0001337619false00013376192023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: November 8, 2023

Date of Earliest Event Reported: November 8, 2023

ENVESTNET, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34835 | | 20-1409613 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | | | | |

1000 Chesterbrook Boulevard, Suite 250, Berwyn, Pennsylvania | | 19312 |

| (Address of principal executive offices) | | (Zip Code) |

(312) 827-2800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of exchange on which registered |

| Common Stock, par value $0.005 per share | ENV | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition |

On November 8, 2023, Envestnet, Inc. (“Envestnet”) issued a press release regarding Envestnet’s financial results for its third quarter ended September 30, 2023 and its third quarter 2023 supplemental presentation. The full text of Envestnet’s press release and supplemental presentation are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in this Item 2.02 and the attached exhibits are being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing of Envestnet under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 8, 2023

| | | | | |

| ENVESTNET, INC. |

|

| By: | /s/ Peter H. D’Arrigo |

| Name: | Peter H. D’Arrigo |

| Title: | Chief Financial Officer |

Exhibit 99.1

Envestnet Reports Third Quarter 2023 Financial Results

Berwyn, PA — November 8, 2023 — Envestnet (NYSE: ENV), a leading provider of intelligent systems for wealth management and financial wellness, today reported financial results for the three and nine months ended September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | Nine months ended | | |

| Key Financial Metrics | | September 30, | | % | | September 30, | | % |

| (in millions, except per share data) | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| GAAP: | | | | | | | | | | | | |

| Total revenue | | $ | 316.8 | | | $ | 306.7 | | | 3 | % | | $ | 928.0 | | | $ | 946.9 | | | (2) | % |

Net income (loss) attributable to Envestnet, Inc. | | $ | 7.1 | | | $ | (7.3) | | | * | | $ | (55.6) | | | $ | (44.4) | | | (25) | % |

Net income (loss) attributable to Envestnet, Inc. per diluted share | | $ | 0.13 | | | $ | (0.13) | | | * | | $ | (1.02) | | | $ | (0.81) | | | (26) | % |

| | | | | | | | | | | | |

| Non-GAAP: | | | | | | | | | | | | |

Adjusted revenue(1) | | $ | 316.8 | | | $ | 306.7 | | | 3 | % | | $ | 928.1 | | | $ | 947.1 | | | (2) | % |

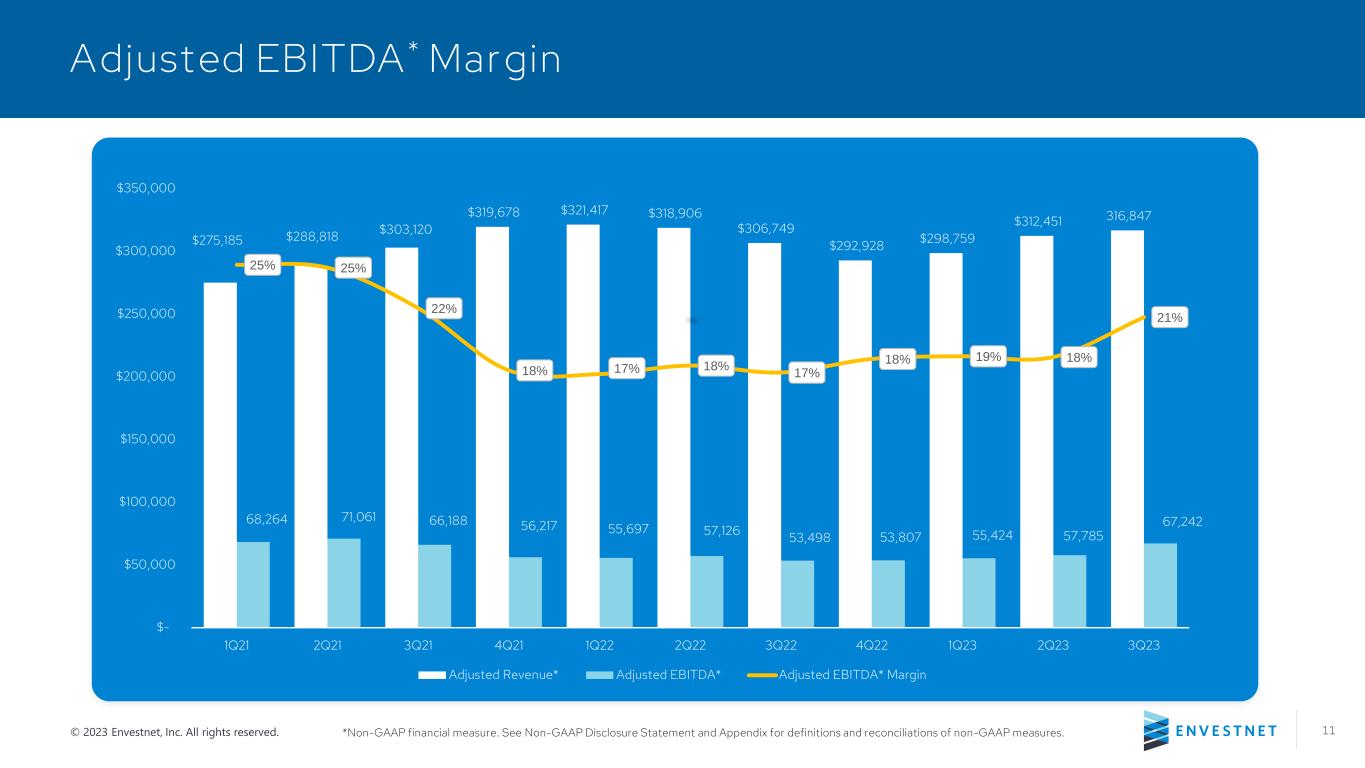

Adjusted EBITDA(1) | | $ | 67.2 | | | $ | 53.5 | | | 26 | % | | $ | 180.5 | | | $ | 166.3 | | | 8 | % |

Adjusted net income(1) | | $ | 36.6 | | | $ | 29.5 | | | 24 | % | | $ | 97.2 | | | $ | 92.6 | | | 5 | % |

Adjusted net income per diluted share(1) | | $ | 0.56 | | | $ | 0.45 | | | 24 | % | | $ | 1.47 | | | $ | 1.41 | | | 4 | % |

_______________________________________________________*Not meaningful

“Envestnet delivers the modern, connected technology platform to lead the industry, making us more embedded and essential to the growth of our clients,” said Bill Crager, Chief Executive Officer. “Our investment cycle is complete. We are now a structurally higher margin company than we were before, have significantly extended our competitive position and our long-term growth thesis is intact.”

Financial Results for the Third Quarter of 2023

Asset-based recurring revenue increased 9% from the third quarter of 2022, and represented 61% of total revenue for the third quarter of 2023, compared to 58% for the third quarter of 2022. Subscription-based recurring revenue decreased 7% from the third quarter of 2022, and represented 36% of total revenue for the third quarter of 2023, compared to 40% for the third quarter of 2022. Professional services and other non-recurring revenue increased 38% from the prior year period. Total revenue increased 3% to $316.8 million for the third quarter of 2023 from $306.7 million for the third quarter of 2022.

Total operating expenses for the third quarter of 2023 increased 3% to $316.2 million from $307.7 million in the prior year period. Direct expense increased to $119.5 million for the third quarter of 2023 from $110.1 million for the prior year period. Employee compensation decreased 3% to $113.3 million for the third quarter of 2023 from $116.8 million for the prior year period. Employee compensation was 36% of total revenue for the third quarter of 2023, compared to 38% for the prior year period. General and administrative expenses increased 4% to $49.1 million for the third quarter of 2023 from $47.4 million for the prior year period. General and administrative expenses remained consistent at 15% of total revenue for both the third quarter of 2023 and the prior year period.

Income from operations was $0.6 million for the third quarter of 2023 compared to a loss of $1.0 million for the third quarter of 2022. Net income attributable to Envestnet, Inc. was $7.1 million for the third quarter of 2023 compared to a net loss attributable to Envestnet, Inc. of $7.3 million for the third quarter of 2022. Net income attributable to Envestnet, Inc. per diluted share was $0.13 for the third quarter of 2023 compared to a net loss attributable to Envestnet, Inc. per diluted share of $(0.13) for the third quarter of 2022.

Adjusted revenue(1) for the third quarter of 2023 increased 3% to $316.8 million from $306.7 million for the prior year period. Adjusted EBITDA(1) for the third quarter of 2023 increased to $67.2 million from $53.5 million for the prior year period. Adjusted net income(1) increased 24% for the third quarter of 2023 to $36.6 million from $29.5 million for the prior year period. Adjusted net income per diluted share(1) for the third quarter of 2023 increased 24% to $0.56 from $0.45 in the third quarter of 2022.

Balance Sheet and Liquidity

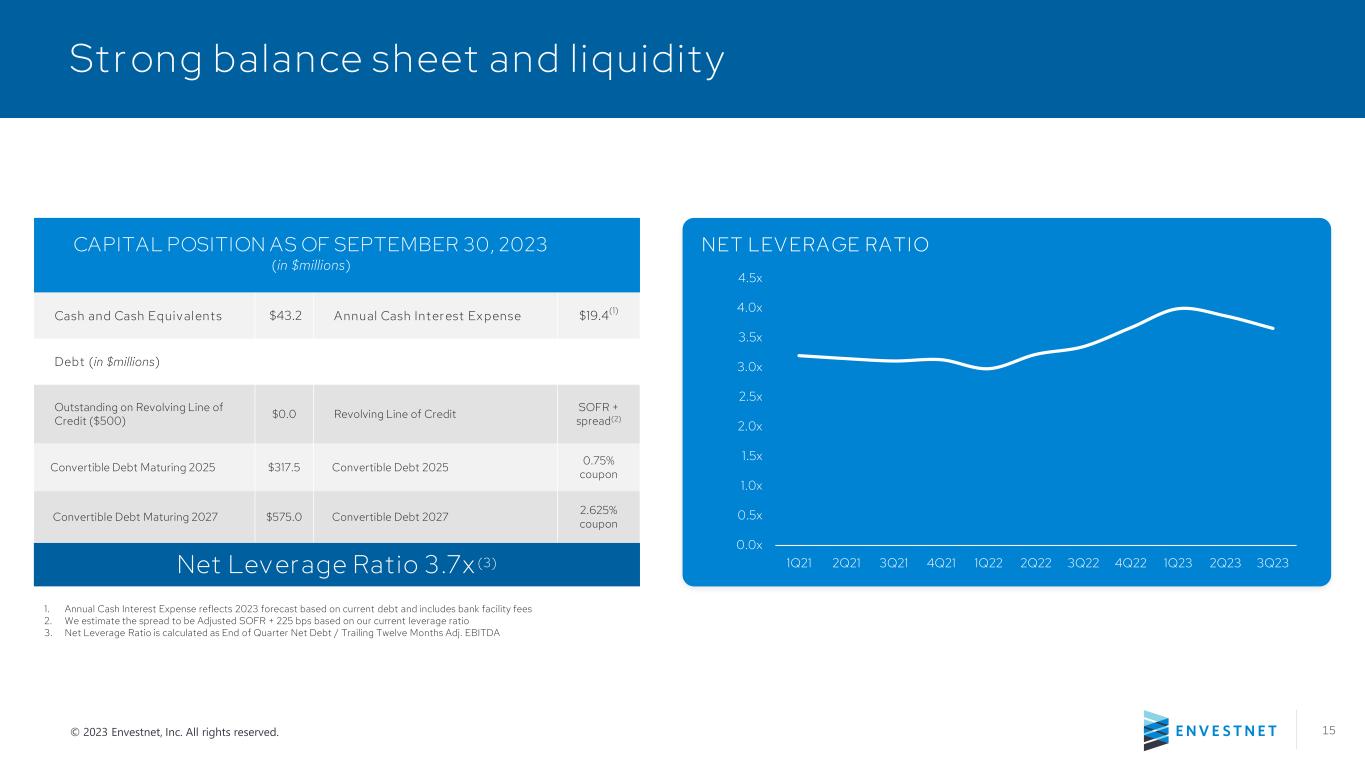

As of September 30, 2023, Envestnet had $43.2 million in cash and cash equivalents and $892.5 million in outstanding debt. Debt as of September 30, 2023 consists of $317.5 million in convertible notes maturing in 2025 and $575.0 million in convertible notes maturing in 2027. Envestnet's $500.0 million revolving credit facility was undrawn as of September 30, 2023.

Outlook

Envestnet provided the following outlook for the fourth quarter and full year ending December 31, 2023. This outlook is based on the market value of assets under management or administration as of September 30, 2023. We caution that we cannot predict the market value of these assets on any future date. See “Cautionary Statement Regarding Forward-Looking Statements.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In Millions, Except Adjusted EPS | | 4Q 2023 | | FY 2023 |

| GAAP: | | | | | | | | | | | | |

| Revenue: | | | | | | | | | | | | |

| Asset-based | | $ | 183.5 | | | - | | $ | 186.5 | | | $ | 740.1 | | | - | | $ | 743.1 | |

| Subscription-based | | 115.5 | | | - | | 117.0 | | | 462.5 | | | - | | 464.0 | |

| Total recurring revenue | | 299.0 | | | - | | 303.5 | | | 1,202.6 | | | - | | 1,207.1 | |

| Professional services and other revenue | | 10.0 | | | - | | 10.5 | | | 34.4 | | | - | | 34.9 | |

| Total revenue | | $ | 309.0 | | | - | | $ | 314.0 | | | $ | 1,237.0 | | | - | | $ | 1,242.0 | |

| | | | | | | | | | | | |

| Asset-based direct expense | | $ | 109.0 | | | - | | $ | 110.5 | | | $ | 433.1 | | | - | | $ | 434.6 | |

| Total direct expense | | $ | 117.5 | | | - | | $ | 119.0 | | | $ | 469.5 | | | - | | $ | 471.0 | |

| | | | | | | | | | | | |

| Net income | | | | (a) | | | | | | (a) | | |

| | | | | | | | | | | | |

| Diluted shares outstanding | | | | 66.1 | | | | | | 66.0 | | |

| Net income per diluted share | | | | (a) | | | | | | (a) | | |

| | | | | | | | | | | | |

| Non-GAAP: | | | | | | | | | | | | |

Adjusted revenue(1): | | | | | | | | | | | | |

| Asset-based | | $ | 183.5 | | | - | | $ | 186.5 | | | $ | 740.1 | | | - | | $ | 743.1 | |

| Subscription-based | | 115.5 | | | - | | 117.0 | | | 462.6 | | | - | | 464.1 | |

| Total recurring revenue | | 299.0 | | | - | | 303.5 | | | 1,202.7 | | | - | | 1,207.2 | |

| Professional services and other revenue | | 10.0 | | | - | | 10.5 | | | 34.4 | | | - | | 34.9 | |

| Total revenue | | $ | 309.0 | | | - | | $ | 314.0 | | | $ | 1,237.1 | | | - | | $ | 1,242.1 | |

| | | | | | | | | | | | |

Adjusted EBITDA(1) | | $ | 64.5 | | | - | | $ | 68.5 | | | $ | 245.0 | | | - | | $ | 249.0 | |

Adjusted net income per diluted share(1) | | $ | 0.51 | | | - | | $ | 0.54 | | | $ | 1.98 | | | - | | $ | 2.01 | |

(a) Envestnet does not forecast net income and net income per diluted share due to the unpredictable nature of various items adjusted for non-GAAP disclosure purposes, including the periodic GAAP income tax provision.

