BIC Group - Press

Release

Clichy - 01 August 2018

First half 2018 Results

Challenging Trading Environment - 2018 Outlook

unchanged

- H1 Net Sales: 959.3 million

euros, down 1.9% on a comparative basis:

-

Challenging market and business

environment

-

Continued solid performance in Eastern

Europe

-

Soft Second Quarter performance in U.S.

Lighters, as expected

-

H1 Normalized Income From Operation margin:

19.6%, down 70 basis points:

-

68.7 million euros of Goodwill Impairment on

Cello (India) as a result of lower growth perspectives in both

domestic and export sales.

-

Solid Operating Cashflow generation

"Faced with

market headwinds in the first half, we continued to invest in our

business and drive operational effectiveness, thus enabling us to

seize opportunities to deliver future growth.

In the balance of

the year, we expect Net Sales growth across all categories. We will

deliver solid growth in e-commerce in US Stationery, strengthen our

distribution in Lighters, while new product launches will drive

Shavers' performance.

Our outlook for

the full year is unchanged. We remain focused on delivering on our

goals and leveraging the value of our brand as we continue to

engage effectively with our consumers."

Gonzalve Bich,

Chief Executive Officer

| Q2 and H1 2018 Key figures[1] |

| In

million euros |

Q2 |

H1 |

| Group Net Sales |

543.9 |

959.3 |

|

Change on a comparative

basis |

-2.3% |

-1.9% |

| Normalized Income From

Operations |

118.7 |

188.2 |

|

Normalized IFO

margin |

21.8% |

19.6% |

| Net Income Group

Share |

22.2 |

70.8 |

| EPS Group Share |

0.49 |

1.55 |

|

Normalized EPS Group Share |

1.99 |

3.05 |

| Net Cash

Position |

55.1 |

55.1 |

Key figures (in million

euros) |

|

|

Q2 2018 vs. Q2

2017 |

|

|

H1 2018 vs. H1

2017 |

| |

Q2 2017 (restated for

IFRS15) |

Q2 2018 |

As

reported |

Constant currency basis |

Compa-rative

basis |

H1 2017

(restated for IFRS15) |

H1 2018 |

As

reported |

Constant currency basis |

Compa-rative

basis |

| Group |

|

|

|

|

|

|

|

|

|

|

| Net Sales |

599.0 |

543.9 |

-9.2% |

-3.1% |

-2.3% |

1,072.3 |

959.3 |

-10.5% |

-3.1% |

-1.9% |

| Gross Profit |

310.5 |

283.9 |

|

|

|

560.5 |

507.4 |

|

|

|

| Normalized Income From Operations (NIFO) |

137.1 |

118.7 |

-13.4% |

|

|

218.2 |

188.2 |

-13.7% |

|

|

| Normalized IFO

margin |

22.9% |

21.8% |

|

|

|

20.3% |

19.6% |

|

|

|

| Income From Operations (IFO) |

119.6 |

50.0 |

-58.2% |

|

|

193.6 |

119.5 |

-38.3% |

|

|

| IFO margin |

20.0% |

9.2% |

|

|

|

18.1% |

12.5% |

|

|

|

| Net Income Group Share |

79.2 |

22.2 |

-72.0% |

|

|

128.7 |

70.8 |

-45.0% |

|

|

| Net Income Group Share excluding Cello

Goodwill Impairment |

