false000172452100017245212023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

________________________________________________________

Arcus Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-38419 | | 47-3898435 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 3928 Point Eden Way | | | | |

Hayward, California | | | | 94545 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 694-6200

(Former Name or Former Address, if Changed Since Last Report)

________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, Par Value $0.0001 Per Share | | RCUS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2023, Arcus Biosciences, Inc. issued a press release announcing its financial results for the three and nine months ended September 30, 2023. The full text of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Item 2.02 of this Form 8-K (including Exhibit 99.1) is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| ARCUS BIOSCIENCES, INC. |

| | |

Date: November 7, 2023 | By: | /s/ Terry Rosen, Ph. D. |

| | Terry Rosen, Ph.D. |

| | Chief Executive Officer (Principal Executive Officer) |

Exhibit 99.1

Arcus Biosciences Reports Third Quarter 2023 Financial Results and Provides a Pipeline Update

•Data were presented from the ongoing EDGE-Gastric Phase 2 study in first-line upper GI cancers at the Annual Meeting of the American Society of Clinical Oncology (ASCO) Plenary Series; domvanalimab is the only Fc-silent anti-TIGIT antibody in Phase 3 for upper GI adenocarcinomas and has the potential to be first-to-market for these cancers.

•Pharmacokinetic and pharmacodynamic data from the dose-escalation phase of ARC-20, a Phase 1b study in cancer patients of AB521, a potential best-in-class HIF-2a inhibitor, are consistent with results seen in healthy volunteers; more details, including preliminary signs of efficacy, are expected in early 2024.

•An analysis of efficacy and safety data from the Phase 1/1b ARC-8 study of quemliclustat in advanced pancreatic cancer will be presented in early 2024.

•With $950 million in cash, cash equivalents and marketable securities and funding expected into 2026, Arcus is well positioned to advance its pipeline.

HAYWARD, Calif. – (BUSINESS WIRE) – November 7, 2023 – Arcus Biosciences, Inc. (NYSE:RCUS), a clinical-stage, global biopharmaceutical company focused on developing differentiated molecules and combination therapies for people with cancer, today reported financial results for the third quarter ended September 30, 2023, and provided a pipeline update on its clinical-stage investigational molecules – targeting TIGIT, the adenosine axis (CD73 and A2a/A2b receptors), HIF-2a and PD-1 – across multiple common cancers.

“As we continue to execute on our Phase 3 trials for domvanalimab in lung and GI cancers, we have one of three important near-term data readouts now behind us. Today’s presentation of data from our Phase 2 EDGE-Gastric study provided important evidence to support domvanalimab’s potential as a differentiated and first-to-market anti-TIGIT antibody for the treatment of first-line upper GI adenocarcinomas. We are also looking forward to sharing more on our HIF-2a inhibitor, AB521, which continues to show a potentially improved clinical profile, with PK/PD results in patients consistent with those seen in healthy volunteers,” said Terry Rosen, Ph.D., chief executive officer of Arcus. “Lastly, we will be presenting mature OS data from our Phase 1/1b study of quemliclustat in pancreatic cancer early next year; we are excited to share next steps in the coming months.”

Pipeline Highlights:

Domvanalimab (Fc-silent anti-TIGIT monoclonal antibody)

•Preliminary data from Arm A1 of the Phase 2 EDGE-Gastric study, evaluating domvanalimab plus zimberelimab and chemotherapy in patients with previously untreated, locally advanced unresectable or metastatic upper gastrointestinal (GI) cancers, were presented during the Annual Meeting of the American Society of Clinical Oncology (ASCO) Plenary Series on November 7, 2023. These data were from the cohort that includes a patient population and dosing regimen similar to the ongoing Phase 3 study, STAR-221.

◦Domvanalimab plus zimberelimab and chemotherapy showed encouraging objective response rates (ORR) of 80% (confirmed ORR (cORR) of 73%) in patients with PD-L1-high tumors (TAP ≥5%), 46% (all confirmed) in patients with PD-L1-low tumors (TAP <5%) and 59% (cORR of 56%) for patients overall.

