We continue to demonstrate the resilience of our business model by generating healthy profits, investing in our business and returning capital to shareholders, while outperforming the global bedding market. - Scott Thompson, Chairman & CEO TEMPUR SEALY INTERNATIONAL, INC., TPX “ “

To Improve the Sleep of More People, Every Night, All Around the World Who We Are Tempur Sealy is committed to improving the sleep of more people, every night, all around the world. As a leading designer, manufacturer, distributor and retailer of bedding products worldwide, we know how crucial a good night of sleep is to overall health and wellness. Utilizing over a century of knowledge and industry-leading innovation, we deliver award-winning products that provide breakthrough sleep solutions to consumers in over 100 countries. Our highly recognized brands include Tempur-Pedic®, Sealy® and Stearns & Foster® and our popular non-branded offerings consist of value-focused private label and OEM products. At Tempur Sealy we understand the importance of meeting our customers wherever and however they want to shop and have developed a strong omni-channel retail strategy. Our products allow for complementary merchandising strategies and are sold through third-party retailers, our 750+ Company-owned stores worldwide and our e-commerce channels. With the range of our offerings and variety of purchasing options, we are dedicated to continuing to turn our mission to improve the sleep of more people, every night, all around the world into a reality. Importantly, we are committed to carrying out our global responsibility to protect the environment and the communities in which we operate. As part of that commitment, we have established the goal of achieving carbon neutrality for our global wholly owned operations by 2040. Global Bedding Industry1 P U R P O S E Estimated global bedding market includes mattresses, foundations, pillows and other bedding products 2 North America TPX Share TPX Share International Retail Value $120 Billion Estimated Tempur Sealy share

68% 10% 8% 14% 3 FY’23 Sales North America Wholesale North America Direct-to- Consumer International Wholesale International Direct-to- Consumer • Headquartered in Lexington, KY, Tempur Sealy International, Inc. is the leading global bedding products company, with a portfolio of iconic brands including Tempur-Pedic, Sealy and Stearns & Foster • TPX manufacturers mattresses, pillows and related accessories across price points and distributes its products through multiple channels, including third-party brick & mortar retailers, its owned websites and third-party online platforms, as well as its owned stores • TPX focuses on premium bedding with its Tempur-Pedic and Stearns & Foster brands A Premium Leader in a Growing Bedding Industry VALUE PREMIUM $1,800 – $6,450 $2,200 – $9,000 $300– $3,500 Private Label 3

Industry • Represents ~$120 billion1 in retail value globally and has historically experienced consistent growth. • U.S. bedding averages mid-single digit growth annually, driven by units and dollars.1 • International bedding is highly fragmented and about 40% larger than the size of the U.S. market.1 Consumer • Recent enhanced focus on health has boosted consumer spending on wellness and related industries. • Consumers continue to make the connection between a good night’s sleep and health & wellness. • Consumer confidence, consumer spending, the housing market, and the wealth effect correlate with the bedding industry. Tempur Sealy • Global omni-channel distribution strategy to be where the consumer wants to shop. • Track record of developing and marketing differentiated products through consumer-centric innovation for the total global bedding market. • Robust free cash flow2 and fortified balance sheet provides flexibility to take advantage of industry and market opportunities and return capital to shareholders. TPX at a Glance 4

Investment Thesis 5 The leading vertically integrated global bedding company with iconic brands and extensive manufacturing capabilities History of market share gains across global omnichannel distribution Seasoned, well-aligned management with proven track record Legacy of strong value creation via capital allocation including share buybacks and acquisitions Over the long term, the bedding industry has consistently grown through ASP and unit expansion

6 Current TPX Management Track Record Since 2015 (in millions, except percentages, multiples, and per common share amounts) Year Ended December 31, 2015 Year Ended December 31, 2023 CAGR Total Growth Net Sales $3,151 $4,925 6% 56% Net Income $65 $368 24% 471% Adjusted Net Income2 $200 $426 10% 113% Adjusted EBITDA2 $456 $877 9% 92% GAAP EPS $0.26 $2.08 30% 708% Adjusted EPS2 $0.80 $2.40 15% 201% Experienced Team’s Value Creation o Since management change in 2015, sales have increased 56%, adjusted EBITDA2 has nearly doubled, and adjusted EPS has increased more than 200% under current leadership >185 YEARS COMBINED TPX EXPERIENCE 15 YEARS AVERAGE TPX TENURE