79.2 |

90.9 |

+14.8% |

|

|

128.7 |

139.5 |

+8.4% |

|

|

| Normalized Earnings Per Share Group Share

(in euros) |

2.04 |

1.99 |

-2.5% |

|

|

3.21 |

3.05 |

-5.0% |

|

|

| Earnings Per Share Group Share (in euros) |

1.70 |

0.49 |

-71.2% |

|

|

2.76 |

1.55 |

-43.8% |

|

|

| Stationery |

|

|

|

|

|

|

|

|

|

|

| Net

Sales |

267.8 |

249.5 |

-6.8% |

-1.7% |

-1.4% |

433.4 |

401.3 |

-7.4% |

-1.1% |

-0.1% |

| Normalized IFO |

41.6 |

37.4 |

|

|

|

47.6 |

47.0 |

|

|

|

| Normalized IFO margin |

15.5% |

15.0% |

|

|

|

11.0% |

11.7% |

|

|

|

| IFO |

35.5 |

-31.3 |

|

|

|

36.0 |

-21.8 |

|

|

|

| IFO

margin |

13.2% |

-12.6% |

|

|

|

8.3% |

-5.4% |

|

|

|

| Lighters |

|

|

|

|

|

|

|

|

|

|

| Net

Sales |

186.4 |

165.0 |

-11.5% |

-4.5% |

-4.5% |

358.6 |

317.7 |

-11.4% |

-2.7% |

-2.6% |

| Normalized IFO |

77.0 |

63.3 |

|

|

|

141.0 |

117.7 |

|

|

|

| Normalized IFO margin |

41.3% |

38.4% |

|

|

|

39.3% |

37.1% |

|

|

|

| IFO |

77.0 |

63.3 |

|

|

|

140.8 |

117.7 |

|

|

|

| IFO

margin |

41.3% |

38.4% |

|

|

|

39.3% |

37.1% |

|

|

|

| Shavers |

|

|

|

|

|

|

|

|

|

|

| Net

Sales |

123.4 |

113.5 |

-8.0% |

-0.3% |

-0.3% |

238.7 |

210.5 |

-11.8% |

-3.1% |

-3.1% |

| Normalized IFO |

17.2 |

16.9 |

|

|

|

31.4 |

24.6 |

|

|

|

| Normalized IFO margin |

14.0% |

14.9% |

|

|

|

13.1% |

11.7% |

|

|

|

| IFO |

17.2 |

16.9 |

|

|

|

31.2 |

24.6 |

|

|

|

| IFO

margin |

13.9% |

14.9% |

|

|

|

13.1% |

11.7% |

|

|

|

| Other products |

|

|

|

|

|

|

|

|

|

|

| Net

Sales |

21.5 |

15.9 |

-25.8% |

-24.2% |

-6.9% |

41.6 |

29.8 |

-28.5% |

-26.8% |

-10.4% |

| Normalized IFO |

1.2 |

1.2 |

|

|

|

-1.8 |

-1.0 |

|

|

|

| IFO |

-10.1 |

1.2 |

|

|

|

-14.4 |

-1.0 |

|

|

|

As of January 1, 2018, the BIC Group has applied

the following IFRS standards:

-

IFRS15 "Revenue from Contracts with Customers."

2017 financial data has been restated

-

IFRS 9 "Financial instruments,"

-

IFRS 16 "Leases" has been early

adopted.

H1 2018 Net

Sales totaled 959.3 million euros, down 10.5% as reported and

down 1.9% on a comparative basis. The unfavorable impact of

currency fluctuations (-7.4%) was mainly due to the depreciation of

the U.S. dollar and Brazilian real against the euro. Europe grew by

0.8% on a comparative basis. North America and Developing Markets

declined by 0.5% and by 6.3%, respectively.

Income From Operations and Normalized Income From

Operations

H1 2018 Gross

Profit margin was 52.9%, compared to 52.3% in H1 2017.

H1 2018

Normalized IFO was 188.2 million euros compared to 218.2

million euros in H1 2017, with Normalized IFO margin of 19.6% vs.

20.3% in H1 2017.

