Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| FIXED INCOME SECURITIES

(96.6%) | |

| | | |

| | |

| Albania (2.1%) | |

| | | |

| | |

| Sovereign (2.1%) | |

| | | |

| | |

| Albania

Government International Bond, | |

| | | |

| | |

| 3.50%, 10/9/25 | |

EUR | 324 | | |

$ | 331 | |

| 5.90%,

6/9/28 | |

| 2,562 | | |

| 2,644 | |

| | |

| | | |

| 2,975 | |

| Angola (1.1%) | |

| | | |

| | |

| Sovereign (1.1%) | |

| | | |

| | |

| Angolan

Government International Bond, | |

| | | |

| | |

| 8.75%,

4/14/32 | |

$ | 1,900 | | |

| 1,532 | |

| | |

| | | |

| | |

| Argentina (0.9%) | |

| | | |

| | |

| Sovereign (0.9%) | |

| | | |

| | |

| Argentine

Republic Government International Bond, | |

| | | |

| | |

| 1.00%, 7/9/29 | |

| 500 | | |

| 140 | |

| 3.50%,

7/9/41 (a) | |

| 800 | | |

| 207 | |

| 4.25%,

1/9/38 (a) | |

| 3,400 | | |

| 1,004 | |

| | |

| | | |

| 1,351 | |

| Armenia (0.2%) | |

| | | |

| | |

| Corporate Bond (0.2%) | |

| | | |

| | |

| Ardshinbank

CJSC Via Dilijan Finance BV, | |

| | | |

| | |

| 6.50%,

1/28/25 | |

| 300 | | |

| 296 | |

| | |

| | | |

| | |

| Bahrain (2.4%) | |

| | | |

| | |

| Sovereign (2.4%) | |

| | | |

| | |

| Bahrain

Government International Bond, | |

| | | |

| | |

| 5.45%, 9/16/32 | |

| 1,720 | | |

| 1,502 | |

| 5.63%, 5/18/34 | |

| 1,000 | | |

| 858 | |

| 7.00%, 10/12/28 | |

| 900 | | |

| 915 | |

| 7.50%,

9/20/47 | |

| 200 | | |

| 178 | |

| | |

| | | |

| 3,453 | |

| Barbados (1.4%) | |

| | | |

| | |

| Sovereign (1.4%) | |

| | | |

| | |

| Barbados

Government International Bond, | |

| | | |

| | |

| 6.50%,

10/1/29 | |

| 2,109 | | |

| 1,970 | |

| | |

| | | |

| | |

| Benin (1.9%) | |

| | | |

| | |

| Sovereign (1.9%) | |

| | | |

| | |

| Benin

Government International Bond, | |

| | | |

| | |

| 4.88%, 1/19/32 | |

EUR | 400 | | |

| 315 | |

| 4.95%, 1/22/35 | |

| 580 | | |

| 422 | |

| 6.88%,

1/19/52 | |

| 2,930 | | |

| 2,076 | |

| | |

| | | |

| 2,813 | |

| Brazil (4.5%) | |

| | | |

| | |

| Corporate Bonds (4.5%) | |

| | | |

| | |

| Coruripe

Netherlands BV, | |

| | | |

| | |

| 10.00%, 2/10/27 | |

$ | 1,250 | | |

| 917 | |

| FORESEA

Holding SA, | |

| | | |

| | |

| 7.50%, 6/15/30 | |

| 730 | | |

| 687 | |

| Guara

Norte Sarl, | |

| | | |

| | |

| 5.20%, 6/15/34 | |

| 619 | | |

| 528 | |

| Hidrovias

International Finance Sarl, | |

| | | |

| | |

| 4.95%, 2/8/31 | |

| 1,000 | | |

| 803 | |

| MC Brazil

Downstream Trading Sarl, | |

| | | |

| | |

| 7.25%, 6/30/31 | |

| 1,150 | | |

| 883 | |

| Minerva

Luxembourg SA, | |

| | | |

| | |

| 8.88%,

9/13/33 (b) | |

| 1,210 | | |

| 1,203 | |

| MV24

Capital BV, | |

| | | |

| | |

| 6.75%, 6/1/34 | |

| 678 | | |

| 599 | |

| Natura &Co.

Luxembourg Holdings Sarl, | |

| | | |

| | |

| 6.00%, 4/19/29 | |

| 171 | | |

| 157 | |

| Natura

Cosmeticos SA, | |

| | | |

| | |

| 4.13%, 5/3/28 | |

| 69 | | |

| 59 | |

| Samarco

Mineracao SA, | |

| | | |

| | |

| 5.75%,

10/24/23 (c)(d) | |

| 750 | | |

| 591 | |

| | |

| | | |

| 6,427 | |

| Bulgaria (0.2%) | |

| | | |

| | |

| Corporate Bond (0.2%) | |

| | | |

| | |

| Bulgarian

Energy Holding EAD, | |

| | | |

| | |

| 2.45%,

7/22/28 | |

EUR | 330 | | |

| 293 | |

| | |

| | | |

| | |

| Burkina Faso (0.8%) | |

| | | |

| | |

| Corporate Bond (0.8%) | |

| | | |

| | |

| Endeavour

Mining PLC, | |

| | | |

| | |

| 5.00%,

10/14/26 | |

$ | 1,280 | | |

| 1,146 | |

| | |

| | | |

| | |

| Chile (2.6%) | |

| | | |

| | |

| Corporate Bonds (1.3%) | |

| | | |

| | |

| AES Andes

SA, | |

| | | |

| | |

| 7.13%, 3/26/79 | |

| 970 | | |

| 916 | |

| Liberty

Latin America Ltd., | |

| | | |

| | |

| 2.00%, 7/15/24 | |

| 451 | | |

| 426 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| Corporate Bonds (cont’d) | |

