Timbercreek Financial Announces 2021 Third Quarter Results

10 November 2021 - 1:00PM

Timbercreek Financial (TSX: TF) (the “Company”) announced today its

financial results for the three months and nine months ended

September 30, 2021 (“Q3 2021”) and changes to its Board of

Directors.

Q3 2021 Highlights

- Funded $176.8 million on new and existing mortgages versus

repayments of $235.6 million, ending the period with a portfolio

size of net mortgage investments at $1,096.0 million. The

transaction volume resulted in a Q3 turnover ratio of 17.1% versus

7.2% in Q2. The Q3 2021 results are reflective of high funding

volumes, however these were offset with significant repayments late

in the quarter. The Company was in a strong liquidity position

entering what is expected to be an active Q4 2021 from a capital

deployment perspective.

- Delivered distributable income and adjusted distributable

income of $13.5 million or $0.17 per share and declared $14.0

million in dividends to shareholders, representing a 103.7% payout

ratio on both distributable income and adjusted distributable

income for the quarter. The year-to-date 2021 adjusted payout ratio

is 94.9% versus 97.9% for year-to-date 2020, within management's

target pay out range of low to mid 90s for the full year.

- Basic and diluted earnings per share was $0.13, and basic and

diluted adjusted earnings per share was $0.17. Adjusted earnings

per share payout ratio was 102.3%.

- Maintained conservative portfolio risk position focused on

income-producing commercial real estate

- 69.6% weighted average loan-to-value

- 90.2% of mortgage investment

portfolio are first mortgages

- 87.1% of mortgage investment

portfolio is invested in cash-flowing properties

- 7.1% quarterly weighted average

interest rate on net mortgage investments

“In what is typically a slower period for new

transaction activity our team drove high volumes of funding,

offsett by a higher level of repayments which position us well to

capitalize on a strong fourth quarter pipeline,” said Blair

Tamblyn, CEO of Timbercreek Financial. “The portfolio delivered

distributable income per share in our historical range while

continuing to demonstrate the stability and durability that are

hallmarks of our investment style. Looking ahead, we have an

expanded capital base and the financial flexibility to achieve

steady growth of the total portfolio.”

