false000179920800017992082024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (date of earliest event reported): |

February 15, 2024

Dun & Bradstreet Holdings, Inc.

(Exact name of registrant as specified in its charter)

Commission file number 1-39361

| | | | | |

| Delaware | 83-2008699 |

(State of

incorporation) | (I.R.S. Employer

Identification No.) |

| |

5335 Gate Parkway

Jacksonville, FL 32256

(Address of principal executive offices)

(904) 648-8006

Registrant’s telephone number, including area code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

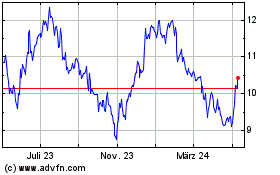

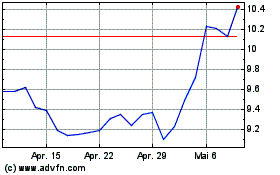

| Common Stock, $0.0001 par value | DNB | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 15, 2024, Dun & Bradstreet Holdings, Inc. (“Dun & Bradstreet” or the “Company”) issued a press release announcing its financial results for the fourth quarter and full year of 2023. A copy of the press release is attached and furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure

On February 15, 2024, Dun & Bradstreet posted an investor presentation regarding the fourth quarter and full year 2023 financial results to its website www.dnb.com. The presentation materials are attached hereto as Exhibit 99.2 and incorporated herein by reference. These materials may also be used by the Company at one or more subsequent conferences with analysts, investors, or other stakeholders.

The information contained in the attached presentation materials is summary information that is intended to be considered in the context of the Company’s Securities and Exchange Commission filings and other public announcements. The Company undertakes no duty or obligation to publicly update or revise this information, although it may do so from time to time.

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

| | | | | |

| Exhibit 99.1 | |

| |

| Exhibit 99.2 |

|

| |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | DUN & BRADSTREET HOLDINGS, INC. |

| | | |

| | By: | /s/ BRYAN T. HIPSHER |

| | | Bryan T. Hipsher |

| | | | Chief Financial Officer |

| Date: | February 15, 2024 | | (Principal Financial Officer) |

DUN & BRADSTREET REPORTS FOURTH QUARTER AND FULL YEAR 2023 FINANCIAL RESULTS

JACKSONVILLE, Fla. - February 15, 2024: Dun & Bradstreet Holdings, Inc. (NYSE: DNB), a leading global provider of business decisioning data and analytics, today announced unaudited financial results for the fourth quarter and year ended December 31, 2023. A reconciliation of U.S. generally accepted accounting principles (“GAAP”) to non-GAAP financial measures has been provided in this press release, including the accompanying tables. An explanation of these measures is also included below under the heading “Use of Non-GAAP Financial Measures.”

•Revenue for the fourth quarter of 2023 was $630.4 million, an increase of 6.0% and 5.1% on a constant currency basis compared to the fourth quarter of 2022.

•GAAP net income for the fourth quarter of 2023 was $1.7 million, or diluted earnings per share of less than $0.01, compared to net income of $22.8 million, or diluted earnings per share of $0.05 for the prior year quarter. Adjusted net income was $139.8 million, or adjusted diluted earnings per share of $0.32, compared to adjusted net income of $131.0 million, or adjusted diluted earnings per share of $0.30 for the prior year quarter.

•Adjusted EBITDA for the fourth quarter of 2023 was $260.6 million, an increase of 4.0% compared to the prior year quarter. Adjusted EBITDA margin for the fourth quarter of 2023 was 41.3%.

“We closed 2023 on a high note, delivering organic revenue growth of 5.1% during the fourth quarter with balanced performance across both our North America and International business segments. We engaged our customers with urgency, delivered our data and analytics with precision, and created new and innovative solutions to satisfy prospects growing needs. Companies throughout the world continue to lean on our breadth of solutions and we see robust demand for master data management and third party and supply chain risk solutions,” said Anthony Jabbour, Dun & Bradstreet Chief Executive Officer. “Overall, our strong financial and operating performance in 2023 was another proof point in our ongoing journey to transform and maximize the value of Dun & Bradstreet. With full year organic revenue growth at 4.3%, adjusted EBITDA of $892 million, and adjusted net earnings of $432 million, we continued to accelerate growth while maintaining excellent margins and improving our balance sheet. We are well-positioned to capture the significant growth opportunities in front of us and we expect to continue to accelerate revenue growth in 2024 despite a challenging macro environment. With improving profitability and cash flows, we expect to continue to deleverage the balance sheet and focus capital allocation strategies on driving increased shareholder returns.”

•Revenue for the year ended December 31, 2023 was $2,314.0 million, an increase of 4.0% and 4.2% on a constant currency basis compared to the year ended December 31, 2022.

•Organic revenue increased 4.3% on a constant currency basis compared to the year ended December 31, 2022.

•GAAP net loss for the year ended December 31, 2023 was $47.0 million, or loss per share of $0.11, compared to net loss of $2.3 million, or loss per share of $0.01 for the prior year. Adjusted net income was $431.6 million, or adjusted diluted earnings per share of $1.00, compared to adjusted net income of $439.6 million, or adjusted diluted earnings per share of $1.02 for the prior year.

•Adjusted EBITDA for the year ended December 31, 2023 was $892.2 million, an increase of 3.3% compared to the year ended December 31, 2022. Adjusted EBITDA margin for the year ended December 31, 2023 was 38.6%.

Segment Results

North America

For the fourth quarter of 2023, North America revenue was $456.8 million, an increase of $21.9 million or 5.0% compared to the fourth quarter of 2022.

•Finance and Risk revenue for the fourth quarter of 2023 was $241.4 million, an increase of $10.3 million or 4.4% compared to the fourth quarter of 2022.

•Sales and Marketing revenue for the fourth quarter of 2023 was $215.4 million, an increase of $11.6 million or 5.7% compared to the fourth quarter of 2022.

North America adjusted EBITDA for the fourth quarter of 2023 was $223.7 million, an increase of 4.1%, with adjusted EBITDA margin of 49.0%.

For the year ended December 31, 2023, North America revenue was $1,644.5 million, an increase of $57.4 million or 3.6% and 3.7% on a constant currency basis compared to the year ended December 31, 2022.

•Finance and Risk revenue for the year ended December 31, 2023 was $888.1 million, an increase of $21.2 million or 2.4% and 2.5% on a constant currency basis compared to the year ended December 31, 2022. This included a $7.5 million negative impact from the expiration of the GSA contract in April of 2022.

•Sales and Marketing revenue for the year ended December 31, 2023 was $756.4 million, an increase of $36.2 million or 5.0% and 5.1% on a constant currency basis compared to the year ended December 31, 2022.

North America adjusted EBITDA for the year ended December 31, 2023 was $743.3 million, an increase of 3.5%, with adjusted EBITDA margin of 45.2%.

International

International revenue for the fourth quarter of 2023 was $173.6 million, an increase of $13.5 million or 8.4% and 5.3% on a constant currency basis compared to the fourth quarter of 2022.

•Finance and Risk revenue for the fourth quarter of 2023 was $116.4 million, an increase of $10.4 million or 9.8% and 6.7% on a constant currency basis compared to the fourth quarter of 2022.

•Sales and Marketing revenue for the fourth quarter of 2023 was $57.2 million, an increase of $3.1 million or 5.8% and 2.6% on a constant currency basis compared to the fourth quarter of 2022.

International adjusted EBITDA for the fourth quarter of 2023 was $55.2 million, an increase of 12.6%, with adjusted EBITDA margin of 31.8%.

