UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2021

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number 001-36353

A.Full title of the plan and the address of the plan, if different from that of the issuer named below:

Perrigo Company Profit-Sharing and Investment Plan

515 Eastern Avenue

Allegan, MI 49010

B.Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Perrigo Company plc

The Sharp Building

Hogan Place

Dublin 2, Ireland

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

Table of Contents

| | | | | | | | |

| | Page |

| | |

| | |

| Financial Statements | | |

| | |

| | |

| | |

| | |

| Supplemental Schedule | | |

| | |

| | |

| | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Perrigo Company Retirement Committee

Perrigo Company Profit-Sharing and Investment Plan

Allegan, MI

Opinion on the 2021 Financial Statements

We have audited the accompanying statement of net assets available for benefits of the Perrigo Company Profit-Sharing and Investment Plan (the “Plan”) as of December 31, 2021, the related 2021 statement of changes in net assets available for benefits for the year then ended, and the related notes (collectively, the financial statements).

In our opinion, these financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021, and the changes in net assets available for benefits for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s 2021 financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to Perrigo Company Profit-Sharing and Investment Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit of the 2021 financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit of the 2021 financial statements provide a reasonable basis for our opinion.

Supplemental Information

The accompanying December 31, 2021 supplemental schedule of assets (held at end of year) has been subjected to audit procedures performed in conjunction with our audit of the 2021 Perrigo Company Profit-Sharing and Investment Plan financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the 2021 financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in relation to the 2021 financial statements as a whole.

Report on the 2020 Financial Statements

The financial statements of Perrigo Company Profit-Sharing and Investment Plan, as of December 31, 2020 were audited by other auditors, whose report dated June 25, 2021 expressed an unqualified opinion on those statements.

\s\ Rehmann Robson, LLC

We have served as Perrigo Company Profit-Sharing and Investment Plan’s independent auditor since 2022.

Grand Rapids, Michigan

June 22, 2022

Report of Independent Registered Public Accounting Firm

To Plan Participants and

Perrigo Company Retirement Plan Committee of the

Perrigo Company Profit-Sharing and Investment Plan

Allegan, Michigan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Perrigo Company Profit-Sharing and Investment Plan (the “Plan”) as of December 31, 2020, and the related notes (collectively, the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by the Plan’s management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

\s\ BDO USA, LLP

We are uncertain as to the year we began serving consecutively as the auditor of the Plan’s financial statements; however, we are aware that we served as the Plan’s auditor consecutively from 2003 to 2021.

Grand Rapids, Michigan

June 25, 2021

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

| | | | | | | | | | | |

| STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS |

| December 31, |

| 2021 | | 2020 |

| Assets | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total investments, at fair value | $ | 1,002,631,657 | | | $ | 912,922,870 | |

| | | |

| Trades pending | 530,018 | | | (90,642) | |

| | | |

| Receivables: | | | |

| Accrued income and other | 22,297 | | | 21,832 | |

| Employer contributions | 12,757,035 | | | 12,960,666 | |

| Notes receivable from participants | 10,440,756 | | | 10,242,244 | |

| | | |

| | | |

| Total receivables | 23,220,088 | | | 23,224,742 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net assets available for benefits | $ | 1,026,381,763 | | | $ | 936,056,970 | |

The accompanying notes are an integral part of these Financial Statements.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

| | | | | | | |

| STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS |

| |

| Year ended December 31, 2021 | | |

| Additions to net assets attributed to | | | |

| Contributions: | | | |

| Participant | $ | 34,539,454 | | | |

| Rollover | 3,885,272 | | | |

| Employer | 24,551,721 | | | |

| Total contributions | 62,976,447 | | | |

| | | |

| Interest from notes receivable from participants | 491,466 | | | |

| | | |

| Investment income: | | | |

| Net appreciation in fair value of investments | 97,879,739 | | | |

| Interest, dividends and other | 19,446,697 | | | |

| Total investment income | 117,326,436 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total Additions | 180,794,349 | | | |

| | | |

| | | |

| Deductions | | | |

| Distribution of benefits to participants | 89,869,955 | | | |

| | | |

| Administrative fees | 599,601 | | | |

| Total Deductions | 90,469,556 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net Increase | 90,324,793 | | | |

| | | |

| Net Assets Available for Benefits, beginning of year | 936,056,970 | | | |

| | | |

| Net Assets Available for Benefits, end of year | $ | 1,026,381,763 | | | |

The accompanying notes are an integral part of these Financial Statements.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

