UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16. UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2024

Commission File Number 001-40695

Dole plc

(Translation of registrant's name into English)

29 North Anne Street

Dublin 7

Ireland

D07 PH36

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ◻ Form 40-F

Entry into a Material Definitive Agreement

On February 27, 2024, Dole plc (“Dole” or the “Company”) and Progressive Produce LLC (“Progressive Produce”), a subsidiary of Dole plc, entered into a definitive agreement with PTF Holdings, LLC (“PTF Holdings”), a Delaware limited liability company and portfolio company of Arable Capital Partners, LLC (“Arable”), pursuant to which Dole has agreed to sell its 65.0% equity stake in Progressive Produce to PTF Holdings for approximately $120.2 million in cash, subject to the satisfaction of customary closing conditions.

On February 27, 2024, the Company issued a press release in connection with the definitive agreement. A copy of the press release is attached as Exhibit 99.1 to this Report on Form 6-K and incorporated herein by reference.

Forward-Looking Statements

Certain statements made in this disclosure that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on management’s beliefs, assumptions and expectations of the Company’s future economic performance, considering the information currently available to management. These statements are not statements of historical fact. The words “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “estimate,” “expect,” “intend,” “objective,” “seek,” “strive,” “target” or similar words, or the negative of these words, identify forward-looking statements. The inclusion of this forward-looking information should not be regarded as a representation by the Company or any other person that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity. Accordingly, there are, or will be, important factors that could cause the Company’s actual results to differ materially from those indicated in these statements. Factors that could cause or contribute to such differences include (i) the parties’ inability to close the definitive agreement in a timely manner or at all due to the failure to satisfy conditions to the closing, (ii) uncertainties as to the timing of the closing, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement, (iv) the outcome of any legal proceedings related to the transaction, (v) the ability of the Company to execute on its strategy and achieve its goals and other expectations after the closing, (vi) legislative, regulatory and economic developments and (vii) those other matters disclosed in the Company’s filings with the U.S. Securities and Exchange Commission. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from what the Company may have expressed or implied by these forward-looking statements. The Company cautions that you should not place undue reliance on any of the Company’s forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and the Company does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made except as required by the federal securities laws.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

DOLE PLC

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| Date: | February 28, 2024 | | DOLE PLC |

| | | (Registrant) |

| | | |

| | | By: /s/ Jacinta Devine |

| | | Name: Jacinta Devine |

| | | Title: Chief Financial Officer |

| | | |

Exhibit 99.1

Dole plc Announces Sale of Progressive Produce to Arable Capital

Dublin – February 27, 2024

Dole plc (NYSE: DOLE) (“Dole” or the “Group”) has today announced that it has reached an agreement to sell its 65% equity stake in Progressive Produce LLC (“Progressive Produce” or the “Company”) to PTF Holdings, LLC (“PTF Holdings”), the parent company of Pacific Trellis Fruit, LLC (“Pacific Trellis Fruit”). PTF Holdings is a portfolio company of Arable Capital Partners, LLC (“Arable”). Dole will receive gross cash proceeds of $120.25 million from this sale.

Progressive Produce, located in Los Angeles, California, is a grower, packer and distributor of conventional and organic produce to the retail, wholesale and foodservice sectors in the U.S. and Canada. Founded in 1967, today the Company is one of California’s premier produce companies with annual sales in excess of $400 million.

Progressive Produce is a subsidiary of Dole plc and is part of the Diversified Fresh Produce – Americas and Rest of World reporting segment.

Post the completion of this transaction, the existing management team of Progressive Produce will remain with the enlarged business of Progressive Produce and Pacific Trellis Fruit and retain an ownership stake.

The transaction is expected to close in March 2024, subject to the satisfaction of customary closing conditions. Net proceeds from the sale received by Dole are currently expected to be used primarily for debt reduction.

Commenting on the transaction, Carl McCann, Executive Chairman of Dole plc said:

“We are pleased to announce the sale of our equity interest in Progressive Produce to Arable Capital Partners. Since our initial investment in 2016, the business has been a strong performer within our Group.

