Standard General to Challenge Media Bureau’s Unprecedented Attempt to Scuttle the Proposed Transaction with TEGNA; Calls on FCC to Bring the Transaction to a Vote by the Full Commission

27 Februar 2023 - 4:50PM

Business Wire

Standard General L.P. is vowing to continue its efforts to

complete its proposed transaction with TEGNA (NYSE: TGNA), despite

the unprecedented actions of the FCC’s Media Bureau, which

belatedly designated two questions related to the deal to an

Administrative Law Judge. The Media Bureau’s action, which was

promptly criticized by two of the FCC’s four current Commissioners,

is tantamount to denying the transaction by initiating a lengthy

process that would extend well beyond the transaction’s Final

Extension Date of May 22, 2023.

Standard General is calling on the Federal Communications

Commission (FCC) to formally vote now on the proposed transaction

and render a decision on the merits.

Commenting on the situation, Standard General’s Managing Partner

Soo Kim said, “A decision delayed is a decision denied. Our

proposed transaction is consistent with all FCC regulations and

precedent. It is bolstered by a voluntary commitment to invest in

local news, preserve newsroom jobs, and address purported concerns

related to consumer pricing. But rather than rule on the

transaction’s merits, as the law requires, the Media Bureau is

attempting to scuttle the deal by ordering a wholly unnecessary

hearing process, that if left standing by the Commission, would

kill the deal.”

As part of Standard General’s efforts to persuade the FCC to

address the Media Bureau’s unprecedented action, it calls attention

to a number of salient facts, some of which have not been widely

reported:

- The TEGNA transaction is a transfer of an existing broadcaster

to Standard General, an entity that had been TEGNA’s sole

“Attributable Owner” under FCC rules. Standard General currently is

a license holder in good standing of multiple television and radio

stations and has been for more than a decade.

- This transaction, which actually makes TEGNA smaller as a

result of the subtraction of several of its largest stations,

complies with all FCC ownership rules and precedent and requires no

waivers. The applicable waiting period under the HSR Act has

expired.

- The FCC had this transaction under review for 354 days and

counting. Not only is this long past the FCC’s own informal 180-day

‘shot clock’ but will soon become the longest reviewed major

television broadcast sale ever.

- Over the course of the extended review process, the FCC has

opened an unprecedented three separate Public Comment

Processes.

- All throughout this period, the Media Bureau has consistently

declined our requests to meet to address any concerns it might

have. The Media Bureau has never provided any feedback to our

responses. The very questions raised in the Hearing Designation

Order we have responded multiple times going back to July 2022.

Note our voluntary remedies were proposed without the benefit of

feedback from the FCC or from the objectors despite every attempt

to engage with them.

- Unlike previous proposed transactions that have been blocked by

the FCC, there is no allegation that this deal violates any FCC

rule, nor are any of the parties accused of any inappropriate

action or conduct.

- To the best of our knowledge, this is the first time that the

FCC has acted through the Media Bureau in a manner designed to kill

a pending transaction:

- Without referencing a single rule or regulation that the

proposed transaction might violate.

- Without any consideration of conditions that would address any

outstanding concerns.

- By raising issues that fall outside the Media Bureau’s

authority.

- By designating it for evidentiary hearing despite having

already received all relevant documents and internal communications

in the unprecedented two prior document productions.

- And much less a transaction of this magnitude without a full

vote of the Commission.

- The transaction advances the FCC’s stated goal of increasing

diversity in media ownership, representing the biggest opportunity

in history to expand minority-ownership and woman-leadership of

local broadcast television stations.

- Despite some of the objectors denying that our ownership would

satisfy this FCC-stated goal, a wide array of civil rights

organizations, legislators and labor and minority media groups

submitted supportive comments to the FCC, detailing the many ways

in which this transaction would advance the public interest.

In all these respects, the Media Bureau’s actions stand in sharp

contrast to other recent broadcast transactions which required

special FCC actions, yet were all approved by the Commission in a

timely manner.

Mr. Kim concluded, “The unavoidable implication is that this

particular transaction may be scuttled not due to substantive or

evidence-based concerns, but rather by the Media Bureau’s

unexplained view that Standard General simply should not be allowed

to own these television stations and that any future applicant to

acquire TEGNA or any other TV station group must meet the test of

being acceptable to the Media Bureau in its sole, absolute, and

unreviewable discretion. This precedent, if allowed to stand

unchallenged, will turn the “Public Interest” standard on its head

by restricting investment in and ownership of wide swaths of the

economy to those deemed acceptable by regulators.”

About Standard General

Standard General was founded in 2007 and manages capital for

public and private pension funds, endowments, foundations, and

high-net-worth individuals. Standard General is a

minority-controlled and operated organization. Soo Kim, Standard

General’s Managing Partner and Chief Investment Officer, is

supported by a diverse, highly experienced 17-person team,

including seven investment professionals with over 120 years of

collective investing experience.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230227005595/en/

For media inquiries: Standard General Andy Brimmer / Jamie Moser

/ Jack Kelleher Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

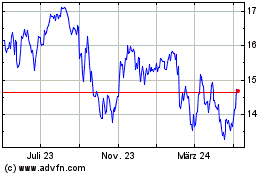

TEGNA (NYSE:TGNA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

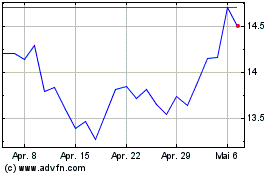

TEGNA (NYSE:TGNA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024