◦Six-month landmark progression-free survival (PFS) was 93% for patients with PD-L1-high tumors (TAP ≥5%), 68% for patients with PD-L1-low tumors (TAP <5%) and 77% for patients overall.

◦Mature PFS has not been reached and data are expected in the second half of 2024.

◦Domvanalimab plus zimberelimab and chemotherapy was well tolerated, with a similar safety profile to what has been reported for anti-PD-1 plus chemotherapy in this setting.

◦Domvanalimab is the only Fc-silent anti-TIGIT antibody in Phase 3 for gastric, gastroesophageal junction and esophageal adenocarcinoma and has the potential to be first to market for these cancers. These tumor types represent a potential drug-treatable population of over 25,000 in the US and over 100,000 in G-7 countries.

AB521 (HIF-2a inhibitor)

•Pharmacokinetic (PK) and pharmacodynamic (PD) data from the dose-escalation phase of ARC-20, a Phase 1/1b study of AB521 in cancer patients, are consistent with the results seen in healthy volunteers to date.

◦No dose-limiting toxicities have been observed to date in ARC-20.

◦Detailed PK, PD and safety data along with preliminary anti-tumor activity from this stage of ARC-20 will be shared in early 2024.

•Enrollment for the dose-expansion stage of ARC-20 in clear cell renal cell carcinoma (ccRCC) patients is near completion. Efficacy data from this stage of the ARC-20 study are expected later in 2024. The dose-expansion stage will include 30 patients on a 100-mg daily dose, which Arcus believes has the potential to achieve substantially greaterHIF-2a inhibition than the approved dose of the marketed competitor.

•A Phase 2 study evaluating AB521 in combination with a tyrosine kinase inhibitor (TKI) is anticipated to begin in the fourth quarter of 2023.

Quemliclustat (small-molecule CD73 inhibitor)

•Arcus conducted an analysis of mature OS data (minimum follow-up of 18 months) from the ongoing Phase 1/1b ARC-8 trial evaluating quemliclustat plus chemotherapy with or without zimberelimab in first-line pancreatic cancer.

◦At this analysis, 122 patients in the study had received the go-forward dose of 100 mg of quemliclustat; median follow-up time was 21 months.

◦These data will be presented in early 2024.

Etrumadenant (A2a/A2b adenosine receptor antagonist)

•Data from ARC-9, a Phase 1b/2 study evaluating etrumadenant plus zimberelimab plus chemotherapy in second-line and third-line metastatic colorectal cancer (mCRC), which is fully enrolled, are expected in the first half of 2024.

Early Clinical and Preclinical Programs

•ARC-25, a Phase 1 trial in cancer patients for AB598, an anti-CD39 antibody, is currently enrolling.

•Arcus initiated a Phase 1 study in healthy volunteers of AB801, its potent and highly selective AXL inhibitor, and expects to initiate a Phase 1 study in advanced cancer patients in the first quarter of 2024.

•Arcus expects to select a new development candidate against KIT, a target involved in multiple allergic and immune-mediated diseases, by year end.

Financial Results for Third Quarter 2023:

•Cash, Cash Equivalents and Marketable Securities were $950 million as of September 30, 2023, compared to $1.1 billion as of December 31, 2022. The decrease during the period is primarily due to the use of cash in research and development activities, partially offset by receipts of $35 million in upfront payments from Gilead to initiate Arcus-led discovery and early development activities on two jointly selected inflammation targets and $25 million in proceeds from the issuance of 1.2 million shares of our common stock. Arcus now expects cash utilization between $265 million and $290 million for the year ended December 31, 2023. Arcus continues to expect cash, cash equivalents and marketable securities on-hand to be sufficient to fund operations into 2026.

•Revenues were $32 million for the third quarter 2023, compared to $33 million for the same period in 2022. In the third quarter 2023, Arcus recognized $22 million in license and development service revenues related to the advancement of programs, primarily the Gilead collaboration, as well as $10 million in other collaboration revenue primarily related to Gilead’s ongoing rights to access Arcus’s research and development pipeline in accordance with the Gilead collaboration agreement. Revenues were $86 million for the nine months ended September 30, 2023, compared to $78 million for the same period in 2022.