| | | |

| | |

| VTR Comunicaciones

SpA, | |

| | | |

| | |

| 4.38%, 4/15/29 | |

$ | 422 | | |

$ | 234 | |

| 5.13%,

1/15/28 | |

| 385 | | |

| 217 | |

| | |

| | | |

| 1,793 | |

| Sovereign (1.3%) | |

| | | |

| | |

| Chile

Government International Bond, | |

| | | |

| | |

| 2.45%, 1/31/31 | |

| 200 | | |

| 165 | |

| 2.55%, 7/27/33 | |

| 1,390 | | |

| 1,071 | |

| 3.50%,

1/25/50 | |

| 990 | | |

| 662 | |

| | |

| | | |

| 1,898 | |

| | |

| | | |

| 3,691 | |

| China (1.3%) | |

| | | |

| | |

| Corporate Bonds (1.3%) | |

| | | |

| | |

| KWG Group

Holdings Ltd., | |

| | | |

| | |

| 7.88%,

8/30/24 (c)(d) | |

| 654 | | |

| 59 | |

| Longfor

Group Holdings Ltd., | |

| | | |

| | |

| 3.85%, 1/13/32 | |

| 338 | | |

| 144 | |

| Meituan, | |

| | | |

| | |

| 0.00%, 4/27/27 | |

| 900 | | |

| 798 | |

| Shimao

Group Holdings Ltd., | |

| | | |

| | |

| 5.60%, 7/15/26 | |

| 1,783 | | |

| 62 | |

| Sunac

China Holdings Ltd., | |

| | | |

| | |

| 8.35%,

4/19/23 (c)(d) | |

| 1,080 | | |

| 163 | |

| Times

China Holdings Ltd., | |

| | | |

| | |

| 5.55%,

6/4/24 (c)(d) | |

| 2,015 | | |

| 71 | |

| 6.75%,

7/16/23 (c)(d) | |

| 410 | | |

| 14 | |

| Yuexiu

REIT MTN Co. Ltd., | |

| | | |

| | |

| 2.65%,

2/2/26 | |

| 629 | | |

| 542 | |

| | |

| | | |

| 1,853 | |

| Colombia (2.2%) | |

| | | |

| | |

| Corporate Bonds (2.2%) | |

| | | |

| | |

| ABRA

Global Finance | |

| | | |

| | |

| 6.00%

Cash, 5.50% PIK, | |

| | | |

| | |

| 11.50%,

3/2/28 (b)(e) | |

| 771 | | |

| 619 | |

| Aris

Mining Corp., | |

| | | |

| | |

| 6.88%, 8/9/26 | |

| 1,150 | | |

| 920 | |

| Avianca

Midco 2 PLC, | |

| | | |

| | |

| 9.00%, 12/1/28 | |

| 430 | | |

| 367 | |

| Canacol

Energy Ltd., | |

| | | |

| | |

| 5.75%, 11/24/28 | |

| 827 | | |

| 657 | |

| SierraCol

Energy Andina LLC, | |

| | | |

| | |

| 6.00%,

6/15/28 | |

| 733 | | |

| 584 | |

| | |

| | | |

| 3,147 | |

| Costa Rica (0.9%) | |

| | | |

| | |

| Corporate Bond (0.6%) | |

| | | |

| | |

| Liberty

Costa Rica Senior Secured Finance, | |

| | | |

| | |

| 10.88%,

1/15/31 (b) | |

| 860 | | |

| 863 | |

| | |

| | | |

| | |

| Sovereign (0.3%) | |

| | | |

| | |

| Costa

Rica Government International Bond, | |

| | | |

| | |

| 6.55%,

4/3/34 | |

| 440 | | |

| 429 | |

| | |

| | | |

| 1,292 | |

| Dominican Republic (2.3%) | |

| | | |

| | |

| Sovereign (2.3%) | |

| | | |

| | |

| Dominican

Republic International Bond, | |

| | | |

| | |

| 4.88%, 9/23/32 | |

| 900 | | |

| 733 | |

| 5.88%, 1/30/60 | |

| 800 | | |

| 575 | |

| 6.00%,

7/19/28 (b) | |

| 600 | | |

| 572 | |

| 6.85%,

1/27/45 (b) | |

| 900 | | |

| 769 | |

| 7.45%,

4/30/44 (b) | |

| 800 | | |

| 733 | |

| | |

| | | |

| 3,382 | |

| Egypt (1.8%) | |

| | | |

| | |

| Sovereign (1.8%) | |

| | | |

| | |

| Egypt

Government International Bond, | |

| | | |

| | |

| 4.75%, 4/16/26 | |

EUR | 480 | | |

| 356 | |

| 5.25%,

10/6/25 (b) | |

$ | 440 | | |

| 340 | |

| 5.75%, 5/29/24 | |

| 400 | | |

| 372 | |

| 6.38%,

4/11/31 (b) | |

EUR | 800 | | |

| 473 | |

| 6.88%, 4/30/40 | |

$ | 121 | | |

| 63 | |

| 7.50%, 2/16/61 | |

| 1,000 | | |

| 508 | |

| 7.90%,

2/21/48 (b) | |

| 490 | | |

| 253 | |

| 8.88%,

5/29/50 | |

| 390 | | |

| 213 | |

| | |

| | | |

| 2,578 | |

| El Salvador (1.0%) | |

| | | |

| | |

| Sovereign (1.0%) | |

| | | |

| | |

| El Salvador

Government International Bond, | |

| | | |

| | |

| 5.88%, 1/30/25 | |

| 99 | | |

| 90 | |

| 6.38%, 1/18/27 | |

| 700 | | |

| 574 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| Sovereign (cont’d) | |