International revenue for the year ended December 31, 2023 was $669.5 million, an increase of $32.0 million or 5.0% and 5.5% on a constant currency basis compared to the year ended December 31, 2022. Excluding the negative impact of foreign exchange of $1.6 million and the impact of the divestiture of the B2C business in Germany, organic revenue on a constant currency basis increased 5.8%.

•Finance and Risk revenue for the year ended December 31, 2023 was $448.6 million, an increase of $29.5 million or 7.0% and 7.2% on a constant currency basis compared to the year ended December 31, 2022.

•Sales and Marketing revenue for the year ended December 31, 2023 was $220.9 million, an increase of $2.5 million or 1.1% and 2.1% on a constant currency basis compared to the year ended December 31, 2022. Excluding the negative impact of the divestiture in 2022, Sales and Marketing organic revenue increased 3.0%.

International adjusted EBITDA for the year ended December 31, 2023 was $215.4 million, an increase of 6.5%, with adjusted EBITDA margin of 32.2%.

Balance Sheet

As of December 31, 2023, we had cash and cash equivalents of $188.1 million and total principal amount of debt of $3,588.6 million. We had $825.0 million available on our $850 million revolving credit facility as of December 31, 2023.

Business Outlook

•Revenues after the impact of foreign exchange are expected to be in the range of $2,400 million to $2,440 million, or ∼3.7% to 5.4%.

•Organic revenue growth is expected to be in the range of 4.1% to 5.1%.

•Adjusted EBITDA is expected to be in the range of $930 million to $950 million.

•Adjusted EPS is expected to be in the range of $1.00 to $1.04.

The foregoing forward-looking statements reflect Dun & Bradstreet’s expectations as of today's date and Revenue assumes constant foreign currency rates. Dun & Bradstreet does not present a qualitative reconciliation of its forward-looking non-GAAP financial measures to the most directly comparable GAAP measure due to the inherent difficulty, without unreasonable efforts, in forecasting and quantifying with reasonable accuracy significant items required for this reconciliation. Given the number of risk factors, uncertainties and assumptions discussed below, actual results may differ materially. Dun & Bradstreet does not intend to update its forward-looking statements until its next quarterly results announcement, other than in publicly available statements.

Earnings Conference Call and Audio Webcast

Dun & Bradstreet will host a conference call to discuss the fourth quarter and full year 2023 financial results on February 15, 2024 at 8:30am ET. The conference call can be accessed live over the phone by dialing 1-877-407-9716 (USA), or 1-201-493-6779 (International). The conference call replay will be available from 11:30am ET on February 15, 2024, through February 29, 2024, by dialing 1-844-512-2921 (USA) or 1-412-317-6671 (International). The replay passcode will be 13743901.

The call will also be webcast live from Dun & Bradstreet’s investor relations website at https://investor.dnb.com. Following the completion of the call, a recorded replay of the webcast will be available on the website.

About Dun & Bradstreet

Dun & Bradstreet, a leading global provider of business decisioning data and analytics, enables companies around the world to improve their business performance. Dun & Bradstreet’s Data Cloud fuels solutions and delivers insights that empower customers to accelerate revenue, lower cost, mitigate risk, and transform their businesses. Since 1841, companies of every size have relied on Dun & Bradstreet to help them manage risk and reveal opportunity. For more information on Dun & Bradstreet, please visit www.dnb.com.

Use of Non-GAAP Financial Measures

In addition to reporting GAAP results, we evaluate performance and report our results on the non-GAAP financial measures discussed below. We believe that the presentation of these non-GAAP measures provides useful information to investors and rating agencies regarding our results, operating trends and performance between periods. These non-GAAP financial measures include organic revenue, adjusted earnings before interest, taxes, depreciation and amortization (‘‘adjusted EBITDA’’), adjusted EBITDA margin, adjusted net income and adjusted net earnings per diluted share. Adjusted results are non-GAAP measures that adjust for the impact due to certain acquisition and divestiture related revenue and expenses, such as costs for banker fees, legal fees, due diligence, retention payments and contingent consideration adjustments, restructuring charges, equity-based compensation, and other non-core gains and charges that are not in the normal course of our business, such as costs associated with early debt redemptions, gains and losses on sales of businesses, impairment charges, the effect of significant changes in tax laws and material tax and legal settlements. We exclude amortization of recognized intangible assets resulting from the application of purchase accounting because it is non-cash and not indicative of our ongoing and underlying operating performance. Intangible assets are recognized as a result of historical merger and acquisition transactions. We believe that recognized intangible assets by their nature are fundamentally different from other depreciating assets that are replaced on a predictable operating cycle. Unlike other depreciating assets, such as developed and purchased software licenses or property and equipment, there is no replacement cost once these recognized intangible assets expire and the assets are not replaced. Additionally, our costs to operate, maintain and extend the life of acquired intangible assets and purchased intellectual property are reflected in our operating costs as personnel, data fees, facilities, overhead and similar items. Management believes it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation. Amortization of recognized intangible assets will recur in future periods until such assets have been fully amortized. In addition, we isolate the effects of changes in foreign exchange rates on our revenue growth because we believe it is useful for investors to be able to compare revenue from one period to another, both after and before the effects of foreign exchange rate changes. The change in revenue performance attributable to foreign currency rates is determined by converting both our prior and current periods’ foreign currency revenue by a constant rate. As a result, we monitor our revenue growth both after and before the effects of foreign exchange rate changes. We believe that these supplemental non-GAAP financial measures provide management and other users with additional meaningful financial information that should be considered when assessing our ongoing performance and comparability of our operating results from period to period. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the factors management uses in planning for and forecasting future periods. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to our reported results prepared in accordance with GAAP.

Our non-GAAP or adjusted financial measures reflect adjustments based on the following items, as well as the related income tax.

Organic Revenue

We define organic revenue as reported revenue before the effect of foreign exchange excluding revenue from acquired businesses, if applicable, for the first twelve months. In addition, organic revenue excludes current and prior year revenue associated with divested businesses, if applicable. We believe the organic measure provides investors and analysts with useful supplemental information regarding the Company’s underlying revenue trends by excluding the impact of acquisitions and divestitures. Revenue from divested businesses is related to the business-to-consumer business in Germany that was sold during the second quarter of 2022.

Adjusted EBITDA and Adjusted EBITDA Margin

We define adjusted EBITDA as net income (loss) attributable to Dun & Bradstreet Holdings, Inc. excluding the following items:

•depreciation and amortization;

•interest expense and income;

•income tax benefit or provision;

•other non-operating expenses or income;

•equity in net income of affiliates;

•net income attributable to non-controlling interests;

•equity-based compensation;

•restructuring charges;

•merger, acquisition and divestiture-related operating costs;

•transition costs primarily consisting of non-recurring expenses associated with transformational and integration activities, as well as incentive expenses associated with our synergy program; and

•other adjustments primarily related to non-cash charges and gains, including impairment charges and adjustments as the result of the application of purchase accounting mainly in 2022 related to the deferred commission cost amortization. In addition, other adjustments also include non-recurring charges such as legal expense associated with significant legal and regulatory matters.

We calculate adjusted EBITDA margin by dividing adjusted EBITDA by revenue.

