SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

(Commission File No. 1-03006)

PLDT Inc.

(Translation of registrant’s name into English)

Ramon Cojuangco Building

Makati Avenue

Makati City

Philippines

(Address of registrant’s principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.)

Form 20-F Form 40-F

(Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____)

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some information in this report may contain forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934. We have based these forward-looking statements on our current beliefs, expectations and intentions as to facts, actions and events that will or may occur in the future. Such statements generally are identified by forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” “will” or other similar words.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We have chosen these assumptions or bases in good faith. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information – Risk Factors” in our annual report on Form 20-F for the fiscal year ended December 31, 2022. You should also keep in mind that any forward-looking statement made by us in this report or elsewhere speaks only as at the date on which we made it. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or how they may affect us. We have no duty to, and do not intend to, update or revise the statements in this report after the date hereof. In light of these risks and uncertainties, you should keep in mind that actual results may differ materially from any forward-looking statement made in this report or elsewhere.

EXHIBIT INDEX

Exhibit Number Page

Copies of the disclosure letters that PLDT Inc. (the “Company”) filed on March 7, 2024 with the Philippine Stock Exchange, the Philippine Securities and Exchange Commission, and the Philippine Dealing and Exchange Corporation in connection with the following:

(a)the declaration by the Company’s Board of Directors of a regular cash dividend of ₱46.00 per outstanding share of Company’s Common Stock, payable on April 5, 2024, to the holders of record of said stock at the close of business on March 21, 2024.

The cash dividend was declared out of the unaudited

unrestricted retained earnings of the Company as at

December 31, 2023, which are sufficient to cover the

total amount of the dividend declared; and

(b) the press release on the unaudited consolidated

financial results of the Company as at and for the

year ended December 31, 2023.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly authorized and caused this report to be signed on its behalf by the undersigned.

|

|

|

|

PLDT Inc. |

|

|

|

By: |

/s/Mark David P. Martinez |

Name: |

Mark David P. Martinez |

Title: |

Assistant Corporate Secretary |

Date: March 7, 2024

Exhibit 99.1

EXHIBITS

|

|

|

Exhibit Number |

|

Page |

99.1 |

Copies of the disclosure letters that PLDT Inc. (the “Company”) filed on March 7, 2024 with the Philippine Stock Exchange, the Philippine Securities and Exchange Commission, and the Philippine Dealing and Exchange Corporation in connection with the following: (a)the declaration by the Company’s Board of Directors of a regular cash dividend of ₱46.00 per outstanding share of Company’s Common Stock, payable on April 5, 2024, to the holders of record of said stock at the close of business on March 21, 2024. (b)the press release on the unaudited consolidated financial results of the Company as at and for the year ended December 31, 2023. The cash dividend was declared out of the unaudited unrestricted retained earnings of the Company as at December 31, 2023, which are sufficient to cover the total amount of the dividend declared; and |

|

March 7, 2024

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Ms. Alexandra D. Tom Wong

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Mr. Vicente Graciano P. Felizmenio, Jr.

Director – Markets and Securities Regulation Department

Philippine Dealing & Exchange Corporation

29th Floor, BDO Equitable Tower

8751 Paseo de Roxas, Makati City 1226

Attention: Mr. Antonino A. Nakpil

President and Chief Executive Officer

Gentlemen:

In compliance with Section 17.1 (b) of the Securities Regulation Code and SRC Rule 17.1.1.1.3(b).2, we submit herewith a copy of SEC Form 17-C regarding the declaration of a regular cash dividend on all outstanding shares of Common Stock of PLDT Inc.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,392 As of January 31, 2024 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5. PHILIPPINES 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 82500254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 4 (Election or Appointment of Director or Officer)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on March 7, 2024, the Board declared a regular cash dividend of ₱46.00 per outstanding share of Company’s Common Stock, payable on April 5, 2024, to the holders of record of said stock at the close of business on March 21, 2024.

The cash dividend was declared out of the unaudited unrestricted retained earnings of the Company as at December 31, 2023, which are sufficient to cover the total amount of the dividend declared.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT INC.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

March 7, 2024

March 7, 2024

The Philippine Stock Exchange, Inc.