| | | |

| | |

| 7.63%, 2/1/41 | |

$ | 463 | | |

$ | 318 | |

| 7.65%, 6/15/35 | |

| 40 | | |

| 28 | |

| 8.25%,

4/10/32 | |

| 572 | | |

| 457 | |

| | |

| | | |

| 1,467 | |

| Ethiopia (1.0%) | |

| | | |

| | |

| Sovereign (1.0%) | |

| | | |

| | |

| Ethiopia

International Bond, | |

| | | |

| | |

| 6.63%,

12/11/24 | |

| 2,230 | | |

| 1,449 | |

| | |

| | | |

| | |

| Gabon (0.2%) | |

| | | |

| | |

| Sovereign (0.2%) | |

| | | |

| | |

| Gabon

Government International Bond, | |

| | | |

| | |

| 6.95%,

6/16/25 (b) | |

| 400 | | |

| 358 | |

| | |

| | | |

| | |

| Georgia (0.4%) | |

| | | |

| | |

| Corporate Bond (0.4%) | |

| | | |

| | |

| TBC Bank

JSC, | |

| | | |

| | |

| 10.78%,

10/3/24 (f) | |

| 540 | | |

| 529 | |

| | |

| | | |

| | |

| Ghana (2.3%) | |

| | | |

| | |

| Corporate Bonds (0.9%) | |

| | | |

| | |

| Kosmos

Energy Ltd., | |

| | | |

| | |

| 7.50%, 3/1/28 | |

| 413 | | |

| 371 | |

| 7.75%, 5/1/27 | |

| 315 | | |

| 292 | |

| Tullow

Oil PLC, | |

| | | |

| | |

| 10.25%,

5/15/26 | |

| 656 | | |

| 571 | |

| | |

| | | |

| 1,234 | |

| Sovereign (1.4%) | |

| | | |

| | |

| Ghana

Government International Bond, | |

| | | |

| | |

| 6.38%,

2/11/27 (c)(d) | |

| 360 | | |

| 161 | |

| 7.63%,

5/16/29 (c)(d) | |

| 200 | | |

| 89 | |

| 7.75%,

4/7/29 (c)(d) | |

| 205 | | |

| 91 | |

| 8.13%,

3/26/32 (c)(d) | |

| 215 | | |

| 95 | |

| 8.63%,

4/7/34 (c)(d) | |

| 649 | | |

| 289 | |

| 8.63%,

6/16/49 (c)(d) | |

| 2,229 | | |

| 954 | |

| 8.75%,

3/11/61 (c)(d) | |

| 408 | | |

| 175 | |

| 8.88%,

5/7/42 (c)(d) | |

| 486 | | |

| 208 | |

| | |

| | | |

| 2,062 | |

| | |

| | | |

| 3,296 | |

| Guatemala (0.7%) | |

| | | |

| | |

| Sovereign (0.7%) | |

| | | |

| | |

| Guatemala

Government Bond, | |

| | | |

| | |

| 3.70%, 10/7/33 | |

| 600 | | |

| 462 | |

| 4.65%,

10/7/41 (b) | |

| 400 | | |

| 297 | |

| 6.13%,

6/1/50 (b) | |

| 380 | | |

| 329 | |

| | |

| | | |

| 1,088 | |

| Honduras (0.1%) | |

| | | |

| | |

| Sovereign (0.1%) | |

| | | |

| | |

| Honduras

Government International Bond, | |

| | | |

| | |

| 6.25%,

1/19/27 | |

| 150 | | |

| 142 | |

| | |

| | | |

| | |

| Hungary (2.2%) | |

| | | |

| | |

| Corporate Bond (0.6%) | |

| | | |

| | |

| OTP Bank

Nyrt, | |

| | | |

| | |

| 8.75%,

5/15/33 | |

| 810 | | |

| 805 | |

| | |

| | | |

| | |

| Sovereign (1.6%) | |

| | | |

| | |

| Hungary

Government International Bond, | |

| | | |

| | |

| 5.38%, 9/12/33 | |

EUR | 196 | | |

| 200 | |

| 6.25%,

9/22/32 (b) | |

$ | 2,150 | | |

| 2,101 | |

| | |

| | | |

| 2,301 | |

| | |

| | | |

| 3,106 | |

| India (1.6%) | |

| | | |

| | |

| Corporate Bonds (1.4%) | |

| | | |

| | |

| Indiabulls

Housing Finance Ltd., | |

| | | |

| | |

| 4.50%, 9/28/26 | |

| 567 | | |

| 517 | |

| JSW Steel

Ltd., | |

| | | |

| | |

| 5.05%, 4/5/32 | |

| 940 | | |

| 755 | |

| Vedanta

Resources Finance II PLC, | |

| | | |

| | |

| 13.88%,

1/21/24 | |

| 800 | | |

| 717 | |

| | |

| | | |

| 1,989 | |

| Sovereign (0.2%) | |

| | | |

| | |

| Export-Import

Bank of India, | |

| | | |

| | |

| 5.50%,

1/18/33 (b) | |

| 400 | | |

| 384 | |

| | |

| | | |

| 2,373 | |

| Indonesia (4.0%) | |

| | | |

| | |

| Corporate Bonds (1.3%) | |

| | | |

| | |

| APL Realty

Holdings Pte. Ltd., | |

| | | |

| | |

| 5.95%, 6/2/24 | |

| 510 | | |

| 396 | |

| Minejesa

Capital BV, | |

| | | |

| | |

| 4.63%,

8/10/30 | |

| 1,706 | | |

| 1,522 | |

| | |

| | | |

| 1,918 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| Sovereign (2.7%) | |

| | | |

| | |

| Indonesia

Government International Bond, | |

| | | |

| | |

| 4.65%, 9/20/32 | |

$ | 1,400 | | |

$ | 1,312 | |

| 4.85%, 1/11/33 | |

| 1,940 | | |

| 1,850 | |

| 5.13%,

1/15/45 (b) | |

| 800 | | |

| 725 | |

| | |

| | | |

| 3,887 | |

| | |

| | | |

| 5,805 | |

| Iraq (0.3%) | |

| | | |

| | |

| Sovereign (0.3%) | |

| | | |

| | |

| Iraq

International Bond, | |

| | | |

| | |

| 5.80%,

1/15/28 | |

| 445 | | |

| 413 | |

| | |

| | | |

| | |

| Ivory Coast (2.6%) | |

| | | |

| | |

| Sovereign (2.6%) | |

| | | |

| | |

| Ivory

Coast Government International Bond, | |

| | | |

| | |

| 4.88%, 1/30/32 | |

EUR | 900 | | |

| 727 | |

| 6.63%, 3/22/48 | |

| 2,867 | | |

| 2,092 | |

| 6.88%,

10/17/40 | |

| 1,128 | | |

| 887 | |

| | |

| | | |

| 3,706 | |

| Jamaica (0.6%) | |

| | | |

| | |

| Corporate Bond (0.6%) | |

| | | |

| | |

| Digicel

International Finance Ltd./Digicel international Holdings Ltd., | |

| | | |

| | |

| 8.75%,

5/25/24 | |

$ | 1,000 | | |

| 902 | |

| | |

| | | |

| | |

| Jordan (0.8%) | |

| | | |

| | |

| Sovereign (0.8%) | |

| | | |

| | |

| Jordan

Government International Bond, | |

| | | |

| | |

| 7.38%,

10/10/47 (b) | |

| 750 | | |

| 621 | |

| 7.50%, 1/13/29 | |

| 300 | | |

| 293 | |

| 7.75%,

1/15/28 | |

| 292 | | |

| 292 | |

| | |

| | | |

| 1,206 | |

| Kazakhstan (0.8%) | |

| | | |

| | |

| Sovereign (0.8%) | |

| | | |

| | |

| Kazakhstan

Government International Bond, | |

| | | |

| | |

| 6.50%,

7/21/45 | |

| 1,100 | | |

| 1,122 | |

| | |

| | | |

| | |

| Kenya (1.0%) | |

| | | |

| | |

| Sovereign (1.0%) | |

| | | |

| | |

| Republic

of Kenya Government International Bond, | |

| | | |

| | |

| 8.00%,

5/22/32 | |

| 1,800 | | |

| 1,404 | |

| | |

| | | |

| | |

| Kuwait (0.5%) | |

| | | |

| | |

| Sovereign (0.5%) | |

| | | |

| | |

| Kuwait

International Government Bond, | |

| | | |

| | |

| 3.50%,

3/20/27 | |

| 720 | | |

| 683 | |

| | |

| | | |

| | |

| Lebanon (0.2%) | |

| | | |

| | |

| Sovereign (0.2%) | |

| | | |

| | |

| Lebanon

Government International Bond, | |

| | | |

| | |

| 6.85%,

3/23/27 - 5/25/29 (c)(d) | |

| 2,870 | | |

| 236 | |

| | |

| | | |

| | |

| Macedonia (2.9%) | |

| | | |

| | |

| Sovereign (2.9%) | |

| | | |

| | |

| North

Macedonia Government International Bond, | |

| | | |

| | |

| 1.63%, 3/10/28 | |

EUR | 2,165 | | |

| 1,866 | |

| 6.96%,

3/13/27 | |

| 2,092 | | |

| 2,257 | |

| | |

| | | |

| 4,123 | |

| Mexico (5.1%) | |

| | | |

| | |

| Corporate Bonds (3.3%) | |

| | | |

| | |

| Banco

Mercantil del Norte SA, | |

| | | |

| | |

| 7.63%,

12/31/99 (f) | |

$ | 213 | | |

| 196 | |

| 8.38%,

10/14/30 (f) | |

| 254 | | |

| 241 | |

| BBVA

Bancomer SA, | |

| | | |

| | |

| 5.13%, 1/18/33 | |

| 474 | | |

| 409 | |

| 8.45%,

6/29/38 (b) | |

| 423 | | |

| 417 | |

| Braskem

Idesa SAPI, | |

| | | |

| | |

| 6.99%, 2/20/32 | |

| 940 | | |

| 566 | |

| 7.45%, 11/15/29 | |

| 562 | | |

| 351 | |

| Cemex

SAB de CV, | |

| | | |

| | |

| 5.13%,

6/8/26 (f) | |

| 440 | | |

| 412 | |

| 9.13%,

3/14/28 (b)(f) | |

| 352 | | |

| 367 | |

| Grupo

Aeromexico SAB de CV, | |

| | | |

| | |

| 8.50%, 3/17/27 | |

| 420 | | |

| 394 | |

| Total

Play Telecomunicaciones SA de CV, | |

| | | |

| | |

| 7.50%,

11/12/25 | |

| 1,975 | | |

| 1,415 | |

| | |

| | | |

| 4,768 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| Sovereign (1.8%) | |

