Eagle Point Insitutional Income Fund Reports Year-End 2022 Financial Results and Declares Monthly Distribution With 8.5% Annualized Distribution Rate

06 März 2023 - 2:30PM

Business Wire

Eagle Point Credit Management LLC (“Eagle Point”), a specialist

credit asset manager with approximately $7.5 billion of assets

under management,1 announced that Eagle Point Institutional Income

Fund (the “Fund”), a non-traded closed-end fund registered under

the Investment Company Act of 1940, reported financial results for

its initial period of operations, from June 1, 2022 to December 31,

2022. The Fund’s net asset value per share as of December 31, 2022

was $9.97, compared to $10.00 per share on June 1, 2022. The Fund

also paid $0.455 per share of total distributions to shareholders

in 2022.

The Fund subsequently paid $0.152 per share of additional

distributions to shareholders in 2023 (January and February 2023

distribution payments), representing an 8.5% annualized

distribution rate.2 The February distribution represents the Fund’s

eighth consecutive monthly distribution since commencing

operations. The Fund’s net asset value per share as of January 31,

2023 was $10.22.

Eagle Point Institutional Income Fund seeks to provide investors

with an attractive income stream by investing primarily in

diversified pools of senior secured loans called collateralized

loan obligations (“CLOs”). Senior secured loans held by CLOs are

typically floating rate loans to U.S. companies with a first lien

position in the capital structure. Through its investments in

equity and junior debt securities of CLOs, the Fund seeks to

provide diversified exposure to U.S. companies across various

industries.

Thomas Majewski, the Fund’s Chief Executive Officer, said, “We

are pleased with the results of Eagle Point Institutional Income

Fund in 2022. During a particularly volatile and challenging

macroeconomic environment, we have been able to preserve capital

and pay an attractive distribution to investors. Notably, our net

investment income coverage of distributions declared and paid in

2022 was 111%. We believe the Fund is well positioned to continue

achieving our investment objectives.”

The Fund seeks to leverage Eagle Point’s established

institutional investment management business to deliver attractive

risk-adjusted returns for the Fund’s investors over the long-term.

The Fund’s investments in CLO securities, which typically pay a

floating rate of interest, are expected to be more resilient than

fixed rate credit investments in a rising interest rate and

inflationary environment. The Fund currently offers its shares on a

continuous basis in monthly closings.

Please refer to the Fund’s annual report available at

www.EPIIF.com for additional information on the Fund’s financial

results for the period ended December 31, 2022.

About Eagle Point Credit Management LLC

Eagle Point is a specialist asset manager focused on

income-oriented credit investments including CLO securities, senior

secured loans and Portfolio Debt Securities. Eagle Point and its

affiliates manages approximately $7.5 billion of assets under

management.1 The senior investment team is comprised of CLO

industry specialists who have been in the market for the majority

of their careers and who have established relationships with key

market participants. Eagle Point was formed in 2012 by Thomas

Majewski and Stone Point Capital.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Statements other than statements of historical facts

included in this press release may constitute forward-looking

statements and are not guarantees of future performance or results

and involve a number of risks and uncertainties. Actual results may

differ materially from those in the forward-looking statements as a

result of a number of factors, including those described in the

Fund’s filings with the U.S. Securities and Exchange Commission

(“SEC”). The Fund undertakes no duty to update any forward-looking

statement made herein. All forward-looking statements speak only as

of the date of this press release.

Securities Disclosure

This press release is provided for informational purposes only,

does not constitute an offer to sell securities of the Fund and is

not a prospectus. Such offering is only made by the Fund’s

prospectus, which includes details as to the Fund’s offering and

other material information. Securities offered through WealthForge

Securities, LLC, member FINRA and SIPC. WealthForge Securities, LLC

and Eagle Point are not affiliated. Investing in the Fund involves

risk of loss of some or all principal invested. Speak to your tax

professional prior to investing. This is neither an offer to sell

nor a solicitation to purchase any security. Please refer to the

prospectus available at www.EPIIF.com for additional information

about the Fund. The prospectus should be read carefully before

investing.

____________________________ 1 As of December 31, 2022.

Calculated in the aggregate with its affiliate Eagle Point Income

Management LLC and includes capital commitments that were undrawn.

2 “Annualized Distribution Rate” reflects the February 2023

declared distribution of $0.077 per share multiplied by twelve and

divided by the January 31, 2023 public offering price (assuming

maximum sales load of 6%) of $10.87. The timing and frequency of

distribution payments is not guaranteed. Distributions may be

comprised of any combination of 1) net investment income and/or 2)

net capital gain. If the Fund distributes an amount in excess of

net investment income and net capital gains, a portion of such

distribution will constitute a return of capital. A distribution

comprised in whole or in part by a return of capital does not

necessarily reflect the Fund’s investment performance and should

not be confused with “yield” or “income.” A return of capital

distribution may reduce the amount of investable funds. The actual

components of the Fund’s distributions for U.S. tax reporting

purposes can only be finally determined as of the end of each

fiscal year of the Fund and are thereafter reported to shareholders

on Form 1099-DIV. In considering returns, investors should bear in

mind that historical performance is not a guarantee, projection or

prediction and is not indicative of future results. Investment

return and principal value of any investment will fluctuate and may

be worth more or less than the amount initially invested.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230306005307/en/

Investor Relations: 866-661-6615 EPIIF@eaglepointcredit.com

www.EPIIF.com

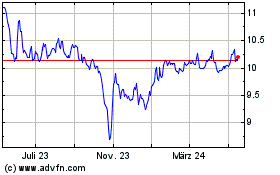

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

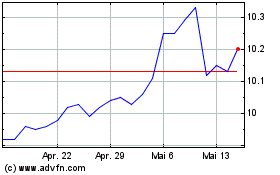

Eagle Point Credit (NYSE:ECC)

Historical Stock Chart

Von Jan 2024 bis Jan 2025