Item 5.02

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Clifford G. Adlerz as Interim CEO and Director; Resignation of Michael Doyle as CEO

On September 6, 2017, the Board of Directors (the “

Board

”) of Surgery Partners, Inc. (the “

Company

”) appointed Clifford G. Adlerz to serve as the interim Chief Executive Officer of the Company, effective as of September 7, 2017. In connection with his appointment, Mr. Adlerz is expected to join the Board effective as of the Stockholder Action Effective Date (further described below). Mr. Adlerz succeeds Michael T. Doyle as Chief Executive Officer of the Company, who stepped down from his role as the Company’s Chief Executive Officer and as an officer of the Company’s subsidiaries effective as of September 7, 2017. Mr. Doyle will continue his service on the Board.

Mr. Adlerz, age 63, currently provides consulting services to Bain Capital Private Equity, LP. Prior to this, Mr. Adlerz served as President of Symbion, Inc. (“

Symbion

”), a multi-specialty provider of ambulatory surgery centers and hospitals, from May 2002 until the Company’s acquisition of Symbion in November 2014. Mr. Adlerz also served as Chief Operating Officer of Symbion from 1996 to 2002 and as director of Symbion from 1996 to 2014. Mr. Adlerz served as Regional Vice President, Midsouth Region for HealthTrust, Inc. from 1992 until its merger with HCA Inc. (“

HCA

”), a healthcare facilities operator, in May 1995, after which time he served as Division Vice President of HCA until September 1995. Mr. Adlerz holds a B.A. in Business and an M.B.A. from the University of Florida.

On September 6, 2017, the Board also appointed Mr. Adlerz as a Class III director, with such appointment to become effective upon the Stockholder Action Effective Date, as further described in Item 5.07 of this Current Report on Form 8-K, which disclosure is incorporated into this Item 5.02 by reference herein. Class III directors will stand for re-election at the 2018 annual meeting of stockholders.

On September 7, 2017, the Company issued a press release announcing Mr. Adlerz’s appointment as interim Chief Executive Officer and his appointment to the Board, and the departure of Mr. Doyle. A copy of the press release has been filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Employment Agreement with Clifford G. Adlerz

On September 7, 2017, the Company entered into an employment agreement with Mr. Adlerz (the “

Employment Agreement

”). Pursuant to the terms of the Employment Agreement, Mr. Adlerz is entitled to receive an annual base salary of $550,000, subject to adjustment at the discretion of the Board or the Compensation Committee of the Board (the “

Compensation Committee

”). In addition, Mr. Adlerz is eligible to earn an annual cash bonus with a target amount equal to $350,000, with the actual amount of such bonus to be determined by the Board or the Compensation Committee based on the achievement of performance goals established annually by the Board or the Compensation Committee. Mr. Adlerz’s agreement also entitles him to participate in Company benefit programs for which employees of the Company are generally eligible, subject to the eligibility and participation requirements thereof.

The Employment Agreement may be terminated (i) by Mr. Adlerz upon 60 days’ advance written notice, (ii) upon Mr. Adlerz’s death or disability, (iii) by the Company upon 60 days’ advance written notice, or at any time for “cause” (as such term is defined in Mr. Adlerz’s Employment Agreement) or (iv) upon the effective date of the Company’s appointment of a permanent Chief Executive Officer. If Mr. Adlerz’s employment is terminated for any reason, Mr. Adlerz is entitled to receive his base salary through the date of termination, a pro-rated portion of his annual bonus (based on actual achievement of any applicable performance goals for the period in which Mr. Adlerz’ employment ends), reimbursement of previously unreimbursed expenses and any accrued and vested amounts owed to Mr. Adlerz pursuant to any employee benefits plans maintained by the Company, except that if Mr. Adlerz’s employment is terminated for “cause,” he will not be eligible to receive a pro-rated portion of his annual bonus.

Pursuant to the Employment Agreement, Mr. Adlerz is bound by certain restrictive covenants, including a covenant relating to confidentiality, a covenant not to compete with the Company and a covenant not to solicit the Company’s employees or other service providers during employment and for the longer of six (6) months following termination of employment or the conclusion of Mr. Adlerz’s service on the Board.

The foregoing description of Mr. Adlerz’s Employment Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Employment Agreement, which is incorporated into this Item 5.02 by reference to Exhibit 10.1 of this Current Report on Form 8-K.

2

Upon the effectiveness of his appointment as interim Chief Executive Officer of the Company, Mr. Adlerz entered into the Company’s standard form of indemnification agreement, a copy of which is filed as Exhibit 10.14 to Amendment No. 1 to the Company’s Registration Statement on Form S-1 filed on September 14, 2015.

