Crédit Agricole S.A. Announces Offer Prices and Final Results of its Tender Offers for EUR and GBP Senior Preferred Notes

04 Juni 2020 - 3:38PM

Crédit Agricole S.A. Announces Offer Prices and Final Results of

its Tender Offers for EUR and GBP Senior Preferred Notes

THIS ANNOUNCEMENT IS FOR INFORMATION ONLY

AND IS NOT AN OFFER TO PURCHASE OR A SOLICITATION OF OFFERS TO SELL

ANY SECURITIES.

Montrouge 4 June 2020

Crédit Agricole S.A. Announces Offer

Prices and Final Results of its Tender Offers for EUR and GBP

Senior Preferred Notes

Summary of the Final Results of its

Tender Offers for USD Senior Preferred Notes and EUR/GBP Senior

Preferred Notes____________________

Crédit Agricole S.A., acting through its London

Branch (the “Company”), today announced the offer

prices and final results for its tender offers (the

“Offers”) to purchase eleven (11) series of Notes

denominated in euros or pounds sterling (the “EUR/GBP

Notes”) launched on 28 May 2020.

The Offers expired on 3 June 2020 at 4:00 p.m.,

Central European Summer time (the “Expiration

Date”). The Offers were made on the terms and subject to

the conditions set forth in the Tender Offer Memorandum dated 28

May 2020 (the “Tender Offer Memorandum”).

The Company has decided to accept for purchase

all the EUR/GBP Notes validly tendered at or prior to the

Expiration Date, representing an aggregate principal amount of

EUR1,927,866,233 (equivalent) EUR/GBP Notes for a total price

(excluding accrued interest) of EUR2,015,064,203

(equivalent). The amount tendered did not exceed the Maximum

Tender Amount of EUR3,500,000,000 (or equivalent), and therefore

pro-rationing will not apply.

The table below set forth the Offer Price and

the aggregate principal amount of each Series of EUR/GBP Notes that

are accepted for purchase by the Company, as well as the principal

amount remaining outstanding for each of them.

|

Title of Notes and ISIN No. |

Original Issued Amount / Principal Amount

Outstanding |

Reference Benchmark |

Reference Yield |

Fixed Spread (basis points) / Yield |

Offer Price(1) |

Principal Amount Tendered and Accepted |

Outstanding Principal Amount after Settlement |

| EUR

Fixed Rate Notes due November 2020 issued as EMTN Series no. 441

ISIN: XS0997520258 |

EUR1,250,000,000 |

N/A(2) |

N/A |

0%

Yield |

101.136% |

EUR100,100,000 |

EUR1,149,900,000 |

| EUR

Fixed Rate Notes due January 2022 issued as EMTN Series no. 367

ISIN: XS0637417790 |

EUR390,000,000 |

January 2022 Interpolated Mid-Swap rate |

-0.280% |

+25

bps |

107.494% |

- |

EUR390,000,000 |

| EUR

Fixed Rate Notes due January 2022 issued as EMTN Series 472 ISIN:

XS1169630602 |

EUR1,500,000,000 |

January 2022 Interpolated Mid-Swap rate |

-0.281% |

+25

bps |

101.471% |

EUR219,100,000 |

EUR1,280,900,000 |

| EUR

Fixed Rate Notes due December 2022 issued as EMTN Series 496 ISIN:

XS1425199848 |

EUR1,000,000,000 |

December 2022 Interpolated Mid-Swap rate |

-0.296% |

+25

bps |

101.983% |

EUR293,800,000 |

EUR706,200,000 |

| EUR

Fixed Rate Notes due April 2023 issued as EMTN Series 361 ISIN:

XS0617251995 |

EUR1,000,000,000 |

April

2023 Interpolated Mid-Swap rate |

-0.295% |

+25

bps |

114.843% |

EUR80,200,000 |

EUR919,800,000 |

| EUR

Fixed Rate Notes due July 2023 issued as EMTN Series 422 ISIN:

XS0953564191 |

EUR1,250,000,000 |

July

2023 Interpolated Mid-Swap rate |

-0.293% |

+30

bps |

109.710% |

EUR92,900,000 |

EUR1,157,100,000 |

| EUR

Fixed Rate Notes due May 2024 issued as EMTN Series 464 ISIN:

XS1069521083 |

EUR1,650,000,000 |

May

2024 Interpolated Mid-Swap rate |

-0.280% |

+35

bps |

109.103% |

EUR440,400,000 |

EUR1,209,600,000 |

| EUR

Fixed Rate Notes due September 2024 issued as EMTN Series 507 ISIN:

