UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

SCHEDULE TO

Tender Offer Statement under

Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

MediaAlpha,

Inc.

(Name of Subject Company (Issuer))

White Mountains Insurance Group, Ltd.

WM Hinson (Bermuda) Ltd.

(Names of Filing Persons (Offerors))

Class A Common Stock, par value

$0.01 per share

(Title of Class of Securities)

58450V104

(CUSIP Number of Class of Securities)

Robert L. Seelig, Esq.

Executive Vice President and

General Counsel

White Mountains Insurance Group, Ltd.

23 South Main Street, Suite

3B

Hanover, New Hampshire 03755-2053

Telephone: (603) 640-2200

(Name, address and telephone number

of person authorized to receive notices and communications on behalf of filing

persons)

With a copy to:

| Andrew

J. Pitts, Esq. |

David Lopez, Esq. |

| David J. Perkins,

Esq. |

Cleary Gottlieb Steen & Hamilton LLP |

| Cravath, Swaine &

Moore LLP |

One Liberty Plaza |

| 825 Eighth Avenue |

New York, New York 10006 |

| New York, New York

10019 |

Telephone: (212) 225-2632 |

| Telephone: (212) 474-1000 |

|

¨ Check

the box if the filing relates solely to preliminary communications made before the commencement of the tender offer.

Check the appropriate boxes below to designate any transactions

to which the statement relates:

x

third-party tender offer subject to Rule 14d-1.

¨ issuer tender offer subject to Rule 13e-4.

¨ going-private

transaction subject to Rule 13e-3.

¨ amendment

to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final

amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

¨ Rule

13e-4(i) (Cross-Border Issuer Tender Offer)

¨ Rule

14d-1(d) (Cross-Border Third-Party Tender Offer)

AMENDMENT NO. 2 TO SCHEDULE TO

This Amendment No. 2 (this “Amendment

No. 2”) amends and supplements the Tender Offer Statement on Schedule TO, initially filed by White Mountains Insurance Group,

Ltd., an exempted company organized and existing under the laws of Bermuda (“White Mountains”), and WM Hinson (Bermuda)

Ltd., an exempted company organized and existing under the laws of Bermuda and wholly owned subsidiary of White Mountains (together

with White Mountains, the “Purchasers”), with the Securities and Exchange Commission on May 26, 2023 (as amended as of

June 27, 2023, and as of the date hereof, the “Schedule TO”), which relates to the offer by the Purchasers to purchase

up to an aggregate of 5,916,816 (as increased from 5,000,000) shares of Class A Common Stock, $0.01 par value per share (each, a

“Common Share”), of MediaAlpha, Inc., a Delaware corporation (the “Company”), at a price of $10.00 per Common Share, net to the seller

in cash, less any applicable withholding taxes and without interest. The Purchasers have increased their initial offer to provide for the the purchase of 916,816 additional Common Shares (within up to 2%

of the Company's outstanding Common Shares).

This Amendment No. 2 is intended to satisfy

the reporting requirements of Rule 14d-3(b)(2) promulgated under the Securities Exchange Act of 1934, as amended. Except as

otherwise set forth below, the information set forth in the Schedule TO, including all exhibits thereto that were previously filed

with the Schedule TO, remains unchanged and is incorporated by reference as relevant to the items in this Amendment No. 2. You

should read this Amendment No. 2 together with the Schedule TO (as amended by Amendment No. 1, dated June 27, 2023), the Offer to

Purchase dated May 26, 2023 (the “Offer to Purchase”) and the related Letter of Transmittal (which together, as they may

be amended or supplemented from time to time, constitute the “Offer”). Capitalized terms used herein and not defined herein shall have the meanings given to them in the Offer to Purchase.

Items 1 through 10.

Items 1 through 10 of the Schedule TO, to the extent

such items incorporated by reference information contained in the Offer to Purchase, are hereby amended and supplemented as follows:

The Offer was initially to purchase up to an

aggregate of 5,000,000 Common Shares, and was oversubscribed. As previously announced, the Purchasers amended the Offer to provide

for the purchase of 916,816 additional Common Shares (within up to 2% of the Company’s outstanding Common Shares). As a

result, based on the number of issued and outstanding Shares as of May 31, 2023, according to the Company, (1) White

Mountains’ beneficial ownership and voting power in the Company will increase to approximately 35.73% of the issued and

outstanding Shares and (2) if the Purchasers transfer such purchased Common Shares to White Mountains Investments, the voting power

of the Stockholders’ Agreement Parties would increase to approximately 68.06% of the issued and outstanding Shares.

ITEM

11. ADDITIONAL INFORMATION

| (1) | Item 11 of the Schedule TO is hereby amended and supplemented by adding the following to the end thereof: |

On June 30, 2023, White Mountains issued a press release

announcing the final results of the Offer. A copy of such press release is filed herewith as Exhibit (a)(5)(iii) to the Schedule TO and

is incorporated herein by reference.

