0001893448

false

0001893448

2023-08-10

2023-08-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

August

10, 2023

Date

of Report (Date of earliest event reported)

STRONG

GLOBAL ENTERTAINMENT, INC.

(Exact

name of registrant as specified in its charter)

| British

Columbia, Canada |

|

001-41688

|

|

N/A

|

| (State

or other jurisdiction of |

|

(Commission

|

|

(IRS

Employer |

| incorporation

or organization) |

|

File

No.) |

|

Identification

Number) |

| 5960

Fairview Road, Suite 275 |

|

|

| Charlotte,

North Carolina |

|

28210

|

| (Address

of principal executive offices) |

|

(Zip

Code) |

(704)

994-8279

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Class

A Common Voting Shares, without par value |

|

SGE |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition

Strong

Global Entertainment, Inc. (the “Company”) issued a press release on August 10, 2023, with earnings information for the

Company’s fiscal quarter ended June 30, 2023. The press release is furnished with this Current Report on Form 8-K (this “Current

Report”) as Exhibit 99.1.

Item

7.01 Regulation FD Disclosure

The

information set forth under Item 2.02 of this Current Report is incorporated herein by reference. In addition, on August 10, 2023, management

of the Company plans to discuss the Company’s financial results for the fiscal quarter ended June 30, 2023, and the Company’s

business plan, strategy and outlook on an earnings conference call with analysts and investors. The supplemental slides to be referenced

during the conference call are furnished with this Current Report as Exhibit 99.2.

The

information contained in Items 2.02 and 7.01 to this Current Report, including in Exhibits 99.1 and 99.2, is being

“furnished” and, as such, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor

shall it be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as

shall be expressly set forth by specific reference in such filing.

Forward

Looking Statements

In

addition to the historical information in this Current Report and in the exhibits furnished with this Current Report, it includes

forward-looking statements which involve a number of risks and uncertainties, including but not limited to those discussed in the “Risk

Factors” section contained in our final prospectus as filed with the SEC on May 16, 2023 pursuant to Rule 424(b)(5) under the

Securities Act, relating to our Registration Statement on Form S-1, and the following risks and uncertainties: the Company’s

ability to maintain and expand its revenue streams to compensate for the lower demand for the Company’s digital cinema products

and installation services; potential interruptions of supplier relationships or higher prices charged by suppliers; the Company’s

ability to successfully compete and introduce enhancements and new features that achieve market acceptance and that keep pace with technological

developments; the Company’s ability to successfully execute its capital allocation strategy or achieve the returns it expects from

these holdings; the Company’s ability to maintain its brand and reputation and retain or replace its significant customers; challenges

associated with the Company’s long sales cycles; the impact of a challenging global economic environment or a downturn in the markets;

the effects of economic, public health, and political conditions that impact business and consumer confidence and spending, including

rising interest rates, periods of heightened inflation and market instability, the outbreak of any highly infectious or contagious diseases,

such as COVID-19 and its variants or other health epidemics or pandemics, and armed conflicts, such as the ongoing military conflict

in Ukraine and related sanctions; economic and political risks of selling products in foreign countries (including tariffs); risks of

non-compliance with U.S. and foreign laws and regulations, potential sales tax collections and claims for uncollected amounts; cybersecurity

risks and risks of damage and interruptions of information technology systems; the Company’s ability to retain key members of management

and successfully integrate new executives; the Company’s ability to complete acquisitions, strategic investments, entry into new

lines of business, divestitures, mergers or other transactions on acceptable terms, or at all; the impact of economic, public health

and political conditions on the companies in which the Company holds equity stakes; the Company’s ability to utilize or assert

its intellectual property rights, the impact of natural disasters and other catastrophic events, whether natural, man-made, or otherwise

(such as the outbreak of any highly infectious or contagious diseases, or armed conflict); the adequacy of the Company’s insurance;

the impact of having a controlling stockholder and vulnerability to fluctuation in the Company’s stock price. Given the risks and

uncertainties, readers should not place undue reliance on any forward-looking statement and should recognize that the statements are

predictions of future results which may not occur as anticipated. Many of the risks listed above have been, and may further be, exacerbated

by the impact of economic, public health (such as a resurgence of the COVID-19 pandemic) and political conditions (such as the military

conflict in Ukraine) that impact consumer confidence and spending, particularly in the cinema, entertainment, and other industries in

which the Company and its subsidiaries operate, and the worsening economic

environment. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results,

due to the risks and uncertainties described herein, as well as others not now anticipated. New risk factors emerge from time to time

and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such factors on our business

or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any

forward-looking statements. Except where required by law, the Company assumes no obligation to update forward-looking statements to reflect

actual results or changes in factors or assumptions affecting such forward-looking statements.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