Key components of

the change in Normalized IFO margin

(in points) |

H1 2017

vs. H1 2016[2] |

Q1 2018

vs. Q1 2017 |

Q2 2018

vs. Q2 2017 |

H1 2018

vs. H1 2017 |

|

|

+0.3 |

+1.6 |

+0.5 |

+1.0 |

|

|

-0.1 |

-0.2 |

+0.2 |

-0.1 |

|

|

-0.3 |

-0.6 |

-0.1 |

-0.4 |

|

|

+0.2 |

+0.4 |

+0.3 |

+0.3 |

|

|

-1.2 |

-1.8 |

-1.8 |

-1.6 |

| Total change in Normalized IFO margin

excluding the special employee bonus |

-1.0 |

-0.4 |

-1.1 |

-0.7 |

| Special employee bonus |

+0.9 |

- |

- |

- |

|

|

+0.5 |

- |

- |

- |

|

|

+0.4 |

- |

- |

- |

| Total change in Normalized IFO

margin |

-0.1 |

-0.4 |

-1.1 |

-0.7 |

| Non-recurring items |

Q1 |

Q2 |

H1 |

| (in million euros) |

2017

(restated from IFRS15) |

2018 |

2017

(restated from IFRS15) |

2018 |

2017

(restated from IFRS15) |

2018 |

| Income From Operations |

74.1 |

69.6 |

119.6 |

50.0 |

193.6 |

119.5 |

| As % of Net Sales |

15.7% |

16.7% |

20.0% |

9.2% |

18.1% |

12.5% |

| Restructuring costs related primarily to BIC Graphic |

7.0 |

- |

17.5 |

|

24.6 |

|

| Cello

goodwill impairment |

|

|

|

68.7 |

|

68.7 |

| Normalized IFO |

81.1 |

69.6 |

137.1 |

118.7 |

218.2 |

188.2 |

| As % of Net Sales |

17.1% |

16.7% |

22.9% |

21.8% |

20.3% |

19.6% |

Cello

goodwill impairment is explained by lower growth perspectives in

both domestic and export sales.

Net Income and EPS

Income before

tax was at 125.3 million euros, compared to 193.6 million euros

in H1 2017. Net finance revenue was 5.8 million euros compared to

nil in H1 2017. H1 2018 was positively impacted, particularly in

Q2, by fair value adjustments to financial assets denominated in

USD when compared to December 2017.

H1 2018 Net

income Group Share was 70.8

million euros, a 45.0% drop as reported (139.5 million euros,

increasing 8.4%, before the Cello goodwill impairment). The

effective tax rate was 43.5% and 28.1% excluding the impact of

Cello goodwill impairment. Q2 2018 Net Income Group Share was 22.2

million euros and would have been 90.9 million euros excluding

Cello goodwill impairment.

EPS Group

share was 1.55 euros, compared to 2.76 euros in H1 2017, i.e.,

down by 43.8%. Normalized H1 EPS Group share decreased 5.0% to 3.05

euros, compared to 3.21 euros in H1 2017. EPS Group Share in Q2

2018 was 0.49 euros compared to 1.70 euros in Q2 2017, down 71.2%.

Normalized Q2 EPS Group share decreased 2.5% to 1.99 euros,

compared to 2.04 euros in Q2 2017.

At the end of June 2018, the

Group's net cash position stood at 55.1 million euros.

Change in net cash position

(in million euros) |

2017 (restated for

IFRS15) |

2018 |

| Net Cash position (beginning of period - December) |

222.2 |

204.9 |

|

|

+77.0 |

+83.1 |

- Of which

operating cash flow

|

+196.9 |

+197.7 |

- Of which change

in working capital and others

|

-119.9 |

-114.6 |

|

|

-74.7 |

-51.6 |

|

|

-161.0 |

-157.8 |

|

|

-18.0 |

-23.9 |

|

|

+0.6 |

+1.4 |

|

|

+55.7 |

+9.2 |

|

|

-14.6 |

-10.2 |

| Net Cash position (end of period - June) |

87.2 |

55.1 |

Net cash from operating activities

was +83.1 million euros, including +197.7 million euros in

operating cash flow. The negative 114.6 million euros change in

working capital, and others was mainly driven by accounts

receivables and inventory increased when compared to December 2017

mainly due to seasonality. Net cash was also negatively impacted by

investments in CAPEX as well as the dividend payments and share

buybacks.

Shareholders' remuneration

-

Ordinary dividend of 3.45 euros per share paid

in May 2018.

-

23.8 million euros in share buy-backs by Société

BIC at the end of June 2018 (296,932 shares purchased at an average

price of 80.04 euros). BIC Corporation had share buy-backs for

0.1 million euros.

Operational trends by category

Stationery H1

2018 Net Sales decreased by 7.4% as reported and by 0.1% on a

comparative basis. Second quarter 2018 Net

Sales were down 6.8% as reported and down 1.4% on a comparative

basis.

- In Europe,

while the market declined 2.2% in value[6], Net Sales

were flat with continued solid performance in Southern Europe

(Spain and Turkey) partially offset by negative back-to-school

phasing in France (shipment to customers postponed from June to

July, versus last year).

- In North

America, Net Sales increased mid-single digit with a strong

performance in e-commerce, the on-going success of our BIC®

Gelocity Quick Dry pen, as well as positive back-to-school phasing.

Year-to-date June 2018, BIC outperformed the declining U.S.

Stationery market (-0.9%), gaining 0.5 points market share in

value[7].

