0000860748false00008607482024-01-252024-01-250000860748us-gaap:CommonStockMember2024-01-252024-01-250000860748kmpr:A5875FixedRateResetJuniorSubordinatedDebenturesDue2062Member2024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2024

Kemper Corporation

(Exact name of registrant as specified in its charter)

Commission File Number: 001-18298

| | | | | | | | |

| | |

| DE | | 95-4255452 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

200 E. Randolph Street, Suite 3300, Chicago, IL 60601

(Address of principal executive offices, including zip code)

312-661-4600

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2.below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.10 per share | KMPR | NYSE |

| 5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062 | KMPB | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of

the Exchange Act. ¨

Section 5 – Corporate Governance and Management

| | | | | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On September 18, 2023, Kemper Corporation (the “Company”) filed a Current Report on Form 8-K (the “Original Form 8-K”) disclosing that James J. McKinney ceased to serve as Chief Financial Officer of the Company, effective September 13, 2023. Between September 13, 2023 and December 31, 2023, Mr. McKinney continued to be employed by the Company to facilitate the transition of his Chief Financial Officer duties. As set forth in the Original Form 8-K, the Company and Mr. McKinney expected to enter into a separation agreement at a later date.

On January 25, 2024, the Company and Mr. McKinney entered into a Separation and Release Agreement (the “Separation Agreement”), pursuant to which, in exchange for Mr. McKinney’s execution and non-revocation of the Separation Agreement, and his compliance with the obligations set forth in the Separation Agreement, including a general waiver and release of any claims against the Company and its affiliates, Mr. McKinney is entitled to (i) a cash severance benefit in the total amount of $1,975,000, less applicable taxes and withholdings, to be paid in two installments; (ii) a payment equivalent to the paid time off that is accrued but unpaid as of his separation date, and (iii) outplacement services.

The foregoing description of the Separation Agreement is a summary and is qualified in its entirety by reference to the full text of the Separation Agreement.

Section 9 – Financial Statements and Exhibits

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

Exhibit Number | Exhibit Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | | Kemper Corporation |

| | |

| Date: | January 26, 2024 | | | /s/ C. Thomas Evans, Jr. |

| | | | C. Thomas Evans, Jr. |

| | | | Executive Vice President, Secretary and General Counsel |

SEPARATION AND RELEASE AGREEMENT

This Separation and Release Agreement (“Agreement”) is made between James J. McKinney (“Executive”) and Merastar Insurance Company (the “Company,” and together with its parent, affiliates and subsidiaries including Kemper Corporation, the “Company Group”) on the date last written below.

BACKGROUND

Company and Executive wish to set forth the terms and conditions governing the termination of Executive’s employment, and to provide for the settlement and release of any and all claims, demands, and causes of action Executive may have against the Company Group arising out of or in any way related to Executive’s employment with Company, and the termination thereof. Executive acknowledges and agrees that he is not eligible for benefits under terms of the Kemper Corporation Employee General Severance Pay Plan.

TERMS AND CONDITIONS

In consideration of their mutual promises and undertakings described below, Executive and Company agree as follows:

1. Employment Separation Date. Executive’s employment with Company ended at the close of business on December 31, 2023 (“Separation Date”).

2. Severance Benefits. Subject to completion of the conditions set forth in Sections 2A through 2D, below, and Executive’s compliance with the terms of this Agreement, Executive shall be entitled to a cash severance benefit in the gross total amount of $1,975,000, less applicable taxes and withholdings. Two-thirds of such amount shall be paid to Executive within fifteen (15) business days after the Effective Date, as defined in Section 20D, and provided the Executive remains in compliance with his obligations under this Agreement, the remaining one-third of such amount shall be paid to Executive on the six-month anniversary of the Separation Date (the “Severance Benefit”). The Severance Benefit shall be subject to completion of all of the following conditions:

A.this Agreement has been signed by Executive and delivered to the Company within twenty-one (21) days, in accordance with Section 20B of this Agreement (entitled “Time to Review Agreement”);

B.the revocation period described in Section 20D (entitled “Right of Revocation”) has expired;

C.the Acknowledgment Form (in the form of Attachment A hereto) confirming Executive’s decision not to revoke this Agreement has been signed by Executive and delivered to the Company in accordance with Section 20E (entitled “Acknowledgement of Non-Revocation”); and

D.Executive has returned any and all Company Group property in accordance with Section 5E.