STRONG

GLOBAL ENTERTAINMENT, INC. |

| |

|

|

| Date:

August 10, 2023 |

By:

|

/s/

Todd R. Major |

| |

|

Todd

R. Major |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 1 of 8 |

Strong Global Entertainment Reports Second Quarter

2023 Operating Results

Charlotte, N.C., – August 10, 2023 – Strong

Global Entertainment, Inc. (NYSE American: SGE) (the “Company” or “Strong”) today announced operating results

for the second quarter ended June 30, 2023.

Operational Highlights

| · | The Company completed its initial public offering and began trading on the NYSE American in May 2023. |

| · | Revenue and Adjusted EBITDA more than doubled for the quarter with increased demand from our cinema customers

and our first significant sale of IP at Strong Studios. |

| · | Added new customer relationships, including preferred screen partnership with Kinepolis, the Company’s

first major European addition, and an exclusive service partnership with U.S.-based MJR Theatres. |

| · | Expanded service team to support increasing demand for laser projection upgrades. |

| · | Strong Studios completed the sale of a portion of the intellectual property for one of its projects, resulting

in initial revenue of $6.4 million. |

Mark Roberson, the Company’s Chief Executive

Officer, commented, “This quarter demonstrated significant growth across our business and the advancement of key strategic initiatives

that should drive long-term value for shareholders. The spin-out and initial public offering was a huge accomplishment for the team,

and we are excited to now be operating as a separate public company. Business continued to strengthen as demand for laser upgrades increased

and we continued to expand our market share. The recent record-breaking box office performances demonstrate the strength of the premium

cinema market and laser projection and other enhancements to the viewing experience continue to drive exhibitor demand. We also continue

to drive growth in our non-cinema screen business, and recently secured a new seven-figure immersive project that we expect to deliver

in the second half of this year.”

Mr. Roberson continued, “Last year we launched

our Strong Studios division to leverage the strength of our cinema business with the development of original feature films and television

series. During the quarter, Strong Studios generated revenue of over $6 million, which we view as a noteworthy validation of our long-term

strategy to create and market original entertainment vehicles. We are encouraged by the division’s progress and multiple projects

in the pipeline.”

Kyle Cerminara, the Company’s Chairman

of the Board, commented, “We are very excited to see Strong Global Entertainment operating as a stand-alone public company. Strong

is an industry leader in the cinema business and has the opportunity to grow into a much larger entertainment company creating meaningful

value for our shareholders.”

Second Quarter 2023 Financial Review (Compared

to Second Quarter 2022)

| · | Revenue grew 102% to $17.8 million compared to $8.8 million in the second quarter of 2022. Revenues from

screen systems and cinema services grew 24% and 42% respectively, as the demand from our cinema customers continued to strengthen. The

Company has been increasing the scope of our services and added resources to better support its customers and to increase market share

in cinema services. Revenue from installation services more than doubling during the quarter and the Strong Studios division realized

$6.4 million in revenue from the sale of an ownership stake in one of its projects. |

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 2 of 8 |

| · | Gross profit increased to $7.2 million, or 40.4% of revenues, compared to $2.1 million, or 23.8% of revenue

in the second quarter of 2022. Gross profit from service revenue was $5.1 million or 54.1% of revenues for the second quarter of 2023

compared to $0.3 million or 11.7% of revenues for the second quarter of 2022. Gross profit percentage increased from the prior year primarily

due to the sale of intellectual property in one of the Company’s projects, as well as slightly higher overall gross margin from

cinema services. Strong expects margins on installation services to continue to improve as the Company continues to onboard and utilize

its internal installation team. |

| · | Income from operations was $0.2 million compared to a loss from operations $0.1 million in the second

quarter of 2022, due to the sale of an ownership stake in one of Strong Studio’s projects, partially offset non-recurring transaction-related

expenses recognized in the current quarter. Excluding non-recurring transaction related expenses, income from operations during the second

quarter of 2022 was $1.3 million. |

| · | Net loss was $0.4 million, or $0.06 per basic and diluted share, as compared to breakeven in the prior

year. The increase in net loss was primarily due to the transaction-related expenses and unfavorable foreign exchange fluctuations. |

| · | Adjusted EBITDA improved to $3.5 million as compared to $0.1 million in the prior year. |

