AMCON Distributing Company (“AMCON” or “the Company”) (NYSE

American: DIT), an Omaha, Nebraska based consumer products company,

is pleased to announce fully diluted earnings per share of $19.46

on net income available to common shareholders of $11.6 million for

the fiscal year ended September 30, 2023.

“We are pleased with our fiscal 2023 results. Our business

continues to encounter numerous operating challenges resulting from

a labor shortage, supply chain issues, inflation, volatility in

energy prices, and rising interest rates. Navigating these

headwinds is the central focus of our management team for the near

term. One of the core operating philosophies that guide our daily

decision-making process is a relentless focus on managing the

Company’s balance sheet and maximizing our liquidity position.

Another of AMCON’s long-standing core operating philosophies is

providing a superior level of customer service. The

customer-centric approach we embrace has guided us through these

challenging times and helped ensure that AMCON’s customers receive

a consistent and timely flow of goods and services,” said

Christopher H. Atayan, AMCON’s Chairman and Chief Executive

Officer. He further noted, “We continue to actively seek strategic

acquisition opportunities for operators who want to align with our

customer-centric management philosophy and further the legacy of

their enterprises.”

The wholesale distribution segment reported revenues of $2.5

billion and operating income of $39.7 million for fiscal 2023 and

the retail health food segment reported revenues of $43.1 million

and an operating loss of $0.7 million for fiscal 2023.

“In the medium term our primary strategic objective is to drive

the growth of our foodservice business through our Henry’s Foods

(“Henry’s”) subsidiary. Henry’s offers a breadth and depth of

proprietary foodservice programs and associated store level

merchandising that is unparalleled in the convenience distribution

industry. Through Henry’s, we now have the capability to offer

turn-key solutions that will enable our customer base to compete

head on with the Quick Service Restaurant industry. We are

investing heavily in our foodservice and technology platforms and

associated staffing for these strategic focus areas,” said Andrew

C. Plummer, AMCON’s President and Chief Operating Officer. “We are

also looking to expand our geographic reach, to better serve our

customers as they grow their store footprints.”

Charles J. Schmaderer, AMCON’s Chief Financial Officer said, “At

September 30, 2023, our shareholders’ equity was $104.2 million. We

continue to prioritize high levels of daily liquidity. Our strong

liquidity position provided maximum flexibility to take advantage

of attractive short-term merchandising opportunities from several

of our key vendor partners that materialized near our fiscal year

end.” Mr. Schmaderer also added, “We are investing capital to

develop our new 175,000 square foot distribution facility in

Springfield, Missouri which will support our customers’ growth

initiatives.”

AMCON’s Healthy Edge Retail Group plays an important role in the

health and wellness of the communities it serves. Our long-term

relationship with the organic/natural products vendor community has

enabled our stores to meet the demands of our customers for total

wellness solutions. Our strategy is to offer a broad selection of

the highest quality organic and natural merchandise available

supported by a high degree of customer service not found at other

big box retailers within our industry. We continue to rationalize

our base of stores as well as developing new store

opportunities.

AMCON is a leading Convenience Distributor of consumer products,

including beverages, candy, tobacco, groceries, foodservice, frozen

and refrigerated foods, automotive supplies and health and beauty

care products with distribution centers in Illinois, Minnesota,

Missouri, Nebraska, North Dakota, South Dakota, Tennessee and West

Virginia. AMCON, through its Healthy Edge Retail Group, operates

seventeen (17) health and natural product retail stores in the

Midwest and Florida.

This news release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management's

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. A

number of factors could affect the future results of the Company

and could cause those results to differ materially from those

expressed in the Company's forward-looking statements including,

without limitation, availability of sufficient cash resources to

conduct its business and meet its capital expenditures needs and

the other factors described under Item 1.A. of the Company’s Annual

Report on Form 10-K. Moreover, past financial performance should

not be considered a reliable indicator of future performance.

Accordingly, the Company claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995 with respect to all such

forward-looking statements.