Adjusted Net Income

We define adjusted net income as net income (loss) attributable to Dun & Bradstreet Holdings, Inc. adjusted for the following items:

•incremental amortization resulting from the application of purchase accounting. We exclude amortization of recognized intangible assets resulting from the application of purchase accounting because it is non-cash and is not indicative of our ongoing and underlying operating performance. The Company believes that recognized intangible assets by their nature are fundamentally different from other depreciating assets that are replaced on a predictable operating cycle. Unlike other depreciating assets, such as developed and purchased software licenses or property and equipment, there is no replacement cost once these recognized intangible assets expire and the assets are not replaced. Additionally, the Company’s costs to operate, maintain and extend the life of acquired intangible assets and purchased intellectual property are reflected in the Company’s operating costs as personnel, data fees, facilities, overhead and similar items;

•equity-based compensation;

•restructuring charges;

•merger, acquisition and divestiture-related operating costs;

•transition costs primarily consisting of non-recurring expenses associated with transformational and integration activities, as well as incentive expenses associated with our synergy program;

•merger, acquisition and divestiture-related non-operating costs;

•debt refinancing and extinguishment costs;

•non-operating pension-related income (expenses) includes certain costs and income associated with our pension and postretirement plans, consisting of interest cost, expected return on plan assets and amortized actuarial gains or losses, prior service credits and if applicable, plan settlement charges. These adjustments

are non-cash and market-driven, primarily due to the changes in the value of pension plan assets and liabilities which are tied to financial market performance and conditions;

•non-cash gain and loss resulting from the modification of our interest rate swaps;

•other adjustments primarily related to non-cash charges and gains, including impairment charges and adjustments as the result of the application of purchase accounting, mainly in 2022 related to the deferred commission cost amortization. In addition, other adjustments also include non-recurring charges such as legal expense associated with significant legal and regulatory matters;

•tax effect of the non-GAAP adjustments; and

•other tax effect adjustments related to the tax impact of statutory tax rate changes on deferred taxes and other discrete items.

Adjusted Net Earnings Per Diluted Share

We calculate adjusted net earnings per diluted share by dividing adjusted net income (loss) by the weighted average number of common shares outstanding for the period plus the dilutive effect of common shares potentially issuable in connection with awards outstanding under our stock incentive plan.

Forward-Looking Statements

The statements contained in this release that are not purely historical are forward-looking statements, including statements regarding expectations, hopes, intentions or strategies regarding the future. Forward-looking statements are based on Dun & Bradstreet’s management’s beliefs, as well as assumptions made by, and information currently available to, them. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook for our future business and financial performance. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. It is not possible to predict or identify all risk factors. Consequently, the risks and uncertainties listed below should not be considered a complete discussion of all of our potential trends, risks and uncertainties. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The risks and uncertainties that forward-looking statements are subject to include, but are not limited to: (i) our ability to implement and execute our strategic plans to transform the business; (ii) our ability to develop or sell solutions in a timely manner or maintain client relationships; (iii) competition for our solutions; (iv) harm to our brand and reputation; (v) unfavorable global economic conditions including, but not limited to, volatility in interest rates, foreign currency markets, inflation, and supply chain disruptions; (vi) risks associated with operating and expanding internationally; (vii) failure to prevent cybersecurity incidents or the perception that confidential information is not secure; (viii) failure in the integrity of our data or systems; (ix) system failures and personnel disruptions, which could delay the delivery of our solutions to our clients; (x) loss of access to data sources or ability to transfer data across the data sources in markets where we operate; (xi) failure of our software vendors and network and cloud providers to perform as expected or if our relationship is terminated; (xii) loss or diminution of one or more of our key clients, business partners or government contracts; (xiii) dependence on strategic alliances, joint ventures and acquisitions to grow our business; (xiv) our ability to protect our intellectual property adequately or cost-effectively; (xv) claims for intellectual property infringement; (xvi) interruptions, delays or outages to subscription or payment processing platforms; (xvii) risks related to acquiring and integrating businesses and divestitures of existing businesses; (xviii) our ability to retain members of the senior leadership team and attract and retain skilled employees; (xix) compliance with governmental laws and regulations; (xx) risks related to registration and other rights held by certain of our largest shareholders; (xxi) an outbreak of disease, global or localized health pandemic or epidemic, or the fear of such an event, including the global economic uncertainty and measures taken in response; (xxii) increased economic uncertainty related to the ongoing conflict between Russia and Ukraine, the conflict in the Middle East, and associated trends in macroeconomic conditions, and (xxiii) the other factors

described under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Cautionary Note Regarding Forward-Looking Statements” and other sections of our Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") on February 23, 2023.

Dun & Bradstreet Holdings, Inc.

Consolidated Statements of Operations

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 630.4 | | | $ | 595.0 | | | $ | 2,314.0 | | | $ | 2,224.6 | |

| Cost of services (exclusive of depreciation and amortization) | 223.6 | | | 188.1 | | | 831.0 | | | 721.4 | |

| Selling and administrative expenses | 190.5 | | | 196.7 | | | 742.7 | | | 745.6 | |

| Depreciation and amortization | 149.7 | | | 145.7 | | | 586.8 | | | 587.2 | |

| Restructuring charges | 2.8 | | | 6.2 | | | 13.2 | | | 20.5 | |

| Operating costs | 566.6 | | | 536.7 | | | 2,173.7 | | | 2,074.7 | |

| Operating income (loss) | 63.8 | | | 58.3 | | | 140.3 | | | 149.9 | |

| Interest income | 1.6 | | | 1.1 | | | 5.8 | | | 2.2 | |

| Interest expense | (53.5) | | | (55.0) | | | (221.9) | | | (193.2) | |

| Other income (expense) - net | (4.1) | | | 3.2 | | | (5.3) | | | 13.9 | |

| Non-operating income (expense) - net | (56.0) | | | (50.7) | | | (221.4) | | | (177.1) | |

| Income (loss) before provision (benefit) for income taxes and equity in net income of affiliates | 7.8 | | | 7.6 | | | (81.1) | | | (27.2) | |

| Less: provision (benefit) for income taxes | 6.3 | | | (15.2) | | | (34.2) | | | (28.8) | |

| Equity in net income of affiliates | 1.1 | | | 0.7 | | | 3.2 | | | 2.5 | |

| Net income (loss) | 2.6 | | | 23.5 | | | (43.7) | | | 4.1 | |

| Less: net (income) loss attributable to the non-controlling interest | (0.9) | | | (0.7) | | | (3.3) | | | (6.4) | |

| | | | | | | |

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | 1.7 | | | $ | 22.8 | | | $ | (47.0) | | | $ | (2.3) | |

| | | | | | | | |

| Basic earnings (loss) per share of common stock attributable to Dun & Bradstreet Holdings, Inc. | $ | 0.00 | | | $ | 0.05 | | | $ | (0.11) | | | $ | (0.01) | |

| Diluted earnings (loss) per share of common stock attributable to Dun & Bradstreet Holdings, Inc. | $ | 0.00 | | | $ | 0.05 | | | $ | (0.11) | | | $ | (0.01) | |

| Weighted average number of shares outstanding-basic | 431.1 | | 429.3 | | 430.5 | | 429.1 |

| Weighted average number of shares outstanding-diluted | 434.2 | | 432.5 | | 430.5 | | 429.1 |

| | | | | | | |

Dun & Bradstreet Holdings, Inc.