6/F Philippine Stock Exchange Tower

28th Street corner 5th Avenue

Bonifacio Global City, Taguig City

Attention: Ms. Alexandra D. Tom Wong

Officer-in-Charge – Disclosure Department

Securities & Exchange Commission

7907 Makati Avenue, Salcedo Village,

Barangay Bel-Air, Makati City

Attention: Mr. Vicente Graciano P. Felizmenio, Jr.

Director – Markets and Securities Regulation Department

Philippine Dealing & Exchange Corporation

29th Floor, BDO Equitable Tower

8751 Paseo de Roxas, Makati City 1226

Attention: Mr. Antonino A. Nakpil

President and Chief Executive Officer

Gentlemen:

In compliance with the PSE’s Revised Disclosure Rules, we submit herewith the press release of PLDT Inc. (the “Company”) in connection with the Company’s unaudited consolidated financial results as at and for the year ended December 31, 2023.

This submission shall also serve as our compliance with Section 17.1 of the Securities Regulation Code regarding the filing of reports on significant developments.

Very truly yours,

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

PLDT Inc.

COVER SHEET

|

|

|

|

|

|

|

|

|

|

|

SEC Registration Number |

P |

W |

- |

5 |

5 |

|

|

|

|

|

|

Company Name

Principal Office (No./Street/Barangay/City/Town/Province)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

A |

M |

O |

N |

|

C |

O |

J |

U |

A |

N |

G |

C |

O |

|

B |

U |

I |

L |

D |

I |

N |

G |

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

A |

V |

E |

N |

U |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

A |

K |

A |

T |

I |

|

C |

I |

T |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Type |

|

|

|

Department requiring the report |

|

|

|

Secondary License Type, If Applicable |

|

|

17 |

- |

C |

|

|

|

|

|

|

|

|

M |

S |

R |

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPANY INFORMATION

|

|

|

|

|

|

|

|

Company’s Email Address |

|

Company’s Telephone Number/s |

|

Mobile Number |

|

|

|

|

88168553 |

|

|

|

|

|

|

|

|

|

|

|

No. of Stockholders |

|

Annual Meeting

Month/Day |

|

Fiscal Year

Month/Day |

|

|

11,392 As of January 31, 2024 |

|

Every 2nd Tuesday of June |

|

December 31 |

|

CONTACT PERSON INFORMATION

The designated contact person MUST be an Officer of the Corporation

|

|

|

|

|

|

|

Name of Contact Person |

|

Email Address |

|

Telephone Number/s |

|

Mobile Number |

Marilyn A. Victorio-Aquino |

|

mvaquino@pldt.com.ph |

|

82500254 |

|

|

|

Contact Person’s Address |

MGO Building, Legaspi St. corner Dela Rosa St., Makati City |

Note: In case of death, resignation or cessation of office of the officer designated as contact person, such incident shall be reported to the Commission within thirty (30) calendar days from the occurrence thereof with information and complete contact details of the new contact person designated.

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE

AND SRC RULE 17.1

Date of Report (Date of earliest event reported)

2.SEC Identification Number PW-55

3.BIR Tax Identification No. 000-488-793

Exact name of issuer as specified in its charter

5. Philippines 6.____________ (SEC Use Only)

Province, country or other jurisdiction Industry Classification Code

of Incorporation

7. Ramon Cojuangco Building, Makati Avenue, Makati City 1200

Address of principal office Postal Code

8. (632) 8250-0254

Issuer's telephone number, including area code

9. Not Applicable

Former name or former address, if changed since last report

10.Securities registered pursuant to Sections 8 and 12 of the Securities Regulation Code and Sections 4 and 8 of the Revised Securities Act

|

|

Title of Each Class |

Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding |

________________________________________________________________

________________________________________________________________

________________________________________________________________

11. Item 9 (Other Events)

We disclose that at the meeting of the Board of Directors of PLDT Inc. (respectively, the “Board” and the “Company”) held on March 7, 2024, the Board approved the Company’s unaudited consolidated financial statements as at and for the year ended December 31, 2023.

A copy of the press release is attached herewith.

Pursuant to the requirements of the Securities Regulation Code, the Company has duly authorized and caused this report to be signed on its behalf by the undersigned.

PLDT Inc.