Conference Call

A conference call to discuss the Company’s

2023 second quarter financial results will be held on Thursday, August 10, 2023 at 4:30 pm Eastern Time. Interested parties can

listen to the call via live webcast or by phone. To access the webcast, visit the Company’s website or use the following

link: SGE Webcast Link. To access the conference call by phone, dial (888) 506-0062 (domestic) or (973) 528-0011 (international)

and use participant code 410426. Please access the webcast or dial in at least five minutes before the start of the call to register.

A replay of the webcast will be available following

the conclusion of the live broadcast and accessible on the Company’s website.

About Strong Global Entertainment, Inc.

Strong Global Entertainment, Inc. is a leader in the

entertainment industry, providing mission critical products and services to cinema exhibitors and entertainment venues for over 90 years.

The Company manufactures and distributes premium large format projection screens, provides comprehensive managed services, technical support

and related products and services primarily to cinema exhibitors, theme parks, educational institutions, and similar venues. In addition

to traditional projection screens, the Company manufactures and distributes its Eclipse curvilinear screens, which are specially designed

for theme parks, immersive exhibitions, as well as simulation applications. It also provides maintenance, repair, installation, network

support services and other services to cinema operators, primarily in the United States. The Company also owns Strong Studios, Inc., which

develops and produces original feature films and television series.

About FG Group Holdings Inc.

FG Group Holdings

Inc. (NYSE American: FGH) is a diversified holding company with operations and investments across a broad range of industries. FG

Group Holdings Inc. The Company has a majority ownership in Strong Global Entertainment, (NYSE American: SGE), which includes STRONG/MDI

Screen Systems (www.strongmdi.com), the leading premium screen and projection coatings supplier in the world and Strong Technical Services

(www.strong-tech.com), which provides comprehensive managed service offerings with 24/7/365 support nationwide to ensure solution uptime

and availability. FG Group Holdings Inc. also holds equity stakes in GreenFirst Forest Products Inc., Firefly Systems, Inc., and

FG Financial Group, Inc., as well as real estate through its Digital Ignition operating business.

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 3 of 8 |

About Fundamental Global®

Fundamental Global® is a private partnership focused

on long-term strategic holdings. Fundamental Global® was co-founded by former T. Rowe Price, Point72 and Tiger Cub portfolio manager

Kyle Cerminara and former Chairman and CEO of TD Ameritrade, Joe Moglia. Its current holdings include FG Financial Group Inc., FG Group Holdings Inc., BK Technologies Corp., GreenFirst Forest Products,

Inc., FG Merger Corp., FG Acquisition Corp., OppFi Inc., Hagerty Inc., and FG Communities, Inc.

The FG® logo is a registered trademark of Fundamental Global®.

Use of Non-GAAP Measures

Strong Global Entertainment, Inc. prepares its consolidated

financial statements in accordance with United States generally accepted accounting principles (“GAAP”). In addition to disclosing

financial results prepared in accordance with GAAP, the Company discloses information regarding Adjusted EBITDA (“Adjusted EBITDA”),

which differs from the commonly used EBITDA (“EBITDA”). Adjusted EBITDA both adjusts net income (loss) to exclude income taxes,

interest, and depreciation and amortization, and excludes share-based compensation, impairment charges, equity method income (loss), fair

value adjustments, severance, foreign currency transaction gains (losses), transactional gains and expenses, gains on insurance recoveries,

certain tax credits and other cash and non-cash charges and gains.

EBITDA and Adjusted EBITDA are not measures of performance

defined in accordance with GAAP. However, Adjusted EBITDA is used internally in planning and evaluating the Company’s operating

performance. Accordingly, management believes that disclosure of these metrics offers investors, bankers and other stakeholders an additional

view of the Company’s operations that, when coupled with the GAAP results, provides a more complete understanding of the Company’s

financial results.

EBITDA and Adjusted EBITDA should not be considered

as an alternative to net income (loss) or to net cash from operating activities as measures of operating results or liquidity. The Company’s

calculation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures used by other companies, and the measures

exclude financial information that some may consider important in evaluating the Company’s performance.

