European Residential Real Estate Investment Trust ("ERES" or the

"REIT") (TSX: ERE.UN) announced today its results for the year

ended December 31, 2023.

ERES’s audited consolidated annual financial

statements and management's discussion and analysis ("MD&A")

for the year ended December 31, 2023 can be found at

www.eresreit.com or under ERES's profile at SEDAR+ at

www.sedarplus.ca.

SIGNIFICANT EVENTS AND

HIGHLIGHTS

Business Update

- On January 24, 2023, the REIT

amended and renewed its existing revolving credit facility,

providing up to €125 million for a three-year period ending January

26, 2026, as well as an accordion feature to increase the limit a

further €25 million upon satisfaction of conditions set out in the

agreement and consent of applicable lenders.

- On March 31, 2023, pursuant to the

departure of Phillip Burns, Mark Kenney assumed the role of Chief

Executive Officer and trustee. Mr. Kenney is currently also the

Chief Executive Officer and President of CAPREIT.

- On June 16, 2023, the REIT

announced that it was working with CBRE, as financial and real

estate advisor, to advise it in connection with a strategic review

of ERES. On December 20, 2023, the REIT announced that the

strategic review process has been concluded and the proposed

transactions would not be proceeded with.

- On June 26, 2023, the REIT secured

mortgage financing on its May 2, 2022 acquisition property,

combined with refinancing of certain existing properties, in the

total principal amount of €76.5 million (excluding financing costs

and fees). The new mortgage financing matures on June 26, 2029, and

carries a fixed contractual interest rate of 4.66%.

Operating Metrics

- Strong operating results continued

into 2023, fuelled by strong rental growth. Same property portfolio

Occupied Average Monthly Rents ("Occupied AMR") increased by 7.2%,

from €992 as at December 31, 2022, to €1,063 as at December 31,

2023, demonstrating the REIT's continued achievement of rental

growth in excess of its target range.

- Turnover was 13.8% for the year

ended December 31, 2023, with rental uplift on turnover remaining

strong at 20.4%, compared to rental uplift of 22.0% on turnover of

12.4% for the year ended December 31, 2022.

- Occupancy for the residential and

commercial properties increased to 98.5% and 100.0%, respectively,

as at December 31, 2023, compared to 98.4% and 99.5%, respectively

as at December 31, 2022, and is at the high end of the REIT's

target range. Moreover, 50.5% of residential vacancies are

attributable to suites undergoing renovation upon turnover, and

27.7% of residential vacancies are due to suites held for potential

sale relating to the REIT's ongoing capital recycling

initiatives.

- Net Operating Income ("NOI")

increased by 8.9% for the year ended December 31, 2023 compared to

the year ended December 31, 2022, primarily driven by higher

monthly rents on the same property portfolio, further supported by

the REIT's extensive protection from inflation and strong cost

control.

Financial Performance

- Funds From Operations ("FFO") per

Unit decreased by 4.7% to €0.161 for the year ended December 31,

2023, compared to €0.169 for the year ended December 31, 2022,

primarily driven by increases in interest and other financing costs

and current income tax expense, partially offset by the positive

impact of increased same property NOI.

- Adjusted Funds From Operations

("AFFO") per Unit decreased by 2.7% to €0.146 for the year ended

December 31, 2023, compared to €0.150 for the year ended December

31, 2022, due to the same reasons mentioned above for FFO per

Unit.

Financial Position and Liquidity

- Overall, liquidity improved from

prior year due to the amendment of the Revolving Credit Facility

increasing the limit by €25.0 million, with immediately available

liquidity of €28.9 million as at December 31, 2023, excluding the

€25.0 million accordion feature on the Revolving Credit Facility,

acquisition capacity on the Pipeline Agreement and alternative

promissory note arrangements with CAPREIT.

- Debt coverage metrics are within

covenant thresholds, with interest and debt service coverage ratios

of 2.9x and 2.4x, respectively, and adjusted debt to gross book

value ratio currently standing at 57.6%.

- The REIT's financial position is

additionally supported by its well-staggered mortgage profile, with

a weighted average term to maturity of 2.9 years and a weighted

average effective interest rate of 2.07%.

"With growing demand for housing in the

Netherlands continuing to outstrip the pace of new supply, we're

experiencing increasingly tight rental market fundamentals which

keep strengthening ERES's operational performance, as we saw again

in 2023,” commented Mark Kenney, Chief Executive Officer.

“Consistent with our track record to date, we're pleased to report

that our occupancies remained as high as possible, while our same

property NOI margin expanded to 78.6% for 2023. This year, we also

proved our commitment to maximizing value for Unitholders in any

way that we can, and we're confident that our current strategy

achieves that objective. Looking ahead, we remain focused on

optimizing our portfolio, enhancing our operational performance and

fortifying our platform, and we're excited to continue making

progress on each of these initiatives."

"We secured €76.5 million in mortgage financing

during 2023, and the weighted average effective interest rate on

our mortgage portfolio remains low at 2.1% today,” added Jenny

Chou, Chief Financial Officer. “This reflects our conservative

financing strategy as we fix 100% of our mortgage interest costs

and stagger our renewals. As such, we're well positioned for next

year with only 9% of our mortgage debt coming due in 2024. We'll

continue to manage our debt and capital structure proactively and

prudently going forward, and we have liquidity-generating programs

in place to strengthen our balance sheet, reduce volatility and

mitigate the impact of mortgages maturing in future years."

