Dynex Capital, Inc. ("Dynex" or the "Company") (NYSE: DX)

reported its third quarter 2024 financial results today. Management

will host a call today at 10:00 a.m. Eastern Time to discuss the

results and business outlook. Details to access the call can be

found below under "Earnings Conference Call."

Financial Performance

Summary

- Total economic return of $0.89 per common share, or 7.1% of

beginning book value

- Book value per common share of $13.00 as of September 30,

2024

- Comprehensive income of $0.93 per common share and net income

of $0.38 per common share

- Dividends declared of $0.39 per common share for the third

quarter

- Purchased $1.1 billion of Agency RMBS

- Liquidity of $708.7 million as of September 30, 2024

- Leverage including to-be-announced ("TBA") securities at cost

was 7.6 times shareholders' equity as of September 30, 2024

- Announced decision by the Board of Directors to increase

monthly dividend to $0.15 per common share

Management Remarks

"Our economic return of 7.1% for the quarter continues to

highlight the skills and experience that we believe are necessary

to navigate the current environment. We continue to expect a

favorable investing environment which supports increasing our

monthly dividend from $0.13 to $0.15 per common share," said Byron

L. Boston, Chairman and Co-CEO.

"We believe the Dynex team has positioned the Company to deliver

solid returns – creating value in four main ways – managing the

existing portfolio, optimizing the capital structure, raising

equity and investing capital at accretive ROEs," said Smriti Laxman

Popenoe, Co-CEO, President, and Chief Investment Officer.

Earnings Conference Call

As previously announced, the Company's conference call to

discuss these results is today at 10:00 a.m. Eastern Time and may

be accessed via telephone in the United States by dialing

1-888-330-2022 or internationally by dialing 1-646-960-0690 and

providing the ID 1957092 or by live audio webcast by clicking the

"Webcast" button in the “Current Events” section on the homepage of

the Company's website (www.dynexcapital.com), which includes a

slide presentation. To listen to the live conference call via

telephone, please dial in at least ten minutes before the call

begins. An archive of the webcast will be available on the

Company's website approximately two hours after the live call

ends.

Consolidated

Balance Sheets (unaudited)

($s in thousands except per share

data)

September 30, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

268,296

$

119,639

Cash collateral posted to

counterparties

137,296

118,225

Mortgage-backed securities (including

pledged of $6,767,948 and $5,880,747, respectively)

7,327,643

6,038,948

Due from counterparties

28,973

1,313

Derivative assets

4,138

54,361

Accrued interest receivable

31,766

28,727

Other assets, net

18,062

8,537

Total assets

$

7,816,174

$

6,369,750

LIABILITIES AND SHAREHOLDERS’

EQUITY

Liabilities:

Repurchase agreements

$

6,423,890

$

5,381,104

Due to counterparties

167,609

95

Derivative liabilities

3,662

—

Cash collateral posted by

counterparties

7,895

46,001

Accrued interest payable

48,570

53,194

Accrued dividends payable

13,684

10,320

Other liabilities

8,304

8,301

Total liabilities

6,673,614

5,499,015

Shareholders’ equity:

Preferred stock

$

107,843

107,843

Common stock

793

570

Additional paid-in capital

1,677,062

1,404,431

Accumulated other comprehensive loss

(135,889

)

(158,502

)

Accumulated deficit

(507,249

)

(483,607

)

Total shareholders' equity

1,142,560

870,735

Total liabilities and shareholders’

equity

$

7,816,174

$

6,369,750

Preferred stock aggregate liquidation

preference

$

111,500

$

111,500

Book value per common share

$

13.00

$

13.31

Common shares outstanding

79,294,324

57,038,247

Consolidated

Comprehensive Statements of Income (unaudited)

Nine Months Ended

Three Months Ended

($s in thousands except per share

data)

September 30, 2024

June 30, 2024

September 30, 2024

INTEREST INCOME (EXPENSE)

Interest income

$

83,458

$

76,054

$

231,038

Interest expense

(82,564

)

(74,767

)

(232,048

)

Net interest income (expense)

894

1,287

(1,010

)

OTHER GAINS (LOSSES)

Realized loss on sales of investments,

net

—

(1,506

)

(1,506

)

Unrealized gain (loss) on investments,

net

192,874

(41,977

)

80,873

(Loss) gain on derivative instruments,

net

(154,064

)

41,135

11,707

Total other gains (losses), net

38,810

(2,348

)

91,074

EXPENSES

General and administrative expenses

(8,271

)

(6,642

)

(25,793

)

Other operating expense, net

(436

)

(601

)