Conference Call

Envestnet will host a conference call to discuss third quarter 2023 financial results today at 5:00 p.m. ET. The live webcast and accompanying presentation can be accessed from Envestnet’s investor relations website at http://investor.envestnet.com/. A replay of the webcast will be available on the investor relations website following the call.

About Envestnet

Envestnet, Inc. (NYSE: ENV) is transforming the way financial advice and wellness are delivered. Our mission is to empower advisors and financial service providers with innovative technology, solutions and intelligence to make financial wellness a reality for everyone. Approximately 107,000 advisors and approximately 6,900 companies including: 16 of the 20 largest U.S. banks, 48 of the 50 largest wealth management and brokerage firms, over 500 of the largest RIAs and hundreds of FinTech companies, leverage Envestnet technology and services that help drive better outcomes for enterprises, advisors and their clients.

For more information on Envestnet, please visit www.envestnet.com and follow us on Twitter @ENVintel.

(1) Non-GAAP Financial Measures

“Adjusted revenue” excludes the effect of purchase accounting on the fair value of acquired deferred revenue. On January 1, 2022, the Company adopted ASU 2021-08 whereby it now accounts for contract assets and contract liabilities obtained upon a business combination in accordance with ASC 606. Prior to the adoption of ASU 2021-08, we recorded at fair value the acquired deferred revenue for contracts in effect at the time the entities were acquired. Consequently, revenue related to acquired entities for periods subsequent to the acquisition did not reflect the full amount of revenue that would have been recorded by these entities had they remained stand-alone entities. Adjusted revenue has limitations as a financial measure, should be considered as supplemental in nature and is not meant as a substitute for revenue prepared in accordance with GAAP.

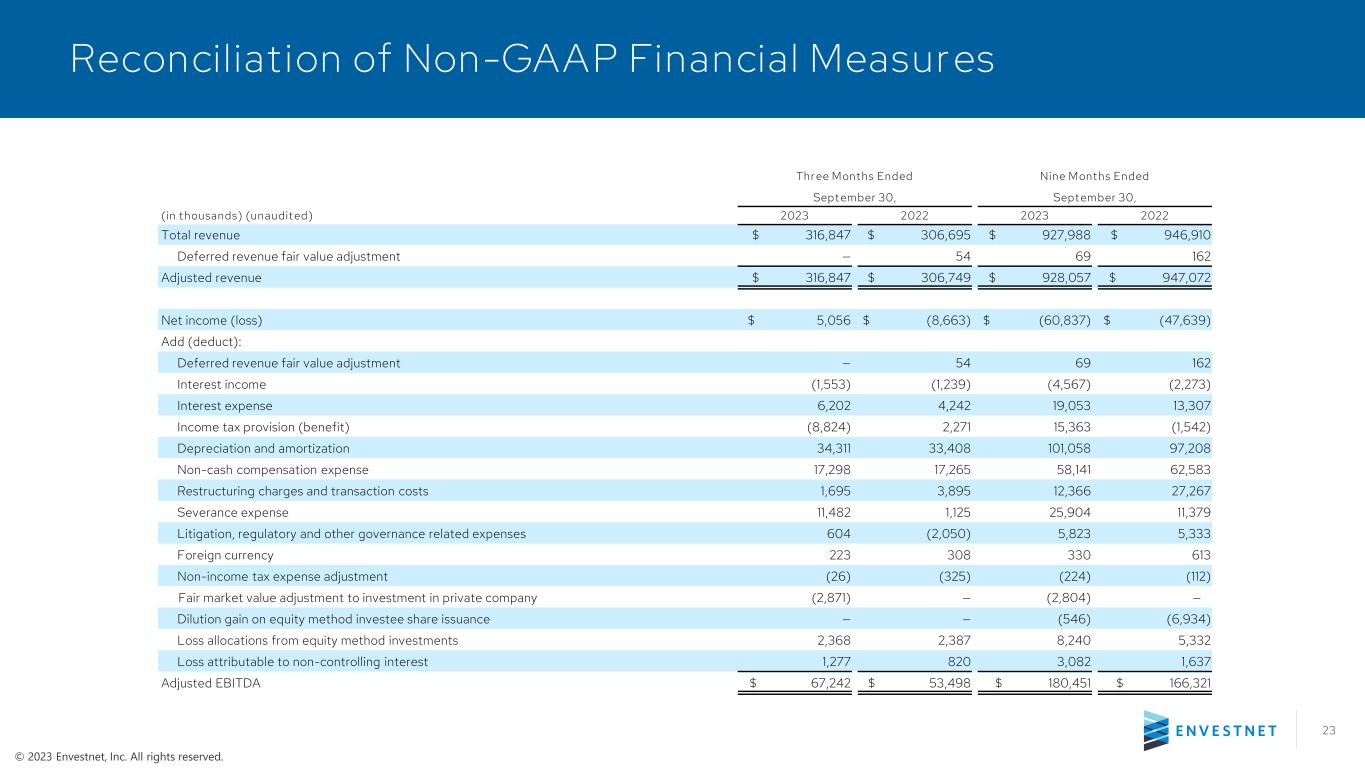

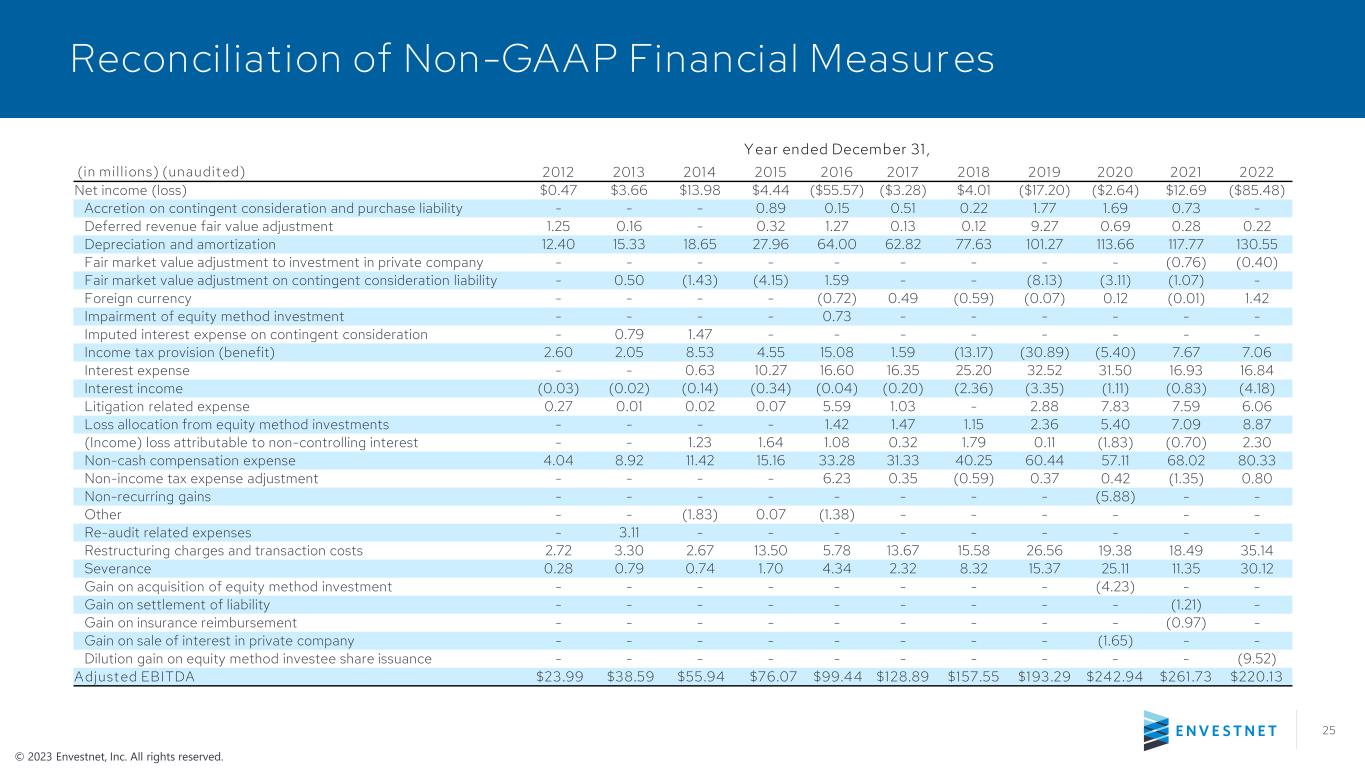

“Adjusted EBITDA” represents net income (loss) before deferred revenue fair value adjustment, interest income, interest expense, income tax provision (benefit), depreciation and amortization, non-cash compensation expense, restructuring charges and transaction costs, severance expense, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, fair market value adjustment to investment in private company, dilution gain on equity method investee share issuance, loss allocations from equity method investments and (income) loss attributable to non-controlling interest.

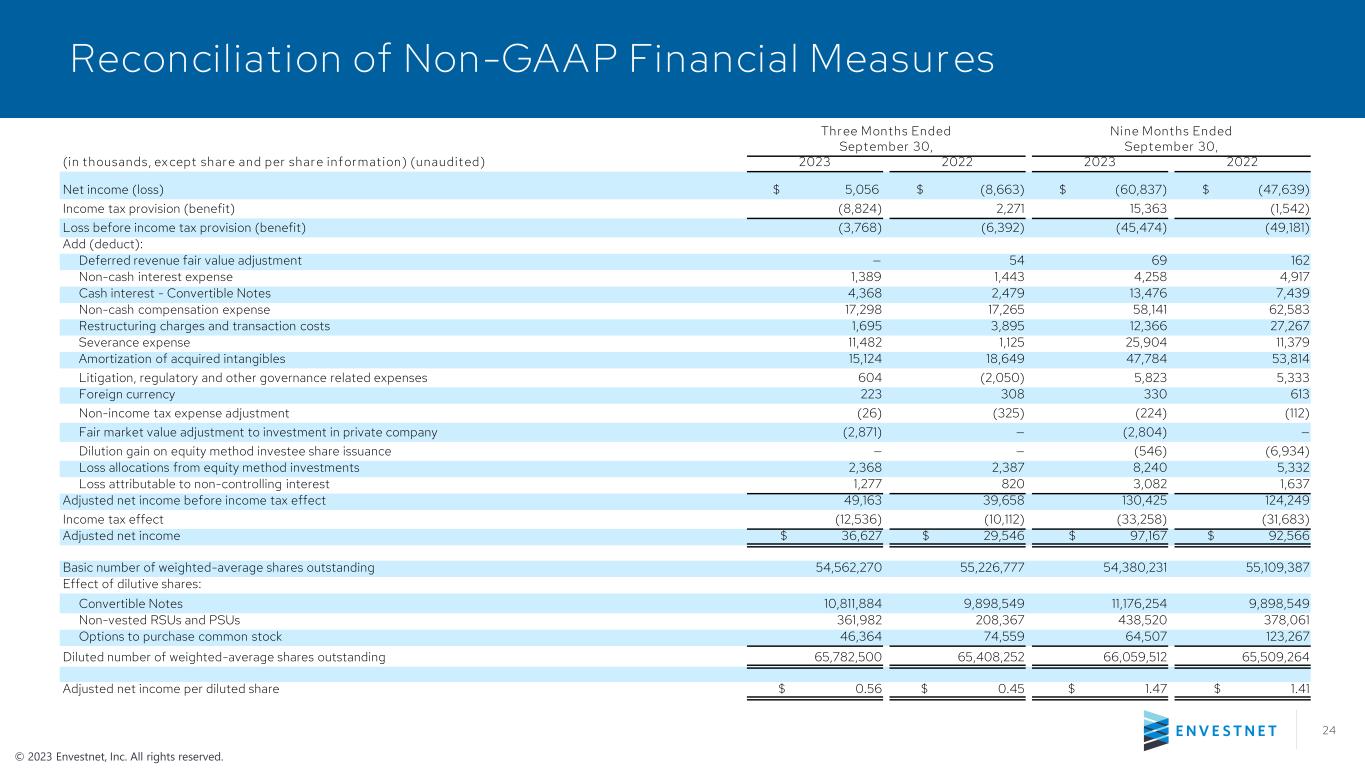

“Adjusted net income” represents net income (loss) before income tax provision (benefit), deferred revenue fair value adjustment, non-cash interest expense, cash interest on our convertible notes, non-cash compensation expense, restructuring charges and transaction costs, severance expense, amortization of acquired intangibles, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, fair market value adjustment to investment in private company, dilution gain on equity method investee share issuance, loss allocations from equity method investments and (income) loss attributable to non-controlling interest. Reconciling items are presented gross of tax, and a normalized tax rate is applied to the total of all reconciling items to arrive at adjusted net income. The normalized tax rate is based solely on the estimated blended statutory income tax rates in the jurisdictions in which we operate. We monitor the normalized tax rate based on events or trends that could materially impact the rate, including tax legislation changes and changes in the geographic mix of our operations.

“Adjusted net income per diluted share” represents adjusted net income attributable to common stockholders divided by the diluted number of weighted-average shares outstanding. For purposes of the adjusted net income per share calculation, we assume all potential shares to be issued in connection with our convertible notes are dilutive.

For further information see reconciliations of Non-GAAP Financial Measures on pages 9-14 of this press release, and the section entitled "Non-GAAP Financial Measures" in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) which are available on the SEC’s website at www.sec.gov or our Investor Relations website at http://investor.envestnet.com/. Reconciliations are not provided for guidance on such measures as the Company is unable to predict the amounts to be adjusted, such as the GAAP tax provision. The Company’s Non-GAAP Financial Measures should not be viewed as a substitute for revenue, net income (loss) or net income (loss) per share determined in accordance with GAAP.

