UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of September, 2024

Commission File Number: 001-35617

Sandstorm Gold Ltd.

(Translation of registrant’s name into English)

Suite 3200 - 733 Seymour Street

Vancouver, British Columbia

V6B 0SB Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

| |

SANDSTORM GOLD LTD. |

| |

|

| |

|

|

| Date: September 5, 2024 |

By: |

/s/ Erfan Kazemi |

| |

|

Name: Erfan Kazemi |

| |

|

Title: Chief Financial Officer |

EXHIBIT 99.1

September 5, 2024

Sandstorm Gold Royalties

Provides Updates on Near-Term

Development Portfolio

Vancouver, BC | Sandstorm Gold Ltd. (“Sandstorm

Gold Royalties”, “Sandstorm” or the “Company”) (NYSE: SAND, TSX: SSL) is pleased to provide updates from

key development projects within its diversified portfolio of streaming and royalty assets.

Greenstone Gold Mine Official

Opening and Ramp-up

On August 29, Equinox Gold Corp. (“Equinox

Gold”) officially opened its 100% owned Greenstone mine in Geraldton, Ontario, marking a significant milestone for the company.

The event featured remarks from Indigenous partners, government officials, and Equinox Gold's leadership. Greg Smith, the company's President

& CEO, highlighted the importance of the Greenstone mine as a cornerstone asset, being one of Canada's largest and lowest-cost gold

producers.

The Greenstone mine, which began construction

in October 2021, poured first gold in May 2024 and is currently ramping up to commercial production. The mine produced approximately 2,625

ounces of gold in May, 13,625 ounces in June, and 19,750 ounces in July, with throughput exceeding 60% of its design capacity during the

month of August.

For more information, visit Equinox Gold’s

website at www.equinoxgold.com and refer to the press release dated August 29, 2024.

Sandstorm holds a gold stream on the Greenstone

mine whereby the Company is entitled to purchase 2.375% of gold produced at the mine until 120,333 ounces are delivered, and then 1.583%

of gold produced thereafter. Sandstorm will make ongoing payments equal to 20% of the spot price of gold per ounce plus an additional

payment of up to US$30 per ounce in ESG contributions.

Platreef Phase 1 Concentrator

Complete; Advancing Toward 2025 Production

Ivanhoe Mines Ltd. (“Ivanhoe”) provided

an update on construction activities at its Platreef PGM mine in South Africa, including the on-schedule completion of the Phase 1 concentrator,

which entered cold commissioning in July. In-line with Platreef’s optimized development plan schedule, the concentrator will be

placed on care and maintenance until the second half of 2025 as Shaft #1 prioritizes waste hoisting to support and accelerate the development

of Phase 2. An updated Feasibility Study for Phase 2 and a Preliminary Economic Assessment for the Phase 3 expansion are underway and

expected to be complete in the fourth quarter of 2024.

Construction of Shaft #2 - critical for the Phase

3 expansion - is advancing well and headgear is approximately 60% complete. Sinking of Shaft #2, which will be the largest on the African

continent once complete, is expected to commence in the first quarter of 2025. The Phase 3 expansion aims to increase Platreef's processing

capacity to 10 million tonnes per annum (“Mtpa”), making it one of the largest and lowest-cost platinum-group metal, nickel,

copper, and gold producers globally.

For more information, visit the Ivanhoe Mines

website at www.ivanhoemines.com and see the press release dated July 31, 2024.

Sandstorm holds a gold stream on the Platreef

project whereby Sandstorm is entitled to purchase 37.5% of payable gold produced from Platreef until 131,250 gold ounces have been delivered,

then 30% of payable gold produced until an aggregate of 256,980 ounces are delivered, then 1.875% thereafter if certain conditions are

met. Sandstorm will make ongoing cash payments of US$100 per ounce of gold until 256,980 ounces have been delivered, and then 80% of the

spot price of gold for each ounce delivered thereafter.

Develop Global Secures Funding

for Woodlawn Restart; Production on Track for 2025

Develop Global Limited (“Develop Global”)

has secured a US$65 million prepayment/loan facility and offtake agreement with global commodities trader Trafigura Pte Ltd. for its Woodlawn

copper-zinc mine in New South Wales, Australia. The facility, combined with Develop Global's existing cash reserves and cash from its

mining services division, ensures that Woodlawn is fully funded through to production. The deal increases the project's net present value

by 11% to A$728 million and forecasts a pre-tax free cash flow of A$1.1 billion over a 10-year mine plan. Develop Global is on track to

make a final investment decision for the Woodlawn project in the third quarter of 2024, putting Woodlawn on track for first production

and cash flows in mid-2025.

For more information, visit Develop Global’s

website at www.develop.com.au and see the press release dated August 2, 2024.

