The strong orderbook at

the end of March and all

forthcoming launches will keep

supporting the Group's commercial

activity" said Thierry

Piéton, Chief Financial

Officer of Renault Group.

Boulogne-Billancourt, April 20, 2023

Commercial results: First quarter highlights

Renault Group recorded 535,000

sales in 2023 Q1, up 14.1% compared to 2022 Q1. In Europe, Group

sales increased by 27.3% in a market up 16.2%.

Renault Group benefited from

the successes of the renewal of its range with, for the Renault

brand, Arkana, Megane E-TECH Electric and Austral, and for the

Dacia brand, Jogger. The Group continued to concentrate on the most

profitable channels: retail sales accounted for 68% in the five

main European countries4.

In Europe, Renault brand sales

amounted to nearly 230,000 vehicles, up nearly 20% in 2023

Q1. The brand continues to successfully develop its sales in

value-creating segments:

-

It maintains its leading position in the electrified5 market with a

24% increase in sales.

-

In the C-segment, Renault recorded growth of more than 51% thanks

to the success of its new models: Arkana, Megane E-TECH Electric

and Austral.

-

More than one out of two sales in our five main countries in

Europe3 in the retail channel.

Dacia recorded sales up 41% to

nearly 150,000 units in Europe thanks to the product momentum and

new brand identity:

-

In 2023 Q1, in Europe, Dacia Sandero ranked first in retail sales

and Dacia Duster remains on the podium of SUVs sold to retail

customers.

-

Dacia Spring continued its momentum and recorded 14,500 units sold

this quarter. It was again on the podium of retail electric

vehicles in Europe.

-

The brand continues to expand its electrified product offering with

Jogger Hybrid 140, the first hybrid in the range and the most

affordable hybrid family car on the market.

First quarter revenue

Reminder relative to the impacts of the disposal

of Russian automotive activities on financial statements: as a

result of the agreements to sell 100% of Renault Group's shares in

Renault Russia to the City of Moscow and its 67.69% stake in

AVTOVAZ to NAMI (the central institute for research and development

of automobiles and engines) announced on May 16th, 2022, the

Russian activities were deconsolidated in Renault Group's financial

statements and treated as discontinued operations under IFRS 5 with

retroactive effect from January 1st, 2022.

The revenue for 2023 Q1 therefore no longer

includes the Russian industrial activities. Group revenue for 2022

Q1 has been adjusted in line with this new scope of activity

(impacts: AVTOVAZ -€527 million and Renault Russia -€367

million).

Group revenue for 2023 Q1

amounted to €11.5 billion, up 29.9% compared to 2022 Q1. At

constant scope and exchange rates6, Group revenue was up 33.5%.

Automotive

revenue reached €10.5 billion, up 29.7% compared

to 2022 Q1. This strong improvement is mainly explained by the

following:

- A strong

volume effect of +18.6 points, essentially due to the increase in

production compared to 2022 Q1, thanks to the commercial success of

new vehicles coupled with an improved availability of EC

components. This volume effect is higher than the growth in

registrations due to a lower destocking of the independent dealer

network in 2023 Q1 compared to 2022 Q1, when EC crisis was at

peak.

- A robust

price effect of +9.4 points, reflecting the continuation of the

commercial policy focused on value, price increases to offset cost

and currency inflation, and an optimization of commercial

discounts.

- An

increasing product mix effect of +5.2 points mainly resulting from

Megane E-TECH Electric and Austral which average revenue per unit

is largely higher than Renault Group’s average.

-

A geographic mix of +2.7 points benefiting from the strong

performance of European sales.

-

A positive impact of sales to partners of +0.9 points, mainly

supported by a dynamic LCV market driving sales to Nissan, Renault

Trucks and Mercedes-Benz as well as from the start of production of

the ASX for Mitsubishi Motors.

These positive effects more than offset:

-

A forex impact of -2.6 points, mainly related to the Argentinian

Peso.

-

An "Other" effect of -4.5 points, related to a decrease in the

contribution of sales from the Renault Retail Group network

following the disposals of branches, partially offset by the

performance in the aftersales activity.

Mobility Services contributed

€9 million to 2023 Q1 revenue compared to €8 million in 2022

Q1.

Mobilize Financial Services

(formerly RCI Bank and Services) posted revenue of €974 million

in 2023 Q1, up 32.2% compared to 2022 Q1 due to higher

interest rates and to the increase of new contracts coupled with

higher average amount financed.

Average performing assets (€49.4 billion)

increased by 13% compared to 2022 Q1. This is supported by vehicle

restocking in the dealerships and by a 17.4% increase in new

financing for the retail business.

At March 31, 2023, total

inventories (including the independent network)

represented 580,000 vehicles:

- The Group is still facing logistics

issues explaining the growth of Group inventories at 273,000

vehicles.

- The independent dealer inventories

stood at 307,000 units in line with the orderbook which remains at

record levels in absolute value.

2023 FY financial outlook

Renault Group confirms its 2023 FY financial

outlook with:

- a Group

operating margin superior or

equal to

6%

- an

Automotive

operational free

cash flow superior

or equal to

€2

billion.

