Regulatory News:

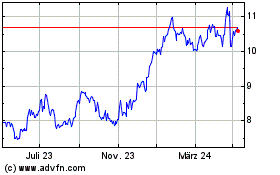

Mercialys (Paris:MERY):

- The food retailers Intermarché, Auchan and Carrefour will

gradually replace the Casino group banners and therefore

considerably improve the Company’s rental risk profile from 2024.

On the basis of publicly available information, these three

retailers are expected to respectively represent 5.2%, 4.1% and

2.0% of Mercialys’ pro- forma rental base.

- Net recurrent earnings (NRE) came to Euro 109.0 million

(+3.3%), with Euro 1.17 per share, up +3.3%, exceeding the

target for growth of at least +2%. The basis for comparison for

2022 incorporated various elements relating to the health crisis.

On a basis restated for these non-recurring impacts, 2023 NRE are

up +11.0%.

- The combination of the stabilization of the reversion rate,

the +4.1% organic growth in invoiced rents and the limited

vacancy rate of 2.9% fully contributed to the growth in

NRE.

- Tenant retailer sales, up +2.2% from 2022, illustrate

the good level of resilience of business for the Company’s

retailers, supported by the sustainable occupancy cost ratio of

10.7%, compared with 11.1% in 2022.

- The EBITDA margin came to 83.9%, reflecting an

improvement compared with 2022 (83.2%), thanks to the robust

letting performance and the effective management of operating

costs.

- The portfolio value including transfer taxes is down

-7.0% like-for-like at end-2023 (-3.7% for the second half of the

year) factoring in an +86bp increase in the average appraisal rate

to 6.61% (+40bp during the second half of the year). Mercialys’

asset portfolio offers a particularly high yield of 405pb above the

risk-free rate. The EPRA NDV came to Euro 17.10 per share,

down -18.4% for 2023 and -9.1% for the second half of the year,

reflecting the decrease in the value of sites and the revaluation

of fixed-rate debt in marked to market.

- The Company’s growth potential remains intact and is in line

with its focus on maintaining a sound financial structure. The

loan to value ratio (excluding transfer taxes) for 2023 came to

an effectively managed level of 38.9% despite the contraction in

asset values, with an ICR of 5.1x.

- Mercialys’ strong financial position will also enable it to

deploy its project pipeline, which represented Euro 429

million at end-2023, with a view to supporting its future growth,

while maintaining a very strict profitability criterion for

projects of at least 250bp above the refinancing cost.

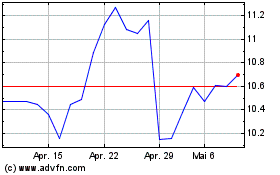

- A proposed dividend of Euro 0.99 per share for 2023, up

+3.1% from 2022. It represents 85% of NRE and offers a

particularly high yield of 9.9% on the end-2023 closing

price.

- 2024 objectives: The Company will maintain its highly

selective approach for choosing its projects and will continue to

focus on ensuring an attractive yield for its shareholders.

Mercialys is targeting NRE per share growth of at least +2.0%,

combined with a dividend ranging from 75% to 95% of 2024 NRE.

Dec 31, 2022

Dec 31, 2023

Change (%)

Organic growth in invoiced rents including

indexation

+4.1%

+4.1%

-

EBITDA (€m)

144.2

149.4

+3.6%

EBITDA margin

83.2%

83.9%

-

Net recurrent earnings (€m)

105.5

109.0

+3.3%

ICR (EBITDA / net finance costs)

5.9x

5.1x

-

LTV (excluding transfer taxes)

35.3%

38.9%

-

LTV (including transfer taxes)

33.0%

36.4%

Portfolio value including transfer taxes

(€m)

3,091.2

2,872.0

-7.0%1

EPRA NRV (€/share)

20.54

18.25

-11.2%

EPRA NTA (€/share)

18.42

16.29

-11.6%

EPRA NDV (€/share)

20.94

17.10

-18.4%

Dividend (€/share)

0.96

0.992

+3.1%

i. full-year business and results

1 - Mercialys is becoming the only real estate partner of all

the major French food distribution networks

On December 18, 2023, the Casino group announced that it had

entered exclusive negotiations with Intermarché and Auchan Retail

with a view to selling virtually the entire scope of Casino group

hypermarkets and supermarkets (excluding Corsica) to Groupement Les

Mousquetaires and Auchan Retail. Following these exclusive

negotiations, Casino announced on January 24 that it had reached

agreements with Auchan Retail and Groupement Les Mousquetaires to

sell 288 stores. This operation, which remains subject to approval

by the competition authorities, is expected to be carried out in

the second quarter of 2024, after consulting with the relevant

employee representative bodies. The agreements plan for the stores

to be transferred in three successive waves: on April 30, 2024, May

31, 2024 and July 1, 2024.

The portfolio of Casino group hypermarkets and supermarkets in

Corsica, where Mercialys has a 60% stake in five Casino

hypermarkets that it owns in partnership with the company Corin,

has not been included by the Casino group in this sales

agreement.

On January 24, 2024, Carrefour also announced that it has

entered into exclusive negotiations with Groupe Intermarché to

acquire 31 stores. Under the terms of the agreement, Carrefour will

substitute Intermarché for the purchase of 26 stores from Casino,

while the remaining 5 stores will be acquired directly from

Intermarché.

On January 25, 2024, the magazine LSA published the list of the

31 points of sale, including the Lanester and Le Puy hypermarkets,

owned by Mercialys.

Through this deep realignment of the retail sector in France,

Mercialys, whose food anchoring was represented exclusively by the

Casino group, which accounted for 20.5% of its rental income in

2023 on a consolidated basis, will become the only European retail

property company to partner with all the major French food

retailers.

Mercialys is once again setting out its strategic conviction to

maintain significant exposure within its rental revenues to food

retail, an asset class offering a foundation for recurring

index-linked revenues.

At end-2023, Mercialys’ rental exposure to large food stores is

split between:

- 5 food stores (including one Monoprix store) operated by Casino

and fully owned by Mercialys

- 5 food stores operated by Casino and 60% owned by

Mercialys

- 10 food stores (9 operated by Casino and 1 by Intermarché since

October 1, 2023) 51% owned by Mercialys (through SAS Immosiris and

SAS Hyperthetis Participation, both 49% owned by BNPP Real

Estate)

- 5 food stores (3 operated by Monoprix, 1 by Casino and 1 by

Intermarché since October 1, 2023) 25% owned by Mercialys (through

SCI AMR, 75% owned by Amundi).

Taking into account the share of rental income depending on how

assets are held through these various entities, Mercialys’ economic

exposure to rent from retailers operated by the Casino Group comes

to 17.4%.

On a pro forma basis and based on information published in the

press (above and article of January 22, in the magazine LSA) and

subject to the final breakdown of the various hypermarkets, the

retailers Intermarché, Auchan and Carrefour would respectively

represent 5.2%, 4.1% and 2.0% of rents on an economic basis.

This realignment will modify and considerably improve the

Company’s rental risk profile. It will make it possible to replace

single-tenant exposure to one struggling retailer with multi-tenant

exposure to retailers that have sound financial foundations and

robust commercial performance levels.

This operation will also make a significant contribution to the

drive to diversify Mercialys’ rental base: the Company’s current

leading tenant will represent considerably less than 10% of the

rental base.

In addition, Mercialys may be able to support these operators,

if required, to optimize their concept and format, capitalizing on

its experience with asset transformation and in synergy with the

adjoining shopping centers.

Looking beyond this scope for sites where Mercialys is directly

exposed to large food stores:

- 19 of its shopping centers are currently anchored by Casino

hypermarkets whose premises it does not own and which are subject

to proposed food banner transfers to Intermarché and Auchan;

- 7 of its shopping centers are already anchored by hypermarkets

whose premises it does not own and which are operated by retailers

other than Casino: Super U in Rennes, Rodez, Montauban, Carrefour

in Le Port, Saint-Benoît and Saint-Pierre (Reunion Island),

RunMarket (Intermarché partner) in Sainte-Marie (Reunion

Island).