(1,459

)

Total operating expenses

(8,707

)

(7,243

)

(27,252

)

Net income (loss)

30,997

(8,304

)

62,812

Preferred stock dividends

(1,923

)

(1,923

)

(5,770

)

Net income (loss) to common

shareholders

$

29,074

$

(10,227

)

$

57,042

Other comprehensive income:

Unrealized gain (loss) on

available-for-sale investments, net

41,667

(1,786

)

22,613

Total other comprehensive income

(loss)

41,667

(1,786

)

22,613

Comprehensive income (loss) to common

shareholders

$

70,741

$

(12,013

)

$

79,655

Weighted average common shares-basic

75,792,527

66,954,870

67,313,385

Weighted average common shares-diluted

76,366,487

66,954,870

67,808,892

Net income (loss) per common

share-basic

$

0.38

$

(0.15

)

$

0.85

Net income (loss) per common

share-diluted

$

0.38

$

(0.15

)

$

0.84

Dividends declared per common share

$

0.39

$

0.39

$

1.17

Discussion of Third Quarter

Results

The Company's total economic return of $0.89 per common share

for the third quarter of 2024 consisted of an increase in book

value of $0.50 per common share and dividends declared of $0.39 per

common share. The fair value of the Company's investment portfolio

benefited from spread tightening and a decline in the 10-year U.S.

Treasury rate during the third quarter of 2024. Because the

Company's interest rate hedges were positioned for a bull

steepening environment where short-term interest rates decline

faster than long term interest rates, the gains on the Company's

investment portfolio outpaced losses on its interest rate hedging

portfolio. The following table summarizes the changes in the

Company's financial position during the third quarter of 2024:

($s in thousands except per share

data)

Net Changes

in Fair Value

Components of Comprehensive

Income

Common Book Value

Rollforward

Per Common Share (1)

Balance as of June 30, 2024 (1)

$

933,763

$

12.50

Net interest income

$

894

Operating expenses

(8,707

)

Preferred stock dividends

(1,923

)

Changes in fair value:

MBS and loans

$

234,541

TBAs

72,191

U.S. Treasury futures

(216,189

)

Interest rate swaps

(10,066

)

Total net change in fair value

80,477

Comprehensive income to common

shareholders

70,741

Capital transactions:

Net proceeds from stock issuance (2)

56,753

Common dividends declared

(30,198

)

Balance as of September 30, 2024

(1)

$

1,031,059

$

13.00

(1)

Amounts represent total shareholders'

equity less the aggregate liquidation preference of the Company's

preferred stock of $111,500.

(2)

Net proceeds from common stock issuances

includes $56.2 million from ATM issuances, and $0.5 million from

amortization of share-based compensation, net of grants.

The following table provides detail on the Company's MBS

investments, including TBA securities as of September 30, 2024:

September 30, 2024

June 30, 2024

($ in millions)

Par Value

Fair Value

% of

Portfolio

Par Value

Fair Value

% of

Portfolio

30-year fixed rate RMBS:

2.0% coupon

$

668,416

$

559,167

6.0

%

$

682,622

$

543,906

6.1

%

2.5% coupon

571,513

499,128

5.4

%

583,629

485,088

5.5

%

4.0% coupon

331,722

321,575

3.5

%

340,558

315,611

3.6

%

4.5% coupon

1,354,851

1,337,957

14.4

%

1,387,896

1,317,480

14.9

%

5.0% coupon

2,062,913

2,074,274

22.2

%

1,996,271

1,941,874

21.9

%

5.5% coupon

1,950,064

1,987,567

21.3

%

1,073,941

1,066,340

12.0

%

6.0% coupon

315,455

325,422

3.5

%

288,922

292,118

3.3

%

TBA 4.0%

462,000

443,447

4.8

%

262,000

240,303

2.7

%

TBA 4.5%

183,000

179,819

1.9

%

183,000

172,821

2.0

%

TBA 5.0% (2)

767,000

766,161

8.2

%

868,000

840,408

9.5

%

TBA 5.5% (2)

592,000

598,752

6.4

%

1,389,000

1,371,677

15.5

%

TBA 6.0%

—

—

—

%

37,000

37,142

0.4

%

Total Agency RMBS

$

9,258,934

$

9,093,269

97.6

%

$

9,092,839

$

8,624,768

97.4

%

Agency CMBS

$

100,957

$

98,026

1.1

%

$

102,299

$

97,482

1.1

%

Agency CMBS IO

(1

)

111,774

1.2

%

(1

)

116,853

1.3

%

Non-Agency CMBS IO

(1

)

12,754

0.1

%

(1

)

16,386

0.2

%

Total

$

9,359,891

$

9,315,823

100.0

%

$

9,195,138

$

8,855,489

100.0

%

(1)

CMBS IO do not have underlying par

values.

