SCHEDULE

OF INVESTMENTS

ROYCE

MICRO-CAP TRUST

SEPTEMBER

30, 2023 (UNAUDITED)

| | |

SHARES | | |

VALUE | |

| | |

| | |

| |

| COMMON STOCKS – 96.9% | |

| | | |

| | |

| | |

| | | |

| | |

| Communication Services – 2.3% | |

| | | |

| | |

| Diversified Telecommunication Services - 0.0% | |

| | | |

| | |

| LICT

Corporation 1,2 | |

| 8 | | |

$ | 132,000 | |

| Entertainment - 1.1% | |

| | | |

| | |

| Chicken

Soup for the Soul Entertainment Cl. A 2 | |

| 477,611 | | |

| 164,776 | |

| IMAX

Corporation 2 | |

| 271,900 | | |

| 5,253,108 | |

| | |

| | | |

| 5,417,884 | |

| Interactive Media & Services - 0.5% | |

| | | |

| | |

| Eventbrite

Cl. A 2 | |

| 57,231 | | |

| 564,298 | |

| QuinStreet

2 | |

| 179,300 | | |

| 1,608,321 | |

| | |

| | | |

| 2,172,619 | |

| Media - 0.7% | |

| | | |

| | |

| Magnite 2 | |

| 172,200 | | |

| 1,298,388 | |

| TechTarget

2 | |

| 61,645 | | |

| 1,871,542 | |

| | |

| | | |

| 3,169,930 | |

| Wireless Telecommunication Services - 0.0% | |

| | | |

| | |

| Machten

1,2 | |

| 1,200 | | |

| 8,340 | |

| Total | |

| | | |

| 10,900,773 | |

| | |

| | | |

| | |

| Consumer Discretionary – 7.2% | |

| | | |

| | |

| Automobile Components - 1.5% | |

| | | |

| | |

| Motorcar

Parts of America 2 | |

| 54,800 | | |

| 443,332 | |

| Patrick

Industries 3 | |

| 17,250 | | |

| 1,294,785 | |

| Sebang

Global Battery 1 | |

| 50,500 | | |

| 2,211,024 | |

| Standard

Motor Products 3 | |

| 47,460 | | |

| 1,595,605 | |

| Stoneridge 2,3 | |

| 56,200 | | |

| 1,127,934 | |

| XPEL

2 | |

| 5,100 | | |

| 393,261 | |

| | |

| | | |

| 7,065,941 | |

| Broadline Retail - 0.2% | |

| | | |

| | |

| 1stdibs.com

2 | |

| 242,405 | | |

| 882,354 | |

| Diversified Consumer Services - 1.0% | |

| | | |

| | |

| Park Lawn | |

| 50,000 | | |

| 687,650 | |

| Universal

Technical Institute 2 | |

| 445,000 | | |

| 3,729,100 | |

| | |

| | | |

| 4,416,750 | |

| Hotels, Restaurants & Leisure - 1.4% | |

| | | |

| | |

| Century

Casinos 2 | |

| 222,500 | | |

| 1,141,425 | |

| First

Watch Restaurant Group 2 | |

| 16,025 | | |

| 277,072 | |

| Inspired

Entertainment 2 | |

| 150,000 | | |

| 1,794,000 | |

| Lindblad

Expeditions Holdings 2,3 | |

| 482,868 | | |

| 3,476,650 | |

| | |

| | | |

| 6,689,147 | |

| Household Durables - 1.2% | |

| | | |

| | |

| Cavco

Industries 2,3,4 | |

| 6,900 | | |

| 1,833,054 | |

| Legacy

Housing 2 | |

| 162,038 | | |

| 3,145,158 | |

| Lifetime

Brands 3 | |

| 119,294 | | |

| 671,625 | |

| | |

| | | |

| 5,649,837 | |

| Leisure Products - 0.4% | |

| | | |

| | |

| Clarus Corporation | |

| 254,903 | | |

| 1,927,067 | |

| Specialty Retail - 1.5% | |

| | | |

| | |

| AutoCanada 2 | |

| 321,700 | | |

| 5,750,691 | |

| Destination

XL Group 2 | |

| 75,000 | | |

| 336,000 | |

| Shoe

Carnival 3 | |

| 34,632 | | |

| 832,207 | |

| | |

| | | |

| 6,918,898 | |

| Textiles, Apparel & Luxury Goods - 0.0% | |

| | |

| |

| Wolverine World Wide | |

| 22,074 | | |

| 177,916 | |

| Total | |

| | | |

| 33,727,910 | |

| | |

| | | |

| | |

| Consumer Staples – 1.8% | |

| | | |

| | |

| Beverages - 0.1% | |

| | | |

| | |

| Primo Water | |

| 26,791 | | |

| 369,716 | |

| Consumer Staples Distribution & Retail - 0.0% | |

| | | |

| | |

| Rite Aid 2 | |

| 200,000 | | |

| 89,600 | |

| Food Products - 1.7% | |

| | | |

| | |

| CubicFarm Systems 2 | |

| 400,000 | | |

| 10,307 | |

| J G Boswell Company 1 | |

| 2,490 | | |

| 1,643,400 | |

| John B. Sanfilippo & Son 3 | |

| 7,900 | | |

| 780,520 | |

| Lifecore Biomedical 2,3,4 | |

| 75,610 | | |

| 570,477 | |

| Seneca Foods Cl. A 2 | |

| 68,291 | | |

| 3,676,105 | |

| Seneca Foods Cl. B 2 | |

| 25,800 | | |

| 1,391,910 | |

| | |

| | | |

| 8,072,719 | |

| Total | |

| | | |

| 8,532,035 | |

| | |

| | | |

| | |

| Energy – 8.2% | |

| | | |

| | |

