Form DEFR14A - Revised definitive proxy soliciting materials

13 Januar 2025 - 10:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 2)

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to § 240.14a-12

|

FRANKLIN COVEY CO.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

FRANKLIN COVEY CO.

AMENDMENT NO. 2 TO THE PROXY STATEMENT DATED DECEMBER 20, 2024

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 24, 2025

The

following information amends disclosures in the definitive proxy statement of Franklin Covey Co. (the Company) filed with the U.S. Securities and Exchange Commission on December 20, 2024, and amended on January 13, 2025 (as amended, the

Proxy Statement), and furnished to shareholders of the Company in connection with the solicitation of proxies by the Board of Directors of the Company for the 2025 Annual Meeting of Shareholders of the Company, to be held on Friday, January 24,

2025 at 8:30 a.m., in the Fontainbleau Room at The Grand America Hotel, 555 South Main Street, Salt Lake City, Utah 84111, and any adjournment or postponement thereof (the Annual Meeting).

The Company is filing this Amendment No. 2 to the Proxy Statement (this Amendment) to include certain historical information relating to the securities

authorized for issuance under the Company’s equity compensation plans.

Securities Authorized for Issuance Under Equity Compensation Plans

The text below is hereby added immediately prior to the heading “Market Value” on page 59 of the Proxy Statement:

Securities Authorized for Issuance Under Equity Compensation Plans at August 31, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

[a] |

|

|

[b] |

|

|

[c] |

|

| Plan Category |

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants, and rights |

|

|

Weighted-average

exercise price of

outstanding options,

warrants, and rights |

|

|

Number of securities remaining

available for future issuance

under equity compensation

plans (excluding securities

reflected in

column [a]) |

|

| |

|

(in thousands) |

|

|

|

|

|

(in thousands) |

|

| Equity compensation plans approved by security holders |

|

|

905 |

(1)(2) |

|

$ |

— |

|

|

|

996 |

(3)(4) |

| (1) |

Excludes 23,136 shares of unvested stock awards that are subject to forfeiture. |

| (2) |

Amount includes 905,231 performance share awards that may be awarded under the terms of various long-term

incentive plans, including stock-based compensation plans associated with the acquisition of Strive in fiscal 2021. The number of shares eventually awarded to participants through some of our long-term incentive plans is variable and based upon the

achievement of specified financial goals. For performance-based compensation awards where the number of shares may fluctuate within a range based on the achievement of the specified goal, this amount includes the maximum number of shares that may be

awarded to participants. The actual number of shares issued to participants therefore, may be less than the amount disclosed. At August 31, 2024 we did not have any unexercised stock options outstanding. For further information on our

stock-based compensation plans, refer to the notes to our financial statements as presented in Item 8 of this report. |

| (3) |

Amount is comprised of the remaining shares authorized under our 2022 Omnibus Incentive Plan and 2017 Employee

Stock Purchase Plan. The number of performance-based plan shares expected to be awarded at August 31, 2024 may change in future periods based upon the achievement of specified goals and revisions to estimates. |

| (4) |

At August 31, 2024, we had approximately 689,000 shares authorized for purchase by participants in our

Employee Stock Purchase Plan. |

Except as described above, this Amendment does not modify, amend, supplement, revise, replace, update or

otherwise affect any of the other disclosures in the Proxy Statement, which continue to speak as of December 20, 2024, as amended by the Amendment No. 1 filed on January 13, 2025. This Amendment does not provide all of the information that

is important to your voting decisions at the Annual Meeting and should be read in conjunction with the Proxy Statement, which contains other important information. From and after the date of this Amendment, any references to the “Proxy

Statement” are to the Proxy Statement as amended hereby.

If you have already voted, you do not need to vote again unless you would like to

change or revoke your prior vote on any proposal. If you would like to change or revoke your prior vote on any proposal, please refer to the paragraph under the heading “May I revoke my vote prior to the Annual Meeting?” on page 3 in

the Proxy Statement for instructions on how to do so.

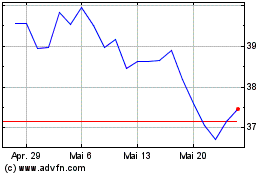

Franklin Covey (NYSE:FC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Franklin Covey (NYSE:FC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025