Osisko Gold Royalties Ltd (the “

Corporation” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

announce that it has acquired a 1.0% net smelter return

(“

NSR”) royalty (the “

Royalty”)

covering the Namdini Gold Project (“

Namdini”) in

Ghana. Osisko has closed the transaction with Savannah Mining

Limited (“

Savannah”), acquiring a direct interest

in 50% of Savannah’s 2.0% NSR royalty for total consideration of

US$35 million (excluding applicable taxes and levies).

HIGHLIGHTS

Near-term gold equivalent ounces (“GEO”) from a

Fully-Permitted Project Currently Under Construction

- Namdini is on the verge of becoming

one of Western Africa’s next significant producing mines with gold

production over the initial three years expected to reach

approximately 360,000 ounces per year, and an average

287,000 ounces per year over an initial 15-year life of

mine;

- First gold production from Namdini

is expected in late 2024;

- As of mid-October 2023, Namdini’s

34.5 kV distribution power lines to site, connected to the national

power grid 30km west of the project, were 99% complete; in

addition, Namdini’s plant bulk earthworks were 99% complete, while

the CIL and Flotation tailings storage facilities were 29% and 39%

complete, respectively.

Operator is a Large-Scale and Experienced Global

Miner

- Namdini is controlled and will be

operated by Shandong Gold Co Ltd. (“Shandong”), a

large-scale and well-capitalized global miner with a history of

development and operational expertise;

- Shandong operates Namdini through

its subsidiary Cardinal Namdini Mining Limited

(“Cardinal”), which is owned in partnership with a

subsidiary of China Railway Construction Group Corp Ltd.

Jurisdiction with Well-Established Mining Act

and Laws

- Ghana is a top gold mining

jurisdiction, ranked 6th in global gold production, and ranked

1st amongst African nations in 2022, based on data from the

World Gold Council;

- Payments associated with Ghanian

Withholding and Value-Added Taxes (VAT), plus associated levies,

result in an additional cash outlay by Osisko to the relevant

authorities of US$7.7 million.

Osisko Granted Additional Rights

- As part of the transaction Savannah

has granted Osisko certain additional rights.

Paul Martin, Interim CEO of Osisko commented:

“Today’s announcement highlights Osisko’s continued ability to

uncover and execute on accretive precious metals transactions.

Namdini is a long-life, low-cost, open-pit gold project located in

Ghana, one of West Africa’s most prolific gold producing countries.

The project is being advanced through construction and into

production by Shandong; a company which Osisko is confident will

continue to develop and operate the mine in a responsible manner.

We look forward to having the 1.0% NSR on Namdini contribute to our

near-term cash flows and GEO growth profile.”

NAMDINI GOLD PROJECT

The Namdini Gold Project is an open-pit gold

project located in Ghana, approximately 50 km southeast of the town

of Bolgatanga, and close to the southern border of Burkina Faso. In

January 2021, Shandong closed the A$540 million (~US$400M)

acquisition of the company that owned Namdini, Cardinal Resources

Inc.

An October 2019 NI 43-101 compliant Feasibility

Study on Namdini, completed by Lycopodium for the previous project

owner Cardinal (the “Feasibility Study”), outlined

average annual gold production of 287,000 ounces over an initial

15-year mine life. The Feasibility Study also highlighted ~421,000

ounces of gold to be produced in the first 12 months of operation,

and 1.1 million ounces forecasted in the first 3 years of full

production. The total Proven and Probable Ore Reserve in the

Feasibility Study was estimated at 138.6 Mt at 1.13 g/t Au with a

contained gold content of 5.1 Moz. Of this total, 92% of the

contained gold was within the Probable Ore Reserve category.

The Feasibility Study also highlighted the

development of a single open-pit mine feeding a conventional

crushing, SAG mill, regrind, high shear oxidation and CIL circuits,

with development expected to initially focus on a high-grade

starter pit area towards the north of the deposit.

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

About Osisko Gold Royalties Ltd.

Osisko Gold Royalties Ltd is an intermediate

precious metal royalty company which holds a North American focused

portfolio of over 180 royalties, streams and precious metal

offtakes, including 23 producing assets. Osisko’s portfolio is

anchored by its cornerstone asset, a 5% net smelter return royalty

on the Canadian Malartic mine, one of Canada’s largest gold

mines.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

For further information, please contact Osisko Gold

Royalties Ltd:

| Grant MoentingVice President,

Capital Markets Tel: (514) 940-0670 #116Mobile : (365)