| Energy Equipment & Services - 3.8% | |

| | | |

| | |

| Bristow Group 2,3 | |

| 177,900 | | |

| 5,011,443 | |

| Pason Systems | |

| 412,798 | | |

| 4,096,829 | |

| SEACOR Marine Holdings 2,3 | |

| 216,957 | | |

| 3,011,363 | |

| TerraVest Industries | |

| 192,600 | | |

| 5,388,404 | |

| | |

| | | |

| 17,508,039 | |

| Oil, Gas & Consumable Fuels - 4.4% | |

| | | |

| | |

| Dorchester Minerals L.P. | |

| 153,963 | | |

| 4,472,625 | |

| Dorian LPG | |

| 181,292 | | |

| 5,208,519 | |

| GeoPark | |

| 69,218 | | |

| 711,561 | |

| Kimbell Royalty Partners L.P. | |

| 68,500 | | |

| 1,096,000 | |

| Logan Energy 2 | |

| 75,750 | | |

| 56,328 | |

| Navigator Holdings | |

| 175,000 | | |

| 2,584,750 | |

| Northern Oil and Gas 3 | |

| 34,200 | | |

| 1,375,866 | |

| Sabine Royalty Trust 3 | |

| 42,848 | | |

| 2,823,683 | |

| Sitio Royalties Cl. A 3 | |

| 50,974 | | |

| 1,234,081 | |

| StealthGas 2 | |

| 229,664 | | |

| 1,156,358 | |

| | |

| | | |

| 20,719,771 | |

| Total | |

| | | |

| 38,227,810 | |

| | |

| | | |

| | |

| Financials – 14.1% | |

| | | |

| | |

| Banks - 2.1% | |

| | | |

| | |

| Bank of N.T. Butterfield & Son | |

| 34,000 | | |

| 920,720 | |

| BankFirst Capital 1 | |

| 3,755 | | |

| 120,536 | |

| Bay Community Bancorp Cl. A 1 | |

| 16,500 | | |

| 126,225 | |

| Chemung Financial 3 | |

| 31,000 | | |

| 1,227,910 | |

| Citizens Bancshares 1 | |

| 3,160 | | |

| 116,604 | |

| First Commonwealth Financial | |

| 10,723 | | |

| 130,928 | |

| First National Bank Alaska 1 | |

| 695 | | |

| 130,486 | |

| Greene County Bancorp | |

| 3,415 | | |

| 82,131 | |

| Harbor Bankshares 1 | |

| 8,419 | | |

| 107,342 | |

| HBT Financial | |

| 53,452 | | |

| 974,964 | |

| Live Oak Bancshares 3 | |

| 47,414 | | |

| 1,372,635 | |

| M&F Bancorp 1 | |

| 7,300 | | |

| 116,800 | |

| Midway Investments 2,5 | |

| 735,647 | | |

| 0 | |

| OP Bancorp | |

| 14,500 | | |

| 132,675 | |

| PCB Bancorp | |

| 11,338 | | |

| 175,172 | |

| Triumph Financial 2 | |

| 4,780 | | |

| 309,696 | |

| United Bancorporation of Alabama 1 | |

| 3,447 | | |

| 132,296 | |

| Virginia National Bankshares 3 | |

| 89,910 | | |

| 2,728,769 | |

| WSFS Financial | |

| 22,500 | | |

| 821,250 | |

| | |

| | | |

| 9,727,139 | |

| Capital Markets - 9.0% | |

| | | |

| | |

| B. Riley Financial | |

| 116,600 | | |

| 4,779,434 | |

| Barings BDC | |

| 215,300 | | |

| 1,918,323 | |

| Bolsa Mexicana de Valores | |

| 1,068,000 | | |

| 1,999,647 | |

| Bridge Investment Group Holdings Cl. A | |

| 33,130 | | |

| 304,796 | |

| Canaccord Genuity Group | |

| 399,993 | | |

| 2,373,601 | |

| Donnelley Financial Solutions 2,3,4 | |

| 94,000 | | |

| 5,290,320 | |

| Fiera Capital Cl. A | |

| 78,000 | | |

| 322,739 | |

| GCM Grosvenor Cl. A | |

| 263,725 | | |

| 2,046,506 | |

| MarketWise Cl. A | |

| 500,000 | | |

| 800,000 | |

| Perella Weinberg Partners Cl. A | |

| 65,467 | | |

| 666,454 | |

| Silvercrest Asset Management Group Cl. A 3 | |

| 281,400 | | |

| 4,465,818 | |

| Sprott | |

| 212,453 | | |

| 6,470,959 | |

| StoneX Group 2,3 | |

| 43,627 | | |

| 4,228,329 | |

| Tel Aviv Stock Exchange 1,2 | |

| 343,000 | | |

| 1,969,896 | |

| U.S. Global Investors Cl. A | |

| 439,454 | | |

| 1,252,444 | |

| Urbana Corporation | |

| 237,600 | | |

| 834,421 | |

| Value Line | |

| 23,570 | | |

| 1,030,480 | |

| Westaim Corporation (The) 2 | |

| 500,000 | | |

| 1,303,147 | |

| | |

| | | |

| 42,057,314 | |

| Consumer Finance - 0.4% | |

| | | |

| | |

| EZCORP Cl. A 2,3,4 | |

| 201,000 | | |

| 1,658,250 | |

| Financial Services - 2.5% | |

| | | |

| | |

| Acacia Research 2,3,4 | |

| 459,269 | | |

| 1,676,332 | |

| Cantaloupe 2 | |

| 50,000 | | |

| 312,500 | |

| ECN Capital | |

| 1,155,179 | | |

| 1,956,129 | |

| International Money Express 2 | |

| 94,594 | | |

| 1,601,476 | |

