- Q2 2023 revenue of €2.1 million, stable compared with Q2

2022

- Continuation of the sales momentum for the new Medical

Equipment activity

- First outcomes of the technological alliance signed with Sanyou

Medical

Regulatory News:

IMPLANET (Euronext Growth: ALIMP, FR0013470168, eligible for

PEA-PME equity savings plans), a medical technology company

specializing in vertebral implants for orthopedic surgery and the

distribution of technological medical equipment, today announced

its revenue for the first half of 2023.

Ludovic Lastennet, IMPLANET’s CEO, stated: “Implanet

recorded stable revenue in the first half of 2023 compared with the

same period of 2022, but the semester was marked by determined

commercial launches resulting from our acquisition of OSD and our

partnership with Sanyou Medical. Firstly, the exclusive

distribution contract signed for Europe with SMTP, a subsidiary of

Sanyou Medical, allows Implanet to offer a new activity

distributing medical equipment to healthcare facilities. This

activity, which has recorded a strong commercial performance since

March, should represent a real growth engine in the coming months.

At the same time, we have strengthened our presence in the United

States with the FDA’s approval of our SqualeTM range of anterior

cages. This range will be supplemented at the end of the year with

a fixation system enabling us to provide a comprehensive range for

treating cervical pathologies. Lastly, in June we initiated the

European commercial launch of an innovative minimally invasive

pedicle screw system. This is the first range resulting from

Implanet and Sanyou Medical’s combined expertise. These various

elements are fully consistent with the strategy we have been

deploying over the last two years or so aimed at establishing

Implanet as a key player in spine surgery. We intend to build on

this momentum over the coming months, the culmination being the

upcoming initiation of Sanyou Medical’s distribution of our JAZZ®

range in China, the world’s largest spine market by volume, with

the first surgeries expected before the end of the year”.

Financial information for the first

half of 2023

Revenue (in € thousands -

IFRS*)

H1 2023

H1 2022

Change

Spine

France

1,788

1,801

-1%

United States

818

802

+2%

Rest of the world

1,334

1,487

-10%

Spine revenue

3,940

4,090

-4%

Medical equipment (SMTP)

250

-

-

Services (MADISONTM)

78

23

-

Total consolidated revenue,

IFRS

4,268

4,112

+4%

(in € thousands -IFRS*)

2023

2022

Change

First-quarter revenue

2,208

2,016

+10%

Second-quarter revenue

2,060

2,096

-2%

First-half revenue

4,268

4,112

+4%

*Unaudited figures

In the first half of 2023, Spine activity decreased slightly, by

around 4%, from €4.1 million to €3.9 million. Activity on the

French and American markets, where the Company operates directly,

generated stable revenue over the period at €1.8 million and €0.8

million respectively. Export activity, notably in Europe and Latin

America, decreased by around 10% compared with the first half of

2022.

Financial information for the second

quarter of 2023

Revenue (in € thousands -

IFRS*)

Q2 2023

Q2 2022

Change

Spine

France

846

849

-0%

United States

359

429

-16%

Rest of the world

660

810

-19%

Spine revenue

1,865

2,088

-11%

Medical equipment (SMTP)

127

-

-

Services (MADISONTM)

69

9

-

Total consolidated revenue,

IFRS

2,060

2,096

-2%

*Unaudited figures

Spine activity generated sales of €1.87 million in the second

quarter of 2023, a decrease of 11% on the figure of €2.09 million

recorded in the same quarter of 2022. Activity in France, the

Company’s second largest direct market, was stable compared with

the second quarter of 2022.

In the United States, although volumes increased by 20% in the

second quarter compared with the same quarter last year, the

product mix and distribution channels negatively affected revenue,

which fell 16% from €0.43 million in Q2 2022 to €0.36 million in Q2

2023.

Export activity in the rest of the world generated revenue of

€0.66 million in the second quarter of 2023, versus €0.81 million

in the same period of 2022.

