Fidelity Director Analyzes Bitcoin Potential: Could It Hit $6 Trillion Market Cap?

24 Februar 2024 - 3:00AM

NEWSBTC

In recent years, the debate surrounding Bitcoin’s (BTC) potential

market share relative to gold has garnered significant attention,

as recently approved Bitcoin Exchange-Traded Funds (ETFs) can bring

Bitcoin significantly closer to gold in key metrics. Jurrien

Timmer, Director of Global Macro at Fidelity Investments, has put

forward an analysis that sheds light on this subject. By examining

the value of “monetary gold” and Bitcoin’s market capitalization,

as well as considering the impact of halvings on Bitcoin’s supply,

Timmer presents insights into the future dynamics of these two

assets. Gold Vs Bitcoin Timmer’s analysis begins by

estimating the share of gold held by central banks and private

investors for monetary purposes, excluding jewelry and industrial

usage. While this estimation is not exact, based on data from the

World Gold Council, Timmer suggests that monetary gold accounts for

approximately 40% of the total above-ground gold. Drawing upon his

previous calculations, Timmer posits that Bitcoin has the potential

to capture around a quarter of the monetary gold market,

with monetary gold valued at around $6 trillion and Bitcoin’s

market capitalization at $1 trillion. Related Reading: Avalanche

C-Chain Experiences Block Production Halt, AVAX Price Responds

Timmer further delves into the impact of Bitcoin halvings on its

price. Historically, halvings have had a substantial effect on

Bitcoin’s value. However, Timmer raises the hypothesis that

diminishing returns may occur in the future as the incremental

supply of new Bitcoin decreases. By comparing the outstanding

supply and incremental supply of Bitcoin with those of gold, Timmer

demonstrates that the diminishing impact of the halvings is likely

to be more pronounced in the future. As the number of coins

available for mining dwindles, the influence of each subsequent

halving event on Bitcoin’s price may diminish. This insight prompts

Timmer to explore alternative ways to project Bitcoin’s price

trajectory. BTC’s Price Projections To account for the diminishing

impact of halvings, Timmer introduces the concept of a modified

Stock To Flow (S2F) curve. This curve is derived by overlaying an

asymptotic supply curve, representing the percentage of coins mined

relative to the final supply cap, onto the original S2F curve.

Timmer proposes using a regression formula incorporating PlanB’s

original S2F curve and the asymptotic supply curve as independent

variables. This modified S2F curve aligns more closely with the

supply dynamics of gold, reflecting a scenario in which Bitcoin’s

scarcity advantage continues, but its impact on price gradually

diminishes over time. Using the modified S2F model and considering

the supply characteristics of gold, Timmer generates hypothetical

price projections for Bitcoin that place the cryptocurrency at

approximately $100,000 by the end of 2024. Related Reading: Uniswap

Foundation Unveils Major Upgrade Plan, UNI Price Skyrockets 52%

According to Timmer, if Bitcoin were to capture a quarter of the

monetary gold market, it would represent a remarkable shift in the

global distribution of wealth, which would gradually drive up the

cryptocurrency’s price over the coming years. Featured image from

Shutterstock, chart from TradingView.com

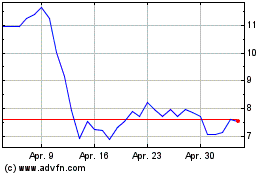

Uniswap (COIN:UNIUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024