| NewtekOne | |

| 378,975 | | |

| 5,589,881 | |

| Repay Holdings Cl. A 2 | |

| 69,689 | | |

| 528,940 | |

| Waterloo Investment Holdings 2,5 | |

| 806,000 | | |

| 225,680 | |

| | |

| | | |

| 11,890,938 | |

| Insurance - 0.1% | |

| | | |

| | |

| Ambac Financial Group 2 | |

| 15,274 | | |

| 184,204 | |

| Investors Title Company | |

| 1,675 | | |

| 248,051 | |

| | |

| | | |

| 432,255 | |

| Total | |

| | | |

| 65,765,896 | |

| | |

| | | |

| | |

| Health Care – 12.1% | |

| | | |

| | |

| Biotechnology - 2.6% | |

| | | |

| | |

| Actinium Pharmaceuticals 2 | |

| 50,000 | | |

| 296,000 | |

| Agios Pharmaceuticals 2 | |

| 3,500 | | |

| 86,625 | |

| Arcturus Therapeutics Holdings 2 | |

| 129,836 | | |

| 3,317,310 | |

| CareDx 2 | |

| 100,000 | | |

| 700,000 | |

| Caribou Biosciences 2 | |

| 24,315 | | |

| 116,226 | |

| Catalyst Pharmaceuticals 2 | |

| 49,550 | | |

| 579,239 | |

| Fate Therapeutics 2 | |

| 30,339 | | |

| 64,319 | |

| 4D Molecular Therapeutics 2 | |

| 8,897 | | |

| 113,259 | |

| Kymera Therapeutics 2 | |

| 8,072 | | |

| 112,201 | |

| MeiraGTx Holdings 2 | |

| 114,400 | | |

| 561,704 | |

| Travere Therapeutics 2 | |

| 18,339 | | |

| 163,950 | |

| X4 Pharmaceuticals 2 | |

| 119,006 | | |

| 129,716 | |

| Zealand Pharma 1,2 | |

| 137,715 | | |

| 5,957,122 | |

| | |

| | | |

| 12,197,671 | |

| Health Care Equipment & Supplies - 3.6% | |

| | | |

| | |

| Artivion 2 | |

| 62,700 | | |

| 950,532 | |

| AtriCure 2,3 | |

| 15,000 | | |

| 657,000 | |

| Atrion Corporation | |

| 5,489 | | |

| 2,267,890 | |

| Cutera 2,3,4 | |

| 49,700 | | |

| 299,194 | |

| Opsens 2 | |

| 226,414 | | |

| 295,051 | |

| OrthoPediatrics Corp. 2 | |

| 6,500 | | |

| 208,000 | |

| Profound Medical 2 | |

| 189,100 | | |

| 1,896,221 | |

| Semler Scientific 2,3 | |

| 22,400 | | |

| 568,288 | |

| Surmodics 2,3 | |

| 85,300 | | |

| 2,737,277 | |

| UFP Technologies 2,3,4 | |

| 24,745 | | |

| 3,995,080 | |

| Utah Medical Products | |

| 31,981 | | |

| 2,750,366 | |

| | |

| | | |

| 16,624,899 | |

| Health Care Providers & Services - 1.7% | |

| | | |

| | |

| Castle Biosciences 2 | |

| 22,809 | | |

| 385,244 | |

| Cross Country Healthcare 2,3,4 | |

| 58,900 | | |

| 1,460,131 | |

| Great Elm Group 2 | |

| 682,245 | | |

| 1,460,005 | |

| Hims & Hers Health Cl. A 2 | |

| 200,000 | | |

| 1,258,000 | |

| Joint Corp. (The) 2 | |

| 127,484 | | |

| 1,146,081 | |

| National Research 3 | |

| 46,668 | | |

| 2,070,659 | |

| | |

| | | |

| 7,780,120 | |

| Health Care Technology - 0.6% | |

| | | |

| | |

| Simulations Plus 3 | |

| 72,770 | | |

| 3,034,509 | |

| Life Sciences Tools & Services - 3.4% | |

| | | |

| | |

| Azenta 2,3,4 | |

| 15,700 | | |

| 787,983 | |

| BioLife Solutions 2 | |

| 39,716 | | |

| 548,478 | |

| Cytek Biosciences 2 | |

| 78,934 | | |

| 435,716 | |

| Harvard Bioscience 2 | |

| 317,400 | | |

| 1,364,820 | |

| MaxCyte 2 | |

| 172,560 | | |

| 538,387 | |

| Mesa Laboratories 3 | |

| 61,095 | | |

| 6,419,252 | |

| OmniAb 2 | |

| 45,663 | | |

| 236,991 | |

| Quanterix Corporation 2 | |

| 199,800 | | |

| 5,422,572 | |

| SomaLogic Cl. A 2 | |

| 92,293 | | |

| 220,580 | |

| | |

| | | |

| 15,974,779 | |

| Pharmaceuticals - 0.2% | |

| | | |

| | |

| Knight Therapeutics 2 | |

| 187,000 | | |

| 619,547 | |

| Theravance Biopharma 2,3,4 | |

| 59,009 | | |

| 509,248 | |

| | |

| | | |

| 1,128,795 | |

| Total | |

| | | |

| 56,740,773 | |

| | |

| | | |

| | |

| Industrials – 19.0% | |

| | | |

| | |

| Aerospace & Defense - 0.8% | |

| | | |

| | |

| Astronics Corporation 2 | |

| 56,929 | | |

| 902,894 | |

| CPI Aerostructures 2 | |

| 189,700 | | |

| 633,598 | |

| Innovative Solutions and Support 2 | |

| 78,828 | | |

| 599,093 | |

| Park Aerospace | |

| 101,300 | | |

| 1,573,189 | |

| | |

| | | |

| 3,708,774 | |

| Building Products - 1.3% | |

