Dynex Capital, Inc. Welcomes New Head of Strategy and Research, Acquires Contingent Macro’s Proprietary Models and Data Library

18 September 2023 - 2:00PM

Business Wire

Dynex Capital, Inc. (NYSE: DX) announced a significant addition

to its leadership team. Terrence (“T.J.”) Connelly, a seasoned

expert in global economics, fixed-income investing, and financial

modeling has joined Dynex to spearhead its strategic initiatives

and research efforts.

With an outstanding track record in the asset management

industry, Connelly brings a wealth of knowledge and experience to

Dynex. Prior to joining Dynex, he was the Founder and Head of

Research at Contingent Macro Advisors, where he was instrumental in

developing innovative models and proprietary solutions, advising,

and managing assets for some of the largest asset managers in the

world.

In a strategic move to bolster its position as a market leader,

Dynex has also acquired the cutting-edge models and proprietary

data developed by Contingent Macro under Connelly's leadership.

These assets will play a pivotal role in leveraging evolving

technologies to enhance Dynex's capabilities and enable the company

to maintain its investment edge and industry-leading risk

management in complex global markets.

Commenting on this development, Byron L. Boston, the Company’s

Chief Executive Officer of Dynex, said, "We are thrilled to welcome

T.J. to our team. His exceptional expertise and the acquisition of

Contingent Macro's models and proprietary data represent a

significant step forward for Dynex. We are committed to delivering

outstanding results for our investors, and this strategic move

aligns perfectly with our goals."

Connelly also expressed enthusiasm about joining Dynex and the

potential for innovation, saying, "I am honored to be part of the

Dynex team, an outstanding organization committed to excellence. It

is also a joy to be reunited with Byron and Smriti, whose

leadership I’ve admired for over 25 years. With the acquisition of

Contingent Macro's assets, we have the opportunity to drive

innovation and deliver even greater value to our investors."

About Dynex Capital

Dynex Capital, Inc. is a financial services company committed to

ethical stewardship of stakeholders' capital; employing

comprehensive risk management and disciplined capital allocation to

generate dividend income and long-term total returns through the

diversified financing of real estate assets in the United States.

Dynex operates as a REIT and is internally managed to maximize

stakeholder alignment. Additional information about Dynex Capital,

Inc. is available at www.dynexcapital.com.

Forward Looking Statement

“Safe Harbor” Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this press release regarding the

business of Dynex Capital, Inc. that are not historical facts are

“forward-looking statements” that involve risks and uncertainties.

For a discussion of these risks and uncertainties, which could

cause actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in the Company’s

Annual Report on Form 10-K and other reports filed with the

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230918086781/en/

Alison Griffin 804-217-5897

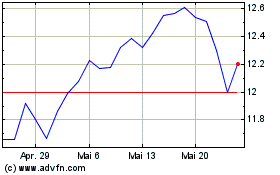

Dynex Capital (NYSE:DX)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Dynex Capital (NYSE:DX)

Historical Stock Chart

Von Dez 2023 bis Dez 2024