•Research and Development (R&D) Expenses were $82 million for the third quarter 2023, compared to $77 million for the same period in 2022. The net increase of $5 million was primarily driven by: $7 million of

higher spend for Arcus programs not under a cost-sharing collaboration due to our expanding clinical and development activities; partially offset by a net decrease of $2 million in shared costs for programs optioned by our collaboration partners, primarily from the Gilead collaboration. The net decrease of $2 million was due to a decrease in shared collaboration costs of $10 million primarily from the timing of clinical manufacturing; with a corresponding decrease in reimbursements for shared expenses of $8 million. Non-cash stock-based compensation expense was $8 million for each of the third quarter 2023 and 2022. R&D expenses were $247 million for the nine months ended September 30, 2023, compared to $208 million for the same period in 2022. For third quarter 2023 and 2022, Arcus recognized reimbursements of $33 million and $41 million, respectively, for shared expenses from its collaborations, primarily the Gilead collaboration. Reimbursements were $119 million for the nine months ended September 30, 2023, compared to $111 million for the same period in 2022. R&D expense by quarter may fluctuate due to the timing of clinical manufacturing and standard-of-care therapeutic purchases with a corresponding impact on reimbursements.

•General and Administrative (G&A) Expenses were $30 million for the third quarter 2023, compared to $26 million for the same period in 2022. The increase was primarily driven by the increased complexity of supporting Arcus's expanding clinical pipeline and partnership obligations. Non-cash stock-based compensation expense was $10 million for the third quarter 2023, compared to $8 million for the same period in 2022. G&A expenses were $88 million for the nine months ended September 30, 2023, compared to $76 million for the same period in 2022.

•Net Loss was $71 million for the third quarter 2023, compared to $65 million for the same period in 2022. The increase in net loss included an increase of $2 million in income tax expense primarily due to an increase in taxable income compared to the prior year. Net loss was $226 million for the nine months ended September 30, 2023, compared to $200 million for the same period in 2022.

Arcus Ongoing and Announced Clinical Studies:

| | | | | | | | | | | | | | |

| Trial Name | Arms | Setting | Status | NCT No. |

| Lung Cancer |

| ARC-7 | zim vs. dom + zim vs. etruma + dom + zim | 1L NSCLC (PD-L1 ≥ 50%) | Ongoing Randomized Phase 2 | NCT04262856 |

PACIFIC-8 (Operationalized by AZ) | dom + durva vs. durva | Curative-Intent Stage 3 NSCLC | Ongoing Registrational Phase 3 | NCT05211895 |

| ARC-10 | dom + zim vs. pembro | 1L NSCLC (PD-L1 ≥ 50%) | Ongoing Registrational Phase 3 | NCT04736173 |

STAR-121 (Operationalized by Gilead) | dom + zim + chemo vs. pembro + chemo | 1L NSCLC (PD-L1 all-comers) | Ongoing Registrational Phase 3 | NCT05502237 |

| EDGE-Lung | dom +/- zim +/- quemli +/- chemo | 1L/2L NSCLC (lung cancer platform study) | Ongoing Randomized Phase 2 | NCT05676931 |

VELOCITY-Lung (Operationalized by Gilead) | dom +/- zim +/- etruma +/- sacituzumab govitecan-hziy or other combos | 1L/2L NSCLC (lung cancer platform study) | Ongoing Randomized Phase 2 | NCT05633667 |

| Gastrointestinal Cancers |

| ARC-9 | etruma + zim + mFOLFOX vs. SOC | 2L/3L/3L+ CRC | Ongoing Randomized Phase 2 | NCT04660812 |

| EDGE-Gastric (ARC-21) | dom +/- zim +/- quemli +/- chemo | 1L/2L Upper GI Malignancies | Ongoing Randomized Phase 2 | NCT05329766 |