| | | |

| | |

| Burnham Holdings Cl. A 1 | |

| 117,000 | | |

| 1,428,570 | |

| CSW Industrials 3 | |

| 6,700 | | |

| 1,174,108 | |

| Gibraltar Industries 2 | |

| 10,659 | | |

| 719,589 | |

| Insteel Industries 3 | |

| 49,700 | | |

| 1,613,262 | |

| Janus International Group 2 | |

| 97,610 | | |

| 1,044,427 | |

| Quanex Building Products | |

| 9,900 | | |

| 278,883 | |

| | |

| | | |

| 6,258,839 | |

| Commercial Services & Supplies - 0.7% | |

| | | |

| | |

| Acme United | |

| 25,000 | | |

| 747,250 | |

| ACV Auctions Cl. A 2 | |

| 30,825 | | |

| 467,923 | |

| Civeo Corporation | |

| 37,499 | | |

| 777,354 | |

| Montrose Environmental Group 2 | |

| 24,175 | | |

| 707,361 | |

| VSE Corporation | |

| 10,900 | | |

| 549,796 | |

| | |

| | | |

| 3,249,684 | |

| Construction & Engineering - 2.4% | |

| | |

| |

| Construction Partners Cl. A 2 | |

| 84,900 | | |

| 3,103,944 | |

| Granite Construction | |

| 13,500 | | |

| 513,270 | |

| IES Holdings 2,3 | |

| 62,874 | | |

| 4,141,510 | |

| MasTec 2 | |

| 13,287 | | |

| 956,266 | |

| Matrix Service 2,3 | |

| 40,425 | | |

| 477,015 | |

| Northwest Pipe 2,3 | |

| 65,100 | | |

| 1,964,067 | |

| | |

| | | |

| 11,156,072 | |

| Electrical Equipment - 1.6% | |

| | | |

| | |

| American Superconductor 2 | |

| 104,225 | | |

| 786,899 | |

| Hammond Power Solutions Cl. A | |

| 6,562 | | |

| 246,682 | |

| LSI Industries | |

| 299,940 | | |

| 4,763,047 | |

| Powell Industries 3 | |

| 21,400 | | |

| 1,774,060 | |

| | |

| | | |

| 7,570,688 | |

| Ground Transportation - 0.9% | |

| | | |

| | |

| Covenant Logistics Group Cl. A | |

| 16,655 | | |

| 730,322 | |

| FTAI Infrastructure | |

| 59,250 | | |

| 190,785 | |

| Universal Logistics Holdings 3 | |

| 125,240 | | |

| 3,153,543 | |

| | |

| | | |

| 4,074,650 | |

| Machinery - 2.8% | |

| | | |

| | |

| Graham Corporation 2 | |

| 149,850 | | |

| 2,487,510 | |

| H2O Innovation 2 | |

| 537,300 | | |

| 1,032,470 | |

| Hurco Companies 3 | |

| 16,566 | | |

| 371,575 | |

| L. B. Foster Company 2,3 | |

| 95,300 | | |

| 1,802,123 | |

| Lindsay Corporation 3 | |

| 37,500 | | |

| 4,413,000 | |

| Luxfer Holdings 3 | |

| 22,198 | | |

| 289,684 | |

| Shyft Group (The) | |

| 41,476 | | |

| 620,896 | |

| Standex International | |

| 5,700 | | |

| 830,433 | |

| Tennant Company | |

| 19,200 | | |

| 1,423,680 | |

| | |

| | | |

| 13,271,371 | |

| Marine Transportation - 1.3% | |

| | | |

| | |

| Algoma Central | |

| 40,000 | | |

| 433,499 | |

| Clarkson 1 | |

| 52,700 | | |

| 1,753,886 | |

| Eagle Bulk Shipping 3,4 | |

| 91,799 | | |

| 3,858,312 | |

| | |

| | | |

| 6,045,697 | |

| Passenger Airlines - 0.1% | |

| | | |

| | |

| Harbor Diversified 1,2 | |

| 201,262 | | |

| 400,511 | |

| Professional Services - 1.6% | |

| | | |

| | |

| Forrester Research 2,3,4 | |

| 126,000 | | |

| 3,641,400 | |

| Franklin Covey 2,3 | |

| 40,100 | | |

| 1,721,092 | |

| NV5 Global 2 | |

| 11,400 | | |

| 1,097,022 | |

| Resources Connection | |

| 59,300 | | |

| 884,163 | |

| Spire Global Cl. A 2 | |

| 6,250 | | |

| 30,563 | |

| | |

| | | |

| 7,374,240 | |

| Trading Companies & Distributors - 5.5% | |

| | | |

| | |

| Distribution Solutions Group 2 | |

| 184,590 | | |

| 4,799,340 | |

| EVI Industries 2,3,4 | |

| 352,409 | | |

| 8,746,791 | |

| Transcat 2,3 | |

| 127,775 | | |

| 12,518,117 | |

| | |

| | | |

| 26,064,248 | |

| Total | |

| | | |

| 89,174,774 | |

| | |

| | | |

| | |

| Information Technology – 22.1% | |

| | | |

| | |

| Communications Equipment - 1.5% | |

| | | |

| | |

| Aviat Networks 2 | |

| 7,512 | | |

| 234,374 | |

| Clearfield 2,3,4 | |

| 58,600 | | |

| 1,679,476 | |

| Digi International 2,3 | |

| 70,000 | | |

| 1,890,000 | |

| Genasys 2 | |

| 86,392 | | |

| 173,648 | |

| Harmonic 2 | |

| 135,300 | | |

| 1,302,939 | |