Cautionary Statement Regarding Forward-Looking Statements

The forward-looking statements made in this press release and its attachments concerning, among other things, Envestnet, Inc.’s expected financial performance and outlook for the fourth quarter and full year of 2023, its strategic and operational plans and growth strategy, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties and our actual results could differ materially from the results expressed or implied by such forward-looking statements. Furthermore, reported results should not be considered as an indication of future performance. The potential risks, uncertainties and other factors that could cause actual results to differ from those expressed by the forward-looking statements in this press release include, but are not limited to, the concentration of our revenue from the delivery of our solutions and services to clients in the financial services industry; our reliance on a limited number of clients for a material portion of our revenue; the renegotiation of fees by our clients; changes in the estimates of fair value of reporting units or of long-lived assets; the amount of our debt and our ability to service our debt; limitations on our ability to access information from third parties or charges for accessing such information; the targeting of some of our sales efforts at large financial institutions and large financial technology (“FinTech”) companies which prolongs sales cycles, requires substantial upfront sales costs and results in less predictability in completing some of our sales; changes in investing patterns on the assets on which we derive revenue and the freedom of investors to redeem or withdraw investments generally at any time; the impact of fluctuations in market conditions and interest rates on the demand for our products and services and the value of assets under management or administration; our ability to keep up with rapid technological change, evolving industry standards or changing requirements of clients; risks associated with our international operations; the competitiveness of our solutions and services as compared to those of others; liabilities associated with potential, perceived or actual breaches of fiduciary duties and/or conflicts of interest; harm to our reputation; our ability to successfully identify potential acquisition candidates, complete acquisitions and successfully integrate acquired companies; our ability to successfully execute the conversion of clients’ assets from their technology platform to our technology platforms in a timely and accurate manner; the failure to protect our intellectual property rights; our ability to introduce new solutions and services and enhancements; our ability to maintain the security and integrity of our systems and facilities and to maintain the privacy of personal information and potential liabilities for data security breaches; the effect of privacy laws and regulations, industry standards and contractual obligations and changes to these laws, regulations, standards and obligations on how we operate our business and the negative effects of failure to comply with these requirements; regulatory compliance failures; failure by our customers to obtain proper permissions or waivers for our use of disclosure of information; adverse judicial or regulatory proceedings against us; failure of our solutions, services or systems, or those of third parties on which we rely, to work properly; potential liability for use of inaccurate information by third parties provided by us; the occurrence of a deemed “change of control”; the uncertainty of the application and interpretation of certain tax laws; issuances of additional shares of common stock or issuances of shares of preferred stock or convertible securities on our existing stockholders; changes in the level of inflation; general economic, political and regulatory conditions; changes in trade, monetary and fiscal policies and laws; global events, natural disasters, environmental disasters, terrorist attacks and pandemics or health crises, including their impact on the economy and trading markets; social, environmental and sustainability concerns that may arise, including from our business activities; and management’s response to these factors. More information regarding these and other risks, uncertainties and factors is contained in our filings with the SEC which are available on the SEC’s website at www.sec.gov or our Investor Relations website at http://investor.envestnet.com/. You are cautioned not to unduly rely on these forward-looking statements, which speak only as of the date of this press release. All information in this press release and its attachments is as of November 8, 2023 and, unless required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this press release or to report the occurrence of unanticipated events.

| | | | | | | | |

| Contacts | | |

| Investor Relations | | Media Relations |

| investor.relations@envestnet.com | | mediarelations@envestnet.com |

| (312) 827-3940 | | |

Envestnet, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| | 2023 | | 2022 |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 43,211 | | | $ | 162,173 | |

| Fees receivable, net | | 110,643 | | | 101,696 | |

| Prepaid expenses and other current assets | | 49,299 | | | 41,363 | |

| Total current assets | | 203,153 | | | 305,232 | |

| Property and equipment, net | | 65,785 | | | 62,443 | |

| Internally developed software, net | | 217,411 | | | 184,558 | |

| Intangible assets, net | | 346,211 | | | 379,995 | |

| Goodwill | | 998,381 | | | 998,414 | |

| Operating lease right-of-use assets, net | | 72,929 | | | 81,596 | |

| Other assets | | 127,019 | | | 99,927 | |

| Total assets | | $ | 2,030,889 | | | $ | 2,112,165 | |

| | | | |

| Liabilities and equity | | | | |

| Current liabilities: | | | | |

| Accounts payable, accrued expenses and other current liabilities | | $ | 224,385 | | | $ | 233,866 | |

| Operating lease liabilities | | 13,297 | | | 11,949 | |

| Deferred revenue | | 32,563 | | | 36,363 | |

| Current portion of debt | | — | | | 44,886 | |

| Total current liabilities | | 270,245 | | | 327,064 | |

| Debt | | 875,390 | | | 871,769 | |

| Operating lease liabilities, net of current portion | | 102,717 | | | 110,652 | |

| Deferred tax liabilities, net | | 14,598 | | | 16,196 | |

| Other liabilities | | 16,138 | | | 18,880 | |

| Total liabilities | | 1,279,088 | | | 1,344,561 | |

| | | | |

| Equity: | | | | |

| Total stockholders’ equity, attributable to Envestnet, Inc. | | 743,796 | | | 754,567 | |

| Non-controlling interest | | 8,005 | | | 13,037 | |

| Total liabilities and equity | | $ | 2,030,889 | | | $ | 2,112,165 | |

Envestnet, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share information)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 193,901 | | | $ | 177,131 | | | $ | 556,595 | | | $ | 571,820 | |

| Subscription-based | | 114,939 | | | 123,747 | | | 346,977 | | | 356,601 | |

| Total recurring revenue | | 308,840 | | | 300,878 | | | 903,572 | | | 928,421 | |

| Professional services and other revenue | | 8,007 | | | 5,817 | | | 24,416 | | | 18,489 | |

| Total revenue | | 316,847 | | | 306,695 | | | 927,988 | | | 946,910 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense | | 119,538 | | | 110,108 | | | 352,024 | | | 361,872 | |

| Employee compensation | | 113,334 | | | 116,837 | | | 344,646 | | | 369,453 | |

| General and administrative | | 49,063 | | | 47,388 | | | 156,028 | | | 157,867 | |

| Depreciation and amortization | | 34,311 | | | 33,408 | | | 101,058 | | | 97,208 | |

| Total operating expenses | | 316,246 | | | 307,741 | | | 953,756 | | | 986,400 | |

| | | | | | | | |

| Income (loss) from operations | | 601 | | | (1,046) | | | (25,768) | | | (39,490) | |

| Other expense, net | | (4,369) | | | (5,346) | | | (19,706) | | | (9,691) | |

| Loss before income tax provision (benefit) | | (3,768) | | | (6,392) | | | (45,474) | | | (49,181) | |

| | | | | | | | |

| Income tax provision (benefit) | | (8,824) | | | 2,271 | | | 15,363 | | | (1,542) | |

| | | | | | | | |

Net income (loss) | | 5,056 | | | (8,663) | | | (60,837) | | | (47,639) | |

| Add: Net loss attributable to non-controlling interest | | 2,035 | | | 1,373 | | | 5,284 | | | 3,205 | |

Net income (loss) attributable to Envestnet, Inc. | | $ | 7,091 | | | $ | (7,290) | | | $ | (55,553) | | | $ | (44,434) | |

| | | | | | | | |

Net income (loss) attributable to Envestnet, Inc. per share: | | | | | | | | |

Basic | | $ | 0.13 | | | $ | (0.13) | | | $ | (1.02) | | | $ | (0.81) | |

| | | | | | | | |

| | | | | | | | |

Diluted | | $ | 0.13 | | | $ | (0.13) | | | $ | (1.02) | | | $ | (0.81) | |

| Weighted average common shares outstanding: | | | | | | | | |

Basic | | 54,562,270 | | | 55,226,777 | | | 54,380,231 | | | 55,109,387 | |

Diluted | | 54,970,616 | | | 55,226,777 | | | 54,380,231 | | | 55,109,387 | |

| | | | | | | | |

| | | | | | | | |

Envestnet, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2023 | | 2022 |

| Cash flows from operating activities: | | | | |

| Net loss | | $ | (60,837) | | | $ | (47,639) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 101,058 | | | 97,208 | |

| Deferred income taxes | | (1,458) | | | (4,380) | |

| Release of uncertain tax positions | | — | | | (3,095) | |

| Non-cash compensation expense | | 58,141 | | | 62,583 | |

| Non-cash interest expense | | 6,822 | | | 5,436 | |

| Loss allocations from equity method investments | | 8,240 | | | 5,332 | |

Fair market value adjustment to investment in private company | | (2,804) | | | — | |

| Dilution gain on equity method investee share issuance | | (546) | | | (6,934) | |

| Lease related impairments | | 2,483 | | | 14,050 | |

| Loss on property and equipment disposals - office closures | | — | | | 3,710 | |

| Other | | 1,155 | | | (149) | |

| Changes in operating assets and liabilities: | | | | |

| Fees receivable, net | | (9,621) | | | 1,546 | |

| Prepaid expenses and other assets | | (17,534) | | | (12,524) | |

| Accounts payable, accrued expenses and other liabilities | | (1,848) | | | (26,580) | |

| Deferred revenue | | (3,974) | | | (2,329) | |

| Net cash provided by operating activities | | 79,277 | | | 86,235 | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment | | (18,275) | | | (13,114) | |

| Capitalization of internally developed software | | (71,117) | | | (67,755) | |

| Acquisitions of businesses, net of cash acquired | | — | | | (104,185) | |

| Investments in private companies | | (4,175) | | | (16,351) | |

| Acquisition of proprietary technology | | (12,000) | | | (19,000) | |

| Issuance of loan receivable to private company | | (20,000) | | | — | |

| Issuance of note receivable to equity method investees | | — | | | (6,350) | |

| Other | | 400 | | | — | |

| Net cash used in investing activities | | (125,167) | | | (226,755) | |

| Cash flows from financing activities: | | | | |

| Proceeds from borrowings on Revolving Credit Facility | | 55,000 | | | — | |

| Payments related to Revolving Credit Facility | | (55,000) | | | (1,872) | |

| Payments related to Convertible Notes | | (45,000) | | | — | |

| Payments on finance lease obligations | | (5,511) | | | (14,544) | |

| Proceeds from exercise of stock options | | 839 | | | 2,559 | |

| Payments related to tax withholdings for stock-based compensation | | (17,004) | | | (20,613) | |

| Payments related to share repurchases | | (9,289) | | | (9,235) | |

| Purchase of non-controlling units from third-party shareholders | | (1,008) | | | — | |

| Payments of contingent consideration | | — | | | (750) | |

| Other | | 4 | | | 5 | |

| Net cash used in financing activities | | (76,969) | | | (44,450) | |

| Effect of exchange rate on changes on cash, cash equivalents and restricted cash | | 3,897 | | | (3,128) | |

| Net change in cash, cash equivalents and restricted cash | | (118,962) | | | (188,098) | |

| Cash, cash equivalents and restricted cash, beginning of period | | 162,173 | | | 429,428 | |

| Cash, cash equivalents and restricted cash, end of period | | $ | 43,211 | | | $ | 241,330 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Total revenue | | $ | 316,847 | | | $ | 306,695 | | | $ | 927,988 | | | $ | 946,910 | |

Deferred revenue fair value adjustment (a) | | — | | | 54 | | | 69 | | | 162 | |

| Adjusted revenue | | $ | 316,847 | | | $ | 306,749 | | | $ | 928,057 | | | $ | 947,072 | |

| | | | | | | | |

Net income (loss) | | $ | 5,056 | | | $ | (8,663) | | | $ | (60,837) | | | $ | (47,639) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | — | | | 54 | | | 69 | | | 162 | |

Interest income (b) | | (1,553) | | | (1,239) | | | (4,567) | | | (2,273) | |

Interest expense (b) | | 6,202 | | | 4,242 | | | 19,053 | | | 13,307 | |

| Income tax provision (benefit) | | (8,824) | | | 2,271 | | | 15,363 | | | (1,542) | |

| Depreciation and amortization | | 34,311 | | | 33,408 | | | 101,058 | | | 97,208 | |

Non-cash compensation expense (d) | | 17,298 | | | 17,265 | | | 58,141 | | | 62,583 | |

Restructuring charges and transaction costs (e) | | 1,695 | | | 3,895 | | | 12,366 | | | 27,267 | |

Severance expense (d) | | 11,482 | | | 1,125 | | | 25,904 | | | 11,379 | |

Litigation, regulatory and other governance related expenses (c) | | 604 | | | (2,050) | | | 5,823 | | | 5,333 | |

Foreign currency (b) | | 223 | | | 308 | | | 330 | | | 613 | |

Non-income tax expense adjustment (c) | | (26) | | | (325) | | | (224) | | | (112) | |

Fair market value adjustment to investment in private company (b) | | (2,871) | | | — | | | (2,804) | | | — | |

Dilution gain on equity method investee share issuance (b) | | — | | | — | | | (546) | | | (6,934) | |

Loss allocations from equity method investments (b) | | 2,368 | | | 2,387 | | | 8,240 | | | 5,332 | |

| Loss attributable to non-controlling interest | | 1,277 | | | 820 | | | 3,082 | | | 1,637 | |

| Adjusted EBITDA | | $ | 67,242 | | | $ | 53,498 | | | $ | 180,451 | | | $ | 166,321 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within other expense, net in the condensed consolidated statements of operations.

(c)Included within general and administrative expense in the condensed consolidated statements of operations.

(d)Included within employee compensation expense in the condensed consolidated statements of operations.