EBITDA and Adjusted EBITDA have limitations as analytical

tools, and you should not consider them in isolation, or as substitutes for analysis of the Company’s results as reported under

GAAP. Some of these limitations are: (i) they do not reflect the Company’s cash expenditures, or future requirements for capital

expenditures or contractual commitments, (ii) they do not reflect changes in, or cash requirements for, the Company’s working capital

needs, (iii) EBITDA and Adjusted EBITDA do not reflect interest expense, or the cash requirements necessary to service interest or principal

payments, on the Company’s debt, (iv) although depreciation and amortization are non-cash charges, the assets being depreciated

and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such

replacements, (v) they do not adjust for all non-cash income or expense items that are reflected in the Company’s statements of

cash flows, (vi) they do not reflect the impact of earnings or charges resulting from matters management considers not to be indicative

of the Company’s ongoing operations, and (vii) other companies in the Company’s industry may calculate these measures differently

than the Company does, limiting their usefulness as comparative measures.

Management believes EBITDA and Adjusted EBITDA facilitate

operating performance comparisons from period to period by isolating the effects of some items that vary from period to period without

any correlation to core operating performance or that vary widely among similar companies. These potential differences may be caused by

variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in

effective tax rates or net operating losses) and the age and book depreciation of facilities and equipment (affecting relative depreciation

expense). The Company also presents EBITDA and Adjusted EBITDA because (i) management believes these measures are frequently used by securities

analysts, investors and other interested parties to evaluate companies in the Company’s industry, (ii) management believes investors

will find these measures useful in assessing the Company’s ability to service or incur indebtedness, and (iii) management uses EBITDA

and Adjusted EBITDA internally as benchmarks to evaluate the Company’s operating performance or compare the Company’s performance

to that of its competitors.

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 4 of 8 |

Forward-Looking Statements

In addition to the historical information included

herein, this press release contains “forward-looking statements” that are subject to substantial risks and uncertainties.

All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking

statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,”

“contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,”

“may,” “might,” “plan,” “potential,” “predict,” “project,” “target,”

“aim,” “should,” “will” “would,” or the negative of these words or other similar expressions,

although not all forward-looking statements contain these words. Forward-looking statements are based on the Company’s current expectations

and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements

are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described

more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the SEC.

Forward-looking statements contained in this announcement are made as of this date, and the Company undertakes no duty to update such

information except as required under applicable law.

Investor Relations Contacts:

Mark Roberson

Strong Global Entertainment, Inc. - Chief Executive

Officer

(704) 471-6784

IR@strong-entertainment.com

John Nesbett/Jennifer Belodeau

IMS Investor Relations

(203) 972-9200

sge@imsinvestorrelations.com

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 5 of 8 |

Strong Global Entertainment, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,371 | | |