(2)

Amounts shown for TBA 5.0% and TBA 5.5%

coupons as of June 30, 2024 have been updated from the numbers

reported last quarter.

The following table provides detail on the Company's repurchase

agreement borrowings outstanding as of the dates indicated:

September 30, 2024

June 30, 2024

Remaining Term to Maturity

Balance

Weighted

Average Rate

WAVG Original Term to

Maturity

Balance

Weighted

Average Rate

WAVG Original Term to

Maturity

($s in thousands)

Less than 30 days

$

4,403,523

5.39

%

59

$

2,350,410

5.46

%

99

30 to 90 days

2,020,367

5.40

%

89

3,015,537

5.47

%

89

91 to 180 days

—

—

%

—

128,481

5.43

%

113

Total

$

6,423,890

5.40

%

68

$

5,494,428

5.46

%

94

The following table provides information about the performance

of the Company's MBS (including TBA securities) and repurchase

agreement financing for the third quarter of 2024 compared to the

prior quarter:

Three Months Ended

September 30, 2024

June 30, 2024

($s in thousands)

Interest Income/Ex

pense

Average Balance (1)(2)

Effective Yield/

Financing Cost(3)(4)

Interest Income/Ex

pense

Average Balance (1)(2)

Effective Yield/

Financing Cost(3)(4)

Agency RMBS

$

75,083

$

6,627,198

4.53

%

$

67,927

$

6,153,663

4.42

%

Agency CMBS

770

101,771

2.96

%

792

105,321

2.97

%

CMBS IO(5)

2,902

133,172

8.20

%

2,868

146,161

7.25

%

Non-Agency MBS and other

17

1,298

5.05

%

19

1,437

5.00

%

78,772

6,863,439

4.58

%

71,606

6,406,582

4.46

%

Cash equivalents

4,686

4,448

Total interest income

$

83,458

$

76,054

Repurchase agreement financing (6)

(82,564

)

5,943,805

(5.44

)%

(74,767

)

5,410,282

(5.47

)%

Net interest income/net interest

spread

$

894

(0.86

)%

$

1,287

(1.01

)%

(1)

Average balance for assets is calculated

as a simple average of the daily amortized cost and excludes

securities pending settlement if applicable.

(2)

Average balance for liabilities is

calculated as a simple average of the daily borrowings outstanding

during the period.

(3)

Effective yield is calculated by dividing

interest income by the average balance of asset type outstanding

during the reporting period. Unscheduled adjustments to

premium/discount amortization/accretion, such as for prepayment

compensation, are not annualized in this calculation.

(4)

Financing cost is calculated by dividing

annualized interest expense by the total average balance of

borrowings outstanding during the period with an assumption of 360

days in a year.

(5)

CMBS IO ("Interest only") includes Agency

and non-Agency issued securities.

(6)

Amounts exclude net periodic interest

benefit from effective interest rate swaps of $4,162 and $17 for

the three months ended September 30, 2024 and June 30, 2024,

respectively, or 0.28% and 0%, respectively, as a percentage of

repurchase agreement borrowings outstanding during the respective

periods.

Hedging Portfolio

The Company uses derivative instruments to hedge exposure to

interest rate risk arising from its investment and financing

portfolio. As of September 30, 2024, the Company held short

positions in 10-year U.S. Treasury futures with a notional amount

of $3.9 billion, short positions in 30-year U.S. Treasury futures

with a notional amount of $505.0 million, and short positions in

5-year and 7-year interest rate swaps with a notional amount of

$1.5 billion.

For the Company, realized gains and losses on interest rate

hedges are recognized in GAAP net income in the same reporting

period in which the derivative instrument matures, is terminated or

periodically settled (excluding daily margin requirements) by the

Company. Maturities and terminations are not included in the

Company's earnings available for distribution ("EAD"), a non-GAAP

measure, during any reporting period, but the periodic interest

settlement on interest rate swaps is included in EAD. As of

September 30, 2024, all of the Company's interest rate swaps and

all of its 10-year U.S. Treasury futures were designated as hedges

for tax purposes. The realized gains and losses on derivative

instruments designated as hedges for tax purposes, other than

periodic interest rate swap settlements, are amortized into the

Company's REIT taxable income over the original periods hedged by

those derivatives. The benefit expected to be recognized in taxable

income is estimated to be $26.7 million, or $0.35 per average

common share outstanding, for the third quarter of 2024. The

Company's remaining estimated net deferred tax hedge gains from its

interest rate hedging portfolio was $625.4 million as of September

30, 2024. These hedge gains will be part of the Company's future

distribution requirements along with net interest income and other

ordinary gains and losses in future periods.