Across all these sites, the attractive price positioning of

Intermarché, Auchan and Carrefour will consolidate Mercialys’

retail mix, focused on affordable day-to-day products, and will

support the consistency of the offering, help drive footfall in its

centers and boost the retailers’ operational performances.

2 - The excellent commercial performances by the centers,

focused on day-to-day needs, are supporting the good trend for

operational indicators

In 2023, the +0.6% increase in household purchasing power,

supported by higher wages and savings income, was reflected in

+0.7% growth in consumption, following +2.1% in 2022, according to

the latest projections of the Banque de France (Dec 19, 2023). This

trend masks a number of trade-offs made by consumers with their

spending to limit the impacts of inflation, which remained high in

2023, with consumer prices climbing +4.5 % year-on-year in the last

quarter of 2023.

Footfall in Mercialys’ shopping centers (excluding hypermarkets)

is up +1.4% for 2023, compared with +1.9% for the Quantaflow

national index. The -50bp performance differential compared with

the national index was reduced throughout the year (-140bp at

end-June and -80bp at end-September) and reflects the attractive

positioning of the centers, offsetting the deceleration of the

hypermarkets managed by the Casino group, which recorded a -8.7%

decline in footfall over the year.

From October 15, 2023, the opening under the Intermarché banner

of two hypermarkets previously operated by Casino and owned by

Mercialys in Le Puy (51% stake, with the remaining interest held by

BNPP Real Estate) and Besançon (25% stake, with the remaining

interest held by Amundi), has been well-received by customers. As a

result, the footfall at the Besançon hypermarket have shown a

significant improvement in the last two months of the year, with an

increase of +24.9% in November and +37.5% in December, compared to

stable footfall in the first 9 months of 2023.

In this context, the average basket for consumption at the

Company’s centers continued to progress in 2023 to reach Euro 20.3

per visitor, compared with Euro 19.3 in 2022 (+5.2%). Looking

beyond the impact of inflation, this increase reflects the

continued attractive positioning of Mercialys’ shopping centers

through their affordable offering focused on essential needs, which

is proving resilient faced with the trade-offs that consumers are

being forced to make.

This increase in the transformation rate helped drive further

progress with retailer sales across Mercialys’ portfolio, up +2.2%

in 2023 compared with 2022, while the national panel (FACT)

increased by +3.3%.

Change in the relative performance of Mercialys shopping

centers vs. the national panel (FACT) for 2023

Sales (year to)

1st half of 2023

2nd half of 2023

End-December 2023

Mercialys’ retailers

+3.5%

-1.3%

+2.2%

FACT activity index

+4.8%

-1.4%

+3.3%

Delta

-130bp

+10bp

- 110bp

The outperformance by the FACT panel, linked mainly to a very

favorable base effect during the first quarter (large shopping

centers had been affected by the rollout of the vaccine pass in the

first quarter of 2022), reversed during the second half of the

year, reflecting the good commercial performance by Mercialys’

retailers.

The occupancy cost ratio3 was 10.7% in 2023, compared

with 11.1% in 2022 and 10.9% for the first half of 2023. This

ratio, which shows an improvement and remains at a particularly

measured level, makes it possible to assess the sustainability of

rents for the Company’s tenant retailers. This reasonable real

estate occupancy cost is underpinned by an average level of service

charges per sq.m (excluding property taxes) for retailers of Euro

48, reflecting the increase in charges due to inflation, as well as

the Company’s extensive work to limit its impact, particularly

through energy efficiency measures.

Alongside this, the collection rate for rent and charges

for 2023 was 96.3% at end-January 2024, while noting that to date,

the Casino group is paying its rents in line with its contractual

commitments.

The current financial vacancy rate4 came to 2.9% at

end-December 2023, showing a significant improvement compared with

the 3.3% recorded at end-June 2023 and in line with the 2.9% from

end-December 2022.

This stability of the current financial vacancy rate is

particularly satisfactory considering the significant number of

retailers, primarily in the textile sector, that filed for

bankruptcy or went into liquidation in 2023 in a context of the

emergence from the health crisis and the withdrawal of government

support measures.

Mercialys’ intense reletting activity throughout 2023 enabled it

to keep the current financial vacancy level effectively under

control at just 40bp above its all-time low of 2.5% from 2019.

This robust performance is illustrated by the 150 leases signed

for renewals or reletting during 2023, as in 2022. While the

year-on-year comparison is not meaningful considering the diversity

of the lease schedule, Mercialys recorded a very sustained

commercial performance and an acceleration in the last quarter.

The 2023 reversion rate, linked to these negotiations,

was stable (+0.1%) and consistent with the high level of indexation

in 2023 of +3.7%.

Mercialys’ strategy of continuing to focus its retail mix moving

towards recognized, affordable and essential retailers for

consumers was illustrated by the leases signed in 2023, reflecting

its focus on continuing to enhance the letting potential and

attractive features of its sites. This concerns both leading assets

and sites that are looking to reconquer positions within Mercialys’

portfolio.

Among the leading centers, Angers and Nîmes saw new leases

signed in 2023 with retailers that are popular with clients, such

as Rituals, Darty, Intimissimi, The Waffle Factory and Amorino in

Angers, and Adidas Originals, Project X Paris, Adopt, Rituals,

Bouygues Telecom and La Fabrique Cookies in Nîmes.

In terms of the centers that are in a reconquest phase, the

Fenouillet center in Toulouse benefited from 14 leases signed in

2023, with 4 in the culture-leisure-gifts segment (including Wizzle

and Media Clinic) and 3 in health-beauty (Krys Audition, Afflelou

and La Boutique du Coiffeur), as well as the discount fashion

retailer Naumy in a mid-size unit. The Annecy center, which also

opened a Megarama cinema at the start of the year, signed several

leases with leading national retailers such as New Yorker and

Normal.

These leases illustrate Mercialys’ ability to relet its units

following defaults by retailers, while scaling back the weighting

of textiles and expanding the selection offered to consumers,

helping further strengthen the letting potential of its sites.

The retail mix, excluding large food stores, of the 150 leases

signed for renewals and relettings in 2023, presented in the chart

below, clearly illustrates this in-depth trend.

Personal items accounted for 20% of the new leases signed (in

terms of the number), while this category represents 36.5% of the

Company’s rental base excluding large food stores at end-2023.

Health-beauty accounted for just under 27% of the leases signed in

2023, while this segment currently represents 16.4% of the rental

base excluding large food stores at end-2023.

Breakdown of renewals or reletting leases signed in 2023 by

business segment

[Graphic omitted]

3 - Net recurrent earnings growth exceeding the target set,

driven by sustained organic growth and the effective management of

operating costs and financial expenses

Invoiced rents came to Euro 177.5 million, up +2.8% on a

current basis and +4.1% like-for-like. These changes reflect the

following elements:

Year to end-December

2022

Year to end-December

2023

Indexation

+1.9 pp

+€3.3m

+3.7 pp

+€6.3m

Contribution by Casual Leasing

+0.7 pp

+€1.3m

-0.3 pp

-€0.5m

Contribution by variable rents

-0.1 pp

-€0.3m

+1.1 pp

+€1.9m

Actions carried out on the portfolio

+1.0 pp

+€1.7m

-0.8 pp

-€1.4m

Accounting impact of “Covid-19 rent

relief” granted to retailers

+0.5 pp

+€0.9m

+0.4 pp

+€0.8m

Like-for-like growth

+4.1 pp

+€6.9m

+4.1 pp

+€7.1m

Asset acquisitions and sales

-2.5 pp

-€4.3m

-1.2 pp

-€2.0m

Other effects

-0.2 pp

-€0.4m

-0.1 pp

-€0.2m

Growth on a current basis

+1.3 pp

+€2.3m

+2.8 pp

+€4.9m

Organic growth5 in invoiced rents, up +4.1%,

reflects the impact of indexation at +3.7% and the contribution by

variable rents, illustrating the good level of business for tenant

retailers.