$ | 3,615 | |

| Accounts receivable, net | |

| 6,377 | | |

| 6,148 | |

| Inventories, net | |

| 3,125 | | |

| 3,389 | |

| Other current assets | |

| 11,813 | | |

| 4,547 | |

| Total current assets | |

| 25,686 | | |

| 17,699 | |

| Property, plant and equipment, net | |

| 1,655 | | |

| 4,607 | |

| Operating lease right-of-use assets | |

| 4,761 | | |

| 237 | |

| Finance lease right-of-use asset | |

| 853 | | |

| 606 | |

| Film and television programming rights, net | |

| 7,691 | | |

| 1,501 | |

| Intangible assets, net | |

| 2 | | |

| 6 | |

| Goodwill | |

| 902 | | |

| 882 | |

| Total assets | |

$ | 41,550 | | |

$ | 25,538 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,232 | | |

$ | 4,106 | |

| Accrued expenses | |

| 7,327 | | |

| 4,486 | |

| Payable to FG Group Holdings Inc. | |

| 2,264 | | |

| 1,861 | |

| Short-term debt | |

| 12,219 | | |

| 2,510 | |

| Current portion of long-term debt | |

| 37 | | |

| 36 | |

| Current portion of operating lease obligations | |

| 326 | | |

| 64 | |

| Current portion of finance lease obligations | |

| 166 | | |

| 105 | |

| Deferred revenue and customer deposits | |

| 1,140 | | |

| 1,769 | |

| Total current liabilities | |

| 26,711 | | |

| 14,937 | |

| Operating lease obligations, net of current portion | |

| 4,545 | | |

| 234 | |

| Finance lease obligations, net of current portion | |

| 690 | | |

| 502 | |

| Long-term debt, net of current portion | |

| 107 | | |

| 126 | |

| Deferred income taxes | |

| - | | |

| 529 | |

| Other long-term liabilities | |

| 625 | | |

| 6 | |

| Total liabilities | |

| 32,678 | | |

| 16,334 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Common stock | |

| - | | |

| - | |

| Additional paid-in-capital | |

| 14,989 | | |

| - | |

| Accumulated deficit | |

| (841 | ) | |

| - | |

| Accumulated other comprehensive loss | |

| (5,276 | ) | |

| (5,024 | ) |

| Net parent investment | |

| - | | |

| 14,228 | |

| Total equity | |

| 8,872 | | |

| 9,204 | |

| Total liabilities and equity | |

$ | 41,550 | | |

$ | 25,538 | |

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 6 of 8 |

Strong Global Entertainment, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net product sales | |

$ | 8,411 | | |

$ | 6,683 | | |

$ | 15,615 | | |

$ | 14,386 | |

| Net service revenues | |

| 9,428 | | |

| 2,140 | | |

| 12,175 | | |

| 4,157 | |

| Total net revenues | |

| 17,839 | | |

| 8,823 | | |

| 27,790 | | |

| 18,543 | |

| Total cost of products | |

| 6,305 | | |

| 4,834 | | |

| 11,770 | | |

| 10,692 | |

| Total cost of services | |

| 4,325 | | |

| 1,890 | | |

| 6,490 | | |

| 3,547 | |

| Total cost of revenues | |

| 10,630 | | |

| 6,724 | | |

| 18,260 | | |

| 14,239 | |

| Gross profit | |

| 7,209 | | |

| 2,099 | | |

| 9,530 | | |

| 4,304 | |

| Selling and administrative expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling | |

| 618 | | |

| 684 | | |

| 1,151 | | |

| 1,225 | |

| Administrative | |

| 6,414 | | |

| 1,475 | | |

| 7,845 | | |

| 2,770 | |

| Total selling and administrative expenses | |

| 7,032 | | |

| 2,159 | | |

| 8,996 | | |

| 3,995 | |

| Gain on disposal of assets | |

| - | | |

| - | | |

| 1 | | |

| - | |

| Income (loss) from operations | |

| 177 | | |

| (60 | ) | |

| 535 | | |

| 309 | |

| Other (expense) income: | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (62 | ) | |

| (27 | ) | |

| (118 | ) | |

| (51 | ) |

| Foreign currency transaction (loss) gain | |

| (426 | ) | |

| 206 | | |

| (309 | ) | |

| 128 | |

| Other income, net | |

| (15 | ) | |

| 3 | | |

| (4 | ) | |

| 4 | |

| Total other (expense) income | |

| (503 | ) | |

| 182 | | |

| (431 | ) | |

| 81 | |

| (Loss) income before income taxes | |

| (326 | ) | |

| 122 | | |

| 104 | | |

| 390 | |

| Income tax expense | |

| (90 | ) | |

| (109 | ) | |

| (144 | ) | |

| (184 | ) |

| Net (loss) income | |

$ | (416 | ) | |

$ | 13 | | |

$ | (40 | ) | |

$ | 206 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income per share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.06 | ) | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | 0.03 | |

| Diluted | |

$ | (0.06 | ) | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | 0.03 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used in computing net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 6,553 | | |

| 6,000 | | |

| 6,278 | | |

| 6,000 | |

| Diluted | |

| 6,553 | | |

| 6,000 | | |

| 6,278 | | |

| 6,000 | |

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 7 of 8 |

Strong Global Entertainment, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net (loss) income | |