By:

/s/Mark David P. Martinez

Mark David P. Martinez

Assistant Corporate Secretary

March 7, 2024

GROSS SERVICE REVENUES ROSE BY 3% TO ₱201.8B

NET SERVICE REVENUES REACH ₱191.4B IN 2023—ANOTHER HISTORIC HIGH EXCLUDING LEGACY BUSINESSES, DATA NET SERVICE REVENUES WERE UP BY 6%

EXPENSES LOWER BY 2% OR ₱1.5B

FROM BROAD-BASED COST MANAGEMENT

EBITDA ROSE TO RECORD HIGH ₱104.3B IN 2023

FY23 MARGIN EXPANDED TO 52%

TELCO CORE INCOME UP 3% TO ₱34.3B, AHEAD OF 2023 GUIDANCE

DATA AND BROADBAND UP 4% TO ₱157.6B —

82% OF CONSOLIDATED SERVICE REVENUES

FIBER-ONLY REVENUES GREW 9% TO ALL-TIME HIGH ₱53B –

88% OF TOTAL HOME REVENUES, NET ADDS 234K FOR FY 2023

ENTERPRISE REVENUES AT RECORD-HIGH OF ₱47.1B

DRIVEN BY EXPANSION IN CORPORATE DATA AND ICT BUSINESS

WIRELESS CONSUMER MOBILE DATA REVENUES UP BY 6% to ₱71.1B

DATA NOW 87% OF WIRELESS BUSINESS

ACTIVE DATA USERS GREW TO 39.0M

SMART AHEAD OF COMPETITION WITH 57.8M MOBILE SUBSCRIBERS,

TNT LEADING SIM BRAND AS OF YEAR-END 2023

CAPEX AT ₱85.1B IN 2023, LOWER BY ₱11.7B IN 2022

FINAL REGULAR DIVIDENDS OF ₱46 PER SHARE

TOTAL DIVIDENDS OF ₱95 FOR 2023

EFFECTIVE PAYOUT OF 60% OF TELCO CORE INCOME

PLDT FURTHER STRENGTHENS SUSTAINABILITY IN OPERATIONS

₱1.0B GREEN LOAN FACILITY SECURED FOR FIBER UPGRADE

MANILA, Philippines 7th March 2024 – Notwithstanding an increasingly difficult macro-economic landscape, PLDT Inc. (PLDT) (PSE: TEL) (NYSE: PHI) today announced that its Gross Service Revenues grew by 3% or ₱6.5 billion to ₱201.8 billion, while Consolidated Service Revenues (net of interconnect costs) grew by 1% or ₱2.2 billion to

a record ₱191.4 billion in 2023. Excluding revenues from legacy businesses, data and data-related net services revenues were higher by 6% year-on-year.

Data and broadband, which grew by 4% or ₱5.9 billion to ₱157.6 billion, contributed 82% of consolidated service revenues.

“PLDT is aiming not just for higher profits but to return PLDT and Smart to their premier positions, where they rightfully belong. This requires a commitment to excellence all around—encompassing the quality of our network, the efficiency of our installations and repairs, the innovations we pursue and the speed of our services,” said Manuel V Pangilinan, PLDT and Smart Chairman and CEO.

Consolidated EBITDA grew by 4%, or ₱3.7 billion, year-on-year to a record ₱104.3 billion in 2023, also an all-time high, resulting from higher revenues and lower opex. EBITDA margin was at 52% for the period.

Telco Core Income, excluding the impact of asset sales and Maya Innovations Holdings (formerly Voyager Innovations Holdings), reached ₱34.3 billion, up 3%, or ₱1 billion, from the previous year, ahead of guidance.

Reported Net Income grew by 154% to ₱26.6 billion in 2023 from last year.

Consolidated Net Debt as of end-December amounted to ₱239.8 billion; Net Debt-to-EBITDA stood at 2.30x. Gross Debt stood at ₱256.9 billion, with maturities well spread out. Only 16% of Gross Debt is denominated in U.S. dollars and 5% is unhedged. PLDT credit ratings from Moody’s and S&P Global remained at investment grade.

In line with PLDT’s dividend policy of paying out 60% of core earnings, a final cash dividend of ₱46 per share will be paid out on April 5 to shareholders on record as of March 21. An interim dividend of ₱49 per share was paid in September 2023, bringing total dividends declared from 2023 earnings to ₱95 per share. Based on the closing share price of ₱1,279 on the last trading day of 2023, dividend yield stood at 7.4%.