Consolidated Balance Sheets

(In millions, except share data and per share data)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 188.1 | | | $ | 208.4 | |

Accounts receivable, net of allowance of $20.1 at December 31, 2023 and $14.3 at December 31, 2022 | 258.0 | | | 271.6 | |

| Prepaid taxes | 51.8 | | | 57.7 | |

| Other prepaids | 100.1 | | | 77.2 | |

| | | |

| Other current assets | 58.3 | | | 89.0 | |

| Total current assets | 656.3 | | | 703.9 | |

| Non-current assets | | | |

Property, plant and equipment, net of accumulated depreciation of $45.7 at December 31, 2023 and $38.4 at December 31, 2022 | 102.1 | | | 96.9 | |

Computer software, net of accumulated amortization of $507.1 at December 31, 2023 and $348.8 at December 31, 2022 | 666.3 | | | 631.8 | |

| Goodwill | 3,445.8 | | | 3,431.3 | |

| | | |

| Other intangibles | 3,915.9 | | | 4,320.1 | |

| Deferred costs | 161.7 | | | 143.7 | |

| Other non-current assets | 187.8 | | | 144.2 | |

| Total non-current assets | 8,479.6 | | | 8,768.0 | |

| Total assets | $ | 9,135.9 | | | $ | 9,471.9 | |

| Liabilities | | | |

| Current liabilities | | | |

| Accounts payable | $ | 111.7 | | | $ | 80.5 | |

| Accrued payroll | 111.9 | | | 109.5 | |

| Short-term debt | 32.7 | | | 32.7 | |

| Deferred revenue | 590.0 | | | 563.1 | |

| Other accrued and current liabilities | 196.1 | | | 316.8 | |

| Total current liabilities | 1,042.4 | | | 1,102.6 | |

| Long-term pension and postretirement benefits | 143.9 | | | 158.2 | |

| Long-term debt | 3,512.5 | | | 3,552.2 | |

| Deferred income tax | 887.3 | | | 1,023.7 | |

| Other non-current liabilities | 118.2 | | | 126.8 | |

| Total liabilities | 5,704.3 | | | 5,963.5 | |

| Commitments and contingencies | | | |

| | | | |

| Equity | | | |

Common Stock, $0.0001 par value per share, authorized—2,000,000,000 shares; 439,735,256 shares issued and 438,848,336 shares outstanding at December 31, 2023 and 436,604,447 shares issued and 435,717,527 shares outstanding at December 31, 2022 | — | | | — | |

| Capital surplus | 4,429.2 | | | 4,443.7 | |

| Accumulated deficit | (811.1) | | | (764.1) | |

Treasury Stock, 886,920 shares at both December 31, 2023 and December 31, 2022 | (0.3) | | | (0.3) | |

| Accumulated other comprehensive loss | (198.7) | | | (180.0) | |

Total stockholders' equity | 3,419.1 | | | 3,499.3 | |

| Non-controlling interest | 12.5 | | | 9.1 | |

| Total equity | 3,431.6 | | | 3,508.4 | |

Total liabilities and stockholders' equity | $ | 9,135.9 | | | $ | 9,471.9 | |

Dun & Bradstreet Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(In millions)

| | | | | | | | | | | |

| Year ended December 31, |

| | 2023 | | 2022 |

| Cash flows provided by (used in) operating activities: | | | |

| Net income (loss) | $ | (43.7) | | | $ | 4.1 | |

| Reconciliation of net income (loss) to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 586.8 | | | 587.2 | |

| Amortization of unrecognized pension loss (gain) | (2.8) | | | (0.4) | |

| Debt early redemption premium expense | — | | | 16.3 | |

| Deferred debt issuance costs amortization and write-off | 18.3 | | | 23.8 | |

| Pension settlement charge | — | | | 2.1 | |

| Equity-based compensation expense | 83.4 | | | 66.0 | |

| Restructuring charge | 13.2 | | | 20.5 | |

| Restructuring payments | (15.2) | | | (16.9) | |

| Changes in deferred income taxes | (131.9) | | | (151.0) | |

| | | |

| Changes in operating assets and liabilities: | | | |

| (Increase) decrease in accounts receivable | 13.7 | | | 113.3 | |

| (Increase) decrease in prepaid taxes, other prepaids and other current assets | (13.2) | | | (23.2) | |

| Increase (decrease) in deferred revenue | 25.8 | | | 8.8 | |

| Increase (decrease) in accounts payable | 30.2 | | | (5.2) | |

| Increase (decrease) in accrued payroll | 5.1 | | | 3.6 | |

| Increase (decrease) in other accrued and current liabilities | (35.9) | | | (18.1) | |

| (Increase) decrease in other long-term assets | (41.6) | | | (53.2) | |

| Increase (decrease) in long-term liabilities | (38.1) | | | (41.2) | |

| Net, other non-cash adjustments | (1.9) | | | 0.6 | |

| Net cash provided by (used in) operating activities | 452.2 | | | 537.1 | |

| Cash flows provided by (used in) investing activities: | | | |

| Acquisitions of businesses, net of cash acquired | — | | | (0.5) | |

| Cash settlements of foreign currency contracts and net investment hedge | 5.0 | | | 6.0 | |

| Capital expenditures | (4.7) | | | (12.6) | |

| Additions to computer software and other intangibles | (194.7) | | | (205.3) | |

| Other investing activities, net | 2.6 | | | 1.9 | |

| Net cash provided by (used in) investing activities | (191.8) | | | (210.5) | |

| Cash flows provided by (used in) financing activities: | | | |

| Payment for debt early redemption premiums | — | | | (16.3) | |

| Payments of dividends | (86.1) | | | (42.9) | |

| Payment of long term debt | — | | | (420.0) | |

| Proceeds from borrowings on Credit Facility | 515.1 | | | 315.1 | |

| | | |

| Proceeds from borrowings on Term Loan Facility | — | | | 460.0 | |

| Payments of borrowings on Credit Facility | (540.4) | | | (424.8) | |

| Payments of borrowing on Term Loan Facility | (32.7) | | | (106.6) | |

| Payment of debt issuance costs | — | | | (7.4) | |

| Payment for purchase of non-controlling interests | (95.7) | | | (23.6) | |

| Other financing activities, net | (42.6) | | | (14.6) | |

| Net cash provided by (used in) financing activities | (282.4) | | | (281.1) | |

| Effect of exchange rate changes on cash and cash equivalents | 1.7 | | | (14.2) | |

| Increase (decrease) in cash and cash equivalents | (20.3) | | | 31.3 | |

| Cash and Cash Equivalents, Beginning of Period | 208.4 | | | 177.1 | |

| Cash and Cash Equivalents, End of Period | $ | 188.1 | | | $ | 208.4 | |

| | | |

| Supplemental Disclosure of Cash Flow Information: | | | |

| | | |

| Cash Paid for: | | | |

| Income taxes payment (refund), net | $ | 100.2 | | | $ | 139.8 | |

| Interest | $ | 213.3 | | | $ | 178.5 | |

Dun & Bradstreet Holdings, Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | 1.7 | | | $ | 22.8 | | | $ | (47.0) | | | $ | (2.3) | |

| Depreciation and amortization | 149.7 | | | 145.7 | | | 586.8 | | | 587.2 | |

| Interest expense - net | 51.9 | | | 53.9 | | | 216.1 | | | 191.0 | |

| (Benefit) provision for income tax - net | 6.3 | | | (15.2) | | | (34.2) | | | (28.8) | |

| EBITDA | 209.6 | | | 207.2 | | | 721.7 | | | 747.1 | |

| Other income (expense) - net | 4.1 | | | (3.2) | | | 5.3 | | | (13.9) | |

| Equity in net income of affiliates | (1.1) | | | (0.7) | | | (3.2) | | | (2.5) | |