3. Executive Acknowledgements and Agreements. Executive acknowledges and agrees that:

A.Executive will not seek reinstatement, future employment, or other working relationship with the Company Group, provided, however, that in the event Executive is employed by an entity at the time such entity is acquired by, or acquires, Kemper Corporation or any member of the Company Group, this Section 3A shall not be invoked to terminate Executive’s employment or to declare Executive’s continued employment by such entity or any affiliate or successor entity a violation of this Agreement.

B.The following are true statements:

(i) Executive has reported to the Company any and all work-related injuries incurred during employment;

(ii) The Company properly provided any leave of absence because of Executive’s or a family member’s health condition and Executive has not been subjected to any improper treatment, conduct or actions due to a request for or taking such leave; and

(iii) Executive has had the opportunity to provide the Company Group with written notice of any and all known concerns regarding suspected ethical and compliance issues or violations on the part of the Company Group or any Released Party (as defined in Section 6 below), and to report to the Company Group any complaints, claims, or actions filed against the Company Group or any Released Party, subject to Sections 6B and 6C, below.

C.Termination of Executive’s employment will result in forfeiture of (i) any amounts potentially payable to Executive as a cash bonus for 2023 or any prior years; and (ii) any outstanding awards to Executive under Kemper Corporation’s 2011 Omnibus Equity Plan, 2020 Omnibus Equity Plan and 2023 Omnibus Plan, in accordance with such plans and the termination provisions of the respective award agreements to which Executive is a party, subject to the post-termination exercise provisions in the applicable agreements.

4. PTO. Executive will receive payment equivalent to Paid Time Off (“PTO”) that is accrued but unpaid on the Separation Date; payment will be made on the next scheduled pay day following the Separation Date in accordance with legal requirements.

5. Obligations of Executive.

Executive agrees to the following covenants, subject to the provisions of Sections 6B and 6C, below:

A.Non-disclosure. Except as required by applicable law, Executive covenants and agrees not to use, share, publish, communicate, make available or otherwise disclose, any confidential or proprietary information (“Confidential Information”) concerning the Company Group. Confidential Information includes non-public information relating to the business of the Company Group such as business or marketing plans, M&A opportunity analysis, corporate or business development strategies, financial records, reserves, research, pending or threatened litigation, product pricing data, trade secrets, employee and customer information, commercial terms with vendors and consultants, and any compilation of this information obtained solely through the course of employment with the Company Group; provided that Confidential Information shall not include (i) any information that becomes publicly available without any direct or indirect involvement of Executive, whether before, on or after the date of this Agreement or (ii) information to the extent developed by Executive outside of his duties and responsibilities to the Company Group and without the use of confidential or proprietary information of the Company Group. In addition, nothing in this Section 5A shall preclude Executive from disclosing Confidential Information to Executive’s legal and personal financial advisors (including such legal and financial advisors who provide advice to trusts or other fiduciary or estate planning accounts existing as of December 31, 2023 of which Executive and his family are beneficiaries) (collectively, “Advisors”) to the extent such disclosure is within the scope of and germane to the legal representation or financial advice that they provide, and such Advisors are informed by Executive of the confidential nature of the Confidential Information and are directed and agree to keep such Confidential Information confidential in accordance with the terms of this Agreement.