$ | (40 | ) | |

$ | 206 | |

| Adjustments to reconcile net income to net cash used in operating activities: | |

| | | |

| | |

| (Recovery of) provision for doubtful accounts | |

| (3 | ) | |

| 3 | |

| Provision for obsolete inventory | |

| 29 | | |

| 6 | |

| Provision for warranty | |

| 73 | | |

| 15 | |

| Depreciation and amortization | |

| 2,309 | | |

| 367 | |

| Amortization and accretion of operating leases | |

| 32 | | |

| 36 | |

| Deferred income taxes | |

| (763 | ) | |

| (48 | ) |

| Stock-based compensation expense | |

| 766 | | |

| 72 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (213 | ) | |

| (1,100 | ) |

| Inventories | |

| 286 | | |

| (602 | ) |

| Current income taxes | |

| 38 | | |

| 417 | |

| Other assets | |

| (8,542 | ) | |

| 1,330 | |

| Accounts payable and accrued expenses | |

| 6,116 | | |

| (2,622 | ) |

| Deferred revenue and customer deposits | |

| (636 | ) | |

| (71 | ) |

| Operating lease obligations | |

| (38 | ) | |

| (31 | ) |

| Net cash used in operating activities | |

| (586 | ) | |

| (2,022 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Capital expenditures | |

| (316 | ) | |

| (179 | ) |

| Acquisition of programming rights | |

| (86 | ) | |

| (337 | ) |

| Net cash used in investing activities | |

| (402 | ) | |

| (516 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Principal payments on short-term debt | |

| (282 | ) | |

| (156 | ) |

| Principal payments on long-term debt | |

| (18 | ) | |

| (11 | ) |

| Borrowings under credit facility | |

| 4,344 | | |

| - | |

| Repayments under credit facility | |

| (2,132 | ) | |

| - | |

| Payments on finance lease obligations | |

| (60 | ) | |

| - | |

| Proceeds from initial public offering | |

| 2,411 | | |

| - | |

| Payments of withholding taxes for net share settlement of equity awards | |

| (104 | ) | |

| - | |

| Net cash transferred (to) from parent | |

| (2,283 | ) | |

| 1,065 | |

| Net cash provided by (used in) financing activities | |

| 1,876 | | |

| 898 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (132 | ) | |

| 112 | |

| Net increase (decrease) in cash and cash equivalents | |

| 756 | | |

| (1,528 | ) |

| Cash and cash equivalents at beginning of period | |

| 3,615 | | |

| 4,494 | |

| Cash and cash equivalents at end of period | |

$ | 4,371 | | |

$ | 2,966 | |

Strong Global Entertainment, Inc. – Fiscal Year 2023

Second Quarter 2023 Results |

Page 8 of 8 |

Strong Global Entertainment, Inc. and Subsidiaries

Reconciliation of Net Income (Loss) to Adjusted

EBITDA

(In thousands)

(Unaudited)

| | |

Quarters Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Net (loss) income | |

$ | (416 | ) | |

$ | 13 | | |

$ | (40 | ) | |

$ | 206 | |

| Interest expense, net | |

| 62 | | |

| 27 | | |

| 118 | | |

| 51 | |

| Income tax expense | |

| 90 | | |

| 109 | | |

| 144 | | |

| 184 | |

| Depreciation and amortization | |

| 2,130 | | |

| 154 | | |

| 2,309 | | |

| 367 | |

| EBITDA | |

| 1,866 | | |

| 303 | | |

| 2,531 | | |

| 808 | |

| Stock-based compensation expense | |

| 748 | | |

| 33 | | |

| 766 | | |

| 72 | |

| IPO related expenses | |

| 475 | | |

| - | | |

| 475 | | |

| - | |

| Foreign currency transaction loss (gain) | |

| 426 | | |

| (206 | ) | |

| 309 | | |

| (128 | ) |

| Adjusted EBITDA | |

$ | 3,515 | | |

$ | 130 | | |

$ | 4,081 | | |

$ | 752 | |

Exhibit

99.2

v3.23.2

Cover

|

Aug. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 10, 2023

|

| Entity File Number |

001-41688

|

| Entity Registrant Name |

STRONG

GLOBAL ENTERTAINMENT, INC.

|

| Entity Central Index Key |

0001893448

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

5960

Fairview Road

|

| Entity Address, Address Line Two |

Suite 275

|

| Entity Address, City or Town |

Charlotte

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28210

|

| City Area Code |

(704)

|

| Local Phone Number |

994-8279

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Voting Shares, without par value

|

| Trading Symbol |

SGE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

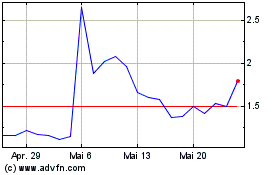

Strong Global Entertainm... (AMEX:SGE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Strong Global Entertainm... (AMEX:SGE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024