- €11.6 million capital increase aimed at institutional and

individual investors (via the PrimaryBid platform) at a

subscription price of €4.70 per share

- Agreement finalized for a €10 million convertible bonds issue

at a fixed interest rate and with a conversion price of €6.458, to

be subscribed by long-term shareholder Celestial Successor Fund,

LP

- Company’s financing outlook extended until 2025

DO NOT DISTRIBUTE DIRECTLY OR INDIRECTLY IN

THE USA, CANADA, AUSTRALIA OR JAPAN

Regulatory News:

Median Technologies (Euronext Growth – ALMDT) (the

"Company") announces the success of its capital increase

aimed at institutional investors and retail investors (via the

PrimaryBid platform) for a total gross amount of €11.6 million (the

"Global Offering").

Fredrik Brag, Chief Executive Officer of Median Technologies,

said : ”I want to thank both our historical and new

shareholders for their support and trust, and particularly

Celestial Successor Fund, LP for their continued engagement. We

were also pleased to offer retail investors the opportunity to take

part in the offering. The financing initiatives we have taken are

extending the outlook for the Company's financing until 2025,

giving Median Technologies meaningful leeway to further accelerate

the growth of iCRO and pursue several significant development

milestones for iBiopsy. We are currently finalizing the launch of

the academic clinical sites involved in carrying out our two

pivotal studies for our iBiopsy® LCS CADe/CADx Software as Medical

Device, aiming to obtain marketing authorizations for the US and

European markets in 2024."

Terms and conditions of the Global

Offering

The Global Offering amounted to a total of approximately €11.6

million (share issue premium included), including 96.4% from

institutional investors and 3.6% from retail investors via the

PrimaryBid platform.

The Global Offering, without preferential subscription rights,

totaled 2,469,159 new ordinary shares (the “New Shares”),

including:

- a capital increase carried out via a private placement of

approximately €11.2 million (share issue premium included) of

2,380,668 New Shares with cancellation of shareholders'

preferential subscription rights, to the benefit of institutional

investors (pursuant to the provisions of Article L.225-136 of the

French Commercial Code and Article L. 411-2,1° of the French

Monetary and Financial Code and in accordance with the 19th

resolution of the Company's Combined General Meeting of June 20,

2023) (the "Private Placement"); and

- a capital increase with cancellation of shareholders'

preferential subscription rights, through a public offering to

retail investors via the PrimaryBid platform, for an amount of

approximately €0.4 million (share issue premium included), through

the issuance of 88,491 New Shares (in accordance with the 18th

resolution of the Company's Combined General Meeting of June 20,

2023) (the “PrimaryBid Offering”).

The New Shares, representing approximately 15.6% of the

Company's share capital on a non-diluted basis prior to the

completion of the Global Offering, and 13.5% of the Company's share

capital, on a non-diluted basis after completion of the Global

Offering, were issued by decision of the Chief Executive Officer of

the Company, pursuant to the delegation of authority granted on

July 3, 2023, by the Company's board of directors (Conseil

d’administration) pursuant to the 18th and 19th resolutions of the

General Assembly of the Company of June 20, 2023.

The subscription price per New Share issued in the Global

Offering has been set at €4.70, corresponding to a discount of

6.93% against the closing share price of July 12, 2023.

Settlement and delivery of the New Shares and their admission

for trading on Euronext Growth Paris are expected on July 17, 2023.

The New Shares will be of the same category and fungible with the

existing ordinary shares, will be entitled to all the rights

associated with the existing ordinary shares, and will be admitted

to trading on Euronext Growth Paris under the same ISIN code:

FR0011049824 - ALMDT.

Pursuant to Article 1.4 and 3.2 of EU Regulation 2017/1129 of

the European Parliament and of the Council of 14 June 2017, as

amended, to Article L.411-2 and L.411-2-1 of the French Monetary

and Financial Code and to Article 211-2 of the French Financial

Market Authority (the “AMF”) General Regulation, the Private

Placement and the PrimaryBid Offering have not given rise and will

not require the publication of a prospectus subject to the approval

of the AMF.

Impact of the Global Offering on Median

Technologies shareholding

Upon completion of the transaction, the share capital of Median

Technologies will amount to €913,530.40 and will be composed of

18,270,608 ordinary shares with a par value of €0.05 each.