| STAR-221 | dom + zim + chemo vs. nivo + chemo | 1L Gastric, Gastroesophageal Junction (GEJ) and Esophageal Adenocarcinoma (EAC) | Ongoing Registrational Phase 3 | NCT05568095 |

| Pancreatic Cancer |

| ARC-8 | quemli + zim + gem/nab-pac vs. quemli + gem/nab-pac | 1L, 2L PDAC | Ongoing Randomized Phase 1/1b | NCT04104672 |

| Prostate Cancer |

| ARC-6 | etruma + zim + SOC vs. SOC | 2L/3L CRPC | Ongoing Randomized Phase 2 | NCT04381832 |

| Renal Cancer |

| ARC-20 | AB521 | Cancer Patients / ccRCC | Ongoing Phase 1/1b | NCT05536141 |

| Other |

| ARC-25 | AB598 | Advanced Malignancies | Ongoing | NCT05891171 |

| ARC-26 | AB801 | Healthy Volunteers | Ongoing | NCT06004921 |

| ARC-27 | AB801 | Advanced Malignancies | Planned | NCT06120075 |

dom: domvanalimab; durva: durvalumab; etruma: etrumadenant; gem/nab-pac: gemcitabine/nab-paclitaxel; nivo: nivolumab; pembro: pembrolizumab; quemli: quemliclustat; SOC: standard of care; zim: zimberelimab;

ccRCC: clear-cell renal cell carcinoma; CRC: colorectal cancer; CRPC: castrate-resistant prostate cancer; GI: gastrointestinal; NSCLC: non-small cell lung cancer; PDAC: pancreatic ductal adenocarcinoma

About the Gilead Collaboration

In May 2020, Arcus established a 10-year collaboration with Gilead to strategically advance our portfolio. Under this collaboration, Gilead obtained time-limited exclusive option rights to all of our clinical programs arising during the collaboration term. Arcus and Gilead are co-developing five investigational products, including zimberelimab (Arcus's anti-PD-1 molecule), domvanalimab (Arcus's anti-TIGIT antibody), etrumadenant (Arcus's adenosine receptor antagonist) and quemliclustat (Arcus's CD73 inhibitor). The collaboration was expanded in November 2021 to include research directed to two targets for oncology, which research collaboration was further expanded in May 2023 to add up to four targets for inflammatory diseases.

About Arcus Biosciences

Arcus Biosciences is a clinical-stage, global biopharmaceutical company developing differentiated molecules and combination medicines for people with cancer. In partnership with industry partners, patients and physicians around the world, Arcus is expediting the development of first- or best-in-class medicines against well-characterized biological targets and pathways and studying novel, biology-driven combinations that have the potential to help people with cancer live longer. Founded in 2015, the company has expedited the development of multiple investigational medicines into clinical studies, including new combination approaches that target TIGIT, PD-1, the adenosine axis (CD73 and dual A2a/A2b receptor) and HIF-2a. For more information about Arcus Biosciences’ clinical and pre-clinical programs, please visit www.arcusbio.com or follow us on Twitter.

Domvanalimab, etrumadenant, quemliclustat, and zimberelimab are investigational molecules, and neither Gilead nor Arcus has received approval from any regulatory authority for any use globally, and their safety and efficacy have not been established. AB521 and AB598 are also investigational molecules, and Arcus has not received approval from any regulatory authority for any use globally, and their safety and efficacy have not been established.

