Spark Power Announces $20 Million Bought Deal Public Offering of Convertible Debentures

18 Februar 2021 - 9:47PM

Spark Power Group Inc. ("Spark Power" or the "Company") (TSX: SPG)

is pleased to announce that it has entered into a $20 million

bought-deal financing (the "Convertible Debenture Financing") of

convertible unsecured subordinated debentures (the "Debentures")

with a syndicate of underwriters (the "Underwriters") led by

Raymond James Ltd. The Debentures will have a coupon of 7.5% per

annum, and a conversion price of $3.05 per Spark Power common share

(a "Common Share"), subject to adjustment in certain circumstances.

The conversion price represents a conversion premium of

approximately 25%. The Company has granted the Underwriters an

over-allotment option to purchase up to an additional $3 million

aggregate principal amount of Debentures on the same terms,

exercisable in whole or in part at any time up to the 30th day

following the closing of the Convertible Debenture Financing. The

Debentures will mature on March 31, 2026.

The net proceeds from the Convertible Debenture

Financing will be used to provide additional working capital to

support the continued growth of the business.

Except in certain circumstances involving a

“Change of Control”, the Debentures will not be redeemable at the

option of the Company before March 31, 2024. On or after March 31,

2024 and prior to March 31, 2025, the Debentures may be redeemed in

whole or in part at the option of the Company on not more than 60

days and not less than 30 days prior notice at a price equal to

their principal amount thereof plus accrued and unpaid interest,

provided that the volume weighted average trading price of the

Shares on the TSX for the 20 consecutive trading days preceding the

date on which the notice of redemption is given is not less than

125% of the Conversion Price. On or after March 31, 2025 and prior

to the Maturity Date or in certain circumstances involving certain

“Change of Control” transactions,, the Debentures may be redeemed

in whole or in part at the option of the Company on not more than

60 days and not less than 30 days prior notice at a price equal to

their principal amount plus accrued and unpaid interest.

The offering is subject to normal regulatory

approvals, including approval of the Toronto Stock Exchange, and is

expected to close on or about March 11, 2021.

The Debentures will be offered by way of a short

form prospectus in all of the provinces and territories of Canada,

except Quebec, and may also be offered by way of private placement

in the United States. The securities offered have not been

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful.

About Spark Power

Spark Power, a wholly owned subsidiary of Spark

Power Group Inc. (TSX: SPG), is a leading independent provider of

end-to-end electrical contracting, operations and maintenance

services, and energy sustainability solutions to the industrial,

commercial, utility, and renewable asset markets in North America.

We work to earn the right to be our customers’ Trusted Partner in

Power™. Our highly skilled and dedicated people, located in the

communities we serve, combined with our knowledge of the power

industry, technology expertise, and commitment to safety, ensures

we deliver the right solutions that keep our customers’ operations

up and running today and better equipped for tomorrow. Learn more

at www.sparkpowercorp.com.

Forward looking and other cautionary

statements

This news release may contain forward-looking

statements (within the meaning of applicable securities laws) which

reflect Spark Power’s current expectations regarding future events.

Forward-looking statements are identified by words such as

“believe”, “anticipate”, “project”, “expect”, “intend”, “plan”,

“will”, “may”, “estimate” and other similar expressions. Such

information and statements are based on the current expectations of

Spark Power’s management and are based on assumptions and subject

to risks and uncertainties. Although Spark Power’s management

believes that the assumptions underlying such information and

statements are reasonable, they may prove to be incorrect. The

forward-looking events and circumstances discussed in this press

release may not occur by certain specified dates or at all and

could differ materially as a result of known and unknown risk

factors and uncertainties affecting Spark Power, including risks

relating to: general economic and stock market conditions; adverse

industry events; loss of markets; future legislative and regulatory

developments in Canada and elsewhere; the power industry in Canada

generally; the ability of Spark Power to implement its business

strategies; risks and uncertainties detailed from time to time in

Spark Power’s filings with the Canadian Securities Administrators;

the Company’s inability to raise capital or have the liquidity to

operate or advance its strategic initiatives and many other factors

beyond the control of Spark Power.

Investor and Regulatory Inquiries

Dan Ardila, Executive Vice President & Chief

Financial Officer dardila@sparkpowercorp.com+1 (905) 829-3336

x127

Media Inquiries

Kim Samlall, Director, Marketing

Communicationsmedia@sparkpowercorp.com+1 (905) 829-3336 x185

Spark Power (TSX:SPG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

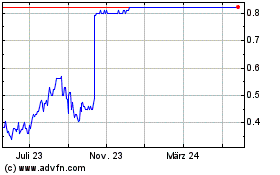

Spark Power (TSX:SPG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024