For informational purposes only, to the Company's knowledge the

breakdown of share capital before and after the settlement and

delivery of the Global Offering will be as follows:

Before transaction

Shareholders

Nbr shares

%

Nbr Theoretical Voting

rights

%

Furui Medical Science

1,507,692

9.5%

1,507,692

9.6%

Celestial Successor Fund

1,288,958

8.2%

1,288,958

8.2%

Abingworth

956,819

6.1%

956,819

6.1%

Canon

961,826

6.1%

961,826

6.1%

Founder – Management –

Employees

1,036,673

6.6%

1,013,473

6.4%

Treasury shares

28,970

0.2%

28,970

0.2%

Free-Float

10,020,511

63.4%

10,020,511

63.5%

Total

15,801,449

100%

15,778,249

100%

After transaction

Shareholders

Nbr shares

%

Nbr Theoretical Voting

rights

%

Furui Medical Science

1,507,692

8.3%

1,507,692

8.3%

Celestial Successor Fund

1,288,958

7.1%

1,288,958

7.1%

Abingworth

956,819

5.2%

956,819

5.2%

Canon

961,826

5.3%

961,826

5.3%

Founder – Management –

Employees

1,036,673

5.7%

1,013,473

5.6%

Treasury shares

28,970

0.2%

28,970

0.2%

Free Float

12,489,670

68.4%

12,489,670

68.4%

Total

18,270,608

100%

18,247,408

100%

For informational purposes only, a shareholder holding 1% of the

Company's capital before the completion of the Global Offering

(calculated on the basis of the number of shares comprising the

Company's share capital on July 12, 2023) will hold a 0.86% stake

after the issue of the 2,469,159 New Shares.

Lock-up commitments

In connection with the Global Offering, the Company, the

executive officers and the members of the board of directors

(Conseil d’administration) of the Company have signed a lock-up

agreement that comes into effect on the date of the signing of the

placement agreement to be concluded between the Company and Bryan,

Garnier & Co and for a period of 90 days following the

settlement and delivery of the Global Offering, subject to certain

customary exceptions.

Convertible bonds at a fixed interest

rate

The Company has also signed a Securities Purchase Agreement with

Celestial Successor Fund, LP ("CSF"), for a convertible

bonds issuance (the "Convertible Bonds") to CSF for an

amount of €10 million. Upon the completion of the Global Offering,

subscription of the Convertible Bonds by CSF will commence, with a

settlement and delivery expected on July 21, 2023.

The Convertible Bonds, with a 7-year maturity, will bear

paid-in-kind interest at a fixed interest rate of 8.5%. The

conversion price of the Convertible Bonds was set at €6.458.

EIB Loan

Subject to certain conditions, the Company may draw the second

tranche of the loan granted by the European Investment bank (EIB)

for a further €10 million.

Financial Intermediaries

Bryan, Garnier & Co has acted as sole Coordinator, Lead

Manager and Bookrunner for the Private Placement.

Investors were only able to participate in the PrimaryBid

Offering via the PrimaryBid partners referred to on the PrimaryBid

website (www.PrimaryBid.fr). The PrimaryBid Offering is not subject

to any placement agreement. For further details, please see the

PrimaryBid website at www.PrimaryBid.fr.

Cautionary Statement

The Company draws the public's attention to the fact that:

- the risk factors presented in the Annual Financial Report for

the financial year ended on December 31, 2022; the occurrence of

all or part of these risks may have an adverse effect on the

activity, financial position or results of the Company or on its

ability to achieve its objectives.

- the main risks of the capital increase are:

- The market price of the Company's shares may fluctuate and fall

below the issue price of the new shares;

- Due to fluctuations of the stock markets, the volatility and

liquidity of the Company's shares may vary significantly;

- The issue of the Convertible Bonds is subject to certain

conditions, in particular the success of the Global Offering, and

once issued, the Company shall be obliged to follow its financing

plan and adhere to other commitments;

- Company shares may be transferred on the secondary market,

after the completion of the capital increase, and this could have

an unfavorable impact on the Company's share price;

- The Company has some flexibility with regard to the use of

proceeds from the Global Offering and the Convertible Bond issuance

and may use the proceeds in a way that investors may not approve or

that may not increase the short-term value of their

investment;

- A new offering on the market by the Company, after the capital

increase, would lead to an additional dilution for investors.

Detailed information about Median Technologies, in particular

its activity, its results and risk factors were presented in the

Annual Financial Report for the financial period ended on December

31, 2022, published on April 20, 2023 and in the Management Report

presented to the General Meeting of June 20, 2023. These documents

and other regulated information and press releases are available on

the Company's website in the Investor's section

(www.mediantechnologies.com).

Disclaimer

This press release is issued for information purposes only. This

press release is not and may not be considered to constitute a

public offering, a subscription offer, a sales offer or an

invitation to the public for a public offering of securities in any

country.