OPERATING RESULTS

Rental Rates

|

Total and Same Property Portfolio |

Suite Count1 |

Occupied AMR/ABR2 |

Occupancy % |

|

As at December 31, |

2023 |

2022 |

2023 |

2022 |

AMR |

2023 |

2022 |

| |

|

|

€ |

€ |

% Change |

|

|

|

Residential Properties |

6,886 |

6,900 |

1,063 |

992 |

7.2 |

98.5 |

98.4 |

|

Commercial Properties3 |

|

|

19.4 |

18.2 |

6.6 |

100.0 |

99.5 |

|

1 |

Same property suite count only includes the properties owned by the

REIT as at both December 31, 2023 and December 31, 2022, and

therefore does not take into account the impact of any property

acquisitions completed between the two dates. |

|

2 |

Average In-Place Base Rent ("ABR"). |

|

3 |

Represents 450,911 square feet of commercial gross leasable

area. |

|

|

|

Occupied AMR increased by 7.2% for both the

total and same property multi-residential portfolios, compared to

the prior year. The increase was mainly driven by indexation,

turnover and the conversion of regulated suites to liberalized

suites. The REIT's achievement of growth in rental revenues

significantly in excess of its target range of 3% to 5%

demonstrates its ability to consistently operate in a complex and

fluid regulatory regime.

Suite Turnovers

|

For the Three Months Ended December 31, |

2023 |

2022 |

|

|

Change in Monthly Rent |

Turnovers2 |

Change in Monthly Rent |

Turnovers2 |

|

|

% |

% |

% |

% |

|

Regulated suites turnover1 |

11.9 |

0.3 |

2.2 |

0.4 |

|

Liberalized suites turnover1 |

18.6 |

2.7 |

18.5 |

3.2 |

|

Regulated suites converted to liberalized suites1 |

41.8 |

0.4 |

82.2 |

0.4 |

|

Weighted average turnovers1 |

20.3 |

3.4 |

23.8 |

3.9 |

|

Weighted average turnovers excluding service charge

income |

19.2 |

3.4 |

23.1 |

3.9 |

|

1 |

Represents the percentage increase in monthly rent inclusive of

service charge income. |

|

2 |

Percentage of suites turned over during the period based on the

weighted average number of residential suites held during the

period. |

|

|

|

|

For the Year Ended December 31, |

2023 |

2022 |

|

|

Change in Monthly Rent |

Turnovers2 |

Change in Monthly Rent |

Turnovers2 |

|

|

% |

% |

% |

% |

|

Regulated suites turnover1 |

10.5 |

1.1 |

1.7 |

1.3 |

|

Liberalized suites turnover1 |

17.7 |

11.0 |

18.6 |

9.7 |

|

Regulated suites converted to liberalized suites1 |

51.8 |

1.6 |

65.0 |

1.4 |

|

Weighted average turnovers1 |

20.4 |

13.8 |

22.0 |

12.4 |

|

Weighted average turnovers excluding service charge

income |

19.5 |

13.8 |

21.4 |

12.4 |

|

1 |

Represents the percentage increase in monthly rent inclusive of

service charge income. |

|

2 |

Percentage of suites turned over during the period based on the

weighted average number of residential suites held during the

period. |

|

|

|

Suite Renewals

Lease renewals generally occur on July 1st for

residential suites. Other than the household income adjustment,

maximum rent indexation from July 1, 2023 to June 30, 2024 for all

Regulated Units is set at the annual wage development figure of

3.1%. For the period from July 1, 2024 up to and including June 30,

2025, the indexation for all Regulated Units has been set at the

annual wage development figure of 5.8% with a monthly rent of more

than €300. Annual rental increases due to indexation for

Liberalized Suites are also capped, as per the previously enacted

Dutch government legislation, effective for an initial period of

three years from May 1, 2021 up to and including April 30, 2024.

The indexation for the period from January 1, 2023 to January 1,

2024 has been capped for Liberalized Suites to the annual wage

development figure + 1.0%, resulting in a maximum indexation of

4.1% based on the annual wage development figure of 3.1%. For the

period from January 1, 2024 to January 1, 2025, the rental cap

limits indexation for Liberalized Suites to the annual inflation

number ("CPI") + 1.0%, resulting in a maximum indexation of 5.5%

based on CPI of 4.5%.

Accordingly, for rental increases due to

indexation beginning on July 1, 2023, the REIT served tenant

notices to 6,659 suites, representing 97% of the residential

portfolio, across which the average rental increase due to

indexation and household income adjustments is 4.0%. In the prior

year, the REIT served tenant notices to 6,499 suites, representing

96% of the residential portfolio, across which the average rental

increase due to indexation and household income adjustments was

3.0%.

There was one lease renewal in the REIT's

commercial portfolio during the year ended December 31, 2023 (year

ended December 31, 2022 — three lease renewals).