- In Latin

America, Net Sales decreased low-single digit, negatively

impacted by the 10-day transportation strike in May in Brazil,

combined with on-going inventory adjustments by customers, as well

as a negative back-to-school phasing in Mexico.

- Cello Pens

Domestic Sales were flat on a comparable basis as Cello continues

its product trade-up strategy and portfolio streamlining.

H1 2018

Normalized IFO margin for Stationery was

11.7%, compared to 11.0% in H1 2017 with favorable Sales Mix

and cost efficiency, offsetting increasing Raw Material costs.

Q2 2018 Normalized IFO margin was 15.0%,

compared to 15.5% in Q2 2017.

H1 2018

Net Sales of Lighters decreased by 11.4% as

reported and by 2.6% on a comparative basis. Second quarter 2018 Net Sales were down 11.5% as reported

and down 4.5% on a comparative

basis.

- Europe Net

Sales were flat in H1. In Western Europe, in spite of unchanged

market conditions and distribution channels for BIC, performance

was impacted by the decision to adjust a part of our

route-to-market in traditional networks. In Eastern Europe, we

continued to grow market share.

- North

American Net Sales decreased slightly in H1. Following pre-buys

from retailers in Q1 ahead of the April 1st price

increase, Q2 performance was soft, as expected. The non-refillable

pocket lighter market in the US declined by 0.3%[8].

- In Latin

America, Net Sales decreased high-single digit, due to on-going

inventory adjustments by customers in Brazil. In addition to this,

Brazil's performance was impacted by the 10-day transportation

strike in May. Mexico performed well with a positive trend in Q2,

driven by enlarged distribution in traditional stores.

H1 2018

Normalized IFO margin for Lighters was 37.1%, compared to 39.3%

in H1 2017, reflecting an increase in Raw Materials and Brand

Support, as well as unfavorable fixed cost absorption. Q2 2018 Normalized IFO margin was 38.4%, compared to

41.3% in Q2 2017.

H1 2018 Net Sales

of Shaver's decreased by 11.8% as reported, and by 3.1%

on a constant currency basis.

Second quarter 2018 Net Sales decreased by 8.0% as reported and by

0.3% on a constant currency basis.

- The performance was solid in

Europe with Net Sales increasing mid-single

digit. This was mainly due to continued growth in Eastern Europe,

notably in Russia with a market share increase driven by BIC® Flex

3 Hybrid and new distribution gains. Western Europe Net Sales were

flat in spite of a declining market (down 1.1% in value, YTD May

2018[9]) for the

one-piece segment.

- In North

America, Net Sales decreased mid-single digit, negatively

impacted by the on-going market disruption including competitive

pressure. BIC underperformed the U.S. one-piece market (down 3.9%

in value), losing 0.5 points resulting with 26.4% market share in

value (YTD June 2018[10]), in spite

of the continued success of our new products BIC® Soleil® Balance,

N°1 new product on the female one-piece market, BIC® Flex 3 Hybrid

and BIC® Soleil® Bella Click.

- In Latin

America, Net Sales were flat. In Brazil, the impact of the

10-day transportation strike was more than offset by our

distribution expansion and market share momentum, while market

declined 2.7% in value (YTD May 2018[11]). BIC

gained 2.5 points to reach 21.2% market share in value, driven by

BIC® 3 and our latest launches such as BIC® Flex 3 and BIC® Soleil

Sensitive.

- In the Middle-East and Africa, Net Sales decreased

double-digit with performance negatively impacted by a decrease in

promotional activities and current unfavorable importation

legislation in North Africa.

H1 2018

Normalized IFO margin for Shaver's was 11.7%

compared to 13.1% in H1 2017, driven by low volumes, unfavorable

product mix, increase in Raw Material costs partially offset by

lower Brand Support compared to last year.

Q2 2018 Normalized IFO margin was 14.9%,

compared to 14.0% in Q2 2017.

H1 2018 Net Sales

of Other Products decreased by 28.5% as reported and by -10.4%

on a comparative

basis. Second quarter 2018

Net Sales decreased by 25.8% as reported and by 6.9% on a comparative basis.

BIC Sport posted a low

double-digit decrease in its Net Sales on a comparative basis.

H1 2018

Normalized IFO for Other Products was a

negative 1.0 million euros, compared to a

negative 1.8 million euros in H1 2017. Q2 2018

Normalized IFO for Other Products was

a positive 1.2 million euros, flat vs. last

year.