In 2023, PLDT and Smart clinched Company of the Year at the 20th Quill Awards and 59th Anvil Awards. The Quill recognition is a back-to-back win, given by the International Association of Business Communicators Philippines. PLDT Group meanwhile sustained its recognition at the Anvils for a fourth year in a row. PLDT was also among six Philippine companies cited in TIME Magazine’s World’s Best Companies 2023, where it scored highest in sustainability. For maintaining the highest ethical standards and best corporate governance practices, PLDT again garnered the 3-Golden Arrow Award at the ASEAN Corporate Governance Scorecard organized by the Institute of Corporate Directors. PLDT also received a “Leader” status in the 2023 Children’s Rights and Business Benchmark by the Global Child Forum, which has been assessing companies on how well they address children’s rights in their operations.

Home: Fiber continues to deliver quarter-on-quarter revenue growth

PLDT Home’s fiber-only service revenues continued to grow, registering a 9% or ₱4.5 billion increase, to a record ₱53.0 billion in 2023. Fiber-only revenues accounted for 88% of total Home revenues of ₱60.4 billion.

Total fiber subscribers as of end-2023 stood at 3.2 million, with 234,000 fiber net additions for the year.

Recently, PLDT started rolling out next generation fiber technology, with the first commercial deployment of XGS-PON in the Philippines. This brings ultra-fast Gigabit Fiber plans to PLDT Home customers, with speeds ranging from 1 Gbps to 10 Gbps, on par with developed countries like the US, South Korea and Singapore. This groundbreaking Fiber broadband service ushers in a new era of connectivity that gives customers an unmatched digital experience, with internet speeds of up to 100 times faster than the average 100 Mbps connection at home.

PLDT Home just announced a pioneering innovation that capitalizes on the robustness of the group's fixed and mobile networks. A first in the industry, the new Always-On broadband service delivers uninterrupted connectivity for PLDT Home customers. By leveraging on PLDT’s fastest fixed infrastructure and Smart’s robust wireless network, this innovation provides a seamless, ultra high-speed connection ensuring customers 24/7 access for work, study, or entertainment.

Enterprise: Corporate data and ICT, support growth

PLDT Group’s B2B arm, PLDT Enterprise, reached a record ₱47.1 billion in net service revenues, driven by an expansion in its dynamic ICT business and core data revenues. PLDT Enterprise maintained its market leadership, reinforcing the company’s ambition to being the trusted digital transformation partner of businesses.

Through ePLDT and VITRO Inc., its ICT and data center arms, PLDT Enterprise continued its growth momentum in data centers and multi-cloud services. VITRO Inc. maintains the largest network of data centers in the Philippines, with 10 state-of-the-art facilities located in key locations nationwide. Set to go live in July 2024, VITRO Sta. Rosa (VSR) in Sta. Rosa, Laguna will be the country’s largest and first true hyperscaler data center. With 4,500 racks and 50MW power capacity, VSR will double VITRO Inc.’s ultimate facility capacity to about 100 MW, cementing its Philippine market leadership and the country’s position to be the next data center hub in Asia Pacific.

In support of the Government’s Cloud-First Policy, ePLDT launched Pilipinas Cloud, the Philippines’ first sovereign cloud, to host and secure highly sensitive government data and applications. This cloud infrastructure is envisioned to enhance the delivery of Government services.

On the other hand, PLDT Enterprise's Internet of Things (IoT) business has experienced substantial growth, with over 200,000 new additions to its IoT platform, marking a milestone as the first IoT Connectivity platform in the Philippines. Notably, PLDT Enterprise has forged partnerships and implemented customized solutions across various sectors such as automotive, retail, logistics, and utilities, bolstering its position as a key player in data-driven technologies.

PLDT Global, the global arm of the PLDT Group, identified its fifth global point-of-presence in Guam and has signed a partnership agreement with GTA Teleguam (GTA), Guam's primary telecommunications company, for this initiative. Furthermore, PLDT Global introduced its Virtual Points-of-Presence service, empowering customers to optimize their existing IEPL subscriptions with PLDT across significant global hubs. PLDT Global’s Virtual Points-of-Presence extends the network reach of customers to markets across Australia, Taiwan, South Korea, Indonesia, Vietnam, and Europe.

Individual Wireless: Sustained quarterly growth in 2023 signals recovery

PLDT’s Individual Wireless segment posted revenues of ₱81.8 billion in 2023, higher year-on-year by 2% or ₱1.5 billion, as mobile data revenues grew by 6% to ₱71.1 billion for the period, driven by an 11% year-on-year increase in mobile data traffic to 4,898 Petabytes.