______________________________________________________________________________________________________

1. Plan Description

The following description of the Perrigo Company Profit-Sharing and Investment Plan (the "Plan") provides only general information. Participants should refer to the Plan document or Plan summary for a more complete description of the Plan's provisions.

General

The Plan Sponsor is Perrigo Company. The Plan is a defined contribution plan in which substantially all U.S. employees of Perrigo Company and certain of it’s domestic related companies (collectively, the "Company" or "Employer") are eligible to participate. The Company acquired the oral care assets of High Ridge Brands during the 2020 Plan year and employees became eligible to participate in the Plan effective April 1, 2020. Additionally, the Company completed the sale of its prescription RX pharmaceuticals business in the 2021 Plan year. Eligible impacted employees had the option to retain their accrued benefits and loans outstanding under the Plan or to roll them over to the acquiring entity's plan.

The minimum term of service for employees to participate in the elective deferral and matching contribution components of the Plan is one month of service, which means a consecutive 30-day period of employment beginning with the employee's date of hire. There is no minimum term of service for employees to participate in the Employer nonelective and discretionary contribution components of the Plan. Plan entry dates are at the beginning of each payroll period after the minimum term requirements (if applicable) are satisfied.

The Plan has an automatic enrollment feature for new hires that begins with an initial pre-tax contribution rate of 4% of a participant's eligible compensation, as defined in the Plan document, and is invested in the Plan's Qualified Default Investment Alternative, unless the participant has affirmatively elected another investment from among the Plan's investment options. Automatic enrollment occurs on or around the date that the employee becomes eligible to participate, as defined above. The automatic enrollment percentage increases annually by 1% up to a maximum deferral percentage of 10%. Prior to automatic enrollment and at any other time, employees may elect to opt out from participating in the Plan, or they may elect to defer more or less than the 4% automatic elective deferral as well as choose their own investment allocations offered by the Plan.

The Plan conforms to the safe harbor provisions of Sections 401(k) and 401(m) of the Internal Revenue Code ("IRC"). The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). The Plan is administered by the Retirement Plan Committee (the "Committee").

Contributions

A participant may elect to defer, in whole percentages, an amount between 1% and 50% of eligible compensation, not to exceed Internal Revenue Service ("IRS") limitations for the Plan year. The total IRS limit was $19,500 for the 2021 Plan year. In addition, participants who are at least 50 years of age by the end of a Plan year may elect to make an additional "catch up" contribution, not to exceed the IRS limit of $6,500 for the 2021 Plan year. Participants may also make a Roth contribution on an after-tax basis. Additionally, participants may make contributions to a traditional after-tax source between 1% and 4% of eligible compensation.

Effective January 1, 2017, participants are no longer permitted to invest more than 20% of their total account balance in the Perrigo Company Stock Fund, which holds the Perrigo Company plc ordinary shares.

•If more than 20% of a participant's account was invested in the Perrigo Company Stock Fund as of January 1, 2017, the amount in excess of the 20% limit was grandfathered in and allowed to remain invested in the Perrigo Company Stock Fund.

•Upon initial enrollment in the Plan, participants may direct no more than 20% of their account to be invested in the Perrigo Company Stock Fund.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

______________________________________________________________________________________________________

•Future allocation changes and exchanges into the Perrigo Company Stock Fund are limited to 20% of each participant's account.