We expect 2018 Group Net Sales

to increase between +1 and +3% on a comparative

basis, with all categories contributing to the growth. Major

factors affecting sales performance could include continued

competitive pressures in Shaver, further inventory reductions from

retailers, and continued softness in the Brazilian

economy.

Gross Profit will be impacted by an increase in raw material costs,

higher depreciation, while we will continue to invest in targeted

Brand Support and Operating Expenses.

2018 Normalized Income from Operations will also be impacted by

sales performance. Based on these factors we expect Normalized Income from Operations margin to be between 17%

and 18%.

BIC Group Net Sales by

geography

(in million euros) |

Q2 2018 vs. Q2 2017 |

|

|

H1 2018 vs. H1 2017 |

| |

Q2 2017

(Restated for IFRS15) |

Q2 2018 |

As reported |

Comparative

basis |

H1 2017 (Restated for

IFRS15) |

H1 2018 |

As reported |

Comparative

basis |

| Group |

|

|

|

|

|

|

|

|

| Net Sales |

599.0 |

543.9 |

-9.2% |

-2.3% |

1,072.3 |

959.3 |

-10.5% |

-1.9% |

| Europe |

|

|

|

|

|

|

|

|

| Net

Sales |

181.2 |

176.1 |

-2.8% |

+1.7% |

312.8 |

300.3 |

-4.0% |

+0.8% |

| North America |

|

|

|

|

|

|

|

|

| Net

Sales |

241.9 |

224.9 |

-7.0% |

-0.7% |

420.4 |

379.8 |

-9.7% |

-0.5% |

| Developing Markets |

|

|

|

|

|

|

|

|

| Net

Sales |

175.9 |

142.9 |

-18.7% |

-8.5% |

339.1 |

279.1 |

-17.7% |

-6.3% |

Impact of change in perimeter and

currency fluctuations on Net Sales

(in %) |

Q2 2017 |

Q2 2018 |

H1 2017 |

H1 2018 |

| Perimeter |

-0.3% |

-0.8% |

-0.2% |

-1.2% |

| Currencies |

+2.0% |

-6.1% |

+2.9% |

-7.4% |

| Of which USD |

+0.8% |

-2.6% |

+1.1% |

-3.6% |

| Of which BRL |

+0.8% |

-1.2% |

+1.4% |

-1.3% |

| Of which ARS |

-0.1% |

-0.4% |

-0.1% |

-0.6% |

| Of which INR |

+0.2% |

-0.3% |

+0.2% |

-0.4% |

| Of which MXN |

+0.0% |

-0.7% |

-0.2% |

-0.5% |

| Of which RUB and UAH |

+0.2% |

-0.3% |

+0.2% |

-0.3% |

Condensed profit and loss

account

(in million euros) |

|

Q2 2018 vs. Q2 2017 |

|

|

H1 2018 vs. H1 2017 |

| |

Q2 2017 (restated for IFRS15) |

Q2 2018 |

As reported |

Comparative basis |

H1 2017 (restated for IFRS15) |

H1 2018 |

As reported |

Comparative basis |

| Net Sales |

599.0 |

543.9 |

-9.2% |

-2.3% |

1,072.3 |

959.3 |

-10.5% |

-1.9% |

| Cost of

goods |

-288.5 |

-260.0 |

|

|

-511.8 |

-451.9 |

|

|

| Gross Profit |

310.5 |

283.9 |

|

|

560.5 |

507.4 |

|

|

|

Administrative & other operating expenses (incl. Cello goodwill

impairment in 2018) |

-190.9 |

-233.9 |

|

|

-366.9 |

-387.9 |

|

|

| Income from operations |

119.6 |

50.0 |

|

|

193.6 |

119.5 |

|

|

| Finance

revenue/costs |

-0.8 |

7.8 |

|

|

0.0 |

5.8 |

|

|

| Income before tax |

118.8 |

57.8 |

|

|

193.6 |

125.3 |

|

|

| Income

tax expense |

-35.7 |

-35.5 |

|

|

-58.1 |

-54.5 |

|

|

| Net

Income From Continuing Operations |

83.1 |

22.2 |

|

|

135.5 |

70.8 |

|

|

| Net

Income From Discontinued Operations |

-3.9 |

- |

|

|

-6.7 |

- |

|

|

| NET INCOME GROUP SHARE |

79.2 |

22.2 |

|

|

128.7 |

70.8 |

|

|

| Earnings Per Share From Continuing Operations (in euros) |

1.78 |

0.49 |

|

|

2.90 |

1.55 |

|

|

| Earnings Per Share From Discontinued Operations (in

