Paramount Resources Ltd. Announces Acquisition of ProspEx Resources Ltd. and Equity Financing

08 April 2011 - 2:27PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES. ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A

VIOLATION OF U.S. SECURITIES LAW

Paramount Resources Ltd. ("Paramount" or the "Company") (TSX:POU) has entered

into an agreement with ProspEx Resources Ltd. ("ProspEx") (TSX:PSX) providing

for the acquisition by Paramount of all of the issued and outstanding voting

common shares of ProspEx ("ProspEx Shares") not already owned by Paramount (the

"Transaction"). Under the terms of the Transaction, shareholders of ProspEx may

elect to receive either: (i) 0.07162 of a Class A common share of Paramount

("Paramount Share"); or (ii) $2.40 cash, for each ProspEx Share, provided that

Paramount will issue an aggregate of 2,000,000 Paramount Shares pursuant to the

Transaction. The total cost to Paramount is approximately $180 million,

including the assumption of estimated net debt of approximately $40 million and

the cost of approximately 9% of the outstanding ProspEx Shares already held by

Paramount.

The Transaction is to be completed through an arrangement pursuant to the

Business Corporations Act (Alberta) and is expected to be completed by the end

of May 2011. Completion of the Transaction is subject to approval by ProspEx

shareholders, court approval and regulatory approvals.

The Board of Directors of ProspEx has unanimously determined to recommend that

ProspEx shareholders vote their ProspEx Shares in favour of the Transaction. All

of the directors and officers of ProspEx, collectively holding approximately 5%

of the ProspEx Shares, have entered into agreements with Paramount to vote their

ProspEx Shares in favour of the Transaction.

Transaction Highlights

Through the Transaction, Paramount is acquiring a suite of high impact liquids

rich natural gas assets with significant multi-zone and horizontal drilling

potential in several zones from the Triassic Montney Formations up to the Late

Cretaceous Cardium Formations, including the prolific Falher C zone in the Kakwa

area. These assets will increase Paramount's already significant Deep Basin land

holdings in the Kakwa, Elmworth, and Wapiti areas of Alberta. The Transaction

also includes considerable assets in the Pembina and Brazeau areas, which have

substantial Falher and Notikewin horizontal potential and numerous drilling

locations in the Birch area of northeast British Columbia, a liquids-rich

Montney gas opportunity. In addition, the acquisition includes predictable long

life reserves and production from the Ricinus and Harmattan areas of Alberta.

The Transaction has the following

characteristics:

Production forecast (1): 2,925 BOE/d fiscal 2011

3,860 BOE/d fiscal 2012

Proved plus probable reserves (2): 18.6 MMBOE

Undeveloped land: 132,300 gross (104,000 net) acres

Estimated risked drilling locations: 47+ gross (30+ net)

(1) Based on Paramount's development plans for ProspEx's properties.

(2) Reserves evaluated by GLJ Petroleum Consultants Ltd. ("GLJ") as at

December 31, 2010 in a report dated February 18, 2011 prepared in

accordance with the COGE Handbook and National Instrument 51-101.

Transaction Metrics

The Transaction is accretive to Paramount, on a per share basis, to production,

cash flow and reserves. Net of undeveloped land at an internally estimated value

of approximately $29 million and based on a purchase price of $2.40 per ProspEx

Share, the Transaction metrics are as follows:

2011 production: $51,900 per BOE/d

2012 production: $39,300 per BOE/d

Proved plus probable reserves: $8.17 per BOE

An information circular with respect to the Transaction is expected to be mailed

to all ProspEx shareholders in early May 2011 and a special meeting of ProspEx

shareholders is anticipated to be held in late May 2011. Under certain

circumstances, ProspEx has agreed to pay a non-completion fee of $6.5 million to

Paramount.

Peters & Co. Limited acted as financial advisor to Paramount in connection with

the Transaction.

