Time to Buy This Top Ranked Dividend ETF? - ETF News And Commentary

18 März 2013 - 2:30PM

Zacks

Although some European worries are impacting stocks, the S&P

500 continues to surge higher. The key benchmark is now within

striking distance of its all-time high levels, with many expecting

a surge beyond those marks.

Still, with recent worries in some key markets, some are also

expecting a breather in the short-term. This could be especially

true if domestic data turns south or if the current relationship

between the dollar and the market falls apart (see Italy ETF

Plunges on Election Chaos).

Furthermore, the U.S. economy is also faced with headwinds in

the near future with the Federal Reserve divided on the monetary

easing front. Of course the better-than-expected earnings season

has been a positive for the stock market sentiment which was a

major catalyst behind the market surge.

Also, volatility has been fairly subdued in the recent months

with the market sentiments on a high. However, with the recent

developments in the domestic as well as global economic space,

anxiety seems to be returning in the market. Also, finding avenues

for current income has been a pain for a long time for investors

(see Homebuilder ETFs After Housing Data).

With this backdrop, let us have a look at an exchange traded

fund (ETF) which combines low volatility and dividend payouts in

one single product, the WisdomTree Large Cap Dividend ETF

(DLN). This fund could

be an interesting choice for those seeking a great combo of the two

above features, while also utilizing the Zacks ETF Rank.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook of the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors as well.

The aim of our models is to select the best ETFs within each

risk category. We assign each ETF one of five ranks within each

risk bucket. Thus, Zacks Rank reflects the expected return of an

ETF relative to other ETFs with similar level of risk (see more in

the Zacks ETF Center).

Using this strategy, we have found a Ranked 1 or ‘Strong Buy’

large cap ETF which we have highlighted in greater detail

below:

DLN in Focus

Launched in June of 2006, DLN tracks the WisdomTree Large Cap

Dividend Index, an index which measures the performance of large

cap companies which are good dividend payers. The index is dividend

weighted and its portfolio is comprised of 300 stocks, while it is

also a subset of the WisdomTree Dividend Index.

The ETF is hheavily concentrated in Consumer Staples (15.93%),

Information Technology (14%), Financials (12.83%), Healthcare

(11.55%) and Energy (11%). From an individual holdings perspective,

AT&T Inc, Exxon Mobil Corp, Apple Inc, General Electric Co and

Microsoft Corp form the top 5 holdings which together account for

15.5% of its portfolio.

DLN had a total return of 12.58% for the fiscal year 2012. It

also pays out a yield of 2.50%. One of the major disadvantages for

the ETF is that compared to other broad market products, it charges

a relatively steep expense ratio of 28 basis points. Of course the

decent dividend yield is a plus, especially when compared to

dividend products like VIG or SDY

(read Inside the Top Zacks Ranked Retail ETF).

Furthermore, the ETF also goes a long way in mitigating the

exposure to volatility as it has only exhibited a volatility of

15.68%, measured by the annualized standard deviation. In the same

time, the S&P 500 has had a volatility of around 18.5%. DLN has

an asset base of $1.38 billion.

DLN has a Zacks ETF Rank of 1 or ‘Strong Buy’

with a ‘Low’ risk outlook.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-LC DIV (DLN): ETF Research Reports

SPDR-SP DIV ETF (SDY): ETF Research Reports

VANGD-DIV APPRC (VIG): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

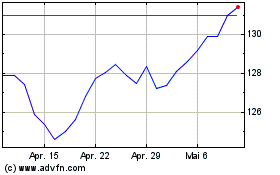

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

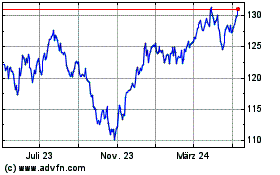

SPDR S&P Dividend (AMEX:SDY)

Historical Stock Chart

Von Dez 2023 bis Dez 2024