| Net income (loss) attributable to non-controlling interest | 0.9 | | | 0.7 | | | 3.3 | | | 6.4 | |

| Equity-based compensation | 17.3 | | | 22.1 | | | 83.4 | | | 66.0 | |

| Restructuring charges | 2.8 | | | 6.2 | | | 13.2 | | | 20.5 | |

Merger, acquisition and divestiture-related operating costs | 1.7 | | | 6.1 | | | 7.1 | | | 23.4 | |

| Transition costs | 21.8 | | | 10.7 | | | 52.9 | | | 24.4 | |

Other adjustments (1) | 3.5 | | | 1.3 | | | 8.5 | | | (7.9) | |

| Adjusted EBITDA | $ | 260.6 | | | $ | 250.4 | | | $ | 892.2 | | | $ | 863.5 | |

| | | | | | | |

| North America | $ | 223.7 | | | $ | 214.9 | | | $ | 743.3 | | | $ | 718.0 | |

| International | 55.2 | | | 49.0 | | | 215.4 | | | 202.2 | |

| Corporate and other | (18.3) | | | (13.5) | | | (66.5) | | | (56.7) | |

| Adjusted EBITDA | $ | 260.6 | | | $ | 250.4 | | | $ | 892.2 | | | $ | 863.5 | |

| Adjusted EBITDA Margin | 41.3 | % | | 42.1 | % | | 38.6 | % | | 38.8 | % |

(1)Adjustments for 2023 were primarily related to legal fees associated with ongoing legal matters and impairment charges. Adjustments for 2022 were primarily related to non-cash purchase accounting adjustments for deferred commission cost amortization.

Dun & Bradstreet Holdings, Inc.

Segment Revenue and Adjusted EBITDA (Unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, 2023 |

| North America | | International | | Corporate and Other | | Total |

| Revenue | $ | 456.8 | | | $ | 173.6 | | | $ | — | | | $ | 630.4 | |

| Total operating costs | 258.9 | | | 125.0 | | | 19.9 | | | 403.8 | |

| Operating income (loss) | 197.9 | | | 48.6 | | | (19.9) | | | 226.6 | |

| Depreciation and amortization | 25.8 | | | 6.6 | | | 1.6 | | | 34.0 | |

| Adjusted EBITDA | $ | 223.7 | | | $ | 55.2 | | | $ | (18.3) | | | $ | 260.6 | |

| | | | | | | |

| Adjusted EBITDA margin | 49.0 | % | | 31.8 | % | | N/A | | 41.3 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2023 |

| North America | | International | | Corporate and Other | | Total |

Revenue | $ | 1,644.5 | | | $ | 669.5 | | | $ | — | | | $ | 2,314.0 | |

| Total operating costs | 993.8 | | | 476.0 | | | 73.0 | | | 1,542.8 | |

| Operating income (loss) | 650.7 | | | 193.5 | | | (73.0) | | | 771.2 | |

| Depreciation and amortization | 92.6 | | | 21.9 | | | 6.5 | | | 121.0 | |

| Adjusted EBITDA | $ | 743.3 | | | $ | 215.4 | | | $ | (66.5) | | | $ | 892.2 | |

| | | | | | | |

| Adjusted EBITDA margin | 45.2 | % | | 32.2 | % | | N/A | | 38.6 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, 2022 |

| North America | | International | | Corporate and Other | | Total |

| Revenue | $ | 434.9 | | | $ | 160.1 | | | $ | — | | | $ | 595.0 | |

| Total operating costs | 237.8 | | | 115.2 | | | 15.2 | | | 368.2 | |

| Operating income (loss) | 197.1 | | | 44.9 | | | (15.2) | | | 226.8 | |

| Depreciation and amortization | 17.8 | | | 4.1 | | | 1.7 | | | 23.6 | |

| Adjusted EBITDA | $ | 214.9 | | | $ | 49.0 | | | $ | (13.5) | | | $ | 250.4 | |

| | | | | | | |

| Adjusted EBITDA margin | 49.4 | % | | 30.6 | % | | N/A | | 42.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2022 |

| North America | | International | | Corporate and Other | | Total |

Revenue | $ | 1,587.1 | | | $ | 637.5 | | | $ | — | | | $ | 2,224.6 | |

| Total operating costs | 940.5 | | | 450.3 | | | 63.4 | | | 1,454.2 | |

| Operating income (loss) | 646.6 | | | 187.2 | | | (63.4) | | | 770.4 | |

| Depreciation and amortization | 71.4 | | | 15.0 | | | 6.7 | | | 93.1 | |

| Adjusted EBITDA | $ | 718.0 | | | $ | 202.2 | | | $ | (56.7) | | | $ | 863.5 | |

| | | | | | | |

| Adjusted EBITDA margin | 45.2 | % | | 31.7 | % | | N/A | | 38.8 | % |

| | | | | | | |

Dun & Bradstreet Holdings, Inc.

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss)

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. | $ | 1.7 | | | $ | 22.8 | | | $ | (47.0) | | | $ | (2.3) | |

| Incremental amortization of intangible assets resulting from the application of purchase accounting | 115.7 | | | 122.0 | | | 465.8 | | | 494.0 | |

| Equity-based compensation | 17.3 | | | 22.1 | | | 83.4 | | | 66.0 | |

| Restructuring charges | 2.8 | | | 6.2 | | | 13.2 | | | 20.5 | |

Merger, acquisition and divestiture-related operating costs | 1.7 | | | 6.1 | | | 7.1 | | | 23.4 | |

| Transition costs | 21.8 | | | 10.7 | | | 52.9 | | | 24.4 | |

Merger, acquisition and divestiture-related non-operating costs | 1.8 | | | 1.7 | | | 1.8 | | | 3.7 | |

| Debt refinancing and extinguishment costs | — | | | — | | | 2.5 | | | 24.3 | |

| | | | | | | |

| Non-operating pension-related income | (4.5) | | | (8.9) | | | (18.3) | | | (42.2) | |

Non-cash gain from interest rate swap amendment (1) | (8.0) | | | — | | | (10.6) | | | — | |

Other adjustments (2) | 3.6 | | | 1.3 | | | 9.7 | | | (7.9) | |

| Tax effect of non-GAAP adjustments | (26.1) | | | (37.7) | | | (142.6) | | | (144.6) | |

| Other tax effect adjustments | 12.0 | | | (15.3) | | | 13.7 | | | (19.7) | |

Adjusted net income (loss) attributable to Dun & Bradstreet Holdings, Inc. (3) | $ | 139.8 | | | $ | 131.0 | | | $ | 431.6 | | | $ | 439.6 | |

| Adjusted diluted earnings (loss) per share of common stock | $ | 0.32 | | | $ | 0.30 | | | $ | 1.00 | | | $ | 1.02 | |

| Weighted average number of shares outstanding - diluted | 434.2 | | | 432.5 | | | 432.8 | | | 430.0 | |

(1)Amount represents non-cash amortization gain resulted from the amendment of our interest rate swap derivatives. The amount is reported within "Interest expense-net" for the year ended December 31, 2023.

(2)Adjustments for 2023 were primarily related to legal fees associated with ongoing legal matters. Adjustments for 2022 were primarily related to non-cash purchase accounting adjustments for deferred commission cost amortization.

(3)Starting in the first quarter of 2023, we exclude non-operating pension-related income from Adjusted net income (loss) and all prior periods have been adjusted accordingly.