Mr. Adlerz is a limited partner of BCPE Seminole Holdings LP (“

Seminole

”), a Delaware limited partnership, the Company’s controlling stockholder and an affiliate of Bain Capital Private Equity, LP. Except as described herein, there is no arrangement or understanding between Mr. Adlerz and any other persons or entities pursuant to which he was appointed as an officer or nominated as a director. There are no family relationships between Mr. Adlerz and any director or executive officer of the Company or any of its subsidiaries. Except as described herein, there are no transactions between the Company or any of its subsidiaries and Mr. Adlerz that require disclosure under Item 404(a) of Regulation S-K.

Separation Agreement with Michael Doyle

On September 7, 2017, in connection with Mr. Doyle’s resignation as Chief Executive Officer of the Company, the Company entered into a termination and release agreement (the “

Separation Agreement

”) with Mr. Doyle. Pursuant to the Separation Agreement, Mr. Doyle will receive the separation benefits payable to him under his employment agreement with the Company, dated September 17, 2015 ( a copy of which was filed as Exhibit 10.10 to the Company’s Registration Statement on Form S-1 filed on September 21, 2015 and is incorporated herein by reference) (the “

Doyle EA

”), which consists of the Company’s payment of the following: (i) Mr. Doyle’s base salary through September 7, 2017, the effective date of his resignation (the “

Resignation Date

”), (ii) cash severance in the amount of $550,000, to be paid over a period of twelve (12) months after the Resignation Date in accordance with the Company’s normal payroll practices, (iii) a pro rata portion of the annual bonus Mr. Doyle would have earned in respect of the 2017 performance period (based on actual performance as determined consistent with other senior executives) under the Doyle EA had his employment not been terminated, to be paid on the date the Company pays 2017 bonuses generally, but not later than March 15, 2018, (iv) the full amount of Mr. Doyle’s COBRA premiums for continued coverage under the Company’s group health plans, including coverage for Mr. Doyle’s eligible dependents, until the twelve (12) month anniversary of the Resignation Date (or in lieu of payment of such amounts, reimbursement therefor) and (v) $15,000. Such payments are subject to Mr. Doyle’s execution and non-revocation of a general waiver and release of claims and his continued compliance with certain restrictive covenants, further described below.

In addition, the Separation Agreement provides that Mr. Doyle’s outstanding equity-based awards shall be treated in a manner consistent with the Company’s 2015 Omnibus Incentive Plan (a copy of which was filed as Exhibit 4.3 to the Company’s Registration Statement on Form S-8 filed on October 6, 2015) (the “

Incentive Plan

”) and the agreements pursuant to which such awards were granted, as follows: (i) in accordance with the restricted stock award agreements (the form of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on March 15, 2016), upon the Resignation Date, any shares that are then outstanding and not yet vested will automatically, and without any action on the part of Mr. Doyle, become vested, and as such, 71,928 shares became vested effective September 7, 2017 and (ii) in accordance with the performance stock unit award agreements (the form of which was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on July 5, 2016), upon the Resignation Date, any Earned Shares (as defined in the performance stock unit award agreement) that are then outstanding and not yet vested will automatically, and without any action on the part of Mr. Doyle, become vested and, as such, 22,281 Earned Shares from Mr. Doyle’s August 2, 2016 award agreement became vested effective September 7, 2017 and any Earned Shares from the March 31, 2017 award agreement will be delivered to Mr. Doyle, if applicable, once the Administrator (as defined in the Incentive Plan) certifies the achievement of the applicable performance objectives; provided, however, that if the vesting of any Earned Shares from the March 31, 2017 award agreement would make Mr. Doyle’s payments and benefits under the Separation Agreement subject to excise tax under Section 4999 of the Internal Revenue Code, then such Earned Shares will be only be delivered to the extent such Earned Shares will not subject Mr. Doyle to excise tax under Section 4999 of the Internal Revenue Code. Except for the March 31, 2017 award agreement, which will remain outstanding until the Administrator determines whether any performance stock units became Earned Shares in accordance with the terms thereof, all other equity-based awards granted to Mr. Doyle pursuant to the Incentive Plan that remain unvested as of the Resignation Date were forfeited and of no further force or effect as September 7, 2017.

In consideration for the foregoing, Mr. Doyle agreed to certain restrictions on competition for eighteen (18) months following the Resignation Date and certain restrictions on solicitation of customers, employees and consultants for twenty-four (24) months following the Resignation Date.