euros) |

-0.08 |

- |

|

|

-0.14 |

- |

|

|

| Earnings per share Group share (in

euros) |

1.70 |

0.49 |

|

|

2.76 |

1.55 |

|

|

| Average number of shares outstanding (net of treasury

shares) |

46,683,913 |

45,755,483 |

|

|

46,683,913 |

45,755,483 |

|

|

Condensed balance sheet

(in million euros) |

June 30, 2017

(restated for

IFRS15) |

December 31, 2017

(restated for IFRS15) |

January 1, 2018

(new IFRS implementation) |

June 30, 2018 |

| Assets |

|

|

|

|

| Property, plant &

equipment |

586.5 |

631.1 |

684.6 |

676.9 |

| Investment

properties |

1.9 |

1.8 |

1.8 |

1.8 |

| Goodwill and

intangible assets |

359.1 |

350.6 |

350.6 |

278.6 |

| Other non-current

assets |

233.1 |

185.5 |

185.5 |

150.7 |

| Non-current assets |

1,180.6 |

1,169.0 |

1,222.5 |

1,108.0 |

| Inventories |

469.7 |

429.0 |

429.0 |

470.2 |

| Trade and other

receivables |

615.2 |

477.1 |

473.5 |

574.0 |

| Other current

assets |

38.3 |

45.0 |

45.0 |

30.4 |

| Other current

financial assets and derivative instruments |

12.6 |

45.0 |

45.0 |

34.4 |

| Cash and cash

equivalents |

291.2 |

188.6 |

188.6 |

170.5 |

| Current assets |

1,427.0 |

1,184.7 |

1,181.1 |

1,279.5 |

| TOTAL ASSETS |

2,607.6 |

2,353.7 |

2,403.6 |

2,387.5 |

| Liabilities & shareholders' equity |

|

|

|

|

| Shareholders' equity |

1,707.1 |

1,702.2 |

1,698.6 |

1.569.6 |

| Non-current

borrowings |

0.2 |

0.2 |

51.6 |

35.3 |

| Other non-current

liabilities |

271.4 |

265.7 |

266.2 |

216.3 |

| Non-current liabilities |

271.6 |

265.9 |

317.8 |

251.6 |

| Trade and other

payables |

136.8 |

125.5 |

125.5 |

130.7 |

| Current

borrowings |

208.4 |

4.8 |

6.4 |

154.0 |

| Other current

liabilities |

283.7 |

255.3 |

255.3 |

281.6 |

| Current liabilities |

628.9 |

385.6 |

387.2 |

566.3 |

| TOTAL LIABILITIES & SHAREHOLDERS' EQUITY |

2,607.6 |

2,353.7 |

2,403.6 |

2,387.5 |

| Cash flow statement (in million

euros) |

H1 2017

(restated for IFRS15) |

H1 2018 |

| Group Net

income |

128.7 |

70.8 |

| Net

income from discontinued operations |

-6.7 |

- |

| Net income from continuing operations |

135.4 |

70.8 |

| Amortization and

provisions |

61.8 |

131.4 |

| (Gain)/Loss from

disposal of fixed assets |

10.2 |

- |

| Others |

-3.8 |

-4.5 |

| CASH FLOW FROM OPERATIONS |

196.9 |

197.7 |

| (Increase) / decrease

in net current working capital |

-123.9 |

-134.4 |

| Others |

4.0 |

19.8 |

| Net

Cash from operating activities from continuing operations |

70.9 |

83.1 |

| Net

Cash from operating activities from discontinued

operations |

6.1 |

- |

| NET CASH FROM OPERATING ACTIVITIES (A) |

77.0 |

83.1 |

| Net capital

expenditure |

-73.9 |

-51.0 |

| (Purchase)/Sale of

other current financial assets |

24.7 |

5.0 |

| Divestiture of BIC

Graphic North America and Asian Sourcing |

55.7 |

- |

| Other

Investments |

-0.4 |

0.1 |

| Net

Cash from investing activities from continuing

operations |

9.5 |

-45.9 |

| Net

Cash from investing activities from

discontinued operations |

-3.4 |

- |

| NET CASH FROM INVESTING ACTIVITIES (B) |

6.1 |

-45.9 |

| Dividends paid |

-161.0 |

-157.8 |

|

Borrowings/(Repayments)/(loans) |

130.6 |

100.9 |

| Share buy-back program

net of stock-options exercised |