•Rollovers are not permitted directly into the Perrigo Company Stock Fund.

•Any future contributions and/or loan repayments that would exceed the Plan's 20% limit on investment to the Perrigo Company Stock Fund will be redirected to the Plan's Qualified Default Investment Alternative, which is the Retirement Choice Portfolio Moderate as of December 31, 2021.

The Company matches pre-tax and Roth employee contributions per Plan year at the rate of 100% of the first 2% of employee contributions and 50% of the next 2% of employee contributions. Matching contributions are effective upon meeting the 30-day service requirement and participation in the Plan. The Company has the right under the Plan to reduce or suspend such contributions at any time. After-tax contributions are not eligible for a Company match.

In accordance with the safe harbor provisions, the Plan includes an annual Employer nonelective contribution of 3% of an employee's eligible compensation, as defined in the Plan document. In addition, the Company may make a discretionary contribution at the option of the Board of Directors of Perrigo. Employees are eligible as of their date of hire to receive both the Employer nonelective and discretionary contributions, which are deposited in the eligible employee's investment account after the end of each Plan year. The Employer nonelective and discretionary contribution amounts approved for the 2021 Plan year was $12,557,804, which is included in the employer contribution receivable on the statements of net assets available for benefits for the year ended December 31, 2021.

Participant Accounts

Each participant's account is credited with the participant's contributions, allocations of Employer matching, Employer discretionary and nonelective profit-sharing contributions, and Plan earnings. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account. As of December 31, 2021, the Plan offers mutual funds, common collective trusts, a money market fund, and Perrigo's ordinary shares as investment options for Plan participants. Participants elect which of these investment options meet their risk and return objectives.

Vesting

Amounts credited to a participant's investment account relating to participant contributions and Employer matching and profit-sharing contributions are 100% vested at all times.

Notes Receivable from Participants

Participants may borrow from their investment accounts, as defined in the Plan document, a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their account balance. The loans are secured by an equivalent amount in the remaining portion of the participant's accounts. All loans must be repaid within five years, except for loans used to acquire or rehabilitate a principal residence, which must be repaid within 10 years. Interest rates ranged from 4.25% to 9% on outstanding loans at December 31, 2021. The loans are repaid ratably through payroll deductions. Participant loans are valued at their unpaid principal balance plus any accrued but unpaid interest. The interest earned on participant loans is allocated to the respective funds in accordance with participant elections.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

______________________________________________________________________________________________________

Withdrawals

Subject to certain restrictions as set forth in the Plan document, a participant may make a hardship withdrawal from his or her account balance during employment. This hardship withdrawal is subject to a 10% federal income tax penalty if the participant is below the age of 591/2. A participant may also elect to make a withdrawal, provided that the participant has reached 591/2 years of age, even if the participant is still employed. Other in-service withdrawal rights include the ability to withdraw rollover contributions, after-tax contributions, and elective transfer contributions at any time, as well as the right to request a qualified reservist distribution or a deemed severance withdrawal under the Heroes Earnings Assistance and Relief Tax Act of 2008 (the HEART Act).

Payment of Benefits

Upon termination of service, participants may elect to receive a lump-sum amount equal to the value of their vested account, installments or a partial payment. Participants may also elect to roll over their account balance into another qualified retirement plan, or postpone distributions until such time they are required. If no action is taken at the time of separation, vested account balances of $1,000 or less are distributed to the participant, and vested account balances between $1,000 and $5,000 are rolled into an IRA established for the participant.

Forfeitures

There were no forfeited non-vested amounts in the 2021 Plan year.

Administrative Expenses

The Company pays the administrative costs of the Plan associated with any professional services provided to the Plan and the cost of communications to the participants. Administrative expenses, such as loan administration and some withdrawal fees, are deducted directly from the participants' accounts.