• U.S. produced units declined -17% y/y to 20.4M in 2022 and we expect U.S. produced units could decline a further -12% y/y to 18.0M in 2023. • 2022 and projected 2023 volumes are well below the industry 20-year average of 21.7M units. • U.S. produced units as a percent of total U.S. population is also trending at a 10-year trough – expected to be down 5.4% in 2023 relative to the 10-year average of 7.0%. • 2022 and 2023 unit demand is a significant deviation from the U.S. produced mattress unit CAGR of 2.5% between 2011 – 2021. • Anticipate units will stabilize and return to year-over-year growth later in 2024. • U.S. import units are also pressured, with reported import volumes down 22% in the trailing twelve months ended October 31, 2023. U.S. Produced Mattress Units (Units in millions) Current Industry Trends U.S. Industry Historical Volumes1 7 Source: ISPA, U.S. ITC, management estimates 1 18.1 20.1 20.9 22.5 24.3 23.5 23.6 23.5 24.1 24.7 20.4 18.0 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 15.0 16.0 17.0 18.0 19.0 20.0 21.0 22.0 23.0 24.0 25.0 2009 20-year Trough 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 U .S . P ro du ce d U ni ts / U .S . P op ul at io n U .S . P ro du ce d U ni ts (M ill io ns ) U.S. Produced Units 10-Year Average 20-Year Trough (2009) U.S. Produced Units / U.S. Population

18% 17% 16% 16% 14% 14% 14% 14% 30% 28% 29% 28% 27% 27% 27% 27% 29% 28% 30% 31% 29% 30% 30% 30% 24% 27% 25% 25% 29% 29% 29% 30% 2015 2016 2017 2018 2019 2020 2021 2022 36% 38% 37% 41% 34% 34% 33% 33% 41% 35% 36% 32% 36% 35% 35% 35% 17% 19% 20% 19% 22% 22% 23% 23% 7% 7% 7% 8% 8% 9% 9% 9% 2015 2016 2017 2018 2019 2020 2021 2022 8 U.S. Mattress Market Segmentation (Units) U.S. Mattress Market Segmentation (Dollars) • The $1,000+ ASP segment of the market has grown unit share by 8% and dollar share by 7% since 2015 • $2,000+ premium segment has grown more rapidly than $1,000 – $2,000 segment, with 30% dollar share, up from 24% in 2015 $2k+ $1k - $2k $500 - $1k <$500 Source: ISPA Current Industry Trends U.S. Bedding Industry Premiumization

Strategic Advantages

Tempur-Pedic®: leading worldwide premium bedding brand • Tempur-Pedic® uniquely adapts, supports, and aligns to you to deliver truly life-changing sleep. $2,200-$9,000* Stearns & Foster®: high-end-targeted brand • The world’s finest beds that are made with exceptional materials, time-honored craftsmanship, and impeccable design. $1,800-$6,450* Sealy®: #1 bedding brand in the U.S.3 • Combines innovation, engineering, and industry- leading testing to ensure quality and durability. $300-$3,500* Private Label Offerings: customized product • Offers products for the value-oriented consumer. Portfolio of Global Brands 10 • From its founding, Tempur-Pedic pursued a direct advertising strategy that touted the clear benefits of its proprietary Tempur material, creating a luxury aura – generating strong same sales velocity in premium products. • Over the last 15 years, Tempur-Pedic spent ~$2B on direct advertising, significantly more than other top brands in the category. The premium brand that was built through direct advertising and R&D allows for sustainable ROICs well above traditional mattress peers. *Retail prices for a standard queen mattress

Leading Manufacturing Capabilities • 71 manufacturing facilities • 20 million square feet of manufacturing & distribution operations R&D Innovation • 75,000 square feet of research & development • 4 state-of-the art product-testing locations Wholly owned (32) Joint Venture (8) Licensee (27)Tempur-Pedic® Facility (4) World-Class Manufacturing Capabilities 34 NORTH AMERICAN FACILITIES | 37 INTERNATIONAL FACILITIES Albuquerque, NM 11

• Significant worldwide sales growth • Highly profitable and rapidly expanding • Direct customer relationships Ecommerce • Luxury Tempur-Pedic®, Dreams, and multi-branded showroom experiences • Operate over 750 stores worldwide and expanding direct customer relationships • Highly profitable Company- Owned Stores • Third-party retailers are our largest distribution channel • Significant private label opportunity • Valued win-win relationships with suppliers Wholesale Successful Omni-Distribution Platform 12