The foregoing description of the Separation Agreement does not purport to be complete and is subject to, and qualified in its entirety by the full text of the Separation Agreement, which is incorporated into this Item 5.02 by reference to Exhibit 10.2 of this Current Report on Form 8-K.

3

Consulting Agreement with Michael Doyle

Also on September 7, 2017, the Company and Mr. Doyle entered into a consulting services agreement (the “

Consulting Agreement

”), pursuant to which Mr. Doyle will provide certain consulting services to the Company and its subsidiaries for a period of six (6) months following the Resignation Date. In exchange, the Company will pay Mr. Doyle an aggregate consulting fee of $275,000, payable in equal monthly installments. The Company may terminate the Consulting Agreement in the event Mr. Doyle repeatedly fails to perform services reasonably requested under the Consulting Agreement. Mr. Doyle may terminate the Consulting Agreement upon two weeks’ advance written notice to the Company, after the first month anniversary of the commencement date of the Consulting Agreement.

The foregoing description of the Consulting Agreement does not purport to be complete and is subject to, and qualified in its entirety by the full text of the Consulting Agreement, which is incorporated into this Item 5.02 by reference to Exhibit 10.3 of this Current Report on Form 8-K.

TRA Assignment Agreement with Michael Doyle

On September 8, 2017, Mr. Doyle entered into a TRA Waiver and Assignment Agreement (the “

TRA Assignment Agreement

”) with the Company, pursuant to which the Company agreed to accept the assignment of 50% of Mr. Doyle’s (and his affiliates’) interest in future payments to which such parties are entitled pursuant to the Income Tax Receivable Agreement, dated September 30, 2015, by and among the Company, H.I.G. Surgery Centers, LLC (in its capacity as the stockholders representative) and the other parties referred to therein, as amended effective August 31, 2017, in exchange for an upfront payment of approximately $5.1 million, in the aggregate, as set forth in the TRA Assignment Agreement. Copies of the Income Tax Receivable Agreement and the amendment thereto were filed as Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q filed on November 13, 2015 and Exhibit 10.3 to the Company’s Current Report on Form 8-K filed May 11, 2017, respectively.

The foregoing description of the TRA Assignment Agreement does not purport to be complete and is subject to, and qualified in its entirety by the full text of the TRA Assignment Agreement, which is incorporated into this Item 5.02 by reference to Exhibit 10.4 of this Current Report on Form 8-K.

Approval of Leveraged Performance Incentive Award

On September 7, 2017, the Compensation Committee approved a form of leveraged performance unit award agreement (the “

Form LPU Award Agreement

”) under the existing Incentive Plan, which may be used for future grants of leveraged performance units by the Company to certain employees. The Form LPU Award Agreement is filed as Exhibit 10.5 of this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07

Submission of Matters to a Vote of Security Holders.

On September 8, 2017, Seminole, as the holder of at least a majority of the combined voting power of the issued and outstanding shares of the Company’s common stock and the issued and outstanding shares of the Company’s 10.00% Series A Convertible Perpetual Participating Preferred Stock, acting by written consent in lieu of a meeting of the stockholders of the Company, voted all such shares to approve (x) the expansion of the size of the Board from six (6) directors to seven (7) directors (the “

Board Expansion

”) in order to effectuate the appointment of Mr. Adlerz to the Board and (y) the Third Amended and Restated Certificate of Incorporation of the Company (collectively, the “

Stockholder Approvals

”), with such approvals to be effective as of the Stockholder Action Effective Date (as defined below).

The Company’s Second Amended and Restated Certificate of Incorporation, as in effect as of September 8, 2017, provides that prior to the date that Seminole ceases to beneficially own 50% or more of the Company’s voting stock (the “

Trigger Date

”), (i) vacancies on the Board shall be filled by a vote of a majority of the then outstanding voting stock, (ii) the size of the Board shall be determined by a vote of a majority of the then outstanding voting stock and (iii) newly-created directorships shall be filled by a vote of a majority of the directors then on the Board. The Company’s Third Amended and Restated Certificate of Incorporation will provide that, prior to the Trigger Date, the size of the Board shall be determined by, and vacancies and newly created directorships on the Board shall be filled by, either a vote of a majority of the then outstanding voting stock or a vote of a majority of the directors then on the Board.

Seminole’s action by written consent in lieu of a meeting of the stockholders of the Company was the only vote required in respect of the Stockholder Approvals, and as such, there were no votes cast against or withheld, and no abstentions or broker non-votes with respect to the Stockholder Approvals.