| | | |

| | |

| Petroleos

Mexicanos, | |

| | | |

| | |

| 4.25%, 1/15/25 | |

$ | 200 | | |

$ | 191 | |

| 5.95%, 1/28/31 | |

| 1,200 | | |

| 860 | |

| 6.35%, 2/12/48 | |

| 400 | | |

| 229 | |

| 6.70%, 2/16/32 | |

| 600 | | |

| 446 | |

| 6.88%, 8/4/26 | |

| 400 | | |

| 369 | |

| 10.00%,

2/7/33 (b) | |

| 587 | | |

| 523 | |

| | |

| | | |

| 2,618 | |

| | |

| | | |

| 7,386 | |

| Moldova (0.3%) | |

| | | |

| | |

| Corporate Bond (0.3%) | |

| | | |

| | |

| Aragvi

Finance International DAC, | |

| | | |

| | |

| 8.45%,

4/29/26 | |

| 660 | | |

| 455 | |

| | |

| | | |

| | |

| Mongolia (0.3%) | |

| | | |

| | |

| Corporate Bond (0.3%) | |

| | | |

| | |

| Mongolian

Mining Corp./Energy Resources LLC, | |

| | | |

| | |

| 9.25%,

4/15/24 | |

| 388 | | |

| 388 | |

| | |

| | | |

| | |

| Morocco (0.6%) | |

| | | |

| | |

| Sovereign (0.6%) | |

| | | |

| | |

| Morocco

Government International Bond, | |

| | | |

| | |

| 3.00%, 12/15/32 | |

| 500 | | |

| 382 | |

| 4.00%,

12/15/50 (b) | |

| 820 | | |

| 510 | |

| | |

| | | |

| 892 | |

| Nigeria (3.2%) | |

| | | |

| | |

| Corporate Bonds (0.6%) | |

| | | |

| | |

| IHS Netherlands

Holdco BV, | |

| | | |

| | |

| 8.00%,

9/18/27 (b) | |

| 383 | | |

| 322 | |

| SEPLAT

Energy PLC, | |

| | | |

| | |

| 7.75%,

4/1/26 | |

| 624 | | |

| 534 | |

| | |

| | | |

| 856 | |

| Sovereign (2.6%) | |

| | | |

| | |

| Nigeria

Government International Bond, | |

| | | |

| | |

| 6.50%,

11/28/27 (b) | |

| 820 | | |

| 686 | |

| 7.38%, 9/28/33 | |

| 1,212 | | |

| 899 | |

| 7.63%, 11/28/47 | |

| 200 | | |

| 134 | |

| 7.70%, 2/23/38 | |

| 1,108 | | |

| 779 | |

| 8.25%,

9/28/51 | |

| 1,860 | | |

| 1,293 | |

| | |

| | | |

| 3,791 | |

| | |

| | | |

| 4,647 | |

| Oman (2.6%) | |

| | | |

| | |

| Sovereign (2.6%) | |

| | | |

| | |

| Oman

Government International Bond, | |

| | | |

| | |

| 5.38%, 3/8/27 | |

| 500 | | |

| 488 | |

| 6.25%,

1/25/31 (b) | |

| 2,530 | | |

| 2,504 | |

| 6.75%, 1/17/48 | |

| 500 | | |

| 461 | |

| 7.38%,

10/28/32 | |

| 270 | | |

| 286 | |

| | |

| | | |

| 3,739 | |

| Panama (2.4%) | |

| | | |

| | |

| Corporate Bonds (1.2%) | |

| | | |

| | |

| C&W

Senior Financing DAC, | |

| | | |

| | |

| 6.88%, 9/15/27 | |

| 1,136 | | |

| 1,000 | |

| Multibank, Inc., | |

| | | |

| | |

| 7.75%,

2/3/28 (b) | |

| 756 | | |

| 763 | |

| | |

| | | |

| 1,763 | |

| Sovereign (1.2%) | |

| | | |

| | |

| Panama

Bonos del Tesoro, | |

| | | |

| | |

| 6.38%, 7/25/33 | |

| 187 | | |

| 177 | |

| Panama

Government International Bond, | |

| | | |

| | |

| 2.25%, 9/29/32 | |

| 1,280 | | |

| 930 | |

| 3.87%, 7/23/60 | |

| 550 | | |

| 320 | |

| 4.50%,

4/1/56 | |

| 410 | | |

| 271 | |

| | |

| | | |

| 1,698 | |

| | |

| | | |

| 3,461 | |

| Paraguay (1.4%) | |

| | | |

| | |

| Corporate Bond (0.7%) | |

| | | |

| | |

| Frigorifico

Concepcion SA, | |

| | | |

| | |

| 7.70%,

7/21/28 | |

| 1,152 | | |

| 954 | |

| | |

| | | |

| | |

| Sovereign (0.7%) | |

| | | |

| | |

| Paraguay

Government International Bond, | |

| | | |

| | |

| 5.40%,

3/30/50 (b) | |

| 1,264 | | |

| 1,000 | |

| | |

| | | |

| 1,954 | |

| Peru (2.6%) | |

| | | |

| | |

| Corporate Bonds (1.9%) | |

| | | |

| | |

| Auna

SAA, | |

| | | |

| | |

| 6.50%, 11/20/25 | |

| 1,440 | | |

| 1,327 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| Corporate Bonds (cont’d) | |

