By Don Clark and Kim Nash

Hewlett Packard Enterprise Co. sent reassuring signals about

corporate technology demand, though currency issues continued to

weigh on its revenue.

The Silicon Valley company, reporting its first quarterly

results since it split in November from printer and personal

computer maker HP Inc., on Thursday said net income in its first

fiscal quarter fell 52%, including restructuring costs. Revenue

declined 2.5%.

Excluding the effects of a stronger dollar, however, the company

said revenue rose 4%--the third consecutive quarter of growth on a

constant currency basis--and both revenue and adjusted profit beat

Wall Street expectations.

HP Enterprise shares jumped 6% after hours.

"We had a strong quarter," said Meg Whitman, the company's chief

executive, in an interview. "As I look back, I see separating this

company was so much the right thing to do."

Jitters about corporate technology demand emerged in the

fourth-quarter results of several big technology vendors. Intel

Corp., for example, said in January that fourth-quarter revenue

from its data center group rose only 5% in the period ended in

December, down from a 12% growth rate in the third period.

The following month, networking equipment giant Cisco Systems

Inc. said it had seen customers holding off purchases in January in

reaction to turmoil in the stock market.

Ms. Whitman said HP Enterprise had sensed the same pattern in

January, particularly in North America. But business began to pick

up in February as the second fiscal quarter began, she said.

The company reaffirmed its financial guidance for the fiscal

year.

Some technology buyers sounded similarly upbeat. Avnet Inc., a

big electronics distributor, expects overall technology spending in

2016 to be slightly up or flat, said Steve Phillips, its chief

information officer.

Western Union Co. expects to increase technology spending this

year, as it has each year since 2013, said David Thompson,

executive vice president of global operations and technology and

CIO. It plans to invest in areas such as digital payments

technology and cybersecurity analytics software.

Market watchers aren't expecting a boom. Gartner Inc., for

example, in early February projected total information- technology

spending in 2016 would grow 0.6%, compared with a 5.8% decline in

2015.

But the contrast between HP Enterprise's results and Wall

Street's worries was dramatic. "The investment community was

bracing for potentially disappointing results," said Toni

Sacconaghi, an analyst at Sanford C. Bernstein.

The former enterprise technology businesses of Hewlett-Packard

Co. were widely expected to be more profitable than its PC and

printing operations, which make up the core of HP Inc.'s business.

That newly separate company last week said earnings from continuing

operations declined 16% in the first fiscal quarter on revenue that

fell 12% from the year-earlier period.

HP Enterprise is the largest maker of server systems, accounting

for about a third of the global market. The company on Thursday

said first-quarter server revenue fell 1%, but improved by 5% on a

constant currency basis.

Ms. Whitman said the most active purchasers of those computers

remain large Web companies. "They are buying," she said.

Some other hardware businesses grew at a much faster clip,

particularly some data-storage systems based on flash memory chips

rather than disks, Ms. Whitman said. Sales in networking equipment

soared 54%, buoyed by the $3 billion acquisition last year of

wireless equipment maker Aruba Networks.

Weak spots for the company include technology services such as

product support. Revenue in that business declined 9%, while

technology outsourcing revenue was 8% lower. Revenue from software

fell 10%.

In all, HP Enterprise reported first-quarter net income of $267

million, or 15 cents a share, down from $547 million, or 30 cents a

share, a year earlier. Revenue declined to $12.72 billion from

$13.05 billion.

Excluding restructuring charges, costs related to its separation

and other items, the company said adjusted per-share earnings came

to 41 cents. Analysts on that basis had projected earnings of 31

cents on revenue of $12.7 billion, according to Thomson

Reuters.

For the second quarter, the company forecast per-share earnings

of 39 cents to 43 cents. Analysts polled by Thomson Reuters

expected per-share profit of 42 cents.

--Tess Stynes contributed to this article.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

March 03, 2016 19:27 ET (00:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

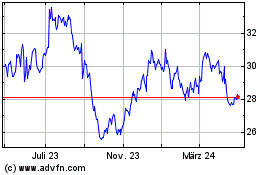

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

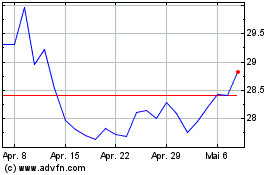

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024