false

0000712770

0000712770

2023-12-21

2023-12-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 21, 2023

ONE LIBERTY PROPERTIES, INC.

(Exact name of Registrant as specified in charter)

| Maryland |

|

001-09279 |

|

13-3147497 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission file No.) |

|

(IRS Employer I.D. No.) |

| 60 Cutter Mill Road, Suite 303, Great Neck, New York |

|

11021 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area

code: 516-466-3100

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

OLP |

|

New York Stock Exchange |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

Sale of Manahawkin, NJ property

We indicated in our Current Report on Form 8-K filed on September 8, 2023 and our Quarterly Report on Form 10-Q for the period ended September 30, 2023, that a venture in which we have a 50% equity interest had entered into an agreement to sell a multi-tenant shopping center in Manahawkin, NJ. On December 15, 2023, the venture completed the sale of this property for a sales price of $36.5 million. Our share of the net proceeds from the sale, after paying down our share of the mortgage debt, was approximately $7.1 million. During the quarter ended September 30, 2023, we recorded $850,000 of equity in loss from this unconsolidated joint venture in connection with this sale. In 2022 and 2021, we generated $210,000 and $11,000, respectively, of equity in earnings from this unconsolidated joint venture.

Completed Property Sales

We indicated in our Current Report on Form 8-K filed December 1, 2023 that we entered into contracts to sell several properties. Subsequent to the filing of such report, we completed the following sales (dollars in thousands):

| | |

| |

| | |

Estimated

Gain on Sale of | | |

Nine

Months Ended

September 30, 2023 | |

| | |

Date | |

Gross | | |

Real Estate, | | |

Rental | | |

Operating | |

| Description of Property | |

Sold | |

Sales Price | | |

Net | | |

Income, net | | |

Expenses | |

| Applebees restaurant | |

| |

| | |

| | |

| | |

| |

| Carrolton, Georgia | |

12/5/23 | |

$ | 3,800 | | |

$ | 1,300 | | |

$ | 188 | | |

$ | 48 | |

| Applebees restaurant | |

| |

| | | |

| | | |

| | | |

| | |

| Cartersville, Georgia | |

12/5/23 | |

| 3,500 | | |

| 1,300 | | |

| 178 | | |

| 40 | |

| Applebees restaurant | |

| |

| | | |

| | | |

| | | |

| | |

| Lawrenceville, Georgia | |

12/7/23 | |

| 2,900 | (a) | |

| 1,000 | | |

| 145 | | |

| 28 | |

| Havertys retail property | |

| |

| | | |

| | | |

| | | |

| | |

| Virginia Beach, Virginia | |

12/15/23 | |

| 5,500 | | |

| 1,700 | | |

| 300 | | |

| 73 | |

| Barnes & Noble retail property | |

| |

| | | |

| | | |

| | | |

| | |

| Fort Myers, Florida | |

12/21/23 | |

| 7,300 | | |

| 4,000 | | |

| 370 | | |

| 116 | |

| Totals | |

| |

$ | 23,000 | | |

$ | 9,300 | (b) | |

$ | 1,181 | | |

$ | 305 | (c) |

| (a) | In connection with this sale,

we provided seller-financing of $1,816 bearing interest at 8.0% with a maturity of six months after the closing date, with a buyer’s

option to extend the maturity an additional six months. |

| (b) | As a result of these sales, we

will write-off, as a reduction to Gain on sale of real estate, net, an aggregate of $580 of unbilled rent receivable and $950 of unamortized

intangible lease assets. |

| (c) | Includes an aggregate of $265

of depreciation and amortization expense and $40 of real estate expenses. |

The estimated net proceeds to us from these five

sales will be approximately 19 million.

Contemplated Sales

We anticipate that over the next several months,

we will enter into several additional contracts to sell retail and/or restaurant properties.

Use of Proceeds; Industrial Portfolio

We used the net proceeds from these transactions

to pay down the approximate $7.5 million balance outstanding as of December 1, 2023 on our credit facility. We anticipate that we will

use the approximate $19 million balance of proceeds remaining from the completed sales described in this Current Report for general working

capital purposes (including the payment of dividends) and, as market conditions warrant, acquire properties, reduce mortgage debt and

repurchase our stock. We anticipate investing these proceeds in short-term Treasury bills, pending their application.

As of December 15, 2023, OLP’s available

liquidity was approximately $120 million, including approximately $20 million of cash and cash equivalents (including the credit facility’s

required $3 million average deposit maintenance balance) and $100 million available under its credit facility.

The Company anticipates that its industrial portfolio

will contribute approximately $47 million, or 66%, of expected 2024 base rent.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING

STATEMENTS

This communication contains certain forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the

Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provision for forward-looking statements contained

in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally

identifiable by use of the words “may,” “will,” “could,” “believe,” “expect,”

“intend,” “anticipate,” “estimate,” “project,” or similar expressions or variations thereof.

You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are,

in some cases, beyond our control and which could materially affect actual results, performance or achievements. Factors which may cause

actual results to differ materially from current expectations are described under the captions “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in our Securities and Exchange Commission

(“SEC”) filings and reports, including our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual

Report”), and the reports filed or to be filed subsequent to the filing of the Annual Report. Estimates of 2024 base rent exclude

$235,000 representing our share of base rent from unconsolidated joint ventures and make certain other assumptions, including that we

will collect an aggregate of approximately $806,000 in 2024 from non-industrial tenants whose leases may terminate or at which a property

may be sold. In addition, estimates of gains and proceeds from property sales are subject to adjustment, among other things, because actual

closing costs may differ from the estimated costs, and the net proceeds from the sales described above may be applied in a manner other

than as described above. Moreover, other risks and uncertainties of which we are not currently aware may also affect our forward-looking

statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements

made in this communication are made only as of the date hereof or as of the dates indicated in the forward-looking statements, even if

they are subsequently made available by us on our websites or otherwise. We do not undertake any obligation to update or supplement any

forward-looking statements to reflect actual results, new information, future events, changes in its expectations or other circumstances

that exist after the date as of which the forward-looking statements were made.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description of Exhibit |

| 104 |

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ONE LIBERTY PROPERTIES, INC. |

| |

|

|

| Date: December 21, 2023 |

By: |

/s/ Isaac Kalish |

| |

|

Isaac Kalish |

| |

|

Senior Vice President and |

| |

|

Chief Financial Officer |

3

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

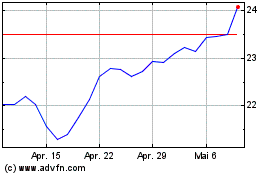

One Liberty Properties (NYSE:OLP)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

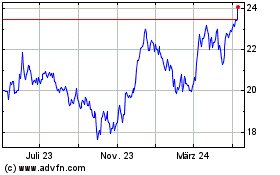

One Liberty Properties (NYSE:OLP)

Historical Stock Chart

Von Mai 2023 bis Mai 2024