| | | |

| | |

| Hunt

Oil Co. of Peru LLC Sucursal Del Peru, | |

| | | |

| | |

| 8.55%,

9/18/33 (b) | |

$ | 448 | | |

$ | 453 | |

| Peru

LNG Srl, | |

| | | |

| | |

| 5.38%,

3/22/30 | |

| 1,326 | | |

| 1,042 | |

| | |

| | | |

| 2,822 | |

| Sovereign (0.7%) | |

| | | |

| | |

| Peruvian

Government International Bond, | |

| | | |

| | |

| 2.78%, 1/23/31 | |

| 300 | | |

| 247 | |

| 3.00%, 1/15/34 | |

| 400 | | |

| 309 | |

| 3.55%, 3/10/51 | |

| 200 | | |

| 132 | |

| 6.55%,

3/14/37 | |

| 300 | | |

| 311 | |

| | |

| | | |

| 999 | |

| | |

| | | |

| 3,821 | |

| Romania (5.5%) | |

| | | |

| | |

| Sovereign (5.5%) | |

| | | |

| | |

| Romanian

Government International Bond, | |

| | | |

| | |

| 1.75%,

7/13/30 (b) | |

EUR | 3,320 | | |

| 2,664 | |

| 2.00%, 1/28/32 - 4/14/33 | |

| 796 | | |

| 582 | |

| 2.12%, 7/16/31 | |

| 681 | | |

| 535 | |

| 2.13%, 3/7/28 | |

| 300 | | |

| 276 | |

| 3.62%, 5/26/30 | |

| 28 | | |

| 26 | |

| 3.75%,

2/7/34 (b) | |

| 999 | | |

| 837 | |

| 4.00%, 2/14/51 | |

$ | 1,100 | | |

| 704 | |

| 6.13%, 1/22/44 | |

| 800 | | |

| 717 | |

| 6.63%,

9/27/29 | |

EUR | 1,395 | | |

| 1,519 | |

| | |

| | | |

| 7,860 | |

| Senegal (0.2%) | |

| | | |

| | |

| Sovereign (0.2%) | |

| | | |

| | |

| Senegal

Government International Bond, | |

| | | |

| | |

| 6.25%,

5/23/33 | |

$ | 400 | | |

| 322 | |

| | |

| | | |

| | |

| Serbia (1.7%) | |

| | | |

| | |

| Sovereign (1.7%) | |

| | | |

| | |

| Serbia

International Bond, | |

| | | |

| | |

| 1.50%, 6/26/29 | |

EUR | 1,240 | | |

| 1,011 | |

| 2.05%, 9/23/36 | |

| 432 | | |

| 272 | |

| 2.13%,

12/1/30 (b) | |

$ | 1,400 | | |

| 1,031 | |

| 6.50%,

9/26/33 | |

| 200 | | |

| 191 | |

| | |

| | | |

| 2,505 | |

| South Africa (1.1%) | |

| | | |

| | |

| Corporate Bonds (1.1%) | |

| | | |

| | |

| Petra

Diamonds U.S. Treasury PLC | |

| | | |

| | |

| 6.07%

Cash, 3.96 % PIK, | |

| | | |

| | |

| 9.75%,

3/8/26 (e) | |

| 221 | | |

| 193 | |

| Sasol

Financing USA LLC, | |

| | | |

| | |

| 5.50%, 3/18/31 | |

| 1,270 | | |

| 997 | |

| 8.75%,

5/3/29 | |

| 357 | | |

| 344 | |

| | |

| | | |

| 1,534 | |

| Sri Lanka (2.4%) | |

| | | |

| | |

| Sovereign (2.4%) | |

| | | |

| | |

| Sri Lanka

Government International Bond, | |

| | | |

| | |

| 5.75%,

4/18/23 (c)(d) | |

| 320 | | |

| 154 | |

| 6.20%,

5/11/27 (c)(d) | |

| 2,850 | | |

| 1,331 | |

| 6.35%,

6/28/24 (c)(d) | |

| 200 | | |

| 96 | |

| 6.75%,

4/18/28 (c)(d) | |

| 400 | | |

| 188 | |

| 6.83%,

7/18/26 (c)(d) | |

| 400 | | |

| 193 | |

| 6.85%,

3/14/24 - 11/3/25 (c)(d) | |

| 2,770 | | |

| 1,340 | |

| 7.85%,

3/14/29 (c)(d) | |

| 200 | | |

| 94 | |

| | |

| | | |

| 3,396 | |

| Suriname (5.8%) | |

| | | |

| | |

| Sovereign (5.8%) | |

| | | |

| | |

| Suriname

Government International Bond, | |

| | | |

| | |

| 9.25%,

10/26/26 (c)(d) | |

| 6,515 | | |

| 5,619 | |

| 12.88%,

12/30/23 (a)(b)(c)(d) | |

| 2,993 | | |

| 2,697 | |

| | |

| | | |

| 8,316 | |

| Tanzania, United Republic

Of (0.7%) | |

| | | |

| | |

| Corporate Bonds (0.7%) | |

| | | |

| | |

| HTA Group

Ltd., | |

| | | |

| | |

| 2.88%, 3/18/27 | |

| 200 | | |

| 165 | |

| 7.00%,

12/18/25 | |

| 900 | | |

| 869 | |

| | |

| | | |

| 1,034 | |

| Trinidad And Tobago (0.3%) | |

| | | |

| | |

| Sovereign (0.3%) | |

| | | |

| | |

| Trinidad &

Tobago Government International Bond, | |

| | | |

| | |

| 4.50%,

6/26/30 | |

| 500 | | |

| 461 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Face Amount | | |

Value | |

| | |

(000) | | |

(000) | |

| Sovereign (cont’d) | |

| | | |

| | |

| Turkey (2.1%) | |

| | | |

| | |

| Corporate Bonds (2.1%) | |

| | | |

| | |

| Limak

Iskenderun Uluslararasi Liman Isletmeciligi AS, | |

| | | |

| | |

| 9.50%, 7/10/36 | |

$ | 1,134 | | |

$ | 1,023 | |

| Ulker

Biskuvi Sanayi AS, | |

| | | |

| | |

| 6.95%, 10/30/25 | |

| 1,080 | | |

| 1,018 | |

| WE Soda

Investments Holding PLC, | |

| | | |

| | |

| 9.50%,

10/6/28 | |

| 992 | | |

| 1,002 | |

| | |

| | | |

| 3,043 | |

| Ukraine (0.9%) | |

| | | |

| | |

| Sovereign (0.9%) | |

| | | |

| | |

| Ukraine

Government Bond, | |

| | | |

| | |

| 7.75%,

9/1/25 (c)(d) | |

| 745 | | |

| 247 | |

| Ukraine

Government International Bond, | |

| | | |

| | |

| 6.88%,

5/21/31 (c)(d) | |

| 1,500 | | |

| 401 | |

| 7.75%,

9/1/24 - 9/1/28 (c)(d) | |

| 1,601 | | |

| 525 | |

| 7.75%,

8/1/41 (c)(d)(g) | |

| 440 | | |

| 204 | |

| | |

| | | |

| 1,377 | |

| United Arab Emirates (3.2%) | |

| | | |

| | |

| Sovereign (3.2%) | |

| | | |

| | |

| Finance

Department Government of Sharjah, | |

| | | |

| | |

| 4.00%, 7/28/50 | |

| 2,562 | | |

| 1,496 | |

| 4.38%, 3/10/51 | |

| 500 | | |

| 314 | |

| 6.50%,

11/23/32 (b) | |

| 2,750 | | |

| 2,747 | |

| | |

| | | |

| 4,557 | |

| Uruguay (1.7%) | |

| | | |

| | |

| Sovereign (1.7%) | |

| | | |

| | |

| Uruguay

Government International Bond, | |

| | | |

| | |

| 4.38%, 1/23/31 | |

| 790 | | |

| 757 | |

| 5.10%, 6/18/50 | |

| 1,080 | | |

| 960 | |

| 5.75%,

10/28/34 | |

| 710 | | |

| 724 | |

| | |

| | | |

| 2,441 | |

| Uzbekistan (1.6%) | |

| | | |

| | |

| Corporate Bonds (0.3%) | |

| | | |

| | |

| Ipoteka-Bank

ATIB, | |

| | | |

| | |

| 5.50%, 11/19/25 | |

| 230 | | |

| 209 | |

| Uzbek

Industrial and Construction Bank ATB, | |

| | | |

| | |

| 5.75%,

12/2/24 | |

| 249 | | |

| 238 | |

| | |

| | | |

| 447 | |

| Sovereign (1.3%) | |

| | | |

| | |

| Republic

of Uzbekistan International Bond, | |

| | | |

| | |

| 3.70%,

11/25/30 (b) | |

| 301 | | |

| 236 | |

| 3.90%, 10/19/31 | |

| 1,000 | | |

| 782 | |

| 5.38%,

2/20/29 | |

| 900 | | |

| 808 | |

| | |

| | | |

| 1,826 | |

| | |

| | | |

| 2,273 | |