B.Standstill. Executive covenants and agrees that through the period ending one day after the release of earnings by Kemper Corporation for the second quarter of 2024, or August 9, 2024, whichever date is earlier, he shall not, directly or indirectly, whether as a principal, agent, officer, director, partner, employee, consultant, advisor, independent contractor or in any capacity whatsoever, alone or in association with any other person, carry on, or be engaged, concerned or take part in, any effort to acquire by purchase, tender offer, agreement or business combination any material assets or businesses of the Company Group or in any effort by Executive, or any “group” with which Executive in any way participants or is affiliated, to (i) engage in any “solicitation” or become a “participant” in a “solicitation” (as such terms are defined in Regulation 14A under the Securities Exchange Act of 1934) of proxies or consents, in each case with respect to any securities of the Company, (ii) seek or knowingly encourage or take any other action with respect to the appointment, election or removal of any directors or officers of the Company Group, (iii) publicly comment on any third party proposal regarding any governance changes, merger, takeover offer, tender (or exchange) offer, acquisition, recapitalization,

restructuring, disposition, spin-off, or other business combination involving the Company Group, or (iv) own, acquire, offer or propose to acquire or agree to acquire, whether by purchase, tender or exchange offer, or through the acquisition of control of another person or entity (including by way of merger or consolidation) any additional shares of the outstanding common stock of the Company, any rights to vote or direct the voting of any additional shares of the Company’s common stock (i.e., in excess of the number of shares held by Executive as of the Separation Date), or any securities convertible into common stock of the Company except for (x) additional shares acquired by way of stock splits, stock dividends, stock reclassifications or other distributions or offerings made available and, if applicable, exercised on a pro rata basis, to holders of the common stock of the Company generally and (y) additional shares acquired upon the exercise of stock options granted by Kemper Corporation in accordance with the terms and conditions of the applicable equity compensation plan and stock option award agreement; provided that, subject to Executive’s compliance with all other material terms of this Agreement, including Sections 5A and 5D, nothing in this Section 5B shall restrict Executive (or any entity or group with which Executive is associated) from confidentially communicating to the Kemper Corporation’s board of directors, chief executive officer or chief financial officer any non-public proposals regarding potential transactions in such a manner as would not reasonably be expected to require public disclosure thereof under any law applicable to the Company Group or its representatives. This covenant does not prohibit passive ownership of stock or debt of any public corporation, including shares of common stock of Kemper Corporation that are currently owned by Executive, as long as the Executive is not otherwise in violation of this covenant.

C.Non-solicitation. Executive covenants and agrees that Executive shall not for a period of twelve (12) months immediately following the Separation Date, solicit, induce or entice any person to leave the employ of the Company Group. This covenant applies to any employee with whom Executive had Material Contact. For purposes of this Agreement, “Material Contact” means interaction between Executive and another employee of the Company Group: (i) with whom Executive actually dealt as part of Executive’s job duties; or (ii) whose employment or dealings with the Company Group were handled, coordinated, managed, or supervised by Executive.

D.Non-disparagement. Executive covenants and agrees not to make statements, directly or indirectly, to clients, customers, competitors, reinsurers, investors, rating agencies, proxy advisors, analysts and suppliers of the Company Group or otherwise make public statements that are in any way disparaging towards the Company Group, including without limitation its current and former directors, officers and employees, and its products and services, and agrees not to encourage or aid any person or entity in the pursuit of any claim or cause of action against the Company Group, except as contemplated by Section 6C, below. The Company shall instruct each person who is a director or executive officer of Kemper Corporation as of the Separation Date not to make statements to clients, customers, competitors, reinsurers, investors, rating agencies, analysts and suppliers of the Company Group or otherwise make public statements that are in any way disparaging towards the Executive. Notwithstanding anything to the contrary in this Section 5D, nothing shall prohibit the Company Group or its directors or executive officers from giving truthful testimony or evidence to a governmental entity, or if properly subpoenaed or otherwise required to do so under applicable law.

E.Return of Property. Executive covenants and agrees to return all Company Group credit cards, identification cards, access cards and keys to Company’s properties or facilities that Executive may have in his possession. Executive shall return any and all Company Group confidential files and all Company Group confidential and proprietary information that Executive may have in his possession. Executive shall return any and all of Company Group's property, including but not limited to, computer equipment, peripherals and printers. The Company shall issue to Executive a receipt documenting all property that Executive has returned to the Company Group. Executive represents that as of the date of this Agreement Executive is in possession of two iPads and one iPhone that belong to the Company Group and that he will return such property promptly following the Separation Date. If the Company determines that Executive is in possession of any other Company Group property, it will notify Executive of such determination and Executive shall return such property to the Company Group promptly after such notice.

