From National Threat to Opportunity, How Regulation is Changing With Crypto.

06 Oktober 2022 - 6:42AM

NEWSBTC

Amid one of the worst crypto winters, polls and research indicate

that crypto enthusiasm is still high. Public opinion about

cryptocurrencies like Bitcoin continues to trend positively. Polls

from The Ascent, made in May 2022, suggest crypto could become a

significant political force moving forward. Analysis from a

StarkWave survey in March 2022 found that 53% of American

respondents believe crypto will be ‘the future of finance.’ Within

the 25-34 age range, this figure swelled to 68%. A late September

report from VC firm Haun Ventures found somewhat similar sentiment

even amid bear markets for all of 2022. 72% of crypto holders in

the poll, who lived in one of four major U.S. Cities, said they

owned digital assets because “they want an economic system that is

more democratized, fair, and works for more people.” Notably – Haun

Ventures wrote, “voters are less likely to support candidates

perceived as standing in the way of a decentralized internet.”

These findings are notable as cryptos like Ethereum and stablecoins

help drive DeFi. As public sentiment grows warmer towards crypto,

surprisingly, some national governments might not be far behind.

For example, Colombia’s newly-minted President, Gustavo Petro,

explained in 2021 how “virtual currency is pure information and

therefore energy.” To the ire of some within the European

Parliament, French regulators approved the Binance crypto exchange

in May 2022. Will The U.S.A Be The Global Leader In Crypto

Regulation? Some speculate national governments could be looking to

the United States on how to handle cryptocurrencies. Notably, two

U.S. Senators announced the Responsible Financial Innovation Act in

early June 2022, which proposes a long list of crypto regulations

and attempts to clear up lingering questions about how to handle

the industry. The legislation came just a couple of months after

President Joe Biden announced a first-of-its-kind crypto executive

order, spearheading a ‘whole government approach’ towards

regulation. In an accompanying fact sheet, the White House

acknowledged crypto was here to stay and that “…digital assets can

also provide opportunities for American innovation and

competitiveness and promote financial inclusion.” A more detailed

framework followed in September 2022, marking a busy Fall 2022 for

crypto-focused activity in the hallways of Washington, D.C. In

early October, Senators Cynthia Lummis and Marsha Blackburn revised

the Cybersecurity Information Sharing Act, which, if passed, would

also open up opportunities for crypto-focused companies to report

cyber threats to government agencies directly. Around the same

time, Senator Bill Hagerty introduced the Digital Trading Clarity

Act of 2022, designed to help cover crypto exchanges from “certain”

SEC enforcement actions. Crypto regulation has long been a

controversial topic. Still, many argue clarity is needed to help

attract more users to the space and turn the vibrant digital asset

world into a more significant economic engine. Why Regulation Could

Be The Biggest Rocket Fuel For The Crypto World Brookings

Institution Senior Fellow Aaron Klein asserts that crypto-focused

regulation that strikes the right balance can help protect

long-term investors, help crypto companies innovate, and cut down

on fraud. ONANA senior market analyst Edward Moya argued in March

2022 that the overall crypto market cap at the time could double

within two years if successful crypto regulation came into force in

the United States. The United Arab Emirates and the Philippines

have already worked to pass legislation that provides apparent

regulatory oversight – ushering in opportunities for the

establishment of ‘ecozones’ where blockchain and crypto-focused

entities could set up and experiment in a business-friendly

environment. The cross-border nature of cryptocurrencies means any

sound regulatory approach requires cohesion between governments,

public officials, private industry professionals, and crypto

experts. Entities like the P3 Network continue to work towards

‘addressing the crypto question’ by unifying public and private

sector officials together to understand how disruptive technology

can support their goals of stable grids. Counting industry leaders

like Solidus Labs, IOHK, and Prime Trust as contributors, the P3

Network offers region-specific crypto roundtables with access to a

U.S. Congressional Technological Advisory Group that provides

recommendations to committees, companies and nations with

investment opportunities through P3 Network venture arm P3 Captial.

Learn more about the Miami-based thought leadership platform by

visiting the P3 Network website.

(COIN:XCNNUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

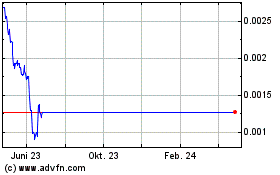

(COIN:XCNNUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über (Cryptocurrency): 0 Nachrichtenartikel

Weitere Chain News-Artikel