| Venezuela (0.3%) | |

| | | |

| | |

| Sovereign (0.3%) | |

| | | |

| | |

| Petroleos

de Venezuela SA, | |

| | | |

| | |

| 6.00%,

11/15/26 (c)(d) | |

| 8,500 | | |

| 489 | |

| | |

| | | |

| | |

| Vietnam (0.6%) | |

| | | |

| | |

| Corporate Bond (0.6%) | |

| | | |

| | |

| Mong

Duong Finance Holdings BV, | |

| | | |

| | |

| 5.13%,

5/7/29 | |

| 957 | | |

| 869 | |

| | |

| | | |

| | |

| Zambia (0.2%) | |

| | | |

| | |

| Sovereign (0.2%) | |

| | | |

| | |

| Zambia

Government International Bond, | |

| | | |

| | |

| 8.50%,

4/14/24 (c)(d) | |

| 587 | | |

| 324 | |

| TOTAL

FIXED INCOME SECURITIES (COST $158,422) | |

| | | |

| 139,151 | |

| | |

No. of

Warrants | | |

| |

| WARRANTS (0.0%)‡ | |

| | | |

| | |

| Venezuela (0.0%)‡ | |

| | | |

| | |

| Venezuela Government International Bond, Oil-Linked Payment Obligation, expires 4/15/20 (h)(i) (Cost $—) | |

| 5,450 | | |

| 27 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

(Showing Percentage of Total Value

of Investments)

| | |

Shares | | |

Value

(000) | |

| SHORT-TERM INVESTMENTS (2.3%) | |

| | | |

| | |

| Investment Company (2.2%) | |

| | | |

| | |

| Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio - Institutional Class (j) (Cost $3,076) | |

| 3,076,262 | | |

$ | 3,076 | |

| | |

Face Amount

(000) | | |

| |

| United States (0.1%) | |

| | | |

| | |

| U.S. Treasury Security (0.1%) | |

| | | |

| | |

| U.S. Treasury Bill, | |

| | | |

| | |

| 4.47%, 11/30/23 (k) (Cost $174) | |

$ | 175 | | |

| 174 | |

| TOTAL SHORT-TERM INVESTMENTS (COST $3,250) | |

| | | |

| 3,250 | |

| Total Investments (98.9%) (Cost

$161,672) (l)(m)(n) | |

| | | |

| 142,428 | |

| Other Assets in Excess of Liabilities (1.1%) | |

| | | |

| 1,591 | |

| Net Assets (100.0%) | |

| | | |

$ | 144,019 | |

Country assignments and aggregations

are based generally on third party vendor classifications and information, and may be different from the assignments and aggregations

under the policies set forth in the Fund’s prospectus and/or statement of additional information relating to geographic classifications.

| ‡ |

Amount

is less than 0.05%. |

| (a) |

Multi-step

— Coupon rate changes in predetermined increments to maturity. Rate disclosed is as of September 30, 2023. Maturity date

disclosed is the ultimate maturity date. |

| (b) |

144A

security – Certain conditions for public sale may exist. Unless otherwise noted, these securities are deemed to be liquid. |

| (c) |

Issuer

in bankruptcy. |

| (d) |

Non-income

producing security; bond in default. |

| (e) |

Income

may be paid in additional securities and/or cash at the discretion of the issuer. |

| (f) |

Perpetual

- One or more securities do not have a predetermined maturity date. Rates for these securities are fixed for a period of time after

which they revert to a floating rate. Interest rates in effect are as of September 30, 2023. |

| (g) |

Floating

or variable rate securities: The rates disclosed are as of September 30, 2023. For securities based on a published reference

rate and spread, the reference rate and spread are indicated in the description in the Portfolio of Investments. Certain variable

rate securities may not be based on a published reference rate and spread but are determined by the issuer or agent and are based

on current market conditions. These securities do not indicate a reference rate and spread in their description in the Portfolio

of Investments. |

| (h) |

Perpetual

maturity date. Date disclosed is the last expiration date. |

| (i) |

Non-income

producing security. |

| (j) |

The

Fund invests in the Institutional Class of the Morgan Stanley Institutional Liquidity Funds - Treasury Securities Portfolio

- (the "Liquidity Funds"), an open-end management investment company managed by the Adviser. Advisory fees paid by the

Fund are reduced by an amount equal to its pro-rata share of the advisory and administration fees paid by the Fund due to its investment

in the Liquidity Funds. For the nine months ended September 30, 2023, advisory fees paid were reduced by approximately $9,000

relating to the Fund's investment in the Liquidity Funds. |

| (k) |

Rate

shown is the yield to maturity at September 30, 2023. |

| (l) |

Securities

are available for collateral in connection with purchase of open foreign currency forward exchange contracts and futures contracts. |

| (m) |

The

Fund is permitted to purchase and sell securities ("cross-trade") from and to other Morgan Stanley Funds as well as other

funds and client accounts for which the Adviser or an affiliate of the Adviser serves as investment adviser, pursuant to procedures

approved by the Directors in compliance with Rule 17a-7 under the Act (the "Rule"). Each cross-trade is executed at

the current market price in compliance with provisions of the Rule. For the nine months ended September 30, 2023, the Fund did

not engage in any cross-trade transactions. |

| (n) |

At

September 30, 2023, the aggregate cost for federal income tax purposes approximates the aggregate cost for book purposes. The

aggregate gross unrealized appreciation is approximately $3,319,000 and the aggregate gross unrealized depreciation is approximately

$23,777,000, resulting in net unrealized depreciation of approximately $20,458,000. |

| DAC |

Designated

Activity Company. |

| MTN |

Medium Term

Note. |

| PIK |

Payment-in-Kind. |

| REIT |

Real Estate

Investment Trust. |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

Foreign

Currency Forward Exchange Contracts:

The Fund had the following foreign currency forward exchange contracts open at September 30, 2023:

| Counterparty | |

Contracts

to Deliver

(000) | |

In

Exchange

For

(000) | |

Delivery

Date | |

Unrealized

Appreciation

(Depreciation)