Quarterly Comparison

| $

millions |

Q3 2021 |

|

|

Q3 2020 |

|

Q2 2021 |

| |

|

|

|

|

|

|

|

Net Mortgage Investments |

$ |

1,096.0 |

|

|

|

$ |

1,153.2 |

|

|

$ |

1,159.2 |

|

| Enhanced Return Portfolio

Investments |

$ |

97.6 |

|

|

|

$ |

93.6 |

|

|

$ |

94.7 |

|

| |

|

|

|

|

|

|

| Net Investment Income |

$ |

22.0 |

|

|

|

$ |

23.9 |

|

|

$ |

23.4 |

|

| Income from Operations |

$ |

15.4 |

|

|

|

$ |

20.2 |

|

|

$ |

18.8 |

|

| Net Income and comprehensive

Income |

$ |

10.4 |

|

|

|

$ |

14.4 |

|

|

$ |

13.5 |

|

| --Adjusted Net Income and

comprehensive Income |

$ |

13.7 |

|

|

|

$ |

14.0 |

|

|

$ |

13.6 |

|

| Distributable Income |

$ |

13.5 |

|

|

|

$ |

14.2 |

|

|

$ |

16.1 |

|

| --Adjusted Distributable

Income |

$ |

13.5 |

|

|

|

$ |

14.2 |

|

|

$ |

15.4 |

|

| Dividends declared to

Shareholders |

$ |

14.0 |

|

|

|

$ |

14.0 |

|

|

$ |

14.0 |

|

| |

|

|

|

|

|

|

| $ per

share |

Q3 2021 |

|

|

Q3 2020 |

|

Q2 2021 |

| |

|

|

|

|

|

|

| Dividends per share |

$ |

0.17 |

|

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

| Distributable Income per

share |

$ |

0.17 |

|

|

|

$ |

0.18 |

|

|

$ |

0.20 |

|

| Adjusted distributable Income

per share |

$ |

0.17 |

|

|

|

$ |

0.18 |

|

|

$ |

0.19 |

|

| Earnings per share |

$ |

0.13 |

|

|

|

$ |

0.18 |

|

|

$ |

0.17 |

|

| --Adjusted Earnings per

share |

$ |

0.17 |

|

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

| |

|

|

|

|

|

|

| Payout Ratio on Distributable

Income |

103.7 |

% |

|

|

98.3 |

% |

|

86.8 |

% |

| --Payout ratio on Adjusted

Distributable Income |

103.7 |

% |

|

|

98.3 |

% |

|

90.8 |

% |

| Payout Ratio on Earnings per

share |

134.7 |

% |

|

|

96.7 |

% |

|

103.7 |

% |

| --Payout Ratio on Adjusted

Earnings per share |

102.3 |

% |

|

|

99.6 |

% |

|

102.7 |

% |

| |

|

|

|

|

|

|

| Net Mortgage

Investments |

Q3 2021 |

|

|

Q3 2020 |

|

Q2 2021 |

| |

|

|

|

|

|

|

| Weighted Average

Loan-to-Value |

69.6 |

% |

|

|

68.2 |

% |

|

69.7 |

% |

| Weighted Average Remaining

Term to Maturity |

0.9 yr |

|

|

|

1.1 yr |

|

|

0.9 yr |

|

| First Mortgages |

90.2 |

% |

|

|

90.4 |

% |

|

92.0 |

% |

| Cash-Flowing Properties |

87.1 |

% |

|

|

84.1 |

% |

|

89.0 |

% |

| Rental Apartments |

49.4 |

% |

|

|

50.0 |

% |

|

51.4 |

% |

| Floating Rate Loans with rate

floors (at quarter end) |

82.7 |

% |

|

|

77.3 |

% |

|

79.5 |

% |

| |

|

|

|

|

|

|

| Weighted Average Interest

Rate |

|

|

|

|

|

|

| For the quarter

ended |

7.1 |

% |

|

|

7.2 |

% |

|

7.2 |

% |

| Weighted Average Lender

Fee |

|

|

|

|

|

|

| New and Renewed |

0.6 |

% |

|

|

0.7 |

% |

|

0.8 |

% |

| New Net Mortgage

Investment Only |

0.9 |

% |

|

|

1.2 |

% |

|

1.3 |

% |

Board of Director Changes

The Company also announced the following changes

to its Board of Directors;

- Deborah Robinson

joins the Board as an independent director. Ms. Robinson is

President and the Founder of Bay Street HR, and has over 25 years

of diverse Human Resources and Governance experience in a variety

of sectors and has an extensive network in the Canadian Capital

Markets community. Prior to founding Bay Street HR, Ms. Robinson

was an Executive Director at CIBC World Markets, overseeing human

resources for Global Investment Banking. Ms. Robinson is a director

of Park Lawn (TSX:PLC), Blockchain Foundry (CSNX:BCFN), a Director

and Co- Founder of Best Buddies Charitable Foundation and is a

graduate of the Directors Education Program of the Institute of

Corporate Directors and holds the institute´s ICD.D

designation.

- Tracy Johnston,

Chief Financial Officer of the Company and Timbercreek Capital,

joins the Board as a director. Ms. Johnston is responsible for

overseeing financial and taxation reporting, treasury, corporate

financing and the financial reporting and risk analytics platform.

Ms. Johnston has over 15 years of progressive finance experience.

Prior to joining Timbercreek, Ms. Johnston held positions at

Cadillac Fairview and DREAM Office REIT. Ms. Johnston started her

career in the assurance and advisory practice at Deloitte and has

her CPA, CA designation.

