PayPal Incentivizing People To Provide PYUSD Liquidity On Curve, CRV To The Moon?

11 Januar 2024 - 1:00AM

NEWSBTC

In a landmark move, PayPal, the payment processor, has incentivized

PYUSD liquidity on Curve Finance, the world’s largest stablecoin

decentralized exchange (DEX) by trading volume. PayPal

Incentivizing PYUSD Liquidity Via Curve This development, which

Stake DAO first captured on January 10, sent shockwaves through the

crypto community, with many experts predicting that Curve is on its

way to becoming the go-to platform for institutional and corporate

trading of on-chain stablecoins. PayPal’s decision to incentivize

PYUSD liquidity on Curve is a significant step forward for adopting

stablecoins and promoting decentralized finance (DeFi) protocols in

general. By providing attractive rewards for liquidity providers,

PayPal is signaling its commitment to the growth of this rapidly

evolving sector. Related Reading: Cardano Price Explosion: Crypto

Analyst Predicts ADA Price To Hit $6 As part of its incentive

program, PayPal has deposited vote incentives worth $132k in PYUSD

on Votemarket, a vote incentive platform. These rewards are

designed to encourage users to increase their liquidity on Curve.

In addition, PayPal will offer direct rewards to liquidity

providers distributed in PYUSD, with an APY of 11%. Observers note

that the $66,000 allocated weekly to Votemarket could direct at

least $55k in CRV, a governance token on Curve Finance, to the

PYUSD-USDC pool. Institutional Endorsement: Will CRV Rally Above

$0.75? With PayPal’s endorsement, Curve may attract even more

liquidity and cement its position as a leader in on-chain

stablecoin trading. It is unclear whether other Wall Street

heavyweights on the wings are ready to enhance liquidity via Curve

or other DeFi protocols. Their involvement will validate Curve and

DeFi’s potential, accelerating adoption among institutional

investors. According to DeFiLlama data on January 10,

Curve has a total value locked (TVL) of $1.82 billion, with a big

chunk of this in Ethereum. The protocol has deployed in Ethereum

layer-2s and other Ethereum Virtual Machine (EVM) compatible

platforms, including Arbitrum. For now, CRV, the native token of

Curve, remains under pressure. Looking at the performance in the

daily chart, the token is down 30% from recent December peaks,

sliding when writing. Related Reading: Bitcoin ETF Drama

Reveals Post-Approval Price Trend: Experts From price technical

analysis, any break above $0.75 could spark more demand, lifting

the token to new 2024 highs. Presently, CRV is trending inside a

bear candlestick, signaling general weakness. In the short term,

sharp losses below $0.45 might trigger a sell-off. CRV risks

dropping to September 2023 lows of around $0.40 in that case.

Feature image from Canva, chart from TradingView

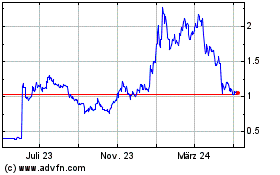

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

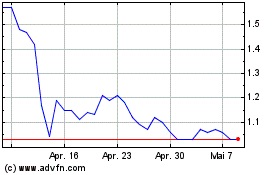

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024