13 Tempur-Pedic manufacturing Sealy / S&F manufacturing Private label manufacturing Dreams manufacturing Portfolio of Owned Brands Brick & Mortar & E-Commerce DTC Retail Owned Manufacturing Vertical Integration Multi-brand retail Mono-brand retail E-commerce

Growth Potential 14

Increase total addressable market internationally through new product launches in Europe & APAC. Expand into OEM market to drive further sales growth. Grow wholesale through existing and new retail relationships. Invest in innovation to meet customer demand. Execute on capital allocation strategy. Expand direct-to-consumer through ecommerce and company-owned stores. Building Blocks to Future Growth 15 Invest in Stearns & Foster product and marketing to more than double the brand’s global sales.

Natural Comfort Snoring Support Climate Sleep-Health Metrics Innovative Technologies 16

17 • Our OEM business leverages global manufacturing expertise, diversifies sales streams and realizes the manufacturing profits of the bedding brands it produces • Expanded into OEM market through the acquisition of Sherwood Bedding in 2020; a 3rd generation American manufacturer of private label innerspring mattresses, and subsequently began exploring opportunities to leverage foam-pouring capabilities to manufacture private label foam mattresses • Opportunity to serve as a provider for third-party bedding brands (including retailers’ private label brands) at value-end price points • Expected to drive down overall cost per unit • We see an opportunity to grow our OEM operations to $600 million1 of annualized sales Wholesale Third-Party Retailers • Largest pillar of our omni-channel distribution strategy, grounded in win- win relationships • Broad-based worldwide distribution through over 5,400 retail partners • Global sales force of over 500 people supporting our portfolio of brands • While we are well-represented today, we continue to pursue opportunities to further expand our third-party retail presence U.S. OEM Expansion

18 With more than 175 years of history, Stearns & Foster is positioned to become the luxury leader in innerspring beds. We have several initiatives underway with an objective of growing Stearns & Foster to be our next billion-dollar brand. • We launched an all-new collection of Stearns & Foster products in 2023. This updated portfolio features superior innovation, an elevated design and enhanced step-up opportunities, all intended to further differentiate Stearns & Foster. • After years of no direct advertising, we supported Stearns & Foster with record advertising beginning in 2022 and continued investments through 2024. These campaigns are designed to increase consumer awareness and desire to purchase a premium innerspring mattress. • We have meaningfully expanded Stearns & Foster’s omni-channel presence through 20% slot growth at third-party retailers in 2023, combined with the expansion of Stearns & Foster into DTC e-commerce in late 2022. Stearns & Foster Opportunity Dual-Approach to Luxury Bedding Leading Luxury Specialty Foam Brand Portfolio Midpoint $3,650* Leading Luxury Innerspring Brand Portfolio Midpoint $3,300* <$500 M $1,000 M 2022 Opportunity1 *Retail prices for a standard queen mattress

$- $200 $400 $600 $800 $1,000 $1,200 $1,400 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 Global Direct Sales International North America • Strong, long-term growth of high-margin sales from web, call center, and company-owned stores • Ability to own customer relationship allows for market insights that we leverage for innovation process and growth strategy Direct to Consumer 19 13% 14% 23% 24% 26% 5% 10% 15% 20% 25% 30% Q4 2019 Q4 2020 Q4 2021 Q4 2022 Q4 2023 Direct Channel Sales as a Percentage of Total Sales

TEMPUR® EuropeSealy® Gallery Asia SOVA® SwedenSleep Outfitters® U.S. Tempur-Pedic® U.S. Tempur-Pedic® MexicoDreams UK We see an opportunity to organically increase our store count through opening an average of 60+ new stores per year. 20 Company-Owned Store Strategy Operating Over 750 Retail Stores Globally TEMPUR® Asia

21 International Markets FY’23 Sales $398M $672M Four-Pronged Strategy $325M $235M Wholly-Owned TEMPUR Wholesale Brand & Manufacturing Licensing Wholly-Owned Direct (Dreams Retail, TEMPUR Retail, TEMPUR E-commerce) Sealy Joint Ventures Traditional wholesale business operating in 22 key markets throughout Europe and Asia Our UK-based Dreams retailer represents approximately 75% of our international wholly-owned direct sales The Sealy joint venture operation reported $325M of FY23 sales, of which Tempur Sealy receives 50% income under equity accounting Utilizes our portfolio brands to generate licensing revenues and extend the brand $1.6B Total International Brand Sales* *Total international brand value represents the total sales associated with our brands in international markets in FY23. Our wholly-owned wholesale and direct sales, which includes royalty income from licensing, are included in ‘Net Sales’ in our income statement. We recognize our 50% ownership of Sealy joint venture income as ‘Equity Income in Earnings of Unconsolidated Affiliates’ in our income statement.