6. Consideration to Company – Release of Claims and Agreement Not to Sue.

A.Except as stated below, Executive forever releases, discharges and holds harmless Company and its respective parent company, subsidiaries, affiliates, predecessors, successors and assigns, and their officers, directors, shareholders, principals, Executives, insurers, and agents (“Released Parties”) from any claim or cause of action whatsoever which Executive either has or may have against the Released Parties resulting from or arising out of or related to Executive’s employment by the Company, or the termination of that employment, including any claims or causes of action Executive has or may have pursuant to the Age Discrimination in Employment Act (“ADEA”); the Older Workers Benefit Protection Act of 1990 (“OWBPA”); Title VII of the Civil Rights Act of 1964, as amended by the Civil Rights Act of 1991; the Americans with Disabilities Act; the Rehabilitation Act of 1973; the Family and Medical Leave Act of 1993; the Employee Retirement Income Security Act of 1974; the Illinois Human Rights Act; and discrimination and retaliation based on filing a workers’ compensation claim, and any other law or regulation of any local, state or federal jurisdiction.

B.This release does not apply to any claims or rights that may arise after the date that Executive signs this Agreement, or relate to the consideration for this Agreement, vested rights under the Company Group’s employee benefit plans as applicable on the date Executive signs this Agreement, or any claims that the controlling law clearly states may not be released by private agreement.

C.Nothing in this Agreement (including but not limited to the release of claims, promise not to sue, Executive acknowledgements, confidentiality, Executive cooperation and assistance, nondisparagement, non-solicitation, and return of property provisions): (i) limits or affects Executive’s right, if any, to challenge the validity of this release under the ADEA or the OWBPA; (ii) prevents Executive from filing a charge or complaint with, providing documents or other information to, or participating in an investigation or proceeding conducted by, the Equal Employment Opportunity Commission, the National Labor Relations Board, the Securities and Exchange Commission or any other federal, state or local government agency; or (iii) prevents Executive from exercising his rights under Section 7 of the National Labor Relations Act to engage in protected, concerted activity with other Executives, although by signing this Agreement Executive is waiving any right Executive may have to recover any individual relief (including any backpay, front pay, reinstatement or other legal or equitable relief) in any charge, complaint, or lawsuit or other proceeding brought by or on behalf of Executive, except for any right Executive may have to receive a payment from a government agency (and not the Company Group) for information provided to such agency, or other waiver prohibited by applicable law.

D.Any action for breach of this Agreement shall be brought in accordance with the arbitration agreement in effect between Executive and the Company Group, and Executive expressly acknowledges that if Executive files any claim regarding any matter described in this Agreement, the Company Group may be entitled to recover from Executive some or all money paid under this Agreement. In any action brought by either party under this Agreement, the prevailing party shall be entitled to reasonable attorneys’ fees and costs incurred in prosecuting or defending against such action, to the extent permitted by law.

E.Notwithstanding Executive’s confidentiality and non-disclosure obligations under this Agreement or otherwise, as provided in the federal Defend Trade Secrets Act, Executive shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made: (i) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law, or to Executive’s attorney in connection with a lawsuit for retaliation for reporting a suspected violation of law; or (ii) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal so that it is not made public.

7. Unemployment Benefits. Company agrees that the release provided in Section 6 shall not prevent Executive from applying for and receiving any unemployment benefits to which Executive may be entitled under applicable law and the Company agrees not to oppose any such application by Executive.

8. Outplacement Services. The Company agrees to provide at its cost up to twelve (12) months of outplacement services for Executive through Lee Hecht Harrison, provided that Executive commences utilization of those services not later than April 30, 2024.

9. Expense Reimbursement. Executive agrees to submit an expense account form to the Company within fourteen (14) days after the Separation Date for reimbursement of reasonable business expense items incurred on behalf of the Company Group on or prior to the Separation Date for which the Company Group has not yet then paid. Within thirty (30) days of the receipt of such an expense account form, together with such supporting documentation as Company may reasonably require, Company will pay Executive for such reasonable business expense items incurred on behalf of Company. Executive confirms that Executive has paid all company credit card account balances for any personal charges before execution of this Agreement.

