Eguana Technologies Inc. ("

Eguana" or the

"

Company") (TSXV: EGT) (OTCQB:EGTYF) is pleased to

announce that ITOCHU Corporation (“

ITOCHU”), a

strategic investor in the Company, and Eguana have agreed to

convert $1,164,493.14 of interest owing under the Company’s 7%

unsecured convertible debenture (“

Convertible

Debenture”) into 13,580,094 common shares of Eguana

(“

Common Shares”) in full satisfaction of the

interest payment due on September 1, 2023 (the

”

Payment”).

“Aligned with the Eguana vision, ITOCHU

continues to be a valuable strategic investor and partner. The

election of interest in the form of shares demonstrates their

confidence in our partnership and the growth opportunities, as the

power grid modernizes,” commented Eguana CEO Justin Holland. “The

virtual power plant (VPP) market is evolving quickly, where we

maintain a competitive technology advantage for utility companies.

To execute these VPP opportunities, along with near-term

opportunities in our three key markets, Eguana truly values the

continued support from ITOCHU.”

In connection with the interest conversion,

Eguana will issue 13,580,094 Common Shares at a deemed price of

$0.08575 per share on September 28, 2023. All of the Common Shares

will be subject to a four-month and one-day hold period in

accordance with applicable Canadian securities laws. The Conversion

remains subject to final approval by the TSX Venture Exchange (the

“TSXV”). Additional details regarding the

Convertible Debenture issued on August 31, 2022, can be found in

the Company’s news releases dated August 26 and August 31, 2022,

all of which are available on the Company’s profile on SEDAR+ at

www.sedarplus.ca.

As a result of ITOCHU’s status as an insider of

the Company, the foregoing interest conversion constitutes a

related-party transaction under Multilateral Instrument 61-101 –

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). This transaction is exempt from the

formal valuation and minority shareholder approval requirements of

MI 61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as

neither the fair market value of the securities issued, nor the

consideration provided therefore exceed 25% of the Company’s market

capitalization.

Immediately prior to the Payment, ITOCHU owned

or exercised control or direction over 54,923,281 Common Shares,

representing 12.95% of the total issued and outstanding Common

Shares of Eguana. Immediately following the Payment, ITOCHU will

hold 68,503,375 Common Shares representing 15.65% of the total

issued and outstanding Common Shares of Eguana.

ITOCHU acquired the Common Shares for investment

purposes and to support the growth of Eguana’s business. ITOCHU

may, from time to time and at any time, acquire additional shares

and/or other equity, debt or other securities or instruments

(collectively, “Securities”) of the Company in the

open market or otherwise, and reserves the right to dispose of any

or all of its Securities in the open market or otherwise at any

time and from time to time, and to engage in similar transactions

with respect to the Securities, the whole depending on market

conditions, the business and prospects of the Company and other

relevant factors.

ITOCHU will file an early warning report with

the securities regulators with respect to the foregoing matters

pursuant to National Instrument 62-103 – The Early Warning System

and Related Take-Over Bid and Insider Reporting Issues, a copy of

which will be available under Eguana’s profile on SEDAR+ at

www.sedarplus.ca.

About ITOCHU

Corporation

The history of ITOCHU Corporation dates back to

1858 when the Company's founder Chubei Itoh commenced linen trading

operations. Since then, ITOCHU has evolved and grown over 150

years. With approximately 110 bases in 63 countries, ITOCHU, one of

the leading sogo shosha, is engaging in domestic trading,

import/export, and overseas trading of various products such as

textiles, machinery, metals, minerals, energy, chemicals, food,

general products, realty, information and communications

technology, and finance, as well as business investment in Japan

and overseas.

About Eguana

Technologies Inc.

Based in Calgary, Alberta Canada, Eguana

Technologies Inc. (TSXV: EGT) (OTCQB: EGTYF) designs and

manufactures high-performance residential and commercial energy

storage systems. Eguana has two decades of experience delivering

grid-edge power electronics for fuel cell, photovoltaic, and

battery applications, and delivers proven, durable, high-quality

solutions from its high-capacity manufacturing facilities in

Europe, Australia, and North America.

With thousands of its proprietary energy storage

inverters deployed in the European and North American markets,

Eguana is one of the leading suppliers of power controls for solar

self-consumption, grid services, and demand charge applications at

the grid edge.

Company

Inquiries

Eguana Technologies Inc.Justin

HollandCEO+1.416.728.7635Justin.Holland@EguanaTech.com

To learn more, visit www.eguanatech.com or

follow us on Twitter @EguanaTech

Forward

Looking Information

The reader is advised that some of the

information herein may constitute forward-looking statements and

forward-looking information (together, "forward-looking

statements") within the meaning assigned by National Instrument

51-102 – Continuous Disclosure Obligations and other relevant

securities legislation. In particular, we include, among other

things: the Company’s ability to obtain necessary approvals from

the TSXV and the issuance of the Common Shares.

Forward-looking statements are not a guarantee

of future performance and involves a number of risks and

uncertainties. Many factors could cause the Company's actual

results, performance or achievements, or future events or

developments, to differ materially from those expressed or implied

by the forward-looking information. Such factors include, but are

not limited to, risks associated with: failure to obtain necessary

regulatory approvals, general economic, market and business

conditions,; the operations of Eguana's assets, competitive

factors, achieving the strategic objectives, future financial

results and liquidity, ability to fund operations or obtain

financing with debt or equity, and other factors set out in the

"Risk Factors" section of the Company's most recent management's

discussion and analysis for the three and six months ended June 30,

2023, which may be found on its website or at sedarplus.ca. Readers

are cautioned not to place undue reliance on forward-looking

information, which speaks only as of the date hereof. The Company

does not undertake any obligation to release publicly any revisions

to forward-looking statements contained herein to reflect events or

circumstances that occur after the date hereof or to reflect the

occurrence of unanticipated events, except as may be required under

applicable securities laws.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

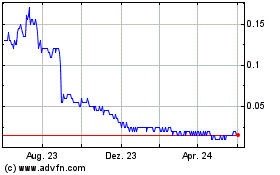

Eguana Technologies (TSXV:EGT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

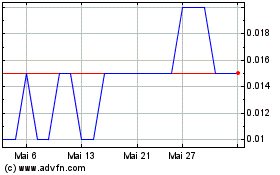

Eguana Technologies (TSXV:EGT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024