Equity Financing

Paramount has entered into an agreement to sell, to a syndicate of underwriters

co-led by Peters & Co. Limited and BMO Capital Markets and including Cormark

Securities Inc., FirstEnergy Capital Corp., GMP Securities L.P. and Stifel

Nicolaus Canada Inc., 1,500,000 Paramount Shares at a price of $32.50 per share

for gross proceeds of approximately $48.8 million. Paramount has also granted an

overallotment option to the underwriters to acquire an additional 225,000

Paramount Shares at a price of $32.50 per share. If the overallotment option is

exercised in full, the gross proceeds of the issue will be approximately $56.1

million. The Paramount Shares will be offered for sale by short form prospectus

in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario

and Nova Scotia and on a private placement basis in the United States pursuant

to exemptions from the registration requirements of the U.S. Securities Act of

1933, as amended, (the "1933 Act"). Closing of the offering is expected to occur

on or about April 29, 2011. The net proceeds of the offering will be used to

advance Paramount's overall business strategy, including supplementing existing

working capital available to fund its ongoing 2011 capital expenditure program

and for general corporate purposes.

In conjunction with this offering, Paramount also intends to issue to Clayton H.

Riddell or companies controlled by Mr. Riddell, Paramount's Chairman and Chief

Executive Officer, on a private placement basis, 150,000 flow-through Class A

common shares of Paramount at a price of $36.50 per share for gross proceeds of

approximately $5.5 million (which proceeds will be used by Paramount to incur

eligible Canadian Development Expenses). Mr. Riddell currently beneficially owns

or controls, directly or indirectly, approximately 50% of the outstanding

Paramount Shares.

The aggregate gross proceeds from these equity offerings (assuming full exercise

of the underwriters' overallotment option) will be approximately $61.5 million.

The completion of each of the equity offerings is subject to satisfaction of

certain conditions customary for transactions of this nature including Paramount

receiving all necessary regulatory approvals.

The Transaction is not subject to completion of the equity offerings, nor are

the equity offerings subject to completion of the Transaction. Paramount has

available cash and borrowing capacity under its credit facility to fund the

entire cash portion of the Transaction.

Paramount is a Canadian oil and natural gas exploration, development and

production company with operations focused in Western Canada. Paramount's common

shares are listed on the Toronto Stock Exchange under the symbol "POU".

Forward-Looking Statements. Certain information provided in this press release

constitutes forward-looking statements. The words "anticipate", "expect",

"project", "estimate", "forecast" and similar expressions are intended to

identify such forward-looking statements. Specifically, this press release

contains forward-looking statements relating to the Transaction, reserves, land

values, production forecasts and drilling locations and closing of and use of

proceeds of the equity offerings. The reader is cautioned that assumptions used

in the preparation of such information, although considered reasonable at the

time of preparation, may prove to be incorrect. Actual results achieved during

the forecast period will vary from the information provided herein as a result

of numerous known and unknown risks and uncertainties and other factors. You can

find a discussion of those risks and uncertainties in Paramount's Canadian

securities filings. Such factors include, but are not limited to: the failure to

obtain necessary ProspEx shareholder approval with respect to the Transaction,

the failure to obtain necessary regulatory approvals or satisfy the conditions

to closing the Transaction or the equity offerings, as applicable, general

economic, market and business conditions; fluctuations in oil and natural gas

prices; the results of exploration and development drilling; recompletions and

related activities; timing and rig availability; the uncertainty of reserve

estimates; changes in environmental and other regulations; risks associated with

oil and gas operations; and other factors, many of which are beyond the control

of the Company. Except as may be required by applicable securities laws,

Paramount assumes no obligation to publicly update or revise any forward-looking

statements made herein or otherwise, whether as a result of new information,

future events or otherwise.

BOE. Disclosure provided herein in respect of boes may be misleading,

particularly if used in isolation. A boe conversation ratio of 6 mcf:1 bbl is

based on an energy equivalency conversion method primarily applicable at the

burner tip and does not represent an economic value at the wellhead.

The Paramount Shares and Paramount Shares to be issued on a flow-through basis

have not been and will not be registered under the United States Securities Act

of 1933, as amended, or any states securities laws and may not be offered, sold

or delivered in the United States or to or for the account or benefit of U.S.

persons absent registration or applicable exemption from the registration

requirement of such act or any applicable states securities laws. This news

release does not constitute an offer to sell or a solicitation of an offer to

buy securities in the United States.

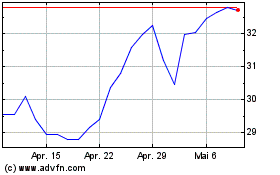

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Paramount Resources (TSX:POU)

Historical Stock Chart

Von Jul 2023 bis Jul 2024