• Broad geographic presence, established leading position at the cutting edge of sleep technology in highly fragmented global bedding market • TEMPUR sold in 90+ countries, 22 key markets served through wholly owned subsidiaries, rest by distributors • Acquired Dreams, the leading bedding retailer in the UK in 2021 • Increasing total addressable market internationally through new product launches in Europe & APAC • Continue to grow as a leader, while broadening our product assortment to address a wider range of consumer needs • Seeding markets for growth with incremental advertising and launch investments 22 Wholly-owned Third-party distributors International Markets: Wholly-Owned Market Share Growth Opportunity

• Founded in 2000 • Operates in 22 countries and territories • Top 3 internationally branded bedding manufacturer in China • Full-time employees: 1,300+ Asia • Acquired in 2020 • Full-time employees: 210+ United Kingdom ~$325 MILLION OF JOINT VENTURE SALES IN 2023 23 International Markets: Joint Venture Market Share Growth Opportunity

Expanding Global Licensing Sales Sealy Manufacturing Licensees: • Our 27 licensee manufacturing facilities generate high return on investment • They represent a low-risk opportunity to introduce our brands and products in regions in which we do not currently operate, primarily across EMEA, APAC, and Latin America Brand Extension Licensees: • We license our Tempur-Pedic, Sealy and Stearns & Foster brands across North America, Europe and Asia, to drive incremental profits and expand brand awareness • Licensed products are complementary to our core operations and include sleep-adjacent categories such as bedding, pajamas, and pet sleep 24 Significantly increases global brand awareness and drives incremental profits

Generative Artificial Intelligence AI Driving for Success 25 Tempur Sealy utilizes artificial intelligence to avoid cost, increase effectiveness, and gain new insights across a variety of functions. AI strategy as a fast follower. New Insights Cost Avoidance Effectiveness DTC E-commerce & Marketing Product Development IT Security Operations Corporate Functions

Recent Performance 26

Three Months Ended Year Ended (in millions, except percentages and per common share amounts) December 31, 2023 December 31, 2022 % Change December 31, 2023 December 31, 2022 % Change Net Sales $1,170.5 $1,187.4 -1.4% $4,925.4 $4,921.2 0.1% Net Income $77.1 $101.7 -24.2% $368.1 $455.7 -19.2% Adjusted Net Income2 $93.9 $96.2 -2.4% $425.6 $467.9 -9.0% GAAP EPS $0.43 $0.57 -24.6% $2.08 $2.53 -17.8% Adjusted EPS2 $0.53 $0.54 -1.9% $2.40 $2.60 -7.7% Fourth Quarter Performance 27 Q4’23 Sales by Channel 26% 74% Direct Wholesale

Expect full-year adjusted EPS2 between $2.60 and $2.90 Other Modeling Assumptions Depreciation & Amortization $200M - $210M Capital Expenditures ~$150M Interest Expense $135M - $140M U.S. Federal Tax Rate 25% Diluted Share Count 179M shares 2024 Outlook4 28 Our 2024 expectations include: • Sales growth of low to mid-single digits compared to the prior year, driven by execution of our initiatives • Record advertising spend of approximately $500M • Resulting in adjusted EBITDA2 of approximately $1 billion at the midpoint $0.74 $1.00 $1.94 $3.19 $2.60 $2.40 $2.75 15 20 25 30 $- $1.00 $2.00 $3.00 $4.00 2018 2019 2020 2021 2022 2023 2024 Midpoint U .S . P ro du ce d U ni ts (M ill io ns ) Ad ju st ed E PS 2 Projected Adjusted EPS2 CAGR of 24% 2018-2024 Adjusted EPS U.S. Produced Mattress Units