-17.4 |

-22.5 |

| Others |

-2.7 |

-7.9 |

| Net

Cash from financing activities from continuing

operations |

-48.2 |

-87.3 |

| Net

Cash from financing activities from

discontinued operations |

-2.3 |

- |

| NET CASH FROM FINANCING ACTIVITIES (C) |

-50.5 |

-87.3 |

| NET INCREASE/ (DECREASE) IN CASH AND CASH EQUIVALENTS

NET OF BANK OVERDRAFTS (A+B+C) |

32.6 |

-50.1 |

| OPENING CASH AND CASH EQUIVALENTS NET OF BANK

OVERDRAFTS |

217.4 |

187.0 |

| Net increase/decrease

in cash and cash equivalents net of bank overdrafts (A+B+C) |

32.6 |

-50.1 |

| Exchange

difference |

-14.7 |

-3.2 |

| CLOSING CASH AND CASH EQUIVALENTS NET OF BANK

OVERDRAFTS |

235.3 |

133.7 |

| Share buy-back program - Societe

BIC |

Number of shares

acquired |

Average weighted price in € |

Amount

in M€ |

| February

2018 |

100,009 |

83.37 |

8.3 |

| March

2018 |

165,000 |

78.07 |

12.9 |

| April

2018 |

- |

- |

- |

| May

2018 |

- |

- |

- |

| June

2018 |

31,923 |

79.74 |

2.6 |

| Total |

296,932 |

80.04 |

23.8 |

Reconciliation with

Alternative Performance Measures

| Normalized IFO reconciliation |

|

|

| (in million euros) |

H1 2017 (restated for

IFRS15) |

FY 2017 (restated for

IFRS15) |

H1 2018 |

| Income From Operations |

193.6 |

374.9 |

119.5 |

| Restructuring costs related primarily to BIC

Graphic |

+24.6 |

+24.7 |

- |

| Cello

goodwill impairment |

- |

- |

+68.7 |

| Normalized IFO |

218.2 |

399.6 |

188.2 |

| Normalized EPS reconciliation |

|

|

| (in euros) |

H1 2017 (restated for

IFRS15) |

FY 2017 (restated for

IFRS15) |

H1 2018 |

| EPS |

2.76 |

6.18 |

1.55 |

| Net loss from the

divestiture of BIC Graphic North America and Asian Sourcing |

+0.09 |

+0.09 |

- |

| Normalized EPS excluding impairment recognized for BIC

Graphic North America and Asia Sourcing |

2.85 |

6.27 |

1.55 |

| Restructuring costs

related primarily to BIC Graphic |

+0.36 |

+0.38 |

- |

| Cello goodwill

impairment |

- |

- |

+1.50 |

| Normalized EPS |

3.21 |

6.65 |

3.05 |

Net cash reconciliation

(in million euros - rounded figures) |

December 31,

2017 |

June 30,

2018 |

| Cash and cash

equivalents (1) |

188.6 |

170.5 |

| Other current

financial assets (2)[12] |

21.4 |

25.1 |

| Current borrowings

(3)12 |

-4.9 |

-140.5 |

| Non-current borrowings

(4) |

-0.2 |

- |

| NET CASH POSITION (1) + (2) - (3) - (4) |

204.9 |

55.1 |

Capital and voting rights, June 30, 2018

As of June 30, 2018, the total

number of issued shares of SOCIÉTÉ BIC was 46,645,433 shares,

representing:

-

68,003,531 voting rights,

-

67,055,750 voting rights excluding shares

without voting rights.

Total number of treasury shares

held at the end of June 2018: 947,781.

-

Constant currency basis:

constant currency figures are calculated by translating the current

year figures at prior year monthly average exchange rates.

-

Organic growth or Comparative

basis: at constant currencies and constant perimeter. Figures

at constant perimeter exclude the impacts of acquisitions and/or

disposals that occurred during the current year and/or during the

previous year, until their anniversary date. All Net Sales category

comments are made on a comparative basis.

-

Gross profit is the margin

that the Group realizes after deducting its manufacturing

costs.

