Atico Mining Corporation (the “Company” or “Atico”) (TSX.V: ATY |

OTCQX: ATCMF) is pleased to announce operating results for the

three months and year ended December 31, 2024 from its El Roble

mine. Production totaled 3.7 million pounds of copper with 1,918

ounces of gold for the fourth quarter (“Q4 2024”) and 13.67 million

pounds of copper with 9,025 ounces of gold in concentrates for the

full year in 2024.

“The Company had a solid operational year

overall as we met our production guidance for most metrics. Gold

production was slightly below budget, primarily due to a decrease

in head grade, while copper production, our primary commodity,

reached this year’s target. We expect these results to generate

strong revenue and improved financial performance for year ended

2024." said Fernando E. Ganoza, CEO. "In the coming year, we have

key milestones yet to achieve. In the first quarter, we anticipate

an arbitration ruling related to the royalty dispute at the El

Roble mine. Furthermore, at El Roble we plan to allocate

significant effort to drilling the deposit and exploring for

additional mineralization in the mine vicinity. At La Plata in

Ecuador, we will continue to advance the project to secure the

environmental license, with the goal of reaching a positive

construction decision in the second half of the year."

Fourth Quarter and Full Year Operational

Highlights

Fourth Quarter

- Production of 3.7 million pounds of

copper contained in concentrates; a decrease of 16% over Q4

2023.

- Production of 1,918 ounces of gold

contained in concentrates; a decrease of 26% over Q4 2023.

- Average processed tonnes per day of

827; a decrease of 3% over Q4 2023.

- Copper and gold head grades of

2.60% and 1.29 grams per tonne, respectively; a decrease of 10% for

copper and a decrease of 26% for gold over Q4 2023.

- Copper and gold recovery of 92.2%

and 66.0%, respectively; a decrease of 2% for copper and an

increase of 5% for gold over Q4 2023.

2024 Year-end

- Production of 13.67 million pounds

of copper contained in concentrates; an increase of 3% over

2023.

- Production of 9,025 ounces of gold

contained in concentrates; a decrease of 11% over 2023.

- Average processed tonnes per day of

836; no significant change over 2023.

- Copper and gold head grades of

2.46% and 1.61 grams per tonne, respectively; an increase of 5% for

copper and a decrease of 15% for gold over 2023.

- Copper and gold recovery of 92.1%

and 63.6%, respectively; no significant change for copper and an

increase of 5% for gold over 2023.

Fourth Quarter and Full Year Operational

Details

|

|

Q1 Total |

Q2 Total |

Q3 Total |

Q4 Total |

2024 Total |

|

Production (Contained in Concentrates) |

|

|

|

|

|

|

Copper (000s pounds) |

3,349 |

3,710 |

2,912 |

3,697 |

13,668 |

|

Gold (ounces) |

2,185 |

2,850 |

2,072 |

1,918 |

9,025 |

|

Mine |

|

|

|

|

|

|

Tonnes of ore mined |

64,873 |

70,826 |

67,869 |

69,696 |

273,264 |

|

Mill |

|

|

|

|

|

|

Tonnes processed |

65,787 |

71,079 |

67,354 |

69,961 |

274,181 |

|

Tonnes processed per day |

811 |

852 |

856 |

827 |

836 |

|

Copper grade (%) |

2.52 |

2.57 |

2.13 |

2.60 |

2.46 |

|

Gold grade (g/t) |

1.67 |

1.95 |

1.52 |

1.29 |

1.61 |

|

Recoveries |

|

|

|

|

|

|

Copper (%) |

91.8 |

92.0 |

92.2 |

92.2 |

92.1 |

|

Gold (%) |

61.7 |

64.2 |

62.9 |

66.0 |

63.6 |

|

Concentrates |

|

|

|

|

|

|

Copper and gold concentrates (dmt) |

8,274 |

9,197 |

7,248 |

9,203 |

33,922 |

|

|

|

|

|

|

|

|

Payable copper produced (000s lbs) |

3,148 |

3,487 |

2,737 |

3,474 |

12,846 |

Note: Metal production figures are subject to

adjustments based on final settlement.

Concentrate Inventory

The number of shipments the Company can export

in any given quarter depends on several variables some of which the

Company does not control, hence there may be an inherent

variability in tonnes shipped quarter to quarter.

|

|

Q4 2024 |

|

Amounts in dry metric tonnes |

|

|

Opening inventory |

5,823 |

|

Production |

9,203 |

|

Sales |

-8,852 |

|

Adjustments |

-5 |

|

Closing inventory |

6,169 |

|

Number of shipments |

1 |

Note: Concentrate figures are subject to

adjustments based on final surveys and final settlement of

sales.