Year-on-year, the fourth quarter posted a ₱1.2 billion or 6% growth.

Wireless Consumer Mobile Data revenues now account for 87% of total Individual Wireless revenues, with active data users growing to 39.0 million. Average data usage per sub grew 19% to 11GB from 2022.

Driving this increase in data usage are Smart’s long-validity offers, higher velocity top-up products, and the recently launched eSIMs.

Smart also recently announced a collaboration with Google Cloud, becoming one of the first mobile operators in the world to deploy Telecom Subscriber Insights, Google Cloud's AI-powered solution that will enable Smart’s subscribers to access and engage with relevant offers as needed.

As of the end of 2023, Smart had registered 57.8 million mobile subscribers.

Network: the Philippines’ most extensive fiber footprint

The PLDT Group has further expanded its total fiber footprint to over 1.1 million cable kilometers, consisting of over 0.9 million cable kilometers of domestic fiber and more than 200,000 cable kilometers of international fiber as of end-2023. Homes passed reached more than 17.5 million in 70% of the country’s towns and 91% of municipalities.

PLDT’s fiber infrastructure supports Smart’s over 74,000 base stations deployed nationwide. Smart’s combined 5G/4G/3G network covers around 97% of the population.

Capex for 2023 amounted to ₱85.1 billion, lower than the ₱96.8 billion for the same period last year. Capex intensity ratio (capex as a percentage of revenues) was at 42%, versus 50% last year.

For 2024, Capex is anticipated to land at a range of ₱75-78 billion—a decline in Capex spend for the second year in a row. This is in line with the goal of reducing capex spend in the near- to medium-term, and attaining positive free cash flow position as soon as practicable.

Maya: Unique Ecosystem Drives Growth

Maya, the #1 Fintech platform in the Philippines powered by the #1 Digital Bank and #1 Payment Processor, continues to deliver significant growth and cement its leadership position. This was achieved on the back of innovative banking services delivered to its payment customer base of consumers and enterprises.

Maya enables high-engagement banking by integrating consumer payments with the bank account and, as a result, is able to offer interest rates up to 15% p.a. on savings accounts for consumers. This strategy has doubled its depositor base to 3 million and increased deposit balances by 69% to ₱25 billion as of the end of December 2023, over a year from the Maya Bank launch. Maya has also introduced a suite of savings and wealth-building products such as Maya Time Deposit Plus, Maya Funds, and Maya Stocks. Meanwhile, the enhanced Maya Card enables users to use their Maya account globally.

Maya has championed consumer lending in the Philippines by using alternative data. It has built proprietary AI models driven by machine learning, enabling it to lend profitably at scale. Loan disbursements surged by 585%, hitting ₱22 billion in 2023 as compared with 2022. Each of Maya's products is built in-house to address the local market's requirements and offer a unique experience to financial services in the Philippines.

On the enterprise front, Maya has solidified its leadership as the "Payments Backbone of the Philippines" by empowering businesses to accept various payment methods seamlessly. Its omni-channel offering has established Maya as the #1 processor of payment transactions for credit and debit cards and QR Ph transactions for consecutive years, based on Visa and BancNet data.

Maya is now bringing banking to the micro, small, and medium enterprises in the Philippines. Maya provides higher business deposit interest rates than traditional banks and offers up to ₱2 million in unsecured credit to businesses that typically do not have

access to credit, exemplifying Maya's commitment to supporting the financial needs of businesses of all sizes.

Sustainability: Deepening integration into operations

In support of the company’s purpose of inspiring innovations and creating meaningful creations and its ambition of becoming a sustainability leader in the region, the PLDT Group continued to pursue its sustainability roadmap in 2023.

Recently, PLDT enacted a policy that institutionalizes a human rights-based approach in its operations, value chain activities, and business partnerships. The PLDT Human Rights Policy, approved by the Board of Directors, identifies relevant human rights impact areas and details the company’s actions and governance approach for each, providing guidance on the proper conduct of business for its directors, employees, consultants, and other contracted personnel.

As a global best practice, the Policy demonstrates PLDT’s commitment to sustainability and corporate governance, affirms PLDT’s institutional thrust to respect the rights of various stakeholders, and sets expectations for suppliers, partners, and other third-parties that deal with the company to observe the same human rights standards and principles.