For more information, please contact:

Investor Contact:

904-648-8006

IR@dnb.com

Media Contact:

Dawn McAbee

904-648-6328

Mcabeed@dnb.com

Restricted Confidential February 15, 2024 Fourth Quarter And Full Year 2023 Financial Results

Restricted Confidential Disclaimer This presentation contains statements that are not purely historical but are forward-looking statements, including statements regarding expectations, hopes, intentions or strategies regarding the future. Forward-looking statements are based on Dun & Bradstreet’s management’s beliefs, as well as assumptions made by, and information currently available to, them. Forward-looking statements can be identified by words such as “anticipates,” “intends,” “plans,” “seeks,” “believes,” “estimates,” “expects” and similar references to future periods, or by the inclusion of forecasts or projections. Examples of forward-looking statements include, but are not limited to, statements we make regarding the outlook for our future business and financial performance. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. It is not possible to predict or identify all risk factors. Consequently, the risks and uncertainties listed below should not be considered a complete discussion of all of our potential trends, risks and uncertainties. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. You are cautioned not to place undue reliance on the utility of the information in this Presentation as a predictor of future performance. Any estimates and statements contained herein may be forward-looking in nature and involve significant elements of subjective judgment and analysis, which may or may not be correct. Risks, uncertainties and other factors may cause actual results to vary materially and potentially adversely from those anticipated, estimated or projected. For example, throughout this Presentation we discuss the Company’s business strategy and certain short and long term financial and operational expectations that we believe would be achieved based upon our planned business strategy for the next several years. These expectations can only be achieved if the assumptions underlying our business strategy are fully realized –some of which we cannot control (e.g., market growth rates, macroeconomic conditions and customer preferences) and we will review these assumptions as part of our annual planning process. The risks and uncertainties that forward-looking statements are subject to include, but are not limited to: (i) our ability to implement and execute our strategic plans to transform the business; (ii) our ability to develop or sell solutions in a timely manner or maintain client relationships; (iii) competition for our solutions; (iv) harm to our brand and reputation; (v) unfavorable global economic conditions including, but not limited to, volatility in interest rates, foreign currency markets, inflation and supply chain disruptions; (vi) risks associated with operating and expanding internationally; (vii) failure to prevent cybersecurity incidents or the perception that confidential information is not secure; (viii) failure in the integrity of our data or systems; (ix) system failures and personnel disruptions, which could delay the delivery of our solutions to our clients; (x) loss of access to data sources or ability to transfer data across the data sources in markets where we operate; (xi) failure of our software vendors and network and cloud providers to perform as expected or if our relationship is terminated; (xii) loss or diminution of one or more of our key clients, business partners or government contracts; (xiii) dependence on strategic alliances, joint ventures and acquisitions to grow our business; (xiv) our ability to protect our intellectual property adequately or cost-effectively; (xv) claims for intellectual property infringement; (xvi) interruptions, delays or outages to subscription or payment processing platforms; (xvii) risks related to acquiring and integrating businesses and divestitures of existing businesses; (xviii) our ability to retain members of the senior leadership team and attract and retain skilled employees; (xix) compliance with governmental laws and regulations; (xx) risks related to registration and other rights held by certain of our largest shareholders; (xxi) an outbreak of disease, global or localized health pandemic or epidemic, or the fear of such an event, including the global economic uncertainty and measures taken in response; (xxii) increased economic uncertainty related to the ongoing conflict between Russia and Ukraine, the conflict in the Middle East, and associated trends in macroeconomic conditions, and (xxii) the other factors described under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in our consolidated financial statements for the year ended December 31, 2022, included in our Annual Report of Form 10-K filed with the Securities and Exchange Commission ("SEC") on February 23, 2023, our other Quarterly Reports and the Company’s other reports or documents filed with the SEC. All information herein speaks only as of (1) the date hereof, in the case of information about the Company, and (2) the date of such information, in the case of information from persons other than the Company. There can be no assurance any forecasts and estimates will prove accurate in whole or in part. The Company does not undertake any duty to update or revise the information contained herein, publicly or otherwise. The Presentation also includes certain financial information that is not presented in accordance with Generally Accepted Accounting Principles (“GAAP”), including, but not limited to, Organic Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income, and certain ratios and other metrics derived therefrom. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Further, it is important to note that non-GAAP financial measures should not be considered in isolation and may be considered in addition to GAAP financial information but should not be used as substitutes for the corresponding GAAP measures. It is also important to note that EBITDA, Adjusted EBITDA for specified fiscal periods have been calculated in accordance with the definitions thereof as set out in our public disclosures and are not projections of anticipated results but rather reflect permitted adjustments. Additionally, this Presentation contains forward-looking financial measures presented on a non-GAAP basis without reconciliation to the most directly comparable GAAP measure due to the inherent difficulty, without unreasonable efforts, in forecasting and quantifying with reasonable accuracy significant items required for this reconciliation. You should be aware that Dun & Bradstreet’s presentation of these and other non-GAAP financial measures in this Presentation may not be comparable to similarly-titled measures used by other companies. All amounts in this Presentation are in USD unless otherwise stated. All trademarks and logos depicted in this Presentation are the property of their respective owners and are displayed solely for purposes of illustration.

Restricted Confidential Financial Highlights (GAAP) Metrics Fourth Quarter 2023 Full Year 2023 Revenue $630.4 million, +6.0% (+5.1% constant currency) $2,314 million, +4.0% (+4.2% constant currency) Net income (loss) $1.7 million vs. $22.8 million Q4’22 $(47.0) million vs. $(2.3) million FY’22 Diluted earnings (loss) per share Less than $0.01 $(0.11) 1

Restricted Confidential Financial Highlights (Non-GAAP) Metrics Fourth Quarter 2023 Full Year 2023 Revenue $630.4 million, +6.0% (+5.1% constant currency) $2,314 million, +4.0% (+4.2% constant currency) Organic revenue growth +5.1% +4.3% Adjusted EBITDA $260.6 million, +4.0% $892.2 million, +3.3% Adjusted EBITDA Margin 41.3% 38.6% Adjusted net income $139.8 million $431.6 million Adjusted diluted earnings per share $0.32 $1.00 2

Restricted Confidential 203.7 215.4 231.2 241.4 Q4 2022 Q4 2023 +5% +5% +4% +4% +6% +6% • Organic revenue grew 5.0 percent • Finance & Risk revenues increased 4 percent primarily due to a net increase in revenue across our Third Party and Supply Chain Risk Management and Finance Solutions • Sales and Marketing revenues increased 6 percent primarily driven by higher revenue from our Master Data Management Solutions • Adjusted EBITDA increase was primarily due to revenue growth, partially offset by associated data acquisition and data processing costs North America – Q4 Fourth Quarter Highlights Finance & Risk Sales & Marketing $434.9 $456.8 AFX BFX (1) $ in millions REVENUE ADJUSTED EBITDA ADJUSTED EBITDA MARGIN % $214.9 $223.7 Q4 2022 Q4 2023 49.4% 49.0% Q4 2022 Q4 2023 +4.1% -40 bps (1) BFX represents the growth rate before the impact of foreign exchange 3