(e)For the three months ended September 30, 2023 and 2022, $1.2 million and $4.1 million were included within general and administrative expense, respectively, in the condensed consolidated statements of operations. For the three months ended September 30, 2023 and 2022, $0.5 million and $0.2 million were included within employee compensation expense, respectively, in the condensed consolidated statements of operations. For the three months ended September 30, 2023 and 2022, $0.0 million and $(0.4) million were included within other expense, net, respectively, in the condensed consolidated statements of operations. For the nine months ended September 30, 2023 and 2022, $10.2 million and $27.5 million were included within general and administrative expense, respectively, in the condensed consolidated statements of operations. For the nine months ended September 30, 2023 and 2022, $2.2 million and $0.2 million were included within employee compensation expense, respectively, in the condensed consolidated statements of operations. For the nine months ended September 30, 2023 and 2022, $0.0 million and $(0.4) million were included within other expense, net, respectively, in the condensed consolidated statements of operations.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

(in thousands, except share and per share information)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Net income (loss) | | $ | 5,056 | | | $ | (8,663) | | | $ | (60,837) | | | $ | (47,639) | |

Income tax provision (benefit) (a) | | (8,824) | | | 2,271 | | | 15,363 | | | (1,542) | |

| Loss before income tax provision (benefit) | | (3,768) | | | (6,392) | | | (45,474) | | | (49,181) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (b) | | — | | | 54 | | | 69 | | | 162 | |

Non-cash interest expense (d) | | 1,389 | | | 1,443 | | | 4,258 | | | 4,917 | |

Cash interest - Convertible Notes (d) | | 4,368 | | | 2,479 | | | 13,476 | | | 7,439 | |

Non-cash compensation expense (e) | | 17,298 | | | 17,265 | | | 58,141 | | | 62,583 | |

Restructuring charges and transaction costs (g) | | 1,695 | | | 3,895 | | | 12,366 | | | 27,267 | |

Severance expense (e) | | 11,482 | | | 1,125 | | | 25,904 | | | 11,379 | |

Amortization of acquired intangibles (f) | | 15,124 | | | 18,649 | | | 47,784 | | | 53,814 | |

Litigation, regulatory and other governance related expenses (c) | | 604 | | | (2,050) | | | 5,823 | | | 5,333 | |

Foreign currency (d) | | 223 | | | 308 | | | 330 | | | 613 | |

Non-income tax expense adjustment (c) | | (26) | | | (325) | | | (224) | | | (112) | |

Fair market value adjustment to investment in private company (d) | | (2,871) | | | — | | | (2,804) | | | — | |

Dilution gain on equity method investee share issuance (d) | | — | | | — | | | (546) | | | (6,934) | |

Loss allocations from equity method investments (d) | | 2,368 | | | 2,387 | | | 8,240 | | | 5,332 | |

| Loss attributable to non-controlling interest | | 1,277 | | | 820 | | | 3,082 | | | 1,637 | |

| Adjusted net income before income tax effect | | 49,163 | | | 39,658 | | | 130,425 | | | 124,249 | |

Income tax effect (h) | | (12,536) | | | (10,112) | | | (33,258) | | | (31,683) | |

| Adjusted net income | | $ | 36,627 | | | $ | 29,546 | | | $ | 97,167 | | | $ | 92,566 | |

| | | | | | | | |

| Basic number of weighted-average shares outstanding | | 54,562,270 | | | 55,226,777 | | | 54,380,231 | | | 55,109,387 | |

| Effect of dilutive shares: | | | | | | | | |

| Convertible Notes | | 10,811,884 | | | 9,898,549 | | | 11,176,254 | | | 9,898,549 | |

| Non-vested RSUs and PSUs | | 361,982 | | | 208,367 | | | 438,520 | | | 378,061 | |

| Options to purchase common stock | | 46,364 | | | 74,559 | | | 64,507 | | | 123,267 | |

| | | | | | | | |

| Diluted number of weighted-average shares outstanding | | 65,782,500 | | | 65,408,252 | | | 66,059,512 | | | 65,509,264 | |

| | | | | | | | |

| Adjusted net income per diluted share | | $ | 0.56 | | | $ | 0.45 | | | $ | 1.47 | | | $ | 1.41 | |

(a)For the three months ended September 30, 2023 and 2022, the effective tax rate computed in accordance with GAAP equaled 234.2% and (35.5)%, respectively. For the nine months ended September 30, 2023 and 2022, the effective tax rate computed in accordance with GAAP equaled (33.8)% and 3.1%, respectively.

(b)Included within subscription-based revenue in the condensed consolidated statements of operations.

(c)Included within general and administrative expense in the condensed consolidated statements of operations.

(d)Included within other expense, net in the condensed consolidated statements of operations.

(e)Included within employee compensation expense in the condensed consolidated statements of operations.

(f)Included within depreciation and amortization expense in the condensed consolidated statements of operations.

(g)For the three months ended September 30, 2023 and 2022, $1.2 million and $4.1 million were included within general and administrative expense, respectively, in the condensed consolidated statements of operations. For the three months ended September 30, 2023 and 2022, $0.5 million and $0.2 million were included within employee compensation expense, respectively, in the condensed consolidated statements of operations. For the three months ended September 30, 2023 and 2022, $0.0 million and $(0.4) million were included within other expense, net, respectively, in the condensed consolidated statements of operations. For the nine months ended September 30, 2023 and 2022, $10.2 million and $27.5 million were included within general and administrative expense, respectively, in the condensed consolidated statements of operations. For the nine months ended September 30, 2023 and 2022, $2.2 million and $0.2 million were included within employee compensation expense, respectively, in the condensed consolidated statements of operations. For the nine months ended September 30, 2023 and 2022, $0.0 million and $(0.4) million were included within other expense, net, respectively, in the condensed consolidated statements of operations.

(h)An estimated normalized tax rate of 25.5% has been used to compute adjusted net income for the three and nine months ended September 30, 2023 and 2022.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

Segment Information

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 |

| | Envestnet Wealth Solutions | | Envestnet Data & Analytics | | Nonsegment | | Total |

| Revenue | | $ | 275,027 | | | $ | 41,820 | | | $ | — | | | $ | 316,847 | |

Deferred revenue fair value adjustment (a) | | — | | | — | | | — | | | — | |

| Adjusted revenue | | $ | 275,027 | | | $ | 41,820 | | | $ | — | | | $ | 316,847 | |

| | | | | | | | |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 193,901 | | | $ | — | | | $ | — | | | $ | 193,901 | |

| Subscription-based | | 76,813 | | | 38,126 | | | — | | | 114,939 | |

| Total recurring revenue | | 270,714 | | | 38,126 | | | — | | | 308,840 | |

| Professional services and other revenue | | 4,313 | | | 3,694 | | | — | | | 8,007 | |

| Total revenue | | $ | 275,027 | | | $ | 41,820 | | | $ | — | | | $ | 316,847 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense | | | | | | | | |

| Asset-based | | $ | 112,938 | | | $ | — | | | $ | — | | | $ | 112,938 | |

| Subscription-based | | 1,451 | | | 5,523 | | | — | | | 6,974 | |

| Professional services and other | | (384) | | | 10 | | | — | | | (374) | |

| Total direct expense | | 114,005 | | | 5,533 | | | — | | | 119,538 | |

| Employee compensation | | 76,449 | | | 22,819 | | | 14,066 | | | 113,334 | |

| General and administrative | | 28,646 | | | 12,807 | | | 7,610 | | | 49,063 | |

| Depreciation and amortization | | 24,535 | | | 9,776 | | | — | | | 34,311 | |

| Total operating expenses | | $ | 243,635 | | | $ | 50,935 | | | $ | 21,676 | | | $ | 316,246 | |

| | | | | | | | |

| Income (loss) from operations | | $ | 31,392 | | | $ | (9,115) | | | $ | (21,676) | | | $ | 601 | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | — | | | — | | | — | | | — | |

| Depreciation and amortization | | 24,535 | | | 9,776 | | | — | | | 34,311 | |

Non-cash compensation expense (c) | | 10,682 | | | 2,448 | | | 4,168 | | | 17,298 | |

Restructuring charges and transaction costs (d) | | 1,432 | | | (98) | | | 361 | | | 1,695 | |

Severance expense (c) | | 4,501 | | | 6,302 | | | 679 | | | 11,482 | |

Litigation, regulatory and other governance related expenses (b) | | — | | | 629 | | | (25) | | | 604 | |

Non-income tax expense adjustment (b) | | (26) | | | — | | | — | | | (26) | |

| Loss attributable to non-controlling interest | | 1,277 | | | — | | | — | | | 1,277 | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 73,793 | | | $ | 9,942 | | | $ | (16,493) | | | $ | 67,242 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within general and administrative expense in the condensed consolidated statements of operations.

(c)Included within employee compensation expense in the condensed consolidated statements of operations.

(d)$1.2 million was included within general and administrative expense and $0.5 million was included within employee compensation expense in the condensed consolidated statements of operations.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

Segment Information (continued)

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, 2023 |

| | Envestnet Wealth Solutions | | Envestnet Data & Analytics | | Nonsegment | | Total |

| Revenue | | $ | 803,268 | | | $ | 124,720 | | | $ | — | | | $ | 927,988 | |

Deferred revenue fair value adjustment (a) | | 69 | | | — | | | — | | | 69 | |

| Adjusted revenue | | $ | 803,337 | | | $ | 124,720 | | | $ | — | | | $ | 928,057 | |

| | | | | | | | |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 556,595 | | | $ | — | | | $ | — | | | $ | 556,595 | |

| Subscription-based | | 228,807 | | | 118,170 | | | — | | | 346,977 | |

| Total recurring revenue | | 785,402 | | | 118,170 | | | — | | | 903,572 | |

| Professional services and other revenue | | 17,866 | | | 6,550 | | | — | | | 24,416 | |

| Total revenue | | $ | 803,268 | | | $ | 124,720 | | | $ | — | | | $ | 927,988 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense: | | | | | | | | |

| Asset-based | | $ | 324,093 | | | $ | — | | | $ | — | | | $ | 324,093 | |

| Subscription-based | | 4,328 | | | 15,941 | | | — | | | 20,269 | |

| Professional services and other | | 7,652 | | | 10 | | | — | | | 7,662 | |

| Total direct expense | | 336,073 | | | 15,951 | | | — | | | 352,024 | |

| Employee compensation | | 229,320 | | | 65,974 | | | 49,352 | | | 344,646 | |

| General and administrative | | 86,438 | | | 42,808 | | | 26,782 | | | 156,028 | |

| Depreciation and amortization | | 73,183 | | | 27,875 | | | — | | | 101,058 | |

| Total operating expenses | | $ | 725,014 | | | $ | 152,608 | | | $ | 76,134 | | | $ | 953,756 | |

| | | | | | | | |

| Income (loss) from operations | | $ | 78,254 | | | $ | (27,888) | | | $ | (76,134) | | | $ | (25,768) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | 69 | | | — | | | — | | | 69 | |

| Depreciation and amortization | | 73,183 | | | 27,875 | | | — | | | 101,058 | |

Non-cash compensation expense (c) | | 33,967 | | | 7,837 | | | 16,337 | | | 58,141 | |

Restructuring charges and transaction costs (d) | | 7,984 | | | 215 | | | 4,167 | | | 12,366 | |

Severance expense (c) | | 9,931 | | | 11,849 | | | 4,124 | | | 25,904 | |

Litigation, regulatory and other governance related expenses (b) | | — | | | 4,163 | | | 1,660 | | | 5,823 | |

Non-income tax expense adjustment (b) | | (153) | | | (71) | | | — | | | (224) | |

| Loss attributable to non-controlling interest | | 3,082 | | | — | | | — | | | 3,082 | |

| | | | | | | | |

| Adjusted EBITDA | | $ | 206,317 | | | $ | 23,980 | | | $ | (49,846) | | | $ | 180,451 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within general and administrative expense in the condensed consolidated statements of operations.

(c)Included within employee compensation expense in the condensed consolidated statements of operations.

(d)$10.2 million was included within general and administrative expense and $2.2 million was included within employee compensation expense in the condensed consolidated statements of operations.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

Segment Information (continued)

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, 2022 |

| | Envestnet Wealth Solutions | | Envestnet Data & Analytics | | Nonsegment | | Total |

| Revenue | | $ | 257,335 | | | $ | 49,360 | | | $ | — | | | $ | 306,695 | |

Deferred revenue fair value adjustment (a) | | 54 | | | — | | | — | | | 54 | |

| Adjusted revenue | | $ | 257,389 | | | $ | 49,360 | | | $ | — | | | $ | 306,749 | |

| | | | | | | | |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 177,131 | | | $ | — | | | $ | — | | | $ | 177,131 | |

| Subscription-based | | 75,975 | | | 47,772 | | | — | | | 123,747 | |

| Total recurring revenue | | 253,106 | | | 47,772 | | | — | | | 300,878 | |

| Professional services and other revenue | | 4,229 | | | 1,588 | | | — | | | 5,817 | |

| Total revenue | | $ | 257,335 | | | $ | 49,360 | | | $ | — | | | $ | 306,695 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense: | | | | | | | | |

| Asset-based | | $ | 102,409 | | | $ | — | | | $ | — | | | $ | 102,409 | |

| Subscription-based | | 1,308 | | | 6,460 | | | — | | | 7,768 | |

| Professional services and other | | (99) | | | 30 | | | — | | | (69) | |

| Total direct expense | | 103,618 | | | 6,490 | | | — | | | 110,108 | |

| Employee compensation | | 77,010 | | | 26,174 | | | 13,653 | | | 116,837 | |

| General and administrative | | 31,463 | | | 7,851 | | | 8,074 | | | 47,388 | |

| Depreciation and amortization | | 24,637 | | | 8,771 | | | — | | | 33,408 | |

| Total operating expenses | | $ | 236,728 | | | $ | 49,286 | | | $ | 21,727 | | | $ | 307,741 | |

| | | | | | | | |

| Income (loss) from operations | | $ | 20,607 | | | $ | 74 | | | $ | (21,727) | | | $ | (1,046) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | 54 | | | — | | | — | | | 54 | |

| Depreciation and amortization | | 24,637 | | | 8,771 | | | — | | | 33,408 | |

Non-cash compensation expense (c) | | 11,235 | | | 2,991 | | | 3,039 | | | 17,265 | |

Restructuring charges and transaction costs (d) | | 928 | | | 1,264 | | | 1,703 | | | 3,895 | |

Severance expense (c) | | 686 | | | 281 | | | 158 | | | 1,125 | |

Litigation, regulatory and other governance related expenses (b) | | — | | | (2,050) | | | — | | | (2,050) | |

Non-income tax expense adjustment (b) | | (343) | | | 18 | | | — | | | (325) | |

| Loss attributable to non-controlling interest | | 820 | | | — | | | — | | | 820 | |

Other (e) | | 352 | | | — | | | — | | | 352 | |

| Adjusted EBITDA | | $ | 58,976 | | | $ | 11,349 | | | $ | (16,827) | | | $ | 53,498 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within general and administrative expense in the condensed consolidated statements of operations.