Under the environmental pillar, the PLDT Group scaled up its “Be Kind. Recycle” e-waste program. Its target for 2023 was to raise awareness among various stakeholders, starting with its employees expanding to its customers and the wider community. As part of embedding the e-waste Program in operations, e-waste bins were deployed in various Smart Stores and PLDT and Smart Experience Hubs. PLDT Home’s Fiber All-out campaigns included e-waste collection drives. An e-waste collection partnership with a PLDT Enterprise client was also signed. The program expanded to include collection campaigns at Makati Medical Center and a university.

A total of 2,312 kilos of e-waste were collected and turned-over to accredited recyclers in partnership with UNIDO, DENR and the EcoWaste Coalition.

The company also initiated other waste management programs such as the one focused on hazardous waste, particularly used oil generated from the maintenance of PLDT and Smart’s service vehicles by our accredited service shops.

In 2023, PLDT continued to leverage on technology to enable meaningful connections and help bridge the digital divide to ensure that no one is left behind. Corporate shared value programs in the areas of education, disaster resilience, internet safety, livelihood, and inclusion delivered positive impact to the communities PLDT serves, while helping drive business competitiveness and sustainability.

PLDT and Smart have trained more than 11,000 MSMEs and cooperatives on digital entrepreneurship and e-commerce and supported more than 3,000 farmers through digitalization trainings. The group also reached over 3,000 educators and students in last mile schools through School-in-a-Bag portable digital classrooms, #LearnSmart connectivity learning kits and content.

PLDT and Smart also deployed Ligtas Kits—portable, all-in-one emergency communications packages to 36 LGUs in hazard-prone areas and trained their representatives on emergency communications. To further promote a culture or resilience, the group also trained 100 LGU representatives on psychological first aid and over 6,000 individuals on digital wellness.

Also in 2023, PLDT and Smart launched a flagship inclusion program—IDEATe or Inclusion, Diversity, Equity and Advocacy through Technology, which provides trainings on assistive technology for the visually impaired to help them attain independent mobility and successful participation in the digital economy. Those with physical and psychosocial disabilities are supported with trainings on business basics and virtual tech-related jobs towards entrepreneurship and employment. IDEATe also raises awareness of PLDT and Smart employees and partners on disability sensitivity. This program was the only Philippine initiative recognized as finalist at the recently concluded Global Mobile Awards held in Barcelona, Spain.

In addition to being recognized as a Leader in the Global Child Forum’s (GCF) latest global children’s rights and business benchmark, PLDT and Smart also participated as private sector representatives and highlighted the importance of harmonizing policies with technology during one of the panel sessions in the recent ASEAN ICT Forum on Child Online Protection held in Bangkok, Thailand.

PLDT has also been cited at the 3rd United Nations Global Compact Network Philippines’ Sustainable Development Goals (SDG) Awards – Prosperity Category for its Madiskarte Moms PH (MMPH) program for enabling digital inclusion among women, promoting decent work and economic growth, and supporting the recovery and resilience of micro, small, and medium-sized enterprises (MSMEs).

The year 2023 also saw PLDT investing heavily on its key asset—its people. In line with its vision to be a #HappySpace of empowered individuals and teams, PLDT trained its lens on employee development, culture building and strategic alignment that focused on sustaining high performance and growth.

Among the year’s highlights was the launch of the group’s Corporate University. Backed by a strategic partnership with LinkedIn, PLDT and Smart provided over 16,000 relevant, self-paced courses for the continuous upskilling of its workforce.

PLDT and Smart also rolled out culture-building initiatives to promote the Group’s refreshed core values and signature behaviors. Branded as “The Magic of We,” the

campaign included company-wide events and workshops as well as various engagement activities and merit-based recognition programs.

On March 6, 2024, PLDT secured a 5-year ₱1.0 billion Green Loan Facility from HSBC Philippines to partially fund the company’s ongoing nationwide modernization and expansion of its fiber network. The intended use of loan proceeds aligns with the Green Loan Principles, specifically on achieving energy efficiency. The upgrade of the network to fiber and the resultant energy efficient operations support the PLDT Group decarbonization roadmap and sustainability agenda.

2024 Outlook

Consolidated service revenues and EBITDA are expected to register mid-single digit growth, underpinned by continued topline growth and sustained focus on cost management. Telco core income is anticipated to lie north of ₱35.0 billion.