For the third quarter of 2024, the Company's net periodic

interest benefit from interest rate swaps was $4.2 million, which

is recorded in (loss) gain on derivative instruments, net on the

consolidated comprehensive statement of income. Net periodic

interest benefit from interest rate swap settlements is included in

the Company's taxable income and EAD while changes in the fair

value of remaining interest rate swap cashflows are excluded from

EAD.

The table below provides the projected amortization of the

Company's net deferred tax hedge gains that may be recognized as

taxable income over the periods indicated given conditions known as

of September 30, 2024; however, uncertainty inherent in the forward

interest rate curve makes future realized gains and losses

difficult to estimate, and as such, these projections are subject

to change for any given period.

Projected Period of Recognition for

Remaining Hedge Gains, Net

September 30, 2024

($ in thousands)

Fourth quarter 2024

$

21,981

Fiscal year 2025

88,583

Fiscal year 2026 and thereafter

514,845

$

625,409

Non-GAAP Financial

Measures

In evaluating the Company’s financial and operating performance,

management considers book value per common share, total economic

return to common shareholders, and other operating results

presented in accordance with GAAP as well as EAD to common

shareholders (including per common share), a non-GAAP measure.

Management believes this non-GAAP financial measure is useful to

investors because it is viewed by management as a measure of the

investment portfolio’s return based on the effective yield of its

investments, net of financing costs and other normal recurring

operating income and expenses. Drop income generated by TBA dollar

roll positions, which is included in "gain (loss) on derivatives

instruments, net" on the Company's consolidated statements of

comprehensive income, is included in EAD because management views

drop income as the economic equivalent of net interest income

(interest income less implied financing cost) on the underlying

Agency security from trade date to settlement date. Management also

includes the net periodic interest benefit from its interest rate

swaps, which is also included in "gain (loss) on derivatives

instruments, net", in EAD because interest rate swaps are used by

the Company to economically hedge the impact of changing interest

rates on its borrowing costs from repurchase agreements, and

including net periodic interest benefit from interest rate swaps is

a helpful indicator of the Company’s total financing cost in

addition to GAAP interest expense. However, non-GAAP financial

measures are not a substitute for GAAP earnings and may not be

comparable to similarly titled measures of other REITs because they

may not be calculated in the same manner. Furthermore, though EAD

is one of several factors management considers in determining the

appropriate level of distributions to common shareholders, it

should not be utilized in isolation, and it is not an accurate

indication of the Company’s REIT taxable income nor its

distribution requirements in accordance with the Internal Revenue

Code of 1986, as amended.

The following table provides reconciliations of EAD to

comparable GAAP financial measures for the periods indicated:

Three Months Ended

($s in thousands except per share

data)

September 30, 2024

June 30, 2024

Comprehensive income (loss) to common

shareholders

$

70,741

$

(12,013

)

Less:

Change in fair value of investments, net

(1)

(234,541

)

45,269

Change in fair value of derivative

instruments, net (2)

156,572

(41,351

)

EAD to common shareholders

$

(7,228

)

$

(8,095

)

Weighted average common shares

75,792,527

66,954,870

EAD per common share

$

(0.10

)

$

(0.12

)

Net interest income

$

894

$

1,287

Net periodic interest benefit from

interest rate swaps

4,162

17

TBA drop loss (3)

(1,654

)

(233

)

Operating expenses

(8,707

)

(7,243

)

Preferred stock dividends

(1,923

)

(1,923

)

EAD to common shareholders

$

(7,228

)

$

(8,095

)

(1)

Amount includes realized and unrealized

gains and losses from the Company's MBS.

(2)

Amount includes unrealized gains and

losses from changes in fair value of derivatives (including TBAs

accounted for as derivative instruments) and realized gains and

losses on terminated derivatives and excludes TBA drop income and

net periodic interest benefit from interest rate swaps.

(3)

TBA drop income/loss is calculated by

multiplying the notional amount of the TBA dollar roll positions by

the difference in price between two TBA securities with the same

terms but different settlement dates.

Forward Looking

Statements

This release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “believe,” “expect,” “forecast,” “anticipate,”

“estimate,” “project,” “plan,” "may," "could," "will," "continue"

and similar expressions identify forward-looking statements that

are inherently subject to risks and uncertainties, some of which

cannot be predicted or quantified. Forward-looking statements in

this release, including statements made in Mr. Boston's and Ms.

