FTX Unveils $3.4B Crypto Holdings: $1.16B Solana, $560M Bitcoin – Is Trouble On The Horizon?

11 September 2023 - 11:00PM

NEWSBTC

In a recent Monday court filing, it was disclosed that the estate

of bankrupt crypto exchange FTX has amassed approximately $7

billion in assets (3.4B in crypto), including $1.16 billion worth

of Solana (SOL) tokens and $560 million in Bitcoin (BTC). The

news sent shockwaves through the cryptocurrency market, with SOL

and BTC experiencing negative price movements. Related Reading:

Lost In Transaction: Bitcoin User Overpaid By $500,000 For A $200

Deal SOL And BTC Experience Declines As FTX Prepares For

Liquidation Solana (SOL), trading around the $20 level on Sunday,

witnessed a significant decline in response to the news. Its price

plummeted to its current level of $17.83. Bitcoin (BTC) also

retraced by over 2.7% in the past hours, reaching as low as

$24,9000. In addition to SOL and BTC, the court filing revealed

other significant holdings of the FTX estate. These include

Ethereum (ETH), valued at $192 million, Aptos (APT) at $137

million, Tether’s stablecoin (USDT) at $120 million, and XRP at

$119 million, among others such as wrapped Bitcoin (WBTC) and

wrapped Ethereum (WETH), Bit (BIT), and Stargate Finance (STG). The

court filing further highlighted that the FTX estate had secured

cash throughout the Chapter 11 process, employing a post-petition

cash management system. The Debtors “successfully” navigated the Q1

2023 financial banking turmoil and obtained fiat from more than 30

banking institutions worldwide. Cash has been consolidated

and safeguarded within a Master account, with unrestricted cash

increasing primarily through venture investment monetization and

stablecoin conversions. This Wednesday, the FTX estate is expected

to seek approval to liquidate approximately $3.4 billion of

cryptocurrencies. This step marks a significant milestone in the

bankruptcy proceedings. Options For Relaunch? On September 11,

Fortune Magazine reported that the FTX estate had approached over

75 potential bidders, evaluating the possibility of relaunching the

bankrupt crypto exchange. The stakeholders were given a

deadline of September 24 to submit their proposals for “FTX 2.0.”

The process considers various potential structures, including

acquisition, merger, recapitalization, or other transactions to

relaunch FTX.com and/or FTX US exchanges. While the specific

identities of the bidders remain undisclosed, blockchain technology

company Figure and venture capital firm Tribe Capital have been

previously mentioned as potential suitors for the relaunch.

The exploration of FTX’s relaunch represents a key development in

the effort to sell off, rebrand, or restart the exchange, which has

been at the center of a high-profile white-collar criminal case.

FTX’s native token, FTT, has experienced positive price movement on

news of the potential launch of FTX 2.0. On Monday, it traded

nearly 17% higher than at the beginning of the year, reflecting

market optimism surrounding the prospect of a relaunch. As the

bankruptcy proceedings unfold and the FTX estate moves towards

liquidation, the crypto industry will closely monitor the impact on

the market and the resolution of outstanding debts. The

search for bidders to revive the exchange introduces an additional

layer of complexity to this evolving situation, with potential

implications for the future of FTX and its stakeholders. Related

Reading: Remember That Guy That Lost A Flashdrive With 8,000 BTC?

Here’s What He’s Up To Now Overall, the bankruptcy of the failed

crypto exchange has revealed substantial asset holdings of $7

billion, including significant amounts of Solana (SOL) and Bitcoin

(BTC). The subsequent market reactions and the quest for bidders to

relaunch the exchange have brought further uncertainty to the

crypto landscape. The outcome of the bankruptcy proceedings

and the relaunch efforts will shape the future trajectory of FTX

and its position within the industry. Featured image from iStock,

charts from TradingView.com

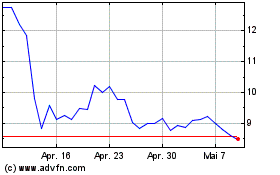

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Aptos (COIN:APTUSD)

Historical Stock Chart

Von Mai 2023 bis Mai 2024