Restricted Confidential 720.2 756.4 866.9 888.1 FY 2022 FY 2023 +4% +4% +2% +3% +5% +5% • Organic revenue grew 3.7 percent • Finance & Risk revenues increased 2 percent due to a net increase in revenue across our Third Party and Supply Chain Risk Management and Finance Solutions, partially offset by decreased revenue from our Credibility Solutions and from Public Sector • Sales and Marketing revenues increased 5 percent driven by growth from our Master Data Management Solutions • Adjusted EBITDA increase was primarily due to revenue growth, lower net personnel costs and lower costs related to professional fees, partially offset by associated data acquisition and data processing costs and the negative impact of foreign exchange associated with our offshore technology facility North America – Full Year Full Year Highlights Finance & Risk Sales & Marketing $1,587.1 $1,644.5 AFX BFX (1) $ in millions REVENUE ADJUSTED EBITDA ADJUSTED EBITDA MARGIN % +3.5% Flat (1) BFX represents the growth rate before the impact of foreign exchange 4 45.2% 45.2% FY 2022 FY 2023 $718.0 $743.3 FY 2022 FY 2023

Restricted Confidential 54.1 57.2 106.0 116.4 Q4 2022 Q4 2023 +8% +5% +10% +7% +6% +3% • Organic revenue grew 5.3 percent with growth across all markets • Finance & Risk solutions remain in high demand with 7 percent BFX growth across all markets • Sales & Marketing grew 3 percent BFX primarily due to higher revenues from U.K. and Europe driven by strong demand for our latest API solutions • Adjusted EBITDA increased 13 percent driven primarily by revenue growth from the underlying business, partially offset by higher costs related to personnel and data processing International – Q4 Fourth Quarter Highlights Finance & Risk Sales & Marketing $160.1 $173.6AFX BFX (1) $ in millions REVENUE ADJUSTED EBITDA ADJUSTED EBITDA MARGIN % $49.0 $55.2 Q4 2022 Q4 2023 30.6% 31.8% Q4 2022 Q4 2023 +12.6% +120 bps (1) BFX represents the growth rate before the impact of foreign exchange 5

Restricted Confidential 218.4 220.9 419.1 448.6 FY 2022 FY 2023 +5% +5% +7% +7% +1% +2% • Organic revenue grew 5.8 percent with growth across all markets • Finance & Risk solutions increased 7 percent BFX with growth across all markets • Sales & Marketing organically grew 3 percent primarily due to higher revenue from U.K. and Europe driven by strong demand for our latest API solutions • Adjusted EBITDA increased 7 percent driven primarily by revenue growth from the underlying business, partially offset by higher costs related to personnel and data processing, and higher foreign exchange losses resulting from a stronger U.S. dollar International – Full Year Full Year Highlights Finance & Risk Sales & Marketing $637.5 $669.5 AFX BFX (1) $ in millions REVENUE ADJUSTED EBITDA ADJUSTED EBITDA MARGIN % $202.2 $215.4 FY 2022 FY 2023 31.7% 32.2% FY 2022 FY 2023 +6.5% +50 bps (1) BFX represents the growth rate before the impact of foreign exchange 6

Restricted Confidential Debt Summary ($ in millions) December 31, 2023 Maturity Interest Rate Cash $188 Revolving Facility ($850.0) (1)(2)(3) $25 2025 SOFR + CSA + 300 bps (2) (3) Term Loan Facility (SOFR) (1) (4) $2,652 2026 SOFR + CSA + 275 bps (3) (4) (5) Term Loan Facility (SOFR) (1) (4) $452 2029 SOFR + 300 bps (5) Unsecured Notes (1) $460 2029 5.00% Total Debt (1) $3,589 Net Debt (1) $3,401 Net Debt / EBITDA 3.8x (1)Represents principal amount (2)Subject to a ratio-based pricing grid (3)As of 1/29/24, repriced to SOFR + 250 bps (subject to pricing grid) and extended to February 2029 (4)As of 1/29/24, repriced and consolidated into a single tranche of $3.1 billion at SOFR + 275 bps • 89 percent debt either fixed, or hedged • The $2.7 billion term loan has the following hedges: • $1 billion floating to fixed swap effective to March 2025 at 3.214 percent • $1.5 billion floating to fixed swap effective to February 2026 at 3.695 percent. • The $453 million term loan has $250 million swapped from floating to fixed which expires February 2025 at 1.629 percent • We also have 3 cross currency swaps at $125M each which settle in July 2024, 2025 and 2026 7

Restricted Confidential Debt Summary (Proforma with January 2024 Debt Transactions) ($ in millions) December 31, 2023 Maturity Interest Rate Cash $188 Revolving Facility ($850.0) (1)(2)(3) $25 2029 SOFR + 250 bps Term Loan Facility (1)(4) $3,104 2029 SOFR + 275 bps Unsecured Notes (1) $460 2029 5.00% Total Debt (1) $3,589 Net Debt (1) $3,401 Net Debt / EBITDA 3.8x (1)Represents principal amount (2)Subject to a ratio-based pricing grid (3)As of 1/29/24, repriced from SOFR+CSA+300bps to SOFR+250bps (subject to pricing grid) and extended from September 2025 to February 2029 (4)As of 1/29/24, previous $2,652 million (SOFR+CSA+275bps) and $452 million (SOFR+300bps) tranches repriced and consolidated into a single tranche of $3,104 million at SOFR+275 bps • 89 percent debt either fixed, or hedged • The $3.1 billion term loan has the following hedges: • $250 million floating to fixed swap effective to February 2025 at 1.629 percent • $1 billion floating to fixed swap effective to March 2025 at 3.214 percent • $1.5 billion floating to fixed swap effective to February 2026 at 3.695 percent. • We also have 3 cross currency swaps at $125M each which settle in July 2024, 2025 and 2026 8

Restricted Confidential Full Year 2024 Financial Guidance Financial Metrics 2024 Guidance Total Revenue $2,400 million to $2,440 million Organic revenue growth 4.1% to 5.1% Adjusted EBITDA $930 million to $950 million Adjusted diluted earnings per share $1.00 to $1.04 Full year 2024 guidance is based upon the following estimates and assumptions: • Adjusted interest expense of approximately $220 million • Depreciation and amortization expense of approximately $125 million to $135 million (excluding incremental depreciation and amortization expense resulting from purchase accounting) • Adjusted effective tax rate approximately 22% to 23% • Weighted average diluted shares outstanding of approximately 433 million • Capex of $150-$160 million of internally developed software and $45 million of Property, Plant and Equipment and Purchased Software 9