Total Portfolio Performance

| |

Three Months Ended, |

Year Ended |

| |

December 31, |

December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Operating Revenues (000s) |

€ |

24,717 |

|

€ |

22,932 |

|

€ |

95,684 |

|

€ |

89,252 |

|

|

NOI (000s) |

€ |

19,505 |

|

€ |

17,546 |

|

€ |

75,131 |

|

€ |

68,980 |

|

|

NOI Margin1 |

78.9 |

% |

76.5 |

% |

78.5 |

% |

77.3 |

% |

|

Weighted Average Number of Suites |

6,894 |

|

6,900 |

|

6,898 |

|

6,811 |

|

|

1 |

Excluding service charge income and expense, the total portfolio

NOI margin for the three months and year ended December 31, 2023

was 84.2% and 83.8%, respectively (three months and year ended

December 31, 2022 — 82.1% and 83.1%, respectively). |

| |

|

Operating revenues increased by 7.8% and 7.2%

for the three months and year ended December 31, 2023,

respectively, compared to the same periods last year, primarily due

to increase in monthly rents on the same property portfolio.

NOI increased by 11.2% and 8.9% for the three

months and year ended December 31, 2023, respectively, versus the

same periods last year. Moreover, for the three months ended

December 31, 2023, the NOI margin on the total portfolio increased

to 78.9% from 76.5% for the comparable quarter (excluding service

charges, total portfolio NOI margin increased to 84.2% from 82.1%

for the comparable quarter). For the year ended December 31, 2023,

the NOI margin on the total portfolio increased to 78.5% from 77.3%

for the prior year (excluding service charges, total portfolio NOI

margin increased to 83.8% from 83.1% for the prior year). The

increases were primarily driven by higher operating revenues from

increased total portfolio occupied AMR and substantial reduction in

onsite costs, as a result of the abolishment of landlord levy tax.

Service charge expenses are fully recoverable from tenants via

service charge income and therefore have a nil net impact on NOI.

The increase in the total portfolio NOI margin excluding service

charges reflects the REIT's ability to successfully control costs

as well as its limited exposure to inflationary pressures

Same Property Portfolio

Performance

| |

Three Months Ended, |

Year Ended |

| |

December 31, |

December 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Operating Revenues (000s) |

€ |

23,522 |

|

€ |

21,887 |

|

€ |

91,162 |

|

€ |

86,076 |

|

|

NOI (000s) |

€ |

18,576 |

|

€ |

16,799 |

|

€ |

71,680 |

|

€ |

66,492 |

|

|

NOI Margin1 |

79.0 |

% |

76.8 |

% |

78.6 |

% |

77.2 |

% |

|

Same Property Number of Suites2 |

6,542 |

|

6,545 |

|

6,542 |

|

6,545 |

|

|

1 |

Excluding service charge income and expense, the same property

portfolio NOI margin for the three months and year ended December

31, 2023 was 84.2% and 83.9%, respectively (three months and year

ended December 31, 2022 — 82.4% and 83.1%, respectively). |

|

2 |

The number of suites for same property NOI is based on the weighted

average number of suites owned by the REIT during the current and

comparative prior year periods, respectively, excluding property

acquisitions or property dispositions completed during 2022 and

2023. |

|

|

|

The increases in same property NOI by 10.6% and

7.8% for the three months and year ended December 31, 2023,

respectively, compared to the same periods last year, were

primarily driven by higher operating revenues from increased

monthly rents and reduction in onsite costs, as a result of the

abolishment of landlord levy tax. The increases in same property

NOI margin including and excluding service charges for the three

months and year ended December 31, 2023 are primarily driven by the

same reasons for the increases in same property NOI mentioned

above.

The REIT is focused on continuing to further

improve NOI and NOI margin through a combination of rental growth

and cost control, and investment in capital programs to enhance the

quality and value of its portfolio. In addition, the REIT notes

that its property operating costs are largely insulated from

inflation, as tenants are responsible for all of their own energy

and other utility costs, the REIT incurs no wage costs, and

property management fees are a fixed percentage of operating

revenues. This further preserves the REIT's property operating

costs and, combined with its strong growth in rental revenues,

improves its NOI margin.

Financial Performance

FFO is a measure of operating performance based

on the funds generated by the business before reinvestment or

provision for other capital needs. AFFO is a supplemental measure

which adjusts FFO for costs associated with certain capital

expenditures, leasing costs and tenant improvements. FFO and AFFO

as presented are in accordance with the recommendations of the Real

Property Association of Canada ("REALpac") as published in

January 2023, with the exception of certain adjustments made to the

REALpac defined FFO, which relate to (i) acquisition research

costs, (ii) mortgage refinancing costs, (iii) senior management

termination and retirement costs, (iv) costs related to the

concluded strategic review of the REIT, and (v) expired base shelf

prospectus fees. FFO and AFFO may not, however, be comparable to

similar measures presented by other real estate investment trusts

or companies in similar or different industries. Management

considers FFO and AFFO to be important measures of the REIT’s

operating performance. Please refer to "Basis of Presentation and

Non-IFRS Measures" within this press release for further

information.

