Form 8-K - Current report

01 März 2024 - 1:10PM

Edgar (US Regulatory)

0000074260false00000742602024-03-012024-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: (Date of earliest event reported) March 1, 2024

| | | | | | | | | | | | | | |

| OLD REPUBLIC INTERNATIONAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-10607 | | 36-2678171 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | | | | | | | |

| 307 North Michigan Avenue | Chicago | Illinois | 60601 | |

| (Address of principal executive offices) (Zip Code) | |

| | | | | |

| (312) | 346-8100 | | | |

| (Registrant’s telephone number, including area code) | |

| | | | | |

| N /A | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 140.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock / $1 par value | | ORI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure

At its quarterly meeting held on February 29, 2024, the Board of Directors of Old Republic International Corporation (the “Board of Directors”) declared a regular quarterly cash dividend of $0.265 per common share to be paid on March 21, 2024 to shareholders of record on March 11, 2024. On March 1, 2024, Old Republic International Corporation (the “Company”) issued a press release announcing this regular cash dividend. The full text of this press release is included as Exhibit 99.1 hereto.

At this meeting, the Board of Directors also authorized a $1.10 billion share repurchase program. On March 1, 2024, the Company issued a press release announcing this action. The full text of this press release is included as Exhibit 99.2 hereto.

The information provided pursuant to this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| (d) | Exhibits |

| |

| Exhibit No. | Description |

| |

| |

| |

| 104 | Cover page Interactive Data file (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| OLD REPUBLIC INTERNATIONAL CORPORATION |

| Registrant |

| |

| |

| |

| Date: March 1, 2024 | By: /s/ Thomas A. Dare |

| | Thomas A. Dare |

| | Senior Vice President, |

| | Secretary and General Counsel |

| | |

NEWS RELEASE At Old Republic: At Financial Relations Board: Craig R. Smiddy: President and Chief Executive Officer Analysts/Investors: Joe Calabrese 212/827-3772 OLD REPUBLIC DECLARES FIRST QUARTER REGULAR CASH DIVIDEND OF 26.5 CENTS PER SHARE CHICAGO – March 1, 2024 – Old Republic International Corporation (NYSE: ORI) – today announced its Board of Directors has declared a regular quarterly cash dividend of 26.5 cents per common share. This dividend is payable on March 21, 2024 to shareholders of record on March 11, 2024. Subject to Board approval of each quarter’s new rate, the full year’s cash dividend will amount to $1.06 per share compared to $0.98 paid in 2023, an 8.2% increase. 2024 marks the 43rd consecutive year that Old Republic has increased its regular cash dividend and the 83rd year of uninterrupted regular cash dividend payments. About Old Republic Chicago-based Old Republic International Corporation is one of the nation's 50 largest shareholder-owned insurance businesses. It is a member of the Fortune 500 listing of America’s largest companies. The Company is organized as an insurance holding company whose subsidiaries actively market, underwrite, and provide risk management services for a wide variety of coverages mostly in the general and title insurance fields. Old Republic’s general insurance business ranks among the nation’s 50 largest, while its title insurance business is the third largest in its industry. For Old Republic’s latest news releases and other corporate documents: Please visit us at www.oldrepublic.com Alternatively, please write or call: Investor Relations Old Republic International Corporation 307 North Michigan Avenue, Chicago, IL 60601 (312) 346-8100

NEWS RELEASE At Old Republic: At Financial Relations Board: Craig R. Smiddy: President and Chief Executive Officer Analysts/Investors: Joe Calabrese 212/827-3772 OLD REPUBLIC ANNOUNCES SHARE REPURCHASE AUTHORIZATION CHICAGO – March 1, 2024 – Old Republic International Corporation (NYSE: ORI) – today announced that its Board of Directors has authorized a $1.10 billion share repurchase program. The Company recently completed its previously announced $450 million share repurchase program authorization. Under the share repurchase program, Old Republic may purchase shares on a discretionary basis from time to time through open market purchases, private negotiated transactions or other means. The timing and amount of any transactions will be conducted subject to the discretion of Old Republic based upon valuation, market conditions and other considerations. Old Republic may also from time to time repurchase shares pursuant to written, pre- arranged Rule 10b5-1 plans, which will be established and conducted in accordance with applicable regulations. The repurchase program is intended to comply with Rule 10b-18 and has no expiration date, does not require the purchase of any minimum number of shares, and may be suspended, modified or discontinued at any time without prior notice. In reaching its decision to authorize the share repurchase program, the Board of Directors evaluated such factors as the current and foreseeable liquidity and capital needs of the parent holding company and its insurance company subsidiaries. Craig R. Smiddy, President and CEO, commented, “Today’s announcement authorizing the return of $1.1 billion to shareholders continues a long history of prudent capital management. It reflects the strength of our balance sheet and continued confidence in the growth and earnings potential of our diversified portfolio of specialty insurance businesses.” Since December 31, 2018, Old Republic has returned over $3.5 billion to shareholders through regular and special cash dividends and share repurchases. As separately announced, the new annualized regular cash dividend rate of $1.06 per share, an 8.2% increase, marks the 43rd consecutive year that Old Republic has increased its regular cash dividend and the 83rd year of uninterrupted regular cash dividend payments. About Old Republic Chicago-based Old Republic International Corporation is one of the nation's 50 largest shareholder-owned insurance businesses. It is a member of the Fortune 500 listing of America’s largest companies. The Company is organized as an insurance holding company whose subsidiaries actively market, underwrite, and provide risk management services for a wide variety of coverages mostly in the general and title insurance fields. Old Republic’s general insurance business ranks among the nation’s 50 largest, while its title insurance business is the third largest in its industry. For Old Republic’s latest news releases and other corporate documents: Please visit us at www.oldrepublic.com Alternatively, please write or call: Investor Relations Old Republic International Corporation 307 North Michigan Avenue, Chicago, IL 60601 (312) 346-8100

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

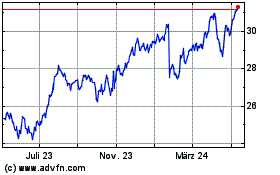

Old Republic (NYSE:ORI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Old Republic (NYSE:ORI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024