Popenoe's quotes, may include, without limitation, statements

regarding the Company's financial performance in future periods,

future interest rates, future market credit spreads, management's

views on expected characteristics of future investment and

macroeconomic environments, central bank strategies, prepayment

rates and investment risks, future investment strategies, future

leverage levels and financing strategies, the use of specific

financing and hedging instruments and the future impacts of these

strategies, future actions by the Federal Reserve, and the expected

performance of the Company's investments. The Company's actual

results and timing of certain events could differ materially from

those projected in or contemplated by the forward-looking

statements as a result of unforeseen external factors. These

factors may include, but are not limited to, ability to find

suitable investment opportunities; changes in domestic economic

conditions; geopolitical events, such as terrorism, war or other

military conflict, including the wars between Russia and Ukraine

and between Israel and Hamas and the related impacts on

macroeconomic conditions as a result of such conflicts; changes in

interest rates and credit spreads, including the repricing of

interest-earning assets and interest-bearing liabilities; the

Company’s investment portfolio performance, particularly as it

relates to cash flow, prepayment rates and credit performance; the

impact on markets and asset prices from changes in the Federal

Reserve’s policies regarding purchases of Agency RMBS, Agency CMBS,

and U.S. Treasuries; actual or anticipated changes in Federal

Reserve monetary policy or the monetary policy of other central

banks; adverse reactions in U.S. financial markets related to

actions of foreign central banks or the economic performance of

foreign economies including in particular China, Japan, the

European Union, and the United Kingdom; uncertainty concerning the

long-term fiscal health and stability of the United States; the

cost and availability of financing, including the future

availability of financing due to changes to regulation of, and

capital requirements imposed upon, financial institutions; the cost

and availability of new equity capital; changes in the Company’s

use of leverage; changes to the Company’s investment strategy,

operating policies, dividend policy or asset allocations; the

quality of performance of third-party servicer providers, including

the Company's sole third-party service provider for our critical

operations and trade functions; the loss or unavailability of the

Company’s third-party service provider’s service and technology

that supports critical functions of the Company’s business related

to the Company’s trading and borrowing activities due to outages,

interruptions, or other failures; the level of defaults by

borrowers on loans underlying MBS; changes in the Company’s

industry; increased competition; changes in government regulations

affecting the Company’s business; changes or volatility in the

repurchase agreement financing markets and other credit markets;

changes to the market for interest rate swaps and other derivative

instruments, including changes to margin requirements on derivative

instruments; uncertainty regarding continued government support of

the U.S. financial system and U.S. housing and real estate markets,

or to reform the U.S. housing finance system including the

resolution of the conservatorship of Fannie Mae and Freddie Mac;

the composition of the Board of Governors of the Federal Reserve;

the political environment in the U.S.; systems failures or

cybersecurity incidents; and exposure to current and future claims

and litigation. For additional information on risk factors that

could affect the Company's forward-looking statements, see the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, and other reports filed with and furnished to the

Securities and Exchange Commission.

All forward-looking statements are qualified in their entirety

by these and other cautionary statements that the Company makes

from time to time in its filings with the Securities and Exchange

Commission and other public communications. The Company cannot

assure the reader that it will realize the results or developments

the Company anticipates or, even if substantially realized, that

they will result in the consequences or affect the Company or its

operations in the way the Company expects. Forward-looking

statements speak only as of the date made. The Company undertakes

no obligation to update or revise any forward-looking statements to

reflect events or circumstances arising after the date on which

they were made, except as otherwise required by law. As a result of

these risks and uncertainties, readers are cautioned not to place

undue reliance on any forward-looking statements included herein or

that may be made elsewhere from time to time by, or on behalf of,

the Company.

Company Description

Dynex Capital, Inc. is a financial services company committed to

ethical stewardship of stakeholders' capital, employing

comprehensive risk management and disciplined capital allocation to

generate dividend income and long-term total returns through the

diversified financing of real estate assets in the United States.

Dynex operates as a REIT and is internally managed to maximize

stakeholder alignment. Additional information about Dynex Capital,

Inc. is available at www.dynexcapital.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021607799/en/

Alison Griffin (804) 217-5897

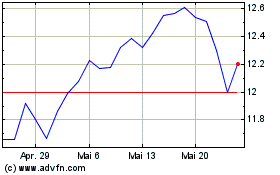

Dynex Capital (NYSE:DX)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Dynex Capital (NYSE:DX)

Historical Stock Chart

Von Jan 2024 bis Jan 2025