A reconciliation of net (loss) income and

comprehensive (loss) income to FFO is as follows:

|

(€ Thousands, except per Unit amounts) |

Three Months Ended |

Year Ended |

|

|

December 31, |

December 31, |

|

|

2023 |

2022 |

2023 |

2022 |

|

Net (loss) income and comprehensive (loss) income for the

period |

€ |

(35,917 |

) |

€ |

(48,790 |

) |

€ |

(114,229 |

) |

€ |

116,416 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Net movement in fair value of investment properties |

35,337 |

|

93,599 |

|

230,229 |

|

79,449 |

|

|

Net movement in fair value of Class B LP Units |

8,218 |

|

(15,443 |

) |

(46,299 |

) |

(148,289 |

) |

|

Fair value adjustments of Unit Option liabilities |

(194 |

) |

(1 |

) |

(1,311 |

) |

(1,850 |

) |

|

Interest expense on Class B LP Units |

4,261 |

|

4,261 |

|

17,044 |

|

16,809 |

|

|

Deferred income taxes |

(10,538 |

) |

(22,944 |

) |

(59,679 |

) |

(10,240 |

) |

|

Foreign exchange loss (gain)1 |

224 |

|

1,148 |

|

(568 |

) |

10,544 |

|

|

Net loss (gain) on derivative financial instruments |

6,304 |

|

(2,496 |

) |

9,244 |

|

(34,252 |

) |

|

Other activities and loss on transactions2 |

950 |

|

— |

|

2,765 |

|

— |

|

|

Tax on suite dispositions3 |

234 |

|

— |

|

314 |

|

— |

|

|

Senior management termination and retirement costs4 |

— |

|

— |

|

74 |

|

— |

|

|

Impairment of goodwill |

— |

|

— |

|

— |

|

10,541 |

|

|

Mortgage refinancing costs5 |

— |

|

— |

|

— |

|

121 |

|

|

Acquisition research costs |

— |

|

— |

|

— |

|

11 |

|

|

FFO |

€ |

8,879 |

|

€ |

9,334 |

|

€ |

37,584 |

|

€ |

39,260 |

|

|

FFO per Unit – diluted6 |

€ |

0.038 |

|

€ |

0.040 |

|

€ |

0.161 |

|

€ |

0.169 |

|

|

|

|

|

|

|

|

|

|

|

|

Total distributions declared |

€ |

7,002 |

|

€ |

6,967 |

|

€ |

27,949 |

|

€ |

27,434 |

|

|

FFO payout ratio |

78.9 |

% |

74.6 |

% |

74.4 |

% |

69.9 |

% |

|

1 |

Relates to foreign exchange movements recognized on remeasurement

of Unit Option liabilities as well as on remeasurement of the

REIT's US Dollar draw on the Revolving Credit Facility as part of

effective hedging. |

|

2 |

Relate to costs associated with the concluded strategic review of

the REIT, loss on suite dispositions, and expired base shelf

prospectus fees. |

|

3 |

Included in current income tax expense in the consolidated

statements of net (loss) income and comprehensive (loss)

income. |

|

4 |

For the three months and year ended December 31, 2023, includes nil

and €59, respectively, of accelerated vesting of previously granted

Unit Options and nil and €15, respectively, in associated legal

fees (three months and year ended December 31, 2022 — nil). |

|

5 |

Relate to accelerated amortization of deferred financing costs for

the year ended December 31, 2022 associated with the refinancing

component of the REIT's mortgage, which closed on June 14,

2022. |

|

6 |

Includes Class B LP Units and the dilutive impact of unexercised

Unit Options, calculated based on the treasury method. |

|

|

|

|

The table below illustrates a reconciliation of the REIT's FFO and

AFFO: |

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

Year Ended |

|

(€ Thousands, except per Unit amounts) |

December 31, |

December 31, |

|

|

2023 |

2022 |

2023 |

2022 |

|

FFO |

€ |

8,879 |

|

€ |

9,334 |

|

€ |

37,584 |

|

€ |

39,260 |

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Non-discretionary capital expenditure reserve1 |

(769 |

) |

(988 |

) |

(3,073 |

) |

(3,951 |

) |

|

Leasing cost reserve2 |

(139 |

) |

(129 |

) |

(556 |

) |

(518 |

) |

|

AFFO |

€ |

7,971 |

|

€ |

8,217 |

|

€ |

33,955 |

|

€ |

34,791 |

|

|

AFFO per Unit – diluted3 |

€ |

0.034 |

|

€ |

0.035 |

|

€ |

0.146 |

|

€ |

0.150 |

|

|

|

|

|

|

|

|

|

|

|

|

Total distributions declared |

€ |

7,002 |

|

€ |

6,967 |

|

€ |

27,949 |

|

€ |

27,434 |

|

|

AFFO payout ratio |

87.8 |

% |

84.8 |

% |

82.3 |

% |

78.9 |

% |

|

1 |

Non-discretionary capital expenditure reserve is determined based

on management's best estimate of expected annual non-discretionary

capital expenditure requirements per suite, divided by four for the

quarter, and multiplied by the weighted average number of

residential suites during the period. The estimated annual

non-discretionary capital expenditure reserve per suite for 2023

and 2022 is €445 and €580, respectively. The estimated full year

weighted average number of residential suites as at December 31,

2023 and December 31, 2022 is 6,898 and 6,811, respectively. |

|

2 |

Leasing cost reserve is based on annualized 10-year forecast of

external leasing costs on the commercial properties. |

|

3 |

Includes Class B LP Units and the dilutive impact of unexercised

Unit Options, calculated based on the treasury method. |

|

|

|

FFO per Unit and AFFO per Unit for the three

months and year ended December 31, 2023 decreased from the same

periods last year primarily due to increases in interest and other

financing costs and current income tax expense, partially offset by

the positive impact of increased same property NOI.