- Steven Scott, a

long-time director of the Company is resigning from the Board to

focus on other commitments. Mr. Scott will remain strategically

involved as an investor in and director of, the broader asset

management platform.

"We're excited to add Deborah and Tracy as new

directors. Deborah's extensive knowledge in human resources and

governance matters make her an exceptional and complementary

addition to the Board. Given Tracy's direct experience with

Timbercreek Capital, we look forward to her direct involvement with

the Board. We want to thank Steve for his time at the Company, his

contributions have been significant and we look forward to his

continued involvement at Timbercreek Capital in the years ahead,"

added Mr. Tamblyn.

Quarterly Conference Call

Interested parties are invited to participate in

a conference call with management on Wednesday, November 10,

2021 at 1:00 p.m. (ET) which will be followed by a question and

answer period with analysts. To join the call:

https://timbercreekfinancial.adobeconnect.com/tfq32021/Participant

Toll Free Dial-In Number: (866) 211-4953Participant International

Dial-In Number: (873) 415-0258Provide the Operator with the

Conference ID Number: 1902839

The playback of the conference call will also be

available on www.timbercreekfinancial.com following the call.

About the Company

Timbercreek Financial is a leading non-bank,

commercial real estate lender providing shorter-duration,

structured financing solutions to commercial real estate

professionals. Our sophisticated, service-oriented approach allows

us to meet the needs of borrowers, including faster execution and

more flexible terms that are not typically provided by Canadian

financial institutions. By employing thorough underwriting, active

management and strong governance, we are able to meet these needs

while generating strong risk-adjusted yields for investors. Further

information is available on our website,

www.timbercreekfinancial.com.

Non-IFRS Measures

The Company prepares and releases financial

statements in accordance with IFRS. As a complement to results

provided in accordance with IFRS, the Company discloses certain

financial measures not recognized under IFRS and that do not have

standard meanings prescribed by IFRS (collectively the “non-IFRS

measures”). These non-IFRS measures are further described in

Management's Discussion and Analysis ("MD&A") available on

SEDAR. The Company has presented such non-IFRS measures because the

Manager believes they are relevant measures of the Company’s

ability to earn and distribute cash dividends to shareholders and

to evaluate its performance. The following non-IFRS financial

measures should not be construed as alternatives to total net

income and comprehensive income or cash flows from operating

activities as determined in accordance with IFRS as indicators of

the Company’s performance.

Certain statements contained in this news

release may contain projections and "forward looking statements"

within the meaning of that phrase under Canadian securities laws.

When used in this news release, the words "may", "would", "should",

"could", "will", "intend", "plan", "anticipate", "believe",

"estimate", "expect", "objective" and similar expressions may be

used to identify forward looking statements. By their nature,

forward looking statements reflect the Company's current views,

beliefs, assumptions and intentions and are subject to certain

risks and uncertainties, known and unknown, including, without

limitation, those risks disclosed in the Company's public filings.

Many factors could cause actual results, performance or

achievements to be materially different from any future results,

performance or achievements that may be expressed or implied by

these forward looking statements. The Company does not intend to

nor assumes any obligation to update these forward looking

statements whether as a result of new information, plans, events or

otherwise, unless required by law.

SOURCE: Timbercreek Financial

For further information, please contact:

Timbercreek FinancialBlair Tamblyn, CEOTracy

Johnston, CFO Karynna Ma, Vice President, Investor Relations

1-844-304-9967www.timbercreekfinancial.com

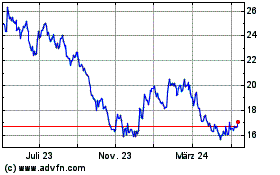

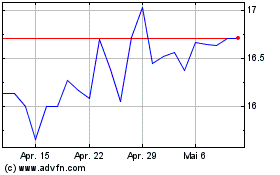

Park Lawn (TSX:PLC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Park Lawn (TSX:PLC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024