| Ituran Location and Control | |

| 50,000 | | |

| 1,495,000 | |

| | |

| | | |

| 6,775,437 | |

| Electronic Equipment, Instruments & Components - 6.8% | |

| | |

| |

| Bel Fuse Cl. A | |

| 18,805 | | |

| 886,280 | |

| Daktronics 2 | |

| 19,665 | | |

| 175,412 | |

| Evolv Technologies Holdings 2 | |

| 168,000 | | |

| 816,480 | |

| Fabrinet 2 | |

| 2,200 | | |

| 366,564 | |

| FARO Technologies 2,3,4 | |

| 104,800 | | |

| 1,596,104 | |

| HollySys Automation Technologies 2 | |

| 51,900 | | |

| 1,029,696 | |

| Luna Innovations 2 | |

| 428,678 | | |

| 2,512,053 | |

| nLIGHT 2,3 | |

| 634,714 | | |

| 6,601,026 | |

| PAR Technology 2 | |

| 287,024 | | |

| 11,061,905 | |

| PC Connection 3 | |

| 9,200 | | |

| 491,096 | |

| PowerFleet 2 | |

| 943,450 | | |

| 1,952,941 | |

| Richardson Electronics | |

| 252,800 | | |

| 2,763,104 | |

| Vishay Precision Group 2,3 | |

| 45,600 | | |

| 1,531,248 | |

| | |

| | | |

| 31,783,909 | |

| IT Services - 0.1% | |

| | | |

| | |

| Hackett Group (The) 3 | |

| 27,700 | | |

| 653,443 | |

| Liberated Syndication 2,5 | |

| 56,000 | | |

| 0 | |

| | |

| | | |

| 653,443 | |

| Semiconductors & Semiconductor Equipment - 8.3% | |

| | | |

| | |

| Alpha and Omega Semiconductor 2,3 | |

| 17,900 | | |

| 534,136 | |

| Alphawave IP Group 1,2 | |

| 42,941 | | |

| 59,823 | |

| Amtech Systems 2,3,4 | |

| 92,184 | | |

| 702,442 | |

| Axcelis Technologies 2 | |

| 3,800 | | |

| 619,590 | |

| AXT 2 | |

| 300,909 | | |

| 722,181 | |

| Camtek 2,3,4 | |

| 134,492 | | |

| 8,373,472 | |

| Cohu 2,3 | |

| 38,990 | | |

| 1,342,816 | |

| FormFactor 2 | |

| 22,869 | | |

| 799,043 | |

| Ichor Holdings 2 | |

| 32,000 | | |

| 990,720 | |

| Kulicke & Soffa Industries 3 | |

| 51,200 | | |

| 2,489,856 | |

| Nova 2,3 | |

| 35,000 | | |

| 3,935,400 | |

| NVE Corporation 3 | |

| 34,400 | | |

| 2,825,616 | |

| Onto Innovation 2,3,4 | |

| 40,150 | | |

| 5,119,928 | |

| PDF Solutions 2,3 | |

| 155,500 | | |

| 5,038,200 | |

| Photronics 2,3,4 | |

| 187,451 | | |

| 3,788,385 | |

| Ultra Clean Holdings 2,3 | |

| 52,000 | | |

| 1,542,840 | |

| | |

| | | |

| 38,884,448 | |

| Software - 3.8% | |

| | | |

| | |

| Alkami Technology 2 | |

| 100,156 | | |

| 1,824,842 | |

| American Software Cl. A 3 | |

| 111,152 | | |

| 1,273,802 | |

| Cellebrite DI 2 | |

| 714,100 | | |

| 5,462,865 | |

| Computer Modelling Group | |

| 629,875 | | |

| 3,941,791 | |

| Digital Turbine 2 | |

| 241,500 | | |

| 1,461,075 | |

| Model N 2 | |

| 25,000 | | |

| 610,250 | |

| Optiva 2 | |

| 28,000 | | |

| 114,412 | |

| PROS Holdings 2,3,4 | |

| 69,390 | | |

| 2,402,282 | |

| Riskified 2 | |

| 44,815 | | |

| 200,771 | |

| Upland Software 2 | |

| 144,100 | | |

| 665,742 | |

| | |

| | | |

| 17,957,832 | |

| Technology Hardware, Storage & Peripherals - 1.6% | |

| | | |

| | |

| AstroNova 2 | |

| 115,860 | | |

| 1,448,250 | |

| Avid Technology 2,3 | |

| 153,000 | | |

| 4,111,110 | |

| Intevac 2 | |

| 539,400 | | |

| 1,677,534 | |

| | |

| | | |

| 7,236,894 | |

| Total | |

| | | |

| 103,291,963 | |

| | |

| | | |

| | |

| Materials – 7.5% | |

| | | |

| | |

| Chemicals - 1.1% | |

| | | |

| | |

| Aspen Aerogels 2 | |

| 325,085 | | |

| 2,795,731 | |

| LSB Industries 2 | |

| 176,540 | | |

| 1,806,004 | |

| Orion | |

| 19,675 | | |

| 418,684 | |

| Rayonier Advanced Materials 2 | |

| 50,000 | | |

| 177,000 | |

| | |

| | | |

| 5,197,419 | |

| Construction Materials - 0.3% | |

| | | |

| | |

| Monarch Cement 1 | |

| 8,150 | | |

| 1,222,500 | |

| Metals & Mining - 6.1% | |

| | | |

| | |

| Alamos Gold Cl. A | |

| 261,044 | | |

| 2,944,373 | |

| Altius Minerals | |

| 171,100 | | |

| 2,766,321 | |

| Haynes International 3 | |

| 96,832 | | |

| 4,504,625 | |

| Imdex 1 | |

| 569,466 | | |

| 564,068 | |

| MAG Silver 2 | |

| 154,050 | | |

| 1,597,498 | |