The dissemination, publication or distribution of this press

release in certain countries may constitute a breach of the legal

provisions in force. The information contained in this press

release does not constitute an offering of securities in France,

the USA, Canada, Australia, Japan or any other country. This press

release must not be published, transmitted or distributed, directly

or indirectly, in the territory of the USA, Canada, Australia or

Japan. This document does not constitute a sales offer or a public

offering of shares in Median Technologies in the USA or any other

country.

In France, the offer of Median Technologies shares described

below will be made in the context of (i) an offer to the benefit

qualified investors, as defined in Article 2(1)(e) of the

Prospectus Regulation (as defined below) and in accordance with

article L. 411-2 1° of the French Monetary and Financial code (code

monétaire et financier) and applicable regulatory provisions and

(ii) a public offering primarily intended to retail investors

through the PrimaryBid platform. Pursuant to article 211-3 of the

General regulations of the French financial markets authority

(Autorité des marchés financiers) (the “AMF”), articles 1(4)

and 3 of the Regulation (EU) 2017/1129 of the European Parliament

and of the Council of 14 June 2017, as amended (the “Prospectus

Regulation”) and applicable regulations, the offer of Median

Technologies shares will not require the publication of a

prospectus approved by the AMF.

With respect to Member States of the European Economic Area, no

action has been taken or will be taken to permit a public offering

of the securities referred to in this press release requiring the

publication of a prospectus in any Member State. Therefore, such

securities may not be and shall not be offered in any Member State

other than in accordance with the exemptions of Article 1(4) of the

Prospectus Regulation or, otherwise, in cases not requiring the

publication of a prospectus under Article 3 of the Prospectus

Regulation and/or the applicable regulations in such Member State

and according to the applicable regulations.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom and are (i)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the “Order”), (ii) high net worth entities

and other such persons falling within Article 49(2)(a) to (d) of

the Order (“high net worth companies”, “unincorporated

associations”, etc.) or (iii) other persons to whom an invitation

or inducement to participate in investment activity (within the

meaning of Section 21 of the Financial Services and Market Act

2000) may otherwise lawfully be communicated or caused to be

communicated (all such persons in (y)(i), (y)(ii) and (y)(iii)

together being referred to as “Relevant Persons”). Any

invitation, offer or agreement to subscribe, purchase or otherwise

acquire securities to which this press release relates will only be

engaged with Relevant Persons. Any person who is not a Relevant

Person should not act or rely on this press release or any of its

contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities in the United States or any other

jurisdiction where restrictions may apply. Securities may not be

offered or sold in the United States absent registration or an

exemption from registration under the U.S. Securities Act of 1933,

as amended (the “Securities Act”). The securities of Median

Technologies have not been and will not be registered under the

Securities Act, and Median Technologies does not intend to conduct

a public offering in the United States.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of Median Technologies must be made solely based on

information publicly available about Median Technologies. Such

information is not the responsibility of Bryan, Garnier & Co

and has not been independently verified by Bryan, Garnier &

Co.

About Median Technologies: Median Technologies provides

innovative imaging solutions and services to advance healthcare for

everyone. We harness the power of medical images by using the most

advanced Artificial Intelligence technologies, to increase the

accuracy of diagnosis and treatment of many cancers and other

metabolic diseases at their earliest stages and provide insights

into novel therapies for patients. Our iCRO solutions for medical

image analysis and management in oncology trials and iBiopsy®, our

AI-powered imaging platform for the development of software as

medical devices (SaMD) help biopharmaceutical companies and

clinicians to bring new treatments and diagnose patients earlier

and more accurately. This is how we are helping to create a

healthier world.

Founded in 2002, based in Sophia-Antipolis, France, with a

subsidiary in the US and another one in Shanghai, Median has

received the label “Innovative company” by the BPI and is listed on

Euronext Growth market (Paris). FR0011049824– ticker: ALMDT. Median

is eligible for the French SME equity savings plan scheme

(PEA-PME). For more information: www.mediantechnologies.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230712988915/en/

Median Technologies Emmanuelle Leygues Head of Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Press - ALIZE RP Caroline Carmagnol +33 6 64 18 99 59

median@alizerp.com

Investors - ACTIFIN Ghislaine Gasparetto +33 6 21 10 49

24 ggasparetto@actifin.fr

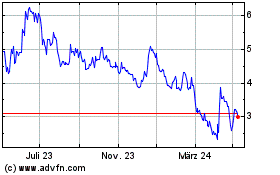

Median Technologies (EU:ALMDT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

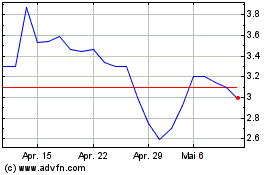

Median Technologies (EU:ALMDT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024