Sandstorm has a silver stream on the Woodlawn

project whereby the Company has the right to receive an amount of silver equal to 80% of payable silver produced, to a maximum value of

A$27 million. In addition, the Company holds a second stream on Woodlawn under which the operator has agreed to pay Sandstorm A$1.0 million

for each 1 million tonnes of tailings ore processed at Woodlawn, subject to a cumulative cap of A$10 million.

Construction Progress at Bayan

Khundii Targets First Production in 2025

Erdene Resource Development Corp. (“Erdene”)

reported continued progress at the Bayan Khundii gold project located in Mongolia. The company continues to make significant strides in

the project’s development, with construction having reached approximately 30% completion at the end of June 2024. The process plant,

a critical path facility for the project, was nearly 40% constructed, with all major mechanical equipment now on-site. Construction has

also begun on key non-process infrastructure, including the overhead transmission line. As of August 2024, approximately US$60 million

has been invested in the project with almost 500 personnel on-site. The project remains largely on schedule with first gold production

anticipated in mid-2025.

Exploration efforts within the Khundii Minerals

District have also yielded promising results, identifying several new gold targets across the Khundii and Zuun Mod licenses. Drilling

is currently underway at Bayan Khundii to test targets west of the economic pit, with the goal of expanding the Resource base and increasing

confidence in the high-grade ore scheduled for mining in the first year of production. The results of these exploratory activities are

expected to be released in 2024.

For more information, visit Erdene’s website

and www.erdene.com and see the press release dated August 8, 2024. Sandstorm has a 1.0%

net smelter returns (“NSR”) royalty on the Bayan Khundii project.

Allied Gold Secures Funding for

Advancements at Côte d’Ivoire Assets

Allied Gold Corporation (“Allied Gold”)

announced the closing of US$53 million in stream financing for advancement initiatives at its Côte d'Ivoire Complex (CDI Complex),

which includes the Bonikro and Agbaou gold mines. The stream financing will support the advancement of highly prospective sites with Allied

Gold allocating a total of US$16.5 million in 2024 to advance high priority targets such as Oume, Akissi-So, Agbalé, and others,

which are located within Sandstorm’s Bonikro stream claim. Allied Gold expects to accelerate projects that aim to optimize operations,

extend mine life, and increase asset value by unlocking additional upside potential.

For more information, visit Allied Gold’s

website at www.alliedgold.com and see the press releases dated August 7 and August 14, 2024.

In conjunction with Allied Gold’s financing,

Sandstorm amended its Bonikro gold stream such that the Company is entitled to minimum annual deliveries of 4,000-6,000 ounces in the

2024-2026 period and 2,000-3,000 ounces in the 2027-2029 period (the “Annual Delivery Amount”). No other changes were made

to the delivery or payment terms under the stream. Sandstorm’s gold stream on the Bonikro mine allows the Company to purchase 6%

of gold produced at the mine until 39,000 ounces of gold are delivered, then 3.5% of gold produced until 61,750 cumulative ounces of gold

have been delivered, then 2% thereafter, subject to the Annual Delivery Amount. Sandstorm will make ongoing payments of $400 per gold

ounce delivered.

Contact Information

For more information about Sandstorm Gold Royalties,

please visit our website at www.sandstormgold.com or email us at info@sandstormgold.com.

| Nolan Watson |

Mark Klausen |

| President & CEO |

Corporate Communications |

| 604 689 0234 |

604 628 1164 |

ABOUT

SANDSTORM GOLD ROYALTIES

Sandstorm

is a precious metals-focused royalty company that provides upfront financing to mining companies and receives the right to a percentage

of production from a mine, for the life of the mine. Sandstorm holds a portfolio of over 230 royalties, of which 41 of the underlying

mines are producing. Sandstorm plans to grow and diversify its low-cost production profile through the acquisition of additional gold

royalties. For more information visit: www.sandstormgold.com.

CAUTIONARY

STATEMENTS TO U.S. SECURITYHOLDERS

The

financial information included or incorporated by reference in this press release or the documents referenced herein has been prepared

in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, which differs

from US generally accepted accounting principles (“US GAAP”) in certain material respects, and thus are not directly comparable

to financial statements prepared in accordance with US GAAP.

This

press release and the documents incorporated by reference herein, as applicable, have been prepared in accordance with Canadian standards

for the reporting of mineral resource and mineral reserve estimates, which differ from the previous and current standards of the United

States securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”,

“proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,”, “indicated

mineral resources,” “measured mineral resources” and “mineral resources” used or referenced herein and the

documents incorporated by reference herein, as applicable, are Canadian mineral disclosure terms as defined in accordance with Canadian

National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining,

Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the

CIM Council, as amended (the “CIM Definition Standards”).

