After Celsius: How Crypto Lenders Can Improve Sustainability

23 August 2022 - 3:25PM

NEWSBTC

We’re in the midst of an intriguing cryptocurrency bear market, to

say the least. The past several months provided high-profile

collapses such as algorithmic stablecoin TerraUSD, crypto hedge

fund Three Arrows Capital and more recently, crypto lender Celsius

Network. While overall macro events take some responsibility for

the failure of these organizations, there’s more to it than that.

Celsius, in particular, left a gaping hole in the crypto lending

industry due to their unsustainable business model and risky,

off-platform practices. Now, as Celsius attends its bankruptcy

trial, analysts are gathering around to see just what went wrong

and how crypto lenders can improve sustainability going forward.

Why did Celsius Network collapse? This week, crypto lending

platform Celsius filed for bankruptcy. A move that came with no

surprise. Ever since Celsius froze its user’s assets a few weeks

ago, it was just a matter of time before the once powerful lending

platform collapsed. But how did they get to that point, to begin

with? Last year, CEO Alex Mashinsky announced that Celsius has a

total of $25 billion in assets under management. Now, that number

is down to just $156 million. Celsius still owes around $4.7

billion to its customers plus a mysterious $1.2 billion hole found

on its balance sheet. The source of this implosion is traced to

leverage. Blockchain researchers used on-chain data to theorize

Celsius allegedly used DeFi protocols for yield farming strategies

with its client’s funds. Celsius was famous for offering a high

yield to its clients that held crypto on its platforms. Now, we’re

learning this yield came from these off-platform, DeFi yield

farming strategies. Adding to the case, Nic Carter from venture

capital firm Castle Island Ventures went on CNBC to suggest Celsius

were “subsidizing it [the yields] and taking losses to get clients

in the door. The yields on the other end were fake and subsidized.

They were pulling through returns from [Ponzi schemes]. Lending

funds to DeFi protocols comes with a variety of risks. For one,

there is an overall protocol risk, smart contract failure risk, and

of course, exposure to volatile markets. Several macroeconomic

events resulted in market volatility, crashing crypto prices, and

liquidating Celsius’s risky loans in the process. This resulted in

a permanent loss of client funds. How did the market react?

Financial markets are partially driven by emotion. Typically, when

there is a lot of fear in the market, prices decrease. If there is

an excess of greed, prices increase. The Celsius event is a classic

example of how mass fear is induced. When the crypto market bull

run came to an abrupt end in 2022, many investors (including

Celsius) were unprepared. Investors were fearful and began

withdrawing liquidity from Celsius faster than other users were

depositing it. Hence, Celsius were forced to lock withdrawals to

maintain whatever liquidity it had left. When the market tanked

even further, their leveraged long positions were liquidated. The

Celsius name is now tarnished and its CEL token is now trading at

around 70 cents, down from nearly $8 a year ago. Fear and lack of

trust within the crypto market are at high levels. A large part of

this is due to poor business practices from companies like Celsius,

in addition to the overall global economy. It’s a perfect storm for

a long, cold bear market. One we are in the midst of right now. As

we all know, however, prices move in waves. The market will recover

and brighter days are ahead. Bear markets are the perfect

opportunity for crypto lenders to look within themselves and

develop a more sustainable business model. That way, they can avoid

such disastrous failures in the future. How crypto lending can

improve in the future Using client funds for risk investment

maneuvers is not a new concept. We’ve seen this many times in both

traditional financial markets and within the cryptocurrency

industry. Yet, when the strategy fails, the results are disastrous.

Within the niche of crypto lending, there is always some element of

risk. Yet, with a sustainable business model, this risk is

mitigated more effectively. Take European FinTech platform

YouHodler for example. Starting in 2018 as a simple crypto lending

platform, YouHodler has since evolved to become a multifaceted

crypto wallet, exchange, yield generation tool, and crypto trading

solution. Like Celsius, YouHodler offers yield on crypto deposits

but the similarities stop there. Speaking with CoinTelegraph in a

live “ask me anything” session, YouHodler CEO Ilya Volkov revealed

key aspects of YouHodler’s business model that other crypto lenders

can use for inspiration. Volkov states that Youhodler is a

“self-sufficient” platform that is not backed by an initial coin

offering (ICO) or venture capitalization. Client funds are never

placed under anyone’s management besides YouHodler. “We keep all

client operations within the platform and have zero connections to

other DeFi protocols,” said Volkov. “We realize this results in

more conservative returns for our clients but ultimately, it is a

more secure and sustainable approach to yield generation.

Protecting our client’s funds is a primary goal of ours.” YouHodler

is also big on never “over-promising and under-delivering.” The

company takes a realistic approach to expectations. For example,

the current market environment caused YouHodler to decrease the

maximum amount that each client can earn a yield – from $100,000 to

$25,000. While it’s an inconvenience to some clients, it’s a

necessary move to keep operations working efficiently. When the

market recovers, these amounts will rise again. Bear markets are

never easy but there is a formula to them. Just as we are seeing

now, there is a lot of panic in the market. Celsius didn’t help

that panic nor did the high inflation, key rate hikes from central

banks, and the constant talks of a global recession. However,

companies like YouHodler were born in previous bear markets and

went on to thrive. Without a doubt, this current “crypto winter”

will produce new innovative solutions to our most important

financial problems. We can only hope they are approached with a new

focus on sustainability instead of pure profitability. Only then

will this market reach peak maturity and achieve its maximum

potential.

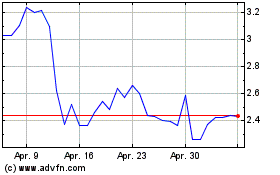

Waves (COIN:WAVESUSD)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Waves (COIN:WAVESUSD)

Historical Stock Chart

Von Nov 2023 bis Nov 2024