| Major Drilling Group International 2 | |

| 1,230,763 | | |

| 7,493,768 | |

| Newcrest Mining | |

| 26,859 | | |

| 423,970 | |

| Olympic Steel | |

| 62,100 | | |

| 3,490,641 | |

| Ryerson Holding Corporation | |

| 23,230 | | |

| 675,761 | |

| Sandstorm Gold 3,4 | |

| 810,000 | | |

| 3,774,600 | |

| Universal Stainless & Alloy Products 2,3 | |

| 33,620 | | |

| 440,758 | |

| | |

| | | |

| 28,676,383 | |

| Total | |

| | | |

| 35,096,302 | |

| | |

| | | |

| | |

| Real Estate – 2.4% | |

| | | |

| | |

| Office REITs - 0.3% | |

| | | |

| | |

| Postal Realty Trust Cl. A | |

| 114,000 | | |

| 1,539,000 | |

| Real Estate Management & Development - 2.1% | |

| | | |

| | |

| Altus Group | |

| 101,400 | | |

| 3,510,273 | |

| Real Matters 2 | |

| 229,500 | | |

| 1,047,598 | |

| RMR Group (The) Cl. A 3 | |

| 108,200 | | |

| 2,653,064 | |

| Tejon Ranch 2,3 | |

| 154,994 | | |

| 2,514,002 | |

| | |

| | | |

| 9,724,937 | |

| Total | |

| | | |

| 11,263,937 | |

| | |

| | | |

| | |

| Utilities – 0.2% | |

| | | |

| | |

| Water Utilities - 0.2% | |

| | | |

| | |

| Global Water Resources | |

| 106,000 | | |

| 1,033,500 | |

| Total | |

| | | |

| 1,033,500 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (Cost $374,258,510) | |

| | | |

| 453,755,673 | |

| | |

| | | |

| | |

| DIVERSIFIED INVESTMENT COMPANIES – 0.5% | |

| | | |

| | |

| Financials – 0.5% | |

| | | |

| | |

| Capital Markets - 0.5% | |

| | | |

| | |

| ASA Gold and Precious Metals | |

| 171,150 | | |

| 2,281,429 | |

| (Cost $2,914,815) | |

| | | |

| 2,281,429 | |

| | |

| | | |

| | |

| PREFERRED STOCK – 0.0% | |

| | | |

| | |

| Energy – 0.0% | |

| | | |

| | |

| Oil, Gas & Consumable Fuels - 0.0% | |

| | | |

| | |

| Imperial Petroleum 8.75% Series A | |

| 4,784 | | |

| 96,063 | |

| (Cost $71,808) | |

| | | |

| 96,063 | |

| | |

| | | |

| | |

| REPURCHASE AGREEMENT – 7.7% | |

| | | |

| | |

Fixed

Income Clearing Corporation,

3.15% dated 9/29/23, due 10/2/23,

maturity value $36,216,343 (collateralized

by obligations of

U.S. Government

Agencies, 0.75% due 5/31/26, valued at $36,931,053) | |

| | | |

| | |

| (Cost $36,206,838) | |

| | | |

| 36,206,838 | |

| TOTAL INVESTMENTS – 105.1% | |

| |

| (Cost $413,451,971) | |

| 492,340,003 | |

| | |

| | |

LIABILITIES LESS CASH

AND OTHER

ASSETS – (5.1)% | |

| (23,997,284 | ) |

NET ASSETS – 100.0% | |

$ | 468,342,719 | |

| 1 | These

securities are defined as Level 2 securities due to fair value being based on quoted prices for similar securities and/or due

to the application of fair value factors. |

| 3 | All

or a portion of these securities were pledged as collateral in connection with the Fund’s revolving credit agreement as

of September 30, 2023. Total market value of pledged securities as of September 30, 2023, was $41,227,749. |

| 4 | As

of September 30, 2023, a portion of these securities, in the aggregate amount of $20,699,212, were rehypothecated by BNP Paribas

Prime Brokerage International, Limited in connection with the Fund’s revolving credit agreement. |

| 5 | Securities

for which market quotations are not readily available represent 0.0% of net assets. These securities have been valued at their

fair value under procedures approved by the Fund’s Board of Directors. These securities are defined as Level 3 securities

due to the use of significant unobservable inputs in the determination of fair value. |

TAX

INFORMATION: The cost of total investments for Federal income tax purposes was $413,700,903. As of September 30, 2023, net

unrealized appreciation for all securities was $78,639,100, consisting of aggregate gross unrealized appreciation of $132,062,258

and aggregate gross unrealized depreciation of $53,423,158. The primary cause of the difference between book and tax basis cost

is the timing of the recognition of losses on securities sold.

