Stablecoin Market Share Dwindles As USDC And BUSD Supply Deplete

20 April 2023 - 7:00PM

NEWSBTC

The top 4 stablecoin valuations have declined significantly since

this year. USDC and BUSD supply has depleted by $31 billion,

pushing down the overall stablecoin market share. In

addition, the top 4 stablecoins’ market capitalization has dropped

by 23% from a peak of $161 billion per Glassnode’s report. The

report noted the major cause of the shrinking stablecoin market cap

is the dwindling supply of USDC and BUSD. USDT Dominance Increases

As BUSD And USDC Supply Shrink The stablecoin market has faced its

share of challenges this year, partly due to regulatory roadblocks

on BUSD and USDC. BUSD’s supply has reduced since its issuer Paxos

suspended minting after receiving a desist order from US

regulators. Related Reading: Bitcoin Bearish Signal: Supply Older

Than 7 Years On The Move Also, Circle announced that $3.3 billion

of USDCs are stuck on Silicon Valley Bank. As a result, the

aggregate market cap of the top four stablecoins fell from $161

billion by 23%. According to Glassnode’s report, USDC circulating

supply has declined by $20 billion while BUSD’s reduced by $11

billion from their peaks. Also, Tether (USDT), the number 1

stablecoin, lost $1.3 billion from its supply, while DAI lost $4.4

billion. At press time, the total market capitalization of all

stablecoins stands at $132 billion, an over 20% decline. More so,

stablecoins occupy 10.4% of the total crypto market cap, which has

fallen by over 50% from its peak. The top 4 stablecoins

account for nearly 90% billion of the overall stablecoin market

cap, with USDT dominating the chart. Although BUSD and USDC’s

decline affected the broader stablecoin market, the news brought

more shine to USDT. As a result, USDT’s supply dominance has

increased by over 60%. Moreover, the Tether printer appears to mint

more this year, adding $15 billion to the stablecoin’s supply. That

has pushed Tether’s supply to 81 billion USDT, nearly equaling its

May 2022 all-time high of 83 billion USDT. Stablecoin Market

Improves While Cryptocurrencies Turn Bearish Although BUSD and

USDC’s supply shortage is significant, over the past month, other

stablecoins increased supply. That includes the Pax Dollar (USDP),

which saw a 40% increase in circulating supply since the start of

April. The increased USDP minting pushed its circulating supply

above 1 billion. Related Reading: Yield Curve Reaches Historic Low,

What It Means For Bitcoin USDP isn’t the only stablecoin that

witnessed an increase in circulating supply. Gemini Dollar (GUSD)

also did, even though its supply is only a speck in the overall

stablecoin market share. This stablecoin witnessed an over 12%

increase in supply to $440,000 in the last month. Despite the total

stablecoin market share falling from its previous peak, it recorded

a slight increase of 0.06% in the last 24 hours. But the global

cryptocurrency market cap has declined by 1.36% over the past 24

hours. The crypto market has met a correction over the past

48 hours after several weeks of a bullish uptrend. At press time,

the two chief cryptocurrencies, Bitcoin and Ethereum, are trading

bearish. Meanwhile, most stablecoins are green today, with

USDT, USDC, and BUSD trading at a 0.01% price increase over the

past 24 hours. Featured image from Pixabay and chart from

Tradingview

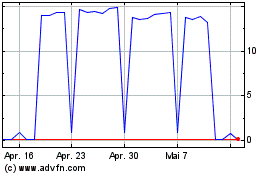

USDP Stablecoin (COIN:USDPPUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

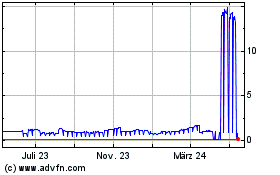

USDP Stablecoin (COIN:USDPPUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über USDP Stablecoin (Cryptocurrency): 0 Nachrichtenartikel

Weitere Pax Dollar News-Artikel