The contribution from Casual Leasing is down slightly for

the full year in 2023. This business was impacted by the decrease

in hypermarket footfall levels for certain types of activities.

The scope effects had a Euro -2.0 million impact on

rental income for 2023, linked mainly to the sales completed in

April 2022 (Géant Casino hypermarkets in Annecy Seynod and

Saint-Etienne Monthieu) and December 2022 (Marseille Sainte-Anne

and Marseille Croix-Rouge centers).

Rental revenues are up Euro +4.7 million (+2.7%) compared

with 2022 to Euro 178.0 million, reflecting the change in invoiced

rents and the drop in lease rights and despecialization

indemnities.

Net rental income is up +3.0% end-2023 to Euro 170.9

million. Two key factors were behind this change.

The Company benefited from the lower level of management fees

paid after various activities were brought in-house beginning 2023

for around Euro 6 million. However, in 2022, Euro +7.8 million of

net income was recorded for various impacts relating to the health

crisis: a non-recurring positive effect linked to reversals of

provisions for arrears recorded for 2020-2021 for a total of Euro

+9.2 million and, alongside this, a Euro -1.4 million expense

relating to rent relief. In 2023, the net impact relating to this

exceptional situation was very limited, representing Euro +0.4

million, split between a Euro -0.7 million expense corresponding to

relief on the rent billed and a reversal of provisions relating to

the arrears resulting directly from the health crisis for Euro +1.1

million. Excluding these non-recurring items associated with the

health crisis, net rental income would be up +7.8% for 2023.

Despite this strong basis of comparison effect, EBITDA

totaled Euro 149.4 million, up +3.6% from 2022. An indicator for

the efficiency of the Company’s operational management, EBITDA

benefited from the rental income growth achieved and was supported

by strict control over site operating costs and overheads. The

EBITDA margin is up to 83.9% (vs. 83.2% in 2022).

The net financial expenses used to calculate net

recurrent earnings totaled Euro 29.6 million, stable compared with

2022 (Euro 29.7 million). The real average cost of drawn

debt was 2.3% for the full year in 2023, compared with 2.1% at

end-June 2023. The +30bp increase compared with end-2022 (2.0%) is

linked primarily to the fixed/floating rate products extinguished,

helping further strengthen the hedging of fixed-rate debt, up to

96%, in line with what the Company had announced in a context of

interest rate volatility. However, the increase in financial income

from the cash invested made it possible to largely offset the

increase in the average cost of drawn debt.

Other operating income and expenses (excluding capital

gains or losses on disposals and impairment) came to Euro +2.2

million, compared with Euro +0.6 million in 2022, primarily

including the impact of net reversals of provisions. Specifically,

a Euro 2.1 million provision for a dispute concerning a site on

Reunion Island, relating to an issue with the road network, was

reversed at the end of June 2023.

The tax retained to calculate net recurrent earnings

represents a Euro -0.6 million expense at end-December 2023,

compared with Euro -0.5 million at end-December 2022. This amount

corresponds primarily to a CVAE corporate value-added tax

expense.

The share of net income from associates and joint

ventures (excluding capital gains or losses, amortization and

impairment) came to Euro 3.6 million in 2023, compared with Euro

3.7 million at December 31, 2022.

Non-controlling interests (excluding capital gains or

losses, amortization and impairment) came to Euro -11.2 million for

2023, compared with Euro -10.4 million in 2022.

Net recurrent earnings are up +3.3% from 2022 to Euro

109.0 million. This operational performance enabled the Company to

record Euro 1.17 of net recurrent earnings per share6, up +3.3%,

with this performance exceeding the target set for net recurrent

earnings per share growth of at least +2% versus 2022. As indicated

above, the basis for comparison at December 31, 2022 benefited from

Euro +7.8 million of net income for various impacts relating to the

health crisis, compared with Euro +0.4 million of net income in the

accounts at end-December 2023. Net recurrent earnings restated for

these non-recurring items would be up +11.0%.

(In thousands of euros)

Dec 31, 2022

Dec 31, 2023

Change (%)

Invoiced rents

172,602

177,495

+2.8%

Lease rights and despecialization

indemnities

674

515

-23.6%

Rental revenues

173,277

178,010

+2.7%

Non-recovered building service charges and

property taxes and other net property operating expenses

-7,345

-7,086

-3.5%

Net rental income

165,932

170,924

+3.0%

Management, administrative and other

activities income

2,846

3,078

+8.1%

Other income and expenses

-5,859

-4,433

-24.3%

Personnel expenses

-18,690

-20,169

+7.9%

EBITDA

144,229

149,400

+3.6%

EBITDA margin (% of rental revenues)

83.2%

83.9%

-

Net financial items (excluding

non-recurring elements 7)

-29,659

-29,593

-0.2%

Reversals of / (Allowances for)

provisions

-2,527

-4,774

+88.9%

Other operating income and expenses

(excluding capital gains or losses on

disposals and impairment)

624

2,179

na

Tax expense

-463

-634

+36.9%

Share of net income from associates and

joint ventures

(excluding capital gains or losses,

amortization and impairment)

3,680

3,574

-2.9%

Non-controlling interests

(excluding capital gains or losses,

amortization and impairment)

-10,360

-11,191

+8.0%

Net recurrent earnings 8

105,524

108,961

+3.3%

Net recurrent earnings per share

(€)

1.13

1.17

+3.3%

ii. Very healthy financial structure making

it possible to absorb the portfolio value adjustment

1. - EPRA Net Disposal Value (NDV) down -9.1% over six months

and -18.4% over 12 months, reflecting the lower valuation of sites

and a significant impact of the revaluation of fixed-rate debt in

marked to market

Mercialys’ portfolio value came to Euro 2,872.0 million

including transfer taxes, down -3.8% over six months and - 7.1%

over 12 months. Like-for-like9, it is down -3.7% over six months

and -7.0% over 12 months.

Excluding transfer taxes, the portfolio value was Euro 2,692.3

million, down -3.8% over six months and -7.1% over 12 months.

Like-for-like9, it is down -3.7% over six months and -7.0% over 12

months.

At end-December 2023, Mercialys’ portfolio mainly comprised

48 shopping centers10, with 25 large regional shopping centers and

23 leading local retail sites.

The average appraisal yield rate was 6.61% at December

31, 2023, compared with 5.75% at December 31, 2022 and 6.21% at

June 30, 2023. This decompression of the appraisal rates by 40bp

during the second half of the year and 86bp over the full year

reflects the context of rising interest rates between 2022 and

2023, as well as an overall increase in the risk premium recognized

by the appraisers across the real estate sector in general and

specifically for Mercialys, with this risk considered to be higher

with regard to the sustainability of rental income from the Casino

group, before the completion of the restructuring process. However,

the economic and financial assumptions retained by the appraisers

do not show any fundamental changes from year to year, reflecting

the strong position of the Company’s sites, illustrated by a low

vacancy rate and the positive indexation.

This decompression of the appraisal rate to 6.61% enables

Mercialys to offer a significant yield spread on its assets of

405bp versus the risk-free rate (10-year OAT) at December 31,

2023.

One would need to go back to 2006 to find a relatively similar

appraisal rate of 6.30% for Mercialys, which at the time

represented a yield spread versus the OAT of 231bp, some way below

the level recorded at end-2023. During this period of over 15

years, the Company has made in-depth changes to the structure of

its asset portfolio through a large-scale realignment,

transitioning from 157 assets to 48 sites. The Company has further

strengthened its portfolio considerably through these successive

rationalizations, with the unit value of its assets up to Euro 60

million in 2023 compared with Euro 8.1 million in 2006.