275-1954Email: gmoenting@osiskogr.com |

Heather TaylorVice President,

Sustainability & Communications Tel: (514) 940-0670 #105Email:

htaylor@osiskogr.com |

CAUTIONARY

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, ongoing

development of the Namdini project, that once in production, the

project’s performance will conform to the forecasts in the

Feasibility Study, that opportunities will arise to allow Osisko to

exercise certain additional rights granted by Savannah , production

estimates of Osisko’s assets (including increase of production),

timely developments of mining properties over which Osisko has

royalties, streams, offtakes and investments, management’s

expectations regarding Osisko’s growth, results of operations,

estimated future revenues, production costs, carrying value of

assets, ability to continue to pay dividend, requirements for

additional capital, business prospects and opportunities future

demand for and fluctuation of prices of commodities (including

outlook on gold, silver, diamonds, other commodities) currency,

markets and general market conditions. In addition, statements and

estimates (including data in tables) relating to mineral reserves

and resources and gold equivalent ounces are forward-looking

statements, as they involve implied assessment, based on certain

estimates and assumptions, and no assurance can be given that the

estimates will be realized. Forward-looking statements are

statements that are not historical facts and are generally, but not

always, identified by the words “expects”, “plans”, “anticipates”,

“believes”, “intends”, “estimates”, “projects”, “potential”,

“scheduled” and similar expressions or variations (including

negative variations), or that events or conditions “will”, “would”,

“may”, “could” or “should” occur. Forward-looking statements are

subject to known and unknown risks, uncertainties and other

factors, most of which are beyond the control of Osisko, and actual

results may accordingly differ materially from those in

forward-looking statements. Such risk factors include, without

limitation, (i) with respect to properties in which Osisko holds a

royalty, stream or other interest; risks related to: (a) the

operators of the properties, (b) timely development, permitting,

construction, commencement of production, ramp-up (including

operating and technical challenges), (c) differences in rate and

timing of production from resource estimates or production

forecasts by operators, (d) differences in conversion rate from

resources to reserves and ability to replace resources, (e) the

unfavorable outcome of any challenges or litigation relating title,

permit or license, (f) hazards and uncertainty associated with the

business of exploring, development and mining including, but not

limited to unusual or unexpected geological and metallurgical

conditions, slope failures or cave-ins, flooding and other natural

disasters or civil unrest or other uninsured risks, (g) that

development of the Namdini project will be pursued diligently and

in a timely manner, (ii) with respect to other external factors:

(a) fluctuations in the prices of the commodities that drive

royalties, streams, offtakes and investments held by Osisko, (b)

fluctuations in the value of the Canadian dollar relative to the

U.S. dollar, (c) regulatory changes by national and local

governments, including permitting and licensing regimes and

taxation policies, regulations and political or economic

developments in any of the countries where properties in which

Osisko holds a royalty, stream or other interest are located or

through which they are held, (d) continued availability of capital

and financing and general economic, market or business conditions,

and (e) responses of relevant governments to infectious diseases

outbreaks and the effectiveness of such response and the potential

impact of such outbreaks on Osisko’s business, operations and

financial condition, (f) that conditions will be met to allow

Osisko to exercise to exercise certain additional rights granted by

Savannah; (iii) with respect to internal factors: (a) business

opportunities that may or not become available to, or are pursued

by Osisko, (b) the integration of acquired assets or (c) the

determination of Osisko’s PFIC status. The forward-looking

statements contained in this press release are based upon

assumptions management believes to be reasonable, including,

without limitation: that Shandong will achieve production of the

Namdini project in a manner consistent with the Feasibility Study;

that public disclosure concerning the Namdini project remails

accurate; that no adverse development occurs in respect of the

Namdini project; and the absence of any other factors that could

cause actions, events or results to differ from those anticipated,

estimated or intended and the absence of significant change in the

Corporation’s ongoing income and assets relating to determination

of its PFIC status; the absence of any other factors that could

cause actions, events or results to differ from those anticipated,

estimated or intended and, with respect to properties in which

Osisko holds a royalty, stream or other interest, (i) the ongoing

operation of the properties by the owners or operators of such

properties in a manner consistent with past practice and with

public disclosure (including forecast of production), (ii) the

accuracy of public statements and disclosures made by the owners or

operators of such underlying properties (including expectations for

the development of underlying properties that are not yet in

production), (iii) no adverse development in respect of any

significant property, (iv) that statements and estimates relating

to mineral reserves and resources by owners and operators are

accurate and (v) the implementation of an adequate plan for

integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR at www.sedar.com

and EDGAR at www.sec.gov which also provides additional general

assumptions in connection with these statements. Osisko cautions

that the foregoing list of risk and uncertainties is not

exhaustive. Investors and others should carefully consider the

above factors as well as the uncertainties they represent and the

risk they entail. Osisko believes that the assumptions reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be accurate as

actual results and prospective events could materially differ from

those anticipated such the forward looking statements and such

forward-looking statements included in this press release are not

guarantee of future performance and should not be unduly relied

upon. In this press release, Osisko relies on public

information available on the Namdini Project and assumes no

liability for such third party public disclosure. These

statements speak only as of the date of this press release. Osisko

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, other than as required by applicable

law.

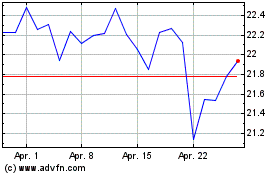

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024