Valuation

of Investments:

Royce

Micro-Cap Trust, Inc. (the “Fund”), is a diversified closed-end investment company that was incorporated under the

laws of the State of Maryland on September 9, 1993. The Fund commenced operations on December 14, 1993. Royce & Associates,

LP, the Fund’s investment adviser, is a majority-owned subsidiary of Franklin Resources, Inc. and primarily conducts business

using the name Royce Investment Partners (“Royce”). Investment transactions are accounted for on the trade date. Portfolio

securities held by the Fund are valued as of the close of trading on the New York Stock Exchange (“NYSE”) (generally

4:00 p.m. Eastern time) on the valuation date. Investments in money market funds are valued at net asset value per share. Values

for non-U.S. dollar denominated equity securities are converted to U.S. dollars daily based upon prevailing foreign currency exchange

rates as quoted by a major bank.

Equity

securities that are listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative

trading system, are valued: (i) on the basis of their last reported sales prices or official closing prices, as applicable, on

a valuation date; or (ii) at their highest reported bid prices in the event such equity securities did not trade on a valuation

date. Such inputs are generally referred to as “Level 1” inputs because they represent reliable quoted prices in active

markets for identical securities.

If

the value of a portfolio security held by the Fund cannot be determined solely by reference to Level 1 inputs, such portfolio

security will be “fair valued.” The Fund’s Board of Directors has designated Royce as valuation designee to

perform fair value determinations for such portfolio securities in accordance with Rule 2a-5 under the Investment Company Act

of 1940 (“Rule 2a-5”). Pursuant to Rule 2a-5, fair values are determined in accordance with policies and procedures

approved by the Fund’s Board of Directors and policies and procedures adopted by Royce in its capacity as valuation designee

for the Fund. Fair valued securities are reported as either “Level 2” or “Level 3” securities.

As

a general principle, the fair value of a security is the amount which the Fund might reasonably expect to receive for the security

upon its current sale. However, in light of the judgment involved in fair valuations, no assurance can be given that a fair value

assigned to a particular portfolio security will be the amount which the Fund might be able to receive upon its current sale.

When a fair value pricing methodology is used, the fair value prices used by the Fund for such securities will likely differ from

the quoted or published prices for the same securities.

Level

2 inputs are other significant observable inputs (e.g., dealer bid side quotes and quoted prices for securities with comparable

characteristics). Examples of situations in which Level 2 inputs are used to fair value portfolio securities held by the Fund

on a particular valuation date include:

| ● | Over-the-counter

equity securities other than those traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system (collectively

referred to herein as “Other OTC Equity Securities”) are fair valued at their highest bid price when Royce receives

at least two bid side quotes from dealers who make markets in such securities; |

| ● | Certain

bonds and other fixed income securities may be fair valued by reference to other securities with comparable ratings, interest

rates, and maturities in accordance with valuation methodologies maintained by certain independent pricing services; and |

| ● | The

Fund uses an independent pricing service to fair value certain non-U.S. equity securities when U.S. market volatility exceeds

a certain threshold. This pricing service uses proprietary correlations it has developed between the movement of prices of non-U.S.

equity securities and indices of U.S.-traded securities, futures contracts, and other indications to estimate the fair value of

such non-U.S. securities. |

Level

3 inputs are significant unobservable inputs. Examples of Level 3 inputs include (without limitation) the last trade price for a security

before trading was suspended or terminated; discounts to last trade price for lack of marketability or otherwise; market price information

regarding other securities; information received from the issuer and/or published documents, including SEC filings and financial statements;

and other publicly available information. Pursuant to the above-referenced policies and procedures, Royce may use various techniques

in making fair value determinations based upon Level 3 inputs, which techniques may include (without limitation): (i) workout valuation

methods (e.g., earnings multiples, discounted cash flows, liquidation values, derivations of book value, firm or probable offers from

qualified buyers for the issuer’s ongoing business, etc.); (ii) discount or premium from market, or compilation of other observable

market information, for other similar freely traded securities; (iii) conversion from the readily available market price of a security

into which an affected security is convertible or exchangeable; and (iv) pricing models or other formulas. In the case of restricted

securities, fair value determinations generally start with the inherent or intrinsic worth of the relevant security, without regard to

the restrictive feature, and are reduced for any diminution in value resulting from the restrictive feature. Due to the inherent uncertainty

of such valuations, these fair values may differ significantly from the values that would have been used had an active market existed.