(c)Included within employee compensation expense in the condensed consolidated statements of operations.

(d)$4.1 million was included within general and administrative expense, $0.2 million was included within employee compensation expense and $(0.4) million was included in other expense, net, in the condensed consolidated statements of operations.

(e)Included in other expense, net, in the condensed consolidated statements of operations.

Envestnet, Inc.

Reconciliation of Non-GAAP Financial Measures

Segment Information (continued)

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine months ended September 30, 2022 |

| | Envestnet Wealth Solutions | | Envestnet Data & Analytics | | Nonsegment | | Total |

| Revenue | | $ | 802,903 | | | $ | 144,007 | | | $ | — | | | $ | 946,910 | |

Deferred revenue fair value adjustment (a) | | 162 | | | — | | | — | | | 162 | |

| Adjusted revenue | | $ | 803,065 | | | $ | 144,007 | | | $ | — | | | $ | 947,072 | |

| | | | | | | | |

| Revenue: | | | | | | | | |

| Asset-based | | $ | 571,820 | | | $ | — | | | $ | — | | | $ | 571,820 | |

| Subscription-based | | 218,080 | | | 138,521 | | | — | | | 356,601 | |

| Total recurring revenue | | 789,900 | | | 138,521 | | | — | | | 928,421 | |

| Professional services and other revenue | | 13,003 | | | 5,486 | | | — | | | 18,489 | |

| Total revenue | | $ | 802,903 | | | $ | 144,007 | | | $ | — | | | $ | 946,910 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Direct expense: | | | | | | | | |

| Asset-based | | $ | 332,138 | | | $ | — | | | $ | — | | | $ | 332,138 | |

| Subscription-based | | 4,177 | | | 18,643 | | | — | | | 22,820 | |

| Professional services and other | | 6,833 | | | 81 | | | — | | | 6,914 | |

| Total direct expense | | 343,148 | | | 18,724 | | | — | | | 361,872 | |

| Employee compensation | | 234,413 | | | 80,334 | | | 54,706 | | | 369,453 | |

| General and administrative | | 103,824 | | | 28,633 | | | 25,410 | | | 157,867 | |

| Depreciation and amortization | | 71,674 | | | 25,534 | | | — | | | 97,208 | |

| Total operating expenses | | $ | 753,059 | | | $ | 153,225 | | | $ | 80,116 | | | $ | 986,400 | |

| | | | | | | | |

| Income (loss) from operations | | $ | 49,844 | | | $ | (9,218) | | | $ | (80,116) | | | $ | (39,490) | |

| Add (deduct): | | | | | | | | |

Deferred revenue fair value adjustment (a) | | 162 | | | — | | | — | | | 162 | |

| Depreciation and amortization | | 71,674 | | | 25,534 | | | — | | | 97,208 | |

Non-cash compensation expense (c) | | 35,889 | | | 8,378 | | | 18,316 | | | 62,583 | |

Restructuring charges and transaction costs (d) | | 18,109 | | | 2,014 | | | 7,144 | | | 27,267 | |

Severance expense (c) | | 4,909 | | | 1,492 | | | 4,978 | | | 11,379 | |

Litigation, regulatory and other governance related expenses (b) | | — | | | 5,333 | | | — | | | 5,333 | |

Non-income tax expense adjustment (b) | | (52) | | | (60) | | | — | | | (112) | |

| Loss attributable to non-controlling interest | | 1,637 | | | — | | | — | | | 1,637 | |

Other (e) | | 352 | | | 2 | | | — | | | 354 | |

| Adjusted EBITDA | | $ | 182,524 | | | $ | 33,475 | | | $ | (49,678) | | | $ | 166,321 | |

(a)Included within subscription-based revenue in the condensed consolidated statements of operations.

(b)Included within general and administrative expense in the condensed consolidated statements of operations.

(c)Included within employee compensation expense in the condensed consolidated statements of operations.

(d)$27.5 million was included within general and administrative expense, $0.2 million was included within employee compensation expense and $(0.4) million was included in other expense, net, in the condensed consolidated statements of operations.

(e)Included in other expense, net, in the condensed consolidated statements of operations.

Envestnet, Inc.

Key Metrics

(in millions, except accounts and advisors data)

(unaudited)

Envestnet Wealth Solutions Segment

The following table provides information regarding the amount of assets utilizing our platforms, financial advisors and investor accounts in the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | September 30, | | December 31, | | March 31, | | June 30, | | September 30, |

| | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| | | | | | | | | | |

| | (in millions, except accounts and advisors data) |

| Platform Assets | | | | | | | | | | |

| Assets under Management (“AUM”) | | $ | 315,883 | | | $ | 341,144 | | | $ | 363,244 | | | $ | 384,773 | | | $ | 375,408 | |

| Assets under Administration (“AUA”) | | 350,576 | | | 367,412 | | | 379,843 | | | 394,078 | | | 398,082 | |

| Total AUM/A | | 666,459 | | | 708,556 | | | 743,087 | | | 778,851 | | | 773,490 | |

| Subscription | | 4,134,414 | | | 4,382,109 | | | 4,566,971 | | | 4,643,313 | | | 4,579,248 | |

| Total Platform Assets | | $ | 4,800,873 | | | $ | 5,090,665 | | | $ | 5,310,058 | | | $ | 5,422,164 | | | $ | 5,352,738 | |

| Platform Accounts | | | | | | | | | | |

| AUM | | 1,522,968 | | 1,547,009 | | 1,571,862 | | 1,609,677 | | 1,614,873 |

| AUA | | 1,135,302 | | 1,135,026 | | 1,142,166 | | 1,144,375 | | 1,257,094 |

| Total AUM/A | | 2,658,270 | | 2,682,035 | | 2,714,028 | | 2,754,052 | | 2,871,967 |

| Subscription | | 15,596,403 | | 15,665,020 | | 15,779,980 | | 15,916,955 | | 16,072,848 |

| Total Platform Accounts | | 18,254,673 | | 18,347,055 | | 18,494,008 | | 18,671,007 | | 18,944,815 |

| Advisors | | | | | | | | | | |

| AUM/A | | 38,417 | | 38,025 | | 38,611 | | 38,809 | | 38,078 |

| Subscription | | 67,348 | | 67,520 | | 67,843 | | 68,439 | | 69,318 |

| Total Advisors | | 105,765 | | 105,545 | | 106,454 | | 107,248 | | 107,396 |

The following table summarizes the changes in AUM and AUA for the three months ended September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Asset Rollforward - Three Months Ended September 30, 2023 |

| | As of June 30, | | Gross | | | | Net | | Market | | Reclass to | | | | As of September 30, |

| | 2023 | | Sales | | Redemptions | | Flows | | Impact | | Subscription | | | | 2023 |

| | | | | | | | | | | | | | | | |

| | (in millions, except account data) |

| AUM | | $ | 384,773 | | | $ | 24,754 | | | $ | (19,846) | | | $ | 4,908 | | | $ | (12,821) | | | $ | (1,452) | | | | | $ | 375,408 | |

| AUA | | 394,078 | | | 39,624 | | | (23,889) | | | 15,735 | | | (11,731) | | | — | | | | | 398,082 | |

| Total AUM/A | | $ | 778,851 | | | $ | 64,378 | | | $ | (43,735) | | | $ | 20,643 | | | $ | (24,552) | | | $ | (1,452) | | | | | $ | 773,490 | |

| Fee-Based Accounts | | 2,754,052 | | | | | | | 128,548 | | | | | (10,633) | | | | | 2,871,967 | |

The above AUM/A gross sales figures for the three months ended September 30, 2023 include $25.8 billion in new client conversions. We onboarded an additional $28.5 billion in subscription conversions during the three months ended September 30, 2023 bringing total conversions for the three months ended September 30, 2023 to $54.3 billion.

Envestnet, Inc.

Key Metrics

(in millions, except accounts and advisors data)

(unaudited)

The following table summarizes the changes in AUM and AUA for the nine months ended September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Asset Rollforward - Nine Months Ended September 30, 2023 |

| | | As of December 31, | | Gross | | | | Net | | Market | | Reclass to | | | | As of September 30, |

| | | 2022 | | Sales | | Redemptions | | Flows | | Impact | | Subscription | | | | 2023 |

| | | | | | | | | | | | | | | | |

| | | (in millions, except account data) |

| AUM | | $ | 341,144 | | | $ | 74,693 | | | $ | (52,153) | | | $ | 22,540 | | | $ | 14,315 | | | $ | (2,591) | | | | | $ | 375,408 | |

| AUA | | 367,412 | | | 97,564 | | | (69,449) | | | 28,115 | | | 16,427 | | | (13,872) | | | | | 398,082 | |

| Total AUM/A | | $ | 708,556 | | | $ | 172,257 | | | $ | (121,602) | | | $ | 50,655 | | | $ | 30,742 | | | $ | (16,463) | | | | | $ | 773,490 | |

| Fee-Based Accounts | | 2,682,035 | | | | | | | 289,041 | | | | | (99,109) | | | | | 2,871,967 | |

The above AUM/A gross sales figures for the nine months ended September 30, 2023 include $54.6 billion in new client conversions. We onboarded an additional $96.6 billion in subscription conversions during the nine months ended September 30, 2023 bringing total conversions for the nine months ended September 30, 2023 to $151.2 billion.

Asset and account figures in the “Reclass to Subscription” columns for the three and nine months ended September 30, 2023 represent enterprise customers whose billing arrangements in future periods are subscription-based, rather than asset-based. Such amounts are included in Subscription metrics at the end of the quarter in which the reclassification occurred, with no impact on total platform assets or accounts.

Envestnet Data & Analytics Segment

The following table provides information regarding the amount of paid-end users and firms using the Envestnet Data & Analytics platform in the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of |

| | September 30, | | December 31, | | March 31, | | June 30, | | September 30 |

| | 2022 | | 2022 | | 2023 | | 2023 | | 2023 |

| | | | | | | | | | |

| | (in millions, except number of firms data) |

| Number of paying users | | 38.1 | | | 38.8 | | | 37.5 | | | 38.0 | | | 42.3 | |

| Number of firms | | 1,815 | | | 1,827 | | | 1,851 | | | 1,873 | | | 1,855 | |

Envestnet 3Q 2023 Earnings November 8, 2023

2 Safe Harbor Disclosure The forward-looking statements made in this presentation concerning, among other things, Envestnet, Inc.’s expected financial performance and outlook for the fourth quarter and full year of 2023, its strategic and operational plans and growth strategy, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties, and the Company’s actual results could differ materially from the results expressed or implied by such forward-looking statements. Furthermore, reported results should not be considered as an indication of future performance. The potential risks, uncertainties and other factors that could cause actual results to differ from those expressed by the forward-looking statements in this presentation include, but are not limited to, the concentration of our revenue from the delivery of our solutions and services to clients in the financial services industry; our reliance on a limited number of clients for a material portion of our revenue; the renegotiation of fees by our clients; changes in the estimates of fair value of reporting units or of long-lived assets; the amount of our debt and our ability to service our debt; limitations on our ability to access information from third parties or charges for accessing such information; the targeting of some of our sales efforts at large financial institutions and large financial technology (“FinTech”) companies which prolongs sales cycles, requires substantial upfront sales costs and results in less predictability in completing some of our sales; changes in investing patterns on the assets on which we derive revenue and the freedom of investors to redeem or withdraw investments generally at any time; the impact of fluctuations in market conditions and interest rates on the demand for our products and services and the value of assets under management or administration; our ability to keep up with rapid technological change, evolving industry standards or changing requirements of clients; risks associated with our international operations; the competitiveness of our solutions and services as compared to those of others; liabilities associated with potential, perceived or actual breaches of fiduciary duties and/or conflicts of interest; harm to our reputation; our ability to successfully identify potential acquisition candidates, complete acquisitions and successfully integrate acquired companies; our ability to successfully execute the conversion of clients’ assets from their technology platform to our technology platforms in a timely and accurate manner; the failure to protect our intellectual property rights; our ability to introduce new solutions and services and enhancements; our ability to maintain the security and integrity of our systems and facilities and to maintain the privacy of personal information and potential liabilities for data security breaches; the effect of privacy laws and regulations, industry standards and contractual obligations and changes to these laws, regulations, standards and obligations on how we operate our business and the negative effects of failure to comply with these requirements; regulatory compliance failures; failure by our customers to obtain proper permissions or waivers for our use of disclosure of information; adverse judicial or regulatory proceedings against us; failure of our solutions, services or systems, or those of third parties on which we rely, to work properly; potential liability for use of inaccurate information by third parties provided by us; the occurrence of a deemed “change of control”; the uncertainty of the application and interpretation of certain tax laws; issuances of additional shares of common stock or issuances of shares of preferred stock or convertible securities on our existing stockholders; changes in the level of inflation; general economic, political and regulatory conditions; changes in trade, monetary and fiscal policies and laws; global events, natural disasters, environmental disasters, terrorist attacks and pandemics or health crises, including their impact on the economy and trading markets; social, environmental and sustainability concerns that may arise, including from our business activities; and management’s response to these factors. More information regarding these and other risks, uncertainties and factors is contained in our filings with the Securities and Exchange Commission (“SEC”) which are available on the SEC’s website at www.sec.gov or our Investor Relations website at http://investor.envestnet.com/. You are cautioned not to unduly rely on these forward-looking statements, which speak only as of the date of this presentation. All information in this presentation is as of September 30, 2023, and, unless required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this presentation or to report the occurrence of unanticipated events. © 2023 Envestnet, Inc. All rights reserved.