The EPRA net asset value indicators are as follows:

EPRA NRV

EPRA NTA

EPRA NDV

Dec 31, 2022

Jun 30, 2023

Dec 31, 2023

Dec 31, 2022

Jun 30, 2023

Dec 31, 2023

Dec 31, 2022

Jun 30, 2023

Dec 31, 2023

€ / share

20.54

19.03

18.25

18.42

16.99

16.29

20.94

18.80

17.10

Change over 6 months

+0.9%

-7.4%

-4.1%

+1.0%

-7.8%

-4.1%

+6.6%

-10.2%

-9.1%

Change over 12 months

+0.1%

-6.5%

-11.2%

+0.2%

-6.9%

-11.6%

+19.0%

-4.3%

-18.4%

The EPRA Net Disposal Value (NDV) came to Euro 17.10 per

share, down -9.1% over 6 months and -18.4% over 12 months. The Euro

-3.84 per share change over 12 months takes into account the

following impacts:

- Dividend payment: Euro -0.96;

- Net recurrent earnings: Euro +1.17;

- Change in unrealized capital gains or losses11: Euro -2.04,

including a yield effect for Euro -4.07, a rent effect for Euro

+1.90 and other effects12 for Euro +0.13;

- Change in fair value of fixed-rate debt: Euro -1.53;

- Change in fair value of derivatives and other items: Euro

-0.49;

2. - Loan to value ratio (LTV) including transfer taxes of

36.4% and ICR of 5.1x reflecting a particularly solid financial

profile

The real average cost of drawn debt13 for 2023 came to

2.3%, following a limited increase compared with the 2.0% recorded

at end-2022 and 2.1% at end-June 2023. This change is linked mainly

to the instruments set up to fix and extinguish the fixed/floating

rate products, helping further strengthen debt hedging. In a

context of interest rate volatility and significant increases in

rates from the first half of 2022, Mercialys further strengthened

its hedging rate for its fixed-rate debt, up to 96% for 2023. For

2024, the hedging instruments set up on the residual debt will make

it possible to reach 100% hedging for fixed-rate debt, with

the real average cost of drawn debt, on this basis, expected to

move closer to the average cost of bond debt, i.e. 2.6%.

At end-December 2023, drawn debt represented Euro

1,192 million. It is made up of three bond issues and a private

placement, with a residual nominal amount of Euro 1,150 million, as

well as commercial paper, with Euro 42 million outstanding at

end-December 2023. Alongside this, the cash position totaled Euro

118 million at end-2023.

The average maturity of drawn debt was 3.8 years

at December 31, 2023, compared with 4.2 years at end-June 2023 and

4.5 years at December 31, 2022. Excluding commercial paper,

Mercialys does not have any drawn debt maturities before February

2026.

Mercialys continues to benefit from a very healthy financial

structure, with an LTV ratio excluding transfer taxes14

of 38.9% at December 31, 2023 (compared with 38.6% at June

30, 2023 and 35.3% at December 31, 2022) and an LTV ratio including

transfer taxes of 36.4% on the same date (versus 36.1% at June 30

and 33.0% at December 31, 2022). The LTV ratio is significantly

below the bank covenant level of 55% concerning 92% of the undrawn

lines.

The ICR was 5.1x 15 at December 31, 2023, compared with

5.2x at June 30, 2023 and 5.9x at December 31, 2022, reflecting the

impacts of the operational performance on EBITDA. It is

significantly higher than the minimum level of at least 2x set by

the bank covenants.

Mercialys also has Euro 385 million of undrawn financing

resources, stable compared with end-December 2022, with the

maturity of 90% of them extended in 2023. The average maturity of

undrawn bank resources represents 2.9 years. In addition, at

end-2023, 100% of the undrawn bank lines included ESG criteria,

compared with just over 53% at end-2022.

On October 20, 2023, Standard & Poor’s confirmed its BBB

/ stable outlook rating for Mercialys.

With its particularly robust balance sheet, Mercialys has the

capacity to accelerate its growth through its major project

pipeline, as well as opportunities for acquisitions.

iii. Resilient risk profile and effectively

managed growth

At the end of the financial year 2023, with an uncertain

economic environment, excellent operational and financial

performances and relatively marked adjustments to the property

values by the appraisers, Mercialys is moving into 2024 with a

significant change in its food retail exposure.

In this context, the Company will continue to be ambitious as it

looks to grow its real estate fundamentals, while benefiting from

the relaunch of the hypermarkets anchoring its portfolio and

deploying its resources to work on its project pipeline and

potential for investments.

1. - Focusing on the key financial balances

Following an intense phase to rationalize its portfolio from

2019 to 2022, when Mercialys divested close to Euro 500 million of

assets (100%-owned) after considerably developing their attractive

positioning, the Company is maintaining its opportunistic approach

to new disposals with a view to focusing on the most promising

sites with potential for medium-term growth in terms of value

creation.

Thanks to its very sound financial structure, the Company has

resources in place to firmly commit to a development phase over the

coming years.

This growth strategy will be achieved through the development

pipeline or through targeted accretive acquisitions focused on

retail property or related activities, including shopping centers,

retail parks and storage centers. Specifically, the Company will

aim to ensure that the yield on these operations is at least 250bp

higher than the refinancing cost for the projects or

acquisitions.

2. - Continuing to make progress with the Company’s

management in line with the core pillars of the 2020-2030 CSR

strategy

In 2023, Mercialys made concrete progress with key milestones

from the roadmap set out with its 10-year CSR strategy “4 Fair

Impacts for 2030”.

Various objectives aimed at improving the environmental

footprint of sites are showing very positive trends, including:

- a reduction in greenhouse gas emissions per sq.m by -24%

compared with 2020 and -35% versus 2017, the date when Mercialys

rolled out its carbon trajectory,

- a waste recovery rate of 66.2%,

- 100% BREEAM In Use certification for strategic centers,

including the regular renewal of this certification in line with

the increasingly demanding rating criteria. Illustrating this, the

average score of strategic assets in part 2 is 72.0%,

- nearly 60% of the strategic centers have multifunctional

spaces and 75.9% are equipped with electric vehicle charging

stations.

This strategy also concerns the Company’s ethical management,

and this dimension is illustrated in particular by its very good

performance in terms of gender equality, measured by the workplace

equality index (drawn up by the French Ministry of Labor,

Employment and Inclusion), after Mercialys scored 93 / 100 in 2023,

compared with a national average of 88 / 100.

Lastly, Mercialys structures its governance in line with the

best corporate governance standards, as illustrated by its Board of

Directors, since 78% of its directors are independent and 56% are

women.

The Company’s committed approach around the various CSR pillars

is recognized by the leading sustainability rating agencies and

public authorities. In 2023, Mercialys was once again ranked second

for the representation of women in management structures on the SBF

120. The Company also maintained its second-place ranking in its

category (listed retail property companies in Europe) in the GRESB,

with a high score of 89/100, and was recognized as a “Regional and

Industry Top ESG Performer” for the third year running by

Sustainalytics. Lastly, in February 2024, Mercialys was included in

the Carbon Disclosure Project’s Climate A List for the sixth

consecutive year.

3. - Capitalizing on opportunities for external growth,

illustrated by the achievements in 2023

The two external growth operations carried out in 2023

contribute to the desire for development and the creation of new

real estate tools.

In September 2023, Mercialys announced the acquisition, in two

phases, of the investment management company Imocom Partners. In

December 2023, after this operation was approved by the French

financial markets authority (AMF), Mercialys acquired 30% of the

capital from the company’s longstanding shareholders for Euro 5.7

million. The remaining 70% will be acquired by the Company during

the first half of 2025, after the approval by the French financial

market authority and following an interim period during which the

current management team will accompany and support the company’s

development. The price of this second tranche will be adjusted

based on the performance of the SGP and the underlying fund.