Concentration of Investments

Investments at December 31, 2021 and 2020 included Perrigo ordinary shares amounting to 332,078 shares totaling $12,917,846 and 350,022 shares totaling $15,652,968, respectively. This investment represented approximately 1% of total investments at December 31, 2021 and 2020. The quoted market value of Perrigo ordinary shares decreased by 13% from December 31, 2020 to December 31, 2021.

Risks and Uncertainties

Participants in the Plan invest in various investment securities. Investment securities, including Perrigo's ordinary shares, are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the financial statements.

In March, 2020, the World Health Organization declared the novel coronavirus (COVID-19) a global pandemic. This pandemic has affected global economic activity and contributed to instability in financial markets. The situation surrounding COVID-19 remains fluid due to changes in cases, strains, restrictions and other uncertainties. It is possible the COVID-19 pandemic could result in adverse impacts in the future. Plan management cannot reasonably estimate the full impact the COVID-19 pandemic could have on the Plan.

On March 27, 2020 the CARES Act was enacted and signed into law as part of the response to the COVID-19 global pandemic. As permitted by the CARES Act, the Plan adopted a provision that allows employees impacted by the COVID-19 pandemic (qualified individuals) to delay loan repayments due from March 27, 2020 to December 31, 2020 for up to one year. General loan payment relief was also available on new and existing participant loans through July 15, 2020. In addition, participants could request that their

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

______________________________________________________________________________________________________

required minimum distributions from the Plan for 2020 be suspended. The Plan has not adopted any other provision as permitted by the CARES Act.

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP").

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of net assets and changes therein. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Investment purchases and sales are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded on the ex-dividend date. Capital gain distributions are included in dividend income. Net appreciation includes the Plan's gains and losses on investments bought and sold as well as held during the year. The Plan's investments are stated at fair value. See Note 4 for a discussion of fair value measurements.

Payment of Benefits

Distributions of benefits are recorded when paid.

3. Assets in Trust Fund

Vanguard Fiduciary Trust Company ("Vanguard") is the Plan's Trustee. The Trustee manages the trust fund on behalf of the Plan. The Trustee has no discretionary investment authority over the investment options made available to participants under the Plan, including the investments in Perrigo's ordinary shares. Each participant is entitled to exercise voting rights attributable to the Perrigo ordinary shares allocated to his or her account and is notified by the Trustee prior to the time such rights are to be exercised. The Trustee is not permitted to vote any allocated shares for which instructions have not been given by a participant. The Trustee is required, however, to vote any unallocated shares on behalf of the collective best interest of Plan participants and beneficiaries.

4. Investments

The Plan's investments are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date.

Inputs to valuation techniques refer to the assumptions that market participants would use in pricing the asset. The Plan utilizes a fair value hierarchy for valuation inputs that gives the highest priority to quoted prices in active markets for identical assets (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). A financial instrument's level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. The three levels of the fair value hierarchy are described as follows:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices for identical assets in active markets.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

______________________________________________________________________________________________________

Level 2 - Inputs to the valuation methodology include quoted prices for similar assets in active markets, quoted prices for identical or similar assets in inactive markets, other inputs that are observable or can be corroborated by observable market data.

Level 3 - Inputs to the valuation methodology are both significant to the fair value measurement and unobservable.

The following valuation methodologies were used to measure the fair value of the Plan's investments:

Mutual funds and money market fund: Valued at quoted market prices on an exchange and in active markets, which represent the net asset values (“NAV”) of shares held by the Plan and are classified as Level 1 investments. Mutual funds held by the Plan are open-ended mutual funds that are registered with the SEC. Shares held in money market funds are comprised of debt securities that are structured to maintain a value of $1 per share.

Common collective trusts: Valued based on the year-end unit NAV. The NAV is used as a practical expedient to estimate fair value. Unit values are determined by the issuer or third party administrator by dividing the fair values of the total net assets at year-end by the outstanding units. Were the Plan to initiate a significant redemption of the collective trust, a notification period is required and investment advisers may reserve the right to temporarily delay withdrawal from the trust in order to ensure the securities liquidations will be carried out in an orderly business manner. The funds held by the Plan have no unfunded commitments or notice period requirement for participants.