ITEM 12. EXHIBITS

| (1) | Item 12 of the Schedule TO is hereby amended and supplemented by adding the following exhibits: |

*Filed herewith

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Dated: June 30, 2023

| |

WHITE MOUNTAINS INSURANCE GROUP, LTD. |

| |

|

| |

|

By: |

/s/ Robert L. Seelig |

| |

|

|

Name: |

Robert L. Seelig |

| |

|

|

Title: |

Executive Vice President and General Counsel |

| |

WM Hinson (Bermuda) Ltd. |

| |

|

| |

|

By: |

/s/ John Sinkus |

| |

|

|

Name: |

John Sinkus |

| |

|

|

Title: |

Vice President |

Exhibit (a)(5)(iii)

White Mountains Insurance Group, Ltd. Announces

the Final Results of White Mountains Insurance Group, Ltd. and WM Hinson (Bermuda) Ltd.’s Tender Offer for up to 5,916,816 Shares

of Class A Common Stock of MediaAlpha, Inc.

HAMILTON, Bermuda, June 30,

2023 - White Mountains Insurance Group, Ltd. (NYSE: WTM) (“White Mountains”) today announced the final results

of the cash tender offer (the “Offer”) by White Mountains and its wholly owned subsidiary, WM Hinson (Bermuda) Ltd. (“WM

Hinson” and together with White Mountains, the “Purchasers”) to purchase shares of Class A Common Stock, $0.01 par value

per share (each, a “Common Share”), of MediaAlpha, Inc., a Delaware corporation (NYSE: MAX) (the “Company”), at

a price of $10.00 per Common Share, net to the seller in cash, less any applicable withholding taxes and without interest, which expired

at one minute following 11:59 p.m., New York City time, on Monday, June 26, 2023.

Based on the final count by

the depositary for the Offer, 7,856,550 Common Shares were properly tendered and not properly withdrawn.

The Offer was initially to

purchase up to an aggregate of 5,000,000 Common Shares, and was oversubscribed. As previously announced, the Purchasers amended the Offer

to provide for the purchase of 916,816 additional Common Shares (within up to 2% of the Company’s outstanding Common Shares). As

a result, the Purchasers have accepted for payment 5,916,816 Common Shares at the purchase price of $10.00 per Common Share on a pro rata

basis, for a total cost of approximately $59.2 million, excluding fees and expenses related to the Offer. The proration factor for the

Offer was approximately 75.3%. On a pro forma basis after giving effect to this transaction, White Mountains would have beneficially owned

approximately 49.9% of the Company’s outstanding Common Shares as of May 31, 2023.

The depositary will promptly pay for the Common

Shares accepted for purchase and will return all other Common Shares tendered and not purchased.

Questions regarding the Offer

and requests for assistance in connection with the Offer may be directed to D.F. King & Co., Inc., the information agent for the Offer,

by contacting (877) 896-3199 (toll-free). Banks and brokers may contact D.F. King at (212) 269-5550 or max@dfking.com or the dealer manager,

J.P. Morgan Securities LLC at (877) 371-5947 (toll-free). Computershare Trust Company, N.A. is acting as depositary for the Offer. J.P.

Morgan Securities LLC is acting as dealer manager in connection with the Offer.

White Mountains Insurance Group, Ltd.

White Mountains Insurance

Group, Ltd., based in Hamilton, Bermuda, is a diversified insurance and related financial services holding company.

Contacts

White Mountains Insurance Group, Ltd.

Robert Seelig

(603) 640-2212

Exhibit 107

Calculation

of Filing Fee Table

Table

1: Transaction Valuation

| | |

Transaction

Valuation | | |

Fee

rate | | |

Amount

of Filing Fee | |

| Fees to Be Paid | |

$ | 9,168,160.00 | * | |

| 0.00011020 | | |

$ | 1,010.33 | ** |

| Fees Previously Paid | |

$ | 50,000,000.00 | | |

| | | |

$ | 5,510.00 | |

| Total Transaction Valuation | |

$ | 59,168,160.00 | | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 6,520.33 | |

| Total Fees Previously Paid | |

| | | |

| | | |

$ | 5,510.00 | |

| Total Fee Offsets | |

| | | |

| | | |

$ | — | |

| Net Fee Due | |

| | | |

| | | |

$ | 1,010.33 | |

| * | The

transaction valuation is estimated solely for the purpose of calculating the amount of the

filing fee pursuant to Rule 0-11 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), based on the product of (i) $10.00 per share, the maximum

offering price and (ii) 5,916,816, the maximum number of shares of Class A common stock of

MediaAlpha, Inc. purchased in the Offer. |

| ** | The

amount of the filing fee was calculated in accordance with Rule 0-11 of the Exchange Act,

and Fee Rate Advisory #1 for fiscal year 2023 beginning on October 1, 2022, issued on August

26, 2022, by multiplying the transaction valuation by 0.00011020. |

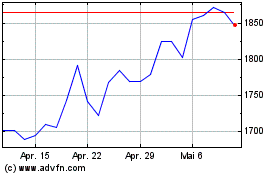

White Moutains Insurance (NYSE:WTM)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

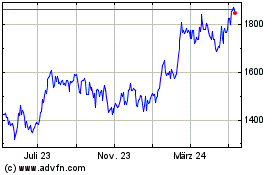

White Moutains Insurance (NYSE:WTM)

Historical Stock Chart

Von Mai 2023 bis Mai 2024