3 Non-GAAP Disclosure Statement This presentation contains the non-GAAP financial measures, “adjusted revenue”, “adjusted EBITDA”, “adjusted net income” and “adjusted net income per diluted share”. • “Adjusted revenue” excludes the effect of purchase accounting on the fair value of acquired deferred revenue. On January 1, 2022, the Company adopted ASU 2021-08 whereby it now accounts for contract assets and contract liabilities obtained upon a business combination in accordance with ASC 606. Prior to the adoption of ASU 2021-08, we recorded at fair value the acquired deferred revenue for contracts in effect at the time the entities were acquired. Consequently, revenue related to acquired entities for periods subsequent to the acquisition did not reflect the full amount of revenue that would have been recorded by these entities had they remained stand-alone entities. Adjusted revenue has limitations as a financial measure, should be considered as supplemental in nature and is not meant as a substitute for revenue prepared in accordance with GAAP. • “Adjusted EBITDA” represents net income (loss) before deferred revenue fair value adjustment, interest income, interest expense, income tax provision (benefit), depreciation and amortization, non-cash compensation expense, restructuring charges and transaction costs, severance expense, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, fair market value adjustment to investment in private company, dilution gain on equity method investee share issuance, loss allocations from equity method investments and (income) loss attributable to non-controlling interest. • “Adjusted net income” represents net income (loss) before income tax provision (benefit), deferred revenue fair value adjustment, non-cash interest expense, cash interest on our convertible notes, non-cash compensation expense, restructuring charges and transaction costs, severance expense, amortization of acquired intangibles, litigation, regulatory and other governance related expenses, foreign currency, non-income tax expense adjustment, fair market value adjustment to investment in private company, dilution gain on equity method investee share issuance, loss allocations from equity method investments and (income) loss attributable to non-controlling interest. Reconciling items are presented gross of tax, and a normalized tax rate is applied to the total of all reconciling items to arrive at adjusted net income. The normalized tax rate is based solely on the estimated blended statutory income tax rates in the jurisdictions in which we operate. We monitor the normalized tax rate based on events or trends that could materially impact the rate, including tax legislation changes and changes in the geographic mix of our operations. • “Adjusted net income per diluted share” represents adjusted net income attributable to common stockholders divided by the diluted number of weighted-average shares outstanding. For purposes of the adjusted net income per share calculation, we assume all potential shares to be issued in connection with our convertible notes are dilutive. These measures are not calculated in accordance with GAAP and may be calculated differently than similar non-GAAP measures for other companies. Quantitative reconciliations of our non-GAAP financial information to the most directly comparable GAAP information appear in the appendix to this presentation and more information is contained in our filings with the SEC which are available on the SEC’s website at www.sec.gov or our Investor Relations website at https://investor.envestnet.com/. Reconciliations are not provided for guidance on such measures as we are unable to predict the amounts to be adjusted, such as the GAAP tax provision. Our non-GAAP financial measures should not be viewed as a substitute for revenue, net income (loss) or net income (loss) per share determined in accordance with GAAP. © 2023 Envestnet, Inc. All rights reserved.

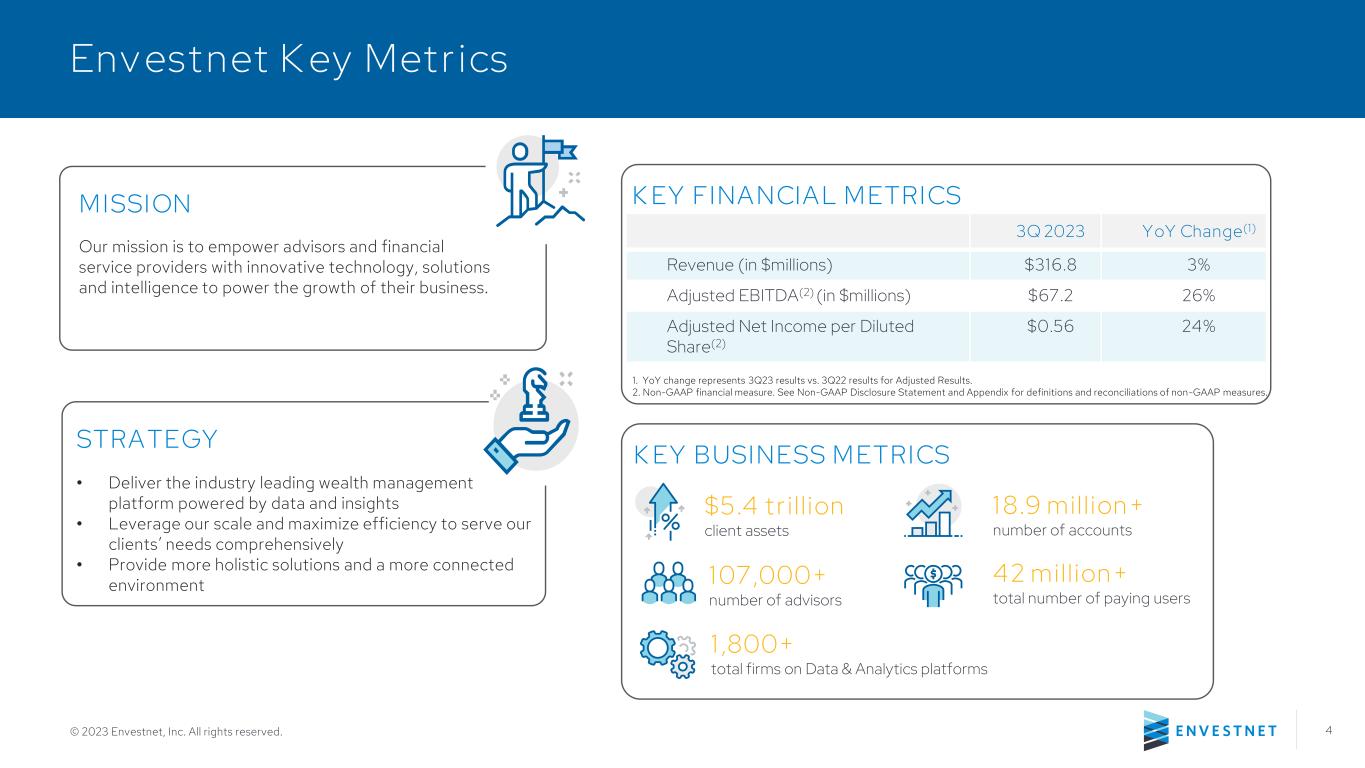

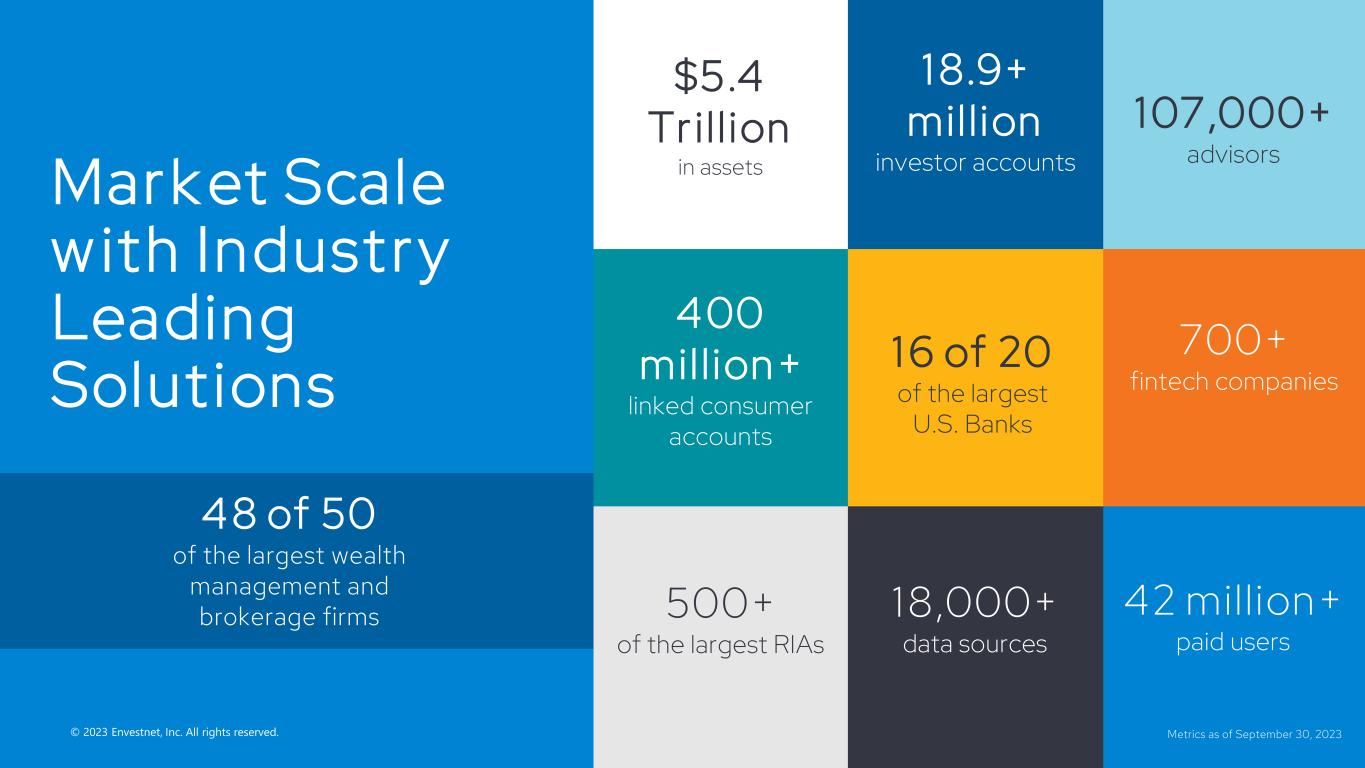

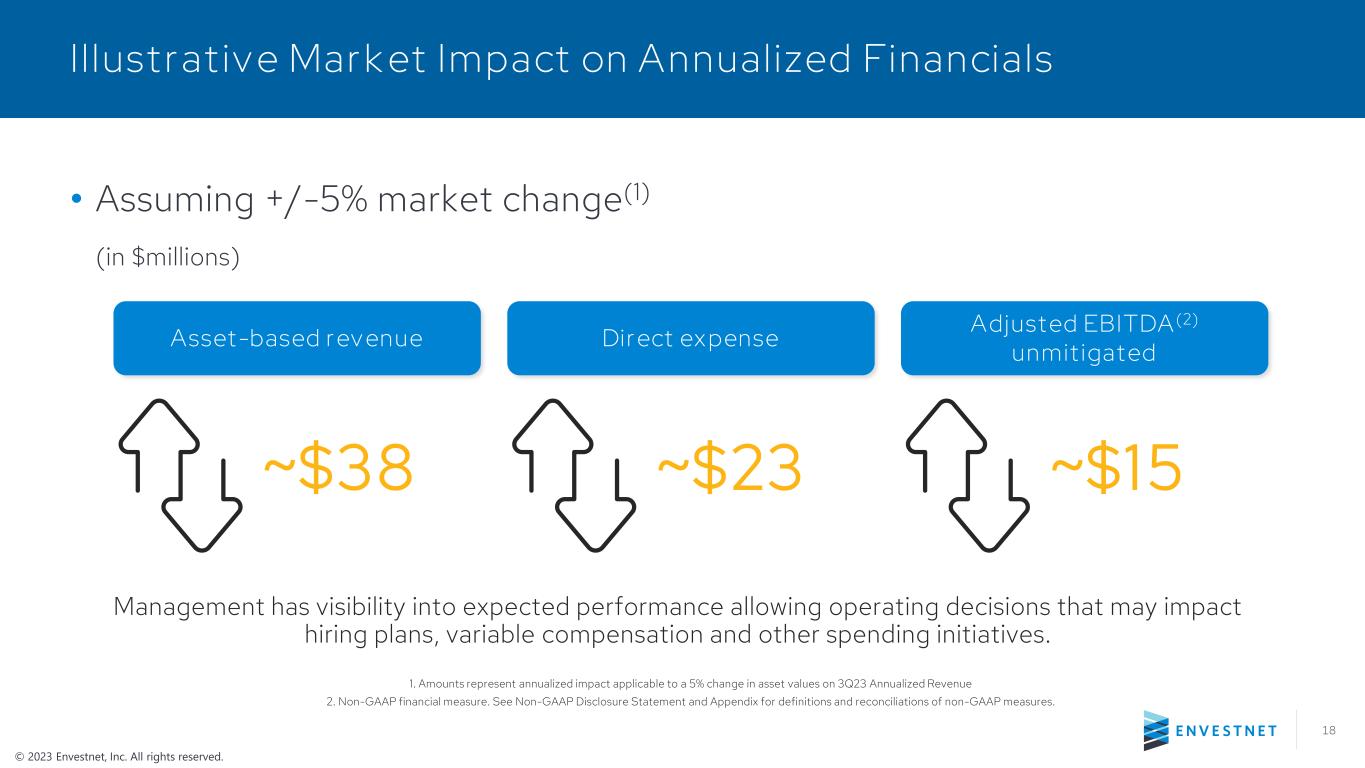

4 Envestnet Key Metrics © 2023 Envestnet, Inc. All rights reserved. MISSION Our mission is to empower advisors and financial service providers with innovative technology, solutions and intelligence to power the growth of their business. 3Q 2023 YoY Change(1) Revenue (in $millions) $316.8 3% Adjusted EBITDA(2) (in $millions) $67.2 26% Adjusted Net Income per Diluted Share(2) $0.56 24% 1. YoY change represents 3Q23 results vs. 3Q22 results for Adjusted Results. 2. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. KEY FINANCIAL METRICS KEY BUSINESS METRICS $5.4 trillion client assets 107,000+ number of advisors 18.9 million+ number of accounts 42 million+ total number of paying users 1,800+ total firms on Data & Analytics platforms STRATEGY • Deliver the industry leading wealth management platform powered by data and insights • Leverage our scale and maximize efficiency to serve our clients’ needs comprehensively • Provide more holistic solutions and a more connected environment

5 Envestnet Key Metrics © 2023 Envestnet, Inc. All rights reserved. ENDING ACCOUNTS OVER TIME ADVISOR COUNT OVER TIMEENDING ASSETS OVER TIME 4.6T 4.8T 5.0T 5.2T 5.4T 5.6T 5.8T 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 105,000 105,500 106,000 106,500 107,000 107,500 108,000 108,500 109,000 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 13,500,000 14,500,000 15,500,000 16,500,000 17,500,000 18,500,000 19,500,000 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 All data is quarterly.