(000) | |

| Barclays Bank PLC | |

EUR | 1,498 | |

$ | 1,608 | |

10/6/23 | |

$ | 24 | |

| Citibank NA | |

EUR | 90 | |

$ | 97 | |

10/6/23 | |

| 1 | |

| Citibank NA | |

$ | 220 | |

EUR | 205 | |

10/6/23 | |

| (4 | ) |

| HSBC Bank PLC | |

EUR | 385 | |

$ | 414 | |

10/6/23 | |

| 7 | |

| HSBC Bank PLC | |

EUR | 438 | |

$ | 471 | |

10/6/23 | |

| 8 | |

| HSBC Bank PLC | |

EUR | 1,729 | |

$ | 1,859 | |

10/6/23 | |

| 31 | |

| HSBC Bank PLC | |

EUR | 942 | |

$ | 1,013 | |

10/6/23 | |

| 17 | |

| HSBC Bank PLC | |

EUR | 382 | |

$ | 411 | |

10/6/23 | |

| 7 | |

| HSBC Bank PLC | |

EUR | 396 | |

$ | 426 | |

10/6/23 | |

| 7 | |

| HSBC Bank PLC | |

EUR | 77 | |

$ | 83 | |

10/6/23 | |

| 1 | |

| State Street Bank and Trust Co. | |

EUR | 701 | |

$ | 751 | |

10/6/23 | |

| 10 | |

| State Street Bank and Trust Co. | |

EUR | 1,726 | |

$ | 1,851 | |

10/6/23 | |

| 26 | |

| State Street Bank and Trust Co. | |

EUR | 726 | |

$ | 778 | |

10/6/23 | |

| 11 | |

| State Street Bank and Trust Co. | |

EUR | 803 | |

$ | 861 | |

10/6/23 | |

| 12 | |

| State Street Bank and Trust Co. | |

EUR | 3,172 | |

$ | 3,402 | |

10/6/23 | |

| 48 | |

| State Street Bank and Trust Co. | |

EUR | 707 | |

$ | 758 | |

10/6/23 | |

| 11 | |

| State Street Bank and Trust Co. | |

EUR | 1,728 | |

$ | 1,857 | |

10/6/23 | |

| 30 | |

| State Street Bank and Trust Co. | |

EUR | 438 | |

$ | 471 | |

10/6/23 | |

| 7 | |

| State Street Bank and Trust Co. | |

EUR | 385 | |

$ | 414 | |

10/6/23 | |

| 7 | |

| State Street Bank and Trust Co. | |

EUR | 382 | |

$ | 410 | |

10/6/23 | |

| 7 | |

| State Street Bank and Trust Co. | |

EUR | 942 | |

$ | 1,012 | |

10/6/23 | |

| 16 | |

| State Street Bank and Trust Co. | |

EUR | 396 | |

$ | 425 | |

10/6/23 | |

| 7 | |

| State Street Bank and Trust Co. | |

EUR | 2,681 | |

$ | 2,875 | |

10/6/23 | |

| 40 | |

| State Street Bank and Trust Co. | |

EUR | 1,459 | |

$ | 1,565 | |

10/6/23 | |

| 22 | |

| State Street Bank and Trust Co. | |

EUR | 678 | |

$ | 727 | |

10/6/23 | |

| 10 | |

| State Street Bank and Trust Co. | |

EUR | 613 | |

$ | 657 | |

10/6/23 | |

| 9 | |

| State Street Bank and Trust Co. | |

EUR | 593 | |

$ | 636 | |

10/6/23 | |

$ | 9 | |

| State Street Bank and Trust Co. | |

EUR | 597 | |

$ | 640 | |

10/6/23 | |

| 9 | |

| UBS AG | |

EUR | 74 | |

$ | 80 | |

10/6/23 | |

| 1 | |

| UBS AG | |

EUR | 173 | |

$ | 183 | |

10/6/23 | |

| — | @ |

| | |

| | |

| | |

| |

$ | 391 | |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter

Report – September 30, 2023 (unaudited)

Portfolio of Investments (cont’d)

Futures Contracts:

The Fund had the following futures contracts open at September 30, 2023:

| | |

Number of

Contracts | | |

Expiration

Date | |

Notional

Amount

(000) | | |

Value

(000) | | |

Unrealized

Appreciation

(Depreciation)

(000) | |

| Long: | |

| | |

| |

| | | |

| | | |

| | |

| U.S. Treasury 2 yr. Note (United States) | |

12 | | |

Dec-23 | |

$ | 2,400 | | |

$ | 2,433 | | |

$ | (7 | ) |

| U.S. Treasury 5 yr. Note (United States) | |

54 | | |

Dec-23 | |

| 5,400 | | |

| 5,689 | | |

| (50 | ) |

| U.S. Treasury 10 yr. Note (United States) | |

3 | | |

Dec-23 | |

| 300 | | |

| 324 | | |

| (6 | ) |

| U.S. Treasury 10 yr. Ultra Note (United States) | |

203 | | |

Dec-23 | |

| 20,300 | | |

| 22,647 | | |

| (638 | ) |

| U.S. Treasury Long Bond (United States) | |

11 | | |

Dec-23 | |

| 1,100 | | |

| 1,252 | | |

| (69 | ) |

| U.S. Treasury Ultra Bond (United States) | |

146 | | |

Dec-23 | |

| 14,600 | | |

| 17,328 | | |

| (1,275 | ) |

| Short: | |

| | |

| |

| | | |

| | | |

| | |

| Euro-Buxl 30 yr. Bond (Germany) | |

13 | | |

Dec-23 | |

EUR | (1,300 | ) | |

| (1,682 | ) | |

| 117 | |

| German Euro-Bobl Index (Germany) | |

57 | | |

Dec-23 | |

| (5,700 | ) | |

| (6,975 | ) | |

| 72 | |

| German Euro-Bund Index (Germany) | |

68 | | |

Dec-23 | |

| (6,800 | ) | |

| (9,248 | ) | |

| 193 | |

| U.S. Treasury 5 yr. Note (United States) | |

75 | | |

Dec-23 | |

$ | (7,500 | ) | |

| (7,902 | ) | |

| 57 | |

| U.S. Treasury 10 yr. Note (United States) | |

13 | | |

Dec-23 | |

| (1,300 | ) | |

| (1,405 | ) | |

| 1 | |

| | |

| | |

| |

| | | |

| | | |

$ | (1,605 | ) |

EUR — Euro

USD — United States Dollar

Portfolio Composition

| Classification | |

Percentage of

Total Investments | |

| Sovereign | |

68.1 | % |

| Corporate Bonds | |

29.6 | |

| Other* | |

2.3 | |

| Total Investments | |

100.0 | %** |

| * |

Industries

and/or investment types representing less than 5% of total investments. |

| ** |

Does not include

open long/short futures contracts with a value of approximately $76,885 and net unrealized depreciation of approximately $1,605,000. Does

not include open foreign currency forward exchange contracts with net unrealized appreciation of approximately $391,000. |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter Report – September 30,

2023 (unaudited)

Notes to the Portfolio

of Investments

The ongoing conflict between Russia

and Ukraine has led many countries, including the U.S., to impose economic sanctions on Russian governmental institutions, Russian entities,

and Russian individuals. These sanctions have had a negative impact on the Russian economy and currency, and on investments and companies

economically tied to Russia, Ukraine and certain neighboring countries. In response, Russia imposed its own restrictions against investors

and countries outside Russia. Businesses in the U.S. and globally have experienced shortages in materials and increased costs for transportation,

energy and raw materials due, in part, to the adverse effects of the conflict on the global economy. The escalation or continuation of

the conflict between Russia and Ukraine or other hostilities presents heightened risks relating to, among other things, cyber-attacks,

the frequency and volume of failures to settle securities transactions, supply chain disruptions, inflation, and potential increased

volatility in commodity, currency and other financial markets. This conflict could continue to adversely affect global markets performance

and liquidity, thereby negatively affecting the value of the Fund’s investments beyond any direct exposure to Russian or Ukrainian

issuers, markets or economies. The duration and extent of the economic impacts resulting from the military conflict between Russia and

Ukraine and related sanctions remains uncertain at this time.

