Corbion management update

29 Januar 2020 - 7:00AM

Corbion management update

Corbion management update

- Corbion will invest approximately US$ 190 million in a

new 125,000 metric tons lactic acid plant in

Thailand, operating at the highest sustainability standards and

lowest costs

- Corbion committed to Algae Ingredients with stronger

focus. Slower than expected progress triggered non-cash impairment,

impacting net result by approx. € -25 million

- Preliminary (unaudited) FY 2019 results exceeded most

recent management guidance

- Capital Markets Day set for 9 March

Olivier Rigaud, CEO, commented: “We are making good progress in

the review of our current strategy. We will give an extensive

update during a Capital Markets Day on 9 March, at which time we

will also publish our fully audited results. However, several

important strategic decisions have already been made.

We are the global market leader in lactic acid production. To

further strengthen this leadership position in an attractive growth

market, we have decided to build a new lactic acid plant at the

existing Corbion site in Rayong Province in Thailand. As PLA is

developing better than expected, the urgency behind expanding our

lactic acid production capacity has only increased. The new plant

will be based on our innovative and proprietary gypsum-free

technology. This new technology will further enhance our position

as lowest cost producer of lactic acid at the highest

sustainability standards.

I am a firm believer in the potential of algae technology. The

current strategic review has already led to the decision to

continue to invest in Algae Ingredients. However, pushing into new

territories with revolutionary new ingredients goes hand in hand

with timelines to commercial success that are inherently difficult

to predict. Going forward we will be more selective in our target

markets, and significantly reduce our cost base of Algae

Ingredients. As we indicated earlier, Algae Ingredients is

developing slower than expected which required us to review the

asset value, subsequently followed by an impairment.

I am pleased with the strong fourth quarter as we saw a further

acceleration of organic growth. The preliminary (unaudited) FY 2019

results exceeded our most recent management guidance (October 2019)

for Ingredient Solutions, while Innovation Platforms performed as

expected. We expect to report FY 2019 Net sales of € 976.4 million

and Adjusted EBITDA of € 145.9 million.”

- 20200129 PR Corbion FINAL

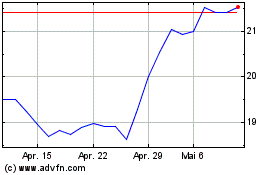

Corbion N.V (EU:CRBN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Corbion N.V (EU:CRBN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025