Lastly, it should be noted that, as announced on June 21, 2023,

the Company initiated the launch of a minimally invasive pedicle

screw system in Europe in June and has already received its first

orders. Deliveries of this product, the first innovation resulting

from the partnership with Sanyou Medical, will begin during the

third quarter of 2023.

Cash position

At June 30, 2023, Implanet had a cash position of €1.5

million.

As a reminder, the payment of the balance of the MADISONTM

business, totaling €2.30 million, is spread over time depending on

the achievement of certain regulatory milestones relating to CE

marking, with €1.45 million of this figure received as expected

during the second quarter of 2023 and €0.85 million due to be

received in 2024.

Given these elements, combined with short-term actions to

optimize cash flow, the Company considers that it has the means to

cover its expected business financing requirements through to the

end of 2023. The Company is actively studying several financing

solutions in order to support the commercial development of its

medical devices.

Key H1 2023 events

- Commercial launch of SMTP’s ultrasound surgical scalpel in

March 2023;

- FDA approval of the SqualeTM range of anterior cervical cages

in the United States;

- Commercial launch in Europe of the MIS range, a minimally

invasive pedicle screw positioning system.

2023 strategy and

outlook

- Finalize the registration of existing products within the

framework of the new European Medical Device Regulation (MDR).

- Reinvigorate the Company’s presence in the United States:

- strengthen the resources and commercial means made available to

the historical team;

- strengthen the Company’s direct approach by expanding our

scientific team of thought leaders;

- successfully register, with the FDA, the OriginTM product range

resulting from the OSD acquisition.

- Strengthen market momentum and the product offering:

- continue developing our existing strategic partnerships in the

United States (SeaSpine) and Germany (ulrich medical®);

- deploy the commercial and technological partnership with Sanyou

Medical to jointly develop an innovative new European range of

hybrid posterior fixation;

- initiate the distribution of the JAZZ® platform in China (the

world’s largest spine market by volume) with Sanyou Medical;

- distribute technological medical equipment in Europe such as

SMTP Technology Co.’s ultrasound surgical scalpel.

Upcoming financial press

release

- 2023 first-half results, on September 19, 2023, after

market close

About IMPLANET Founded in 2007, IMPLANET is a medical

technology company that manufactures high-quality implants for

orthopedic surgery and distributing medical technology equipment.

Its activity revolves around a comprehensive innovative solution

for improving the treatment of spinal pathologies (JAZZ®)

complemented by the product range offered by Orthopaedic &

Spine Development (OSD), acquired in May 2021 (thoraco-lumbar

screws, cages and cervical plates). Implanet’s tried-and-tested

orthopedic platform is based on the traceability of its products.

Protected by four families of international patents, JAZZ® has

obtained 510(k) regulatory clearance from the Food and Drug

Administration (FDA) in the United States, the CE mark in Europe

and ANVISA approval in Brazil. In 2022, IMPLANET entered into a

commercial, technological and financial partnership with SANYOU

MEDICAL, China's second largest medical device manufacturer.

IMPLANET employs 43 staff and recorded a consolidated revenue of

€8.0 million in 2022. Based near Bordeaux in France, IMPLANET

opened a US subsidiary in Boston in 2013. IMPLANET is listed on the

Euronext Growth market in Paris. For further information, please

visit www.Implanet.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230711127691/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tél. : +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Mathilde Bohin Nicolas Fossiez

Tél.: +33 (0)1 44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Arthur Rouillé Tél.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

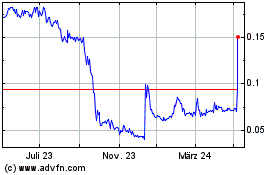

Implanet (EU:ALIMP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

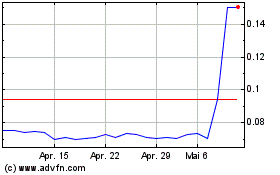

Implanet (EU:ALIMP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024