Flexible Cost Structure1 29 • The business model is highly-variable, with 85% of COGS and 45% of operating expenses flexing with sales • In total, the variability of our operating cost structure is approximately 70% • Our business model also provides opportunity for costs to further flex with sales Variable 85% Fixed 15% Cost of Goods Sold Variability Variable 45% Fixed 55% Operating Expense Variability Note: Including discretionary cost cuts, we estimate a total of 80% of expenses could flex with sales

Leading Balance Sheet & Cash Flow 30

Credit ratings: Fitch: BB+ (August 2021) Moody’s: Ba1 (September 2021) S&P: BB (August 2023) Strong Balance Sheet & Cash Flow 31 $0 $200 $400 $600 $800 $1,000 $1,200 2019 2020 2021 2022 2023 Full-Year Adjusted EBITDA2 1.00x 1.50x 2.00x 2.50x 3.00x 3.50x 4Q22 1Q23 2Q23 3Q23 4Q23 Leverage2 Target Range Leverage

32 Capital Structure • In October 2023, we refinanced our credit facilities, which include a $1.15B revolving credit facility and a $500M term loan facility • In February, we entered into an amendment under the same terms and conditions that provides for increased loan commitments of up to $625 million and a $40 million increase in availability on the existing incremental revolving loan. This is in connection with our financing strategy for the pending acquisition of Mattress Firm in mid to late 2024 • Favorable borrowing rates, over $1 billion of liquidity at 12/31, and no meaningful maturities until 2028 $183 $500 $158 $800 $800 2023 2024 2025 2026 2027 2028 2029 2030 2031 Debt Maturities Updated for the Refinancing of our Credit Facilities Revolving Credit Facility Term Loan Securitized Debt 2029 Senior Notes 2031 Senior Notes

• Long-term target leverage ratio of 2.0 – 3.0x2 • Continue to invest in the business, including a new domestic foam-pouring plant that became operational in 2023 • Disciplined approach to long-term shareholder returns includes a quarterly dividend and opportunistic share repurchases • Maintain capacity for strategic acquisitions Balanced Capital Allocation Strategy 33 $0.05 $0.07 $0.09 $0.11 $0.13 $0.15 2021- Initiation 2022 2023 2024 Consistent Dividend Growth Since Initiation $888 $1,962 $211 $491 Allocated $3.5B Since 2018 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2018 2019 2020 2021 2022 2023 Capital Allocation Capex Share Repurchases Dividend Acquisitions & Investments

Mattress Firm Agreement Mattress Firm is the largest mattress specialty retailer in the U.S., operating over 2,300 brick and mortar retail locations and a growing e-commerce platform

Transaction Rationale Expands consumer touchpoints to enhance ability to keep pace with evolving consumer preferences Accelerates U.S. omni-channel strategy, enabling a seamless consumer experience Simplifies consumer purchase journey, reducing friction at each touchpoint Aligns new product development and testing, facilitating consumer-centric innovation Streamlines operations and enhances supply chain management, resulting in operational efficiencies Drives adjusted EPS2 accretion 1 2 3 4 5 6 35

TPX Go-Forward Investment Thesis Leading, vertically-integrated global company with iconic brands and extensive manufacturing and direct-to-consumer capabilities Proven historical growth through organic and inorganic initiatives Proven ability to successfully operate worldwide omni- channel distribution Legacy of disciplined capital allocation, including dividends, share repurchases, and acquisitions Seasoned, well-aligned management team with track record of success Serves $120 billion1 growing bedding market