10. Executive Cooperation and Assistance. Executive shall not solicit, assist or encourage any former or current executive of the Company Group to sue the Company Group regarding issues arising out of employment with the Company Group, and Executive agrees that Executive will not voluntarily participate in the prosecution of any employment related case against the Company Group or any Released Party without a lawfully issued subpoena or as otherwise required by law. Executive agrees to cooperate with the Company Group in all reasonable respects in the defense or prosecution of any lawsuits, arbitrations, or any other types of proceedings, and in the preparation of any response to any examination or investigation by any government entity or agency, and with respect to any other claims or matters (all such lawsuits, arbitrations, proceedings, examinations, investigation, claims and matters being collectively referred to as “Proceedings”), arising out of or in any way related to the policies, practices, or conduct of the Company Group and their affiliates during the time Executive was employed by the Company and with respect to which Executive has knowledge or was involved, and shall testify fully and truthfully in connection therewith. In addition, Executive agrees that, upon reasonable notice and conditions, Executive will participate in such informal interviews by counsel for the Company Group as may be reasonably necessary to ascertain Executive’s knowledge concerning the facts relating to any such Proceedings, and to cooperate with such counsel in providing testimony whether through deposition or affidavit in any such Proceeding.

Executive agrees to immediately notify Company if Executive is served with legal process to compel disclosure of any information related to either Executive’s employment with Company or information regarding one or more of its affiliates, unless prohibited by law. Executive further agrees to immediately notify Company if Executive is contacted regarding any legal claim or legal matter related to his employment with Company, unless prohibited by applicable law.

Company will reimburse Executive for Executive’s reasonable travel, lodging and other out-of-pocket expenses associated with Executive’s compliance with this Section. Company will also compensate Executive for all time reasonably spent cooperating with Company, as described above, at a rate of $600.00 per hour. Company will make every reasonable effort to accommodate Executive’s personal and business schedules when requesting his assistance and cooperation.

Executive further agrees to cooperate with the Company Group in all reasonable respects in any internal investigations conducted by the Company Group and arising out of or in any way related to the policies, practices, or conduct of the Company Group and their affiliates during the time Executive was employed by the Company and with respect to which Executive has knowledge or was involved.

11. Indemnification; Right to Counsel. Company agrees to indemnify Executive, in accordance with the terms and conditions of the Indemnification Agreement between Kemper Corporation and Executive, dated February 5, 2020 (which is incorporated herein by reference), Kemper Corporation’s Amended and Restated Bylaws and Certificate of Incorporation, and applicable Delaware law.

12. No Admission of Liability. Nothing in this Agreement shall be construed to be an admission of liability by the Company Group or its shareholders, officers, executives, directors, agents, successors, assigns, or any other affiliated person or entity for any alleged violation of any of Executive’s statutory rights or any common law duty imposed upon the Company Group.

13. Adequate Consideration. Executive agrees that the severance pay and any other benefits provided under this Agreement is above and beyond any amounts already owed to him and is adequate consideration for all promises and releases by Executive contained in this Agreement.

14. Non-waiver. The waiver by either party of a breach of any provision of this Agreement by the other party shall not operate or be construed as a waiver of any subsequent breach of the same or any other provision of this Agreement.

15. Notices. Any notices required or permitted to be given under this Agreement shall be sufficient if in writing and personally delivered or sent by a recognized overnight courier service to Executive’s residence as last shown on Company’s employment records, in the case of Executive, or to Kemper Corporate Services Inc., ATTN: Ismat Duckson Aziz, 200 East Randolph Street, Suite 3300, Chicago, IL 60601, in the case of Company.

16. Successors and Assigns. Except as otherwise provided in specific provisions above, this Agreement shall be binding upon and inure to the benefit of Executive, his heirs, executors, administrators, designated beneficiaries and upon anyone claiming under Executive, and shall be binding and inure to the benefit of Company and its successors and assigns.