A

security that is valued by reference to Level 1 or Level 2 inputs may drop to Level 3 on a particular valuation date for several

reasons, including if:

| ● | an

equity security that is listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative

trading system, has not traded and there are no bids; |

| ● | Royce does not receive at least two bid side quotes for an Other OTC Equity Security; |

| ● | the independent pricing services are unable to supply fair value prices; or |

| ● | the

Level 1 or Level 2 inputs become otherwise unreliable for any reason (e.g., a significant event occurs after the close of trading

for a security but prior to the time the Fund prices its shares). |

The

table below shows the aggregate value of the various Level 1, Level 2, and Level 3 securities held by the Fund as of September

30, 2023. Any Level 2 or Level 3 securities held by the Fund are noted in its Schedule of Investments. The inputs or methodology

used for valuing securities are not necessarily an indication of the risk associated with owning those securities.

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks | |

| $435,328,563 | | |

| $18,201,430 | | |

| $225,680 | | |

| $453,755,673 | |

| Diversified Investment Companies | |

| 2,281,429 | | |

| – | | |

| – | | |

| 2,281,429 | |

| Preferred Stock | |

| 96,063 | | |

| – | | |

| – | | |

| 96,063 | |

| Repurchase Agreement | |

| – | | |

| 36,206,838 | | |

| – | | |

| 36,206,838 | |

Level 3 Reconciliation:

| | |

| | | |

| | | |

| | | |

Unrealized Gain (Loss) | | |

| | |

| | |

| Balance as of

12/31/22 | | |

| Sales | | |

| Realized

Gain (Loss) | | |

Currently Held

Securities | |

| Securities No

Longer Held | | |

| Balance as of

9/30/23 | |

| Common Stocks | |

| $225,680 | | |

| $– | | |

| $– | | |

$0 | |

| $– | | |

| $225,680 | |

Repurchase

Agreements:

The

Fund may enter into repurchase agreements with institutions that the Fund’s investment adviser has determined are creditworthy.

The Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase

agreements, which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at

least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve

certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability

of the Fund to dispose of its underlying securities. The remaining contractual maturity of the repurchase agreement held by the

Fund as of September 30, 2023, is next business day and continuous.

Borrowings:

The

Fund is party to a revolving credit agreement (the “credit agreement”) with BNP Paribas Prime Brokerage International,

Limited (BNPPI). The Fund pays a commitment fee of 0.50% per annum on the unused portion of the then-current maximum amount that

may be borrowed by the Fund under the credit agreement. The credit agreement has a 179-day rolling term that resets daily. The

Fund pledges eligible portfolio securities as collateral and has granted a security interest in such pledged securities to, and

in favor of, BNPPI as security for the loan balance outstanding. The amount of eligible portfolio securities required to be pledged

as collateral is determined by BNPPI in accordance with the credit agreement. In determining collateral requirements, the value

of eligible securities pledged as collateral is subject to discount by BNPPI based upon a variety of factors set forth in the

credit agreement. As of September 30, 2023, the market value of eligible securities pledged as collateral was approximately 1.87

times the loan balance outstanding.

If

the Fund fails to meet certain requirements, or comply with other financial covenants set forth in the credit agreement, the Fund

may be required to repay immediately, in part or in full, the loan balance outstanding under the credit agreement, which may necessitate

the sale of portfolio securities at potentially inopportune times. BNPPI may terminate the credit agreement upon certain ratings

downgrades of its corporate parent, which would result in the Fund’s entire loan balance becoming immediately due and payable.

The occurrence of such ratings downgrades may necessitate the sale of portfolio securities at potentially inopportune times. BNPPI

may also terminate the credit agreement upon sixty (60) calendar days’ prior written notice to the Fund in the event the

Fund’s net asset value per share as of the close of business on the last business day of any calendar month declines by

thirty-five percent (35%) or more from the Fund’s net asset value per share as of the close of business on the last business

day of the immediately preceding calendar month.

The

credit agreement also permits, subject to certain conditions, BNPPI to rehypothecate portfolio securities pledged by the Fund

up to the amount of the loan balance outstanding. The Fund continues to receive payments in lieu of dividends and interest on

rehypothecated securities. The Fund also has the right under the credit agreement to recall the rehypothecated securities from

BNPPI on demand. If BNPPI fails to deliver the recalled security in a timely manner, the Fund is compensated by BNPPI for any

fees or losses related to the failed delivery or, in the event a recalled security is not returned by BNPPI, the Fund, upon notice

to BNPPI, may reduce the loan balance outstanding by the value of the recalled security failed to be returned. The Fund receives

a portion of the fees earned by BNPPI in connection with the rehypothecation of portfolio securities.

The

maximum amount the Fund may borrow under the credit agreement is $22,000,000. The Fund has the right to further reduce the maximum

amount it can borrow under the credit agreement upon one (1) business day’s prior written notice to BNPPI. In addition,

the Fund and BNPPI may agree to increase the maximum amount the Fund can borrow under the credit agreement, which amount may not

exceed $60,000,000.

As

of September 30, 2023, the Fund had outstanding borrowings of $22,000,000. During the nine-month period ended September 30, 2023,

the Fund had an average daily loan balance of $21,355,311. As of September 30, 2023, the aggregate value of rehypothecated securities

was $20,699,212.

Other

information regarding the Fund is available in the Fund’s most recent Report to Stockholders. This information is available

through Royce Investment Partners (www.royceinvest.com) and on the Securities and Exchange Commission’s website (www.sec.gov).

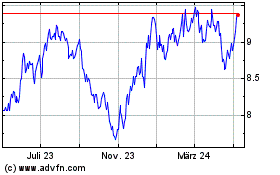

Royce Micro Cap (NYSE:RMT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Royce Micro Cap (NYSE:RMT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024