Forward-Looking Statements

This press release contains forward-looking statements. All statements regarding events or results to occur in the future contained herein are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, the statements in Dr. Rosen’s quote and statements regarding: Arcus’s expectation that its cash, cash equivalents and marketable securities on-hand are sufficient to fund operations into 2026; the timing and scope of analyses, data disclosures and presentations; whether data and results from current studies support further development of a program;whether any of Arcus's investigational products will be first-to-market in a given indication; the potential drug-treatable population of any indications being pursued by Arcus's programs; the potential of AB521 to achieve substantially greater HIF-2a inhibition than the approved dose of the marketed competitor; selection of new development candidates, including the timeline for making a selection; the potency, efficacy or safety of Arcus’s investigational products; and the initiation of and associated timing for future studies. All forward-looking statements involve known and unknown risks and uncertainties and other important factors that may cause Arcus’s actual results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: risks associated with preliminary and interim data not being guarantees that future data will be similar; the unexpected emergence of adverse events or other undesirable side effects; difficulties or delays in initiating or conducting clinical trials due to difficulties or delays in the regulatory process, enrolling subjects or manufacturing or supplying product for such clinical trials; Arcus’s dependence on the collaboration with Gilead for the successful development and commercialization of its optioned molecules; difficulties associated with the management of the collaboration activities or expanded clinical programs; changes in the competitive landscape for Arcus’s programs; and the inherent uncertainty associated with pharmaceutical product development and clinical trials. Risks and uncertainties facing Arcus are described more fully in the "Risk Factors" section of Arcus's most recent Quarterly Report on Form 10Q filed with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this press release. Arcus disclaims any obligation or undertaking to update, supplement or revise any forward-looking statements contained in this press release except to the extent required by law.

The Arcus name and logo are trademarks of Arcus Biosciences, Inc. All other trademarks belong to their respective owners.

Investor Inquiries:

Pia Eaves

Head of Investor Relations & Strategy

(617) 459-2006

peaves@arcusbio.com

Media Inquiries:

Holli Kolkey

VP of Corporate Communications

(650) 922-1269

hkolkey@arcusbio.com

ARCUS BIOSCIENCES, INC.

Consolidated Statements of Operations

(unaudited)

(In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| License and development service revenue | $ | 22 | | | $ | 23 | | | $ | 58 | | | $ | 48 | |

| Other collaboration revenue | 10 | | | 10 | | | 28 | | | 30 | |

| Total revenues | 32 | | | 33 | | | 86 | | | 78 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 82 | | | 77 | | | 247 | | | 208 | |

| General and administrative | 30 | | | 26 | | | 88 | | | 76 | |

| Total operating expenses | 112 | | | 103 | | | 335 | | | 284 | |

| | | | | | | |

| Loss from operations | (80) | | | (70) | | | (249) | | | (206) | |

| | | | | | | |

| Non-operating income (expense): | | | | | | | |

| Interest and other income, net | 12 | | | 5 | | | 30 | | | 8 | |

| Effective interest on liability for sale of future royalties | (1) | | | — | | | (2) | | | (1) | |

| Total non-operating income, net | 11 | | | 5 | | | 28 | | | 7 | |

| | | | | | | |

| Net loss before income taxes | (69) | | | (65) | | | (221) | | | (199) | |

| | | | | | | |

| Income tax expense | (2) | | | — | | | (5) | | | (1) | |

| | | | | | | |

| Net loss | $ | (71) | | | $ | (65) | | | $ | (226) | | | $ | (200) | |

| | | | | | | |

| Net loss per share: | | | | | | | |

| Basic and diluted | $ | (0.94) | | | $ | (0.90) | | | $ | (3.07) | | | $ | (2.78) | |

| | | | | | | |

| Shares used to compute net loss per share: | | | | | | | |

| Basic and diluted | 74.6 | | 72.2 | | 73.6 | | 71.8 |

Selected Consolidated Balance Sheet Data

(unaudited)

(In millions)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Cash, cash equivalents and marketable securities | $ | 950 | | | $ | 1,138 | |

| Total assets | 1,191 | | | 1,345 | |

| Total liabilities | 671 | | | 688 | |

| Total stockholders’ equity | 520 | | | 657 | |

(1)Derived from the audited financial statements for the quarter ended December 31, 2022, included in the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 28, 2023.

###

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

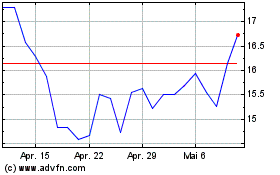

Arcus Biosciences (NYSE:RCUS)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Arcus Biosciences (NYSE:RCUS)

Historical Stock Chart

Von Mai 2023 bis Mai 2024