Ethereum Risk-Reward Ratio Is Now Attractive, Brokerage Firm Explains

03 Dezember 2024 - 6:00AM

NEWSBTC

Ethereum (ETH) now offers an attractive risk-reward ratio,

according to analysts at research and brokerage firm Bernstein.

Despite underperforming compared to other major cryptocurrencies

like Bitcoin (BTC), Solana (SOL), and XRP for most of 2024,

Ethereum’s strong fundamentals may set the stage for a potential

rally. Why Is Ethereum Struggling? Bernstein Analysts Explain

Ethereum, the second-largest cryptocurrency with a market cap

exceeding $430 billion, may be on the verge of significant positive

price action. Bernstein analysts suggest that ETH’s fundamentals

remain strong despite its underperformance, making it an appealing

investment opportunity. To put Ethereum’s performance into

perspective, on a year-to-date (YTD) basis, Bitcoin and Solana have

surged 125% and 122%, respectively, while ETH has only managed a

57% increase. In a client note shared today, analysts led by Gautam

Chhugani highlighted several factors contributing to Ethereum’s

struggles. One issue is that ETH has not established itself as a

store of value to the same extent as BTC. Additionally, the leading

smart contract platform faces increasing competition from

low-latency Layer 1 blockchains such as Solana, Sui, and Aptos.

Related Reading: Ethereum Accumulation Rises As 70% Holders Are In

Profit: What It Means For ETH Price? The note also pointed out that

Ethereum’s reliance on Layer 2 blockchains, including Optimism,

Arbitrum, and Base, often redirects users away from Ethereum’s main

chain. This hampers user retention and limits transaction fee

growth, creating a headwind for ETH’s price momentum. Is Now The

Right Time To Buy ETH? Bernstein analysts argue that Ethereum’s

outlook could improve substantially, particularly in light of

Republican presidential candidate Donald Trump’s recent election

victory. Following Trump’s win, the total cryptocurrency market cap

has surged over 45%, surpassing $3.5 trillion. Ethereum has been

one of the biggest beneficiaries of this rally, gaining 46% since

the election compared to Bitcoin’s 41% and Solana’s 36%. The

analysts also noted key developments that could support Ethereum’s

growth moving forward. They highlighted the increasing likelihood

of staking yield approval in Ethereum exchange-traded funds (ETFs)

under a Trump-led, crypto-friendly Securities and Exchange

Commission (SEC). The analysts explained: We believe, under a new

Trump 2.0 crypto-friendly SEC, ETH staking yield will likely be

approved. The analysts added that Ethereum’s current yield rate of

3% could increase to as high as 4% to 5%, which could be an

attractive yield rate for investors in a declining interest rate

environment. Further, the recently observed growth in Ethereum ETFs

in the form of higher inflows could benefit ETH. Although ETH ETFs

had a lukewarm launch, they have recently outperformed Bitcoin ETFs

in daily inflows. For instance, on November 29, spot ETH ETFs in

the US attracted $332.9 million in inflows, compared to $320

million for Bitcoin ETFs. Related Reading: Ethereum Spot ETFs

Attract Record $295 Million Daily Inflows – Is ETH Set For New

Highs? In addition, Ethereum’s transition to a proof-of-stake (PoS)

consensus algorithm in September 2023 and the protocol’s burn

mechanism have stabilized ETH’s total supply around 120 million. Of

these, about 28% is tied in staking contracts while roughly 10% is

in lending protocols or Layer 2 bridges. With a high proportion –

close to 60% – of total ETH supply unmoved in the past year, the

analysts at Bernstein believe the digital asset might benefit from

favourable demand-supply dynamics. At press time, ETH trades at

$3,644, down 1.8% in the past 24 hours. Featured image from

Unsplash, chart from Tradingview.com

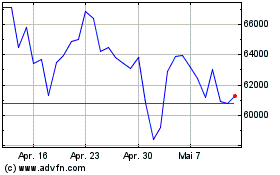

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

Von Dez 2023 bis Dez 2024