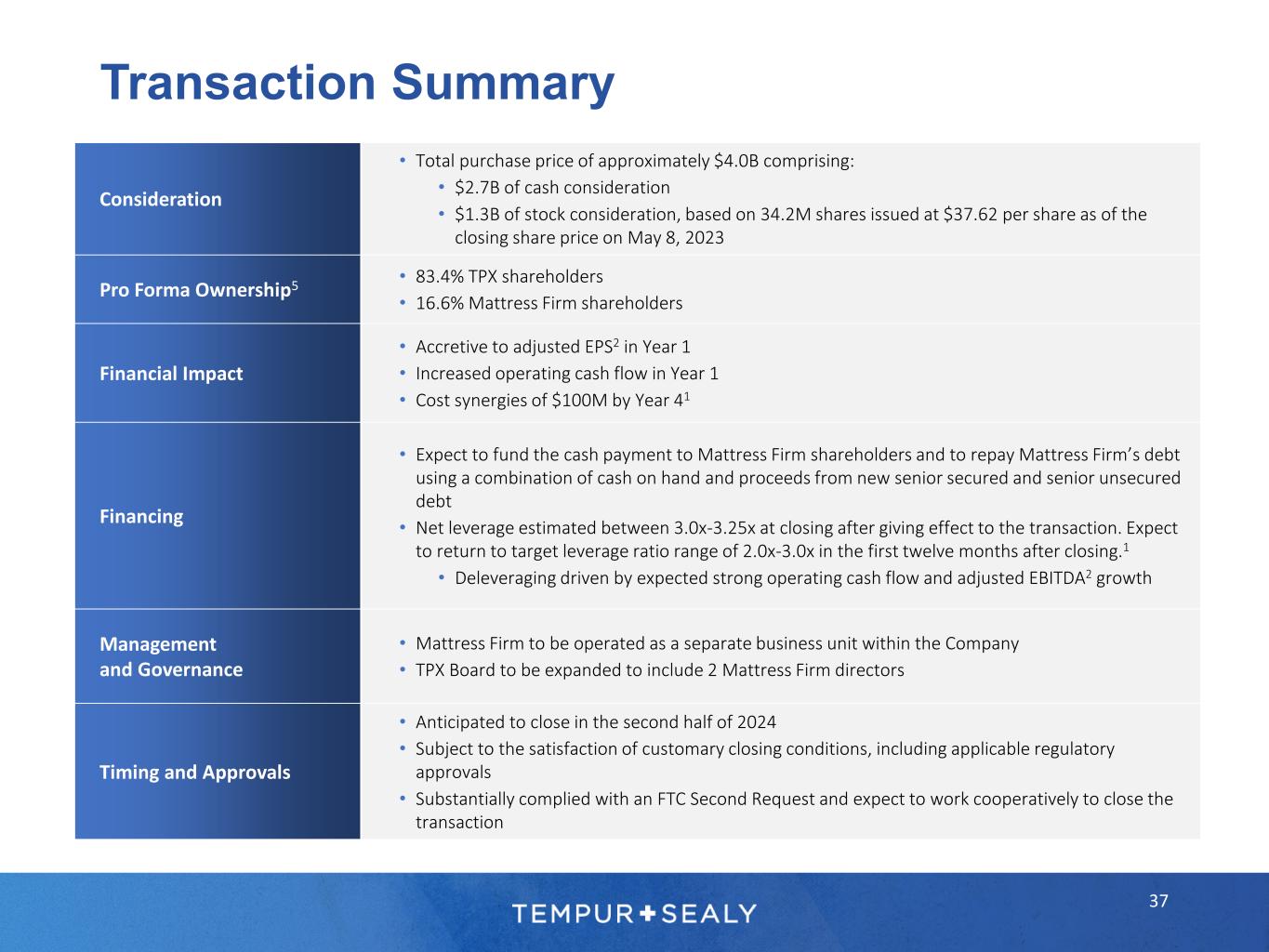

Consideration • Total purchase price of approximately $4.0B comprising: • $2.7B of cash consideration • $1.3B of stock consideration, based on 34.2M shares issued at $37.62 per share as of the closing share price on May 8, 2023 Pro Forma Ownership5 • 83.4% TPX shareholders • 16.6% Mattress Firm shareholders Financial Impact • Accretive to adjusted EPS2 in Year 1 • Increased operating cash flow in Year 1 • Cost synergies of $100M by Year 41 Financing • Expect to fund the cash payment to Mattress Firm shareholders and to repay Mattress Firm’s debt using a combination of cash on hand and proceeds from new senior secured and senior unsecured debt • Net leverage estimated between 3.0x-3.25x at closing after giving effect to the transaction. Expect to return to target leverage ratio range of 2.0x-3.0x in the first twelve months after closing.1 • Deleveraging driven by expected strong operating cash flow and adjusted EBITDA2 growth Management and Governance • Mattress Firm to be operated as a separate business unit within the Company • TPX Board to be expanded to include 2 Mattress Firm directors Timing and Approvals • Anticipated to close in the second half of 2024 • Subject to the satisfaction of customary closing conditions, including applicable regulatory approvals • Substantially complied with an FTC Second Request and expect to work cooperatively to close the transaction Transaction Summary 37

Environmental, Social, & Corporate Governance 38

Environmental, Social, & Governance Tempur Sealy is committed to protecting and improving our communities and environment. 39