17. Severability. If a court or other body of competent jurisdiction should determine that any term or provision of this Agreement is invalid or unenforceable, such term or provision shall be reformed rather than voided, if possible, in accordance with the purposes stated in this Agreement and with applicable law, and all other terms and provisions of this Agreement shall be deemed valid and enforceable to the extent possible.

18. Complete Agreement; Counterparts. With the exception of any documents expressly referenced herein, this Agreement supersedes any prior agreements or understanding covering this subject matter, either written or oral, between the parties. This Agreement may be executed in counterparts, each of which shall be deemed an original.

19. Applicable Law and Venue. This Agreement shall be construed under the laws of the State of Illinois applicable to contracts entered into and to be performed therein. To the extent any claims are not properly subjected to the arbitration provision in Section 6D of this Agreement, any and all disputes arising from or relating to this Agreement shall be resolved in a court of competent jurisdiction in Cook County, Illinois. The Parties submit to the personal jurisdiction of the courts of Cook County, Illinois and shall not oppose any motion to transfer venue brought to enforce this provision.

20. Consultation with Counsel; Acknowledgement of Rights and Deadlines.

A.Counsel. The Company advises Executive to consult with an attorney prior to signing this Agreement, which includes a release of certain specified rights.

B.Time to Review Agreement. Executive acknowledges and understands that Executive has up to twenty-one (21) days following his receipt of this Agreement to sign and return this Agreement to the contact person and address for the Company provided above in Section 15 of this Agreement.

C.ADEA Waiver. Executive acknowledges and understands that the severance payment and any other benefits due to Executive under this Agreement provides adequate consideration to Executive for the waiver of any rights Executive may have under the ADEA and the other releases provided under Section 6.

D.Right of Revocation. Executive understands that Executive has the right within seven (7) days of the signing of this Agreement to revoke his waiver of rights to claim damages under Section 6, including the ADEA if applicable. If Executive does revoke that waiver within the seven (7) day period, this Agreement shall be null and void. If Executive does not revoke his waiver of rights to claim damages under Section 6, this Agreement shall become effective on the eighth day following the date signed by Executive below (the “Effective Date”). Any revocation must be in writing and delivered to the contact person and address for the Company provided in Section 15 of this Agreement. Revocation must be delivered no later than 5:00 p.m. Central Time on the seventh day after Executive signs this Agreement. Unless Executive returns the revocation in person, it must be: 1) properly addressed; 2) postmarked no later than seven (7) days after execution of this Agreement; and 3) sent by overnight courier or certified mail, return receipt requested.

E.Acknowledgement of Non-Revocation. If Executive does not revoke his waiver of rights specified in Section 20D, above, Executive must deliver written acknowledgement in the form of Attachment A to the contact person and address for the Company provided above in the “Notices” section of this Agreement.

21. Section 409A of the Internal Revenue Code. This Agreement is intended to comply with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and shall be interpreted and construed consistently with such intent. The payments to Executive pursuant to this Agreement are also intended to be exempt from Section 409A of the Code to the maximum extent possible, under either the separation pay exemption pursuant to Treasury regulation §1.409A-1(b)(9)(iii) or as short-term deferrals pursuant to Treasury regulation §1.409A-1(b)(4), and for this purpose each payment shall constitute a “separately identified” amount within the meaning of Treasury Regulation §1.409A-2(b)(2). In the event the terms of this Agreement would subject Executive to taxes or penalties under Section 409A of the Code (“409A Penalties”), the Company and Executive shall cooperate diligently to amend the terms of this Agreement to avoid such 409A Penalties, to the extent possible; provided that in no event shall the Company be responsible for any 409A Penalties that arise in connection with any amounts payable under this Agreement. To the extent any amounts under this Agreement are payable by reference to Executive’s “termination of employment,” such term shall be deemed to refer to Executive’s “separation from service,” within the meaning of Section 409A of the Code. Notwithstanding any other provision in this Agreement, if the Executive is a “specified employee,” as defined in Section 409A of the Code, as of the date of Executive’s separation from service, then to the extent any amount payable to Executive (i) constitutes the payment of nonqualified deferred compensation, within the meaning of Section 409A of the Code, (ii) is payable upon Executive’s separation from service and (iii) under the terms of this Agreement would be payable prior to the six-month anniversary of Executive’s separation from service, such payment shall be delayed until the earlier to occur of (a) the first business day following the six-month anniversary of the separation from service and (b) the date of Executive’s death. Any reimbursement or advancement payable to the Executive pursuant to this Agreement or otherwise shall be conditioned on the submission by the Executive of all expense reports reasonably required by the Company under any applicable expense reimbursement policy, and shall be paid to the Executive in accordance with such policy, but in no event later than the last day of the calendar year following the calendar year in which Executive incurred the reimbursable expense. Any amount of expenses eligible for reimbursement, or in-kind benefit provided, during a calendar year shall not affect the amount of expenses eligible for reimbursement, or in-kind benefit to be provided, during any other calendar year. The right to any reimbursement or in-kind benefit pursuant to this Agreement or otherwise shall not be subject to liquidation or exchange for any other benefit.