Net Asset Value

Net Asset Value ("NAV") represents total

Unitholders' equity per the REIT's consolidated balance sheets,

adjusted to exclude certain amounts in order to provide what

management considers to be a key measure of the intrinsic value of

the REIT on an ongoing basis. Management believes that this measure

reflects the residual value of the REIT to its Unitholders on an

ongoing basis and is therefore used by management on both an

aggregate and per Unit basis to evaluate the net asset value

attributable to Unitholders, and changes thereon based on the

execution of the REIT's strategy. While NAV is calculated based on

items included in the consolidated annual financial statements or

supporting notes, NAV itself is not a standardized financial

measure under IFRS and may not be comparable to similarly termed

financial measures disclosed by other real estate investment trusts

or companies in similar or different industries. Please refer to

the "Basis of Presentation and Non-IFRS Measures" section within

this press release for further information.

|

A reconciliation of Unitholders' equity to NAV is as follows: |

|

|

| |

|

|

|

|

|

(€ Thousands, except per Unit amounts) |

|

|

|

As at |

December 31, 2023 |

|

December 31, 2022 |

|

|

Unitholders' equity |

€ |

427,247 |

|

€ |

550,147 |

|

|

Class B LP Units |

250,554 |

|

296,853 |

|

|

Unit-based compensation financial liabilities |

187 |

|

554 |

|

|

Net deferred income tax liability1 |

14,869 |

|

74,543 |

|

|

Net derivative financial asset2 |

(15,901 |

) |

(22,931 |

) |

|

NAV |

€ |

676,956 |

|

€ |

899,166 |

|

|

NAV per Unit – diluted3 |

€ |

2.90 |

|

€ |

3.87 |

|

|

NAV per Unit – diluted (in

C$)3,4 |

C$ |

4.24 |

|

C$ |

5.61 |

|

|

1 |

Represents deferred income tax liabilities of €28,217 net of

deferred income tax assets of €13,348 as at December 31, 2023

(December 31, 2022 — deferred income tax liabilities of €77,474 net

of deferred income tax assets of €2,931). |

|

2 |

Represents non-current derivative financial assets of €15,901 as at

December 31, 2023 (December 31, 2022 — non-current derivative

financial assets of €23,771, net of current derivative financial

liabilities of €840). |

|

3 |

Includes Class B LP Units and the dilutive impact of unexercised

Unit Options, calculated based on the treasury method. |

|

4 |

Based on the foreign exchange rate of 1.4626 on December 31,

2023 (foreign exchange rate of 1.4498 on December 31, 2022). |

|

|

|

Other Financial Highlights

| |

Three Months Ended |

Year Ended |

| |

December 31, |

December 31, |

|

|

2023 |

2022 |

2023 |

2022 |

|

Weighted Average Number of Units – Diluted (000s)1, 2 |

233,348 |

232,179 |

232,867 |

231,870 |

|

As at |

December 31, 2023 |

December 31, 2022 |

|

Closing Price of REIT Units3 |

€ |

1.76 |

€ |

2.09 |

|

Closing Price of REIT Units (in C$) |

C$ |

2.58 |

C$ |

3.03 |

|

Market Capitalization (millions)1, 3 |

€ |

412 |

€ |

486 |

|

Market Capitalization (millions in C$)1 |

C$ |

602 |

C$ |

704 |

|

1 |

Includes Class B LP Units. |

|

2 |

Dilutive impact of unexercised Unit Options is calculated based on

the treasury method. |

|

3 |

Based on the foreign exchange rate of 1.4626 on December 31,

2023 (rate of 1.4498 on December 31, 2022). |

|

|

|

FINANCIAL POSITION

|

As at |

December 31, 2023 |

|

December 31, 2022 |

|

|

Ratio of Adjusted Debt to Gross Book Value1 |

57.6 |

% |

51.0 |

% |

|

Weighted Average Mortgage Effective Interest Rate4 |

2.07 |

% |

1.77 |

% |

|

Weighted Average Mortgage Term (years) |

2.9 |

|

3.4 |

|

|

Debt Service Coverage Ratio (times)1,2 |

2.4 |

x |

3.1 |

x |

|

Interest Coverage Ratio (times)1,2 |

2.9 |

x |

3.8 |

x |

|

Available Liquidity (000s)3 |

€ |

28,893 |

|

€ |

21,386 |

|

|

1 |

Please refer to the "Basis of Presentation and Non-IFRS Measures"