“PLDT is charting a bold, new course, armed by strategic foresight and our unwavering commitment to excellence. Our updated vision is to reshape the PLDT Group, strengthening our market leadership, pursuing growth and value, and spearheading our transformative drive towards becoming a Digico. To this end, we are pleased to announce the formation of a digital entity that will harness the data assets of the MVP Group of Companies and provide new growth opportunities for them. Co-owned by PLDT, Smart, Meralco, and Metro Pacific Investments Corporation, Digico’s goal is to create an integrated platform that will bring a unified customer experience across the MVP Group and its partners. This represents the first step in our collective effort to drive new growth using technology across the MVP group.” Pangilinan said.

X X X

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED ASSETS, LIABILITIES AND EQUITY

As at December 31, 2023 and 2022

(in million pesos)

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022 |

|

|

|

(Unaudited) |

|

|

(Audited) |

|

ASSETS |

|

TOTAL ASSETS |

|

|

609,477 |

|

|

|

624,162 |

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES |

|

|

|

|

|

|

|

|

Total Equity Attributable to Equity Holders of PLDT |

|

|

105,218 |

|

|

|

108,727 |

|

Noncontrolling interests |

|

|

5,168 |

|

|

|

5,234 |

|

TOTAL EQUITY |

|

|

110,386 |

|

|

|

113,961 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

499,091 |

|

|

|

510,201 |

|

TOTAL EQUITY AND LIABILITIES |

|

|

609,477 |

|

|

|

624,162 |

|

PLDT INC. AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENTS

For the Years Ended December 31, 2023, 2022 and 2021

(in million pesos, except earnings per common share amounts which are in pesos)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2022(1) |

|

|

2021(1) |

|

|

|

(Unaudited) |

|

|

(Audited) |

|

CONTINUING OPERATIONS |

|

|

|

|

|

|

|

|

|

REVENUES FROM CONTRACTS WITH CUSTOMERS |

|

|

|

|

|

|

|

|

|

Service revenues |

|

|

201,832 |

|

|

|

195,344 |

|

|

|

184,680 |

|

Non-service revenues |

|

|

9,121 |

|

|

|

9,018 |

|

|

|

7,506 |

|

|

|

|

210,953 |

|

|

|

204,362 |

|

|

|

192,186 |

|

EXPENSES |

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

81,876 |

|

|

|

84,476 |

|

|

|

77,686 |

|

Depreciation and amortization |

|

|

46,652 |

|

|

|

98,631 |

|

|

|

52,072 |

|

Cost of sales and services |

|

|

15,092 |

|

|

|

14,172 |

|

|

|

12,917 |

|

Asset impairment |

|

|

4,432 |

|

|

|

6,044 |

|

|

|

4,942 |

|

Interconnection costs |

|

|

10,418 |

|

|

|

6,104 |

|

|

|

3,698 |

|

|

|

|

158,470 |

|

|

|

209,427 |

|

|

|

151,315 |

|

|

|

|

52,483 |

|

|

|

(5,065 |

) |

|

|

40,871 |

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSES) – NET |

|

|

(16,006 |

) |

|

|

19,097 |

|

|

|

(6,615 |

) |

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX FROM CONTINUING OPERATIONS |