Perrigo Company plc ordinary shares: Valued at the closing price reported on the active market on which the security is traded and is classified as a Level 1 investment.

The Plan's valuation methods may result in a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Although Plan management believes the valuation methods are appropriate and consistent with the market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

There were no transfers between Level 1, 2, and 3 investments during the 2021 and 2020 Plan years. Two common collective trusts (Harbor Capital Appreciation CIT; Class 4 and Schroder International Multi-Cap Equity Trust; Class 1) were added during the 2021 plan year which replaced two mutual fund which were removed during the 2021 plan year (Harbor Capital Appreciation Fund; Institutional Class and Hartford Schrodes International Multi-Cap Value Fund Class SDR). Participants funds were automatically transferred at the time the new investment options were added to the Plan.

The tables below set forth by level within the fair value hierarchy the Plan's investments.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| December 31, 2021 | | Level 1 | | NAV (1) | | Total | | | | | | |

| | | | | | | | | | | | |

| Mutual funds | | $ | 786,483,790 | | | $ | — | | | $ | 786,483,790 | | | | | | | |

| Common collective trusts | | — | | | 159,458,723 | | | 159,458,723 | | | | | | | |

| Perrigo Company plc ordinary shares | | 12,917,846 | | | — | | | 12,917,846 | | | | | | | |

| Money market fund | | 43,771,298 | | | — | | | 43,771,298 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Investments, at fair value | | $ | 843,172,934 | | | $ | 159,458,723 | | | $ | 1,002,631,657 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| December 31, 2020 | | Level 1 | | NAV (1) | | Total | | | | | | |

| | | | | | | | | | | | |

| Mutual funds | | $ | 848,518,115 | | | $ | — | | | $ | 848,518,115 | | | | | | | |

| | | | | | | | | | | | |

| Perrigo Company plc ordinary shares | | 15,652,968 | | | — | | | 15,652,968 | | | | | | | |

| Money market fund | | 48,751,787 | | | — | | | 48,751,787 | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Investments, at fair value | | $ | 912,922,870 | | | $ | — | | | $ | 912,922,870 | | | | | | | |

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

NOTES TO FINANCIAL STATEMENTS

______________________________________________________________________________________________________

(1) Assets are measured at the NAV (or its equivalent) on a non-active market and therefore have not been classified in the fair value hierarchy.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. Plan management evaluates the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to total net assets available for benefits.

5. Related Party Transactions

The trustee of the Plan, Vanguard, manages investments in its sponsored funds and, therefore, is deemed a party-in-interest and a related party. Fees paid to Vanguard were $599,601 in 2021, exclusive of $29,050 of loan origination fees collected on behalf of participants. The Plan also invests in Perrigo ordinary shares, therefore these transactions qualify as party-in-interest transactions. Cash dividends of $323,810 were paid to the Plan by the Company during 2021 related to shares held by the Plan on the dividend record dates. These dividends are included as dividend income in the statement of changes in net assets available for benefits.

6. Plan Termination

Although the Company has not expressed any intent to do so, it has the right to reduce or suspend contributions at any time and to terminate the Plan, subject to the provisions of ERISA.

7. Income Tax Status

Effective January 1, 2021, the Plan was amended and restated on a volume submitter plan document sponsored by Vanguard. Vanguard received an advisory letter from the IRS, dated June 30, 2020, which states that the volume submitter document satisfies the applicable provisions of the IRC. The Plan itself has not received a determination letter from the IRS. However, the Committee and the Plan’s tax counsel believe that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC, and therefore believe the Plan is qualified and the related trust is tax-exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. As of December 31, 2021, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Committee believes the Plan is no longer subject to income tax examinations for years prior to 2018.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

SCHEDULE H, LINE 4i - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

December 31, 2021

EIN: 38-2799573

Plan Number: 003 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | |

| (a) | | (b)