Visit AMCON Distributing Company's web site

at: www.amcon.com

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED BALANCE

SHEETS

September

September

2023

2022

ASSETS

Current assets:

Cash

$

790,931

$

431,576

Accounts receivable, less allowance for

doubtful accounts of $2.4 million at September 2023 and $2.5

million at September 2022

70,878,420

62,367,888

Inventories, net

158,582,816

134,654,637

Income taxes receivable

1,854,484

819,595

Prepaid expenses and other current

assets

13,564,056

12,702,084

Total current assets

245,670,707

210,975,780

Property and equipment, net

80,607,451

48,085,520

Operating lease right-of-use assets,

net

23,173,287

19,941,009

Goodwill

5,778,325

5,277,950

Other intangible assets, net

5,284,935

2,093,113

Other assets

2,914,495

2,751,155

Total assets

$

363,429,200

$

289,124,527

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

43,099,326

$

39,962,363

Accrued expenses

14,922,279

14,446,210

Accrued wages, salaries and bonuses

8,886,529

7,811,207

Current operating lease liabilities

6,063,048

6,454,473

Current maturities of long-term debt

1,955,065

1,595,309

Current mandatorily redeemable

non-controlling interest

1,703,604

1,712,095

Total current liabilities

76,629,851

71,981,657

Credit facilities

140,437,989

91,262,438

Deferred income tax liability, net

4,917,960

2,328,588

Long-term operating lease liabilities

17,408,758

13,787,721

Long-term debt, less current

maturities

11,675,439

7,384,260

Mandatorily redeemable non-controlling

interest, less current portion

7,787,227

9,446,460

Other long-term liabilities

402,882

103,968

Shareholders’ equity:

Preferred stock, $.01 par value, 1,000,000

shares authorized

—

—

Common stock, $.01 par value, 3,000,000

shares authorized, 608,689 shares outstanding at September 2023 and

584,789 shares outstanding at September 2022

9,431

9,168

Additional paid-in capital

30,585,388

26,903,201

Retained earnings

104,846,438

96,784,353

Treasury stock at cost

(31,272,163

)

(30,867,287

)

Total shareholders’ equity

104,169,094

92,829,435

Total liabilities and shareholders’

equity

$

363,429,200

$

289,124,527

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF

OPERATIONS

Fiscal Years Ended

September

2023

2022

Sales (including excise taxes of $564.6

million and $467.1 million, respectively)

$

2,539,994,999

$

2,010,798,385

Cost of sales

2,369,150,102

1,883,078,819

Gross profit

170,844,897

127,719,566

Selling, general and administrative

expenses

137,301,668

101,474,359

Depreciation and amortization

7,576,646

3,643,840

144,878,314

105,118,199

Operating income

25,966,583

22,601,367

Other expense (income):

Interest expense

8,550,431

2,249,552

Change in fair value of mandatorily

redeemable non-controlling interest

1,307,599

1,476,986

Other (income), net

(1,193,840

)

(2,600,675

)

8,664,190

1,125,863

Income from operations before income

taxes

17,302,393

21,475,504

Income tax expense

5,706,000

6,473,380

Equity method investment earnings, net of

tax

—

1,670,133

Net income available to common

shareholders

$

11,596,393

$

16,672,257

Basic earnings per share available to

common shareholders

$

19.85

$

29.37

Diluted earnings per share available to

common shareholders

$

19.46

$

28.59

Basic weighted average shares

outstanding

584,148

567,697

Diluted weighted average shares

outstanding

595,850

583,062

Dividends paid per common share

$

5.72

$

5.72

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF

SHAREHOLDERS’ EQUITY

Additional

Common Stock

Treasury Stock

Paid-in

Retained

Shares

Amount

Shares

Amount

Capital

Earnings

Total

Balance, October 1, 2021

883,589

$

8,834

(332,220

)

$

(30,867,287

)

$

24,918,781

$

83,552,298

$

77,612,626

Dividends on common stock, $5.72 per

share

—

—

—

—

—

(3,440,202

)

(3,440,202

)

Compensation expense and issuance of stock

in connection with equity-based awards

33,420

334

—

—

1,984,420

—

1,984,754

Net income available to common

shareholders

—

—

—

—

—

16,672,257

16,672,257

Balance, September 30, 2022

917,009

$

9,168

(332,220

)

$

(30,867,287

)

$

26,903,201

$

96,784,353

$

92,829,435

Dividends on common stock, $5.72 per

share

—

—

—

—

—

(3,534,308

)

