2023’s Crypto Bounty: These Top 13 Airdrops Distributed Over $4 Billion

26 Dezember 2023 - 9:30PM

NEWSBTC

023 has emerged as a significant year for crypto airdrops. A recent

analysis revealed that out of the 50 most substantial crypto

airdrops since 2020, 13 occurred in 2023, collectively distributing

roughly $4.56 billion worth of tokens. These figures are calculated

based on the tokens’ values at their respective all-time highs

(ATHs), painting a picture of substantial distribution. The year

2023’s airdrop landscape was less crowded than 2021, which had 18

entries in the top 50, but the impact was notable. A report from

CoinGecko highlights this trend shift, contrasting it with the mere

5 airdrops in 2020 and 14 in 2022. Related Reading: Arbitrum

Network Faces Major Outage, ARB Token Faces 4% Decline Arbitrum

Leads 2023’s Airdrop Charge Arbitrum, an Ethereum layer 2 scaling

solution, topped the 2023 airdrop chart by distributing ARB tokens

valued at $1.96 billion on March 23. This move significantly

impacted its total value locked (TVL), which surged by 147% during

the anticipation period. This airdrop alone constituted a

substantial portion of the total value distributed in the year.

Celestia, with its TIA tokens, followed suit, distributing $728

million on October 31. The airdrop targeted a diverse group,

including developers, Ethereum rollup users, and stakeholders in

the Cosmos Hub and Osmosis. Blur’s first airdrop, which handed out

$446 million worth of BLUR on February 14, ranked third. The

success of this initial airdrop set the stage for a second, which

distributed an additional $327 million, ranking fourth. A Closer

Look At 2023’s Crypto Airdrop Trends While Arbitrum, Celestia, and

Blur’s first airdrop made up 69.9% of the total airdrop value in

2023, the year saw diverse contributions across the sector. Jito,

Worldcoin, Aidoge, and other projects followed, each adding to the

cumulative value and diversity of the airdrops. The total value

distributed in 2023 may have seen a decline compared to 2022, but

it’s essential to consider the market cycles these newer tokens

have experienced. Unlike earlier tokens which saw the 2021 bull

market and the 2022 non-fungible token (NFT) market surge, many of

2023’s airdropped tokens are yet to undergo a full bull market

cycle. Related Reading: Arbitrum Sale On Binance: How This

Investment Firm Lost $465,000 In An ARB Trade In terms of

performance, Arbitrum and Worldcoin have shown significant gains,

with ARB rising by 22% in the past week to trade at $1.33, at the

time of writing and WLD by over 60% in the past two weeks to trade

at $3.86, at the time of writing. Celestia and Blur follow closely

in terms of price appreciation, with both tokens up by 10.7% and

5.7% respectively in the past 7 days. Conversely, Jito, despite

being the newest among them, has seen a dip in its value down by

9.4% in the past two weeks but shows signs of recovery in the past

week, up by 9%, illustrating the dynamic and often unpredictable

nature of token valuations post-airdrop. Featured image from

iStock, Chart from TradingView

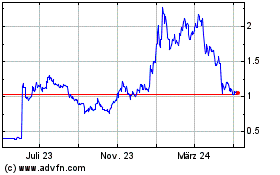

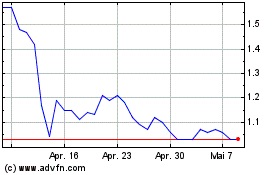

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Arbitrum (COIN:ARBUSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024