Identity of Issue, Borrower, Lessor or Similar Party | | (c)

Description of Investment, including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value | | (d)

Cost | | (e)

Current

Value | |

| | | | | | | | | |

| | Money market fund | | | | | | | | |

| * | | Vanguard Federal Money Market Fund | | 43,771,298 | | shares | | ** | | $ | 43,771,298 | | |

| | | | | | | | | | |

| | Mutual funds | | | | | | | | |

| 0 | | Baird Core Plus Bond Fund; Institutional Class | | 12,094,681 | | shares | | ** | | 141,144,926 | | |

| | | | | | | | | | |

| | MFS Int'l Growth Fund; Class R6 | | 854,303 | | shares | | ** | | 37,290,299 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Neuberger Berman Genesis Fund; Class R6 | | 890,727 | | shares | | ** | | 66,572,924 | | |

| | | | | | | | | | |

| | PIMCO Global Bond Opportunities Fund (Unhedged); Instl CL | | 2,241,118 | | shares | | ** | | 19,789,073 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| * | | Vanguard Equity Income Fund Admiral Shares | | 848,161 | | shares | | ** | | 78,217,371 | | |

| * | | Vanguard Extended Market Index Fund: Inst'l Shares | | 511,245 | | shares | | ** | | 70,904,515 | | |

| * | | Vanguard Inflation-Protected Securities Fund; Inst'l Shares | | 1,143,105 | | shares | | ** | | 13,248,581 | | |

| * | | Vanguard Institutional Index Fund Inst'l Plus Shares | | 533,373 | | shares | | ** | | 216,442,958 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| * | | Vanguard Total Bond Market Index Fund; Inst'l Shares | | 3,206,512 | | shares | | ** | | 35,880,869 | | |

| * | | Vanguard Total International Stock Index Fund; Inst'l Shares | | 782,281 | | shares | | ** | | 106,992,274 | | |

| | Total mutual funds | | | | | | | 786,483,790 | | |

| | | | | | | | | | |

| | Common collective trusts | | | | | | | | |

| | Harbor Capital Appreciation CIT; Class 4 | | 8,119,767 | | shares | | ** | | 114,894,701 | | |

| | Schroder International Multi-Cap Equity Trust; Class 1 | | 3,027,447 | | shares | | ** | | 44,564,022 | | |

| | Total common collective trusts | | | | | | | 159,458,723 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Common stock | | | | | | | | |

| * | | Perrigo Company plc ordinary shares | | 332,078 | | shares | | ** | | 12,917,846 | | |

| | Total investments | | | | | | | 1,002,631,657 | | |

| | | | | | | | | | |

| * | | Participant loans*** | | Various maturity dates, with interest rates ranging from 4.25% to 9%; collateralized by participant account balances | | — | | 10,440,756 | | |

| | | | | | | | | | |

| | Total | | | | | | | $ | 1,013,072,413 | | |

* A party-in-interest as defined by ERISA.

** The cost of participant-directed investments is not required to be disclosed.

*** Inclusive of outstanding deemed distributions.

PERRIGO COMPANY PROFIT-SHARING AND INVESTMENT PLAN

EXHIBIT INDEX

Exhibit Number Description

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | Perrigo Company Profit-Sharing and Investment Plan |

| | | (Name of Plan) | | |

| | | | | |

| | | | | |

| | | | | |

| Date | June 22, 2022 | | /s/ Eduardo Bezerra |

| | | Eduardo Bezerra |

| | | Chief Financial Officer |

| | | Perrigo Company plc |

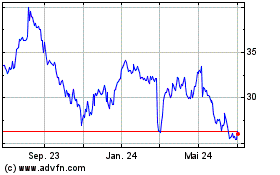

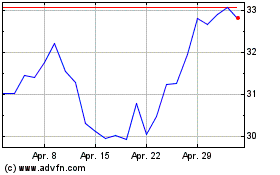

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024