Environmental • Achieved zero waste to landfill status at our Canadian and Mexican manufacturing operations and maintained our zero waste to landfill status at our U.S. and European manufacturing operations • Achieved zero waste to landfill status at 75% of our corporate offices and R&D labs, in line with our goal to achieve zero landfill waste at our corporate offices and R&D labs by 2025 • Progressed towards our goal of achieving carbon neutrality by 2040 through reducing greenhouse gas emissions at our wholly owned manufacturing and logistics operations by 4%* compared to the prior year • Summarized and published our approach to comprehensive chemical supply management in a Chemical Safety Policy Purpose • Continued to bring industry-leading innovation to market that provides consumers with access to higher quality sleep at a variety of price points, including the new U.S. product launches of TEMPUR-Breeze®, TEMPUR-Ergo® Smart Base, and Stearns & Foster, and the new international launches of TEMPUR® products • Contributed approximately $800,000 through the Tempur Sealy Foundation and donated more than 12,100 mattresses worth approximately $16.9 million, bringing our ten-year donation total to over $100 million People • Increased transparency and expanded disclosures around Employee Health & Safety, Ethics Line, and Employee Satisfaction & Engagement • Embedded ESG performance as a factor in executive leadership’s 2023 compensation program *This excludes the impact of new facilities opened in the trailing twelve-month period. Including the impact of new facilities, we reduced greenhouse gas emissions at our wholly owned manufacturing and logistics operations by 1% compared to the prior year. Environmental, Social, & Governance 2023 updates and progress towards our goals. 40

Thank You for Your Interest in Tempur Sealy International For more information, please email: investor.relations@tempursealy.com 41 SOVA

Appendix 42

This investor presentation contains statements regarding the announced Mattress Firm acquisition including the related regulatory approval process, to the Company’s quarterly cash dividend, the Company’s expectations regarding geopolitical events (including the war in Ukraine and the conflict in the Middle East), the Company’s share repurchase targets, the Company’s expectations regarding net sales and adjusted EPS for 2024 and subsequent periods and the Company’s expectations for increasing sales growth, product launches, channel growth, acquisitions and commodities outlook, and expectations regarding supply chain disruptions and the macroeconomic environment. Any forward-looking statements contained herein are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations, meet its guidance, or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company’s control, could cause actual results to differ materially from any that may be expressed herein as forward-looking statements. These potential risks include the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. There may be other factors that may cause the Company’s actual results to differ materially from the forward-looking statements. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Note Regarding Historical Financial Information: In this investor presentation we provide or refer to certain historical information for the Company. For a more detailed discussion of the Company’s financial performance, please refer to the Company’s SEC filings. Note Regarding Trademarks, Trade Names, and Service Marks: TEMPUR®, Tempur-Pedic®, the Tempur-Pedic & Reclining Figure Design®, TEMPUR-Adapt®, TEMPUR-ProAdapt®, TEMPUR-LuxeAdapt®, TEMPUR-PRObreeze°™, TEMPUR-LUXEbreeze°™, TEMPUR- Cloud®, TEMPUR-Contour™, TEMPUR-Rhapsody™, TEMPUR-Flex®, THE GRANDBED BY Tempur-Pedic®, TEMPUR-Ergo®, TEMPUR-UP™, TEMPUR-Neck™, TEMPUR-Symphony™, TEMPUR-Comfort™, TEMPUR-Traditional™, TEMPUR-Home™, Sealy®, Sealy Posturepedic®, Stearns & Foster®, COCOON by Sealy™, SealyChill™, and Clean Shop Promise® are trademarks, trade names, or service marks of Tempur Sealy International, Inc., and/or its subsidiaries. All other trademarks, trade names, and service marks in this presentation are the property of the respective owners. Limitations on Guidance: The guidance included herein is from the Company’s press release and related earnings call on February 8, 2024. The Company is neither reconfirming this guidance as of the date of this investor presentation nor assuming any obligation to update or revise such guidance. See above. Forward-Looking Statements 43