section of this press release for further information. |

|

2 |

Based on trailing four quarters. |

|

3 |

Includes cash and cash equivalents of €6.9 million and unused

credit facility capacity of €22.0 million as at December 31,

2023 (cash and cash equivalents of €10.9 million and unused credit

facility capacity of €10.5 million as at December 31, 2022). |

|

4 |

Includes impact of deferred financing costs, fair value adjustment

and interest rate swaps. |

|

|

|

For the year ended December 31, 2023, ERES's

liquidity improved, as compared to the prior year, primarily driven

by the amended revolving credit facility agreement, which increased

the limit by €25.0 million, with immediately available liquidity of

€28.9 million as at December 31, 2023, excluding the €25.0 million

accordion feature on the Revolving Credit Facility, acquisition

capacity on the Pipeline Agreement and alternative promissory note

arrangements with CAPREIT. The REIT's financial position is

additionally strengthened by its well-staggered mortgage profile,

with a weighted average term to maturity of 2.9 years and fixed

interest payment terms for 100% of its mortgages at a low weighted

average effective interest rate of 2.07%. This is further

reinforced by compliant debt coverage metrics, with interest and

debt service coverage ratios of 2.9x and 2.4x, respectively, and

adjusted debt to gross book value ratio within its target range at

57.6%.

Management aims to maintain an optimal degree of

debt to gross book value of the REIT’s assets, depending on a

number of factors at any given time. Capital adequacy is monitored

against investment and debt restrictions contained in the REIT’s

fourth amended and restated declaration of trust dated April 28,

2020 (the "Declaration of Trust") and the amended and renewed

credit agreement dated January 24, 2023, between the REIT and three

Canadian chartered banks, providing access to up to €125.0 million

with an accordion feature to increase the limit a further €25.0

million upon satisfaction of conditions set out in the agreement

and the consent of applicable lenders (the "Revolving Credit

Facility").

The REIT manages its overall liquidity risk by

maintaining sufficient available credit facility and available cash

on hand to fund its ongoing operational and capital commitments and

distributions to Unitholders, and to provide for future growth in

its business.

DISTRIBUTIONS

During the year ended December 31, 2023, the

REIT declared monthly distributions of €0.01 per Unit (being

equivalent to €0.12 per Unit annualized). Such distributions are

paid to Unitholders of record on each record date, on or about the

15th day of the month following the record date. The REIT intends

to continue to make regular monthly distributions, subject to the

discretion of its Board of Trustees.

CONFERENCE CALL

A conference call hosted by Mark Kenney, Chief

Executive Officer and Jenny Chou, Chief Financial Officer, will be

held on Thursday, February 22, 2024 at 9:00 am EST. The

telephone numbers for the conference call are: Canadian Toll Free:

+1 (833) 950-0062 / International Toll: +1 (929) 526-1599. The

conference call access code is 380011.

The call will also be webcast live and

accessible through the ERES website at www.eresreit.com — click on

"Investor Info" and follow the link at the top of the page. A

replay of the webcast will be available for one year after the

webcast at the same link.

The slide presentation to accompany management's

comments during the conference call will be available on the ERES

website an hour and a half prior to the conference call.

About European Residential Real Estate

Investment Trust

ERES is an unincorporated, open-ended real

estate investment trust. ERES's REIT Units are listed on the TSX

under the symbol ERE.UN. ERES is Canada’s only European-focused

multi-residential REIT, with a current portfolio of high-quality,

multi-residential real estate properties in the Netherlands. As at

December 31, 2023, ERES owned 158 multi-residential properties,

comprised of approximately 6,900 residential suites and ancillary

retail space located in the Netherlands, and owned one commercial

property in Germany and one commercial property in Belgium.

ERES’s registered and principal business office

is located at 11 Church Street, Suite 401, Toronto, Ontario M5E

1W1.

For more information please visit our website at

www.eresreit.com.

Basis of Presentation and Non-IFRS

Measures

Unless otherwise stated, all amounts included in

this press release are in thousands of Euros ("€"), the functional

currency of the REIT. The REIT's audited consolidated annual

financial statements and the notes thereto for the year ended

December 31, 2023, are prepared in accordance with International

Financial Reporting Standards ("IFRS"). Financial information

included within this press release does not contain all disclosures

required by IFRS, and accordingly should be read in conjunction

with the REIT's audited consolidated annual financial statements

and MD&A for the year ended December 31, 2023, which are

available on the REIT's website at www.eresreit.com and on SEDAR+

at www.sedarplus.ca.

Consistent with the REIT's management framework,

management uses certain financial measures to assess the REIT's

financial performance, which are not in accordance with IFRS

("Non-IFRS Measures"). Since these Non-IFRS Measures are not

recognized under IFRS, they may not be comparable to similar

measures reported by other issuers. The REIT presents Non-IFRS

Measures because management believes Non-IFRS Measures are relevant

measures of the ability of the REIT to earn revenue, generate

sustainable economic earnings, and to evaluate its performance and

financial condition. The Non-IFRS Measures should not be construed

as alternatives to the REIT's financial position, net income or

cash flows from operating activities determined in accordance with

IFRS as indicators of the REIT’s performance or the sustainability

of distributions. For full definitions of these measures, please

refer to "Non-IFRS Measures" in Section I and Section IV of the

REIT's MD&A for the year ended December 31, 2023.

Where not otherwise disclosed, reconciliations

for certain Non-IFRS Measures included within this press release

are provided below.

Adjusted Debt and Adjusted Debt Ratio

The REIT's Declaration of Trust and Revolving

Credit Facility requires compliance with certain financial

covenants, including the Ratio of Adjusted Debt to Gross Book

Value. Management uses Total Debt Adjusted for Declaration of Trust

and the Ratio of Adjusted Debt to Gross Book Value as indicators in

assessing if the debt level maintained is sufficient to provide

adequate cash flows for distributions.