Imocom Partners manages the OPPCI investment fund ImocomPark,

which holds a portfolio of 33 retail parks in France, with a total

rental area of over 385,000 sq.m, let to around 400 tenants. The

fund’s assets represent a value of Euro 652 million including

transfer taxes and generate Euro 40 million of annual rental

income.

This operation offers increased visibility in relation to tenant

retailers, while increasing the Company’s capacity to work on

retail or mixed real estate development projects. In a context of

pressures on land reserves, linked in particular to the French

Climate and Resilience Act, land management is becoming

increasingly important and will open up opportunities that

Mercialys and Imocom Partners aim to capitalize on.

Lastly, the development of new retail property funds represents

a major source of value creation for Mercialys.

In 2023, Mercialys also took up a major stake in the round of

fundraising carried out by DEPUR Expériences to become this

company’s second largest shareholder, after its founder, with just

under 23% of its capital, for a total of Euro 1.1 million.

This investment in a company specialized in the design and

execution of major Food & Beverage & Entertainment

(F&B&E) projects, alongside Bouygues Immobilier and the BPI

Tourism/Leisure fund, further strengthened Mercialys’ expertise

covering fine-grained consumption trends.

DEPUR’s approach involves structuring in one place a range of

food and beverage and entertainment services for a customer

experience that extends well beyond culinary know-how.

Thanks to the funds raised with this operation, DEPUR has

resources in place to accelerate its development and further

strengthen its expertise, with its ambition to establish itself as

the first vertically integrated operator specialized in the

F&B&E sector, from conceptualization through to

operations.

4. - Implementing the project pipeline

At end-2023, the pipeline of projects already identified and

likely to be deployed on the mid-term represented Euro 429 million,

as presented below. Mercialys will continue to focus its

development on the retail sector, while capitalizing on its various

areas of real estate expertise, enabling it to take part in calls

for tenders for mixed-use development projects organized by cities

or local authorities looking to reposition their neighborhoods or

developments incorporating property development margins.

The pipeline’s other projects concern 28 sites out of the 48

shopping centers held by Mercialys and include retail space

projects (redevelopments, extensions, retail parks), dining and

leisure projects, and tertiary activity projects (housing,

healthcare, coworking, etc.). This potential reconfiguration of

sites will make it possible to ensure their continued appeal

looking beyond purely convenience retail aspects, while ensuring

the sustainability of their strong positioning in their catchment

areas and their cash flow generation profile over the long

term.

The increase in both borrowing rates and construction costs is

leading to a highly selective approach for projects, which must

meet a demanding criterion for a yield of 250bp above the

refinancing cost. Investments will also need to meet strict quality

criteria in terms of rental exposure (resilient sectors) and

geographic location.

Around 30% of the investment projects concern dining, leisure

and tertiary activities, illustrating the diversification around

projects connected to the retail sector.

(In millions of euros)

Total investment

Investment still to be

committed

Completion date

COMMITTED PROJECTS16

20.2

18.8

2024 / 2026

Tertiary activities

20.2

18.8

2024 / 2026

CONTROLLED PROJECTS

181.2

171.3

2024 / 2026

Retail

152.2

142.6

2024 / 2026

Dining and leisure

14.1

14.0

2025 / 2026

Tertiary activities

14.9

14.7

2025 / 2026

IDENTIFIED PROJECTS

227.5

227.2

2024 / > 2028

Retail

148.5

148.3

2024 / > 2028

Dining and leisure

65.9

65.8

2026 / > 2028

Tertiary activities

13.1

13.1

2025 / > 2028

Total

428.8

417.4

2024 / > 2028

- Committed projects: projects fully secured in terms of land

management, planning and related development permits

- Controlled projects: projects effectively under control in

terms of land management, with various points to be finalized for

regulatory urban planning (constructability), planning or

administrative permits

- Identified projects: projects currently being structured, in

emergence phase

IV. Outlook and dividend

Outlook for 2024

In an environment in which interest rates could remain

considerably higher than the levels from 2015 to 2022, the Company

is moving forward in 2024 with significant assets in place.

Mercialys’ rental risk profile will improve considerably and see

a clear pivot, thanks to the gradual replacement of the Casino

group banners, the Company’s legacy tenant, which still represented

17.4% of rental income in 2023, while benefiting from a diversified

anchoring with all of the major food operators in France.

Mercialys is also once again setting out its strong attachment

to food retail as the foundation for its rental base considering

the proximity and recurrence that it generates with consumers, in

line with the positioning of the centers.

The Company’s sound financial foundations and the visibility

offered by indexation, a core pillar supporting a balanced

landlord-tenant relationship, while continuing to carefully monitor

the solvency of client retailers, enable Mercialys to set the

following objectives for 2024:

- Net recurrent earnings per share growth of at least +2.0% vs.

2023;

- Dividend to range from 75% to 95% of 2024 net recurrent

earnings.

The change in the lower range to 75% of net recurrent earnings

for the year, compared with 85% previously, will make it possible

to free up additional capacity to fund investments in 2024 if

necessary.

Mercialys could capitalize on the opportunity opened up by the

changes in the hypermarkets anchoring its sites to work in

partnership with the new retailers to further strengthen the appeal

for clients (comfort, services, renovations) and establish new

mid-size stores and retailers with activities that effectively

complement those of the hypermarkets, the majority of which have

realigned around their food offering.

In connection with its project pipeline following the work

carried out in the last two years on significant calls for projects

(Chartres and Angers), the Company will need to hold land reserves

while waiting for the work to start up.

This payout range contributes to a yield per share that will

continue to be particularly attractive for 2024, with the financing

potential freed up in this way to support the return for

shareholders over the medium term.

Dividend for 2023

Mercialys’ Board of Directors will submit a proposal at the

General Meeting on April 25, 2024 for a dividend of Euro 0.99

per share, compared with a dividend of Euro 0.96 per share for

2022. The payout corresponds to 85% of 2023 net recurrent earnings

and offers a yield of 5.8% on the NDV of Euro 17.10 per share at

end-2023 and 9.9% on the year’s closing price.

For the last three years, Mercialys will have paid out Euro 2.87

of dividends, representing 85% of its recurrent earnings and

providing an average yield of 10.1% for its shareholders over this

period. Mercialys is therefore fulfilling its role as a listed real

estate investment company (SIIC).

The proposed dividend for 2023 is based on the distribution

requirement with the SIIC tax status concerning exempt profits

from:

- property rental or sub-letting operations (including dividends

paid by the subsidiaries subject to the SIIC system), i.e. Euro

0.86 per share;

- the distribution of exempt income recorded on the Company’s

balance sheet for Euro 0.13 per share.

The ex-dividend date is April 29, 2024, with the dividend to be

paid on May 2, 2024.

* * *

This press release is available on

www.mercialys.com.

A presentation of these results is also

available online, in the following section:

Investors / News and press releases / Financial

press releases

About Mercialys

Mercialys is one of France’s leading real estate companies. It

is specialized in the holding, management and transformation of

retail spaces, anticipating consumer trends, on its own behalf and

for third parties. At December 31, 2023, Mercialys had a real

estate portfolio valued at Euro 2.9 billion (including transfer

taxes). Its portfolio of 2,038 leases represents an annualized

rental base of Euro 175.5 million. Mercialys has been listed on the

stock market since October 12, 2005 (ticker: MERY) and has “SIIC”

real estate investment trust (REIT) tax status. Part of the SBF 120

and Euronext Paris Compartment B, it had 93,886,501 shares

outstanding at December 31, 2023.

IMPORTANT INFORMATION

This press release contains certain forward-looking statements

regarding future events, trends, projects or targets. These

forward-looking statements are subject to identified and

unidentified risks and uncertainties that could cause actual

results to differ materially from the results anticipated in the

forward-looking statements. Please refer to Mercialys’ Universal

Registration Document available at www.mercialys.com for the year

ended December 31, 2022 for more details regarding certain factors,

risks and uncertainties that could affect Mercialys’ business.

Mercialys makes no undertaking in any form to publish updates or

adjustments to these forward-looking statements, nor to report new

information, new future events or any other circumstances that

might cause these statements to be revised.

Financial report

Pursuant to Regulation (EC) No. 1606/2002 of July 19, 2002, the

Mercialys Group’s consolidated financial statements were prepared

in accordance with International Financial Reporting Standards

(IFRS) issued by the International Accounting Standards Board

(IASB) as adopted by the European Union and applicable at December

31, 2023. These standards are available on the European Commission

website at:

https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/financial-reporting_en.

The accounting policies set out below were applied consistently to

all the periods presented in the consolidated financial statements,

after taking into account, or with the exception of, the new

standards and interpretations described below.

1. Financial statements

The audit procedures on the consolidated accounts have been

completed. The certification report is currently being issued.

1.1. Consolidated income statement

(In thousands of euros)

Dec 31, 2022

Dec 31, 2023

Rental

revenues

173,277

178,010

Service

charges and property tax

(45,159)

(51,079)

Charges

and taxes billed to tenants

37,883

45,201

Net

property operating expenses

(69)

(1,208)

Net rental income

165,932

170,924

Management, administrative and other

activities income

2,846

3,078

Other

income

424

-

Other

expenses

(6,283)

(4,433)

Personnel expenses

(18,690)

(20,169)

Depreciation and amortization

(37,729)

(38,540)

Reversals of / (Allowances for)

provisions

(2,527)

(4,774)

Other

operating income

88,740

10,647

Other

operating expenses

(86,486)

(30,915)

Operating income

106,227

85,818

Income

from cash and cash equivalents

246

3,185

Gross

finance costs

(53,480)

(38,194)

(Expenses)/ Income from net financial

debt

(53,234)

(35,009)

Other

financial income

1,089

774

Other

financial expenses

(3,939)

(6,085)

Net financial items

(56,083)

(40,321)

Tax

expense

(709)

(495)

Share of

net income from associates and joint ventures

2,380

1,727

Consolidated net income

51,814

46,730

Attributable to non-controlling

interests

8,720

(6,643)

Attributable to owners of the

parent

43,094

53,373

Earnings per share17

Net

income attributable to owners of the parent (in euros)

0.46

0.57

Diluted

net income attributable to owners of the parent (in

euros)

0.46

0.57

1.2. Consolidated statement of financial position

ASSETS (in thousands of euros)

Dec 31, 2022

Dec 31, 2023

Intangible assets

3,381

3,144

Property, plant and equipment other than

investment property

4,743

5,825

Investment property

1,907,148

1,864,950

Right-of-use assets

10,184

10,615

Investments in associates

35,203

39,557

Other

non-current assets

50,219

37,577

Deferred

tax assets

1,601

1,614

Non-current assets

2,012,478

1,963,282

Trade

receivables

28,557

35,936

Other

current assets

31,854

31,902

Cash and

cash equivalents

216,085

118,155

Investment property held for sale

0

1,400

Current assets

276,496

187,393

Total assets

2,288,974

2,150,676

EQUITY AND LIABILITIES (in thousands of

euros)

Dec 31, 2022

Dec 31, 2023

Share

capital

93,887

93,887

Additional paid-in capital, treasury shares

and other reserves

631,246

583,337

Equity

attributable to owners of the parent

725,132

677,224

Non-controlling interests

205,294

188,871

Shareholders’ equity

930,426

866,095

Non-current provisions

1,225

1,406

Non-current financial liabilities

1,131,974

1,131,627

Deposits

and guarantees

23,622

24,935

Non-current lease liabilities

9,409

9,529

Other

non-current liabilities

2,377

4,834

Non-current liabilities

1,168,607

1,172 332

Trade

payables

13,910

9,265

Current

financial liabilities

126,353

53,037

Current

lease liabilities

1,084

1,331

Current

provisions

13,279

15,581

Other

current liabilities

35,237

32,940

Current

tax liabilities

78

95

Current

liabilities

189,941

112,249

Total equity and liabilities

2,288,974

2,150,676

1.3. Consolidated cash flow statement

(In thousands of euros)

Dec 31, 2022

Dec 31, 2023

Net

income attributable to owners of the parent

43,094

53,373

Non-controlling interests

8,720

(6,643)

Consolidated net income

51,814

46,730

Depreciation, amortization(1) and provisions,

net of reversals

46,161

64,054

Calculated expenses/(income) relating to

stock options and similar

773

763

Other

calculated expenses/(income)(2)

(386)

5,559

Share of

net income from associates and joint ventures

(2,380)

(1,727)

Dividends received from associates and joint

ventures

3,065

2,525

Income

from asset disposals

(8,486)

(766)

Expenses/(income) from net financial

debt

53,234

35,009

Net

financial interest in respect of lease agreements

321

344

Tax expense (including deferred tax)

709

495

Cash flow

144,825

152,987

Taxes

received/(paid)

(1,033)

(569)

Change

in working capital requirement relating to operations, excluding

deposits and guarantees(3)

5,816

(19,464)

Change

in deposits and guarantees

515

1,313

Net cash flow from operating

activities

150,124

134,267

Cash

payments on acquisitions of:

investment properties and other fixed

assets

(19,098)

(22,532)

non-current financial assets

(43)

(4)

Cash

receipts on disposals of:

investment properties and other fixed

assets

81,161

3,964

non-current financial assets

1,274

3,146

Investments in associates and joint

ventures

(6,312)

-

Impact

of changes in scope with change of control

(4,292)

-

Change

in loans and advances granted

-

Net cash

flow from investing activities

59,002

(21,740)

Dividends paid to shareholders of the parent

company (final)

(86,025)

(89,565)

Dividends paid to shareholders of the parent

company (interim)

-

-

Dividends paid to non-controlling

interests

(5,437)

(9,780)

Capital

increase and reduction

-

-

Other

transactions with shareholders

-

-

Changes

in treasury shares

(439)

(744)

Increase

in borrowings and financial debt

754,809

109,000

Decrease

in borrowings and financial debt

(880,222)

(192,204)

Repayment of lease liabilities

(1,398)

(1,231)

Interest

received (4)

20,999

17,880

Interest

paid

(52,484)

(43,727)

Net cash flow from financing

activities

(250,198)

(210,371)

Change in cash position

(41,072)

(97,844)

Net cash

at beginning of year

257,071

215,999

Net cash

at end of year

215,999

118,155

of which

cash and cash equivalents

216,085

118,155

of which

bank overdrafts

(87)

-

(1)

Depreciation and amortization exclude the

impact of impairment on current assets

(2)

Other calculated expenses and income

mainly comprise:

- discounting adjustments to construction

leases

(236)

(207)

- lease rights received from tenants and

spread over the firm term of the lease

(662)

2,920

- deferred financial expenses

826

648

- interest on non-cash loans and other

financial income and expenses

(362)

2,024

(3)

The change in working capital requirement

breaks down as follows:

- trade receivables

8,392

(7,462)

- trade payables

(2,863)

(4,646)

- other receivables and payables

287

(7,356)

Total working capital requirement

5,816

(19,464)

(4)

Primarily comprising interest received on

debt hedging instruments in accordance with IAS 7.16

2. Key developments in 2023

Financing

At end-June 2023, Mercialys set up a new credit line for Euro

180 million, maturing in June 2026, with two options for a one-year

extension. This new credit line, which has not been drawn down to

date, incorporates ESG criteria and replaces the Euro 180 million

line due to mature in December 2024.

Change in the rental base

On December 18, 2023, the Casino group announced that it had

entered exclusive negotiations with Intermarché and Auchan Retail

with a view to selling virtually the entire scope of Casino group

hypermarkets and supermarkets (excluding Corsica) to Groupement Les

Mousquetaires and Auchan Retail. Following these exclusive

negotiations, Casino announced on January 24 that it had reached

agreements with Auchan Retail and Groupement Les Mousquetaires to

sell 288 stores. The sales will be completed in the second quarter

of 2024, after consulting with the relevant employee representative

bodies. The agreements plan for the stores to be transferred in

three successive waves: on April 30, 2024, May 31, 2024 and July 1,

2024.

This operation remains subject to the relevant approvals being

obtained from the competition authorities.

The portfolio of Casino group hypermarkets and supermarkets in

Corsica, where Mercialys has a 60% stake in five Casino

hypermarkets that it owns in partnership with the company Corin,

has not been included by the Casino group in this sales

agreement.

On January 24, 2024, Carrefour also announced that it has

entered into exclusive negotiations with Groupe Intermarché to

acquire 31 stores. Under the terms of the agreement, Carrefour will

substitute Intermarché for the purchase of 26 stores from Casino,

while the remaining 5 stores will be acquired directly from

Intermarché.

On January 25, 2024, the magazine LSA published the list of the

31 points of sale, including the Lanester and Le Puy hypermarkets,

owned by Mercialys.

3. Summary of the main key indicators for the period

Dec 31, 2023

Organic growth in invoiced

rents

+4.1%

EBITDA18

149.4

EBITDA/rental revenues

83.9%

Net recurrent earnings 19

109.0

Net recurrent earnings per

share20

1.17

Fair value of the portfolio

(including transfer taxes)

2,872.0

Change vs. Dec 31, 2022 (current

basis)

-7.1%

Change vs. Dec 31, 2022

(like-for-like)

-7.0%

EPRA NDV per share

17.10

Change vs. Dec 31, 2022

-18.4%

Loan to Value (LTV) – excluding

transfer taxes

38.9%

4. Review of activity

4.1. Main management indicators

- The following table presents details of the lease

schedule:

At Dec 31, 2023

Number of leases

Annual MGR* + variable rents

(€m)

Share of leases expiring (%

annual MGR + variable)

Expired at December 31, 2023

350

23.6

13.5%

2024

157

9.0

5.1%

2025

125

7.8

4.4%

2026

170

16.3

9.3%

2027

205

40.7

23.2%

2028

196

15.1

8.6%

2029

176

11.7

6.7%

2030

255

26.0

14.8%

2031

187

11.6

6.6%

2032

118

6.9

3.9%

2033 and beyond

99

6.8

3.9%

Total

2,038

175.5

100%

* MGR: minimum guaranteed rent

- The stock of expired leases at end-2023 reflects the

negotiations underway, refusals to renew leases with the payment of

compensation for eviction, global negotiations for each retailer,

tactical delays, etc. Among the 13.5% of leases due at the end of

2023, 1.7% are the subject of agreements signed in January

2024.

- At end-January 2024, the collection rate for rent and

charges from 2023 represents 96.3%.

- The current financial vacancy rate - which excludes

“strategic” vacancies following decisions to facilitate the

deployment of extension and redevelopment plans - came to 2.9%21 at

December 31, 2023, stable compared with the level from end-2022 and

showing a significant improvement compared with June 30, 2023

(3.3%). Mercialys’ robust letting activity enabled it to offset the

impact of the retailers going into turnaround or liquidation

proceedings, particularly in the textiles sector.

- The total vacancy rate22 was 4.4% at December 31, 2023,

which is also significantly lower than end-June 2023 (4.7%) and

stable compared with end-2022.

- Mercialys’ robust underlying letting performance led to 150

leases being signed for renewals or relettings in 2023, securing a

reversion rate that is stable (+0.1%) and relevant

considering the combination of high indexation in 2023 at

+3.7%.

- Thanks to the positive trend for retailer activity levels, the

occupancy cost ratio23 remained at a still very measured

rate of 10.7% at end-December 2023, down from end-June (10.9%) and

end-December 2022 (11.1%), despite the like-for-like increase in

rents.

The rents received by Mercialys come from a very diverse range

of retailers as, with the exception of the Casino group retailers

(details presented below), no other tenant represents more than 2%

of total rental income.

The Casino group’s restructuring and the in-depth realignment of

the food retail landscape in France, as presented earlier, will

significantly change Mercialys’ rental structure from 2024.

Casino group retailers accounted for 20.5% of total rental

income at December 31, 2023, down from 21.4% at June 30, 2023 and

21.0% at December 31, 2022. This decrease of exposure to the Casino

group is generated by the transfer of the Besançon and Le Puy

hypermarkets to Intermarché.

This consolidated accounting exposure is calculated factoring in

all of the rent paid by Casino group retailers. Mercialys’ economic

exposure to rent from retailers operated by the Casino group came

to 17.4% vs. 18.3% at June 30 and 18.0% at end-2022, after being

adjusted:

(1) downwards for the 49% minority interest held by BNP Paribas

REIM in SAS Hyperthetis Participations and SAS Immosiris, which

together own a total of nine hypermarkets operating under the Géant

Casino banner (with the Le Puy site operated by Intermarché since

October 2023), and

(2) upwards for Mercialys’ 25% minority interest in SCI AMR,

which holds three Monoprix stores and two hypermarkets operating

under the Géant Casino and Intermarché banners.

The lease schedule for Mercialys’ main tenant is presented

below:

Schedule for key Casino group leases

Site

% held by Mercialys

Type

Lease start date

Lease end date

Lease characteristics

Grenoble

100%

Monoprix

02/2010

02/2022

3 - 6 - 9 - 12 commercial

lease

Quimper

100%

Hypermarket

12/2014

12/2026

3 - 6 - 9 - 12 commercial

lease

Aix-en-Provence

51%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Marseille

100%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Brest

51%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Nîmes

51%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Angers

51%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Lanester

100%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Niort

51%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Fréjus

51%

Hypermarket

06/2015

06/2027

3 - 6 - 9 - 12 commercial

lease

Narbonne

51%

Hypermarket

11/2015

11/2027

3 - 6 - 9 - 12 commercial

lease

Istres

51%

Hypermarket

11/2015

11/2027

3 - 6 - 9 - 12 commercial

lease

Clermont-Ferrand

51%

Hypermarket

11/2015

11/2027

3 - 6 - 9 - 12 commercial

lease

Annemasse

100%

Hypermarket

12/2015

12/2027

3 - 6 - 9 - 12 commercial

lease

Ajaccio

60%

Hypermarket

07/2018

06/2030

12-year commercial lease, 9-year

firm period

Corte

60%

Supermarket

07/2018

06/2030

12-year commercial lease, 9-year

firm period

Furiani

60%

Hypermarket

07/2018

06/2030

12-year commercial lease, 9-year

firm period

Porto-Vecchio

60%

Hypermarket

07/2018

06/2030

12-year commercial lease, 9-year

firm period

Toga

60%

Hypermarket

07/2018

06/2030

12-year commercial lease, 9-year

firm period

Top 10 tenant retailers (excluding Casino

Group)

H&M

Feu Vert

Armand Thiery

Nocibé

FNAC

Mango

Orange

Jules

Sephora

Intersport

13.4% of contractual rents on

an annualized basis

The breakdown by retailer (national, local and retailers

associated with the Casino group) of contractual rents on an

annualized basis is as follows:

Number of leases

Annual MGR* + variable rents

(€m)

Percentage of rent (%)

Dec 31, 2023

Dec 31, 2023

Dec 31, 2022

Dec 31, 2023

National and international retailers

1,401

116.4

65.5%

66.3%

Local retailers

591

23.2

13.5%

13.2%

Casino cafeterias / restaurants

2

0.2

0.1%

0.1%

Monoprix

1

1.2

0.7%

0.7%

Géant Casino and other entities

43

34.5

20.2%

19.7%

Total

2,038

175.5

100.0%

100.0%

* MGR: minimum guaranteed rent

The breakdown by business sector (including large food

stores) of Mercialys’ rents is still highly diversified. Through

its various divestment operations, the Company has further

strengthened its strategy for balanced retail-mixes, while

continuing to scale back its exposure to textiles in favor of

sectors such as health and beauty, culture, gifts and sport:

Percentage of rent (%)

Dec 31, 2022

Dec 31, 2023

Restaurants and catering

8.3%

8.6%

Health and beauty

12.7%

13.0%

Culture, gifts and sports

17.5%

17.9%

Personal items

30.0%

28.9%

Household equipment

7.7%

7.7%

Food-anchored tenants

20.5%

20.9%

Services

3.2%

3.0%

Total

100.0%

100.0%

The rental income structure at December 31, 2023 shows

that the majority of leases, in terms of overall rental income,

include a variable clause. The Company’s exposure to purely

variable rents is however very limited, representing 1.7% of the

rental base.

