Telefonica Sees Modest Growth in Revenue, Earnings Through 2026

08 November 2023 - 1:04PM

Dow Jones News

By Adria Calatayud

Telefonica expects to deliver modest growth in revenue and

earnings over the 2023 to 2026 period while it works to reduce debt

and maintain a dividend of at least the current level.

The Spanish telecommunications company said Wednesday that it is

targeting an annual growth rate of around 1% in revenue and about

2% in earnings before interest, taxes, depreciation and

amortization over the 2023-26 period.

It also aims to bring down its ratio of net debt-to-Ebitda after

leases to between 2.2 and 2.5. At the end of June, the company's

ratio of net debt to Ebitda after leases stood at 2.62.

Telefonica aims to pay dividends of at least 0.30 euros a share

($0.32) over the 2023-26 period, it said.

For the third quarter, Telefonica reported net profit of EUR502

million, up 9.4% on the same period last year, while revenue fell

0.2% to EUR10.32 billion.

Operating income before depreciation and amortization, or Oibda,

for the quarter rose 2.5% to EUR3.33 billion, it said.

Analysts expected Telefonica to report a quarterly net profit of

EUR335 million, Oibda of EUR3.265 billion and revenue of EUR10.29

billion, according to consensus estimates provided by the

company.

The company said its results for the first nine months are in

line with the targets it set for the year as a whole, which call

for organic growth of around 4% in revenue and 3% in Oibda. For the

first nine months, Telefonica's revenue grew 3.5% and Oibda 2.6% on

an organic basis.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

November 08, 2023 06:49 ET (11:49 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

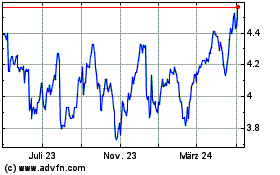

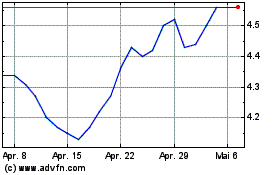

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Telefonica (NYSE:TEF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024