Security

Valuation: (1) Fixed income securities may be valued by an outside pricing service/vendor

approved by the Fund’s Board of Directors (the “Directors”). The pricing service/vendor may employ a pricing model

that takes into account, among other things, bids, yield spreads and/or other market data and specific security characteristics. If the

Adviser determines that the price provided by the outside pricing service/vendor does not reflect the security’s fair value or

is unable to provide a price, prices from brokers/dealers may also be utilized. In these circumstances, the value of the security will

be the mean of bid and asked prices obtained from brokers/dealers; (2) an equity portfolio security listed or traded on an exchange

is valued at its latest reported sales price (or at the exchange official closing price if such exchange reports an official closing

price), and if there were no sales on a given day and if there is no official exchange closing price for that day, the security is valued

at the mean between the last reported bid and asked prices if such bid and asked prices are available on the relevant exchanges. If only

bid prices are available then the latest bid price may be used. Listed equity securities not traded on the valuation date with no reported

bid and asked prices available on the exchange are valued at the mean between the current bid and asked prices obtained from one or more

reputable brokers/dealers. In cases where a security is traded on more than one exchange, the security is valued on the exchange designated

as the primary market; (3) when market quotations are not readily available, as defined by Rule 2a-5 under the Act, including

circumstances under which the Adviser or the Sub-Adviser determines that the closing price, last sale price or the mean between the last

reported bid and asked prices are not reflective of a security’s market value, portfolio securities are valued at their fair value

as determined in good faith under procedures approved by and under the general supervision of the Directors. Occasionally, developments

affecting the closing prices of securities and other assets may occur between the times at which valuations of such securities are determined

(that is, close of the foreign market on which the securities trade) and the close of business of the New York Stock Exchange (“NYSE”).

If developments occur during such periods that are expected to materially affect the value of such securities, such valuations may be

adjusted to reflect the estimated fair value of such securities as of the close of the NYSE, as determined in good faith by the Directors

or by the Adviser using a pricing service and/or procedures approved by the Directors; (4) futures are valued at the settlement

price on the exchange on which they trade or, if a settlement price is unavailable, at the last sale price on the exchange; (5) foreign

exchange transactions (“spot contracts”) and foreign exchange forward contracts (“forward contracts”) are valued

daily using an independent pricing vendor at the spot and forward rates, respectively, as of the close of the NYSE; and (6) investments

in mutual funds, including the Morgan Stanley Institutional Liquidity Funds, are valued at the net asset value as of the close of each

business day.

In connection with Rule 2a-5 of

the Act, the Directors have designated the Fund’s Adviser as its valuation designee. The valuation designee has responsibility

for determining fair value and to make the actual calculations pursuant to the fair valuation methodologies previously approved by the

Directors. Under procedures approved by the Directors, the Fund’s Adviser, as valuation designee, has formed a Valuation Committee

whose members are approved by the Directors. The Valuation Committee provides administration and oversight of the Fund’s valuation

policies and procedures, which are reviewed at least annually by the Directors. These procedures allow the Fund to utilize independent

pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Fair

Value Measurement: Financial Accounting Standards Board (“FASB”) Accounting

Standards CodificationTM ("ASC") 820, "Fair Value Measurement" (“ASC 820”), defines fair

value as the price that would be received to sell an asset or pay to transfer a liability in an orderly transaction between market participants

at the measurement date. ASC 820 establishes a three-tier hierarchy to distinguish between (1) inputs that reflect the assumptions

market participants would use in valuing an asset or liability developed based on market data obtained from sources independent of the

reporting entity (observable inputs) and (2) inputs that reflect the reporting entity's own assumptions about the assumptions market

participants would use in valuing an asset or liability developed based on the best information available in the circumstances (unobservable

inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the

value of the Fund's investments. The inputs are summarized in the three broad levels listed below:

| · | Level 1 – unadjusted quoted

prices in active markets for identical investments |

| | | |

| · | Level 2 – other significant

observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| | | |

| · | Level 3 – significant unobservable

inputs including the Fund’s own assumptions in determining the fair value of investments. Factors considered in making this determination

may include, but are not limited to, information obtained by contacting the issuer, analysts, or the appropriate stock exchange (for

exchange-traded securities), analysis of the issuer's financial statements or other available documents and, if necessary, available

information concerning other securities in similar circumstances. |

Morgan Stanley

Emerging Markets Debt Fund, Inc.

Third Quarter Report – September 30,

2023 (unaudited)

Notes to the Portfolio of Investments (cont’d)

The inputs or methodology used for valuing

securities are not necessarily an indication of the risk associated with investing in those securities and the determination of the significance

of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to each security.

The following is a summary of the inputs

used to value the Fund’s investments as of September 30, 2023:

| Investment Type | |

Level 1

Unadjusted

Quoted

Prices

(000) | | |

Level 2

Other

Significant

Observable

Inputs

(000) | | |

Level 3

Significant

Unobservable

Inputs

(000) | | |

Total

(000) | |

| Assets: |

| Fixed Income Securities |

| Corporate Bonds | |

$ | — | | |

$ | 42,128 | | |

$ | — | | |

$ | 42,128 | |

| Sovereign | |

| — | | |

| 97,023 | | |

| — | | |

| 97,023 | |

| Total Fixed Income Securities | |

| — | | |

| 139,151 | | |

| — | | |

| 139,151 | |

| Warrant | |

| — | | |

| 27 | | |

| — | | |

| 27 | |

| Short-Term Investments |

| U.S. Treasury Security | |

| — | | |

| 174 | | |

| — | | |

| 174 | |

| Investment Company | |

| 3,076 | | |

| — | | |

| — | | |

| 3,076 | |

| Total Short-Term Investments | |

| 3,076 | | |

| 174 | | |

| — | | |

| 3,250 | |

| Foreign Currency Forward Exchange Contracts | |

| — | | |

| 395 | | |

| — | | |

| 395 | |

| Futures Contracts | |

| 440 | | |

| — | | |

| — | | |

| 440 | |

| Total Assets | |

| 3,516 | | |

| 139,747 | | |

| — | | |

| 143,263 | |

| Liabilities: |

| Foreign Currency Forward Exchange Contract | |

| — | | |

| (4 | ) | |

| — | | |

| (4 | ) |

| Futures Contracts | |

| (2,045 | ) | |

| — | | |

| — | | |

| (2,045 | ) |

| Total Liabilities | |

| (2,045 | ) | |

| (4 | ) | |

| — | | |

| (2,049 | ) |

| Total | |

$ | 1,471 | | |

$ | 139,743 | | |

$ | — | | |

$ | 141,214 | |

Transfers between investment levels

may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes.

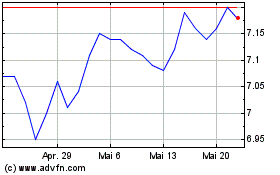

Morgan Stanley Emerging ... (NYSE:MSD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Morgan Stanley Emerging ... (NYSE:MSD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024