We would like to thank the current and former management teams for their dedication, passion, and significant contributions to the growth of this business over the time that we have been partners. We wish the executive team and their new majority owners continued success for the future.

The proceeds from this sale will further strengthen our financial position and enhance the Group’s focus on, and investments in, our core activities.”

Commenting further on the transaction, Derek Yurosek, Managing Director of Arable Capital Partners said:

“Arable is thrilled about the opportunity to partner with Progressive Produce. The Company is a leader in top produce categories and has an impressive and diversified customer base, as well as an exceptional team. We look forward to helping Progressive Produce continue to deliver outstanding products and service to its retail, wholesale, and foodservice customers.

While Progressive Produce and Pacific Trellis Fruit will continue to operate independently, we are excited about the chance for them to work together to continue to grow their businesses and ultimately bring even greater value to their grower partners and customers. This is a fantastic outcome for everyone involved.”

Progressive Produce was advised by Montminy & Co. as financial advisor and Greenberg Traurig, LLP as legal advisor. PTF Holdings and Arable were advised by K&L Gates, LLP as legal advisor.

About Dole plc:

A global leader in fresh produce, Dole plc grows, markets, and distributes an extensive variety of fresh produce sourced locally and from around the world. Dedicated and passionate in exceeding our customers’ requirements in over 75 countries, our goal is to make the world a healthier and a more sustainable place. For more information visit our website at www.doleplc.com.

About Arable Capital Partners:

Arable Capital Partners is a leader in sustainable food and agribusiness investing and partners with businesses and owners across the food value chain. Arable currently has five platform investments, including Pacific Trellis Fruit, organicgirl, Royal Ridge Fruits, Blazer Wilkinson Gee and Laurel Ag & Water. For more information about Arable visit its website at www.arablecp.com.

Forward-Looking Statements

Certain statements made in this press release that are not historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on management’s beliefs, assumptions, and expectations of Dole’s future economic performance, considering the information currently available to management. These statements are not statements of historical fact. The words “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “estimate,” “expect,” “intend,” “objective,” “seek,” “strive,” “target” or similar words, or the negative of these words, identify forward-looking statements. The inclusion of this forward-looking information should not be regarded as a representation by Dole or any other person that the future plans, estimates, or expectations contemplated by Dole will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to Dole’s operations, financial results, financial condition, business prospects, growth strategy and liquidity. Accordingly, there are, or will be, important factors that could cause Dole’s actual results to differ materially from those indicated in these statements. Factors that could cause or contribute to such differences include (i) the parties’ inability to close the definitive agreement in a timely manner or at all due to the failure to satisfy conditions to the closing, (ii) uncertainties as to the timing of the closing, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement, (iv) the outcome of any legal proceedings related to the transaction, (v) the ability of Dole to execute on its strategy and achieve its goals and other expectations after the closing, (vi) legislative, regulatory and economic developments and (vii) those other matters disclosed in Dole’s filings with the U.S. Securities and Exchange Commission. If one or more of these or other risks or uncertainties materialize, or if Dole’s underlying assumptions prove to be incorrect, Dole’s actual results may vary materially from what Dole may have expressed or implied by these forward-looking statements. Dole cautions that you should not place undue reliance on any of Dole’s forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and Dole does not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made except as required by the federal securities laws.

Investor Contact Dole plc:

James O’Regan, Head of Investor Relations

investors@doleplc.com

+353 1 887 2794

Media Contact Dole plc:

Brian Bell, Ogilvy

brian.bell@ogilvy.com

+353 87 2436 130

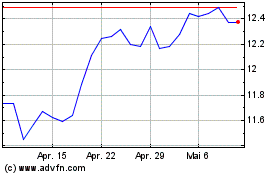

Dole (NYSE:DOLE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

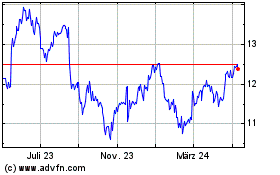

Dole (NYSE:DOLE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024