-

Normalized IFO: normalized

means excluding non-recurring items as detailed on page 3.

-

Normalized IFO margin:

Normalized IFO as a percentage of Net Sales.

-

Net cash from operating

activities: principal revenue-generating activities of the

entity and other activities that are not investing or financing

activities.

-

Net cash position: Cash and

cash equivalents + Other current financial assets - Current

borrowings - Non-current borrowings (except financial liabilities

following IFRS 16 implementation).

SOCIETE BIC

consolidated financial statements as of June 30, 2018, were

approved by the Board of Directors on July 31, 2018. A presentation

related to this announcement is also available on the BIC website (at

www.bicworld.com).

This document contains forward-looking statements.

Although BIC believes its expectations are based on reasonable

assumptions, these statements are subject to numerous risks and

uncertainties. A description of the risks borne by BIC appears in

the section, "Risk Factors" in BIC's 2017 Registration Document

filed with the French financial markets authority (AMF) on March

21, 2018.

| Investor Relations: +33 1 45 19 52 26 |

Press Contacts |

Sophie

Palliez-Capian

sophie.palliez@bicworld.com |

Delphine

Peyrat-Stricker : +33 (0)6 38 81 40 00

dpeyratstricker@image7.fr

|

Michèle

Ventura

michele.ventura@bicworld.com |

|

For more information, please consult the corporate

website: www.bicworld.com

2018 -

2019 Agenda (all dates to be confirmed)

| Third

Quarter 2018 results |

24 October

2018 |

Conference

call |

| Full Year

2018 results |

13 February

2019 |

Meeting -

BIC Headquarters |

| First

Quarter 2019 results |

25 April

2019 |

Conference

call |

| AGM

2019 |

22 May

2019 |

Meeting-

BIC Headquarters |

BIC is a world

leader in stationery, lighters, shavers and promotional products.

For more than 70 years, BIC has honored the tradition of providing

high-quality, affordable products to consumers everywhere. Through

this unwavering dedication and thanks to everyday efforts and

investments, BIC has become one of the most recognized brands and

is a trademark registered worldwide for identifying BIC products

which are sold in more than 160 countries around the world. In

2017, BIC recorded Net Sales of 2,041.4 million euros. The Company

is listed on "Euronext Paris" and is part of the SBF120 and CAC Mid

60 indexes. BIC is also part of the following Socially Responsible

Investment indexes: CDP's "Leadership Level"

(A-) and "Leadership Level" for the additional "Supplier" module,

Euronext Vigeo - Eurozone 120, Euronext Vigeo

- Europe 120, FTSE4Good indexes, Ethibel

Pioneer and Ethibel Excellence Investment Registers, Ethibel Sustainability Index (ESI) Excellence Europe, Stoxx

Global ESG Leaders Index.

2 Before 2017 IFRS15 restatement

as 2016 was not restated.

3 Gross Profit margin excluding promotions and investments

related to consumer and business development support.

4 Total Brand Support: consumer and business development support +

advertising, consumer and trade support.

[5] 2017 Net Cash Position excluded 8.8 million euros of

subordinated loan.

[6] Source: GFK

- YTD May 2018 - Europe 7 (France, UK, Germany, Italy, Spain,

Belgium, Greece)

7 Source: NPD -

YTD June 2018

8 Source: IRI

CMULO - YTD 1-JUL-2018

[9] Source: MAT

Nielsen - May 2018

[10] Source:

IRI total market YTD ending 01-JULY-2018

[11] Source:

Retail Index, YTD May 2018

[12] In the balance sheet at December 31, 2017 and at June 30,

2018, the line "Other current financial assets and derivative

instruments" also includes respectively 23.6 million euros and 9.3

million euros worth of derivative instruments. In the balance sheet

at December 31, 2017 and at June 30, 2018, the line "Current

borrowings" includes also respectively 1.7 million euros and 36.7

million euros worth of bank overdrafts and 3.1 million euros and

103.7 million euros worth of current borrowings.

BIC_ First Half 2018

Results

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: BIC via Globenewswire

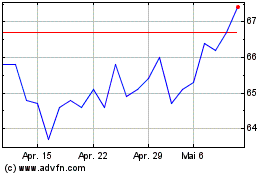

Societe BIC (EU:BB)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Societe BIC (EU:BB)

Historical Stock Chart

Von Jul 2023 bis Jul 2024