In this investor presentation and certain of its press releases and SEC filings, the Company provides information regarding adjusted net income, adjusted EPS, EBITDA, adjusted EBITDA, free cash flow, consolidated indebtedness less netted cash, and leverage, which are not recognized terms under U.S. Generally Accepted Accounting Principles (“GAAP”) and do not purport to be alternatives to net income and earnings per share as a measure of operating performance, an alternative to cash provided by operating activities as a measure of liquidity, or an alternative to total debt. The Company believes these non-GAAP measures provide investors with performance measures that better reflect the Company’s underlying operations and trends, including trends in changes in margin and operating expenses, providing a perspective not immediately apparent from net income and operating income. The adjustments management makes to derive the non-GAAP measures include adjustments to exclude items that may cause short-term fluctuations in the nearest GAAP measure, but which management does not consider to be the fundamental attributes or primary drivers of the Company’s business. The Company believes that exclusion of these items assists in providing a more complete understanding of the Company’s underlying results from continuing operations and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its consolidated and business segment performance compared to prior periods and the marketplace, to establish operational goals and management incentive goals, and to provide continuity to investors for comparability purposes. Limitations associated with the use of these non-GAAP measures include that these measures do not present all the amounts associated with the Company’s results as determined in accordance with GAAP. These non-GAAP measures should be considered supplemental in nature and should not be construed as more significant than comparable measures defined by GAAP. Because not all companies use identical calculations, these presentations may not be comparable to other similarly titled measures of other companies. For more information regarding the use of these non-GAAP financial measures, please refer to the reconciliations on the following pages and the Company’s SEC filings. EBITDA and Adjusted EBITDA A reconciliation of the Company’s GAAP net income to EBITDA and adjusted EBITDA per credit facility (which we refer to in this investor presentation as adjusted EBITDA) is provided on the subsequent slides. Management believes that the use of EBITDA and adjusted EBITDA per credit facility provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period as well as the Company’s compliance with requirements under its credit agreement. Adjusted Net Income and Adjusted EPS A reconciliation of the Company’s GAAP net income to adjusted net income and a calculation of adjusted EPS are provided on subsequent slides. Management believes that the use of adjusted net income and adjusted EPS also provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period. Forward-looking Adjusted EPS is a non-GAAP financial measure. The Company is unable to reconcile this forward-looking non-GAAP measure to EPS, its most directly comparable forward-looking GAAP financial measure, without unreasonable efforts, because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact EPS in 2024. Leverage Consolidated indebtedness less netted cash to adjusted EBITDA per credit facility, which the Company may refer to as leverage, is provided on a subsequent slide and is calculated by dividing consolidated indebtedness less netted cash, as defined by the Company’s senior secured credit facility, by adjusted EBITDA per credit facility. The Company provides this as supplemental information to investors regarding the Company’s operating performance and comparisons from period to period, as well as general information about the Company's progress in managing its leverage. Use of Non-GAAP Financial Measures Information 44

45 QTD Adjusted Net Income2 and Adjusted EPS2 *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings.

46 Year Ended Adjusted Net Income2 and Adjusted EPS2 *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings.

47 Year Ended Adjusted EBITDA2 *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings.

48 Leverage2 Reconciliation *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings.

1 Management estimates. 2 Adjusted net income, EBITDA, adjusted EBITDA, adjusted EPS, leverage, and free cash flow are non-GAAP financial measures. Please refer to the “Use of Non-GAAP Financial Measures Information” on a previous slide for more information regarding the definitions of adjusted net income, EBITDA, adjusted EBITDA, adjusted EPS, leverage, and free cash flow, including the adjustments (as applicable) from the corresponding GAAP information. Please refer to “Forward-Looking Statements” and “Limitations on Guidance” on a previous slide. 3 Sealy® was ranked number one on Furniture Today’s list of the Top 20 U.S. Bedding Producers in June 2021. See Furniture Today’s Top 20 U.S. Bedding Producers methodology that includes Sealy® and Stearns & Foster® products in Sealy ranking. Tempur-Pedic® was ranked number two on Furniture Today’s list of the Top 20 U.S. Bedding Producers in June 2021. Tempur-Pedic® brand was awarded #1 in Customer Satisfaction for the Online Mattress category in the J.D. Power 2023 Mattress Satisfaction Report. 4 Based on the Company’s financial targets provided in the press release dated February 8, 2024, and the related earnings call on February 8, 2024. Please refer to “Forward-Looking Statements” and “Limitations on Guidance.” The Company is unable to reconcile forward-looking adjusted EPS, a non-GAAP financial measure, to EPS, its most directly comparable forward-looking GAAP financial measure, without unreasonable efforts, because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact EPS in 2024. 5 Pro-forma ownership is based on shares outstanding at signing. Footnotes

Thank You 50