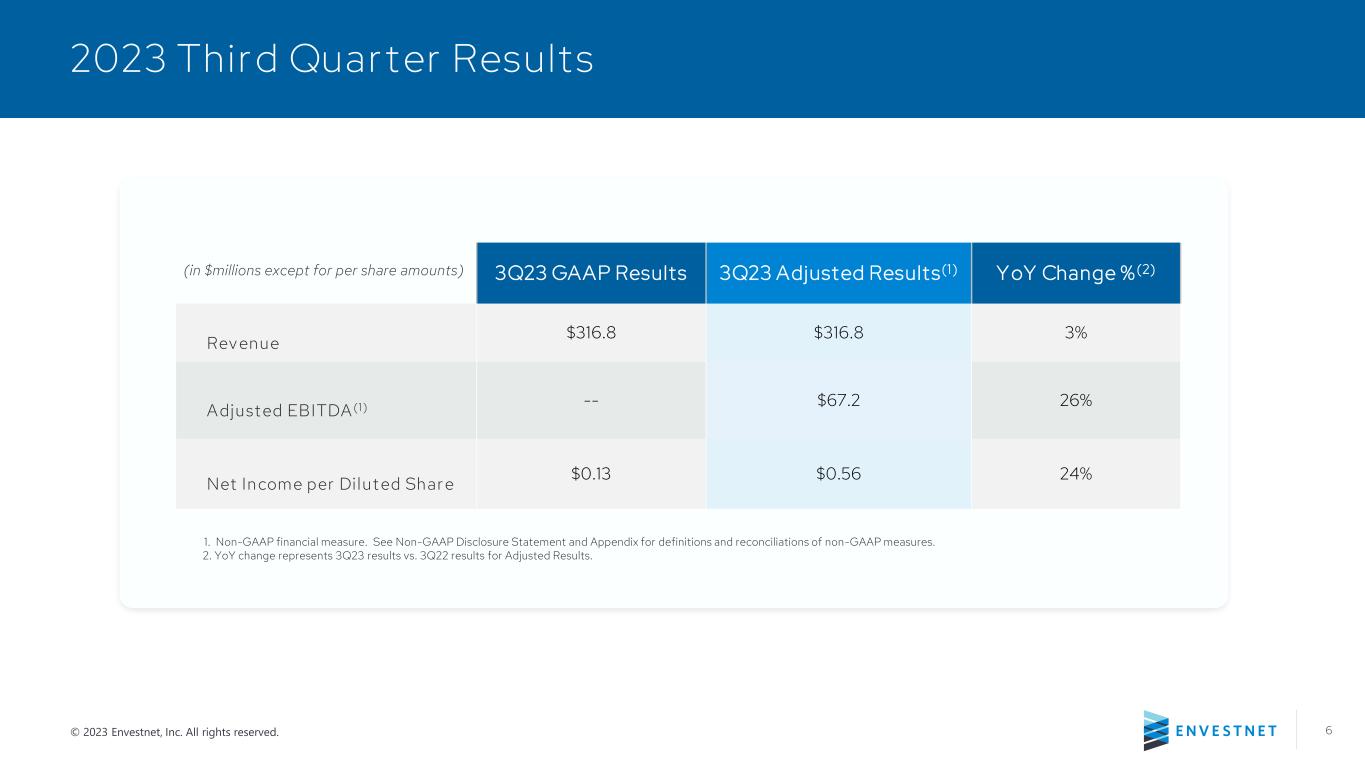

6 2023 Third Quarter Results © 2023 Envestnet, Inc. All rights reserved. 3Q23 GAAP Results 3Q23 Adjusted Results(1) YoY Change %(2) Revenue $316.8 $316.8 3% Adjusted EBITDA(1) -- $67.2 26% Net Income per Diluted Share $0.13 $0.56 24% 1. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. 2. YoY change represents 3Q23 results vs. 3Q22 results for Adjusted Results. (in $millions except for per share amounts)

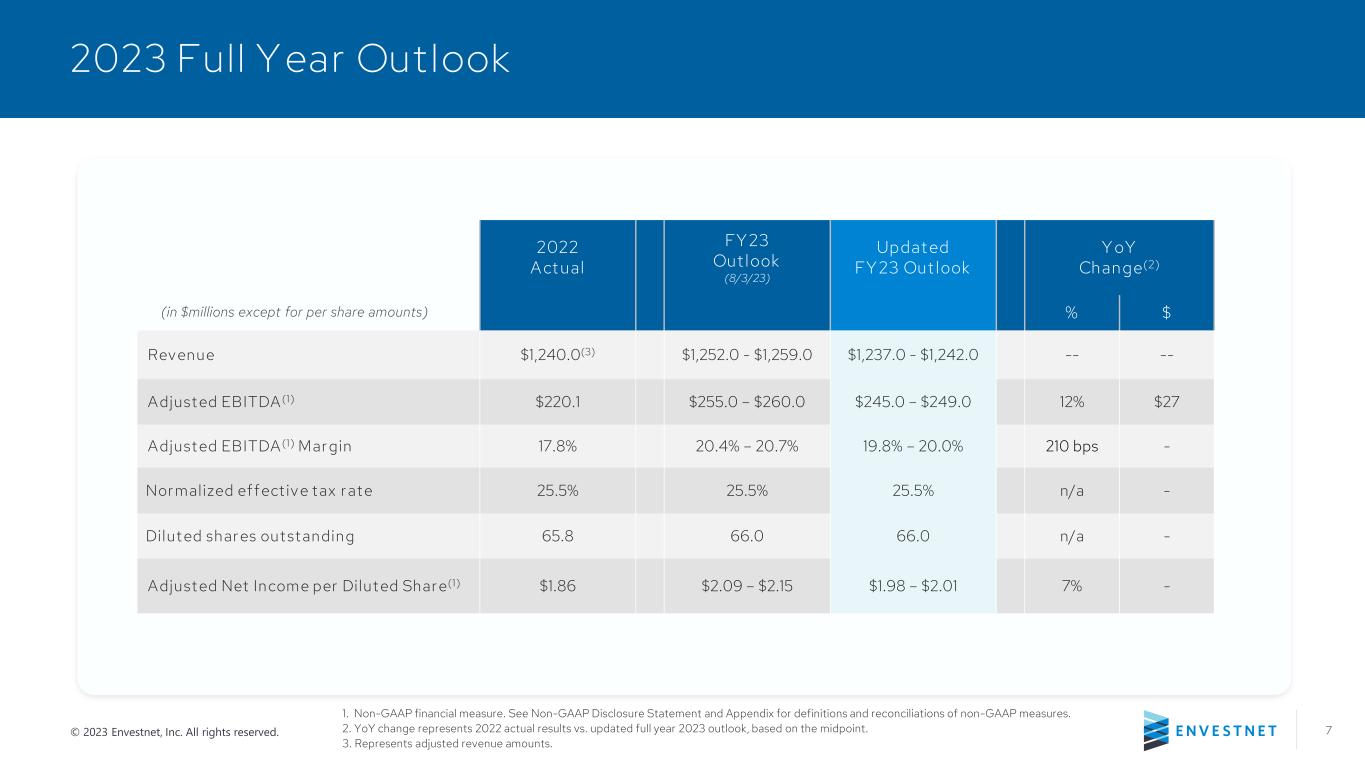

7 2023 Full Year Outlook © 2023 Envestnet, Inc. All rights reserved. 3Q22 Outlook 2022 Actual FY23 Outlook (8/3/23) Updated FY23 Outlook YoY Change(2) % $ Revenue $1,240.0(3) $1,252.0 - $1,259.0 $1,237.0 - $1,242.0 -- -- Adjusted EBITDA(1) $220.1 $255.0 – $260.0 $245.0 – $249.0 12% $27 Adjusted EBITDA(1) Margin 17.8% 20.4% – 20.7% 19.8% – 20.0% 210 bps - Normalized effective tax rate 25.5% 25.5% 25.5% n/a - Diluted shares outstanding 65.8 66.0 66.0 n/a - Adjusted Net Income per Diluted Share(1) $1.86 $2.09 – $2.15 $1.98 – $2.01 7% - 1. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. 2. YoY change represents 2022 actual results vs. updated full year 2023 outlook, based on the midpoint. 3. Represents adjusted revenue amounts. (in $millions except for per share amounts)

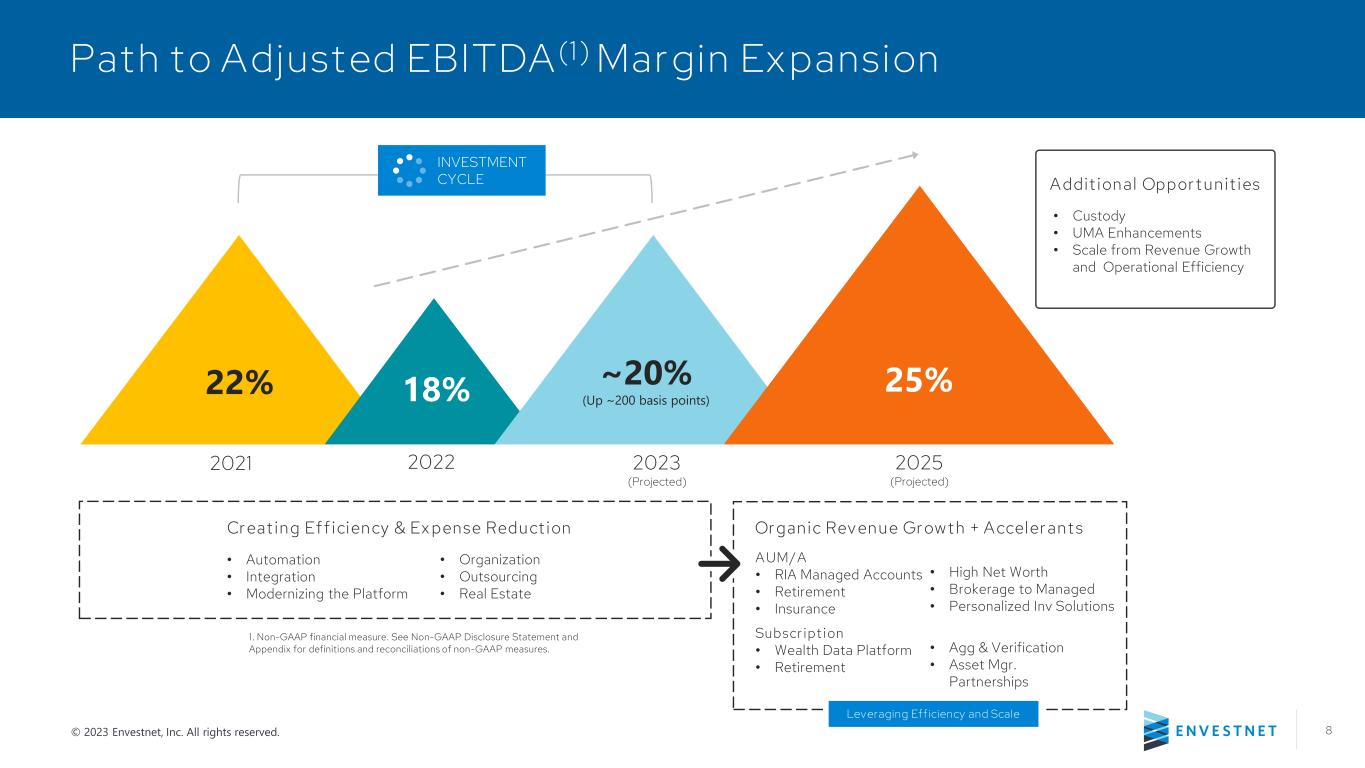

8 Path to Adjusted EBITDA(1) Margin Expansion © 2023 Envestnet, Inc. All rights reserved. 1. Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. 25%18% ~20% (Up ~200 basis points) Creating Efficiency & Expense Reduction • Automation • Integration • Modernizing the Platform • Organization • Outsourcing • Real Estate Organic Revenue Growth + Accelerants AUM/A • RIA Managed Accounts • Retirement • Insurance • High Net Worth • Brokerage to Managed • Personalized Inv Solutions Subscription • Wealth Data Platform • Retirement • Agg & Verification • Asset Mgr. Partnerships Additional Opportunities • Custody • UMA Enhancements • Scale from Revenue Growth and Operational Efficiency 2022 2023 (Projected) Leveraging Efficiency and Scale 22% 2021 INVESTMENT CYCLE 2025 (Projected)

9© 2023 Envestnet, Inc. All rights reserved. Market Scale with Industry Leading Solutions 42 million+ paid users 107,000+ advisors 16 of 20 of the largest U.S. Banks 400 million+ linked consumer accounts 500+ of the largest RIAs 700+ fintech companies 48 of 50 of the largest wealth management and brokerage firms 18.9+ million investor accounts 18,000+ data sources $5.4 Trillion in assets Metrics as of September 30, 2023© 2023 Envestnet, Inc. All rights reserved.

10 Revenue Mix © 2023 Envestnet, Inc. All rights reserved. Three Months Ended September 30 2023 2022 Envestnet Wealth Solutions Envestnet Data & Analytics Total Envestnet Wealth Solutions Envestnet Data & Analytics Total (in thousands) Revenue: Asset-based $ 193,901 $ — $ 193,901 $ 177,131 $ — $ 177,131 Subscription-based 76,813 38,126 114,939 75,975 47,772 123,747 Total recurring revenue 270,714 38,126 308,840 253,106 47,772 300,878 Professional services and other revenue 4,313 3,694 8,007 4,229 1,588 5,817 Total Revenue $ 275,027 $ 41,820 $ 316,847 $ 257,335 $ 49,360 $ 306,695 YoY % Growth 7% (15)% 3% 1% 2% 1%

11 Adjusted EBITDA* Margin © 2023 Envestnet, Inc. All rights reserved. *Non-GAAP financial measure. See Non-GAAP Disclosure Statement and Appendix for definitions and reconciliations of non-GAAP measures. $275,185 $288,818 $303,120 $319,678 $321,417 $318,906 $306,749 $292,928 $298,759 $312,451 316,847 68,264 71,061 66,188 56,217 55,697 57,126 53,498 53,807 55,424 57,785 67,242 25% 25% 22% 18% 17% 18% 17% 18% 19% 18% 21% $- $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 Adjusted Revenue* Adjusted EBITDA* Adjusted EBITDA* Margin