XS1550135831 |

EUR1,000,000,000 |

September 2024 Interpolated Mid-Swap rate |

-0.272% |

+35

bps |

103.939% |

EUR239,300,000 |

EUR760,700,000 |

| GBP

Fixed Rate Notes due December 2021 issued as EMTN Series 354 ISIN:

XS0583495188 |

GBP250,000,000 |

UKT

3.75% September 2021 |

0.050% |

+85

bps |

107.000% |

GBP56,902,000 |

GBP193,098,000 |

| GBP

Senior Preferred Fixed Rate Notes due October 2024 issued as EMTN

Series 564 ISIN: FR0013449600 |

GBP300,000,000 |

UKT

2.75% September 2024 |

0.005% |

+100

bps |

101.018% |

GBP93,900,000 |

GBP206,100,000 |

| EUR

Senior Preferred Floating Rate Notes due January 2022 issued as

EMTN Series no. 542 ISIN: FR0013396777 |

EUR1,500,000,000 |

N/A |

N/A |

N/A |

100.350% |

EUR292,700,000 |

EUR1,207,300,000 |

(1) Per EUR100,000 or GBP100,000, as

applicable, in principal amount of the Notes purchased pursuant to

the Offers. In addition to the Offer Price, Holders that tender

EUR/GBP Notes that are accepted for purchase will also receive

Accrued Interest.

(2) Not applicable.

The settlement of the Offers is expected to

occur on 5 June 2020, on which date the Company will deposit with

Euroclear, Clearstream or CACEIS Corporate Trust S.A., as

applicable, the amount necessary to pay the aggregate Offer Price

and Accrued Interest to the relevant Holder. Euroclear, Clearstream

or CACEIS Corporate Trust S.A., as applicable, will pay or cause to

be paid to each such Holder the relevant Offer Price and Accrued

Interest.

The EUR/GBP Notes so repurchased will be

canceled by the Company immediately following the settlement of the

Offers.

For further details about the terms and

conditions of the Offers, please refer to the Tender Offer

Memorandum. Capitalized terms used in this announcement but not

defined herein have the meanings given to them in the Tender Offer

Memorandum.

Following today’s announcement of the final

results of the Offers and the USD offers, the Company has purchased

an aggregate principal amount of EUR1,433,602,256 (equivalent) USD

Notes and an aggregate principal amount of EUR1,927,866,233

(equivalent) EUR/GBP Notes.

The Offers and the USD offers are expected to

have an immediate impact on revenues of EUR-41 million, which will

be felt in the second quarter of 2020. Taking into

consideration the expected favorable effect of the Offers and USD

offers on future revenues between June 2020 and January 2025, the

expected total impact of the Offers and USD offers on revenues is

expected to be positive and is estimated to be EUR+46 million.

Further Information

Questions and requests for assistance in connection with the

Offers may be directed to:

Sole Structuring Bank for the EUR:GBP

Offers and Dealer Manager

Crédit Agricole Corporate and Investment

Bank.

12, place des Etats-Unis, CS 7005292547 Montrouge

CedexFranceAttn: Liability Management Tel: +44 207 214 5903 Email:

liability.management@ca-cib.com

Questions and requests for assistance in

connection with the tenders of the EUR/GBP Notes including requests

for a copy of the Tender Offer Memorandum may be directed to:

The Tender

Agents and the Information Agent

for the Offers

|

Lucid Issuer Services LimitedTankerton Works12

Argyle WalkLondon WC1H 8HAAttn: Thomas ChoquetTel: +44 20 7704

0880Email: ca@lucid-is.com CACEIS Corporate Trust

S.A.1-3, Place Valhubert75013 ParisFranceAttn: David

PASQUALETel: +33 (6) 37 41 17 59Email: david.pasquale@caceis.com /

LD-F-CT-OST-MARCHE-PRIMAIR@caceis.com |

Disclaimer

This announcement is not an offer to purchase or

a solicitation of offers to sell any securities in the United

States or any other jurisdiction. This announcement is not an

invitation to participate in the Offers. The distribution of this

announcement in certain countries may be prohibited by law. Persons

who receive this press release should inform themselves of and

comply with such restrictions.

- Crédit Agricole S.A. Announces Offer Prices and Final Results

of its Tender Offers for EUR and GBP Senior Preferred Notes

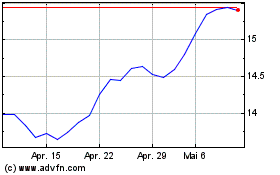

Credit Agricole (TG:XCA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

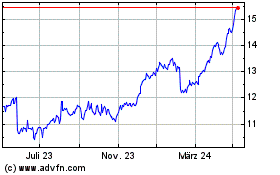

Credit Agricole (TG:XCA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024