2025 Operating and Cost

Guidance

|

|

|

|

Copper (000s pounds) |

11,000 to 12,300 |

|

Gold (ounces) |

12,000 to 13,500 |

|

C1 Cash Cost ($US)(1) |

$1.60 to $1.70 |

Note: Please see “Non-GAAP Financial Measures”

at the end of this release. C1 cash cost per pound of payable

copper produced net of by-product credits.

El Roble Mine

The El Roble mine is a high grade, underground

copper and gold mine with nominal processing plant capacity of

1,000 tonnes per day, located in the Department of Choco in

Colombia. Its commercial product is a copper-gold concentrate.

Since obtaining control of the mine on November

22, 2013, Atico has upgraded the operation from a historical

nominal capacity of 400 tonnes per day.

El Roble’s reserves estimate, with an effective

date of March 12, 2024, includes Proven and Probable mineral

reserves of 828 thousand tonnes averaging 2.49% Cu, 2.20 g/t Au and

a life of mine until Q1-2027. A full NI 43-101 technical report is

available on SEDAR+. For more information on the reserves

estimate refer to SEDAR+ and on the Company’s website.

Mineralization is open at depth and along strike

and the Company plans to further test the limits of the deposit. On

the larger land package, the Company has identified a prospective

stratigraphic contact between volcanic rocks and black and grey

pelagic sediments and cherts that has been traced by Atico

geologists for ten kilometers. This contact has been determined to

be an important control on VMS mineralization on which Atico has

identified numerous target areas prospective for VMS type

mineralization occurrence, which is the focus of the current

surface drill program at El Roble.

Qualified Person

Mr. Thomas Kelly (SME Registered Member

1696580), advisor to the Company and a qualified person under

National Instrument 43-101 standards, is responsible for ensuring

that the technical information contained in this news release is an

accurate summary of the original reports and data provided to or

developed by Atico.

About Atico Mining

Corporation

Atico is a growth-oriented Company, focused on

exploring, developing and mining copper and gold projects in Latin

America. The Company generates significant cash flow through the

operation of the El Roble mine and is developing its high-grade La

Plata VMS project in Ecuador. The Company is also pursuing

additional acquisition of advanced stage opportunities. For more

information, please

visit www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. GanozaCEOAtico Mining

Corporation

Trading symbols: TSX.V: ATY | OTCQX: ATCMF

Investor RelationsIgor DutinaTel:

+1.604.633.9022

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. The

securities being offered have not been, and will not be, registered

under the United States Securities Act of 1933, as amended (the

‘‘U.S. Securities Act’’), or any state securities laws, and may not

be offered or sold in the United States, or to, or for the account

or benefit of, a "U.S. person" (as defined in Regulation S of the

U.S. Securities Act) unless pursuant to an exemption therefrom.

This press release is for information purposes only and does not

constitute an offer to sell or a solicitation of an offer to buy

any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward

Looking Statements

This announcement includes certain

“forward-looking statements” within the meaning of Canadian

securities legislation. All statements, other than statements of

historical fact, included herein, without limitation the use of net

proceeds, are forward-looking statements. Forward- looking

statements involve various risks and uncertainties and are based on

certain factors and assumptions. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Important factors that could cause actual results

to differ materially from the Company’s expectations include

uncertainties relating to interpretation of drill results and the

geology, continuity and grade of mineral deposits; uncertainty of

estimates of capital and operating costs; the need to obtain

additional financing to maintain its interest in and/or explore and

develop the Company’s mineral projects; uncertainty of meeting

anticipated program milestones for the Company’s mineral projects;

and other risks and uncertainties disclosed under the heading “Risk

Factors” in the AIF of the Company dated September 4, 2024 filed

with the Canadian securities regulatory authorities on the SEDAR+

website at www.sedarplus.com.

Non-GAAP Financial Measures

The items marked with a "(1)" are alternative

performance measures and readers should refer to “Non-GAAP

Financial Measures” in the Company's Management's Discussion and

Analysis for the 9 months ended September 30, 2024, (“Q3-2024

MD&A”) as filed on SEDAR+ at www.sedarplus.ca under the

Company’s profile and as available on the Company's website for

further details. To facilitate a better understanding

of these measures as calculated by the Company, descriptions are

provided in “Non-GAAP Financial Measures” in the Company’s Q3-2024

MD&A, including an explanation of their composition; an

explanation of how such measures provide useful information to an

investor and the additional purposes, if any, for which management

of Atico uses such measures; and a qualitative reconciliation of

each non-GAAP financial measure to the most directly comparable

historical financial measure that is disclosed in the Company’s

financial Statements as of September 30, 2024.

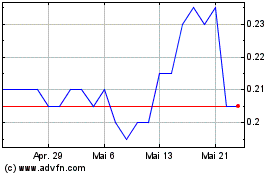

Atico Mining (TSXV:ATY)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Atico Mining (TSXV:ATY)

Historical Stock Chart

Von Jan 2024 bis Jan 2025