Restricted Confidential Appendix

Restricted Confidential Non-GAAP Financial Measures In addition to reporting GAAP results, we evaluate performance and report our results on the non-GAAP financial measures discussed below. We believe that the presentation of these non-GAAP measures provides useful information to investors and rating agencies regarding our results, operating trends and performance between periods. These non-GAAP financial measures include organic revenue, adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA"), adjusted EBITDA margin, adjusted net income and adjusted net earnings per diluted share. Adjusted results are non-GAAP measures that adjust for the impact due to certain acquisition and divestiture related revenue and expenses, such as costs for banker fees, legal fees, due diligence, retention payments and contingent consideration adjustments, restructuring charges, equity- based compensation, and other non-core gains and charges that are not in the normal course of our business, such as costs associated with early debt redemptions, gains and losses on sales of businesses, impairment charges, the effect of significant changes in tax laws and material tax and legal settlements. We exclude amortization of recognized intangible assets resulting from the application of purchase accounting because it is non- cash and not indicative of our ongoing and underlying operating performance. Intangible assets are recognized as a result of historical merger and acquisition transactions. We believe that recognized intangible assets by their nature are fundamentally different from other depreciating assets that are replaced on a predictable operating cycle. Unlike other depreciating assets, such as developed and purchased software licenses or property and equipment, there is no replacement cost once these recognized intangible assets expire and the assets are not replaced. Additionally, our costs to operate, maintain and extend the life of acquired intangible assets and purchased intellectual property are reflected in our operating costs as personnel, data fees, facilities, overhead and similar items. Management believes it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation. Amortization of recognized intangible assets will recur in future periods until such assets have been fully amortized. In addition, we isolate the effects of changes in foreign exchange rates on our revenue growth because we believe it is useful for investors to be able to compare revenue from one period to another, both after and before the effects of foreign exchange rate changes. The change in revenue performance attributable to foreign currency rates is determined by converting both our prior and current periods’ foreign currency revenue by a constant rate. As a result, we monitor our adjusted revenue growth both after and before the effects of foreign exchange rate changes. We believe that these supplemental non-GAAP financial measures provide management and other users with additional meaningful financial information that should be considered when assessing our ongoing performance and comparability of our operating results from period to period. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. These non-GAAP measures are among the factors management uses in planning for and forecasting future periods. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to our reported results prepared in accordance with GAAP. Our non-GAAP or adjusted financial measures reflect adjustments based on the following items, as well as the related income tax. Organic Revenue We define organic revenue as reported revenue before the effect of foreign exchange excluding revenue from acquired businesses, if applicable, for the first twelve months. In addition, organic revenue excludes current and prior year revenue associated with divested businesses, if applicable. We believe the organic measure provides investors and analysts with useful supplemental information regarding the Company’s underlying revenue trends by excluding the impact of acquisitions and divestitures. Revenue from divested businesses is related to the business-to-consumer business in Germany that was sold during the second quarter of 2022. Adjusted EBITDA and Adjusted EBITDA Margin We define adjusted EBITDA as net income (loss) attributable to Dun & Bradstreet Holdings, Inc. excluding the following items: • depreciation and amortization; • interest expense and income; • income tax benefit or provision; • other non-operating expenses or income; • equity in net income of affiliates; • net income attributable to non-controlling interests; • equity-based compensation; • restructuring charges; • merger, acquisition and divestiture-related operating costs; • transition costs primarily consisting of non-recurring expenses associated with transformational and integration activities, as well as incentive expenses associated with our synergy program; and • other adjustments primarily related to non-cash charges and gains, including impairment charges and adjustments as the result of the application of purchase accounting mainly related to the deferred commission cost In addition, other adjustments also include non-recurring charges such as legal expense associated with significant legal and regulatory matters. We calculate adjusted EBITDA margin by dividing adjusted EBITDA by revenue. 10

Restricted Confidential Non-GAAP Financial Measures (Continued) Adjusted Net Income We define adjusted net income as net income (loss) attributable to Dun & Bradstreet Holdings, Inc. adjusted for the following items: • incremental amortization resulting from the application of purchase accounting. We exclude amortization of recognized intangible assets resulting from the application of purchase accounting because it is non-cash and is not indicative of our ongoing and underlying operating performance. The Company believes that recognized intangible assets by their nature are fundamentally different from other depreciating assets that are replaced on a predictable operating cycle. Unlike other depreciating assets, such as developed and purchased software licenses or property and equipment, there is no replacement cost once these recognized intangible assets expire and the assets are not replaced. Additionally, the Company’s costs to operate, maintain and extend the life of acquired intangible assets and purchased intellectual property are reflected in the Company’s operating costs as personnel, data fee, facilities, overhead and similar items; • equity-based compensation; • restructuring charges; • merger, acquisition and divestiture-related operating costs; • transition costs primarily consisting of non-recurring expenses associated with transformational and integration activities, as well as incentive expenses associated with our synergy program; • merger, acquisition and divestiture-related non-operating costs; • debt refinancing and extinguishment costs; • non-operating pension-related income (expenses) includes certain costs and income associated with our pension and postretirement plans, consisting of interest cost, expected return on plan assets and amortized actuarial gains or losses and prior service credits. These adjustments are non-cash and market-driven, primarily due to the changes in the value of pension plan assets and liabilities which are tied to financial market performance and conditions. • Non-cash gain and loss resulting from the modification of our interest rate swaps; • other adjustments primarily related to non-cash charges and gains, including impairment charges and adjustments as the result of the application of purchase accounting mainly in 2022 related to the deferred commission cost. In addition, other adjustments also include non-recurring charges such as legal expense associated with significant legal and regulatory matters. • tax effect of the non-GAAP adjustments; and • other tax effect adjustments related to the tax impact of statutory tax rate changes on deferred taxes and other discrete items. Adjusted Net Earnings Per Diluted Share We calculate adjusted net earnings per diluted share by dividing adjusted net income (loss) by the weighted average number of common shares outstanding for the period plus the dilutive effect of common shares potentially issuable in connection with awards outstanding under our stock incentive plan. 11

Restricted Confidential Non-GAAP Reconciliation: Adjusted EBITDA (Amounts in millions) Three Months Ended December 31 Year Ended December 31 2023 2022 2023 2022 Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. 1.7 22.8 (47.0) (2.3) Depreciation and amortization 149.7 145.7 586.8 587.2 Interest expense - net 51.9 53.9 216.1 191.0 (Benefit) provision for income tax - net 6.3 (15.2) (34.2) (28.8) EBITDA $209.6 $207.2 $721.7 $747.1 Other income (expense) - net 4.1 (3.2) 5.3 (13.9) Equity in net income of affiliates (1.1) (0.7) (3.2) (2.5) Net income (loss) attributable to the non-controlling interest 0.9 0.7 3.3 6.4 Equity-based compensation 17.3 22.1 83.4 66.0 Restructuring charges 2.8 6.2 13.2 20.5 Merger, acquisition and divestiture-related operating costs 1.7 6.1 7.1 23.4 Transition costs 21.8 10.7 52.9 24.4 Other adjustments 3.5 1.3 8.5 (7.9) Adjusted EBITDA $260.6 $250.4 $892.2 $863.5 Adjusted EBITDA Margin (%) 41.3% 42.1% 38.6% 38.8% 12

Restricted Confidential Non-GAAP Reconciliation: Adjusted Net Income (Amounts in millions, except per share data) Three Months Ended December 31 Year Ended December 31 2023 2022 2023 2022 Net income (loss) attributable to Dun & Bradstreet Holdings, Inc. 1.7 22.8 (47.0) (2.3) Incremental amortization of intangible assets resulting from the application of purchase accounting 115.7 122.0 465.8 494.0 Equity-based compensation 17.3 22.1 83.4 66.0 Restructuring charges 2.8 6.2 13.2 20.5 Merger, acquisition and divestiture-related operating costs 1.7 6.1 7.1 23.4 Transition costs 21.8 10.7 52.9 24.4 Merger, acquisition and divestiture-related non-operating costs 1.8 1.7 1.8 3.7 Debt refinancing and extinguishment costs - - 2.5 24.3 Non-operating pension-related income (4.5) (8.9) (18.3) (42.2) Non-cash gain from interest rate swap amendment (8.0) - (10.6) - Other adjustments 3.6 1.3 9.7 (7.9) Tax effect of the non-GAAP adjustments (26.1) (37.7) (142.6) (144.6) Other tax effect adjustments 12.0 (15.3) 13.7 (19.7) Adjusted net income (loss) attributable to Dun & Bradstreet Holdings, Inc. $139.8 $131.0 $431.6 $439.6 Adjusted diluted earnings (loss) per share of common stock $0.32 $0.30 $1.00 $1.02 Weighted average number of shares outstanding – diluted 434.2 432.5 432.8 430.0 13

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |