Forsee Power Draws Down €10 Million as Part of Its Financing Contract With the EIB

08 Dezember 2023 - 6:23PM

Business Wire

Regulatory News:

Forsee Power (FR0014005SB3 – FORSE – the “Company”),

expert in intelligent battery systems for sustainable

electromobility, announces the drawing of a tranche of 10 million

euros from the European Investment Bank (EIB) under the credit

agreement for a maximum principal amount of €50 million signed with

this institution in December 2020.

Drawdown of Tranche C

As of 06/30/2023, the Company had two unused financing lines of

€10 million each (Tranches C and D) contracted with the EIB.

- The drawing of Tranche C for 10 million euros was conditional

on prerequisites (i) achieving consolidated turnover which the

group had already achieved at the close of the 2020 financial year

and (ii) carrying out a capital increase of an amount greater than

10 million euros, which was carried out in November 2021 with the

Company's IPO. It is this Tranche C which is the subject of the

drawing, and which will be paid on December 18, 2023 bearing an

annual interest of 3% and a capitalized interest of 1.5% payable

ultimately upon repayment of the principal (maturity 5 years).

These financing conditions remain competitive compared to current

financing conditions.

- The Company also has the possibility of drawing on a Tranche D

in the amount of 10 million euros subject to the achievement of

certain conditions, which have not been met to date.

The drawing of this Tranche C has already given rise on December

4, 2023, on the basis of the twenty-fourth resolution adopted by

the combined general meeting of June 23, 2023, to the issue for the

benefit of the EIB of 1,000 new bonds of so-called “BEI E” shares

(the warrants) with an exercise price of €5.78 per warrant, each

warrant giving the right, in the event of exercise, to the

subscription of a maximum of 300 new ordinary shares of the Company

(i.e. 0.0004% of the share capital per warrant, on an undiluted

basis).

The main characteristics of warrants are summarized below:

Exercise cases for

warrants

The warrants are exercisable depending on

the occurrence of certain events (carried out after the issuance of

the warrants), in particular:

- Change of control;

- Maturity of Tranche C;

- Reimbursement for any reason whatsoever of one of the Sections

of the credit contract;

- Event of default.

Exercise period for

warrants

20 years from emission date

Sale option to the benefit of

the EIB

Alternatively, to the exercise of the

warrants, the EIB has a promise of sale pursuant to which it can

ask the Company either to repurchase or repay all or part of its

warrants for an amount corresponding to their value.

The issue of these warrants will also result in the

recalculation of the conversion parity of the 6,857 “BEI A”

warrants and the 3,500 “BEI C” warrants held by the EIB giving it

access in the event of exercise to a maximum of 1,622,816 new

ordinary shares of the Company (on a diluted basis).

Use of funds

The funds from the drawdown of Tranche C will be used during the

2024 financial year to strengthen the Company's production

capacity.

About Forsee Power Forsee Power is an industrial group

specializing in smart battery systems for sustainable electric

transport (light vehicles, off-highway vehicles, buses, trucks, and

trains). A major player in Europe, Asia and North America, the

Group designs, assembles, and supplies energy management systems

based on cells that are among the most robust in the market and

provides installation, commissioning, and maintenance on site and

remotely. More than 2,500 buses and 130,000 LEV have been equipped

with Forsee Power’s batteries. The Group also offers financing

solutions (battery leasing) and second-life solutions for transport

batteries. Forsee Power and its 700 employees are committed to

sustainable development and the Group has obtained the Gold medal

from leading sustainability rating agency EcoVadis. For more

information: www.forseepower.com | @ForseePower

Forward-looking statements This press release contains

forward-looking statements about Forsee Power and its subsidiaries.

These statements include financial projections and estimates and

their underlying assumptions, statements regarding plans,

objectives, intentions and expectations with respect to future

financial results, events, operations, services, product

development and potential, or future performance. Forward-looking

statements are generally identified by the words "expects,"

"anticipates," "believes," "intends," "estimates," "forecasts,"

"projects," "seeks," "strives," "aims," "hopes," "plans," "may,"

"goal," "objective," "projection," "outlook" and other similar

expressions. Although Forsee Power's management believes that these

forward-looking statements are reasonable, investors and

shareholders of the group are cautioned that forward-looking

statements are subject to numerous risks and uncertainties, many of

which are difficult to predict and generally beyond the control of

Forsee Power, that could cause actual results and events to differ

materially from those expressed in, or implied or projected by, the

forward-looking information and statements. These risks and

uncertainties include those discussed or identified in public

documents approved by the Autorité des marchés financiers,

including those listed in Chapter 3 "Risk Factors" of Forsee

Power's 2022 universal registration document approved by the

Autorité des marchés financiers on April 25, 2023 under number

R.23-016 and in section 2.9 "Description of the main risks and

uncertainties for the remaining six months" of the 2023 half-year

financial report. These forward-looking statements are made only as

of the date of this press release and Forsee Power undertakes no

obligation to update any forward-looking information or statements

included in this press release to reflect any change in

expectations or events, conditions or circumstances on which any

such forward-looking statement is based. Any information regarding

past performance contained in this press release should not be

construed as a guarantee of future performance. Nothing in this

press release should be construed as an investment recommendation

or legal, tax, investment or accounting advice.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231208560584/en/

Forsee Power Sophie Tricaud VP Corporate affairs and

Sustainability investors@forseepower.com

NewCap Thomas Grojean Quentin Massé Investor Relations

forseepower@newcap.eu +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations

forseepower@newcap.eu +33 (0)1 44 71 94 98

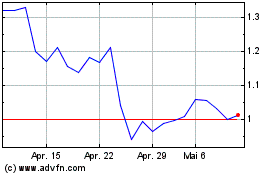

Forsee Power (EU:FORSE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

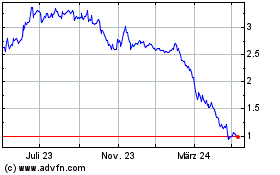

Forsee Power (EU:FORSE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024