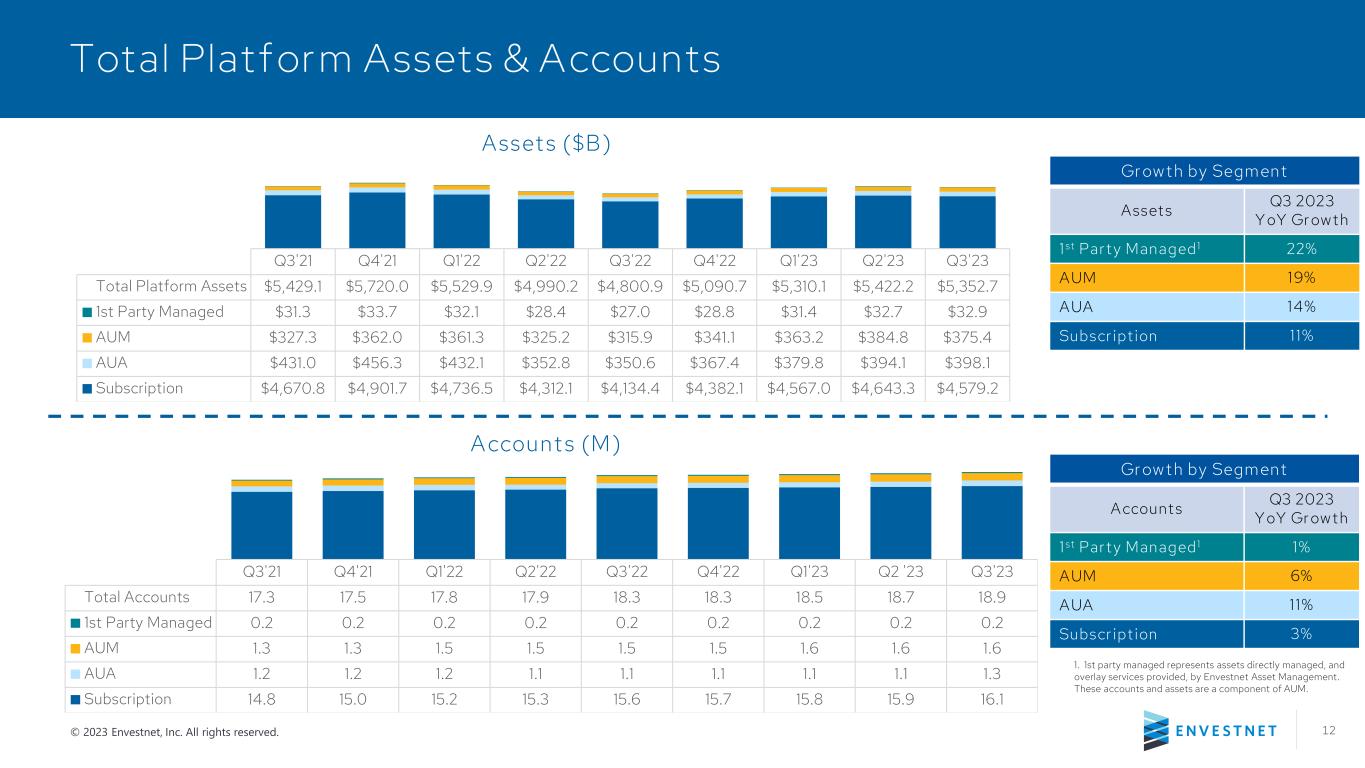

12 Total Platform Assets & Accounts © 2023 Envestnet, Inc. All rights reserved. Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Total Platform Assets $5,429.1 $5,720.0 $5,529.9 $4,990.2 $4,800.9 $5,090.7 $5,310.1 $5,422.2 $5,352.7 1st Party Managed $31.3 $33.7 $32.1 $28.4 $27.0 $28.8 $31.4 $32.7 $32.9 AUM $327.3 $362.0 $361.3 $325.2 $315.9 $341.1 $363.2 $384.8 $375.4 AUA $431.0 $456.3 $432.1 $352.8 $350.6 $367.4 $379.8 $394.1 $398.1 Subscription $4,670.8 $4,901.7 $4,736.5 $4,312.1 $4,134.4 $4,382.1 $4,567.0 $4,643.3 $4,579.2 Assets ($B) Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2 '23 Q3'23 Total Accounts 17.3 17.5 17.8 17.9 18.3 18.3 18.5 18.7 18.9 1st Party Managed 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 AUM 1.3 1.3 1.5 1.5 1.5 1.5 1.6 1.6 1.6 AUA 1.2 1.2 1.2 1.1 1.1 1.1 1.1 1.1 1.3 Subscription 14.8 15.0 15.2 15.3 15.6 15.7 15.8 15.9 16.1 Accounts (M) Growth by Segment Accounts Q3 2023 YoY Growth 1st Party Managed1 1% AUM 6% AUA 11% Subscription 3% Growth by Segment Assets Q3 2023 YoY Growth 1st Party Managed1 22% AUM 19% AUA 14% Subscription 11% 1. 1st party managed represents assets directly managed, and overlay services provided, by Envestnet Asset Management. These accounts and assets are a component of AUM.

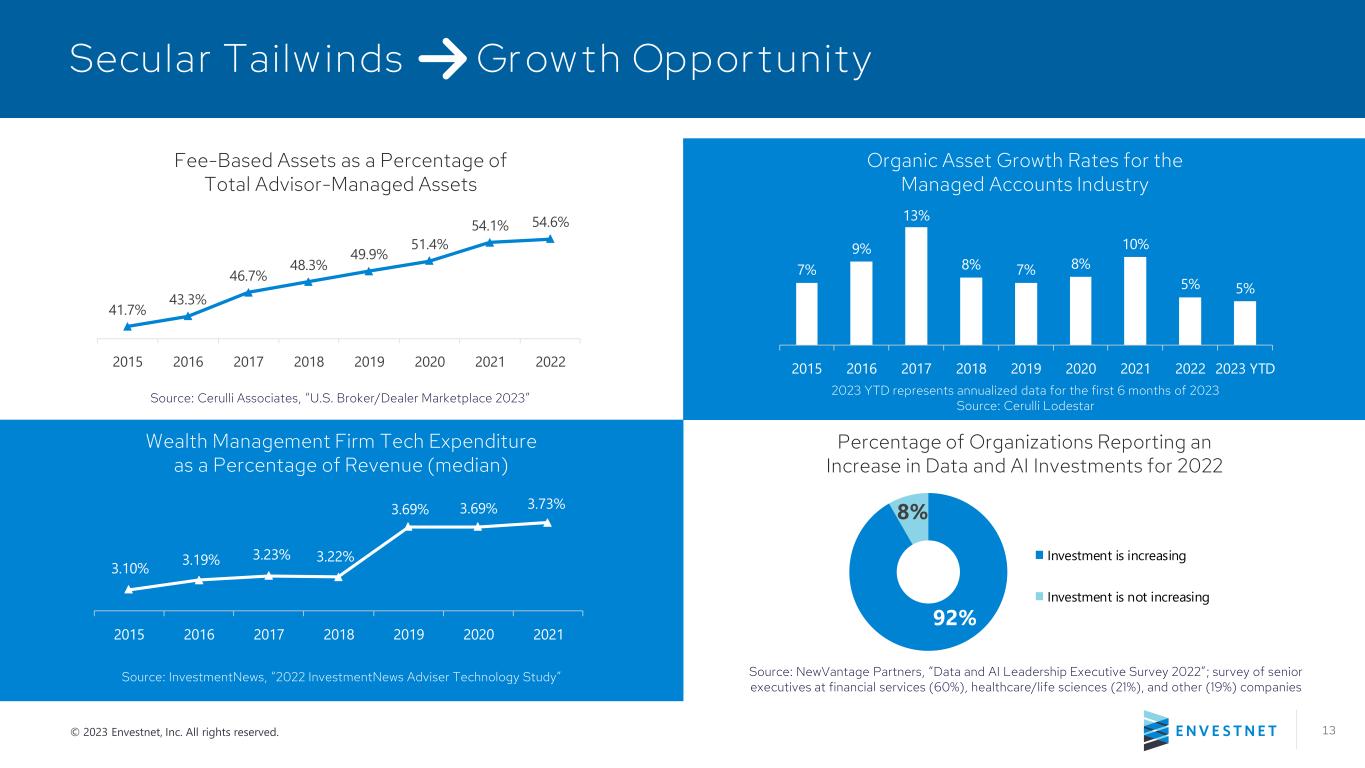

13 41.7% 43.3% 46.7% 48.3% 49.9% 51.4% 54.1% 54.6% 2015 2016 2017 2018 2019 2020 2021 2022 7% 9% 13% 8% 7% 8% 10% 5% 5% 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD 2023 YTD represents annualized data for the first 6 months of 2023 Source: Cerulli Lodestar Secular Tailwinds Growth Opportunity © 2023 Envestnet, Inc. All rights reserved. Source: Cerulli Associates, “U.S. Broker/Dealer Marketplace 2023” Source: InvestmentNews, “2022 InvestmentNews Adviser Technology Study” Source: NewVantage Partners, “Data and AI Leadership Executive Survey 2022”; survey of senior executives at financial services (60%), healthcare/life sciences (21%), and other (19%) companies Wealth Management Firm Tech Expenditure as a Percentage of Revenue (median) 3.10% 3.19% 3.23% 3.22% 3.69% 3.69% 3.73% 2.90% 3.10% 3.30% 3.50% 3.70% 3.90% 2015 2016 2017 2018 2019 2020 2021 Fee-Based Assets as a Percentage of Total Advisor-Managed Assets Organic Asset Growth Rates for the Managed Accounts Industry Percentage of Organizations Reporting an Increase in Data and AI Investments for 2022 92% 8% Investment is increasing Investment is not increasing

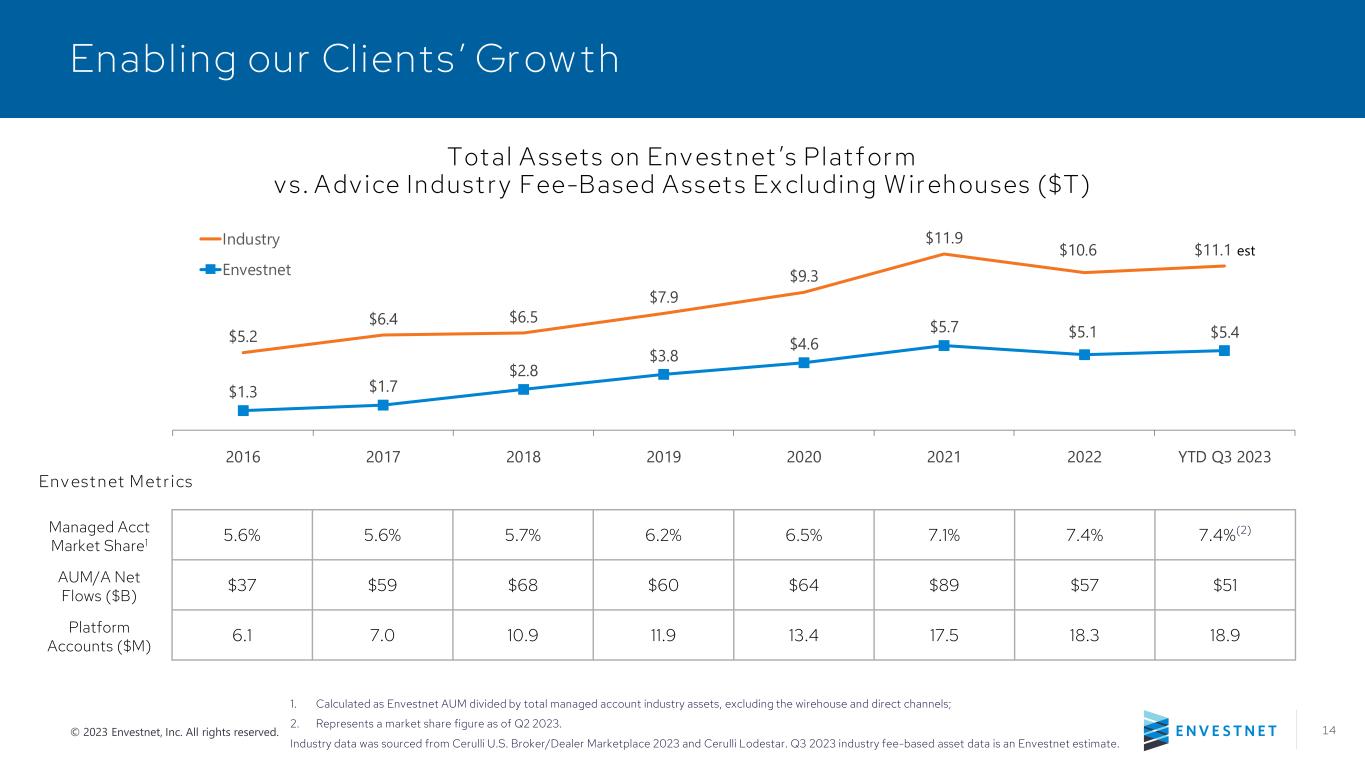

14 https://www.hfr.com/family-indices/hfrx Weighting per Brooks 6/15/22 -22% $5.2 $6.4 $6.5 $7.9 $9.3 $11.9 $10.6 $11.1 est $1.3 $1.7 $2.8 $3.8 $4.6 $5.7 $5.1 $5.4 2016 2017 2018 2019 2020 2021 2022 YTD Q3 2023 Industry Envestnet Enabling our Clients’ Growth © 2023 Envestnet, Inc. All rights reserved. 1. Calculated as Envestnet AUM divided by total managed account industry assets, excluding the wirehouse and direct channels; 2. Represents a market share figure as of Q2 2023. Industry data was sourced from Cerulli U.S. Broker/Dealer Marketplace 2023 and Cerulli Lodestar. Q3 2023 industry fee-based asset data is an Envestnet estimate. Total Assets on Envestnet’s Platform vs. Advice Industry Fee-Based Assets Excluding Wirehouses ($T) AUM/A Net Flows ($B) Platform Accounts ($M) Envestnet Metrics Managed Acct Market Share1 5.6% 5.6% 5.7% 6.2% 6.5% 7.1% 7.4% 7.4%(2) $37 $59 $68 $60 $64 $89 $57 $51 6.1 7.0 10.9 11.9 13.4 17.5 18.3 18.9

15 Strong balance sheet and liquidity © 2023 Envestnet, Inc. All rights reserved. CAPITAL POSITION AS OF SEPTEMBER 30, 2023 (in $millions) Cash and Cash Equivalents $43.2 Annual Cash Interest Expense $19.4(1) Debt (in $millions) Outstanding on Revolving Line of Credit ($500) $0.0 Revolving Line of Credit SOFR + spread(2) Convertible Debt Maturing 2025 $317.5 Convertible Debt 2025 0.75% coupon Convertible Debt Maturing 2027 $575.0 Convertible Debt 2027 2.625% coupon Net Leverage Ratio 3.7x(3) 1. Annual Cash Interest Expense reflects 2023 forecast based on current debt and includes bank facility fees 2. We estimate the spread to be Adjusted SOFR + 225 bps based on our current leverage ratio 3. Net Leverage Ratio is calculated as End of Quarter Net Debt / Trailing Twelve Months Adj. EBITDA NET LEVERAGE RATIO 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 4.5x 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23

Appendix