(3,534,308

)

Compensation expense and issuance of stock

in connection with equity-based awards

26,263

263

—

—

3,682,187

—

3,682,450

Repurchase of common stock

—

—

(2,363

)

(404,876

)

—

—

(404,876

)

Net income available to common

shareholders

—

—

—

—

—

11,596,393

11,596,393

Balance, September 30, 2023

943,272

$

9,431

(334,583

)

$

(31,272,163

)

$

30,585,388

$

104,846,438

$

104,169,094

AMCON Distributing Company and

Subsidiaries

CONSOLIDATED STATEMENTS OF

CASH FLOWS

September

September

2023

2022

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income available to common

shareholders

$

11,596,393

$

16,672,257

Adjustments to reconcile net income

available to common shareholders to net cash flows from (used in)

operating activities:

Depreciation

7,161,468

3,572,953

Amortization

415,178

70,887

Equity method investment earnings, net of

tax

—

(1,670,133

)

Gain on re-valuation of equity method

investment to fair value

—

(2,387,411

)

(Gain) loss on sales of property and

equipment

(133,659

)

(140,139

)

Equity-based compensation

2,717,370

3,103,320

Deferred income taxes

2,589,372

797,360

Provision for losses on doubtful

accounts

(133,924

)

(32,420

)

Inventory allowance

(138,820

)

212,637

Change in fair value of mandatorily

redeemable non-controlling interest

1,307,599

1,476,986

Changes in assets and liabilities, net of

effects of business acquisition:

Accounts receivable

(138,956

)

3,032,876

Inventories

(7,728,394

)

3,240,946

Prepaid and other current assets

(679,229

)

(5,344,754

)

Equity method investment distributions

—

1,095,467

Other assets

(163,340

)

(730,391

)

Accounts payable

2,213,085

332,400

Accrued expenses and accrued wages,

salaries and bonuses

1,574,050

2,482,409

Other long-term liabilities

298,914

(653,419

)

Income taxes payable and receivable

(1,034,889

)

(2,241,755

)

Net cash flows from (used in) operating

activities

19,722,218

22,890,076

CASH FLOWS FROM INVESTING ACTIVITIES:

Purchase of property and equipment

(11,561,347

)

(14,691,799

)

Proceeds from sales of property and

equipment

151,808

152,000

Principal payment received on note

receivable

—

175,000

Cash acquired in business combination

—

7,958

Acquisition of Henry's

(54,865,303

)

—

Net cash flows from (used in) investing

activities

(66,274,842

)

(14,356,841

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Borrowings under revolving credit

facilities

2,512,309,723

2,042,679,688

Repayments under revolving credit

facilities

(2,463,134,172

)

(2,041,106,459

)

Proceeds from borrowings on long-term

debt

7,000,000

—

Principal payments on long-term debt

(2,349,065

)

(4,909,548

)

Proceeds from exercise of stock

options

—

173,590

Repurchase of common stock

(404,876

)

—

Dividends on common stock

(3,534,308

)

(3,440,202

)

Settlement and withholdings of

equity-based awards

—

(1,280,749

)

Redemption and distributions to

non-controlling interest

(2,975,323

)

(737,570

)

Net cash flows from (used in) financing

activities

46,911,979

(8,621,250

)

Net change in cash

359,355

(88,015

)

Cash, beginning of period

431,576

519,591

Cash, end of period

$

790,931

$

431,576

Supplemental disclosure of cash flow

information:

Cash paid during the period for

interest

$

8,311,375

$

2,210,828

Cash paid during the period for income

taxes, net of refunds

4,141,370

7,915,225

Supplemental disclosure of non-cash

information:

Equipment acquisitions classified in

accounts payable

$

1,015,534

$

91,656

Effect of business acquisition

—

23,308,624

Issuance of common stock in connection

with the vesting and exercise of equity-based awards

2,044,805

2,280,783

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108166908/en/

Charles J. Schmaderer AMCON Distributing Company Ph

402-331-3727

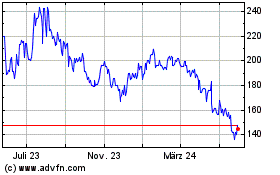

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

AMCON Distributing (AMEX:DIT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024