Renault Group's consolidated revenue

|

(in million euros) |

2022 1 |

2023 |

Change

2023/2022 |

|

1st quarter |

|

|

|

|

Automotive |

8,109 |

10,515 |

+29.7% |

|

Mobility Services |

8 |

9 |

+12.5% |

|

Sales Financing |

737 |

974 |

+32.2% |

|

Total |

8,854 |

11,498 |

+29.9% |

1 2022 Q1 revenue adjusted to reflect the exit

from Russia (excluding AVTOVAZ and Renault Russia, whose disposals

were announced on May 16th, 2022).

Renault Group's top 15 markets at the end of

March 2023

|

|

Year to date March

2023 |

Volumes 1 |

PC + LCV |

|

(in

units) |

market share |

|

|

(in

%) |

|

1 |

FRANCE |

127,052 |

24.9 |

|

2 |

ITALY |

49,689 |

10.5 |

|

3 |

GERMANY |

33,669 |

4.6 |

|

4 |

TURKEY |

32,074 |

13.6 |

|

5 |

SPAIN |

29,709 |

10.9 |

|

6 |

BRAZIL |

26,298 |

6.0 |

|

7 |

UNITED KINGDOM |

23,906 |

4.1 |

|

8 |

ROMANIA |

18,081 |

43.9 |

|

9 |

BELGIUM+LUXEMBOURG |

17,145 |

10.5 |

|

10 |

INDIA |

15,013 |

1.3 |

|

11 |

MOROCCO |

14,040 |

38.1 |

|

12 |

POLAND |

12,961 |

9.3 |

|

13 |

ARGENTINA |

11,661 |

10.2 |

|

14 |

NETHERLANDS |

10,598 |

9.0 |

|

15 |

MEXICO |

9,415 |

3.0 |

1 Sales excluding Twizy

Total Renault Group PC + LCV sales by brand

| |

First quarter |

First quarter |

|

| |

2022 1 |

2023 |

Change % |

|

RENAULT |

|

|

|

PC |

256,840 |

266,867 |

+3.9 |

|

LCV |

69,660 |

87,678 |

+25.9 |

|

PC+LCV |

326,500 |

354,545 |

+8.6 |

|

RENAULT KOREA MOTORS |

|

|

|

PC |

12,032 |

6,908 |

-42.6 |

|

DACIA |

|

|

|

|

PC |

126,462 |

170,496 |

+34.8 |

|

LCV |

1,497 |

1,293 |

-13.6 |

|

PC+LCV |

127,959 |

171,789 |

+34.3 |

|

ALPINE |

|

|

|

|

PC |

710 |

562 |

-20.8 |

|

OTHERS2 |

|

|

|

|

PC |

1,737 |

1,208 |

-30.5 |

|

LCV |

33 |

|

- |

|

PC+LCV |

1,770 |

1,208 |

-31.8 |

|

RENAULT GROUP |

|

|

|

PC |

397,781 |

446,041 |

+12.1 |

|

LCV |

71,190 |

88,971 |

+25.0 |

|

PC+LCV |

468,971 |

535,012 |

+14.1 |

1 2022 volumes excluding Renault Russia and AVTOVAZ2 Mobilize,

Eveasy, Jinbei & Huasong

About Renault Group

Renault Group is at the forefront of a mobility

that is reinventing itself. Strengthened by its alliance with

Nissan and Mitsubishi Motors, and its unique expertise in

electrification, Renault Group comprises 4 complementary brands -

Renault, Dacia, Alpine and Mobilize - offering sustainable and

innovative mobility solutions to its customers. Established in more

than 130 countries, the Group has sold 2.1 million vehicles in

2022. It employs nearly 106,000 people who embody its Purpose every

day, so that mobility brings people closer. Ready to pursue

challenges both on the road and in competition, Renault Group is

committed to an ambitious transformation that will generate value.

This is centred on the development of new technologies and

services, and a new range of even more competitive, balanced and

electrified vehicles. In line with environmental challenges, the

Group’s ambition is to achieve carbon neutrality in Europe by

2040.https://www.renaultgroup.com/en/

| RENAULT

GROUP

INVESTORRELATIONS |

|

Philippine de

Schonen+33 6 13 45 68 39philippine.de-schonen@renault.com

|

|

|

| RENAULT

GROUP PRESS RELATIONS

|

|

Frédéric Texier+33

6 10 78 49 20frederic.texier@renault.com |

Rie Yamane+33 6

03 16 35 20rie.yamane@renault.com |

|

1 2022 adjusted to reflect the disposal of AVTOVAZ and Renault

Russia

2 France, Italy, Germany, Spain, United Kingdom3

Includes EV, Hybrid (HEV) and Plug-In Hybrid (PHEV), excludes

Mild-Hybrid (MHEV)4 France, Italy, Germany, Spain and the United

Kingdom5 Includes EV, Hybrid (HEV) and Plug-In Hybrid (PHEV),

excludes Mild-Hybrid (MHEV)

6 In order to analyze the change in consolidated

revenue at constant scope and exchange rates, Renault Group

recalculates revenue for the current financial year by (applying

the average exchange rates of the previous period and excluding

significant changes in scope during the period

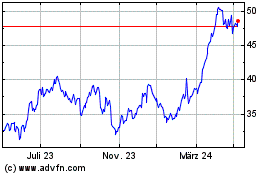

Renault (EU:RNO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

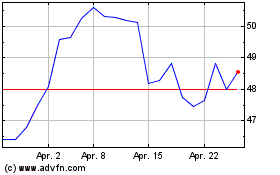

Renault (EU:RNO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024