|

|

36,477 |

|

|

|

14,032 |

|

|

|

34,256 |

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAX |

|

|

9,612 |

|

|

|

2,697 |

|

|

|

7,459 |

|

NET INCOME FROM CONTINUING OPERATIONS |

|

|

26,865 |

|

|

|

11,335 |

|

|

|

26,797 |

|

|

|

|

|

|

|

|

|

|

|

NET LOSS FROM DISCONTINUED OPERATIONS |

|

|

(41 |

) |

|

|

(600 |

) |

|

|

(121 |

) |

NET INCOME |

|

|

26,824 |

|

|

|

10,735 |

|

|

|

26,676 |

|

ATTRIBUTABLE TO: |

|

|

|

|

|

|

|

|

|

Equity holders of PLDT |

|

|

26,614 |

|

|

|

10,485 |

|

|

|

26,367 |

|

Noncontrolling interests |

|

|

210 |

|

|

|

250 |

|

|

|

309 |

|

|

|

|

26,824 |

|

|

|

10,735 |

|

|

|

26,676 |

|

Earnings Per Share Attributable to Common Equity Holders

of PLDT |

|

|

|

|

|

|

|

|

|

Basic |

|

|

122.91 |

|

|

|

48.26 |

|

|

|

121.76 |

|

Diluted |

|

|

122.91 |

|

|

|

48.26 |

|

|

|

121.76 |

|

Earnings Per Share from Continuing Operations Attributable to

Common Equity Holders of PLDT |

|

|

|

|

|

|

|

|

|

Basic |

|

|

123.10 |

|

|

|

51.03 |

|

|

|

122.32 |

|

Diluted |

|

|

123.10 |

|

|

|

51.03 |

|

|

|

122.32 |

|

(1) To be comparable with 2023, certain amounts for the years ended December 31, 2022 and 2021 have been adjusted to reflect the discontinued operations of certain ePLDT subsidiaries.

|

|

|

|

|

|

|

|

PLDT Consolidated |

|

|

|

Full Year |

|

(Php in mn) |

|

2023 |

2022 (a) |

% Change |

|

|

|

|

|

|

|

Total revenues |

|

210,953 |

204,362 |

3% |

|

|

|

|

|

|

|

Service revenues (b) |

|

201,832 |

195,344 |

3% |

|

|

|

|

|

|

|

Expenses (c) |

|

158,470 |

209,427 |

(24%) |

|

|

|

|

|

|

|

EBITDA, exMRP |

|

104,297 |

100,588 |

4% |

|

EBITDA Margin |

|

52% |

51% |

|

|

|

|

|

|

|

|

Income before Income Tax |

|

36,477 |

14,032 |

160% |

|

|

|

|

|

|

|

Provision for Income Tax |

|

9,612 |

2,697 |

256% |

|

|

|

|

|

|

|

Net Income - Attributable to Equity Holders of PLDT |

|

26,614 |

10,485 |

154% |

|

|

|

|

|

|

|

Telco Core Income (d) |

|

34,341 |

33,301 |

3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) To be comparable with 2023, certain amounts for the year ended December 31, 2022 have been adjusted to reflect the discontinued operations of certain ePLDT subsidiaries. |

(b) Service Revenues, gross of interconnection costs |

|

|

|

|

|

Service Revenues, gross of interconnection costs |

|

201,832 |

195,344 |

3% |

|

Interconnection costs |

|

10,418 |

6,104 |

71% |

|

Service Revenues, net of interconnection costs |

|

191,414 |

189,240 |

1% |

|

|

|

|

|

|

|

(c) Expenses includes Interconnection Costs and MRP expenses |

|

(d) Net income as adjusted for the net effect of gain/loss on FX, derivative transactions, MRP and share in Maya Innovations Holdings losses |

This press release may contain some statements which constitute “forward-looking statements” that are subject to a number of risks and opportunities that could affect PLDT’s business and results of operations. Although PLDT believes that expectations reflected in any forward-looking statements are reasonable, it can give no guarantee of future performance, action or events.

For further information, please contact:

|

|

|

Melissa V. Vergel de Dios |

Cathy Y. Yang |

|

pldt_ir_center@pldt.com.ph |

cyyang@pldt.com.ph |

|

About PLDT

PLDT is the Philippines’ largest integrated telco company. Through its principal business groups – from fixed line to wireless – PLDT offers a wide range of telecommunications and digital services across the Philippines’ most extensive fiber optic backbone, and fixed line and cellular networks.

PLDT is listed on the Philippine Stock Exchange (PSE:TEL) and its American Depositary Shares are listed on the New York Stock Exchange (NYSE:PHI). PLDT has one of the largest market capitalizations among Philippine-�listed companies.

Further information can be obtained by visiting www.pldt.com

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

PLDT Inc. |

By |

: |

/s/Mark David P. Martinez |

Name |

: |

Mark David P. Martinez |

Title |

: |

Assistant Corporate Secretary |

Date: March 7, 2024

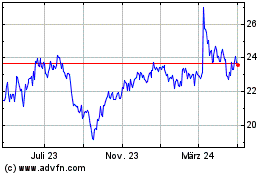

PLDT (NYSE:PHI)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

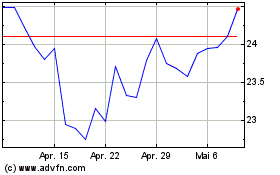

PLDT (NYSE:PHI)

Historical Stock Chart

Von Mai 2023 bis Mai 2024