A reconciliation from total debt is as

follows:

|

(€ Thousands) |

|

|

|

As at |

December 31, 2023 |

|

December 31, 2022 |

|

|

Mortgages payable1 |

€ |

889,749 |

|

€ |

875,615 |

|

|

Credit facility2 |

102,741 |

|

89,259 |

|

|

Promissory note |

— |

|

25,650 |

|

|

Total Debt |

€ |

992,490 |

|

€ |

990,524 |

|

|

|

|

|

|

|

|

Fair value adjustment on mortgages payable |

(816 |

) |

(1,215 |

) |

|

Total Debt Adjusted for Declaration of Trust |

€ |

991,674 |

|

€ |

989,309 |

|

|

Ratio of Adjusted Debt to Gross Book

Value3 |

57.6 |

% |

51.0 |

% |

|

1 |

Represents non-current and current mortgages payable of €809,215

and €80,534, respectively, as at December 31, 2023 (December

31, 2022 — €813,733 and €61,882, respectively). |

|

2 |

Comparative figure was restated to conform with current year

presentation. |

|

3 |

Gross book value is defined by the REIT's Declaration of Trust as

the gross book value of the REIT's assets as per the REIT's

financial statements, determined on a fair value basis for

investment properties. |

|

|

|

Earnings Before Interest, Tax, Depreciation,

Amortization and Fair Value

Earnings Before Interest, Tax, Depreciation,

Amortization and Fair Value ("EBITDAFV") is calculated as

prescribed in the REIT's Revolving Credit Facility for the purpose

of determining the REIT's Debt Service Coverage Ratio and Interest

Coverage Ratio, and is defined as net income (loss) attributable to

Unitholders, reversing, where applicable, income taxes, interest

expense, amortization expense, depreciation expense, impairment,

adjustments to fair value and other adjustments as permitted in the

REIT's Revolving Credit Facility. Management believes EBITDAFV is

useful in assessing the REIT's ability to service its debt, finance

capital expenditures and provide for distributions to its

Unitholders.

A reconciliation of net income (loss) and

comprehensive income (loss) to EBITDAFV is as follows:

|

(€ Thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended, |

Q4 23 |

|

Q3 23 |

|

Q2 23 |

|

Q1 23 |

|

Q4 22 |

|

Q3 22 |

|

Q2 22 |

|

Q1 22 |

|

|

Net (loss) income and comprehensive (loss) income |

€ |

(35,917 |

) |

€ |

24,784 |

|

€ |

3,252 |

|

€ |

(106,348 |

) |

€ |

(48,790 |

) |

€ |

70,000 |

|

€ |

126,935 |

|

€ |

(31,729 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net movement in fair value of investment properties |

35,337 |

|

24,768 |

|

45,398 |

|

124,726 |

|

93,599 |

|

8,099 |

|

9,790 |

|

(32,039 |

) |

|

Net movement in fair value of Class B LP Units |

8,218 |

|

(39,339 |

) |

(31,964 |

) |

16,786 |

|

(15,443 |

) |

(65,136 |

) |

(133,499 |

) |

65,789 |

|

|

Fair value adjustments of Unit Option liabilities |

(194 |

) |

(463 |

) |

(513 |

) |

(141 |

) |

(1 |

) |

(682 |

) |

(2,258 |

) |

1,091 |

|

|

Net loss (gain) on derivative financial instruments |

6,304 |

|

640 |

|

(728 |

) |

3,028 |

|

(2,496 |

) |

(10,385 |

) |

(10,649 |

) |

(10,722 |

) |

|

Foreign exchange loss (gain) |

224 |

|

213 |

|

210 |

|

(1,215 |

) |

1,148 |

|

2,696 |

|

5,003 |

|

1,697 |

|

|

Interest expense on Class B LP Units |

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,261 |

|

4,262 |

|

4,025 |

|

|

Interest on mortgages payable |

4,608 |

|

4,607 |

|

3,843 |

|

3,777 |

|

3,832 |

|

3,862 |

|

3,186 |

|

3,046 |

|

|

Interest on credit facility |

1,422 |

|

1,336 |

|

1,237 |

|

797 |

|

576 |

|

262 |

|

167 |

|

150 |

|

|

Interest on promissory notes |

— |

|

— |

|

70 |

|

234 |

|

197 |

|

97 |

|

256 |

|

50 |

|

|

Amortization |

246 |

|

150 |

|

202 |

|

173 |

|

130 |

|

149 |

|

207 |

|

231 |

|

|

Loss on suite dispositions |

58 |

|

19 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Impairment of goodwill |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

