Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

27 Oktober 2022 - 2:21PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-261845

October 26, 2022

Truist Financial Corporation

Pricing Term Sheet

October 26, 2022

Medium-Term

Notes, Series G (Senior)

$750,000,000

6.123% Fixed-to-Floating Rate Senior Notes due October 28,

2033

|

|

|

| Issuer |

|

Truist Financial Corporation |

|

|

| Security |

|

6.123% Fixed-to-Floating Rate Senior Notes due October 28, 2033 |

|

|

| Expected Ratings* |

|

A3/Stable (Moody’s) / A-/Positive (S&P) / A/Stable (Fitch) / AAL/Stable (DBRS) |

|

|

| Currency |

|

USD |

|

|

| Size |

|

$750,000,000 |

|

|

| Security Type |

|

SEC Registered Medium-Term Notes, Series G (Senior) |

|

|

| Trade Date |

|

October 26, 2022 |

|

|

| Settlement Date |

|

October 28, 2022 (T+2) |

|

|

| Maturity Date |

|

October 28, 2033 |

|

|

| Fixed Rate Period |

|

The period from, and including, the Settlement Date to, but excluding, October 28, 2032 |

|

|

| Floating Rate Period |

|

The period from, and including, October 28, 2032 to, but excluding, the Maturity Date |

|

|

| Fixed Rate Coupon |

|

6.123% |

|

|

| Floating Rate Coupon |

|

An annual floating rate equal to the Base Rate plus a spread of 2.300 % per annum, payable quarterly in arrears during the Floating Rate Period |

|

|

| Base Rate |

|

During the Floating Rate Period, SOFR (compounded daily over a quarterly Interest Period in accordance with the specific formula described in the Preliminary Pricing Supplement). |

|

|

| Floating Rate Reset Frequency |

|

Quarterly during the Floating Rate Period |

|

|

| Payment Frequency |

|

During the Fixed Rate Period, semiannually; during the Floating Rate Period, quarterly |

|

|

| Interest Payment Dates |

|

With respect to the Fixed Rate Period, each April 28 and October 28, commencing April 28, 2023; and with respect to the Floating Rate Period, each January 28, April 28, July 28 and October 28, commencing January 28, 2033, as further

described in the Preliminary Pricing Supplement. |

|

|

|

|

|

| Interest Determination Dates |

|

For the Floating Rate Period, the date two U.S. Government Securities Business Days before each Interest Payment Date |

|

|

| Interest Reset Dates |

|

For the Floating Rate Period, each interest payment date. |

|

|

| Day Count Convention |

|

During the Fixed Rate Period, 30/360; during the Floating Rate Period, Actual/360 |

|

|

| Redemption Provisions |

|

Redeemable (i) at any time after 180 days following the issue date and before October 28, 2032, in whole or in part, at a make-whole redemption price based on the treasury rate plus 35 basis points and (ii) on October

28, 2032, in whole but not in part, or on or after July 28, 2033 (three months prior to the Maturity Date), in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the Notes being

redeemed, in each case, plus accrued and unpaid interest thereon to, but excluding, the date of redemption. We will provide 10 to 60 calendar days’ notice of redemption to the registered holder of the Notes. |

|

|

| Fixed Rate Benchmark Treasury |

|

2.750% US Treasury due August 15, 2032 |

|

|

| Fixed Rate Benchmark Treasury Spot and Yield |

|

89-24+; 4.023% |

|

|

| Fixed Rate Spread to Benchmark Treasury |

|

+ 210 basis points |

|

|

| Fixed Rate Yield to Maturity |

|

6.123% |

|

|

| Price to Public |

|

100.000% of face amount |

|

|

| Net Proceeds (Before Expenses) to Issuer |

|

$747,750,000 (99.700%) |

|

|

| Use of Proceeds |

|

The issuer intends to use the net proceeds from this offering for general corporate purposes, which may include the acquisition of other companies, repurchasing outstanding shares of the issuer’s common stock, repayment of

maturing obligations and refinancing of outstanding indebtedness and extending credit to, or funding investments in, the issuer’s subsidiaries |

|

|

| Denominations |

|

$2,000 x $1,000 |

|

|

| CUSIP / ISIN |

|

89788MAK8 / US89788MAK80 |

|

|

| Joint Book-Running Managers |

|

Truist Securities, Inc. Citigroup Global

Markets Inc. RBC Capital Markets, LLC |

|

|

| Co-Managers |

|

R. Seelaus & Co., LLC Samuel A.

Ramirez & Company, Inc. |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and should be evaluated

independently of any other rating. The rating may be subject to revision or withdrawal at any time by the assigning rating organization. |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC Website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Truist Securities, Inc. at 1-800-685-4786 or by emailing TSIdocs@Truist.com, Citigroup Global Markets Inc. at 1-800-831-9146 or RBC Capital Markets, LLC at 1-866-375-6829.

Any disclaimers or other notices that may appear below are not applicable to this communication and

should be disregarded. Such disclaimers or other notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

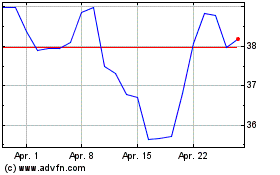

Truist Financial (NYSE:TFC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

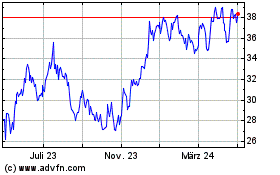

Truist Financial (NYSE:TFC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024