[Signature Page to Follow]

TO EVIDENCE THEIR AGREEMENT, the parties have executed this document as of the date last written below.

| | | | | | | | | | | | | | | | | |

| James J. McKinney | | Merastar Insurance Company | |

| | | | | |

| /s/ James J. McKinney | | By: | /s/ John M. Boschelli | |

| | | | | |

| | | Name: | John M. Boschelli | |

| | | | | |

| | | Title: | Assistant Treasurer | |

| | | | | |

| Date: | 1/25/24 | | Date: | 1/25/24 | |

| | | | | |

Attachment A

Seven Day Right to Revocation

Acknowledgment Form

I, James J. McKinney, hereby acknowledge that Merastar Insurance Company tendered a Separation Agreement offer which I voluntarily agreed to accept on January ____, 2024, a date at least seven (7) days prior to today’s date.

I certify that seven (7) calendar days have elapsed since my voluntary acceptance of the above-referenced offer (i.e., seven days have elapsed since the above date), and that I have voluntarily chosen not to revoke my acceptance of the above-referenced Separation Agreement.

Signed this ____ day of __________________, 2024.

________________________________

James J. McKinney

v3.23.4

Document and Entity Information

|

Jan. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 25, 2024

|

| Entity Registrant Name |

Kemper Corporation

|

| Entity Central Index Key |

0000860748

|

| Amendment Flag |

false

|

| Entity File Number |

001-18298

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

95-4255452

|

| Entity Address, Address Line One |

200 E. Randolph Street

|

| Entity Address, Address Line Two |

Suite 3300

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60601

|

| City Area Code |

312

|

| Local Phone Number |

661-4600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| Trading Symbol |

KMPR

|

| Security Exchange Name |

NYSE

|

| Entity Listings [Line Items] |

|

| Trading Symbol |

KMPR

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

Common Stock, par value $0.10 per share

|

| 5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062 |

|

| Cover [Abstract] |

|

| Title of 12(b) Security |

5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062

|

| Trading Symbol |

KMPB

|

| Security Exchange Name |

NYSE

|

| Entity Listings [Line Items] |

|

| Trading Symbol |

KMPB

|

| Security Exchange Name |

NYSE

|

| Title of 12(b) Security |

5.875% Fixed-Rate Reset Junior Subordinated Debentures due 2062

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=kmpr_A5875FixedRateResetJuniorSubordinatedDebenturesDue2062Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

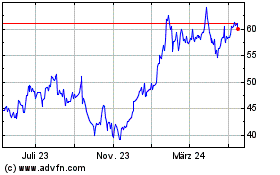

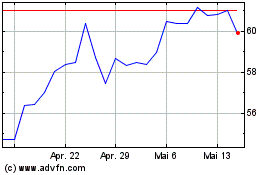

Kemper (NYSE:KMPR)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Kemper (NYSE:KMPR)

Historical Stock Chart

Von Mai 2023 bis Mai 2024