10,541 |

|

— |

|

|

Income tax (recovery) expense |

(8,143 |

) |

(5,081 |

) |

(9,647 |

) |

(30,718 |

) |

(21,926 |

) |

2,371 |

|

540 |

|

12,302 |

|

|

EBITDAFV |

€ |

16,424 |

|

€ |

15,895 |

|

€ |

15,621 |

|

€ |

15,360 |

|

€ |

15,087 |

|

€ |

15,594 |

|

€ |

14,481 |

|

€ |

13,891 |

|

|

Cash taxes |

2,395 |

|

1,251 |

|

1,235 |

|

1,209 |

|

1,018 |

|

983 |

|

875 |

|

651 |

|

|

Tax on suite dispositions |

(234 |

) |

(80 |

) |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

EBITDAFV less cash taxes |

€ |

14,263 |

|

€ |

14,724 |

|

€ |

14,386 |

|

€ |

14,151 |

|

€ |

14,069 |

|

€ |

14,611 |

|

€ |

13,606 |

|

€ |

13,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal repayments1 |

€ |

550 |

|

€ |

550 |

|

€ |

549 |

|

€ |

549 |

|

€ |

548 |

|

€ |

548 |

|

€ |

547 |

|

€ |

547 |

|

|

1 |

For use in the Debt Service Coverage Ratio calculation. |

| |

|

Debt Service Coverage Ratio

The Debt Service Coverage Ratio is defined as

EBITDAFV less cash taxes, divided by the sum of interest expense

(including on mortgages payable, credit facility and promissory

notes) and all regularly scheduled principal payments made with

respect to indebtedness during the period (other than any balloon,

bullet or similar principal payable at maturity or which repays

such indebtedness in full). The Debt Service Coverage Ratio is

calculated as prescribed in the REIT's Revolving Credit Facility,

and is based on the trailing four quarters. Management believes the

Debt Service Coverage Ratio is useful in determining the ability of

the REIT to service the principal and interest requirements of its

outstanding debt.

|

(€ Thousands) |

|

As at |

December 31, 2023 |

|

December 31, 2022 |

|

|

EBITDAFV less cash taxes1 |

€ |

57,524 |

|

€ |

55,526 |

|

|

Debt service payments1,2 |

€ |

24,129 |

|

€ |

17,871 |

|

|

Debt Service Coverage Ratio (times) |

2.4 |

x |

3.1 |

x |

|

1 |

For the trailing 12 months ended. |

|

2 |

Include principal repayments as well as interest on mortgages

payable, credit facility and promissory notes, and exclude interest

expense on Class B LP Units. |

|

|

|

Interest Coverage Ratio

The Interest Coverage Ratio is defined as

EBITDAFV divided by interest expense (including on mortgages

payable, credit facility and promissory notes). The Interest

Coverage Ratio is calculated as prescribed in the REIT's Revolving

Credit Facility, and is based on the trailing four quarters.

Management believes the Interest Coverage Ratio is useful in

determining the REIT's ability to service the interest requirements

of its outstanding debt.

|

(€ Thousands) |

|

As at |

December 31, 2023 |

|

December 31, 2022 |

|

|

EBITDAFV1 |

€ |

63,300 |

|

€ |

59,053 |

|

|

Interest expense1,2 |

€ |

21,931 |

|

€ |

15,681 |

|

|

Interest Coverage Ratio (times) |

2.9 |

x |

3.8 |

x |

|

1 |

For the trailing 12 months ended. |

|

2 |

Includes interest on mortgages payable, credit facility and

promissory notes, and excludes interest expense on Class B LP

Units. |

|

|

|

Forward-Looking Disclaimer

Certain statements contained in this press

release constitute forward-looking statements within the meaning of

applicable Canadian securities laws which reflect the REIT’s

current expectations and projections about future results.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “consider”, “should”, "plan", “predict”, “forward”,

“potential”, “could”, "would", "should", "might", “likely”,

“approximately”, “scheduled”, “forecast”, “variation”, "project",

"budget" or “continue”, or similar expressions suggesting future

outcomes or events. Management's estimates, beliefs and assumptions

are inherently subject to significant business, economic,

competitive and other uncertainties and contingencies regarding

future events and, as such, are subject to change. Although the

forward-looking statements contained in this press release are

based on assumptions and information that are available to

management as of the date on which the statements are made in this

press release, including current market conditions and management's

assessment of acquisition, disposition and other opportunities that

are or may become available to the REIT, which are subject to

change, management believes these statements have been prepared on

a reasonable basis, reflecting the REIT's best estimates and

judgement. However, there can be no assurance that forward-looking

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in this press

release. Accordingly, readers should not place undue reliance on

forward-looking statements. For a detailed discussion of risks and

uncertainties affecting the REIT, refer to the Risks and

Uncertainties section in the MD&A contained in the REIT's 2023

Annual Report.

Except as specifically required by applicable

Canadian securities law, the REIT does not undertake any obligation

to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise,

after the date on which the statements are made or to reflect the

occurrence of unanticipated events. These forward-looking

statements should not be relied upon as representing the REIT’s

views as of any date subsequent to the date of this press

release.

For further information:

| Mark

Kenney |

Jenny

Chou |

| Chief Executive Officer |

Chief Financial Officer |

| Email: m.kenney@capreit.net |

Email: j.chou@capreit.net |

| |

|

Category: Earnings

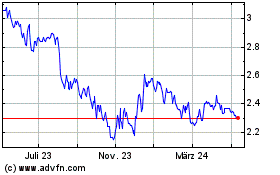

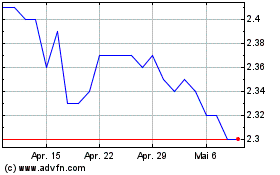

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024