For

United States reporting purposes, the United States Securities and Exchange Commission (the “SEC”) has adopted amendments

to its disclosure rules (the “SEC Modernization Rules”) to modernize the mining property disclosure requirements for issuers

whose securities are registered with the SEC under the Exchange Act, which became effective February 25, 2019. The SEC Modernization Rules

more closely align the SEC’s disclosure requirements and policies for mining properties with current industry and global regulatory

practices and standards, including NI 43-101, and replace the historical property disclosure requirements for mining registrants that

were included in SEC Industry Guide 7. Issuers were required to comply with the SEC Modernization Rules in their first fiscal year beginning

on or after January 1, 2021. As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional

disclosure system, the Corporation is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and

will continue to provide disclosure under NI 43-101 and the CIM Definition Standards. Accordingly, mineral reserve and mineral resource

information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies

subject to the United States federal securities laws and the rules and regulations thereunder.

As

a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources.” In addition, the SEC has amended its definitions

of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the

corresponding CIM Definition Standards that are required under NI 43-101. While the SEC will now recognize “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”, U.S. investors should not assume that all or any

part of the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves

without further work and analysis. Mineralization described using these terms has a greater amount of uncertainty as to its existence

and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that

all or any measured mineral resources, indicated mineral resources, or inferred mineral resources that the Company reports are or will

be economically or legally mineable without further work and analysis. Further, “inferred mineral resources” have a greater

amount of uncertainty and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to

assume that all or any part of inferred mineral resources will be upgraded to a higher category without further work and analysis. Under

Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. While the above terms are “substantially similar” to CIM Definitions, there are differences

in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral

reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”,

“measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under

NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization

Rules or under the prior standards of SEC Industry Guide 7.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING INFORMATION

This

press release contains “forward-looking statements”, within the meaning of the U.S. Securities Act of 1933, the U.S. Securities

Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning

of applicable Canadian securities legislation, concerning the business, operations and financial performance and condition of Sandstorm

Gold Royalties. Forward-looking statements include the future price of gold, silver, copper, iron ore and other metals, the estimation

of mineral reserves and resources, realization of mineral reserve estimates, and the timing and amount of estimated future production.

Forward-looking statements can generally be identified by the use of forward-looking terminology such as “may”, “will”,

“expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”,

“plans”, or similar terminology.

Forward-looking

statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances

or achievements of Sandstorm Gold Royalties to be materially different from future results, performances or achievements expressed or

implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies

and the environment in which Sandstorm Gold Royalties will operate in the future, including the receipt of all required approvals, the

price of gold and copper and anticipated costs. Certain important factors that could cause actual results, performances or achievements

to differ materially from those in the forward-looking statements include, amongst others, failure to receive necessary approvals, changes

in business plans and strategies, market conditions, share price, best use of available cash, gold and other commodity price volatility,

discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries, mining operational

and development risks relating to the parties which produce the gold or other commodity the Company will purchase, regulatory restrictions,

activities by governmental authorities (including changes in taxation), currency fluctuations, the global economic climate, dilution,

share price volatility and competition.

Forward-looking

statements are subject to known and unknown risks, uncertainties and other important factors that may cause the actual results, level

of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking

statements, including but not limited to: the impact of general business and economic conditions, the absence of control over mining operations

from which the Company will purchase gold, other commodities or receive royalties from, and risks related to those mining operations,

including risks related to international operations, government and environmental regulation, actual results of current exploration activities,

conclusions of economic evaluations and changes in project parameters as plans continue to be refined, risks in the marketability of minerals,

fluctuations in the price of gold and other commodities, fluctuation in foreign exchange rates and interest rates, stock market volatility,

as well as those factors discussed in the section entitled “Risks to Sandstorm” in the Company’s annual report for the

financial year ended December 31, 2023 and the section entitled “Risk Factors” contained in the Company’s annual information

form dated March 27, 2024 available at www.sedarplus.com. Although the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results

not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance

on forward-looking statements. The Company does not undertake to update any forward-looking statements that are contained or incorporated

by reference, except in accordance with applicable securities laws.

|  |

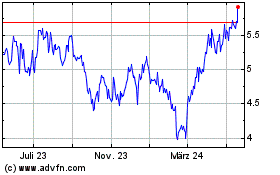

Sandstorm Gold (NYSE:SAND)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

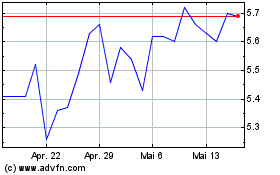

Sandstorm Gold (NYSE:SAND)

Historical Stock Chart

Von Nov 2023 bis Nov 2024