The Company will file an Information Statement on Schedule 14C describing these matters and will deliver a copy of the Information Statement to all stockholders of record as of September 8, 2017. The Stockholder Approvals will be effective on or immediately after the date that is 20 calendar days after the date on which the Information Statement on Schedule 14C first sent or given to the Company’s stockholders (such effective date, the “

Stockholder Action Effective Date

”). The Third Amended and Restated Certificate of Incorporation will become effective upon its filing with the Secretary of State of the State of Delaware, which is expected to occur on or promptly following the Stockholder Action Effective Date.

4

Forward-Looking Statements

This report may contain “forward-looking” statements as defined by the Private Securities Litigation Reform Act of 1995 or by the U.S. Securities and Exchange Commission (the “

SEC

”) in its rules, regulations and releases. These statements include, but are not limited to, management changes and related actions, the performance of the Company’s business and other non-historical statements. These statements can be identified by the use of words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “continues,” “estimates,” “predicts,” “projects,” “forecasts,” and similar expressions. All forward looking statements are based on management’s current expectations and beliefs only as of the date of this report and are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those discussed in, or implied by, the forward-looking statements, including but not limited to, the risks identified and discussed from time to time in the Company’s reports filed with the SEC, including the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2017, filed on August 9, 2017. Readers are strongly encouraged to review carefully the full cautionary statements described in these reports. Except as required by law, the Company undertakes no obligation to revise or update publicly any forward-looking statements to reflect events or circumstances after the date of this report, or to reflect the occurrence of unanticipated events or circumstances.

Item 9.01

Financial Statements and Exhibits.

(d)

Exhibits

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Employment Agreement, by and between Surgery Partners, Inc. and Cliff Adlerz, dated September 7, 2017.

|

|

10.2

|

|

Termination and Release Agreement, by and among Surgery Partners, Inc., Surgery Partners, LLC and Michael T. Doyle, dated September 7, 2017.

|

|

10.3

|

|

Consulting Services Agreement, by and between Surgery Partners, Inc. and Michael T. Doyle, dated September 7, 2017.

|

|

10.4

|

|

TRA Waiver and Assignment Agreement, by and among Surgery Partners, Inc., Michael T. Doyle, the Makayla Doyle 2012 Irrevocable Trust under agreement dated July 20, 2012, the Michael Doyle 2012 Irrevocable Trust under agreement dated July 20, 2012 and the Mason Doyle 2012 Irrevocable Trust under agreement dated July 20, 2012, dated September 8, 2017.

|

|

10.5

|

|

Form of Leveraged Performance Unit Award Agreement.

|

|

99.1

|

|

Press Release, dated September 7, 2017 issued by Surgery Partners, Inc.

|

5

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

10.1

|

|

Employment Agreement, by and between Surgery Partners, Inc. and Cliff Adlerz, dated September 7, 2017.

|

|

10.2

|

|

Termination and Release Agreement, by and among Surgery Partners, Inc., Surgery Partners, LLC and Michael T. Doyle, dated September 7, 2017.

|

|

10.3

|

|

Consulting Services Agreement, by and between Surgery Partners, Inc. and Michael T. Doyle, dated September 7, 2017.

|

|

10.4

|

|

TRA Waiver and Assignment Agreement, by and among Surgery Partners, Inc., Michael T. Doyle, the Makayla Doyle 2012 Irrevocable Trust under agreement dated July 20, 2012, the Michael Doyle 2012 Irrevocable Trust under agreement dated July 20, 2012 and the Mason Doyle 2012 Irrevocable Trust under agreement dated July 20, 2012, dated September 8, 2017.

|

|

10.5

|

|

Form of Leveraged Performance Unit Award Agreement.

|

|

99.1

|

|

Press Release, dated September 7, 2017 issued by Surgery Partners, Inc.

|

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Surgery Partners, Inc.

|

|

|

|

|

|

|

By:

|

/s/ Teresa F. Sparks

|

|

|

|

Teresa F. Sparks

|

|

|

|

Executive Vice President, Chief Financial Officer

|

|

|

|

|

Date: September 8, 2017

|

|

7

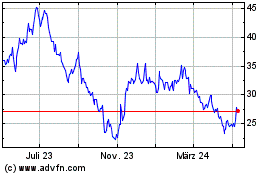

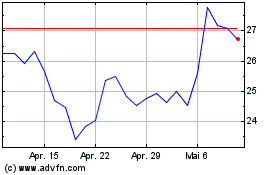

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024