Number of leases

Annual MGR + variable rents

(€m)

Percentage of rent (%)

Dec 31, 2023

Dec 31, 2023

Dec 31, 2022

Dec 31, 2023

Leases with variable clause

1,338

107.5

58%

61%

- of which MGR

103.4

57%

59%

- of which variable rent with MGR

1.1

0%

1%

- of which variable rent without MGR

3.0

2%

2%

Leases without variable clause

700

68.0

42%

39%

Total

2,038

175.5

100%

100%

The rental income structure at December 31, 2023 shows a

predominant share of leases indexed against the French commercial

rent index (ILC). In 2024, as a result of the lease anniversary

dates, the indexation of Mercialys’ rents will be linked for 15% to

the index published in the first quarter of 2023 (+6.69%), with 22%

for the index published in the second quarter of 2023 (+6.60%), 47%

for the index published in the third quarter of 2023 (+5.97%), and

10% for the index published in the fourth quarter of 2023, while

the other indexes represent a residual balance of 6%.

Number of leases

Annual MGR + variable rents

(€m)

Percentage of rent (%)

Dec 31, 2023

Dec 31, 2023

Dec 31, 2022

Dec 31, 2023

Leases index-linked to the retail rent

index (ILC)

1,771

164.8

95%

96%

Leases index-linked to the construction

cost index (ICC)

89

5.4

3%

3%

Leases index-linked to the tertiary

activities rent index (ILAT) and non-adjustable leases

158

1.2

1%

1%

Total

2,018

171.4

100%

100%

5. Review of consolidated results

5.1. Invoiced rents, rental revenues and net rental

income

Rental revenues mainly comprise rents invoiced by the

Company plus a smaller element of lease rights and despecialization

indemnities paid by tenants and spread over the firm period of the

lease (usually 36 months).

(In thousands of euros)

Dec 31, 2022

Dec 31, 2023

Change %

Invoiced rents

172,602

177,495

+2.8%

Lease rights and despecialization

indemnities

674

515

-23.6%

Rental revenues

173,277

178,010

+2.7%

Property taxes

-13,948

-14,265

+2.3%

Rebilling to tenants

11,701

12,048

+3.0%

Non-recovered property taxes

-2,247

-2,217

-1.3%

Service charges

-31,211

-36,813

+18.0%

Rebilling to tenants

26,182

33,152

+26.6%

Non-recovered service charges

-5,029

-3,661

-27.2%

Management fees

-7,073

-952

-86.5%

Rebilling to tenants

4,113

4,032

-2.0%

Losses on and impairment of

receivables

3,263

-4,441

na

Other expenses

-372

153

na

Net property operating expenses

-69

-1,208

na

Net rental income

165,932

170,924

+3.0%

The +2.8 points change in invoiced rents primarily

reflects the following factors:

- the impact of indexation for +3.7 points, representing

Euro +6.3 million;

- contribution by Casual Leasing for -0.3 points,

representing Euro -0.5 million;

- the increase in variable rents for +1.1 points,

representing Euro +1.9 million;

- the actions carried out on the portfolio for -0.8

points, representing Euro -1.4 million;

- the accounting impact of the rent relief granted to retailers

in connection with the health crisis for +0.4 points,

representing Euro +0.8 million;

- the asset acquisitions and sales completed in 2022 and 2023

for -1.2 points, representing Euro -2.0 million;

- other effects primarily including strategic vacancies linked

to current redevelopment programs for -0.1 points,

representing Euro -0.2 million.

Considering the first five effects presented above, organic

growth in invoiced rents shows an increase of +4.1

points.

Lease rights and despecialization indemnities invoiced over

the period24 totaled Euro 3.4 million (compared with Euro 0.2

million at December 31, 2022). After taking into account deferrals

over the firm period of leases as required under IFRS, lease rights

for 2023 totaled Euro 0.5 million, compared with Euro 0.7 million

for 2022.

Rental revenues therefore came to Euro 178.0 million at

December 31, 2023, up +2.7% from end-2022.

Net rental income is up +3.0% from 2022 to Euro 170.9

million. It corresponds to the difference between rental revenues

and the costs that are directly allocated to the sites. These costs

include property taxes and service charges that are not billed back

to tenants, as well as net property operating expenses (primarily

fees paid to the property manager that are not re-invoiced and

various charges relating directly to site operations).

The costs included in the calculation of net rental income

represent Euro 7.1 million for 2023, compared with Euro 7.3 million

in 2022.

In parallel the Company benefited from the lower level of

management fees paid after various activities were brought in-house

in 2022 for around Euro 6 million. However, in 2022, Euro +7.8

million of net income was recorded for various impacts relating to

the health crisis: a non-recurring positive effect linked to

reversals of provisions for arrears recorded for 2020-2021 for a

total of Euro +9.2 million and, alongside this, a Euro -1.4 million

expense relating to rent relief. In 2023, the net impact relating

to this exceptional situation was very limited, representing Euro

+0.4 million, split between a Euro -0.7 million expense

corresponding to relief on the rent billed and a reversal of

provisions relating to the arrears resulting directly from the

health crisis for Euro +1.1 million. Excluding these non-recurring

items intended to spread the impacts associated with the health

crisis, net rental income would be up +7.8% for 2023.

5.2. Management income, operating costs and EBITDA

(In thousands of euros)

Dec 31, 2022

Dec 31, 2023

Change (%)

Net rental income

165,932

170,924

+3.0%

Management, administrative and other

activities income

2,846

3,078

+8.1%

Other income and expenses

-5,859

-4,433

-24.3%

Personnel expenses

-18,690

-20,169

+7.9%

EBITDA

144,229

149,400

+3.6%

% rental revenues

83.2%

83.9%

-

Management, administrative and other activities income

primarily comprises fees charged for services provided by

certain Mercialys teams – in connection with advisory services

provided by the asset management team, or shopping center

management services provided by the teams on site – as well as

letting, asset management and advisory fees relating to

partnerships formed.

Fees charged in 2023 totaled Euro 3.1 million, compared with

Euro 2.8 million for 2022.

No property development margin was recorded in 2023.

No other current income was recorded in 2023 (Euro 0.4

million in 2022). This included the dividends received from the

OPCI fund UIR2, 80%-owned by Union Invest and 20% by Mercialys. The

asset held by the OPCI fund was sold during the first half of

2022.

Other current expenses mainly comprise overheads.

Overheads primarily include financial communications costs,

remuneration paid to members of the Board of Directors, corporate

communications costs, shopping center communications costs,

marketing research costs, professional fees (statutory auditors,

consulting, research) and real estate portfolio appraisal

costs.

For 2023, these expenses totaled Euro 4.4 million, compared

with Euro 6.3 million in 2022. This change takes into account the

increase in certain operating costs, largely offset by the

Company’s committed efforts to moderating operating costs in an

inflationary context.

Personnel expenses came to Euro 20.2 million in 2023,

higher than 2022 (Euro 18.7 million). This change factors in the